Market Outlook 17th August 2011

Diunggah oleh

Angel BrokingDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Market Outlook 17th August 2011

Diunggah oleh

Angel BrokingHak Cipta:

Format Tersedia

Market Outlook

India Research

August 17, 2011

Dealers Diary

The key benchmark indices opened in green following positive global market cues and continued to trade in a range-bound manner in morning trade. Soon the market pared some of its gains on reports that domestic inflation continues to rule at elevated levels. This led to concerns among investors that the central bank may persist with its monetary tightening policy to contain inflation. The indices continued to slide downwards and soon traded in red in the mid-afternoon session as European markets opened in red. The market slumped to a fresh intraday low before recovering slightly and closed the trading session close to the low levels of the day. The Sensex and Nifty fell for the third straight session and closed with losses of 0.7% each. The mid-cap and small-cap indices underperformed the broader market and closed lower by 1.8% and 2.1%, respectively. Among the front runners, TCS, BHEL, Bharti Airtel, ITC and Infosys gained 03%, while Jaiprakash Associates, DLF, Hindalco, HDFC and Cipla lost 28%. Among mid caps, Gujarat Fluorochemicals, Jubiliant Foodworks, Allcargo Global, Dish TV and Wabco TVS gained 39%, while IVRCL, Sujana Towers, SpiceJet, NCC and HDIL lost 1118%.

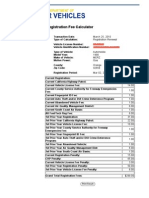

Domestic Indices BSE Sensex Nifty MID CAP SMALL CAP BSE HC BSE PSU BANKEX AUTO METAL OIL & GAS BSE IT Global Indices Dow Jones NASDAQ FTSE Nikkei Hang Seng Straits Times Shanghai Com Indian ADRs Infosys Wipro ICICI Bank HDFC Bank

Chg (%) (0.7) (0.7) (1.8) (2.1) (0.9) (1.0) (1.2) (0.9) (2.0) (1.0) 0.9 Chg (%) (0.7) (1.2) 0.1 0.2 (0.2) (1.5) (0.7) Chg (%) (1.8) (1.9) (4.6) (3.3)

(Pts) (37.2) (116.4) (160.0) (54.1) (81.4) (73.2) (87.0) 45.3 (Pts) (77.0) (31.8) 7.1 21.0 (48.0) (41.7) (18.6) (Pts) (1.0) (0.2) (2.0) (1.1)

(Close) 5,036 6,397 7,461 5,994 7,953 8,461 8,330 5,050 (Close) 11,406 2,523 5,358 9,107 20,212 2,833 2,608 (Close) $53.2 $10.3 $41.1 $32.5

(108.7) 16,731

(139.5) 11,497 (240.6) 12,060

Markets Today

The trend deciding level for the day is 16,813/5,061 levels. If NIFTY trades above this level during the first half-an-hour of trade then we may witness a further rally up to 16,953 17,175/5,107 5,178 levels. However, if NIFTY trades below 16,813/5,061 levels for the first half-an-hour of trade then it may correct up to 16,591 16,451/4,990 4,944 levels.

Indices SENSEX NIFTY S2 16,451 4,944 S1 16,591 4,990 R1 16,953 5,107 R2 17,175 5,178

News Analysis

WPI inflation for July 2011 eases to 9.22% Tata Motors reports 6% yoy decline in global sales in July 2011

Refer detailed news analysis on the following page

Advances / Declines Advances Declines Unchanged

BSE 849 1,984 107

NSE 327 1,143 31

Net Inflows (August 12, 2011) ` cr Purch FII MFs 2,381 656

Sales 2,785 460

Net (404) 196

MTD (5,615) 1,564

YTD 3,118 5,342

Volumes (` cr) BSE NSE 2,109 9,590

FII Derivatives (August 16, 2011) ` cr Index Futures Stock Futures Gainers / Losers Gainers Company Jubiliant Food. Dish TV India TCS BHEL Financial Tech. Price (`) 907 85 974 1,768 735 chg (%) 6.5 3.2 2.4 2.3 2.2 Company IVRCL NCC HDIL Lanco Infra. Punj Lloyd Losers Price (`) 40 54 104 17 56 chg (%) (18.0) (13.8) (11.7) (10.7) (10.7) Sebi Registration No: INB 010996539

1

Purch 3,084 2,346

Sales 2,285 1,832

Net 799 514

Open Interest 14,796 29,175

Please refer to important disclosures at the end of this report

Market Outlook | India Research

WPI inflation for July 2011 eases to 9.22%

Wholesale price-based inflation for July 2011 eased a bit to 9.22% from 9.44% in June 2011. Headline inflation has stubbornly remained above the 9% mark for eight consecutive months now. However, the latest headline inflation print was in-line with the median forecast (9.22%) of Bloombergs survey of economists. Core (non-food manufacturing) inflation which the RBI tracks closely rose at a faster pace of 7.5% as compared to 7.3% in June 2011. Inflation for May 2011 was revised upwards by 50bp to 9.56%. Primary articles inflation eased off considerably to its lowest level in the last 21 months. Driven by slower rise in food and non-food articles, primary articles inflation eased off to 11.3% from 12.2% in June 2011. However, inflation for minerals continued to be high at 25.0%. Fuel and power inflation also eased a bit, from 12.8% in June 2011 to 12.0%, on the back of lower rise in mineral oil prices. Electricity inflation continued to show a negative tick for the third straight month. Manufactured products, which have a weightage of ~65% in overall WPI inflation, continued to rise at an accelerated pace of 7.5%. Manufacturing articles inflation was driven by textiles (12.9%), basic metals (10.1%) and chemicals (7.9%). The spread between primary articles and manufactured products inflation, which was as high as 13.1% in January 2011, narrowed considerably to 3.8% in July 2011 indicating that bulk of pass-through of raw-material cost pressures has already taken place, in our view. Inflationary pressures are likely to ease in the coming months on falling global commodity and energy prices due to sovereign debt crisis concerns in Eurozone countries, concerns of double-dip recession in the US and expected overall slowdown in global growth.

Tata Motors reports a 6% yoy decline in global sales in July 2011

Tata Motors reported a 6% yoy (5% mom) decline in global sales volume in July 2011 to 85,392 units on account of a steep 24% yoy decline in passenger vehicle sales. Global commercial vehicles (including Tata Daewoo and Tata Hispano Carrocera range), on the other hand, witnessed healthy 16% yoy (4.3% mom) volume growth to 47,238 units. Global passenger vehicle volumes stood at 38,154 units, registering a decline of 14.4% mom, primarily on account of a decline in domestic passenger vehicle volumes. Jaguar and Land Rover (JLR) posted marginally lower-than-expected 1.4% yoy (6.1% mom) decline in volumes to 19,119 units. Jaguar sales registered an in-line 23% yoy decline (up 8.3% mom) to 4,372 units, while Land Rover sales came in lower than expected, posting modest 7.6% yoy (down 9.6% sequentially) growth to 14,747 units. Volume decline at JLR can be attributed to moderation in demand in the key markets of US, UK and Europe; however, demand in China and Russia continues to remain strong. We expect JLR sales to gain momentum going ahead, with the launch of highly anticipated Evoque in September 2011 and the new Jaguar XF. We maintain our Accumulate rating on the stock with an SOTP target price of `917.

August 17, 2011

Market Outlook | India Research

Economic and Political News

Global food prices near three-year highs in July 2011: World Bank August inflation to be close to double digits: Government Good monsoon and RBI policy to ease inflation further: Finance Minister

Corporate News

OIL signs MoU with HPCL to jointly pursue business opportunities ONGC to file prospectus for ~`12,000cr FPO by early next month Muthoot Finance to raise `1,000cr via NCD issue UTV seeks CCI approval for merger with Walt Disney NIIT Technologies acquires Spanish firm Proyecta Sistemas de Informacion SA

Source: Economic Times, Business Standard, Business Line, Financial Express, Mint

August 17, 2011

Market Outlook | India Research

Research Team Tel: 022-3935 7800 E-mail: research@angelbroking.com Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

Address: 6th Floor, Ackruti Star, Central Road, MIDC, Andheri (E), Mumbai - 400 093. Tel: (022) 3935 7800

Angel Broking Ltd: BSE Sebi Regn No : INB 010996539 / CDSL Regn No: IN - DP - CDSL - 234 - 2004 / PMS Regn Code: PM/INP000001546 Angel Capital & Debt Market Ltd: INB 231279838 / NSE FNO: INF 231279838 / NSE Member code -12798 Angel Commodities Broking (P) Ltd: MCX Member ID: 12685 / FMC Regn No: MCX / TCM / CORP / 0037 NCDEX : Member ID 00220 / FMC Regn No: NCDEX / TCM / CORP / 0302

August 17, 2011

Anda mungkin juga menyukai

- Market Outlook 13th September 2011Dokumen4 halamanMarket Outlook 13th September 2011Angel BrokingBelum ada peringkat

- Market Outlook 4th August 2011Dokumen4 halamanMarket Outlook 4th August 2011Angel BrokingBelum ada peringkat

- Market Outlook 12th October 2011Dokumen4 halamanMarket Outlook 12th October 2011Angel BrokingBelum ada peringkat

- Market Outlook 13th December 2011Dokumen4 halamanMarket Outlook 13th December 2011Angel BrokingBelum ada peringkat

- Market Outlook 15th September 2011Dokumen4 halamanMarket Outlook 15th September 2011Angel BrokingBelum ada peringkat

- Market Outlook: India Research Dealer's DiaryDokumen4 halamanMarket Outlook: India Research Dealer's DiaryAngel BrokingBelum ada peringkat

- Market Outlook 19th August 2011Dokumen3 halamanMarket Outlook 19th August 2011Angel BrokingBelum ada peringkat

- Market Outlook 5th September 2011Dokumen4 halamanMarket Outlook 5th September 2011Angel BrokingBelum ada peringkat

- Market Outlook 5th August 2011Dokumen4 halamanMarket Outlook 5th August 2011Angel BrokingBelum ada peringkat

- Market Outlook 6th January 2012Dokumen4 halamanMarket Outlook 6th January 2012Angel BrokingBelum ada peringkat

- Market Outlook 22nd November 2011Dokumen4 halamanMarket Outlook 22nd November 2011Angel BrokingBelum ada peringkat

- Market Outlook 23rd December 2011Dokumen4 halamanMarket Outlook 23rd December 2011Angel BrokingBelum ada peringkat

- Market Outlook 2nd September 2011Dokumen4 halamanMarket Outlook 2nd September 2011anon_8523690Belum ada peringkat

- Market Outlook 29th December 2011Dokumen3 halamanMarket Outlook 29th December 2011Angel BrokingBelum ada peringkat

- Market Outlook 27th September 2011Dokumen3 halamanMarket Outlook 27th September 2011angelbrokingBelum ada peringkat

- Market Outlook: Dealer's DiaryDokumen5 halamanMarket Outlook: Dealer's DiaryVaibhav BhadangeBelum ada peringkat

- Market Outlook: Dealer's DiaryDokumen4 halamanMarket Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- Market Outlook 5th January 2012Dokumen3 halamanMarket Outlook 5th January 2012Angel BrokingBelum ada peringkat

- Market Outlook 11th January 2012Dokumen4 halamanMarket Outlook 11th January 2012Angel BrokingBelum ada peringkat

- Market Outlook 7th September 2011Dokumen3 halamanMarket Outlook 7th September 2011Angel BrokingBelum ada peringkat

- Market Outlook 16th March 2012Dokumen4 halamanMarket Outlook 16th March 2012Angel BrokingBelum ada peringkat

- Market Outlook 7th March 2012Dokumen4 halamanMarket Outlook 7th March 2012Angel BrokingBelum ada peringkat

- Market Outlook 17th January 2012Dokumen6 halamanMarket Outlook 17th January 2012Angel BrokingBelum ada peringkat

- Market Outlook 25th August 2011Dokumen3 halamanMarket Outlook 25th August 2011Angel BrokingBelum ada peringkat

- Market Outlook 26th August 2011Dokumen3 halamanMarket Outlook 26th August 2011Angel BrokingBelum ada peringkat

- Market Outlook 20th December 2011Dokumen4 halamanMarket Outlook 20th December 2011Angel BrokingBelum ada peringkat

- Market Outlook 14th September 2011Dokumen4 halamanMarket Outlook 14th September 2011Angel BrokingBelum ada peringkat

- Market Outlook 6th March 2012Dokumen3 halamanMarket Outlook 6th March 2012Angel BrokingBelum ada peringkat

- Market Outlook: Dealer's DiaryDokumen4 halamanMarket Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- Market Outlook 4th October 2011Dokumen3 halamanMarket Outlook 4th October 2011Angel BrokingBelum ada peringkat

- Market Outlook 24th November 2011Dokumen3 halamanMarket Outlook 24th November 2011Angel BrokingBelum ada peringkat

- Market Outlook 28th March 2012Dokumen4 halamanMarket Outlook 28th March 2012Angel BrokingBelum ada peringkat

- Market Outlook 29th November 2011Dokumen3 halamanMarket Outlook 29th November 2011Angel BrokingBelum ada peringkat

- Market Outlook 5th October 2011Dokumen4 halamanMarket Outlook 5th October 2011Angel BrokingBelum ada peringkat

- Market Outlook 24th August 2011Dokumen4 halamanMarket Outlook 24th August 2011Angel BrokingBelum ada peringkat

- Market Outlook 29th March 2012Dokumen3 halamanMarket Outlook 29th March 2012Angel BrokingBelum ada peringkat

- Market Outlook 13th March 2012Dokumen4 halamanMarket Outlook 13th March 2012Angel BrokingBelum ada peringkat

- Market Outlook 22nd August 2011Dokumen4 halamanMarket Outlook 22nd August 2011Angel BrokingBelum ada peringkat

- Market Outlook 12th January 2012Dokumen4 halamanMarket Outlook 12th January 2012Angel BrokingBelum ada peringkat

- Market Outlook: India Research Dealer's DiaryDokumen3 halamanMarket Outlook: India Research Dealer's DiaryAngel BrokingBelum ada peringkat

- Market Outlook 6th September 2011Dokumen4 halamanMarket Outlook 6th September 2011Angel BrokingBelum ada peringkat

- IIP Update-July 2012Dokumen4 halamanIIP Update-July 2012Angel BrokingBelum ada peringkat

- Market Outlook 22nd December 2011Dokumen4 halamanMarket Outlook 22nd December 2011Angel BrokingBelum ada peringkat

- Market Outlook 26th September 2011Dokumen3 halamanMarket Outlook 26th September 2011Angel BrokingBelum ada peringkat

- Market Outlook 17.11.11Dokumen3 halamanMarket Outlook 17.11.11Angel BrokingBelum ada peringkat

- Market Outlook 17th February 2012Dokumen4 halamanMarket Outlook 17th February 2012Angel BrokingBelum ada peringkat

- Market Outlook 30th Decmber 2011Dokumen3 halamanMarket Outlook 30th Decmber 2011Angel BrokingBelum ada peringkat

- Market Outlook 14th March 2012Dokumen3 halamanMarket Outlook 14th March 2012Angel BrokingBelum ada peringkat

- Market Outlook 20th September 2011Dokumen4 halamanMarket Outlook 20th September 2011Angel BrokingBelum ada peringkat

- Market Outlook 18th August 2011Dokumen3 halamanMarket Outlook 18th August 2011Angel BrokingBelum ada peringkat

- Market Outlook 11th August 2011Dokumen4 halamanMarket Outlook 11th August 2011Angel BrokingBelum ada peringkat

- Market Outlook 20th March 2012Dokumen3 halamanMarket Outlook 20th March 2012Angel BrokingBelum ada peringkat

- Market Outlook 2nd November 2011Dokumen8 halamanMarket Outlook 2nd November 2011Angel BrokingBelum ada peringkat

- Market Outlook 2nd August 2011Dokumen6 halamanMarket Outlook 2nd August 2011Angel BrokingBelum ada peringkat

- Derivatives Report 17th August 2011Dokumen3 halamanDerivatives Report 17th August 2011Angel BrokingBelum ada peringkat

- Market Outlook 8th September 2011Dokumen4 halamanMarket Outlook 8th September 2011Angel BrokingBelum ada peringkat

- Market Outlook 30th September 2011Dokumen3 halamanMarket Outlook 30th September 2011Angel BrokingBelum ada peringkat

- Market Outlook 24th February 2012Dokumen4 halamanMarket Outlook 24th February 2012Angel BrokingBelum ada peringkat

- Market Outlook 23rd September 2011Dokumen4 halamanMarket Outlook 23rd September 2011Angel BrokingBelum ada peringkat

- WPIInflation August2013Dokumen5 halamanWPIInflation August2013Angel BrokingBelum ada peringkat

- Oilseeds and Edible Oil UpdateDokumen9 halamanOilseeds and Edible Oil UpdateAngel BrokingBelum ada peringkat

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokumen4 halamanRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingBelum ada peringkat

- Technical & Derivative Analysis Weekly-14092013Dokumen6 halamanTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Special Technical Report On NCDEX Oct SoyabeanDokumen2 halamanSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingBelum ada peringkat

- Metal and Energy Tech Report November 12Dokumen2 halamanMetal and Energy Tech Report November 12Angel BrokingBelum ada peringkat

- International Commodities Evening Update September 16 2013Dokumen3 halamanInternational Commodities Evening Update September 16 2013Angel BrokingBelum ada peringkat

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokumen6 halamanCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingBelum ada peringkat

- Daily Agri Tech Report September 14 2013Dokumen2 halamanDaily Agri Tech Report September 14 2013Angel BrokingBelum ada peringkat

- Daily Metals and Energy Report September 16 2013Dokumen6 halamanDaily Metals and Energy Report September 16 2013Angel BrokingBelum ada peringkat

- Daily Agri Report September 16 2013Dokumen9 halamanDaily Agri Report September 16 2013Angel BrokingBelum ada peringkat

- Currency Daily Report September 16 2013Dokumen4 halamanCurrency Daily Report September 16 2013Angel BrokingBelum ada peringkat

- Daily Agri Tech Report September 16 2013Dokumen2 halamanDaily Agri Tech Report September 16 2013Angel BrokingBelum ada peringkat

- Commodities Weekly Tracker 16th Sept 2013Dokumen23 halamanCommodities Weekly Tracker 16th Sept 2013Angel BrokingBelum ada peringkat

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokumen4 halamanDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingBelum ada peringkat

- IIP CPIDataReleaseDokumen5 halamanIIP CPIDataReleaseAngel BrokingBelum ada peringkat

- Derivatives Report 16 Sept 2013Dokumen3 halamanDerivatives Report 16 Sept 2013Angel BrokingBelum ada peringkat

- Market Outlook 13-09-2013Dokumen12 halamanMarket Outlook 13-09-2013Angel BrokingBelum ada peringkat

- Market Outlook: Dealer's DiaryDokumen13 halamanMarket Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- Technical Report 13.09.2013Dokumen4 halamanTechnical Report 13.09.2013Angel BrokingBelum ada peringkat

- Sugar Update Sepetmber 2013Dokumen7 halamanSugar Update Sepetmber 2013Angel BrokingBelum ada peringkat

- Derivatives Report 8th JanDokumen3 halamanDerivatives Report 8th JanAngel BrokingBelum ada peringkat

- Metal and Energy Tech Report Sept 13Dokumen2 halamanMetal and Energy Tech Report Sept 13Angel BrokingBelum ada peringkat

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokumen1 halamanPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingBelum ada peringkat

- TechMahindra CompanyUpdateDokumen4 halamanTechMahindra CompanyUpdateAngel BrokingBelum ada peringkat

- MetalSectorUpdate September2013Dokumen10 halamanMetalSectorUpdate September2013Angel BrokingBelum ada peringkat

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokumen4 halamanJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingBelum ada peringkat

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokumen6 halamanTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingBelum ada peringkat

- MarketStrategy September2013Dokumen4 halamanMarketStrategy September2013Angel BrokingBelum ada peringkat

- Daily Agri Tech Report September 06 2013Dokumen2 halamanDaily Agri Tech Report September 06 2013Angel BrokingBelum ada peringkat

- Third Party Insurance Under Motor Vehicle Insurance:Recent ChangesDokumen19 halamanThird Party Insurance Under Motor Vehicle Insurance:Recent ChangesSneha Singh100% (1)

- Executive SummaryDokumen2 halamanExecutive SummaryPrateek GoelBelum ada peringkat

- Harley Davidson CaseDokumen7 halamanHarley Davidson CasekapilovichBelum ada peringkat

- KL 900 Details SpecsDokumen4 halamanKL 900 Details SpecsbenBelum ada peringkat

- Airbus A400M AtlasDokumen12 halamanAirbus A400M AtlasAviationaddictBelum ada peringkat

- Service+manual+s068 Rev.1.0 EngDokumen72 halamanService+manual+s068 Rev.1.0 Engtoasterzapper100% (1)

- Auto Parts Industry MexicoDokumen39 halamanAuto Parts Industry MexicoAna Celene RojasBelum ada peringkat

- ACMA Annual Report 2012-13Dokumen91 halamanACMA Annual Report 2012-13Shubham BadgujjarBelum ada peringkat

- Henry FordDokumen3 halamanHenry FordVince ReyesBelum ada peringkat

- Hs 799 ShortDokumen1 halamanHs 799 ShortLevi LittleBelum ada peringkat

- m25 Axial Piston Motor Series 40Dokumen24 halamanm25 Axial Piston Motor Series 40mstan11Belum ada peringkat

- Toyota Motor CorporationDokumen12 halamanToyota Motor CorporationSonu Avinash SinghBelum ada peringkat

- Full - Retrofit and Reconditioning of 40T & 60T EOT CRANEDokumen40 halamanFull - Retrofit and Reconditioning of 40T & 60T EOT CRANEKhalid Mustafa100% (1)

- Report Maruti-SuzukiDokumen79 halamanReport Maruti-SuzukiHarshit gargBelum ada peringkat

- Price Adjustment StrategiesDokumen4 halamanPrice Adjustment StrategiesFatin AfifaBelum ada peringkat

- Latihan Soal StatistikaDokumen14 halamanLatihan Soal StatistikaArgantha Bima WisesaBelum ada peringkat

- Marketing Project Report On Hero CycleDokumen54 halamanMarketing Project Report On Hero Cycleguriqbal singh89% (9)

- Cat 3412eDokumen4 halamanCat 3412eEd Calhe100% (1)

- California License Fee ExtortionDokumen1 halamanCalifornia License Fee ExtortionPaul SalzmanBelum ada peringkat

- Transmission Oils For Transport MiningDokumen37 halamanTransmission Oils For Transport MiningJuan Luis Rojas100% (1)

- Tata Nexon ECM, Model NameNumber 2019Dokumen1 halamanTata Nexon ECM, Model NameNumber 2019Travel EverydayBelum ada peringkat

- Merritt Morning Market-Dec16-#2246Dokumen2 halamanMerritt Morning Market-Dec16-#2246Kim LeclairBelum ada peringkat

- LIST OF YGC and AYALA COMPANIESDokumen3 halamanLIST OF YGC and AYALA COMPANIESJibber JabberBelum ada peringkat

- EATON R Series Parts InformationDokumen8 halamanEATON R Series Parts Informationa04205Belum ada peringkat

- Torque Wrench Pliers: Snap-On Tools PVT LTDDokumen5 halamanTorque Wrench Pliers: Snap-On Tools PVT LTDInamMuradBelum ada peringkat

- ChaleurRegion-PoirierDokumen88 halamanChaleurRegion-PoirierMehdi Bel HajBelum ada peringkat

- Solved You Have Decided That You Are Going To Consume 600Dokumen1 halamanSolved You Have Decided That You Are Going To Consume 600M Bilal SaleemBelum ada peringkat

- Service Operation Project On Maruti SuzukiDokumen12 halamanService Operation Project On Maruti SuzukiPoonam GuptaBelum ada peringkat

- Raise Your Miata PDFDokumen3 halamanRaise Your Miata PDF4lexxBelum ada peringkat

- Proposal 6HDokumen21 halamanProposal 6Hrsp5105Belum ada peringkat