Amvpb3579l Form16a 2012-13 Q1

Diunggah oleh

Vishal BhardwajDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Amvpb3579l Form16a 2012-13 Q1

Diunggah oleh

Vishal BhardwajHak Cipta:

Format Tersedia

Tax Information Network of Income Tax Department

Certificate No.: FEDLMP Last Updated 06/08/2011

FORM NO.16A

[See rule 31(1)(b)] Certificate under section 203 of the Income-tax Act, 1961 for Tax deducted at source Name and address of the Deductor AMWAY INDIA ENTERPRISES PRIVATE LIMITED PLOT NO 5 DDA LOCAL SHOPPING CENTRE, OKHLA COMMERCIAL COMPLEX PHASE II, NEW DELHI DELHI 110020 PAN of the Deductor AAACA5603Q CIT (TDS) The Commissioner of Income Tax (TDS) Aayakar Bhawan District Centre, 6th Floor Room no 610 Hall no. 4, Luxmi Nagar Delhi 110092 Summary of Payment Amount paid/credited ( ) 6,711.00 3,109.00 3,538.00 Nature of payment 194H - Commission or Brokerage 194H - Commission or Brokerage 194H - Commission or Brokerage Date of payment/credit (dd/mm/yyyy) 30/04/2011 31/05/2011 30/06/2011 Status of Booking MATCHED MATCHED MATCHED Name and address of the Deductee BHARDWAJ VISHAL NO 587 9TH A MAIN ROAD, INDIRANAGAR IST STAGE, BANGALORE KARNATAKA 560038 TAN of the Deductor DELA12367F Assessment Year From 2012-13 01/04/2011 30/06/2011 PAN of the Deductee AMVPB3579L Period To

Summary of tax deducted at source in respect of deductee Quarter Receipt Numbers of original quarterly statements of TDS under sub-section (3) of section 200 DOWXCDKA Amount of tax deducted in respect of the deductee ( ) 1,336.00 Amount of tax deposited/ remitted in respect of the deductee ( ) 1,336.00

Q1

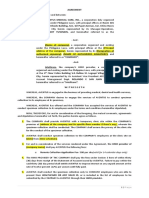

I. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN(The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee) S. No. Tax Deposited in respect of the deductee ( ) ) N.A. Book Identification number (BIN) Receipt numbers of Form No. 24G DDO sequence Number in the Book Adjustment Mini Statement N.A. Date on which tax deposited (dd/mm/yyyy) Status of Booking

Total (

II. DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN (The deductor to provide payment wise details of tax deducted and deposited with respect to the deductee S. No. Tax Deposited in respect of the deductee ( ) 671.00 311.00 354.00 ) 1,336.00 Verification I, Ankur Sharma, son/daughter of Sh. Sarvjeet Sharma working in the capacity of Manager - Tax (designation) do hereby certify that a sum of ( ) 1,336.00 [Rupees One Thousand Three Hundred Thirty Six only] has been deducted and a sum of ( ) 1,336.00 [Rupees One Thousand Three Hundred Thirty Six only] has been deposited to the credit of the Central Government. I further certify that the information given above is true, complete and correct and is based on the books of account, documents, TDS statements, TDS deposited and other available records. Place Date New Delhi 08/08/2011 Signature of person responsible for deduction of tax Challan Identification number (CIN) BSR Code of the Bank Branch 0004329 0004329 0004329 Date on which tax deposited (dd/mm/yyyy) 06/05/2011 06/06/2011 06/07/2011 Challan Serial Number 6328 18408 25500 Status of Booking

1 2 3 Total (

MATCHED MATCHED MATCHED

Page 1 of 2

Tax Information Network of Income Tax Department

TAN of the Deductor DELA12367F PAN of the Deductee AMVPB3579L Assessment Year 2012-13 Quarter Q1

Certificate No.: FEDLMP

Last Updated 06/08/2011

Notes: 1. Government deductors to fill information in item I if tax is paid without production of an Income-tax challan and in item II if tax is paid accompanied by an income-tax challan. 2. Non-Government deductors to fill information in item II. 3. In item I and II, in the column for TDS, give total amount for TDS, Surcharge (if applicable) and education cess. 4. The deductor shall furnish the address of the Commissioner of Income-tax (TDS) having jurisdiction as regards TDS statements of the assessee. 5. This Form shall be applicable only in respect of tax deducted on or after 1st day of April, 2010.

Signature Not Verified

Page 2 of 2

Digitally signed by ANKUR SHARMA Date: 2011.08.09 11:28:46 IST

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Ias Our Dram Gs NotesDokumen129 halamanIas Our Dram Gs Notesbalu56kvBelum ada peringkat

- Pil Delhi High CourtDokumen12 halamanPil Delhi High CourtDevasish Bisht100% (1)

- Case Digest - Section 2GDokumen2 halamanCase Digest - Section 2Gquasideliks100% (1)

- Lululemon V CK - ComplaintDokumen42 halamanLululemon V CK - ComplaintSarah BursteinBelum ada peringkat

- Great White Shark Enterprises v. Caralde, Jr. GR No. 192294 2012 (DIGEST)Dokumen4 halamanGreat White Shark Enterprises v. Caralde, Jr. GR No. 192294 2012 (DIGEST)Nicky Botor100% (1)

- Phrase StructureDokumen24 halamanPhrase StructureTanveer AkramBelum ada peringkat

- DOJ Hands Over Unredacted Mueller ReportDokumen5 halamanDOJ Hands Over Unredacted Mueller ReportWashington Examiner50% (2)

- 105-Executive Secretary v. Southern Heavy Industries Inc., February 20, 2006Dokumen13 halaman105-Executive Secretary v. Southern Heavy Industries Inc., February 20, 2006Jopan SJBelum ada peringkat

- Arizona Chamber of Commerce Vs Hospital Executive Salary Cap InitiativeDokumen55 halamanArizona Chamber of Commerce Vs Hospital Executive Salary Cap Initiativepaul weichBelum ada peringkat

- Mallari Vs CADokumen1 halamanMallari Vs CACeCe EmBelum ada peringkat

- Tuazon Vs ReyesDokumen2 halamanTuazon Vs ReyesVenice SantibañezBelum ada peringkat

- #3 Merida Vs PeopleDokumen3 halaman#3 Merida Vs PeopleCess Bustamante Adriano100% (1)

- TS Sneha - 1497 - 6th Sem - NUALS - LabourLaw - ProjectDokumen11 halamanTS Sneha - 1497 - 6th Sem - NUALS - LabourLaw - Projectyajush tripathiBelum ada peringkat

- July 10th 2014Dokumen84 halamanJuly 10th 2014jorina807100% (1)

- Dresscode For The MasjidDokumen4 halamanDresscode For The MasjidSalemah HasmatallyBelum ada peringkat

- TAX SAVING Form 15g Revised1 SBTDokumen2 halamanTAX SAVING Form 15g Revised1 SBTrkssBelum ada peringkat

- WA and MN V Trump 17-35105 Constitutional Scholars Motion and BriefDokumen29 halamanWA and MN V Trump 17-35105 Constitutional Scholars Motion and Briefsilverbull8Belum ada peringkat

- Instruction Manual CZ 75 SP 01Dokumen19 halamanInstruction Manual CZ 75 SP 01Rocco Volpe100% (2)

- Data Protection Concept NoteDokumen3 halamanData Protection Concept Noteyagnesh2005Belum ada peringkat

- Afi 32 1062Dokumen25 halamanAfi 32 1062José SánchezBelum ada peringkat

- ITT For Supply & Fixing of Conference Table & ChairDokumen17 halamanITT For Supply & Fixing of Conference Table & ChairAnshuman AgrawalBelum ada peringkat

- En Banc: TEODULO V. LARGO, G.R. No. 177244Dokumen10 halamanEn Banc: TEODULO V. LARGO, G.R. No. 177244pdalingayBelum ada peringkat

- Mock Bar Examination Questions in Criminal LawDokumen2 halamanMock Bar Examination Questions in Criminal LawSarah Tarala MoscosaBelum ada peringkat

- Feb Leasing V-BaylonDokumen2 halamanFeb Leasing V-BaylonronaldBelum ada peringkat

- The Denied Community Rights of The Acadian MetisDokumen5 halamanThe Denied Community Rights of The Acadian MetisAppce EcfpaBelum ada peringkat

- Prachi GasDokumen4 halamanPrachi Gassamsa28Belum ada peringkat

- Chapter 3 The Information AgeDokumen24 halamanChapter 3 The Information AgeMARK LOUIE SUGANOBBelum ada peringkat

- Service Minute Programme Officers - EnglishDokumen14 halamanService Minute Programme Officers - EnglishsadagobankBelum ada peringkat

- Aventus Specimen Moa Updated 2019Dokumen2 halamanAventus Specimen Moa Updated 2019laniBelum ada peringkat

- Understanding The Sarbanes-Oxley Act and Its ImpactDokumen3 halamanUnderstanding The Sarbanes-Oxley Act and Its ImpactKatieYoungBelum ada peringkat