D Is Investment

Diunggah oleh

Hinal TejaniDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

D Is Investment

Diunggah oleh

Hinal TejaniHak Cipta:

Format Tersedia

Disinvestment Disinvestment, sometimes referred to as divestment, refers to the use of a concerted economic boycott, with specific emphasis on liquidating

stock, to pressure a government, industry, or company towards a change in policy, or in the case of governments, even regime change. The term was first used in the 1980s, most commonly in the United States, to refer to the use of a concerted economic boycott designed to pressure the government of South Africa into abolishing its policy of apartheid. The term has also been applied to actions targeting Iran, Sudan, Northern Ireland, Myanmar, and Israel. What Does Disinvestment Mean? 1. The action of an organization or government selling or liquidating an asset or subsidiary. Also known as "divestiture".

2. A reduction in capital expenditure, or the decision of a company not to replenish depleted capital goods.

Investopedia explains Disinvestment 1. A company or government organization will divest an asset or subsidiary as a strategic move for the company, planning to put the proceeds from the divestiture to better use that garners a higher return on investment.

2. A company will likely not replace capital goods or continue to invest in certain assets unless it feels it is receiving a return that justifies the investment. If there is a better place to invest, they may deplete certain capital goods and invest in other more profitable assets.

Alternatively a company may have to divest unwillingly if it needs cash to sustain operations In finance and economics,divestmentor divestitureis the reduction of some kind of assetfor either financial or ethical objectives or sale of an existing business by a firm. A divestment is the opposite of aninvestment. Motives Firms may have several motives for divestitures. First, a firm may divest (sell) businesses that are not part of its core operations so that it can focus on what it does best. For example,

Eastman Kodak , Ford Motor Company , and many other firms have sold various businesses that were not closely related to their core businesses. A second motive for divestitures is to obtain funds. Divestitures generate funds for the firm because it is selling one of its businesses in exchange for cash. For example, CSX Corporation made divestitures to focus on its core railroad business and also to obtain funds so that it could pay off some of its existing debt. A third motive for divesting is that a firm's "break-up" value is sometimes believed to be greater than the value of the firm as a whole. In other words, the sum of a firm's individual asset liquidation values exceeds the market value of the firm's combined assets. This encourages firms to sell off what would be worth more when liquidated than when retained. A fourth motive to divest a part of a firm may be to create stability. Philips , for example, divested its chip division called NXP because the chip market was so volatile and unpredictable that NXP was responsible for the majority of Philips's stock fluctuations while it represented only a very small part of Philips NV. A fifth motive for firms to divest a part of the company is that a division is under-performing or even

failing. A sixth reason to divest could be forced on to the firm by the regulatory authorities, example in order to create competition.

Methods of disinvestment Strategic sale: For example say u have company Reliance which has many other business such as Chemicals, Construction, Retail etc. then in this only it s Chemicals business is going well and it s retail business

is going down then he will sell-off the whole retail business to infuse money in it s good going business Chemicals

Capital markets:

Through ipo or private placement to corporate Example of private placement Say maruti buys a stake of 40% in the Hero Honda motors Reduction in Equity Buy back of shares .i.e buying back the shares from the market or from the company to whom it is issued in case of private placement through an offer of price per share over and above the market price or say at Premium Conversion of shares into other instruments Trade sale In this a company does it so to acquire profits from the business buy selling the

whole business to the one making offer. It is different from strategic sale as in this case whole company say from above example Reliance is sold not only his one business. Asset sale and winding up s losses may sell all it s asset and wind up[

In this case the company to cover it the company to pay losses.

Management or employee buyout In this case the management of company or it s employees buy out the company

shares in the proportion of their contribution given to buy the shares. De-merger or spin-off Spin-off A spin-out refers to a type of corporate action where a company "splits off" sections of itself as a separate business. The common definition of spin-out is when a division of a company or organization becomes an independent business. The "spin-out" company takes assets, intellectual property , technology , and/or existing products from the parent organization. Many times the management

team of the new company are from the same parent organization. Often, a spin-out offers the opportunity for a division to be backed by the company but not be affected by the parent company's image or history, giving potential to take existing ideas that had been languishing in an old environment and help them grow in a new environment. In most cases, the parent company or organization offers support doing one or more of the following:

investing equity in the new firm,

being the first customer of the spin-out (helps to create cash flow),

providing incubation space (desk, chairs, phones, internet access, etc.) or

providing services such as legal, finance, technology, etc. All the support from the parent company is provided with the explicit purpose of helping the spinout grow. Demerger In this case a company forming a subsidiary under it s head which gives diret ownership to it s shareholder s of parent company .For example,Tata motors

have subsidiary making it s autoparts component which it demerges and forms as a separate entity in this case upon it s conversion from subsidiary to main

company every shareholder of Tata Motors co. will receive a share in proportion decided by company against shares hold in Tata motors.

Anda mungkin juga menyukai

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Legal DD Checklist PDFDokumen9 halamanLegal DD Checklist PDFbestdealsBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Accounting Capital+Stock+TransactionsDokumen17 halamanAccounting Capital+Stock+TransactionsOckouri BarnesBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Lista Unitati Reparatoare IndependenteDokumen6 halamanLista Unitati Reparatoare IndependenteCsaba CsapoBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Priyanshu DecemberDokumen2 halamanPriyanshu DecemberYash PathakBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- A Note On Valuation For Venture CapitalDokumen14 halamanA Note On Valuation For Venture Capital/jncjdncjdnBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

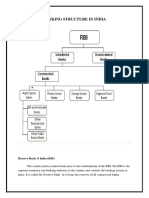

- Banking Structure in IndiaDokumen49 halamanBanking Structure in IndiaAjay RapelliBelum ada peringkat

- New York Stock ExchangeDokumen14 halamanNew York Stock ExchangeGautam VishwanathBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Introduction To ValuationDokumen11 halamanIntroduction To ValuationThe GravityBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Other Forms of Corporate RestructuringDokumen16 halamanOther Forms of Corporate RestructuringDominic100% (1)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Group Structure Chart: Valentino S.P.ADokumen1 halamanGroup Structure Chart: Valentino S.P.APraveen KumarBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Transpo Cases 150 ListDokumen4 halamanTranspo Cases 150 ListDenni Dominic Martinez LeponBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- ZOMATO 11012024165126 ZomatoIntimationSignedDokumen2 halamanZOMATO 11012024165126 ZomatoIntimationSignedbimacag338Belum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- How Can Our Insight Help You Identify and Evaluate Your Next Deal Opportunity?Dokumen20 halamanHow Can Our Insight Help You Identify and Evaluate Your Next Deal Opportunity?aggarwal.aki123Belum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- IT Sector What Doing in Past Five Years: By-Akash KambleDokumen8 halamanIT Sector What Doing in Past Five Years: By-Akash KambleKunal WaghmareBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Enterprise Value AnalysisDokumen9 halamanEnterprise Value AnalysissanjayBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- 2013 2 History of Sun LifeDokumen10 halaman2013 2 History of Sun LifeJayan OommenBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Memorandum of Association - Company Law - BBA - MantraDokumen5 halamanMemorandum of Association - Company Law - BBA - MantrabhupenderBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Organisation Commerce Notes of H.S.C.Dokumen176 halamanOrganisation Commerce Notes of H.S.C.Rajan Anthony Parayar78% (9)

- Accounting Chapter 9Dokumen7 halamanAccounting Chapter 9Angelica Faye DuroBelum ada peringkat

- Correspondent BanksDokumen4 halamanCorrespondent BankscharrisedelarosaBelum ada peringkat

- PortFolioEqtAllDokumen34 halamanPortFolioEqtAllPrasanta Kumar GoswamiBelum ada peringkat

- Pharma Companies by StateDokumen8 halamanPharma Companies by StateMuhammad Farhan KhanBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- LLC Formation Comparison: Delaware vs. TennesseeDokumen48 halamanLLC Formation Comparison: Delaware vs. TennesseenowayBelum ada peringkat

- The Benefits and Costs of Controlling Shareholders: The Rise and Fall of ParmalatDokumen26 halamanThe Benefits and Costs of Controlling Shareholders: The Rise and Fall of ParmalatUmar RazakBelum ada peringkat

- Summary of Responses: Learner's AnswersDokumen7 halamanSummary of Responses: Learner's AnswersjamesngBelum ada peringkat

- Erajaya Ar 2019 Final Preview PDFDokumen356 halamanErajaya Ar 2019 Final Preview PDFFransesco PelealuBelum ada peringkat

- Cs Project ReportpdfDokumen49 halamanCs Project ReportpdfShanu AggarwalBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Winding Up of Visa Power Ltd.Dokumen9 halamanWinding Up of Visa Power Ltd.RishikaBelum ada peringkat

- Post Merger IntegrationDokumen22 halamanPost Merger Integrationharshnika100% (1)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)