Islamic Banking and Finance MBA (Finance) Abasyn University Peshawar. (Farman Qayyum)

Diunggah oleh

farman_qayyumDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Islamic Banking and Finance MBA (Finance) Abasyn University Peshawar. (Farman Qayyum)

Diunggah oleh

farman_qayyumHak Cipta:

Format Tersedia

CHAPTER-1

INTRODUCTION TO ISLAMIC BANKING

1.1 What is Islamic Finance?

Islamic finance was practiced predominantly in the Muslim world throughout the middle Ages, fostering trade and business activities with the development of credit. In Spain and the Mediterranean and Baltic states, Islamic merchants became indispensable middlemen for trading activities. In fact European financiers and businessmen later adopted many concepts, techniques, and instruments of Islamic finance. The Islamic financial system is founded on the absolute prohibition of the payment or receipt of any predetermined, guaranteed rate of return. This closes the door to the concept of interest and precludes the use of debt-based instruments. The system encourages risk sharing, promotes entrepreneurship, discourages speculative behavior, and emphasizes the sanctity of contracts. History Classical Islamic banking During the Islamic Golden Age, early forms of proto-capitalism and free markets were present in the Caliphate, where an early market economy and an early form of mercantilism were developed between the 8th-12th centuries, which some refer to as "Islamic capitalism". A vigorous monetary economy was created on the basis of the expanding levels of circulation of a stable high-value currency (the dinar) and the integration of monetary areas that were previously independent. A number of innovative concepts and techniques were introduced in early Islamic banking, including bills of exchange, the first forms of partnership (mufawada) such as limited partnerships (mudaraba), and the earliest forms of capital (al-mal), capital accumulation (nama al-mal), cheques, promissory notes, trusts (see Waqf), startup companies,, transactional accounts, loaning, ledgers and assignments.[6] Organizational enterprises similar to corporations independent from the state also existed in the medieval Islamic world, while the agency institution was also introduced during that time. Many of these early capitalist concepts were adopted and further advanced in medieval Europe from the 13th century onwards. Modern Islamic banking The first modern experiment with Islamic banking was undertaken in Egypt under cover without projecting an Islamic imagefor fear of being seen as a manifestation of Islamic fundamentalism that was anathema to the political regime. The pioneering effort, led by Ahmad Elnaggar, took the form of a savings bank based on profitsharing in the Egyptian town of Mit Ghamr in 1963. This experiment lasted until 1967 (Ready 1981), by which time there were nine such banks in the country. In 1972, the Mit Ghamr Savings project became part of Nasr Social Bank which, till date, is still in business in Egypt. In 1975, the Islamic Development Bank was set-up with the mission to provide funding to projects in the member countries. The first modern commercial Islamic bank, Dubai Islamic Bank, opened its doors in 1975. In the early years, the products offered were basic and strongly founded on conventional banking products, but in the last few years the industry is starting to see strong development in new products and services. Islamic Banking is growing at a rate of 10-15% per year and with signs of consistent future growth.. Islamic banks have more than 300 institutions spread over 51 countries, including the United States through companies such as the Michiganbased University Bank, as well as an additional 250 mutual funds that comply with 2

Islamic principles. It is estimated that over US$822 billion worldwide shariacompliant assets are managed according to The Economist.. This represents approximately 0.5% of total world estimated assets as of 2005. Allowing for a 25% decrease in total world asset value due to present economic conditions, the world share of sharia compliant assets is 0.7%. The World Islamic Banking Conference, held annually in Bahrain since 1994, is internationally recognized as the largest and most significant gathering of Islamic banking and finance leaders in the world. The Vatican has put forward the idea that "the principles of Islamic finance may represent a possible cure for ailing markets." 1.2 Scope of study Scope of this study includes the modes of financing in Islam and to point out which of them are often being used by the banks. 1.3 Objective The overall objective of this research is to give complete information about Islamic banking system. The problems in Islamic banking are also discussed and recommendations are given for it. In this write up an attempt is made to explain the Islamic banking includes the operation and all the activities regarding it. The first chapter is just about the introduction of Islamic banking, its meaning, history, origin and scope etc. The second chapter begins with the literature reviews, in which the abstracts of different researchers has been given. The financial instruments of Islamic banking are also explained. The third chapter involves the introduction to Meezan Bank along with their background review and share holder structure. The fourth chapter consists of various Islamic modes of Meezan bank and also their branches in Pakistan. Fifth chapter deals with the problems faced by Islamic bank and certain safeguards taken to protect Islamic Banks in Pakistan. 1.4 Research methodology Non-probability convenience sampling method was used for collecting the data. 1.4.1 Primary data: There is no primary data collected for this Research Thesis. Secondary Data: The secondary data will be collected from; 1. The books available on modes of Islamic financing 2. The text available on the Internet. 1.5 sourece of data 1. The text available on modes of Islamic financing 1 Interviews with the bank officials relevant to my topic. 2 The text available on the Internet. 1.6. Limitations Since this project is very large, and needs group thinking form the scholar to produce solid Islamic banking structure, I therefore focus on theory and what is practically implemented by the banks, and how it is purely different from the Islamic

Philosophies and how it become possible to make a change in our system to avoid Riba.

CHAPTER 2

SECTION A

ISLAMIC BANKING IN PRACTICE 2.1. Accepting Deposit Islamic banks offer these different kinds of accounts: 1. Current Accounts 2. Saving Accounts 3. Investment Accounts 2.1.1 Current Accounts Current account are similar to those offered by conventional bank. The deposited capital is guaranteed and made available to the client at any moment no reward is paid on deposits. Saving Accounts In the saving account the deposits allow the bank to use their money but they obtain a grantee of getting the full amount back from the bank at any time wilt a little bit profit depend on deposits cash. In same case capital is not guaranteed but the banks take case to invest money from such account in relatively risk-free short-term projects. As such lower project rate are expected. 2.1.2 Investment Accounts The accounts in which the cash are deposited for agreed period. Customs open investment accounts to yield a financial return. Investment accounts are based on trust financing the depositor is the financing partner, while the bank is managing partner. The bank pools all investment deposits and searcher for suitable investment opportunities the return on investment (positive and negative) is then shared with the depositors. 2.2 Financing

There are 12 Islamic mode of financing the State Bank of Pakistan of brief description of Islamic instruments of financing is as under has approved these A. Loan Financing by Lending B. Trade Related Modes of Financing C. Investment Modes of Financing 2.2.1 Loan Financing By Lending There are three instrument of lending under the caption Loans Financing by Lending as approved by SBP. These modes are 1. Loans with services 2. Qarz-e- Hasana 3. Overdraft 2.2.1.1 Loans with Services Charges It is the new concepts of lending and is based on Ijtehad the bank are permitted to land funds free of interest they re to recover only the actual services charges from the users of funds. The maximum services charges pre-miscible to each bank are determined by the SBP. 2.2.1.2 Qarz-e-Hasana Under the Qarz-e-Hasana scheme, the nationalized banks grant interest free loans to the student who don not have sufficient mean to pursue of their educations. The student with outstanding caliber facing financial difficulties are given interest free loan for carrying o the studies berth within Pakistan and outside the country. Qarz-e-Hasana is given to the students who are less then 35 year age and is available for post intermediate studies in engineering, Medicine Agriculture Electronics, Economics, Commerce etc. Loans sanctioned for studies within Pakistan will be in the name of the student (principal debtor) and will be secured by the guarantee of parents/guardians, where as the loan sanctioned for studies abroad will be in the name of name of parent/guardian (principal debtor) secured by the guarantee of the student for repayment of the loan, a grace period of 2 year is granted after completion of studies (Relax able in deserving cases). In case of dropouts of commission of an act of moral turpitude or crime, the loan will become payable immediately. 2.2.1.3 Overdraft Overdrafts also are to be provided subject to a certain maximum, free of charge. Trade Related Modes of Financing Mark up financing and other variants of trade financing are by far the most popular instatements of financing for Islamic bank. On average, mage than 70% of all financing is provided on the basis of trade financing. The state bank of Pakistan has approved five trade related modes of financing, they in brief are Mark up The mark up or Bai mujjal is purchases of goods by banks and their sale to client at an appropriate mark up in the price on deferred payment basis Mark down It is a purchase of moveable or immoveable property by the bank with Buy Bank Agreement or otherwise According to this trade mode of financing the customers sells the moveable or immoveable property to the bank with a promise to buy back the same from the bank on a future date the payment can be made by the customers in lump sum or in installments. The difference between the purchase price of the property by bank and its sale price of the customer in the profit of the bank.

Leasing Leasing is also called Ijarah is a loan term financing instrument. In this trade mode of financing the lassee acquires the use of as assets from the leasor (Ajir) for a fixed agreed of time. On the payment of a fixed amount, which may be on yearly half yearly or on month. Monthly basis. 1. Hire Purchase In an hire purchase deal, the bank purchase the specified good on the result of the customer and hires tem to the client on the payment of periodical installments. The agreed periodical hire instilments are worked out in such a manner that the bank covers a fair return as well as the actual cost of the goods on full payment. 2. Development charges It is a very useful mode of wide financing. The bank makes advances to customers for the development of land or property. It the taken a share in the value added to the property. The share in the value added to the developed property is named as development charges. 2.2.2 Investment Modes of Financing These are four investment modes of financing. These are: 1. Musharakah 2. Mudarbah 3. Murabaha 4. Ijarah 5. Salam 6. Istisna 1. Musharikah The literal meaning of musharakah is sharing. The root of the world musharakah in Arabic is Shirkah which means being a partner. It is used in the same context as the term Shirk meaning partner to Allah under Islamic jurisprudence, musharakah mean a joint enterprise formed for conducting some business in which all partner share the project according to a specific ratio while the loss is shared according to the ratio of the contribution. It is an ideal alternative for the interest based financing with for reaching effects on both production and distribution.

2. Mudarabah

This is a kind of partnership where one partner gives money to another for investing in a commercial enterprise. The investment comes from the first partner who is called Rab-ul-Maal while the many of the other who is called Mudarib and the profit generated are shared in a predetermined ratio.

3. Murabaha

Murabaha is a particular kin do f sale where the seller expressly mentions the lost of the sold commodity he has incurred and sells it to another person by adding some profit thereon. Thus, muabahah is not a loan given on interest. It is a sale of a commodity for the cash/deferred price. 4. Ijrah

Lease is not originally a mode of financing. It is simply a transaction meant to transfer the use frust of a property from one person to another for an agreed period against an agreed consideration. However, certain financial institutions have adopted leasing as a mode of financing instead of loan term lending on the basis of interest. This transaction of financial lease may be used for Islamic financing. Subject to certain condition. It is not sufficient for this purpose to substitute the name of interest by the name of Rent and replace the name of mortgage by the name of leased assets these must be a substantial difference between leasing and an interest bearing loan.

5. Salam

Salam is a sale whereby the seller undertakes to supply some specific goods to the buyer at a future date in exchange of an advanced price fully paid at spot. Here the price is cash, but the supply of the purchased goods is deferred. The buyer is called rabb-us-salam, the seller muslam ilaih, the cash price is ras-ul-mal and the purchased commodity is termed as muslam fih, but for the purpose of simplicity, I shall use the English synonyms of these terms. Salam was allowed by the Holy Prophet (SW) subject to certain conditions. The basic purpose of this sale was to meet the needs of small farmers who needed money to grow their crops and to feed their families up to the time of harvest. After the prohibition of riba, they could not take usurious loans. Therefore, it was allowed for them to sell the agricultural products in advance. Similarly, the traders of Arabia used to export goods to other places and to import some other goods to their homeland. They needed money to undertake this type of business. They could not borrow from the usurers after the prohibition of riba. It was, therefore, allowed for them that they sell the goods in advance. After receiving their cash price, they could easily undertake the aforesaid business. Salam was beneficial to the seller, because he received the price in advance, and it was beneficial to the buyer also, because normally, the price in salam used to be lower than the price in spot sales.

6. Istisna

Istisna`a is a contract of exchange with deferred delivery, applied to specified made-to-order items. General agreement upon principles of practice is difficult to identify, however it is often stated that:\ a) the nature and quality of the item to be delivered must be specified. b) the manufacturer must make a commitment to produce the item as described. c) the delivery date is not fixed. The item is deliverable upon completion by the manufacturer. d) the contract is irrevocable after the commencement of manufacture except where delivered goods do not meet the contracted terms. e) payment can be made in one lump sum or in instalments, and at any time up to Or after the time of delivery. f) the manufacturer is responsible for the sourcing of inputs to the production process. Istisna`a differs from ijara in that the manufacturer must procure his own raw materials. Otherwise the contract would amount to a hiring of the seller's wage labour as occurs under ijara. Istisna`a also differs from bay salam in that a) the subject matter of the contract is always a made-to-order item, b) the delivery date need not be fixed in advance, c) full advance payment is not required and d) the istisna`a contract can be canceled but only before the seller commences manufacture of the agreed item(s).

SECTION B Literature review A. Research Report on Islamic Banking by Mohamed Ariff, University of Malaya, taken from Asian-Pacific Economic Literature, Vol. 2, No. 2 (September 1988). Absrtract The preceding discussion makes it clear that Islamic banking is not a negligible or merely temporary phenomenon. Islamic banks are here to stay and there are signs that they will continue to grow and expand. Even if one does not subscribe to the Islamic injunction against the institution of interest, one may find in Islamic banking some innovative ideas which could add more variety to the existing financial network. One of the main selling points of Islamic banking, at least in theory, is that, unlike conventional banking, it is concerned about the viability of the project and the profitability of the operation but not the size of the collateral. Good projects which

might be turned down by conventional banks for lack of collateral would be financed by Islamic banks on a profit-sharing basis. It is especially in this sense that Islamic banks can play a catalytic role in stimulating economic development. In many developing countries, of course, development banks are supposed to perform this function. Islamic banks are expected to be more enterprising than their conventional counterparts. In practice, however, Islamic banks have been concentrating on short-term trade finance which is the least risky. Part of the explanation is that long-term financing requires expertise which is not always available. Another reason is that there are no back-up institutional structures such as secondary capital markets for Islamic financial instruments. It is possible also that the tendency to concentrate on short-term financing reflects the early years of operation: it is easier to administer, less risky, and the returns are quicker. The banks may learn to pay more attention to equity financing as they grow older. It is sometimes suggested that Islamic banks are rather complacent. They tend to behave as though they had a captive market in the Muslim masses who will come to them on religious grounds. This complacency seems more pronounced in countries with only one Islamic bank. Many Muslims find it more convenient to deal with conventional banks and have no qualms about shifting their deposits between Islamic banks and conventional ones depending on which bank offers a better return. This might suggest a case for more Islamic banks in those countries as it would force the banks to be more innovative and competitive. Another solution would be to allow the conventional banks to undertake equity financing and/or to operate Islamic counters or windows, subject to strict compliance with the Shariah rules. It is perhaps not too wild a proposition to suggest that there is a need for specialized Islamic financial institutions such as mudaraba banks, murabaha banks and musharaka banks which would compete with one another to provide the best possible services.

B. Role of Islamic Banks in Economic Development By Shahid Saleem University of Punjab (PAKISTAN) - CIMA (U.K.) Abstract: The purpose of this working paper is to give the real meaning of DEVELOPMENT from Islamic perspective. Most of Muslim countries are LDCs and using the religious and social ideology of Islam is very useful to establish institutions and to bring moral and ethical change for development in these countries. Islam appears to be the only dynamic religion and tells us about prevention of interest, similar to Christian and Jewish theologies. But at the same time gives a comprehensive setoff trade and financing modes, not easily and completely described in any other religion or social order. Even TFP, a modern concept for collective efficiency has been advised in Islam, shunning to self interest and individualism of materialistic economics. Some scholars of WEST consider use of Islamic banking more suitable for economic development, while others consider Islam as obstacle & threat to development of Muslim countries. We hope that the paper will be useful in this regard to provide another valuable theoretical dimension to this field of study.

10

C. Islamic Financing Arrangements Used in Islamic Banking Ehsan University April 2, 2007 Abstract: Islamic finance is an old concept but a very young discipline in the academic sense. It lacks the required extent and level of theories and models needed for expansion and implementation of the framework provided by Islam. In these circumstances, unawareness and confusion exist as to the form of the Islamic financial system and instruments. The main difference between the present economic system and the Islamic economic system is that the later is based on keeping in view certain social objectives for the benefit of human beings and society. Islam, through its various principles, guides human life and ensures free enterprise and trade. That is the reason why the conventional banker does not have to be concerned with the moral implications of the business venture for which money is lent. D. International Islamic Banking Shahid University of Punjab Saleem (PAKISTAN) CIMA (U.K.) Zar of Rokh Tehran

Islamic Law and Law of the Muslim World Paper No. 07-02, Vol. 1, No. 1, December 21, 2007 Abstract: The purpose of this exploratory and to some extent descriptive analysis is to highlight the Islamic banking & finance theory, and to explain the practical disparity all over the Muslim Umma along with commonalities of Islamic banking in them. Islamic banking has been now become a value proposition which transcends cultures and will do speedily in next decades despite of cutting throat competition expected in global banking scenario. The size of Islamic Financial Industry has now reached size of US, $250 Billion and its growing annually @ 15% per annum. Institutions like Accounting and Auditing Organization for Islamic Financial Institutions (AAOIFI) and Islamic Finance Services Board (IFSB) have been formed. Due to these collective efforts, Islamic banking is now recognized by IMF, World Bank and Basel Committee. While, 27 Muslim countries including Bahrain, UAE, Saudi Arabia, Malaysia, Brunei and Pakistan 15 non-Muslim countries including USA, UK, Canada, Switzerland, South Africa and Australia has already adopted it, but in all these countries a lot of diversities lie over theory Shariah Principles and their implementation as bank products/services. In such context our effort is expected to be fruitful for not only local but international policymakers and scholars to overcome these disparities and to really make it a value proposition which transcends cultures.

11

CHAPTER 3

Riba (usury, interest) 3.1 Meaning Riba is an Arabic word which means increase, addition, expansion or growth and refers to the additional amount, which a lender recovers from the borrower according to a fixed rate over and above the principal amount. In the New Encyclopedia Britannica, usury is explained as compensation for the use of money regardless of the amount, according to earlier English law. The Concise Oxford Dictionary, however, defines usury as Practice of lending money at exorbitant interest, especially at higher interest than is legal. 3.2Classification of Riba The first and primary type is called Riba An Nasiyah or Rib Al Jahiliya. The second type of Riba Al-Fad"l, Riba An Naqd or Riba Al Bai. 3.2.1Riba An Nasiyah This is the real and primary form of Riba since the verses of Quran have directly rendered this type of Riba as Haraam. It is called Riba Al Quran. Imam Abu Bakr Hasses Razi has outlined. Riba An Nasiyah in following words that kind of loan where specified repayment period and an amount in excess of capital is predetermined

12

Riba in the Holy Prophet (PBOH) Hadith Every loan that draws interest is Riba the famous Sahabi Fazala Bin Obaid has also defined Riba in similar words. Every loan that draws profit is one of the form of Riba. 3.2.2 Riba-Al-Fadl It is related to the exchange of various commodities, like salt, gold, wheat and rice etc. it means that commodities are exchange with one other in unequal amount and quality e.g. it is inequality when a piece of gold is exchange with a few Kg of wheat. So it is prohibited in Islam. 3.3 PROHIBITION OF RIBA 3.3.1Prohibition of Riba: In the Holy Quran The following are the relative verses from the Holy Quran on the subject. It is to be noted that the Holly Quran has used the Arabic Word riba in the verses, which has been retained in the English translation. That which ye give in riba in order that it may increase on (other) peoples property hath no increase with Allah; but that which ye give in charity, seeking Allahs countenance, hath increase manifold. (30: 39) That they took riba, though they were forbidden; and that they devoured mens substance wrongfully. We have prepared for those among them who reject faith, a grievous punishment. (4: 161) O ye who believe! Devour not riba, doubled and multiplied; but fear Allah; that ye may (really) prosper. Fear the fire, which is prepared for those who reject faith, And obey Allah and the Messenger; that ye may obtain mercy. (3:130-2) Those who devour riba will not stand except as stands one whom the evil one by his touch bath driven to madness. That is because they say: Trade is like riba But Allah bath permitted art forbidden riba. Those a receiving direction from their Lord, desist, shall be pardoned for the past; their case is for Allah (to judge). But those who repeat (the offence) are companions of the fire; they will abide therein (forever). (2: 276). Allah will deprive riba of all blessings, but will give increase for deeds of charity; for 1-1c loved not creatures ungrateful and wicked. 275). Those who believe, and do deeds of righteousness and establish regular prayers and regular charity, will have their reward with their Lord: on them shall be no fear, nor shall they grieve. (2: 277) O ye who believe! Fear Allah and give up what remains of your demand for riba, if ye are indeed believers. (2: 278). If you do it not, take notice of war form Allah and His Messenger. But if ye turn back, ye shall have your capital sums. Deal not unjustly, and ye shall not be dealt with unjustly. (2: 279) If the debtor is in a difficulty, grant him time till it is easy for him to repay. But if ye remit it by way of charity, that is best for you, if ye only knew. (2: 281). And fear the Day when ye shall be brought back to Allah. Then shall every soul be paid what it earned, and none shall be dealt with unjustly 281). As the money lending transactions involving usury and interest were prevalent among the Arabs for a long time and taken deep roots in their society, the injunctions of Riba the Holy Quran were revealed in a period spread over a number of years. The contents of Surah Al-Rehman, verse 39, referred above, are merely of an advisory nature and do not in prescribe any punishment. The Almighty Allah in His infinite wisdom tells His followers that wealth does not in fact increase by

13

interest earnings. This verse also motivates people to give more and more to the poor and needy and Allah assures that with His blessings, the wealth of a person, giving charity, will increase manifold. This point has again been emphasized in the Holy Quran (2: 276) wherein Allah says that He deprives riba of all blessings but blesses charity. This is also true from social, economic and moral points of views. There could be no denying of the fact that interest in its very nature, is a hindrance to the moral and material growth of the society. Charity, on the other hand, contributes in the welfare of the poor and the needy. Charity brings in a balance between moral and material dimensions, which are very important for meaningful and stable growth of the society. Charity is based on generosity and compassion. These qualities develop in individuals who give charity as well as in the society as a whole. The moneylenders who grab interest income, notwithstanding the operational results of the transactions conducted with the borrowed money, appear to be motivated by greed, selfishness, narrow-mindedness, selfaggrandizement and malignancy. Large-scale transactions of this nature ultimately develop these negative qualities in the society as a whole or at least dilute the positive qualities mentioned in connection with charity. Further in Surah Al-I-Imran verses 130-2, Allah prohibits Muslims to take usury (compound interest) and promises prosperity to people who obey the orders. In Surah Al Baqarah, (2: 275), it has been clearly mentioned that Allah has permitted trade and forbidden riba. It is important to appreciate the difference between trade and riba (interest), in the context of our discussion. The return on capital invested by an entrepreneur in the business is either positive or negative depending upon the operational results. In case, however, of interest on loans including bank interest, a positive return is assured and a negative return or risk of a negative return is not shared by the lender. The basic difference between trade of commodity and trade of money as prevalent today (riba, usury or interest) is that in (he former case, there is guarantee of a positive return, whereas, in the later case, there is a certainty of a positive return at a fixed rate). In the context of above discussions, riba, usury and interest, therefore, have one and the same meaning and have a common factor of predetermined positive ness. This obviously is in sharp contrast to trade. It is, therefore, crystal clear that according to the verses of the Holy Quran referred to above; riba, usury and interest are strictly prohibited in all forms and intent. The Holy Quran (2: 279) has warned that those who do not forego riba which has already accursed and do not desist from taking it any further, then they are at war path with Allah and His Prophet, peace be upon him. It is, however, significant to note that riba, which had already been recovered before revelation of this verse of the Holy Quran was also not justifiable due to obvious reason that riba was prohibited in earlier religions also, as well as in the earlier revelations of the Holy Quran. Allah, however, did not declare it illegal, as it would have opened a Pandoras box in the form of endless litigations between parties. No demand could, therefore be made for the return of the amount of riba already paid. The income already earned on account of riba, however, remained unethical and polluted. Allah on the Day of Judgment would therefore, take up the matter in individual cases. Muslim scholars are, therefore, of the firm opinion that this money should not be spent on self or family but one should voluntarily return it to the person from whom, it was recovered. If he is not available then the amount should he spent on social welfare.

14

It is significant to note that the verse (2: 278) of the Holy Quran specifically says that: Give up what remains of your demand for riba and in (2: 279) says, You shall have your capital sums. In view of this clear and unambiguous directive of the Holy Quran, all the arguments that prohibition of riba does not cover bank interest do not merit any consideration and are automatically invalidated. There is, therefore, no doubt left that according to the injunctions of the Holy Quran, in money lending transactions, anything recovered in excess of the principal amount is specifically prohibited, by whatever name it is called, riba, usury or interest. The controversy about riba and interest must, therefore, come to an end, once and for all. The word injustice in the context of verse (2: 279) means to take anything excess or give less than the capital and injustice is prohibited in Islam. The Holy Quran says: Allah Commands justice, the doing of good and liberality to kith and kin and He forbids all shameful deeds and injustice and rebellion. (16: 90). In money transactions, the Holy Quran permits the lenders to take back only the amount advanced and no more. It is, however, laid down that if the borrower is in difficulty he should be given extension in repayment date and in fact, believers have also been motivated to forego the principal amount as charity, if the circumstances so warrant. (2: 280). Finally, there is a reminder from Allah in the Holy Quran an (2: 281) to be fearful of Him and that when they will go back to Him on the Day of Resurrection, each one of them will be dealt with in a just and equitable manner. 3.3.2 Prohibition of Riba: in Ahadith There are numerous Ahadith (sayings, deeds or tacit approvals of the Holy Prophet of Islam, peace be upon him) on the subject of riba. The Ahadith containing the directives of the Holy Prophet, peace be upon him, have been narrated by authorities including Imam Malik, Bukhari, Abu Daud, Tirmizi, NasaI, Musnad Ahmed, Ibn Majah, Ahmed bin Hanbal, Dar Qutni, Kitab Al Buyua etc. in their collections of Ahadith. Some of the Ahadith on the subject are: 1) From Jabir: The Prophet, peace be upon him, curse the receiver and the payer of riba, the one who records it and the two witnesses to the transaction and said: They are all alike [guilt]. (Tirmizi) 2) From Abu Hurayrah: The Prophet, peace be upon him, said: On the night of Ascension I came upon people whose stomachs were like houses with snakes visible from the outside. I asked Gabriel who they were. He replied that they were people who had received riba. (Abu Daud) 3) From Abu Hurayrah: The Prophet, peace be upon him, said: There will certainly come a time for mankind when everyone will take riba and if he does not do so, its dust will reach him. (Abu Daud) 4) From Abu Hurayrah: The Prophet, peace be upon him, said: Allah would be justified in not allowing four persons to enter paradise or to taste its blessings: he who drinks habitually, he who takes riba, he who usurps an orphans property without right, and he who is undutiful to his Parnerts. (Kitab ul Buyua) 5) From Ibn Masud: The Prophet, peace be upon him, said: Even when riba is much, it is bound to end up into paltriness. (Musnad Alimed) 6) From Anas Ibn Malik: The Prophet, peace be upon him, said: When one of you grants a loan and the borrower offers him a dish, he should not accept it; and if the borrower offers a ride on an animal, he should not ride, unless the two of them have been previously accustomed to exchanging such favors mutually. (Kitab ul Buyua). In his last sermon during the pilgrimage, the

15

Holy Prophet, Peace Be Upon Him, in the presence of about one hundred thousand reverend companions declared: 7) It is, therefore, clear, that interest, riba and usury, in all forms and intent are strictly prohibited, as per teachings given herein above. 3.4 Prohibition of Riba: In Fiqha All the schools of thought of Muslim jurisprudence hold the unanimous view that riba, usury and interest are strictly prohibited. Jassas (1347 A: 551-52) defining the term riba says it is the loan given for a specific period with the condition that on expiry of the period, the borrower will pay it with sonic excess. The term riba, therefore, signifies different meanings. One is the Riba, which was prevalent in the Arab society at that time, the second is the disparity or differential in the volume or weight of a commodity (in spot transactions) and the third is the forward sale. He further says that in Islamic Law, riba has acquired a connotation that its literal meaning does not convey. He has referred an Ahadith narrated by Usman ibn Zayd, which says that Allah not only prohibited riba transactions that were being practiced at that time but also invalidated some other transactions by labeling them as riba. Mohammad ibn Abdullah (1857: 242) says that riba literally means increase and in Quranic verse (: 275) it stands for every increase not justified by return. Rehman, a compendium on the legal opinions of the four prominent and recognized schools of Muslim jurisprudence, says that riba is one of those unsound transactions, which have been severally prohibited. Illiterally means increase but in Muslim Law, riba means an increase in one of two homogenous equivalents being exchanged, without this increase being accompanied by a return. The specified increased is in return for postponement of, or waiting for, the payment. He asserts that there is no difference among Muslim jurists, that charging of riba is indisputably a major sin as per verses of the Holy Quran, which has prohibited riba vehemently and has reprimanded the person who takes riba so severely that it makes those who believe in Allah and fear His punishment, tremble with fear. He observes that the practice and usage in Arabs at the time of the dawn of Islam was that, when a loan extended by an Arab matured, he would ask the borrower for the return of the principal or for an increase in return for the postponement. This increase was either in quantity like postponing the return of one camel for two camels in the future or even in the age of the animal. The Arabs were also familiar with transactions where a lender would advance money for a period and take a specified amount of riba every month. If the borrower were unable to repay in time, he would be allowed an extension in repayment with the continuation of riba, which he had been receiving from the borrower. It is, therefore, obvious that interest charged by the banks and the financial institutions is similar to the one charged by Arabs in some transactions at that time, which is specifically prohibited by Islam. Qurtabi (1967: 241) says that Muslims have agreed on the authority of the sayings of the Holy Prophet; peace be upon him that a condition for an increase over the amount lent is riba, irrespective of whether it is a handful of fodder or a particle of grain. Ibn Al-Atir (1322 H:66) observes that the original meaning of riba is excess and in the terminology of Islamic jurisprudence, it means increase in the principal without ay contract of sale having taken place. Syed Qutub Shaheed, a famous reformer and Islamic scholar say that interest and Islam cannot remain together in a Muslim together in a Muslim society. All

16

Muhammad (1397: 11:383) says that the dictionary meaning of riba is an absolute increase without any attribute. Qualification and in Islamic Law; it means the increase of excess, which the creditor takes form his debtor in lieu of deferred period for payment of loan. A committee of the Supreme Council of Islamic Affairs of Government of Egypt has stated that the riba referred to in the Holy Quran (2: 275) is a riba prevalent among Arabs in the pre-Islamic era and the is the increase in loans and is unlawful, whether the increase (riba) is less or more. An Islamic Fiqha Academy (Islamic Law Academy) was constituted by the Organization of Islamic Conference in 1983. The Academy representing 43 Muslim countries passed a resolution in December 1985, equating riba with bank interest and declared it unlawful. The academy requested all the Islamic countries to establish banks on Islamic principles. From the above discussions, it is clear that interest is not increase simpliciter but Shariah it is a special kind of increase, as even in a transaction of sale, there is an element of increase, which is known as profit, which is permissible. Interest on the other hand is the consideration compensation payable to the financier, for the period of repayment of loan. Since the period is to a valuable property, any compensation merely for remaining out of pocket is unlawful. It, therefore, follows that, when a loan is advanced to a party to be repaid later, and for that a condition of return in addition to principal amount is stipulated. It is nothing but interest. If we study the commercial activities and credit transactions of Arabs, during the time of the Holy Prophet of Islam, peace be upon him, we would find that all transactions which contained excess or addition over and above the principal loan, which was predetermined in relation to time or period and was to be conditional on the payment of that predetermined excess or addition were treated as riba, which at the present times, is known as interest. 3.5 Few Examples of Riba To demonstrate the devastating power in the mechanism of Riba and the ignorance on the subject, following are few examples. 1) Suppose, if just One Gram of Gold (i.e., one millionth of a metric ton) was loaned at an interest rate of 2% p.a. at the time of first Hijri year (Islamic calendar), then today (after 1422 Islamic years) the quantity of gold required to repay that loan would be 1, 696,071.847 met4ric tons of gold, while the total gold reserve of the world known today (explored unexplored) are less than 160,000 tons. 2) If a nation takes a loan of say US dollars one billion at an interest rate of 3% p.a., it would have to repay US dollars 4.3839 billion after fifty years. One can imagine the multiplying rate of Riba mechanism that had badly affected the economics of already weak nations. 3) The president of a country while targeting his predecessors asking publicly that his country is under plenty of debt and where that money had gone? He was unaware of the fact that despite paying more than the actual amount the country took as loan, they are still under debt by more than the amount they had taken as loan. The fact is, the money he is talking about gone somewhere or eaten up by the politicians never existed and is only present in accounting figure of liabilities. It is the dilemma that even heads of the states are not clear about the artificial behaviour of Riba so what to talk about a common person. 17

3.5.1 Solution to Deal with Riba

We are living in an unfair and unjust world, political and social exploitation and injustices are realized easily even by a common person, but the economic abuse is rarely understood, the abuse is not propagated in a way that every one could understand it. Economy is two-third of the life; everything else combined is the rest, just like the proportion of water in our bodies. The behavior of individuals to the collective behavior of nations depends upon its economic strength. The sovereignty of nations is dependent on its economy. Is would be more appropriate to say that the modern day slavery is economic slavery. When economy is controlling individuals to nations is such a way, no one can afford to sit back and let some one else to control it. It is only possible when one knows as what to do to control its won economy and maintain its sovereignty. The study and statistics shows that every economy in this world is going does somewhere slowly and elsewhere rapidly. General public of Powerful nations to very weak nations are facing the economic system dilemma equally. However, strong nations are well positioned in enforcing their demand charters unjustly to small and weak nations in order to get going. The continuous decline of every economy is a result of the artificial behavior of the economic system that has the power to concentrate resources in few hands; the mechanics of Riba (Interest) has played a pivotal role in this concentration. It is very alarming to note that less than 400 individuals own more than fifty percent of the total worlds wealth, the situation is worsening day by day and no one knows what would happen when the whole economic system would fail. The possibility of failure of the economic system does exists, many economist are predicting it as well. One can imagine the fact that the total money reserve of all OECD countries (the largest economic group of wealthiest nations) cannot survive for half-day session of currency market trading how fragile the political power is, the public of all these countries are at the mercy of forces beyond the control of any government What should be done to create a just system? To eliminate riba (Interest) from the economic system is the first and most important step that must be taken if we have to save our world from more wars and famines. It is strongly realized by the serious economists throughout the world that an alternate system free from Riba (Interest) should be designed as early as possible to switch over before it is too late. There could be any number of solutions; I would like to propose the two solutions given above.

18

CHAPTER 4

19

MEEZAN BANK AS PREMIER ISLAMIC BANK 4.1. BACKGROUND REVIEW Al-Meezan Bank started its commercial operations in September 1997 and got its scheduled commercial status in May 2002 as Meezan Bank Limited. The soundness of the Bank, which is normally measured by reference to the Tier 1 Capital Adequacy Ratio, is above 80%. The internationally acceptable standard, which is also the minimum requirement of the State Bank of Pakistan, is 8%. MBL capital adequacy ratio placed the bank at the top of the industry. Meezan Bank Limited is the first schedule Islamic bank in Pakistan, which has been licensed by the State Bank of Pakistan to operate as an Islamic Commercial Bank. The bank perates strictly under the principles of Islamic Shariah. Our independent Shariah Supervisory Board, comprising of internationally renowned Islamic scholars, regularly reviews the banks activities. Justice (Retd). Muhammad Taqi Usmani (Pakistan)- Chairman Dr. Abdul Sattar Abdu Ghuddah (Saudi Arabic) Sheikh Essam M. Ishaq (Bahrain) Dr. Muhammad Imran Usmani (Pakistan) Meezan Bank Limited maintains a Long term rating of A+, and short term rating of A1+, assess by JCR VIS Credit Rating Co. Ltd, (JCR) an affiliate of Japan Credit Rating Agency Ltd, Japan Signifying \a consistent satisfactory performance. The banks sponsors include solid reputable financial institutions. 4.1.1. Vision Establish Islamic banking as banking of first choice Establish Islamic banking as banking of first choice to facilitate implementation of an equitable economic system, providing a strong foundation for establishing a fair and just society for mankind. 4.1.2. Mission To be a premier Islamic bank.. To be a premier Islamic bank offering a one stop shop for innovative value added products and services to our customers within the bounds of shariah, while optimizing the stakeholders value through an organizational culture based on learning, fairness, respect for individual enterprise and performance. 4.1.3. Core Values Shariah Compliance, Integrity, Professionalism, Service Excellence, Social Responsibility. 4.1.4. Brand Personality A sober and established, strong, empathetic, professional person; who is an extremely loyal and dependable friend and business partner, and is committed to offering comprehensive value based Shariah compliant financial solutions. 4.1.5. Staff Committed, motivated, and professionally trained employees who are empathetic to their customers needs. 4.1.6. Relationships Are long terms with Meezan Bank. We recognize and value our customer needs above all, and strive to ensure their fulfillment. All customers are treated with professionalism and in a friendly manner. It is our endeavor to ensure that they receive efficient and timely service. The Meezan Bank experience is a unique one. 20

4.1.7. Service mission To develop a committed service culture which ensures the consistent delivery of our products and services within the highest quality service parameters, promoting Islamic values and ensuring recognition and a quality banking experience to our customers. The main sponsors of the bank are as under: 4.2. SHAREHOLDING STRUCTURE Percentage 4.2.1. Pakistan Kuwait Investment Company (Pvt) Ltd: (PKIC) 39% Pakistan Kuwait Investment Company Private Limited (PKIC), a joint venture between the Government of Pakistan and Kuwait, is one of the most profitable and respected financial institutions in Pakistan. It is commonly referred to as leading example of sovereign joint ventures. PKIC has nurtured a diversified experience in foreign currency transactions, project finance, and syndications in its 20 years of operations in Pakistan. It is the first financial institution in Pakistan, which has been rated AAA (triple A) for medium to long term by JCRVIS credit rating Company Limited, an affiliate of Japan credit Rating Company. 4.2.2. Shamil Bank of Bahain E.C (SBB): 26% SBB is incorporated in the Kingdom of Bahrain has grown steadily since 1982 to become a leading Islamic Institution with a paid up capital of US$ 230 million. The Bank is a subsidiary of the Dar Al-Maal Al-Islami Trust, a leading Islamic financial Organization based in Geneva. SBB has sizeable in vestments in Pakistan and is also the main sponsor of Faysal Bank Limited. 4.2.3. Islamic Development Bank Jeddah (IDB):- 9% IDB is an international Islamic financial institution established in 1975 in pursuance of a declaration of the conference of Finance Ministers of Muslim Countries. The Bank participates in equity capital and grants loans for productive projects and enterprises besides providing financial assistance in other forms for economic and social development. IDB has a capital base of approximately USD 5 billion and enjoys presence in 53 member countries. 4.2.4. Kuwait AWQAF Public Foundation (KAPF):- 8% KAPF is a charitable institution attached to the Ministry of Awqaf and Islamic Affaris, Government of Kuwait. The foundation has a global investment portfolio and is strictly governed by Shariah Principles. 4.2.5. Others :- 18% In a short span of time the bank has established itself as a sound and profitable financial institution. The management team is comprised of high skilled and motivated professionals with diversified experience and a proven tracks record. The bank recorded a profit after taxation of Rs. 224 million for the year ended Dec. 31, 2004. The customer base of Meezan bank include a large cross section of clients such as Alcatel, ICI, Lever Brothers, Dongfang Electric Company (World Bank funded project), Pride Forasol, Premier Oil, Army welfare Trust, Sui Southern, Fauji Fertilizer Company Ltd, Pakistan State Oil, KESC, Sitara Chemical, Engro Chemicals, Paketel Limited, Attock Refinery Limited, and many more.

21

4.3. ISLAMIC MODES AND BRANCHES OF MEEZAN BANK 4.3.1. Halal Investment As any prudent investor, your main concern would always be total security along with the best return possible. However to invests at a bank. The opportunity need to be in line with your desire to stay away from inset based options and be totally Riba free. With Meezan bank we have a very comprehensive and competitive option, that also brings with it complete inner satisfaction and peace of mind. 4.3.2. Islamic Modes 4.3.2.1 Certificate of Islamic investment Structure The Riba-free certificate of Islamic investment (COII) works under strictly in conformity with the rules of Islamic Shariah. On agreeing to become a (COII) holder, the customer enters into a relationship based on Mudarabah with meezan bank. Under this relationship, the customer is an investor (Rab-ul-Maal) and the bank is muderis of the funds deposit pool. These funds form the pool are utilized to provide financing to customers but are not restricted to Mudarib and ijarah. 1. (Profit shared in COII) The bank calculate the profit every month, of then the profit is distributed between the bank and customers on the basis of pre determined profit sharing ratio announced at the beginning of month. It is also available on the site (www. Meezan bank.com) or can e obtained upon request. The bank almost give additional profit to the customers from its own profit share. In case of a loss as per the rule of Mudarabah the deposit pool shall bear the loss on a pro rata basis. 2. (Key Features of the COII) Enjoy a range of accessible features including:a. High and very competitive returns. b. Long term security ensured. c. Minimum investment amount Rs. 50,000/-. d. Available tenures of 3 months, 6 months, 1yr, 2yr, 3yr, and 5yrs. e. A variety of profit frequencies:- monthly, quarterly and at maturity. f. Premium over the declared profit rates possible for investment above Rs. 500,000/- for individuals. g. Pre-mature withdrawal options available. h. Free on live banking services at our branch network nation wide. 4.3.2.2 Monthly Mudarabah Certificate (MMC) 1. Structure Riba free MMC woks under the principles of Mudarabah and in Strictly in conformity with the rule of Islamic Shariah. Under this agreement the customer is an investor (Rab-ul-Maal) and the bank is the manger (Mudarib) of the fund deposited by the customers. The bank allocete the fund received from the customers to a deposit pool. These funds form the pool are utilized to provide financing to customers under Islamic modes that include but are not retricted to, Mudarabah and Ijarah. Sharing of Profit The bank calculate the profit every month, and the gross profit is distributed between the Mudarib and Rab-ul-Maal on the basis of a pre determined ratio 22

announced at the beginning of the month. Almost the bank at the time of declaration of the profit may give additional profit to customer from its own profit share. In case of loss, as per the rules of Mudarabah, the deposit pool shall bear the loss on a pre rata basis. The weightages used for profit calculation are in the following manner. 100,00 up to 4.99 million 5 million up to 9.99 million 10 million up to 49.99 million 50 million up to 99.99 million 100 million up to 499.99 million 500 million and above Key Features of MMC a. Monthly profit payment to your account or saving account to us. b. Bank balance certificate c. Personnel financial consultancy service d. Free on live banking services at our branch network nation wide

23

4.3 Meezan Providence Meezan providance is a long term investment product specially designed to cater to the needs of corforates and business concems for purpose of investing their proficient and pension funds. 1. Structure Under this agreement the customer is an investor (Rab-ul-Maal) and the bank is the manger (Mudarib) of the fund deposited by the customers. The bank allocete the fund received from the customers to a deposit pool. These funds form the pool are utilized to provide financing to customers under Islamic modes that include but are not retricted to, Mudarabah and Ijarah. Profit sharing The bank calculate the profit every month, and the gross profit is distributed between the Mudarib and Rab-ul-Maal on the basis of a pre determined ratio announced at the beginning of the month. Almost the bank at the time of declaration of the profit may give additional profit to customer from its own profit share. In case of loss, as per the rules of Mudarabah, the deposit pool shall bear the loss on a pre rata basis. The weightages used for profit calculation are in the following manner. 100,00 up to 4.99 million 5 million up to 9.99 million 10 million up to 49.99 million 50 million up to 99.99 million 100 million up to 499.99 million 500 million and above 2 Key Features a. Highest returns possible under shariah. b. Long term security ensured c. Minimum Investment amount Rs. 1000,000 d. Available tenures of 2,3,5 and 7yrs. e. Pre-mature withdrawal option available 4.4 Rupee Saving Account 1. Structure The Riba Free Rupee saving Account works under the principles of with the rules of Islamic Shariah. Under this agreement the customer depost the fund. The bank allocate the fund received from the customer to deposit pool consisting of financing under Islamic modes that includes, but is not restricted to, Murabaha, and ijarah. 2. Sharing of profit Profit/Loss from the investment made by the deposit pool is calculated every month. Gross income is shared between the Rab-ul-Maal and mUdarib on the basis of a pre-determined profit sharing ratio announced at the beginning of each month. The profit/loss earned on this pool is calculated every month and if you maintain a minimum avg. monthly balance of Rs. 10,000 you shall be eligible to receive profit that will be credited to your account every month. The weightage used for profit calculation are in the following manners. 10,000 up to 99,999 100,000 up to 999,999 1 million up to 4.99 million 5 million up to 9.99 million 10 million up to 49.99 million 24

50 million up to 99.99 million 100 million and above Key features of Riba free rupee saving account:a. Instant access to funds at all our on line branches. b. Free on live banking services c. No restriction on withdrawal d. Bank balance certificates and duplicate statements of account e. Stop payment and hold ail instructions f. Dedicated banking hours from 9am to 5pm (Saturday 9am to 12.30pm). 4.5 Riba Free current Account Everyone desire to have the opportunity to desires to have opportunity toe maintain his or her regular savings in a secure and stable bank. However to place ones saving at a bank that must be totally Riba free. So meezan bank provide the opportunity in order to bring the inner satisfaction and peace of mind i.e. Riba free current account. Which is ideal for business and individuals working for shariah compliant banking and professionalism under one roof. Key features 1. Instant access to funds at all our online branches. 2. No restriction on withdrawals a no. of transaction. 3. Bank balance certificate and duplicate statement of account. 4. Stop payment and hold Mail instructions 5. 24/7 cared your ATRS and debit cared in one. 4.6 Islamic Housing Finance Home Finance Owning your own home is one of lifes most important achievements. It represents your security, stability and is a great blessing in itself. It provides that all important safety and comfort for you and your loved ones. However in todays unpredictable and costly environment saving the required money can take a life time in itself. Rising property prices, taxes, inflation, and currency devaluation. Its all very hard bargain. On the other hand owing your own home and paying any easy installment which takes you step by step towards, complete ownership, is so much better than paying result which ultimately only adds to your expenses. In this way Meezan bank offer complete inner satisfaction and peace of mind. Islamic Financing on a Diminishing Musharakah basis With easy home you participate with Meezan Bank in a joint ownership of your property, where the bank will provide a certain amount of financing (usually up to 85%). In fact, the total monthly payment reduces regularly as your share in the property grows. When the installment has been competed than the ownership of have will be given to the customer. As a Diminishing Musharakah it conforms to Shariah Laws Specifically related to financing, ownership and trade. Taking ownership to the consumer instead of simply lending money is the major factor that makes our product shariah compliant. The nature of contract is not a loan but is a co ownership because the transaction is based on lending or borrowing of money. Profit Margin Charged by Meezan Bank correlated to conventional mortgage mkt At Meezan bank, the profit margin is directly correlated to mkt trends to provide a competitive product to our customers. Shariah allows the use of any 25

conventional, mkt factor as benchmark to determine the profit rate of a particular product. The mere fact that the applied profit rate of our product is based on similar factor used in determining the applied rate of inters of a mortgage does not render the transaction or contract invalid from the shariah perspective and neither does it make the transaction an interest bearing one. Buy, Build, Renovate or Replace Buying a Home Choose it and be ready to move in Meezan bank finances up to 85% of the appraised value of your new hoe or up to a value of Rs. 10 million with financing tenor of up to 20yrs. Building a home Meezan Bank provide 70% amount for building of a home appraised value or Rs. 10 million for a tenor of up to 20yrs. Renovating of Home Meezan bank helps with financing up to 85% or Rs. 1million and a financing tenor of up to 7yrs. Replacing your home Meezan Bank helps you to transfer your existing. Liability over to us again up to Rs. 10 million and a tenor of up to 20yrs. Eligibility for home financing a. If you are a Pakistani national b. From 25yrs of age to a maximum of 65yrs at maturity of financing. c. A salaried individual, a self employed professional or a business person. d. Having a minimum of 2yrs working experience or a minimum of 3yrs business experience. e. Meeting the minimum income requirement you can apply for Easy home BRANCH NETOWRK 1. Head Office 3rd Floor PNSC building, M.T Khan Road, Karachi 2. FTC Branch, Karachi 3. Marriott Hotel Branch, Karachi 4. Gulshan-e-Iqbal, Karachi 5. Jodia Bazar Branch, Karachi 6. F.B Area Branch, Karachi 7. Clifton Branch, Karachi 8. Korangi Branch, Karachi 9. S.I.T.E. Branch, Karachi 10. Cloth Market Branch, Karachi 11. Serena Hotel Branch, Faisalabad 12. Kotwali Road, Faisalabad 13. Peoples Colony, , Faisalabad 14. Abdali Road Branch, Multan 15. Railway Road, Branch, Kasur 16. Gulberg, main Boulevard, Lahore 17. Circular Road Branch, Out side Shah Alam Gate, Lahore 18. Azam Cloth Market Branch, Ghandni Chow, Lahore

26

19. 20. 21. 22. 23. 24. 25.

Kashmir Plaza Branch, G.T. Road Gujranwala Kashmir Road Branch, Sialkot Bahria Town, Rawalpindi Bank Road, Rawalpindi Chandni Chow, Rawalpindi Jinnah Avenue Branch, 32, Sohrab Plaza, Jinnah Avenue, Blue Area, Islamabad. Saddar Road, Peshawar Cantt.

27

CHAPTER 5

28

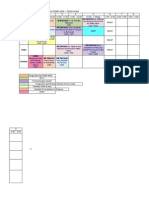

PROBLEMS OF ISLAMIC BANKS & RECOMMENDATION In the previous chapter we discussed the current practices of Islamic banks. As far as banking agencies services is concerned there seems to be not problems. Islamic bans are able to provide nearly all the services that are available in the conventional banks. Islamic banking based on the concept of profit and loss sharing (PLS) is theoretically superior to conventional banking from different angles. However from the practical point of view things do not seem that rosy. Our concern here is this latter aspect. In the over half a decade of full scale experience in implementing the PLS scheme the problems have begun to show up. If one goes by the experience of Pakistan as portrayed in the papers presented at the conference held in Islamabad in 1992, the situation is very serious and to satisfactory remedy seems to emerge. Some of the major difficulties are as under. 5.1 Financing In financing there are four main areas where the Islamic banks find it difficulties under the PLS scheme. a. Financing the small business b. Participating in long term low yield projects c. Government borrowings d. Granting non participating loans to running businesses, 5.1.1 Small businesses Small-scale businesses form a major part of a countrys productive sector. Besides, they form a greater number of the banks clientele. Yet it seems difficult to provide them with the necessary financing under the PLS scheme, even though there is excess liquidity in the banks. Given the comprehensive criteria to be followed in granting loans and monitoring their use by bank, small-scale enterprises have, in general encountered greater difficulties in obtaining financing than their large-scale counterparts. This has large share in the gross domestic product (GDP). The service sector is made up of many small producers for whom the banking sector has not been able to provide sufficient financing. Many of these small producers, who traditionally were able to obtain interest-based credit facilities on the on the basis of collateral, are now finding it difficult to raise funds for their operations. Long-term projects Table I shows the term structure of investment by 20 Islamic Banks in 1988. It is clear that less than 10 percent of the total assets go into medium-and long-term investment. Admittedly the banks are unable or unwilling to participate in long-term projects. This is a very unsatisfactory situation. Table-1 Term Structure of Investment by 20 Islamic Banks, 1988 Type of Investment Amount * Short-term 4,909.8 Social lending 64.2 Real-estate investment 1,498.2 Medium and long-term investment 707.7

% of Total 68.4 0.9 20.9 9.8

29

Source: Aggregate balance sheets prepared by the International Association of Islamic Banks, Bahrain, 1988. Quoted in: Ausaf Ahmed (1994). *Unit of currency not given. The main reason of course is the need to participate in the enterprise on a PLS basis which involves time consuming complicated assessment procedures and negotiations, requiring expertise and experience. The banks do not seem to have developed the latter and they seem to be averse to the former. There are no commonly accepted criteria for project evaluation based on PLS partnerships. Each single case has to be treated separately with utmost care and each has to be assessed and negotiated on its own merits. Other obvious reasons are: a) such investments tie up capital for very long periods, unlike in conventional banking where the capital is recovered in regular installments almost right from the beginning, and the uncertainty and risk are that much higher, b) the longer the maturity of the project the longer it takes to realize the returns and the banks therefore cannot pay a return to their depositors as quick as the conventional banks can. Thus it is no wonder that the banks are averse to such investments. Government borrowing In all countries the Government accounts for a major component of the demand for credit both short-term. Unlike business loans these borrowings are not always for investment purposes, nor for investment in productive enterprises. Even when invested in productive enterprises they are generally of a longer-term type and of low yield. This latter only multiplies the difficulties in estimating a rate of return on these loans if they are granted under the PLS scheme. Continued borrowing on a fixed rate basis by the Government would inevitably index bank charges to this rate than to the actual profits of borrowing entities. Running businesses Running businesses frequently need short-term capital as well as working capital and ready cash for miscellaneous on the spot purchases and sundry expenses. This is the daily reality in the business world. Very little thought seems to have been given to this important aspect of the business worlds requirement. The PLS scheme is not geared to cater to this need. Even if there is complete trust and exchange of information between the bank and the business it is nearly impossible or prohibitively costly to estimate the contribution of such short term financing on the return of a given business. Neither is the much used mark up system suitable in this case. It looks unlikely to be able to arrive at general rules to cover all the different situations. Legislation Existing banking laws do not permit banks to engage directly in business enterprises using depositors funds. But this is the basic asset acquiring method of Islamic bank. Therefore new legislation and/or government authorization are necessary to establish such banks. In Pakistan the Central Bank was authorized to take the necessary steps. In other countries either the banks found ways of using existing regulations or were given special accommodation. In all cases government intervention or active support was necessary to establish Islamic banks working under the PLS scheme. In spite of this, there is still need for further auxiliary legislation in order to fully realize the goals of Islamic banking. For example, in Pakistan,18 The new law has been introduced without fundamental changes in the existing laws governing contracts, mortgages, and pledges. Similarly no law has

30

been introduced to define a mode of participatory financing that is Musharakah19 and PTCs. It is presumed that whenever there is a conflict between the Islamic banking framework and the existing law, the latter will prevail. In essence, therefore, the relationship between the bank and the client that of creditor and debtor is left unchanged as specified by the existing law.The existing banking law was developed to protect mainly the credit transactions; its application to other modes of financing results in the treatment of those modes as credit transactions also. Banks doubt whether some contracts, though consistent with the Islamic banking framework, would be acceptable in the courts. Hence, incentives exist for default and abuse. Pakistan is committed to ridding their economies of riba and has made immense strides in towards achieving it. Yet there are many legal difficulties still to be solved as we have seen above. In other Muslim countries the authorities actively or passively participate in the establishment of Islamic banks on account of their religious persuasion. Such is not the case in non-Muslim countries. Here establishing Islamic banks involves conformation to the existing laws of the concerned country which generally are not conducive to PLS type of financing in the banking sector. Re-training of staff As was seen in the previous section, the bank staff will have to acquire many new skills and learn new procedures to operate the Islamic banking system. This is a time consuming process that is aggravated by two other factors. One, the sheer number of persons that need to be re-trained and, two, the additional staff that need to be recruited and trained to carry out the increased work. Principles are still to be laid down and techniques and procedures evolved to carry them out. It is only after the satisfactory achievement of these that proper training can begin. This delay and the resulting confusion appears to be among the main reasons for the banks to stick to modes of financing that are close to the familiar interest-based modes Other disincentives Among the other disincentives from the borrowers point of view are the need to disclose his accounts to the bank if he were to borrow on the PLS basis, and the fear that eventually the tax authorities will become wise to the extent of his business and the profits. Several writers have lashed out at the lack of business ethics among the business community, but that is a fact of life at least for the foreseeable future. There is a paucity of survey or case studies of clients to see their reaction to current modes of financing. As such we are not aware of further disincentives that might be there. 5.1.2 Accounts When a business is financed under the PLS scheme it is necessary that the actual profit/loss made using that money be calculated. Though no satisfactory methods have yet been devised, the first requirement for any such activity is to have the necessary accounts. On the borrowers side there are tow difficulties: one, many small-time businessmen do not keep any accounts, leave alone proper accounts. The time and money costs will cut into his profits. Larger businesses do not like ________________________________. On the banks side the effort and expense involved in checking the accounts of many small accounts is prohibitive and will again cut into their own share of the profits. Thus both sides would prefer to avoid having to calculate the actually realized profit/loss.

31

5.1.3 Tax The bank is a big business and it has to declare its profit and loss and is legally required to present an audited account of its operations. Once the banks accounts are known it doesnt take much for the tax collectors to figure out the share of the businesses financed by the bank under the PLS scheme. Thus its no surprise that businesses are not too very happy about the situation. The fact that suggestions have been made to use the banks to collect taxes due has not helped the matter either. 5.1.4 Excess liquidity Presence of excess liquidity is reported in nearly all-Islamic banks. This is not due to reduced demand for credit but the due to the inability of the banks to find clients willing to be funded under the new modes of financing. Here we have a situation where there is money available on the one hand and there is need for it on the other but the new rules stand in the way of bringing them together! This is a very strange situationespecially in the developing Muslim countries where money is at a premium even for ordinary economic activities, leave alone development efforts. Removal of Riba was expected to ease such difficulties, not to aggravate the already existing ones! Islamic banking in non-Muslim countries The modern commercial banking system in nearly all countries of the world is mainly evolved from and modeled on the practices in Europe, especially that in the United Kingdom. The philosophical roots of this system revolve around the basic principles of capital certainty for depositors and certainty as to the rate of return on deposits. In order to enforce these principles for the sake of the depositors and to ensure the smooth functioning of the banking system Central Banks have been vested with powers of supervision and control. All banks have to submit to the Central Bank rules. Islamic banks, which wish to operate in non-Muslim countries, have some difficulties in complying with these rules.

32

5.2 RECOMMENDATION Islamic financial markets are operating for below their potential because Islamic banking by itself cannot take root in the absence of the other necessary components of an Islamic financial system. A number of limitations will have to be addressed before any long-term strategy can be formulated. The strategies are as follow: 1. A uniform regulatory and legal framework supportive of an Islamic financial system has not yet been developed. Existing banking regulations in Islamic countries are based on the Western banking model. Similarly, Islamic financial institutions face difficulties operating in non-Islamic countries owing to the absence of a regulatory body that operates in accordance with Islamic principles. The development of a regulatory and supervisory framework that would address the issues specific to Islamic institutions would further enhance the integration of Islamic markets and international financial markets. 2. There is no single, sizable, and organized financial center that can claim to be functioning in accordance with Islamic principles. Although stock markets in emerging Islamic countries such as Egypt, Jordan, and Pakistan are active, they are not fully compatible with Islamic principles. The stock markets in Iran and Sudan may come closest to operating in compliance with Islamic principles. Moreover, the secondary market for Islamic products in extremely shallow and illiquid, and money markets are almost nonexistent, since viable instruments are not currently available. The development of an inter bank market is another challenge. 3. The pace of innovation is slow. For years, the market has offered the same traditional instruments geared toward short and medium term maturities, but it has not yet come up with the necessary instruments to handle maturities at the extremes. There is a need for risk management tools to equip clients with instruments to hedge against the high volatility in currency and commodities markets. In addition, the market lacks the necessary instruments to provide viable alternatives for public debt financing. 4. An Islamic financial system needs sound accounting procedures and standards. Western accounting procedures are not adequate because of the different nature and treatment of financial instruments. Well defined procedures and standards are crucial for information disclosure, building investors confidence, and monitoring and surveillance. Proper standards will also help the integration of Islamic financial markets with international markets. 5. Islamic institutions have a shortage of trained personnel who can analyse and mange portfolios, and develop innovative products according to Islamic financial principles. Only a limited number of Islamic institutions can afford to train their staffs and deploy resources in product development. 6. There is lack of uniformity in the religious principles applied in Islamic countries. In the absence of a universally accepted central religious authority, Islamic banks have formed their own religious boards for guidance. Islamic banks have to consult their respective religious boards, or Shariah advisors, to seek approval for each new instrument. Differences in interpretation of Islamic principles by different schools of though may mean that identical financial instruments are rejected by one board but accepted by another. Thus, the same instrument may not be acceptable in all countries. This problem can be addressed by forming a uniform council representing

33