Lloyd's of London Has Pulled Deposits From European Banks

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Lloyd's of London Has Pulled Deposits From European Banks

Hak Cipta:

Format Tersedia

Lloyds of London has pulled deposits from European banks

Lloyds of London, the worlds oldest insurance market, has pulled deposits from European banks on concerns governments may be unable to support lenders in a worsening debt crisis, Finance Director Luke Savage said. There are a lot of banks who, because of the uncertainty around Europe, the market has stopped using to place deposits with, Savage said today in a telephone interview. If youre worried the government itself might be at risk, then youre certainly worried the banks could be taken down with them. European banks are trying to reassure investors and customers they have enough capital to withstand a default by Greece and slowing economic growth caused by governments austerity measures. Siemens AG (SIE), Europeans biggest engineering company, withdrew short-term deposits from Societe Generale SA, Frances secondlargest bank, in July, a person with knowledge of the matter said yesterday. Lloyds, which holds about a third of its 2.5 billion pounds ($3.9 billion) of central assets in cash, has stopped depositing money with some banks in Europes peripheral economies, Savage said, declining to name the countries or institutions. We have a very conservatively positioned balance sheet, Savage said. Lloyds also holds about a third of its assets in mainly U.S. and U.K. government bonds and a third in corporate bonds, he said. The insurance market The insurance market, founded in a London coffee house in 1688, swung to a 697 million-pound pretax loss in the six months to June 30 after the most expensive first half for natural disasters on record. The market made a profit of 628 million pounds in the same period a year earlier, the London-based market said in a statement today. These are tough times for the insurance industry, but we are well positioned to handle them, Chief Executive Officer Richard Ward said in the statement. While interest rates

are low and equity markets are volatile, we cant rely on investment income to subsidize our underwriting. We must decline under- priced risks. Insurers profits have been hurt by natural catastrophes, including the earthquake and tsunami that struck Japan in March, causing record insured losses of $70 billion in the first half of the year, according to broker Guy Carpenter & Co. At the same time, record low interest rates are crimping investment returns. The insurance markets made 548 million pounds on its investments in the period, 8.2 percent lower than in the first half of 2010 as interest rates in the U.K., U.S. and the euro zone neared record lows. I cannot see any reasonable prospect of making decent investment income in the medium term, Savage said. Lloyds had a combined ratio of 113.3 percent in the first half, meaning for every pound it took in premiums, it paid out 1.13 pounds in claims. That worsened from 98.7 percent in the first half of 2010. The loss was much better than our peer group exposed to the same catastrophes, Savage said. Bermuda insurers combined ratio was 117 percent for the period and U.S. reinsurers posted a ratio of 116 percent, Lloyds said. (source: Bloomberg) Sept. 24. 2011

Mircea Halaciuga, Esq. 0040724581078 Financial news - Eastern Europe

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Prudential Regulation Authority ("PRA") Supervision of International Banks ActionsDokumen4 halamanPrudential Regulation Authority ("PRA") Supervision of International Banks ActionsARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Bank Supervision - Outlook and TrendsDokumen10 halamanBank Supervision - Outlook and TrendsARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- A Two-Speed Europe in 2021Dokumen3 halamanA Two-Speed Europe in 2021ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Articol - Ziaristi de InvestigatieDokumen7 halamanArticol - Ziaristi de InvestigatieARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Mrs. Lagarde: "Progress To Reform The EU System Was Too Slow. "Dokumen4 halamanMrs. Lagarde: "Progress To Reform The EU System Was Too Slow. "ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- "What's Up Doc" in This "Union" That's Not A Union in Fact But Is Called The European UnionDokumen4 halaman"What's Up Doc" in This "Union" That's Not A Union in Fact But Is Called The European UnionARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- My Judgment On This Sinful WorldDokumen11 halamanMy Judgment On This Sinful WorldARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- German Economy Is StrugglingDokumen2 halamanGerman Economy Is StrugglingARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Europe's Determination To Stay With The Common Currency Will Play An Important Role in How The Euro Crisis Unfolds in 2013Dokumen3 halamanEurope's Determination To Stay With The Common Currency Will Play An Important Role in How The Euro Crisis Unfolds in 2013ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- The European Central Bank Could Adopt Negative Interest Rates or Purchase Assets From Banks If NeededDokumen4 halamanThe European Central Bank Could Adopt Negative Interest Rates or Purchase Assets From Banks If NeededARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- The Crisis Has Dealt A Blow To Europe's Rosy ImageDokumen5 halamanThe Crisis Has Dealt A Blow To Europe's Rosy ImageARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike Serban100% (1)

- Currency Swap Agreement - China and The European UnionDokumen4 halamanCurrency Swap Agreement - China and The European UnionARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike Serban100% (1)

- A World of Debt - A "Whole City of Sky-Scrapers" of DebtDokumen4 halamanA World of Debt - A "Whole City of Sky-Scrapers" of DebtARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Democratic Politics Is Not Consumer Goods", It Is Citizen Goods".Dokumen3 halamanDemocratic Politics Is Not Consumer Goods", It Is Citizen Goods".ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Hang in There Guys, You're Doing Ok!Dokumen3 halamanHang in There Guys, You're Doing Ok!ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- In Politics, Supply Is Slow To Meet Demand.Dokumen3 halamanIn Politics, Supply Is Slow To Meet Demand.ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Around The World Economies in A Thousand WordsDokumen3 halamanAround The World Economies in A Thousand WordsARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- The "Shadow Economies" in The Crisis-Ridden Countries of The Euro ZoneDokumen3 halamanThe "Shadow Economies" in The Crisis-Ridden Countries of The Euro ZoneARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- The World Bank Cut Its Forecast For Growth in 2014Dokumen3 halamanThe World Bank Cut Its Forecast For Growth in 2014ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike Serban100% (1)

- A Euro Zone "Disaster" Was Averted But Only Temporarily, Was The Verdict On 2012.Dokumen2 halamanA Euro Zone "Disaster" Was Averted But Only Temporarily, Was The Verdict On 2012.ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- The Cyprus Agreement Did Not Require Ratification by The Cypriot ParliamentDokumen3 halamanThe Cyprus Agreement Did Not Require Ratification by The Cypriot ParliamentARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Private Equity Alert Mezzanine Finance in Central & Eastern Europe 102009Dokumen3 halamanPrivate Equity Alert Mezzanine Finance in Central & Eastern Europe 102009ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike Serban100% (1)

- Euro Zone Monetary Policy Can Only Buy More TimeDokumen4 halamanEuro Zone Monetary Policy Can Only Buy More TimeARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Greece Is A "Test" Site For What It Is To Follow For EuropeDokumen2 halamanGreece Is A "Test" Site For What It Is To Follow For EuropeARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- A Closer Fiscal Union Needs To Be Arranged Before The ECB Is Granted More PowersDokumen3 halamanA Closer Fiscal Union Needs To Be Arranged Before The ECB Is Granted More PowersARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- The Next Boom of The Global Markets and EconomiesDokumen3 halamanThe Next Boom of The Global Markets and EconomiesARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- The Cost of "NonEurope"Dokumen2 halamanThe Cost of "NonEurope"ARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- Greece Is A "Test Site" For What It Is To Follow For EuropeDokumen2 halamanGreece Is A "Test Site" For What It Is To Follow For EuropeARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- The European Banking Union Concept - Fact or FictionDokumen3 halamanThe European Banking Union Concept - Fact or FictionARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- EuroZone Finance Ministers: Spain Has An Extra Year To Bring Its Budget Deficit Under ControlDokumen3 halamanEuroZone Finance Ministers: Spain Has An Extra Year To Bring Its Budget Deficit Under ControlARBITRAJ COMERCIAL -Mircea Halaciuga,Esq. aka. Mike SerbanBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Midterm Sample Questions Based On Chapter 2Dokumen3 halamanMidterm Sample Questions Based On Chapter 2Alejandro HerediaBelum ada peringkat

- 235-Texto Del Artículo-169-1-10-20130220 PDFDokumen55 halaman235-Texto Del Artículo-169-1-10-20130220 PDFVivi ZHBelum ada peringkat

- 002 PDFDokumen59 halaman002 PDFKristine Lapada TanBelum ada peringkat

- Davao Airport Project BriefDokumen3 halamanDavao Airport Project BriefDonnabelle AliwalasBelum ada peringkat

- A True History of Oil and GasDokumen2 halamanA True History of Oil and GasKaiysse YoukéBelum ada peringkat

- Tyrone Goodwin - Motion and Brief in Support For Temporary Restraining Order And/temporary Injunction Against The U.S. Department of Housing and Urban DevelopmentDokumen60 halamanTyrone Goodwin - Motion and Brief in Support For Temporary Restraining Order And/temporary Injunction Against The U.S. Department of Housing and Urban DevelopmentTyrone GoodwinBelum ada peringkat

- Economy 4aaDokumen3 halamanEconomy 4aaabraham benitezBelum ada peringkat

- Jittipat Poonkham - Russia's Pivot To Asia: Visionary or Reactionary?Dokumen8 halamanJittipat Poonkham - Russia's Pivot To Asia: Visionary or Reactionary?Jittipat PoonkhamBelum ada peringkat

- A Theory of Inefficient Markets 2Dokumen7 halamanA Theory of Inefficient Markets 2TraderCat SolarisBelum ada peringkat

- The History of The Spanish EmpireDokumen2 halamanThe History of The Spanish Empireapi-227795658Belum ada peringkat

- الاعتماد على مصادر التمويل المحلي لتحقيق التنمية الاقتصادية عرض تجربة الهند PDFDokumen10 halamanالاعتماد على مصادر التمويل المحلي لتحقيق التنمية الاقتصادية عرض تجربة الهند PDFnono rezigBelum ada peringkat

- Emerging Asian Regionalism: Farizatul AQMA Sena SUH Youngsik KIM Sumi KWON Yeoul KANG Youngbm CHODokumen25 halamanEmerging Asian Regionalism: Farizatul AQMA Sena SUH Youngsik KIM Sumi KWON Yeoul KANG Youngbm CHObuximranBelum ada peringkat

- Nghe HSG 4Dokumen3 halamanNghe HSG 4GiangBelum ada peringkat

- State 0wned BankDokumen7 halamanState 0wned BankFarzana Akter 28Belum ada peringkat

- Final Draft of Toledo City LSPDokumen21 halamanFinal Draft of Toledo City LSPapi-194560166Belum ada peringkat

- Documents - Tips Chopra Scm5 Tif Ch05Dokumen23 halamanDocuments - Tips Chopra Scm5 Tif Ch05shahad100% (2)

- An Introduction To The World Trade Organization (WTO)Dokumen9 halamanAn Introduction To The World Trade Organization (WTO)naeemkhan1976Belum ada peringkat

- Insha Spreadsheet Marketing Contact DataDokumen14 halamanInsha Spreadsheet Marketing Contact DataAbhishek SinghBelum ada peringkat

- Canadian Biblio2011-01Dokumen658 halamanCanadian Biblio2011-01Akaninyene0% (1)

- Boliden Kokkola Oy enDokumen31 halamanBoliden Kokkola Oy enjoescribd55Belum ada peringkat

- Chapter 9 Discretionary Benefits: Strategic Compensation, 8e, Global Edition (Martocchio)Dokumen2 halamanChapter 9 Discretionary Benefits: Strategic Compensation, 8e, Global Edition (Martocchio)NotesfreeBookBelum ada peringkat

- Chapter 7 AbcDokumen5 halamanChapter 7 AbcAyu FaridYaBelum ada peringkat

- LISTDokumen1 halamanLISTHannahLaneGarciaBelum ada peringkat

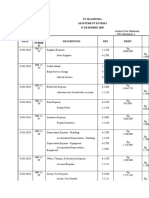

- PT SejahteraDokumen2 halamanPT Sejahtera202010415109 ADITYA FIRNANDOBelum ada peringkat

- Contact Details ICAIDokumen2 halamanContact Details ICAIVikram KumarBelum ada peringkat

- David Robinson Curse On The Land History of The Mozambican Civil WarDokumen373 halamanDavid Robinson Curse On The Land History of The Mozambican Civil WarLisboa24100% (2)

- 07 Opportunities For PoA in Energy Efficiency by Konrad Von RitterDokumen11 halaman07 Opportunities For PoA in Energy Efficiency by Konrad Von RitterThe Outer MarkerBelum ada peringkat

- CapitaLand AR 2007Dokumen278 halamanCapitaLand AR 2007walkwalkBelum ada peringkat

- Irma Irsyad - Southwest Case StudyDokumen27 halamanIrma Irsyad - Southwest Case StudyIrma IrsyadBelum ada peringkat

- RFBT Chapter2 OutlineDokumen20 halamanRFBT Chapter2 OutlineCheriferDahangCoBelum ada peringkat