UTI Taxreckoner

Diunggah oleh

Raghu RaoDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

UTI Taxreckoner

Diunggah oleh

Raghu RaoHak Cipta:

Format Tersedia

#

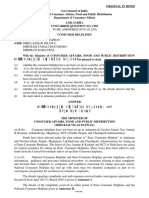

TAX RECKONER

Source & Selection Methodology: www.superbrandindia.com

Investor category

Equity Oriented Funds

Other than Equity Oriented Funds (except money market & Liquid Fund)

Money Market & Liquid Funds

Investors other than Foreign Institutional Investors(FIIs)

Nil {subject to Securities Transaction Tax @ 0.25% (STT)}

Long Term Capital Gains

As applicable for other than @ 10% without cost inflation index benefit or 20% with cost inflation index Equity Funds benefit whichever is lower + applicable Surcharges + education cess (@ 2% on income tax and surcharge) + secondary and higher education cess (@ 1% on income tax and surcharge) @ 10% + applicable Surcharges + education cess (@ 2% onincome tax and surcharge) + secondary and higher education cess (@ 1% on income tax and surcharge) Normal rates to tax as applicable to assessee As applicable for other than Equity Funds

FIIs

Nil subject to STT

Investors other than FIIs

Short Term Capital Gains

@ 15% + applicable Surcharges + education cess (@ 2% on income tax and surcharge) + secondary and higher education cess (@ 1% on income tax and surcharge) subject to STT @ 15% + applicable Surcharges + education cess (@ 2% on income tax and surcharge) + secondary and higher education cess (@ 1% on income tax and surcharge) subject to STT

As applicable for other than Equity Funds

FIIs

@ 30% + applicable Surcharges + education cess (@ 2% onincome tax and surcharge) + secondary and higher education cess (@ 1% on income tax and surcharge)

As applicable for other than Equity Funds

Dividend

Tax Free Individuals and HUFs

Tax Free Nil

Tax Free @ 12.5% + Surcharges @ 5% + education cess (@ 2% on income tax and surcharge) + secondary and higher education cess (@ 1% on income tax and surcharge i.e. 13.5188%)

Tax Free @ 25% + Surcharges @ 5% + education cess (@ 2% on income tax and surcharge) + secondary and higher education cess (@ 1% on income tax and surcharge i.e. 27.0375%) @ 30% + Surcharges @ 5% + education cess (@ 2% on income tax and surcharge) + secondary and higher education cess (@ 1% on income tax and surcharge i.e. 32.445%)

Dividend Distribution Tax

Others

Nil

@ 30% + Surcharges @ 5% + education cess (@ 2% on income tax and surcharge) + secondary and higher education cess (@ 1% on income tax and surcharge i.e. 32.445%)

SURCHARGE - (i) for Domestic Company - @5% of income tax if net income during a financial year exceeds Rs. 100 lacs (ii) Foreign Company - @ 2% of income tax if net income during a financial year exceeds Rs. 100 lacs (iii) For othes - Nil. The position of taxation is as per prevalent tax laws on income tax as on 01st June 2011. Prior to making any investment transaction kindly refer the SID of the respective Scheme & SAI for other tax provisions.

The tax rates provided herein are based on UTI Mutual Funds understanding of the tax laws and only for the purpose of providing general information to the investors of the Mutual Fund Schemes (Schemes). As in the case with any investment there can be no guarantee that the tax position prevailing at the time of investment in the Schemes will endure indefinitely. Further the tax rates mentioned herein are mere expressions of option and are not representations of the Mutual Fund to induce any investor to acquire units whether directly from the Mutual Fund or indirectly from any other persons by the secondary market operations. Thus the prospective investors should not treat the contents herein as advice relating to taxation matter and are advised to consult his or her own tax consultant with respect to the specific tax rates and implications arising out of his or her participation in the Schemes.

Toll Free: 1800 22 1230 Email: invest@uti.co.in

SMS: INVEST to 5676756 Web: www.utimf.com

Mutual Fund investments are subject to market risks. Please read the offer document carefully before investing.

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Glosario JurídicaDokumen56 halamanGlosario JurídicaMaría Cristina MartínezBelum ada peringkat

- Key Economic Indicators For April 2013Dokumen30 halamanKey Economic Indicators For April 2013Raghu RaoBelum ada peringkat

- Cisco Router PerformanceDokumen5 halamanCisco Router PerformanceabulmamaBelum ada peringkat

- Rel 6.1 Netspan Release NotesDokumen23 halamanRel 6.1 Netspan Release NotesRaghu RaoBelum ada peringkat

- CFM Product Line BrochureDokumen4 halamanCFM Product Line Brochurevadims_sapcenkoBelum ada peringkat

- HDFC Asset Management Company LimitedDokumen32 halamanHDFC Asset Management Company LimitedRaghu RaoBelum ada peringkat

- Hindi Song ListDokumen31 halamanHindi Song ListRaghu RaoBelum ada peringkat

- Privateer Press' PIP Codes List - BooksDokumen3 halamanPrivateer Press' PIP Codes List - BooksMarko DimitrovicBelum ada peringkat

- Company Law - Lecture Notes Definition of A "Company"Dokumen105 halamanCompany Law - Lecture Notes Definition of A "Company"namukuve aminaBelum ada peringkat

- School AllotDokumen1 halamanSchool Allotamishameena294Belum ada peringkat

- Abayan, Angela Christine M. Bsba-Ma 4 SAP 6:31-8:01 TTHDokumen16 halamanAbayan, Angela Christine M. Bsba-Ma 4 SAP 6:31-8:01 TTHarbejaybBelum ada peringkat

- Velasco V People GR No. 166479Dokumen2 halamanVelasco V People GR No. 166479Duko Alcala EnjambreBelum ada peringkat

- UST GOLDEN NOTES 2011-InsuranceDokumen35 halamanUST GOLDEN NOTES 2011-InsuranceAnthonette MijaresBelum ada peringkat

- Global MigrationDokumen39 halamanGlobal MigrationLiane Francesita Mendoza100% (1)

- Bài Tập Unit 4Dokumen7 halamanBài Tập Unit 4Nguyễn Lanh AnhBelum ada peringkat

- Luminous PrayersDokumen23 halamanLuminous PrayersRiaz Mohamed RasheedBelum ada peringkat

- Mihkksdrk Ekeys) (KK - VKSJ Lkoztfud Forj.K Ea HDokumen4 halamanMihkksdrk Ekeys) (KK - VKSJ Lkoztfud Forj.K Ea HsettiBelum ada peringkat

- Book No. 3 Ashraf Ali Thanvi Attestation & Al Muhannad (FINAL)Dokumen47 halamanBook No. 3 Ashraf Ali Thanvi Attestation & Al Muhannad (FINAL)Kabeer AhmedBelum ada peringkat

- Was The WWII A Race War?Dokumen5 halamanWas The WWII A Race War?MiBelum ada peringkat

- Lolita Enrico Vs Heirs of Spouses Eulogio Medinaceli and Trinidad MedinaceliDokumen1 halamanLolita Enrico Vs Heirs of Spouses Eulogio Medinaceli and Trinidad MedinaceliVincent Quiña PigaBelum ada peringkat

- Epstein Exhibit 16Dokumen16 halamanEpstein Exhibit 16Hannah NightingaleBelum ada peringkat

- British Collectors Banknotes 1 PDFDokumen104 halamanBritish Collectors Banknotes 1 PDFRafael VegaBelum ada peringkat

- Introduction and Summary: ListedDokumen118 halamanIntroduction and Summary: Listedkcc2012Belum ada peringkat

- Grade 11 Entreprenuership Module 1Dokumen24 halamanGrade 11 Entreprenuership Module 1raymart fajiculayBelum ada peringkat

- Travel Mgt. CompaniesDokumen64 halamanTravel Mgt. CompaniesIris100% (1)

- Adopt-A-Barangay ProgramDokumen2 halamanAdopt-A-Barangay ProgramRonald Candy Lasaten100% (1)

- Accounting Standard - 22Dokumen25 halamanAccounting Standard - 22themeditator100% (1)

- Knapp St. Safety Petition 1Dokumen5 halamanKnapp St. Safety Petition 1WXMIBelum ada peringkat

- The Competition (Amendment) Act, 2023Dokumen21 halamanThe Competition (Amendment) Act, 2023Rahul JindalBelum ada peringkat

- Relevancy of Facts: The Indian Evidence ACT, 1872Dokumen3 halamanRelevancy of Facts: The Indian Evidence ACT, 1872Arun HiroBelum ada peringkat

- Fortigate 400f SeriesDokumen10 halamanFortigate 400f SeriesDaniel MontanoBelum ada peringkat

- Original Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full ChapterDokumen41 halamanOriginal Aucm Accounting For Decision Making 4E Wiley E Text For Deakin Full Chapterbetty.neverson777100% (26)

- Family Law 1 Final Project TopicsDokumen2 halamanFamily Law 1 Final Project TopicsSiddharth100% (4)

- Investing in The Philippine Stock MarketDokumen13 halamanInvesting in The Philippine Stock MarketJohn Carlo AquinoBelum ada peringkat

- Equatorial Realty Development, Inc. v. Mayfair Theater, IncDokumen3 halamanEquatorial Realty Development, Inc. v. Mayfair Theater, IncJm SantosBelum ada peringkat

- River Plate and Brazil Conferences v. Pressed Steel Car Company, Inc., Federal Maritime Board, Intervening, 227 F.2d 60, 2d Cir. (1955)Dokumen6 halamanRiver Plate and Brazil Conferences v. Pressed Steel Car Company, Inc., Federal Maritime Board, Intervening, 227 F.2d 60, 2d Cir. (1955)Scribd Government DocsBelum ada peringkat