CH 1-Review Notes

Diunggah oleh

Tariq EbadiDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CH 1-Review Notes

Diunggah oleh

Tariq EbadiHak Cipta:

Format Tersedia

CHAPTER 1 OVERVIEW

1. Chapter 1 describes the environment that has influenced both the development and use of the financial accounting process. The chapter traces the development of financial accounting standards, focusing on the groups that have had or currently have the responsibility for developing such standards. Certain groups other than those with direct responsibility for developing financial accounting standards have significantly influenced the standard-setting process. These various pressure groups are also discussed in Chapter 1. Nature of Financial Accounting 2. (S.O. 1)Financial accounting is the process that culminates in the preparation of financial reports on the enterprise for use by both internal and external parties. 3. Financial statements are the principal means through which a company communicates its financial information to those outside it. The financial statements most frequently provided are (1) the balance sheet, (2) the income statement, (3) the statement of cash flows, and (4) the statement of owners or stockholders equity. Other means of financial reporting include the presidents letter or supplementary schedules in the corporate annual report, prospectuses, and reports filed with government agencies. 4. (S.O. 2)Accounting is important for markets, free enterprise, and competition because it assists in providing information that leads to capital allocation. The better the information, the more effective the process of capital allocation and then the healthier the economy. 5. (S.O. 3)The challenges facing financial accounting are the following: a. Nonfinancial measurements such as customer satisfaction indexes, backlog information, and reject rates on goods purchased. b. Forward-looking information. c. Soft assets. d. Timeliness. 6. (S.O. 4)The objectives of financial accounting are to provide information that: a. is useful to present and potential investors and creditors and other users in making rational investment, credit, and similar decisions; b. helps present and potential investors, creditors, and other users assess the amounts, timing, and uncertainty of prospective cash receipts from

dividends or interest and the proceeds from the sale, redemption, or maturity of securities or loans; and c. clearly portrays the economic resources of an enterprise, the claims to those resources, and the effects of transactions, events, and circumstances that change its resources and claims to those resources. 7. (S.O. 5)The accounting profession has developed a common set of standards and procedures known as generally accepted accounting principles (GAAP). These principles serve as a general guide to the accounting practitioner in accumulating and reporting the financial information of a business enterprise. Securities and Exchange Commission (SEC) 8. (S.O. 6)After the stock market crash in 1929 and the Great Depression, there were calls for increased government regulation and supervision especially of financial institutions and the stock market. As a result, the federal government established the Securities and Exchange Commission (SEC). The SEC is a federal agency and administers the Securities Exchange Act of 1934 and several other acts. Most companies that issue securities to the public or are listed on a stock exchange are required to file audited financial statements with the SEC. In addition, the SEC has broad powers to prescribe the accounting practices and standards to be employed by companies that fall within its jurisdiction. 9. At the time the SEC was created, it encouraged the creation of a private standards-setting body. As a result, accounting standards have generally been developed in the private sector either through the American Institute of Certified Public Accountants (AICPA) or the Financial Accounting Standards Board (FASB). The SEC has affirmed its support for the FASB by indicating that financial statements conforming to standards set by the FASB will be presumed to have substantial authoritative support. 10. Over its history, the SECs involvement in the development of accounting standards has varied. In some cases, the private sector has attempted to establish a standard, but the SEC has refused to accept it. In other cases, the SEC has prodded the private sector into taking quicker action on setting standards. 11. If the SEC believes that an accounting or disclosure irregularity exists regarding a companys financial statements, the SEC sends a deficiency letter to the company. If the companys response to the deficiency letter proves unsatisfactory, the SEC has the power to issue a stop order, which prevents the registrant from issuing securities or trading securities on the exchanges. Criminal charges may also be brought by the Department of Justice.

The AICPA and Development of Accounting Principles 12. The first group appointed by the AICPA to address the issue of uniformity in accounting practice was the Committee on Accounting Procedure (CAP). This group served the accounting profession from 1939 to 1959. During that period it issued 51 Accounting Research Bulletins (ARBs) that narrowed the wide range of alternative accounting practices then in existence. 13. In 1959, the AICPA created the Accounting Principles Board (APB). The major purposes of this group were (a) to advance the written expression of accounting principles, (b) to deter-mine appropriate practices, and (c) to narrow the areas of difference and inconsistency in practice. The APB was designated as the AICPAs sole authority for public pronouncements on accounting principles. Its pronouncements, known as APB Opinions, were intended to be based mainly on research studies and be supported by reasons and analysis. The FASB 14. The APB operated in a somewhat hostile environment for 13 years. Early in its existence it was criticized for overreacting to certain issues. A committee, known as the Study Group on Establishment of Accounting Principles (Wheat Committee), was set up to study the APB and recommend changes in its structure and operation. The result of the Study Groups findings was the demise of the APB and the creation of the Financial Accounting Standards Board (FASB). The FASB represents the current rule-making body within the accounting profession. 15. The mission of the FASB is to establish and improve standards of financial accounting and reporting for the guidance and education of the public, which includes issuers, auditors, and users of financial information. The FASB differs from the predecessor APB in the following ways: a. Smaller membership (5 versus 18 on the APB). b. Full-time remunerated membership (APB members were unpaid and part-time). c. Greater autonomy (APB was a senior committee of the AICPA). d. Increased independence (FASB members must sever all ties with firms, companies, or institutions). e. Broader representation (it is not necessary to be a CPA to be a member of the FASB). Two basic premises of the FASB are that in establishing financial accounting standards: (a) it should be responsive to the needs and viewpoints of the entire economic community, not just the public accounting profession, and (b) it should operate in full view of the public through a due

process system that gives interested persons ample opportunity to make their views known. 16. The FASB issues three major types of pronouncements: a. Standards, Interpretations, and Staff Positions. b. Financial Accounting Concepts. c. Emerging Issues Task Force Statements. The Standards, Interpretations, and Staff Positions are considered GAAP and must be followed in practice in the same manner as APB Opinions. The Statements of Financial Accounting Concepts (SFAC) represent an attempt to move away from the problem-by-problem approach to standard setting that has been characteristic of the accounting profession. The Concept Statements are intended to form a cohesive set of interrelated concepts, a conceptual framework, that will serve as tools for solving existing and emerging problems in a consistent manner. Unlike FASB statements, the Concept Statements do not establish GAAP. 17. In 1984, the FASB created the Emerging Issues Task Force (EITF). The purpose of the Task Force is to reach a consensus on how to account for new and unusual financial transactions that have the potential for creating differing financial reporting practices. The EITF can deal with short-term accounting issues by reaching a consensus and thus avoiding the need for deliberation by the FASB and the issuance of an FASB Statement. 18. When the FASB was established, the AICPA established the Accounting Standards Division to act as its official voice on accounting and reporting issues. Within the Division the Accounting Standards Executive Committee (AcSEC) was established and spoke through its written communications called Audit and Accounting Guidelines, Statements of Position (SOP) and Practice Bulletins. Recently the role of the AICPA has diminished. After a transition period the AICPA and AcSEC no longer will issue authoritative accounting guidance for public companies. In addition the Sarbanes-Oxley Act of 2002 requires the Public Company Accounting Oversight Board (PCAOB) to oversee the development of auditing standards. 19. (S.O. 7)Generally accepted accounting principles (GAAP) are those principles that have substantial authoritative support. Accounting principles that have substantial authoritative support are those found in FASB Statements, Interpretations, and Staff Positions; APB Opinions; and Accounting Research Bulletins (ARBs). If an accounting transaction is not covered in any of these documents, the accountant may look to other authoritative accounting literature for guidance. 20. The FASB developed the Financial Accounting Standards Board Accounting Standards Codification to provide in one place all the authoritative literature related to a particular topic. The Codification changes the way GAAP is

documented, presented, and updated. The Codification is a major restructuring of accounting and reporting standards. 21. (S.O. 8)Although accounting standards are developed by using careful logic and empirical findings, a certain amount of pressure and influence is brought to bear by groups interested in or affected by accounting standards. The FASB does not exist in a vacuum, and politics and special-interest pressures remain a part of the standard-setting process. 22. Along with establishing the PCAOB, the Sarbanes-Oxley Act implements stronger independence rules for auditors, requires CEOs and CFOs to personally certify that financial statements and disclosures are accurate and complete, requires audit committees to be comprised of independent members, and requires a code of ethics for senior financial officers. In addition, the Sarbanes-Oxley Act requires public companies to attest to the effectiveness of their internal controls over financial reporting. 23. Most countries have recognized the need for more global standards. The International Accounting Standards Board (IASB) and U.S. rule-making bodies are working together to reconcile U.S. GAAP with the IASB Standards. The FASB and the IASB agreed to make their existing financial reporting standards fully compatible as soon as practicable, and coordinate their future work programs to ensure that once achieved, compatibility is maintained. 24. (S.O. 9)In accounting ethical dilemmas are encountered frequently. The whole process of ethical sensitivity and selection among alternatives can be complicated by pressures that may take the form of time pressures, job pressures, client pressures, personal pressures, and peer pressures. Throughout the textbook, ethical considerations are presented to sensitize you to the type of situations you may encounter in your profession.

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Irish Rover - ViolinDokumen1 halamanIrish Rover - ViolinWalter CastagnoBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Business Blue PrintDokumen65 halamanBusiness Blue PrintRahul100% (1)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Audit PlanningDokumen6 halamanAudit PlanningFrancis Martin90% (10)

- 3-Step Google SEO - Learn How To Get Your Website To Thetop of Google.Dokumen5 halaman3-Step Google SEO - Learn How To Get Your Website To Thetop of Google.YourSeo RankingBelum ada peringkat

- What Are Internal Controls, Internal Audit, Internal Check Etc.Dokumen9 halamanWhat Are Internal Controls, Internal Audit, Internal Check Etc.Iswarya SivakumarBelum ada peringkat

- Infosys Life CycleDokumen6 halamanInfosys Life CycleraghupadhyaBelum ada peringkat

- Guidance and Comparison Between 60950-1 and 62368-1Dokumen164 halamanGuidance and Comparison Between 60950-1 and 62368-1meirsag100% (2)

- The What, Why, and How of Master Data ManagementDokumen10 halamanThe What, Why, and How of Master Data ManagementSorin100% (3)

- Chapter 6a Prospecting - The Lifeblood of SellingDokumen39 halamanChapter 6a Prospecting - The Lifeblood of SellingVinodh100% (1)

- Cad Wor X Error NumbersDokumen71 halamanCad Wor X Error Numbersberrima bilelBelum ada peringkat

- Failure of Nokia Full Report.Dokumen23 halamanFailure of Nokia Full Report.MadhurKumar100% (2)

- Summary Reminder PhrasesDokumen2 halamanSummary Reminder PhrasesSaurabh Bansal BansalBelum ada peringkat

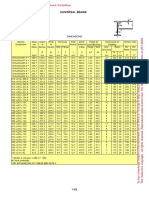

- Section TableDokumen44 halamanSection TableMohammed BarniBelum ada peringkat

- Hero Digital UK Digital Marketing Agency Surrey Online PDFDokumen1 halamanHero Digital UK Digital Marketing Agency Surrey Online PDFTanbin AnowerBelum ada peringkat

- Marketing Plan TemplateDokumen3 halamanMarketing Plan TemplateLawrence Qholloi StrydomBelum ada peringkat

- Demystifying Social Media: Roxane Divol, David Edelman, and Hugo SarrazinDokumen11 halamanDemystifying Social Media: Roxane Divol, David Edelman, and Hugo SarrazinGa AgBelum ada peringkat

- Event Plan MemoDokumen4 halamanEvent Plan MemoAnn StimsonBelum ada peringkat

- A Study of E-Filing of Income Tax ReturnsDokumen4 halamanA Study of E-Filing of Income Tax ReturnsAnsh BhallaBelum ada peringkat

- Evergreen Group Social Enterprise Partnership For DevelopmentDokumen2 halamanEvergreen Group Social Enterprise Partnership For DevelopmentRobbenHtoonBelum ada peringkat

- Preface: AcknowledgementDokumen58 halamanPreface: AcknowledgementTahira KhanBelum ada peringkat

- Statement of Information (Limited Liability Company) - Firepower Records LLCDokumen1 halamanStatement of Information (Limited Liability Company) - Firepower Records LLCAnonymous iGVhBFCMMBelum ada peringkat

- Audit Evidence and Documentation: Mcgraw-Hill/IrwinDokumen32 halamanAudit Evidence and Documentation: Mcgraw-Hill/IrwinSyed Zulqarnain HaiderBelum ada peringkat

- Marketing Test 1Dokumen7 halamanMarketing Test 1LaurenBelum ada peringkat

- Tally MCQ 1Dokumen11 halamanTally MCQ 1rs0100100% (4)

- Business To Business Marketing ManagementDokumen1 halamanBusiness To Business Marketing ManagementLara Michelle Sanday BinudinBelum ada peringkat

- Acquisitions ResearchDokumen11 halamanAcquisitions Researchamit_myfuture0% (1)

- Fujitsu MarquageDokumen11 halamanFujitsu MarquageLuis Alejandro LeonBelum ada peringkat

- Weekly Time Sheet: Company Name/LogoDokumen2 halamanWeekly Time Sheet: Company Name/LogorupinderdsdBelum ada peringkat

- h1b Companylist ToapplyDokumen120 halamanh1b Companylist ToapplybalajisaireddyBelum ada peringkat

- Dimitri Kotov's ResumeDokumen2 halamanDimitri Kotov's ResumeDimitri KotovBelum ada peringkat