Summary On Bloomberg Business Week Magazine

Diunggah oleh

Abhishek RaneDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Summary On Bloomberg Business Week Magazine

Diunggah oleh

Abhishek RaneHak Cipta:

Format Tersedia

Summary On Bloomberg Business Week Magazine

India Raises Rates, Breaks Ranks With BRICs By Kartik Goyal Indias central bank raised interest rates for the 12th time since the start of March 2010, breaking ranks among the so-called BRIC nations that have either cut or held borrowing costs as the global recovery falters. The Reserve Bank of India increased the repurchase rate to 8.25 percent from 8 percent, it said in a statement today. Fourteen of 17 economists in a Bloomberg News survey predicted the decision and three expected no change. Governor Duvvuri Subbaraos move contrasts with Brazil and Russia, which cut borrowing costs in the past month, while China has paused rate increases since early July. Higher food and fuel prices and weakness in the rupee may keep inflation above 9 percent, a level exceeded in each of the last nine months. The decision clearly points out that the RBIs top priority is curbing inflation despite concerns about global turmoil, said Indranil Sen Gupta, Mumbai-based emerging Asia economist at Bank of America Corp. There will be pressure on inflation after last evenings petrol-price increases and the rupees depreciation. The yield on the 7.8 percent bond due April 2021 rose 1 basis point, or 0.01 percentage point, to 8.34 percent at 12:44 p.m. in Mumbai. The Bombay Stock Exchange Sensitive Index gained 1 percent. The rupee advanced 0.1 percent to 47.50 per dollar. As monetary policy operates with a lag, the cumulative impact of policy actions should now be increasingly felt in further moderation in demand and reversal of the inflation trajectory towards the later part of 2011-12, the central bank statement showed.

Three Tax Perks That Should End With or Without Jobs Plan

1

Summary On Bloomberg Business Week Magazine

By the Editors In detailing how to pay for his $447 billion jobs plan, President Barack Obama put on the table three tax reforms hes previously proposed. If the president gets no points for originality, give him credit for sound thinking. All three measures are worth adopting. Most notably, Obamas plan suggests saving $32 billion over 10 years by repealing federal tax breaks for the oil and gas industry. These were written over the past 98 years to help what was once a volatile industry. Breaks for oil companies were created, for example, to keep older fields producing when the price of oil was low or to attract investors to the historically risky business of drilling exploratory wells. Today, such benefits cost taxpayers money while no longer serving a public purpose. We are not opposed to government incentives to business, but they ought to encourage activity in the nations interest that otherwise wouldnt occur. The U.S. oil industry needs no incubation. Its a mature business that does not require a helping hand from the government to find oil and deliver it to consumers. Oil prices are robust and will probably stay high because of rising demand from China, India and other emerging economies. Marketplace rewards, not government tax credits, encourage entrepreneurs to drill. And modern technologies have greatly reduced the risks associated with finding oil since the intangible drilling costs tax benefit was put in place in 1913. Industry insiders usually are the last ones to concede that a government subsidy has become unnecessary to their business. Oil executives threaten that, without the concessions, jobs would be lost and prices at the pump would rise. Given that the Big Five oil companies last year made cumulative profits of more than $77 billion, they are essentially threatening that theyll take a multi-billion-dollar annual bonus from the public one way or another. Congress should call that bluff.

France, U.S. Should Push Europe to Strengthen Military

2

Summary On Bloomberg Business Week Magazine

By the Editors French President Nicolas Sarkozys embrace of the North Atlantic Treaty Organization might be the last best chance to reverse the decline in Europes defense capabilities. In an Aug. 31 address to French ambassadors, Sarkozy said that in Libya, NATO turned out to be a crucial tool in the service of our military operations. This is a dramatic change from the traditional French ambivalence toward the alliance. But this new attitude doesnt change the disproportionate share of the burden that the U.S., France and the U.K. bear for NATOs operations. The good news is that by making NATO an important part of his national-security strategy, Sarkozy now has a powerful reason to push other Europeans to contribute their fair share. Sarkozy understands the problem. In the speech, he forcefully decried Europes declining defense capacity and lack of political will. Europeans, he said, must assume more of their responsibilities, or experience a rude awakening. France and the U.K., he noted, account for half of combined defense spending by all members of the European Union. This is unsustainable. France is struggling with budgetary problems, and the French people are unlikely to support robust military spending if other European nations receive a free pass. Sarkozys words are music to the ears of U.S. and NATO officials who have been making this point for years. In the early 1980s, European countries contributed about 33 percent of total NATO defense spending; this year, its about 20 percent. Anders Fogh Rasmussen, the alliances secretary-general and a former prime minister of Denmark, has said Europes unwillingness to pay for defense means it will have less influence internationally and less capability to resolve cross- border disputes.

Dithering European Leaders Are Defaulting to European Central Bank By the Editors

3

Summary On Bloomberg Business Week Magazine

If this summer has shown us anything, it is this: Europes leaders are unwilling, unprepared or unable to take the necessary measures to solve the continents financial crisis. More and more, it seems, the well- being of world markets rests with the European Central Bank. The latest developments in Greece, where a bailout package adopted in July is threatening to fall apart, make clear the danger of the piecemeal solutions that have been deployed so far. Austerity measures are deepening the Greek recession, lessening the governments chances of paying its debts. European stocks are gyrating, and Italian bond yields have been rising again as investors worry that the trouble could spread to banks and larger governments. Meanwhile, European voters are wearying of failed bailouts, eroding the already limited ability of elected leaders to solve the euro areas problems. As Bloomberg News reported, German officials are talking about contingency plans to protect their banks in the event of a Greek default, suggesting that they think -- as U.S. officials did ahead of the Lehman Brothers Holdings Inc. bankruptcy in 2008 -- that a bit of foam on the runway might suffice. They are woefully mistaken. The market reaction to a disorderly Greek default would put pressure on other countries -including Spain, Italy and possibly even France, with a combined total of more than 5 trillion euros in sovereign debt -- to do the same. The resulting losses for Europes thinly capitalized banks, and for the U.S. institutions that have lent them hundreds of billions of dollars, could trigger a credit freeze bad enough to send the world economy into a deep recession.

9/11, American Values and the Challenges That Lie Ahead By the Editors

4

Summary On Bloomberg Business Week Magazine

It is tempting to hope that the 10th anniversary of the Sept. 11 attacks will serve as a cathartic moment, allowing Americans to turn a page on the worries and errors of the last 10 years without diminishing the successes. But history has no pages. Instead, as we head into the decade after the decade after, our goal should be to look at global terrorism with a sharp eye and a clear head The coarseness that marked aspects of U.S. conduct in the world after Sept. 11 -including a sometimes tragic disregard for the rights of innocents ensnared in a global war against terrorists -- may be understandable. However, much of the world, including many Americans, concluded that it was not excusable. And as the trepidation over another attack receded, the rough edge of American fear was too easily turned inward, with domestic politics assuming a sometimes vicious tone. Over more than two centuries, American democracy has shown a talent for selfcorrection. Time and again, moral shortcomings have been confronted and our society elevated; political excesses of right or left have been supplanted by reason and moderation; an instinct toward adventure or overreach has been overcome. The memory of those who died is eternal, but the shadows of 9/11 are not. In the midst of a global economic crisis rises an Arab Spring and new hopes. The threat of Islamic extremism did not die with Osama bin Laden. Vigilance, judiciously practiced, is still required. Those who would do the U.S. harm will continue, to the best of their dwindling abilities, to find the chinks in our armor. There will be more attacks against the U.S. and its interests, at home and abroad, and some will succeed. This nation has faced a decade-long test of its values, governance and role in the world, with mixed results. Americans have shown great resilience, and with renewed moral force, our full faith in ourselves and our institutions will be redeemed. That, our enemies know, is the ultimate victory.

Anda mungkin juga menyukai

- A Spectre Is Rising. To Bury It Again, Barack Obama Needs To Take The LeadDokumen5 halamanA Spectre Is Rising. To Bury It Again, Barack Obama Needs To Take The Leadirfan shafiqueBelum ada peringkat

- Robert Nemy International 5Dokumen3 halamanRobert Nemy International 5Robert NemyBelum ada peringkat

- 01-15-09 Nation-The Crisis Is Global by William GreiderDokumen2 halaman01-15-09 Nation-The Crisis Is Global by William GreiderMark WelkieBelum ada peringkat

- MARKETS CRISIS EURO US Will The U.S. and Europe Rise Again - or Sink Together - Wharton Oct 2011 2866Dokumen3 halamanMARKETS CRISIS EURO US Will The U.S. and Europe Rise Again - or Sink Together - Wharton Oct 2011 2866Julie OneillBelum ada peringkat

- Issue 31 Citigroup CEO Vikram Pandit Suggests New Way To Gauge RiskDokumen6 halamanIssue 31 Citigroup CEO Vikram Pandit Suggests New Way To Gauge RiskrajuandramaBelum ada peringkat

- Global Market Outlook July 2011Dokumen8 halamanGlobal Market Outlook July 2011IceCap Asset ManagementBelum ada peringkat

- Trinity 2012Dokumen23 halamanTrinity 2012Ling JiaBelum ada peringkat

- Reinventing Economic and Financial PolicyDokumen10 halamanReinventing Economic and Financial PolicySFLDBelum ada peringkat

- Risks and Obstacles: Risks To The U.S. Dollar and EconomyDokumen4 halamanRisks and Obstacles: Risks To The U.S. Dollar and Economysukhmeet singhBelum ada peringkat

- Microsoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Dokumen5 halamanMicrosoft India The Best Employer: Randstad: What Are The Differences Between Closed Economy and Open Economy ?Subramanya BhatBelum ada peringkat

- The Impending Monetary Revolution, the Dollar and GoldDari EverandThe Impending Monetary Revolution, the Dollar and GoldBelum ada peringkat

- U.S. Debt: The Next Financial Crisis?: Journal of Economics, Finance and International BusinessDokumen12 halamanU.S. Debt: The Next Financial Crisis?: Journal of Economics, Finance and International BusinessJhon ArriagaBelum ada peringkat

- Textos Desafios InglesDokumen20 halamanTextos Desafios InglesVanderson Souza PinhoBelum ada peringkat

- Daily Tel ObamaDokumen4 halamanDaily Tel ObamaDonato PaglionicoBelum ada peringkat

- The Global Economy: A Game of Four Halves?: Driving Forward TogetherDokumen22 halamanThe Global Economy: A Game of Four Halves?: Driving Forward Togetherapi-109061352Belum ada peringkat

- Rethinking Globalization - NotesDokumen13 halamanRethinking Globalization - NotesLana HBelum ada peringkat

- With The U.S. EconomyDokumen4 halamanWith The U.S. EconomyBasavaraj PujariBelum ada peringkat

- Bus Tim May 2709 Glob Fix PublDokumen3 halamanBus Tim May 2709 Glob Fix Publchorpharn4269Belum ada peringkat

- Four Nations Four LessonsDokumen3 halamanFour Nations Four Lessonsnaveen261084Belum ada peringkat

- IMF's Bold Recipe For Recovery: TagsDokumen5 halamanIMF's Bold Recipe For Recovery: TagsKrishna SumanthBelum ada peringkat

- Nvestment Ompass: Quarterly CommentaryDokumen4 halamanNvestment Ompass: Quarterly CommentaryPacifica Partners Capital ManagementBelum ada peringkat

- Bob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011Dokumen4 halamanBob Chapman The European Debt Crisis The Creditors Are America's Too Big To Fail Wall Street Banksters 26 10 2011sankaratBelum ada peringkat

- Never Accept Economic Truths Merely Because Somebody Said SoDokumen3 halamanNever Accept Economic Truths Merely Because Somebody Said SoARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Investment Compass - Summer 2011 - Europe, Earnings, and ExpectationsDokumen4 halamanInvestment Compass - Summer 2011 - Europe, Earnings, and ExpectationsPacifica Partners Capital ManagementBelum ada peringkat

- Economic Insights 25 02 13Dokumen16 halamanEconomic Insights 25 02 13vikashpunglia@rediffmail.comBelum ada peringkat

- CFR Insiders Confirm That An Alarming Economic Crisis in The US Is ImminentDokumen12 halamanCFR Insiders Confirm That An Alarming Economic Crisis in The US Is ImminentJeremy JamesBelum ada peringkat

- The Future of The US DollarDokumen10 halamanThe Future of The US Dollar11duongso9Belum ada peringkat

- Globalisation Fractures: How major nations' interests are now in conflictDari EverandGlobalisation Fractures: How major nations' interests are now in conflictBelum ada peringkat

- The King Report: M. Ramsey King Securities, IncDokumen3 halamanThe King Report: M. Ramsey King Securities, InctheFranc23Belum ada peringkat

- g20 Monitor Ma g20 Conflicts Now Need To Be Resolved Not Papered OverDokumen3 halamang20 Monitor Ma g20 Conflicts Now Need To Be Resolved Not Papered OverBruegelBelum ada peringkat

- The Macro Strategist: Starve The Dog To Get Rid of The FleasDokumen5 halamanThe Macro Strategist: Starve The Dog To Get Rid of The FleasMario RossiBelum ada peringkat

- Fear Returns: World EconomyDokumen6 halamanFear Returns: World EconomymuradgwaduriBelum ada peringkat

- Crisis Financiera UsaDokumen10 halamanCrisis Financiera UsaRox BenaducciBelum ada peringkat

- The Big Swerve : 2011 Issue 16 September 15, 2011Dokumen18 halamanThe Big Swerve : 2011 Issue 16 September 15, 2011SteveEvetsBelum ada peringkat

- 5 MythsDokumen6 halaman5 MythsParvesh KhuranaBelum ada peringkat

- Economy DA - MSDI 2019Dokumen99 halamanEconomy DA - MSDI 2019ConnorBelum ada peringkat

- Wien Byron - July 2010 Market Commentary - Smartest ManDokumen4 halamanWien Byron - July 2010 Market Commentary - Smartest ManGlenn BuschBelum ada peringkat

- Economic and Market: A U.S. Recession?Dokumen16 halamanEconomic and Market: A U.S. Recession?dpbasicBelum ada peringkat

- Global EconomyDokumen1 halamanGlobal EconomyRai FahadBelum ada peringkat

- Martin Wolf ColumnDokumen6 halamanMartin Wolf Columnpriyam_22Belum ada peringkat

- The Absolute Return Letter 0911Dokumen9 halamanThe Absolute Return Letter 0911bhrijeshBelum ada peringkat

- May Allah S.W.T Guide Us Through This Financial Crisis.: Universiti Kebangsaan Malaysia Fakulti Undang-UndangDokumen21 halamanMay Allah S.W.T Guide Us Through This Financial Crisis.: Universiti Kebangsaan Malaysia Fakulti Undang-Undangmusbri mohamedBelum ada peringkat

- Introduction The Global Financial CrisisDokumen8 halamanIntroduction The Global Financial CrisisremivictorinBelum ada peringkat

- Running on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItDari EverandRunning on Empty: How the Democratic and Republican Parties Are Bankrupting Our Future and What Americans Can Do About ItPenilaian: 3.5 dari 5 bintang3.5/5 (22)

- AusterityDokumen11 halamanAusterityscriberoneBelum ada peringkat

- China and the US Foreign Debt Crisis: Does China Own the USA?Dari EverandChina and the US Foreign Debt Crisis: Does China Own the USA?Belum ada peringkat

- MPRA Paper 28387Dokumen15 halamanMPRA Paper 28387Tasos KaratasiosBelum ada peringkat

- The Truth About Trade: What Critics Get Wrong About The Global EconomyDokumen8 halamanThe Truth About Trade: What Critics Get Wrong About The Global EconomyMirjamBelum ada peringkat

- 3 Way Split ArticleDokumen3 halaman3 Way Split ArticlesumairjawedBelum ada peringkat

- Greece ScenariosDokumen6 halamanGreece Scenariosletsgogators10Belum ada peringkat

- Global Financial Crisis and Sri LankaDokumen5 halamanGlobal Financial Crisis and Sri LankaRuwan_SuBelum ada peringkat

- Steering Out of The Crisis: Robert WadeDokumen8 halamanSteering Out of The Crisis: Robert WadegootliBelum ada peringkat

- Bob Chapman The European Ponzi Scheme and The Euro 4 1 2012Dokumen5 halamanBob Chapman The European Ponzi Scheme and The Euro 4 1 2012sankaratBelum ada peringkat

- Follow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsDari EverandFollow the Money: Fed Largesse, Inflation, and Moon Shots in Financial MarketsBelum ada peringkat

- May 312010 PostsDokumen25 halamanMay 312010 PostsAlbert L. PeiaBelum ada peringkat

- Final ExamDokumen4 halamanFinal ExamLeticia ScheinkmanBelum ada peringkat

- America for Sale: Fighting the New World Order, Surviving a Global Depression, and Preserving USA SovereigntyDari EverandAmerica for Sale: Fighting the New World Order, Surviving a Global Depression, and Preserving USA SovereigntyPenilaian: 4 dari 5 bintang4/5 (4)

- CIR V. Isabela Cultural Corp.: GR NO 172231 February 12, 2007Dokumen2 halamanCIR V. Isabela Cultural Corp.: GR NO 172231 February 12, 2007Mary AnneBelum ada peringkat

- Form 3251BDokumen2 halamanForm 3251BHarish ChandBelum ada peringkat

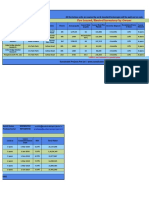

- Statement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceDokumen2 halamanStatement of Account: Date Narration Chq./Ref - No. Value DT Withdrawal Amt. Deposit Amt. Closing BalanceEklavya GuptaBelum ada peringkat

- PayslipDokumen1 halamanPayslipprathmeshBelum ada peringkat

- Dokumen - Tips r12 Overview of Oracle Asset ManagementDokumen36 halamanDokumen - Tips r12 Overview of Oracle Asset ManagementCuong Thai HuyBelum ada peringkat

- Presentation On Business Icon: by Ankita Sthapak Roll No.57Dokumen9 halamanPresentation On Business Icon: by Ankita Sthapak Roll No.57Ankita SthapakBelum ada peringkat

- APC Corporation Exercises Chapter 10Dokumen5 halamanAPC Corporation Exercises Chapter 10AnnGabrielleUretaBelum ada peringkat

- KPMG - IFRS vs. US GAAP - RD CostsDokumen8 halamanKPMG - IFRS vs. US GAAP - RD CoststomasslrsBelum ada peringkat

- CICI Securities LTD Is An Integrated Securities Firm Offering A Wide Range of Services Including Investment BankingDokumen5 halamanCICI Securities LTD Is An Integrated Securities Firm Offering A Wide Range of Services Including Investment Bankingsa20004Belum ada peringkat

- 02 Project SelectionDokumen32 halaman02 Project SelectionShamsul AlamBelum ada peringkat

- Payroll Summary For The Month of AugustDokumen46 halamanPayroll Summary For The Month of AugustAida MohammedBelum ada peringkat

- CFAS Quiz Questions AddedDokumen2 halamanCFAS Quiz Questions AddedSaeym SegoviaBelum ada peringkat

- Bacc 404 Ass 1Dokumen6 halamanBacc 404 Ass 1Denny ChakauyaBelum ada peringkat

- How To Secure BIR Importer Clearance CertificateDokumen6 halamanHow To Secure BIR Importer Clearance CertificateEmely SolonBelum ada peringkat

- Mba IimDokumen3 halamanMba IimYashwanth Reddy YathamBelum ada peringkat

- Revew ExercisesDokumen40 halamanRevew Exercisesjose amoresBelum ada peringkat

- Business-Today 200920 PDFDokumen94 halamanBusiness-Today 200920 PDFPriyabrataTaraiBelum ada peringkat

- 7011 Accounting January 2010Dokumen40 halaman7011 Accounting January 2010raziejazBelum ada peringkat

- General Credit v. Alsons DigestDokumen2 halamanGeneral Credit v. Alsons Digestershaki100% (4)

- Interim ReportDokumen20 halamanInterim ReportanushaBelum ada peringkat

- Chapter 15: Risk and Information: - Describing Risky Outcome - Basic ToolsDokumen38 halamanChapter 15: Risk and Information: - Describing Risky Outcome - Basic ToolsrheaBelum ada peringkat

- Sustainable Pre Leased 06122019Dokumen2 halamanSustainable Pre Leased 06122019vaibhav vermaBelum ada peringkat

- Steps in Accounting CycleDokumen34 halamanSteps in Accounting Cycleahmad100% (4)

- MRK - Fall 2019 - HRM630 - 1 - MC180203268Dokumen2 halamanMRK - Fall 2019 - HRM630 - 1 - MC180203268Z SulemanBelum ada peringkat

- Alpha Graphics CompanyDokumen2 halamanAlpha Graphics CompanyMira FebriasariBelum ada peringkat

- Module 3Dokumen22 halamanModule 3Suprita Karajgi100% (1)

- 1BRNEA2022002Dokumen64 halaman1BRNEA2022002Nguyễn Xuân ThượngBelum ada peringkat

- AACAP - Exercise 2Dokumen4 halamanAACAP - Exercise 2sharielles /Belum ada peringkat

- MT 199 Maribel Gonzalez 27 06 22Dokumen2 halamanMT 199 Maribel Gonzalez 27 06 22ULRICH VOLLERBelum ada peringkat

- Pefindo'S Corporate Default and Rating Transition Study (1996 - 2010)Dokumen21 halamanPefindo'S Corporate Default and Rating Transition Study (1996 - 2010)Theo VladimirBelum ada peringkat