Unit 8 Capital Budgeting: Structure

Diunggah oleh

Samuel DwumfourDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Unit 8 Capital Budgeting: Structure

Diunggah oleh

Samuel DwumfourHak Cipta:

Format Tersedia

FinancialManagement

Unit8

Unit8

Structure

CapitalBudgeting

8.1. 8.2. 8.3. 8.4. 8.5. 8.6. 8.7.

Introduction ImportanceofCapitalbudgeting ComplexitiesinvolvedinCapitalbudgetingdecisions PhasesofCapitalexpendituredecisions Identificationofinvestmentopportunities RationaleofCapitalbudgetingproposals CapitalBudgetingprocess 8.7.1 Technicalappraisal 8.7.2 EconomicAppraisal

8.8. 8.9.

InvestmentEvaluation Appraisalcriteria 8.9.1 Traditionaltechniques 8.9.2 Discountedpaybackperiod

8.10. Summary TerminalQuestions AnswertoSAQsandTQs

8.1 Introduction HDFCBanktakesoverCenturionBankofPunjab.ICICIBanktookoverBankofMadurai.The motivebehindall these mergers is to grow becauseinthisera of globalization theneedof the hour is to grow as big as possible. In all these, one could observe that the desire of the managementtocreatevalueforshareholdersisthemotivatingforce. Another way of growing is through branch expansion, expanding the product mixand reducing cost through improved technology for deeper penetration into the market for the companys products.Forexample,abankwhichisurbanbased,forexpansiontakesoverabankwithrural network. HereurbanbasedbankcanopenmoreurbanbranchesonlywhenitmeetstheReserve BankofIndiaguidelineofhavingaminimumnumberofruralbranches.Thisisthemotiveforthe mergerofurbanbasedbankofICICIwiththeruralbasedBankofMadurai.

SikkimManipalUniversity

113

FinancialManagement

Unit8

In this competitive arena proactive organization makes attempts to convert challenges into opportunities.Indianeconomyisgrowingat9%.Ithasfarreachingimplications.Newlinesof businesssuchas retailing, investment advisory servicesandprivatebankingareemerging. All theseinvolveinvestmentdecisions.Theseinvestmentdecisionsthatcorporatestaketoreapthe benefits arising out of the emerging business opportunities are known as Capital Budgeting decisions.Capitalbudgetingdecisionsinvolveevaluationofspecificinvestmentproposals.Here the word capital refers to the operating assets used in production of goods or rendering of services. Budgeting involves formulating a plan of the expected cash flows during the future period.When wecombineCapital withbudgetwegetCapitalbudget.Capitalbudgetisablue printofplannedinvestmentsinoperatingassets.Therefore,Capitalbudgetingistheprocessof evaluatingtheprofitabilityoftheprojectsunderconsiderationanddecidingontheproposaltobe includedintheCapitalbudgetforimplementation.Capitalbudgetingdecisionsinvolveinvestment ofcurrentfundsinanticipationofcashflowsoccurringoveraseriesofyearsinfuture.Allthese decisions are Strategic because they change the profile of the organizations. Successful organizations have created wealth for their shareholders through Capital budgeting decisions. Investmentofcurrentfundsinlongtermassetsforgenerationofcashflowsinfutureoveraseries ofyearscharacterizesthenatureofCapitalBudgetingdecisions.

LearningObjectives: Afterstudyingthisunit,youshouldbeabletounderstandthefollowing. 1. Explaintheconceptofcapitalbudgeting. 2. Bringouttheimportanceofcapitalbudgeting. 3. Examinethecomplexityofcapitalbudgetingprocedures. 4. Discussthevarioustechniquesofappraisalmethods. 5. Evaluatecapitalbudgetingdecision

8.2 ImportanceofCapitalbudgeting

CapitalbudgetingdecisionsarethemostimportantdecisionsinCorporatefinancialmanagement. Thesedecisionsmakeormarabusinessorganization.Thesedecisionscommitafirmtoinvest itscurrentfundsintheoperatingassets(i,elongtermassets)withthehopeofemployingthem mostefficientlytogenerateaseriesofcashflowsinfuture. Thesedecisionscouldbegroupedinto

SikkimManipalUniversity

114

FinancialManagement

Unit8

1. Replacement decisions: These decisions may be decision to replace the equipments for maintenanceofcurrentlevelofbusinessordecisionsaimingatcostreductions. 2. Decisions on expenditure for increasing the present operating level or expansion through improvednetworkofdistribution. 3. Decisionsforproductsofnewgoodsorrenderingofnewservices. 4. Decisionsonpenetrating intonewgeographicalarea. 5. Decisions to comply with the regulatory structure affecting the operations of the company. InvestmentsinassetstocomplywiththeconditionsimposedbyEnvironmentalProtectionAct comeunderthiscategory. 6. Decisions on investment to build township for providing residential accommodation to employeesworkinginamanufacturingplant.

Therearemanyreasonsthat maketheCapitalbudgetingdecisionsthemostcrucialforfinance managers 1. Thesedecisionsinvolvelargeoutlayoffundsnowinanticipationofcashflowsinfuture.For example, investment in plant and machinery. The economic life of such assets has long periods. The projections of cash flows anticipated involve forecasts of many financial variables.Themostcrucialvariableisthesalesforecast. a. For example, Metal Box spent large sums of money on expansion of its production facilitiesbasedonitsownsalesforecast.Duringthisperiod,hugeinvestmentsinR&Din packaging industry brought about new packaging medium totally replacing metal as an importantcomponentofpackingboxes.AttheendoftheexpansionMetalBoxLtdfound itself that the marketforitsmetal boxes had declineddrastically. The end resultis that Metal Box became a sick company from the position it enjoyed earlier prior to the executionofexpansionasabluechip.Employeeslosttheirjobs.Itaffectedthestandard ofliningandcashflowpositionofitsemployees. Thishighlightstheelementofriskinvolvedinthesetypeofdecisions. b. Equally we have empirical evidence of companies which took decisions on expansion throughtheadditionofnewproductsandadoptionofthelatesttechnologycreatingwealth forshareholders.ThebestexampleistheReliancegroup. c. Any seriouserrorinforecastingSales andhence the amountof capital expenditurecan significantlyaffectthefirm.Anupwardbiasmayleadtoasituationofthefirmcreatingidle capacity,layingthepathforthecancerofsickness.

SikkimManipalUniversity

115

FinancialManagement

Unit8

d. Anydownwardbiasinforecastingmayleadthefirmtoasituationoflosingitsmarkettoits competitors.Bothareriskyfraughtwithgraveconsequences.

2. Alongterminvestmentoffundssometimesmaychangetheriskprofileofthefirm.AFMCG companywithitscorecompetenciesinthebusinessdecidedtoenterintoanewbusinessof power generation. This decision will totally alter the risk profile of the business of the company.Investorsperceptionofriskofthenewbusinesstobetakenupbythecompany willchangehisrequiredrateofreturntoinvestinthecompany.Inthisconnectionitistobe noted that the power pricing is a politically sensitive area affecting the profitability of the organization. Therefore, Capital budgeting decisions change the risk dimensions of the companyandhencetherequiredrateofreturnthattheinvestorswant. 3. MostoftheCapitalbudgetingdecisionsinvolvehugeoutlay.Thefundsrequirementsduring thephaseofexecutionmustbesynchronized withtheflowoffunds.Failuretoachievethe requiredcoordinationbetweentheinflowandoutflowmaycausetimeoverrunandcostover run. These two problems of time over run and cost over run have to be prevented from occurring in the beginning of execution of the project. Quite a lot empirical examples are thereinpublicsectorinIndiainsupportofthisargumentthatcostoverrunandtimeoverrun can make a companys operations unproductive. But the major challenge that the management of a firm faces in managing the uncertain future cash inflows and out flows associatedwiththeplanandexecutionofCapitalbudgetingdecisions. 4. Capital budgeting decisions involve assessment of market for companys products and services, deciding on the scale of operations, selection of relevant technology and finally procurementofcostlyequipment.Ifafirmweretorealizeaftercommittingitselfconsiderable sumsofmoneyintheprocessofimplementingtheCapitalbudgetingdecisionstakenthatthe decision to diversify or expand would become a wealth destroyer to the company, then the firm would have experienced a situation of inability to sell the equipments bought. Loss incurred by the firm on account of this would be heavy if the firm were to scrap the equipments bought specifically for implementing the decision taken. Sometimes these equipmentswillbespecializedcostlyequipments.Therefore,Capitalbudgetingdecisionsare irreversible. 5. ThemostdifficultaspectofCapitalbudgetingdecisionsistheinfluenceoftime.Afirmincurs Capitalexpendituretobuildupcapacityinanticipationoftheexpectedboominthedemand foritsproducts.ThetimingoftheCapitalexpendituredecisionmustmatchwiththeexpected boomindemandforcompanysproducts.Ifitplansinadvanceitmayeffectivelymanagethe

SikkimManipalUniversity

116

FinancialManagement

Unit8

timingandthequalityofassetacquisition.Butmanyfirmssufferfromitsinabilitytoforecast the future operations and formulate strategic decision to acquire the required assets in advanceatthecompetitiverates. 6. All Capital budgeting decisions have three strategic elements. These three elements are cost,quality and timing. Decisions must betaken at the right time which wouldenablethe firmtoprocuretheassetsattheleastcostforproducingtheproductsofrequiredqualityfor customer.Anylapseonthepartofthefirminunderstandingtheeffectoftheseelementson implementation of Capital expenditure decision taken will strategically affect the firms profitability. 7. Liberalization and globalization gave birth to economic institutions like World Trade organization.GeneralElectricalcanexpanditsmarketintoIndiasnatchingthesharealready enjoyedbyfirmslikeBajajElectricalsorKirloskarElectricCompany.AbilityofGEtosellits products in India at a rate less than the rate at which Indian Companies sell cannot be ignored. Therefore, the growth and survival of any firm in todays business environment demandsafirmtobeproactive.Proactivefirmscannotavoidtheriskoftakingchallenging Capitalbudgetingdecisionsforgrowth. Therefore,Capitalbudgetingdecisionsforgrowthhavebecomeanessentialcharacteristicsof successfulfirmstoday. 8. Thesocial,political,economicandtechnologicalforcesgeneratehighlevelofuncertaintyin futurecashflowsstreamsassociatedwithCapitalbudgetingdecisions.Thesefactors make thesedecisionshighlycomplex. 9. Capital expenditure decisions are very expensive. To implement these decisions firms will havetotaptheCapitalmarketforfunds.Thecompositionofdebtandequitymustbeoptimal keepinginviewtheexpectationofinvestorsandriskprofileoftheselectedproject.

SelfAssessmentQuestions1 1. ______________makeormarabusiness. 2. _____decisionsinvolvelargeoutlayoffundsnowinanticipationofcashinflowsinfuture. 3. Social, political, economic and technological forces make capital budgeting decisions ________________. 4. ________areveryexpensive.

SikkimManipalUniversity

117

FinancialManagement

Unit8

8.3 ComplexitiesinvolvedinCapitalbudgetingdecisions

Capitalexpendituredecisioninvolvesforecastingoffutureoperatingcashflows.Suchforecasting suffersfromuncertaintybecausethefutureishighlyuncertain.Forecastingthefuturecashflows demandsthenecessitytomakecertainassumptionsaboutthebehaviourofcostsandrevenues infuture.Fastchangingenvironmentmakesthetechnologyconsideredforimplementationmany timesobsolete.Forexample,thearrivalofmobilerevolutiontotallymadethepagertechnology obsolete.Thefirmswhichinvestedinpagersfacedtheproblemofpagerslosingitsrelevanceas a means of communication. The firms with the ability to adapt the new knowhow in mobile technology could survive the effect of this phase of technological obsolescence. Others who could not manage the effect of change in technology had a natural death and so most Capital expenditure decisions are irreversible. Estimation of future cash flows of Capital budgeting decisionsisreally complex and difficult commitment offunds onlong termbasis along with the associated problem of irreversibility of decisions and difficulty in estimating cash flows makes Capitalexpendituredecisionscomplexinnature.

SelfAssessmentQuestions2 1. Capitalexpendituredecisionsare____________. 2. Forecasting of future operating cash flows suffers from ____ because the future is ____________________.

8.4 PhasesofCapitalexpendituredecisions: ThefollowingstepsareinvolvedinCapitalbudgetingdecisions: 1. Identificationofinvestmentopportunities. 2. Evaluationofeachinvestmentproposal. 3. Examinetheinvestmentsrequiredforeachinvestmentproposal. 4. PreparethestatementsofCostsandbenefitsofinvestmentproposals. 5. Estimate and compare the net present values of the investment proposals that have been clearedbythemanagementonthebasisofscreeningcriteria. 6. Examine the government policiesand regulatory guidelinesto be observedfor execution of each investment proposal screened and cleared based on the criteria stipulated by the management. 7. Budgetingforcapitalexpenditureforapprovalbythemanagement. 8. Implementation. 9. Post_completionaudit.

SikkimManipalUniversity

118

FinancialManagement

Unit8

SelfAssessmentQuestions3 1. Postcompletionauditis_____inthephasesofcapitalbudgetingdecisions. 2. Identification of investment opportunities is the ______ in the phases of capital budgeting decisions.

8.5 Identificationofinvestmentopportunities:

Afirmisinapositiontoidentifyinvestmentproposalonly whenitisresponsivetotheideasfor capital projects emergingfromvariouslevelsoftheorganization. The proposal may beadding newproductstothecompanysproductline,expansionofcapacitytomeettheemergingmarket atdemandforcompanysproductstomeettheemergingmarketdemandforcompanysproduct ornewtechnologybasedprocessofmanufacturethatwillreducethecostofproduction. Forexample,asalesmanagermaycomewithaproposaltoproduceanewproductasperthe requirements of companys consumers. Marketing manager, based on the sales managers proposal may conducta market survey todetermine the expected demandforthe new product under consideration. Once the marketing manager is convinced of the market potential for proposednewproducttheproposalgoestotheengineerstoexaminethesamewithallaspects of production process. Then the proposal goes to the cost accountant to translate the entire gamutoftheproposalintocostsandrevenuesintermsofincrementalcashflowsbothoutflows and inflows. The costbenefit statement generated by cost accountant shall include all incremental costs and benefits that the firm will incur and derive on commercialization of the proposal under consideration. Therefore, generation of ideas with the feasibility to convert the same into investment proposals occupies a crucial place in the Capital budgeting decisions. Proactiveorganizations encourage a continuous flow of investment proposals from alllevels in theorganization. Inthisconnectionfollowingdeservestobeconsidered: 1. MarketCharacteristics: Analysingthedemandandsupplyconditionsofthemarketforthe companysproductcouldbeafertilesourceofpotentialinvestmentproposals. 2. Various reports submitted by production engineers coupled with the information obtained throughmarketsurveysoncustomersperceptionofcompanysproductcouldbeapotential investmentproposaltoredefinethecompanysproductsintermsofcustomersexpectations. 3. CompanieswhichinvestinResearchandDevelopmentconstantlygetexposuretothebenefit of adapting the new technology quite relevant to keep the firm competitive in the most dynamic businessenvironment. Reports emergingfrom R& D section couldbe a potential sourceofinvestmentproposal.

SikkimManipalUniversity

119

FinancialManagement

Unit8

4. Economic growth of the country and the emerging middle class endowed with purchasing power could generate new business opportunities to existing firms. These new business opportunitiescouldbepotentialinvestmentideas. 5. Public awarenessof their rights compels many firms toinitiateprojectsfrom environmental protection angle. If ignored, the firm may have to face the public wrath through PILs entertainedattheSupremecourtandHighcourts. Therefore, project ideas that would improve the competitiveness of the firm by constantly improving the production process with the sole objective of cost reduction and costumer welfareareacceptedbywellmanagedfirms. Therefore,generationofideasforcapitalprojectsandscreeningthesamecanbeconsidered themostcrucialphaseofCapitalbudgetingdecisions.

SelfAssessmentQuestions4 1. Analyzingthedemandandsupplyconditionsofthemarketforthecompanysproductscould be________ofpotentialinvestmentproposal. 2. Generationofideasforcapitalbudgetsandscreeningthesamecanbeconsidered __________ofcapitalbudgetarydecisions.

8.6RationaleofCapitalbudgetingproposals:

Theinvestorsandstakeholdersexpectafirmtofunctionefficientlytosatisfytheirexpectations. Through the stake holders expectation of the performance of the company may clash among themselves,theonethattouchesallthesestakeholdersexpectationcouldbevisualizedinterms of the firms obligation to reduce the operating costs on a continuous basis and increasing its revenues. These twin obligations of a firm form the basis of all Capital budgeting decisions. Therefore,Capitalbudgetingdecisionscouldbegroupedintotwocategories: 1. Decisionsoncostreductionprogrammes. 2. Decisionsonrevenuegenerationthroughexpansionofinstalledcapacity.

SelfAssessmentQuestions5 1._________decisionscouldbegroupedintotwocategories. 2.____________andrevenuegenerationarethetwoimportantcategriesofcapitalbudgeting.

8.7CapitalBudgetingprocess:Oncethescreeningofproposalsforpotentialinvolvementis overthenext.ThecompanyshouldtakeupthefollowingaspectsofCapitalBudgetingprocess.

SikkimManipalUniversity

120

FinancialManagement

Unit8

1. Commercial: A proposal should be commercially viable. The following aspects are examinedtoascertainthecommercialviabilityofanyinvestmentproposal. a. Marketfortheproduct b. Availabilityofrawmaterials c. Sourcesofrawmaterials d. Theelementsthatinfluencethelocationofaplanti,e,thefactorstobeconsideredinthesite selection. 2. Infrastructural facilities such as roads, communications facilities, financial services such as banking,publictransportservices. Amongtheaspectsmentionedabovethecrucialoneistheneedtoascertainthedemandfor the productor services. Itis done by marketappraisal. Inappraisalof marketfor thenew product,thefollowingdetailsarecompiledandanalyzed. a. Consumptiontrends. b. Competitionandplayersinthemarket c. Availabilityofsubstitutes d. Purchasingpowerofconsumers e. RegulationsstipulatedbyGovernmentonpricingtheproposedproductsorservices f. Production constraints: Relevant forecasting technologies are employed to get a realistic picture of the potential demand for the proposed product or service. Many projects fail to achieve the planned targets on profitability and cash flows if the firm could not succeed in forecastingthedemandfortheproductonarealisticbasis.

8.7.1 Technicalappraisal: Thisappraisalisdonetoensurethatalltechnicalaspectsofthe implementationoftheprojectareconsidered. Thetechnicalexaminationoftheprojectconsidersthefollowing: a. Selectionofprocessknowhow b. Decisionondeterminationofplantcapacity c. Selectionofplantandequipmentandscaleofoperation d. Plantdesignandlayout e. Generallayoutandmaternalflow f. Constructionschedule

8.7.2 Economic Appraisal: This appraisal examines the project from the social point of view.Itisalsoknownassocialcostbenefitanalysis.Itexamines:

SikkimManipalUniversity

121

FinancialManagement

Unit8

g. Theimpactoftheprojectontheenvironment h. Theimpactoftheprojectontheincomedistributioninthesociety. i. The impact of the project on fulfillment of certain social objective like generation of employment,attainmentofselfsufficiencyetc. j. Willitmateriallyalterthelevelofsavingsandinvestmentinthesociety?

3. Financial appraisal: This appraisalis to examine the financial viability of the project. It assesses the risk and returns at various stages of project execution. Besides, it examines whether the risk adjusted return from the project exceeds the cost of financing the project. Thefollowingaspectsareexaminedintheprocessofevaluatingaprojectinfinanciallyterms. a. Costoftheproject b. Investmentoutlay c. Meansoffinancingandthecostofcapital d. Expectedprofitability e. Expectedincrementalcashflowsfromtheproject f. Breakevenpoint g. Cashbreakevenpoint h. Riskdimensionsoftheproject i. Willtheprojectmateriallyaltertheriskprofileofthecompany? j. Iftheprojectisfinancedbydebt,expectedDebtServiceCoverageRatio k. Taxholidaybenefits,ifany

SelfAssessmentQuestions6 1. ______________examinestheprojectfromthesocialpointview. 2. Alltechnicalaspectsoftheimplementationoftheprojectareconsideredin_____. 3. ___ofaprojectisexaminedbyfinancialappraisal. 4. Among the elements that are to be examined under commernal appraised the most crucial oneisthe_________________. 8.8 InvestmentEvaluation: followingstepsareinvolvedintheevaluationofanyinvestment proposal: 1. EstimatesofCashflowsbothinflowsandoutflowsoccurringatdifferentstagesofprojectlife cycle. 2. Examinationoftheriskprofileoftheprojecttobetakenupandarrivingattherequiredrateof return

SikkimManipalUniversity

122

FinancialManagement

Unit8

3. Formulatingthedecisioncriteria.

Estimation of Cash flows: Estimating the cash flows associated with the project under considerationisthemostdifficultandcrucialstepintheevaluationofaninvestmentproposal.It istheresultoftheteamworkofmanyprofessionalsinanorganization. 1. Capital outlays are estimated by engineering departments after examining all aspects of productionprocess. 2. Marketing department on the basis of market survey forecasts the expected sales revenue duringtheperiodofaccrualofbenefitsfromprojectexecutions. 3. Operatingcostsareestimatedbycostaccountantsandproductionengineers 4. Incrementalcashflowsandcashoutflowstatementispreparedbythecostaccountantonthe basisofthedetailsgeneratedintheabovesteps.Theabilityofthefirmtoforecastthecash flows with reasonableaccuracy liesat the rootofthe successof theimplementationofany capitalexpendituredecision. Investment (Capital budgeting) decision required the estimation of incremental cash flow stream over the life of the investment. Incremental cash flows are estimated on after tax basis. Incrementalcashflowsstreamofacapitalexpendituredecisionhasthreecomponents. 1. InitialCashoutlay(Initialinvestment):Initialcashoutlaytobeincurredisdeterminedafter consideringanyposttaxcashinflowsifany,Inreplacementdecisionsexistingoldmachinery is disposed of and a new machinery incorporating the latest technology is installed in its place.Ondisposalofexistingoldmachinerythefirmhasacashinflow.Thiscashinflowhas tobecomputedonposttaxbasis.Thenetcashoutflow(totalcashrequiredforinvestmentin capitalassetsminusposttaxcashinflowondisposaloftheoldmachinerybeingreplacedby anewone)thereforeistheincrementalcashoutflow.Additionalnetworkingcapitalrequired onimplementationofnewprojectistobeaddedtoinitialinvestment. 2. OperatingCashinflows:OperatingCashinflowsareestimatedfortheentireeconomiclifeof investment(project).Operatingcashinflowsconstitute astreamofinflowsandoutflowsover the life of the project. Here also incremental inflows and outflows attributable to operating activitiesareconsidered.Anysavingsincostoninstallationofanewmachineryintheplace of the old machinery will have to be accounted to on post tax basis. In this connection incrementalcashflowsrefertothechangeincashflowsonimplementationofanewproposal overtheexistingpositions.

SikkimManipalUniversity

123

FinancialManagement

Unit8

3. TerminalCashinflows: Attheendoftheeconomiclifeoftheproject,theoperatingassets installednowwillbedisposedoff.Itisnormallyknownassalvagevalueofequipments.This terminalcashinflowsiscomputedonposttaxbasis. Prof. Prasanna Chandra in his book Financial Management has identified certain basic principlesofcashflow estimation. The knowledge oftheseprinciples will help a studentin understandingthebasisofcomputingincrementalcashflows. Theseprinciples,asgivenbyProf.PrasannaChandraare: a. Separationprinciple b. Incrementalprinciple c. Posttaxprinciple d. Consistencyprinciple a. Separationprinciple: Theessenceofthisprincipleisthenecessitytotreatinvestment element of the project separately (i,e independently) from that of financing element. The financing costis computed by the cost of capital. Cost ofcapitalisthe cutoff rate and rate of returnexpectedonimplementationoftheprojectiscomparedwiththecostofcapital.Therefore, we compute separately cost offundsforexecutionofproject throughthefinancing mode. The rateofreturnexpectedonimplementationiftheprojectisarrivedatbytheinvestmentprofileof theprojects.Therefore,interestondebtisignoredwhilearrivingatoperatingcashinflows. Thefollowingformulaeisusedtocalculateprofitaftertax. IncrementalPAT=IncrementalEBIT(1t) (Incremental)(Incremental) EBIT=Earnings(Profit)beforeinterestandtaxes. t=taxrate EBITinfactrepresentsincrementalearningsbeforeinterestandtax Whendepreciationchargesoncomputingincrementalposttaxprofitisaddedbacktoincremental profitaftertax,wegetincrementaloperatingcashinflow.

b. Incrementalprinciple:Incrementalprinciplesaysthatthecashflowsofaprojectareto beconsideredinincrementalterms.Incrementalcashflowsarethechangesinthefirms totalcashflowsarisingdirectlyfromtheimplementationoftheproject. Thefollowingaretobekeptinmindindeterminingincrementalcashflows. 1. IgnoreSunkcosts: Asunkcostmeansanoutlayalreadyincurred.Itisnotarelevantcost for the project decisions to be taken now. It is ignored when the decisions on project now underconsiderationistobetaken.

SikkimManipalUniversity

124

FinancialManagement

Unit8

2. OpportunityCosts: Ifthefirmalreadyownsanassetorresourcewhichcouldbeusedinthe execution of the project under consideration theasset or resource has an opportunity cost. Theopportunityofcostofsuchresourceswillhavetobetakenintoaccountintheevaluation oftheprojectfor acceptanceor rejection. For example,thefirm wants to openabranchin Chennai for expansion of its market in Tamil Nadu. The firm already owns a building in Chennai. The building in Chennai is let out to some other firm on an annual rent of Rs.1 Crore.ThefirmtakesadecisiontoopenabrandsatChennai.Foropeningthebranchat Chennaithefirmusesthebuildingitownsbysacrificingtherentalincome whichitreceives now. The opportunity cost of the building at Chennai is Rs.1 crores. This will have to be considered in arriving at the operating cash flows associated with the decision to open a branchatChennai. 3. Need to takeintoaccount all incident effect:Effectsof aproject on the workingof other parts of a firm also known as externalities must be taken into account. For example, expansion or establishment of a branch at a new place may increase the profitability of existing branches because the branch at the new place has a complementary relationship withtheotherexistingbranchesorreducetheprofitabilityofexistingbranchesbecausethe branchatthenewplacecompeteswiththebusinessofotherexistingbranchesortakesaway somebusinessactivitiesfromtheexistingbranches. Cannibalization: Another problem that a firm faces on introduction of a new product is the reductioninthesaleofanexistingproduct.Thisiscalledcannibalization.Themostchallenging task is the handling of problems of cannibalization. Depending on the companys position with that of the competitors in the market, appropriate strategy has to follow. Correspondingly the costofcannibalizationwillhavetobetreatedeitherasrevelentcostofthedecisionorignored. Productcannibalization willaffectthe companys sales if thefirm is marketingitsproducts in a marketcharacterizedbyseverecompetition,withoutanyentrybarriers. In this case costs are not relevant for decision. On the other hand if the firms sales are not affected by competitors activities due to certain unique protection that it enjoys on account of brand positioning or patent protection the costs of cannibalization cannot be ignored in taking decisions c.PostTaxPrinciple: allcashflowsshouldbecomputedonposttaxbasis d. Consistencyprinciple: cashflowsanddiscountratesusedinprojectevaluationneedto consistentwiththeinvestorgroupandinflation.

SikkimManipalUniversity

125

FinancialManagement

Unit8

In capital budgeting, the cash flows applicable to all investors (i.e equity, preference share holders anddebt holders) and weightedaverage cost of capital areconsidered. Nominal cash flowsandnominaldiscountsareconsideredincapitalbudgetingdecision. Example(illustration) Afirmconsideringreplacementofitsexistingmachinebyanewmachine.Thenewmachinewill costRs1,60,000andhavealifeoffiveyears.Thenewmachinewillyieldannualcashrevenue of Rs 2,50,000 andincur annual cashexpensesof Rs 1,30,000. The estimated salvage ofthe newmachineattheendofitseconomiclifeisRs8,000.Theexistingmachinehasabookvalue ofRs40,000andcanbesoldforRs20,000.Theexistingmachine,ifusedforthenextfiveyears is expected to generate annual cash revenue of Rs 2,00,000 and to involve annual cash expensesofRs1,40,000.Ifsoldafterfiveyears,thesalvagevalueoftheexistingmachinewill benegligible. Thecompanypaystaxat30%.Itwritesoffdepreciationact25%onthewrittendownvalue.The companyslostofcapitalis20% Computetheincrementalcashflowsofreplacementdecisions.

Solution: InitialInvestment: Grossinvestmentforthenewmachine Less:Cashreceivedfromthesaleof Existingmachine Netcashoutlay 20,000 (1,40,000) (1,60,000)

AnnualCashflowsfromoperations Incrementalcashflowsfromrevenue50,000 Incrementaldecreaseinexpenditure(10,000) IncrementalDepreciationSchedule

Year

Depreciation (NewMachine(Rs.)

Depreciation (OldMachine) 10,000 7,500 5,625

Incremental Depreciation(Rs.) 35,000 26,250 19,687

1 2 3

SikkimManipalUniversity

45,000 33,750 25,312

126

FinancialManagement

Unit8

4 5

18,984 14,238

4,219 3,164

14,765 11,074

Depreciationiscalculatedasunder BookValue Add:Costofnewmachine 40,000 1,60,000 2,00,000 Less:SaleproceedsofOldMachine 20,000 1,80,000 DepreciationforIyear25% 45,000 1,35,000 DepreciationforIIyear25% 33,750 1,01,250 DepreciationforIIIyear25% 25,312 75,938 DepreciationforIVyear25% 18,984 56,954 DepreciationforVyear25% Bookvalueafter5years 14,238 42,716

StatementofincrementalCashflows Particulars 0Rs 1.Investmentinnew machine 2.Aftertaxsalvagevalue ofoldmachine 3.NetCashOutlay (1,40,000) 20,000 (1,60,000) 1Rs Year 2Rs 3Rs 4Rs 5Rs

SikkimManipalUniversity

127

FinancialManagement

Unit8

4.Increaseinrevenue 5.Decreaseinexpenses 6.Increaseindepreciation 7.IncreaseinEBIT 8.EBIT(1T) 9.IncrementalCashflows fromoperation(8+6) 10.Salvagevalueofnew machine 11.IncrementalCash flows (1,40,000) negative

50,000 10,000 35,000 25,000 17,500 52,500

50,000 10,000 26,250 33,750 23,625 49,875

50,000 10,000 19,687 40,313 28,219 47,906

50,000 10,000 14,765 45,235 31,665 46,430

50,000 10,000 11,074 48,926 34,248 45,322

8,000

52,500

49,875

47,906

46,430

53,322

Thefollowingpointstobekeptindecidingontheappraisaltechnique: 1. Appraisaltechniqueshouldmeasuretheeconomicworthoftheproject. 2. Wealthmaximizationofshareholdersshallbetheguidingprinciple. 3. Itshallconsiderallcashflowsovertheentirelifeoftheprojecttoascertaintheprofitabilityof theproject. 4. Itshallranktheprojectsonascientificbasis. 5. It should ensure an accepted criterion when faced with the need to select fromamong the projectswhicharemutuallyexclusivesoastomakeacorrectchoice. 6. Itshouldrecognizethefactthatinitialhighercashflowsaretobepreferredtosmallerones. 7. Earliercashflowsarepreferredtothatoccurringlater.

SelfAssessmentQuestions7 1. Formulating_isthethirdstepintheevaluationofinvestmentproposal. 2. A_____________isnotarelevantcostfortheprojectdecision. 3. Effectofaprojectontheworkingofotherpartsofafirmisknowas________. 4. Theessenceofseparationprincipleisthenecessitytotreat________ofaprojectseparately fromthatof________. 5. Paybackperiod________timevalueofmoney. 6. IRRgivesarateofreturnthatreflectsthe__theproject.

SikkimManipalUniversity

128

FinancialManagement

Unit8

8.9 Appraisal Criteria: The methodsof appraising aninvestmentproposal can be grouped into 1. Traditionalmethods. 2. Modernmethods. TraditionalMethodare: i. Paybackmethod. ii. AccountingRateofReturn. Moderntechniquesare: a. Netpresentvalue. b. InternalRateofRate. c. Modifiedinternalrateofreturn. d. Profitabilityindex.

8.9.1TraditionalTechniques: a. Payback method: payback period is defined as the length of time required to recover the initialcashoutlay. Example:ThefollowingdetailsareavailableinrespectofthecashflowsoftwoprojectsA&B

Year

ProjectA Cashflows(Rs.)

ProjectB Cashflows(Rs.) (5,00,000) 1,00,000 2,00,000 3,00,000 4,00,000 2,00,000

0 1 2 3 4 5

(4,00,000) 2,00,000 1,75,000 25,000 2,00,000 1,50,000

ComputepaybackperiodforAandB Solution: Year ProjectA Cashflows(Rs.) Cumulative Cashflows 1 2 2,00,000 1,75,000 2,00,000 3,75,000 1,00,000 2,00,000 ProjectB Cashflows(Rs.) Cumulative Cashflows 1,00,000 3,00,000

SikkimManipalUniversity

129

FinancialManagement

Unit8

3 4 5

25,000 2,00,000 1,50,000

4,00,000 6,00,000 7,50,000

3,00,000 4,00,000 2,00,000

6,00,000 10,00,000 12,00,000

From the cumulative cash flows column project A recovers the initial cash outlay of Rs 4,00,000attheendofthethirdyear.Therefore,paybackperiodofprojectAis3years. FromthecumulativecashflowcolumntheinitialcashoutlayofRs5,00,000liesbetween

nd rd 2 yearand3 yearinrespectofprojectB.Therefore,paybackperiodforprojectBis:

5,00,0003,00,000

2+

=2.67years

3,00,000

Evaluationofpaybackperiod: Merits: 1. Simpleinconceptandapplication. 2. Since emphasis is on recovery of initial cash outlay it is the best method for evaluation of projectswithveryhighuncertainty. 3. Withrespecttoacceptorrejectcriterionpaybackmethodfavorsaprojectwhichislessthan orequaltothestandardpaybacksetbythemanagement.Inthisprocessearlycashflows getduerecognition thanlatercashflows.Therefore,paybackperiodcouldbeusedasatool todealwiththerankingofprojectsonthebasisofriskcriterion. 4. Forfirmswithshortagefundsthisispreferredbecauseitmeasuresliquidityoftheproject. Demerits: 1. Itignorestimevalueofmoney. 2. Itdoesnotconsiderthecashflowsthatoccurafterthepaybackperiod. 3. Itdoesnotmeasuretheprofitabilityoftheproject. 4. Itdoesnotthrowanylightonthefirmsliquiditypositionbutjusttellsabouttheabilityofthe projecttoreturnthecashoutlayoriginallymade. 5. Project selected on the basis of pay back criterion may be in conflict with the wealth maximizationgoalofthefirm. Acceptorrejectcriterion: a. Ifprojectsaremutuallyexclusive,selecttheprojectwhichhastheleastpaybackperiod. b. Inrespectofotherprojects,selecttheprojectwhichhavepaybackperiodlessthanorequal tothestandardpaybackstipulatedbythemanagement. Illustration:

SikkimManipalUniversity

130

FinancialManagement

Unit8

Followingdetailsareavailable Paybackperiod: ProjectA=3years ProjectB=2.5years Standardsetupbymanagement=3years Ifprojectsaremutuallyexclusive,acceptprojectBwhichhastheleastpaybackperiod. Ifprojectsarenotmutuallyexclusive,acceptboththeprojectbecausebothhavepaybackperiod lessthanorequaltooriginaltothestandardpaybackperiodsetbythemanagement Paybackperiod formula YearPriortofullrecovery Ofinitialoutlay + Balanceofinitialoutlaytoberecovered atthebeginningoftheyearinwhichfull Recoverytakesplace Cashinflowoftheyearinwhichfullrecovery takesplace

8.9.2 DiscountedPayBackPeriod: Thelengthinyearsrequiredtorecovertheinitialcashoutlayonthepresentvaluebasisiscalled thediscounted pay back period. The opportunity cost of capitalis usedfor calculatingpresent valuesofcashinflows. Discounted pay back period for a project will be always higher than simple pay back period becausethecalculationofdiscountedpaybackperiodisbasedondiscountedcashflows.

Forexample: Year ProjectA Cashflows 0 1 2 3 4 5 (4,00,000) 2,00,000 1,75,000 25,000 2,00,000 1,50,000 PVfactorat10 % 1 0.909 0.826 0.751 0.683 0.621 PVofCash flows (4,00,000) 1,81,800 1,44,550 18,775 1,36,600 93,150 Cumulativepositive Cashflows 1,81,800 3,26,350 3,45,125 4,81,725 5,74,875

DiscountedPaybackperiod:

SikkimManipalUniversity

131

FinancialManagement

Unit8

4,00,0003,45,125

3+

1,36,600

=3.4years

Accountingrateofreturns: ARR measures the profitability of investment (project) using information taken from financial statements: Averageincome

ARR=

Averageinvestment

Averageofposttaxoperatingprofits Averageinvestment

Averageinvestment=

Bookvalueoftheinvestment Inthebeginning

Bookvalueofinvestmentattheendof thelifeoftheprojectorinvestment

2 Illustration: Thefollowingparticularrefertotwoprojects: X Cost Estimatedlife Salvagevalue Estimateincome Aftertax Rs 1 2 3 4 5 Total Average 3,000 4,000 7,000 6,000 8,000 28,000 5,600 Rs 10,000 8,000 2,000 6,000 5,000 31,000 6,200 40,000 5years Rs.3,000 Y 60,000 5years Rs.3,000

SikkimManipalUniversity

132

FinancialManagement

Unit8

Averageinvestment21,50031,500 ARR 5,600 21,500 6,200 31,500

=26%

19.7%

MeritsofAccountingrateofreturn: 1. Itisbasedonaccountinginformation. 2. Simpletounderstand. 3. Itconsiderstheprofitsofentireeconomiclifeoftheproject. 4. Since it is based on accounting information the business executives familiar with the accountinginformationunderstandthistechnique. Demerits: 1. Itisbasedonaccountingincomeandnotbasedoncashflows,asthecashflowapproachis consideredsuperiortoaccountinginformationbasedapproach. 2. Itdoesnotconsiderthetimevalueofmoney. 3. Different investment proposals which require different amounts of investment may have the same accounting rate of return. The ARR fails to differentiate projects on the basis of the amountrequiredforinvestment. 4. ARRisbasedontheinvestmentrequiredfortheproject.Therearemanyapproachesforthe calculation of denominator of average investment. Existence of more than one basis for arriving at the denominator of average investment may result in adoption of many arbitary bases. BecauseofthisthereliabilityofARRasatechniqueofappraisalisreducedwhentwoprojects withthesameARRbutwithdifferinginvestmentamountsaretobeevaluated. Acceptorrejectcriterion: AnyprojectwhichhasanARRmoretheminimumratefixedbythemanagementisaccepted.If actual ARR is less than the cuff rate (minimum rate specified by the management ) then that projectisrejected).Whenprojectsaretoberankedfordecidingontheallocationofcapitalon accountoftheneedforcapitalrationing,projectwithhigherARRarepreferredtotheoneswith lowerARR.

SikkimManipalUniversity

133

FinancialManagement

Unit8

Discountedcashflowmethod: Discountedcashflowmethodortimeadjustedtechniqueisanimprovementoverthetraditional techniques. In evaluation ofthe projects theneed to give weight age to the timing of returnis effectively considered in all DCF methods. DCF methods are cash flow based and take the cognizanceofboththeinterestfactorsandcashflowafterthepaybackperiod. DCFtechniqueinvolvesthefollowing. 1. Estimation of cash flows, both inflows and outflows of a project over the entire life of the project. 2. Discountingthecashflowsbyanappropriateinterestfactor(discountfactor). 3. Sumofthepresentvalueofcashoutflowsisdeductedfromthesumofpresentvalueofcash inflows to arrive at net present value of cash flows, the most popular techniques of DCF methods. DCFmethodsareof3types: 1. Thenetpresentvalue. 2. Theinternalrateofreturn. 3. Profitabilityindex.

Thenetpresentvalue: NPVmethodrecognizesthetimevalueofmoney.Itcorrectlyadmitsthatcashflowsoccurringat differenttimeperiodsdifferinvalue.Therefore,thereistheneedtofindoutthepresentvaluesof allcashflows. NPVmethodisthemostwidelyusedtechniqueamongtheDCFmethods. StepsinvolvedinNPVmethod: 1. Forecast the cash flows, both inflows and outflows of the projects to be taken up for execution. 2. Decisionsondiscountfactororinterestfactor.Theappropriatediscountrateisthefirmscost ofcapitalorrequiredrateofreturnexpectedbytheinvestors. 3. Computethepresentvalueofcashinflowsandoutflowsusingthediscountfactorselected. 4. NPV is calculated by subtracting the PV of cash outflows from the present value of cash inflows.

Acceptorrejectcriterion: If NPV is positive, the project should be accepted. If NPV is negative the project should be rejected.

SikkimManipalUniversity

134

FinancialManagement

Unit8

Acceptorrejectcriterioncanbesummarizedasgivenbelow: 1. NPV>Zero=accept 2. NPV<Zero=reject NPV method canbe used to select between mutually exclusive projects by examining whether incrementalinvestmentgeneratesapositivenetpresentvalue. MeritsofNPVmethod: 1. Ittakesintoaccountthetimevalueofmoney. 2. Itconsiderscashflowsoccurringovertheentirelifeoftheproject. 3. NPVmethodisconsistentthegoalofmaximizingthenetwealthofthecompany. 4. Itanalysesthemeritsofrelativecapitalinvestments. 5. Sincecostofcapitalofthefirmisthehurdlerate,theNPVensuresthattheprojectgenerates profitsfromtheinvestmentmadeforit. Demerits: 1. Forecasting of cash flows in difficult as it involves dealing with the effect of elements of uncertaintiesonoperatingactivitiesofthefirm. 2. Todecideonthediscountingfactor,thereistheneedtoassesstheinvestorsrequiredrateof returnButitisnotpossibletocomputethediscountrateprecisely. 3. Therearepracticalproblemsassociatedwiththeevaluationofprojectswithunequallivesor underfundsconstraints. For ranking of projects under NPV approach the project with the highest positive NPV is preferredtothatwithlowerNPV.

Example:AprojecttcostsRs.25000andisexpectedtogeneratecashinflowsas Year 1 2 3 Cashinflows 10,000 8,000 9,000

46,000 5 7,000

Thecostofcapitalis12%.Thepresentvaluefactorsare: Year 1 2 3 PVfactorat12% 0.893 0.797 0.712

SikkimManipalUniversity

135

FinancialManagement

Unit8

40.636 5 0.567

ComputetheNPVoftheproject Solution: Year Cashflows PVfactorat12 % 1 2 3 4 5 10,000 8,000 9,000 6,000 7,000 0.893 0.797 0.712 0.636 0.567 PVofCash flows 8,930 6,376 6,408 3,816 3,969 29,499

Sumofthepresentvalueofcashinflows Less:Sumofthepresentvalueofcashoutflows NPV 25,500 4,499

TheprojectgeneratesapositiveNPVofRs.4499.Therefore,projectshouldbeaccepted.

Problem: A company is evaluating two alternatives for distribution within the plant. Two alternativesare 1. Csystemwithahighinitialcostbutlowannualoperatingcosts. 2. Fsystemwhichcostslessbuthaveconsiderablyhigheroperatingcosts. The decision to construct the plant has already been made, and the choice here will have no effect on the overall revenues of the project. The cost of capital of the plant is 12% and the projectsexpectednetcostsarelistedbelow: Year ExpectedNetCashCosts CSystems 0 1 2 3 4 5

SikkimManipalUniversity

FSystems (1,20,000) (96,000) (96,000) (96,000) (96,000) (96,000)

(3,00,000) (66,000) (66,000) (66,000) (66,000) (66,000)

136

FinancialManagement

Unit8

Whatisthepresentvalueofcostsofeachalternative? Whichmethodshouldbechosen.? Solution:Computationofpresentvalue

Year CSystems 1 2 3 4 5 (66,000) (66,000) (66,000) (66,000) (66,000) FSystemsIncremental (96,000) (96,000) (96,000) (96,000) (96,000) 30,000 30,000 30,000 30,000 30,000

Presentvalueofincrementalsavings=30,0000xPVIFA(12%,5) =30,000x3.605=1,08,150 Incrementalcashoutlay= 1,80,000 (71,850)

SincethepresentvalueofincrementalnetcashinflowsofCsystemoverFsystemisnegative.C systemisnotrecommended. Therefore,Fsystemisrecommended. PropertiesoftheNPV 1. NPVsareadditive.IftwoprojectsAandBhaveNPV(A)andNPV(B)thenbyadditiverule thenetpresentvalueofthecombinedinvestmentisNPV(A+B) 2. Intermediatecashinflowsarereinvestedatarateofreturnequaltothecostofcapital. DemeritsofNPV: 1. NPVexpressestheabsolutepositiveornegativepresentvalueofnetcashflows.Therefore, itfailstocapturethescaleofinvestment. 2. In the application of NPV rule in the evaluation of mutually exclusive projects with different lives,biasoccursinfavourofthelongtermprojects.

InternalRateofReturn: Itistherateofreturn(i,ediscountrate)whichmakestheNPVofany projectequaltozero.IRRistherateofinterestwhichequatesthePVofcashinflowswiththePV ofcashflows. IRR is also called yield on investment, managerial efficiency of capital, marginal productivity of capital,rateofreturn,timeadjustedrateofreturn.IRRistherateofreturnthataprojectearns.

SikkimManipalUniversity

137

FinancialManagement

Unit8

EvaluationofIRR: 1. IRRtakesintoaccountthetimevalueofmoney 2. IRR calculates the rate of return of the project, taking into account the cash flows over the entirelifeoftheproject. 3. Itgivesarateofreturnthatreflectstheprofitabilityoftheproject. 4. Itisconsistentwiththegoaloffinancialmanagementi,emaximizationofnetwealthofshare holders 5. IRRcanbecomparedwiththefirmscostofcapital. 6. TocalculatetheNPVthediscountratenormallyusediscostofcapital.ButtocalculateIRR, there is no need to calculate and employ the cost of capital for discounting because the projectisevaluatedattherateofreturngeneratedbytheproject.Therateofreturnisinternal totheproject.

Demerits: 1. IRRdoesnotsatisfytheadditiveprinciple. 2. Multipleratesofreturnorabsenceofauniquerateofreturnincertainprojectswillaffectthe utilityofthistechniquesasatoolofdecisionmakinginprojectevaluation. 3. Inprojectevaluation,theprojectswiththehighestIRRaregivenpreferencetotheoneswith lowinternalrates. Applicationofthiscriteriontomutuallyexclusiveprojectsmayleadundercertainsituationsto acceptanceofprojectsoflowprofitabilityatthecostofhighprofitabilityprojects. 4. IRRcomputationisquitetedious.

AcceptorRejectCriterion: Iftheprojectsinternalrateofreturnisgreaterthanthefirmscostofcapital,accepttheproposal. Otherwiserejecttheproposal. IRRcanbedeterminedbysolvingthefollowingequationforr=

CF0 =

Ct

t (1+r)

wheret=1ton

CF0 =Investment Sumofthepresentvaluesofcashinflowsattherateofinterestofr: Ct (1+r)

t

wheret=1ton

SikkimManipalUniversity

138

FinancialManagement

Unit8

Example: A project requires an initial out lay of Rs.1,00,000. It is expected to generate the followingcashinflows: Year 1 2 3 4 Cashinflows 50,000 50,000 30,000 40,000

WhatistheIRRoftheproject? StepI Computetheaverageofannualcashinflows Year 1 2 3 4 Total Cashinflows 50,000 50,000 30,000 40,000 1,70,000

Average=1,70,000=Rs.42,500 4 StepII:Dividetheinitialinvestmentbytheaverageofannualcashinflows: =1,00,000=2.35 42,500 StepIII:FromthePVIFAtablefor4years,theannuityfactorverynear2.35is25%.Therefore thefirstinitialrateis25% Year Cashflows PVfactorat25 % 1 2 3 4 50,000 50,000 30,000 40,000 0.800 0.640 0.512 0.410 Total PVofCash flows 40,000 32,000 15,360 16,400 1,03,760

SincetheinitialinvestmentofRs.1,00,000islessthanthecomputedvalueat25%ofRs.1,03,760 thenexttrialrateis26%.

SikkimManipalUniversity

139

FinancialManagement

Unit8

Year

Cashflows

PVfactorat26 %

PVofCash flows 39,685 31,495 14,997 15,872 1,02,049

1 2 3 4

50,000 50,000 30,000 40,000

0.7937 0.6299 0.4999 0.3968 Total

Thenexttrialrateis27% Year Cashflows PVfactorat27 % 1 2 3 4 50,000 50,000 30,000 40,000 0.7874 0.6200 0.4882 0.3844 Total PVofCash flows 39,370 31,000 14,646 15,376 1,00,392

Thenexttrialrateis28% Year Cashflows PVfactorat26 % 1 2 3 4 50,000 50,000 30,000 40,000 0.7813 0.6104 0.4768 0.3725 Total PVofCash flows 39,065 30,520 14,3047 14,900 98,789

SinceinitialinvestmentofRs.1,00,000liesbetween98789(28%)and1,00,392(27%)theIRRby interpolation. 1,00,3921,00,000

27+

.

1,00,39298,789

X1

392

27+

1603

X1

SikkimManipalUniversity

140

FinancialManagement

Unit8

=27+0.2445 =27.2445=27.24%

ModifiedInternalRateofReturn: MIRRisadistinctimprovementovertheIRR.ManagersfindIRRintuitivelymoreappealingthan the rupees of NPV because IRRisexpressedona percentage rates ofreturn. MIRR modifies IRR.MIRRisabetterindicatorofrelativeprofitabilityoftheprojects. MIRRisdefinedas PVofCosts=PVofterminalvalue TV

PVC= n (1+MIRR)

PVC=PVofcosts TocalculatePVC,thediscountrateusedisthecostofcapital. Tocalculatetheterminalvalue,thefuturevaluefactorisbasedonthecostofcapital ThenobtainMIRRonsolvingthefollowingequation. TV

PVofCosts=

n (1+MIRR)

SuperiorityofMIRRoverIRR 1. MIRRassumesthatcashflowsfromtheprojectarereinvestedatthecostofcapital.The IRRassumesthatthecashflowsfromtheprojectarereinvestedattheprojectsownIRR. Since reinvestment at the cost of capital is considered realistic and correct, the MIRR measurestheprojectstrueprofitability 2. MIRRdoesnothavetheproblemofmultiplerateswhichwecomeacrossinIRR.

Illustration: Year Cashflows (Rsinmillion) 0 1 2 3 4 5 6

(100)(100)306090120130

CostofCapital is12% Presentvalueofcost=100+100 1.12 =100+89.29=189.29

SikkimManipalUniversity

141

FinancialManagement

Unit8

Terminalvalueofcashflows:

4 3 2 =30(1.12) +60(1.12) +90(1.12) +120(1.12)+130

=30x1.5735+60x1.4049+90x1.2544+120x1.12+130 =47.205+84.294+112.896+134.4+130 =508.80 MIRRisobtainedonsolvingthefollowingequation 508.80

6 189.29= (1+MIRR)

508.80

(1+MIRR) =

(1+MIRR) =2.6879 MIRR=17.9%

6

189.29

ProfitabilityIndex:itisalsoknownasBenefitcostratio. Profitability index is the ratio of the present value of cash inflows to initial cash outlay.The discountfactorbasedontherequiredrateofreturnisusedtodiscountthecashinflows.

Presentvalueofcashinflows

PI=

InitialCashoutlay

AcceptorRejectCriterion: 1. AccepttheprojectifPIisgreaterthan1 2. RejecttheprojectifPIislessthan1

If profitability indexis 1 then the management may accept the project because the sum of the presentvalue of cash inflowsis equal to the sum ofpresentvalueofcash outflows. It neither addsnorreducestheexistingwealthofthecompany. MeritsofPI: 1. Ittakesintoaccountthetimevalueofmoney 2. Itisconsistentwiththeprincipleofmaximizationofshareholderswealth. 3. Itmeasurestherelativeprofitability.

Demerits: 1. Estimationofcashflowsanddiscountratecannotbedoneaccuratelywithcertainty.

SikkimManipalUniversity

142

FinancialManagement

Unit8

2. A conflict may arise between NPV and profitability index if a choice between mutually exclusiveprojectshastobemade.

Example X PVofCashinflows Initialcashoutlay NPV ProfitabilityIndex 4,00,000 2,00,000 2,00,000 2 Y 2,00,000 80,000 1,20,000 2.5

AsperNPVmethodprojectXshouldbeaccepted.AsperprofitabilityindexprojectYshouldbe accepted.Thisleadstoaconflictingsituation.TheNPVmethodistobepreferredtoprofitability indexbecausetheNPVrepresentsthenetincreaseinthefirmswealth.

Example: AfirmisconsideringaninvestmentproposalwhichrequiresanintialcashoutlayofRs 8lakhnowandRs2lakhattheendofthethirdyear.Itisexpectedtogeneratecashflowsas under: Year 1 2 3 Cashinflows 3,50,000 8,00,000 2,50,000

Applythediscountrateof12%calculateprofitabilityindex Solution: PresentValueofCashoutflows

Year

PVfactorat12 % 1

Cashoutflows

PVofCash flows

Rs.8lakhs

Rs.8lakhs

2 3 0.712 2lakhs Total 1.424lakhs 9.424lakhs

SikkimManipalUniversity

143

FinancialManagement

Unit8

PresentValueofCashinflows Year PVIF(12%) Cashinflows PVofCash flows 1 2 4 0.893 0.797 0.636 3,50,000 8,00,000 2,50,000 Total 3.1255lakhs 6.376lakhs 1.5900lakhs 11.0915lakhs

PI=Totalofpresentvalueofcashinflows Totalofpresentvalueofcashoutflows =11.0915 9.424 ForeveryRe.1investedtheprojectisexpectedtogiveacashinflowofRs.1.177i,eforevery rupeeinvestedaprofitofRs.0.177isobtained. =1.177

8.10 Summary Capital investment proposals involve current outlay of funds in the expectation of a stream of cashinflowinfuture.Varioustechniquesareavailableforevaluatinginvestmentprojects.They aregroupedintotraditionalandmoderntechniques.Themajortraditionaltechniquesarepayback period and accounting rate of return. The important discounting criteria are net present value, internalrateofreturnandprofitabilityindex.Amajordeficiencyofpaybackperiodisthatitdoes not take into account the time value of money. DCF techniques overcome this limitation. Each methodhasbothpositiveandnegativeaspect.Themostpopularmethodforlargeprojectisthe internal rate of return. Payback period and accounting rate of return are popular for evaluating smallprojects.

TerminalQuestions

1. Examinetheimportanceofcapitalbudgeting. 2. Briefly examine the significance of identification of investment opportunities in capital budgetingprocess. 3. Criticallyexaminethepaybackperiodasatechniqueofapprovalofprojects. 4. SummariesthefeaturesofDCFtechniques.

SikkimManipalUniversity

144

FinancialManagement

Unit8

AnswerforSelfAssessmentQuestions SelfAssessmentQuestions1 1. Capitalbudgeting 2. Capitalbudgeting 3. Highlycomplex 4. Capitalbudgetingdecisions

SelfAssessmentQuestions2 1. Irreversible. 2. Uncertainty,highlyuncertain.

SelfAssessmentQuestions3 1. Finalstep. 2. Firststep SelfAssessmentQuestions4 1. Afertilesource 2. Themostcrucialphase

SelfAssessmentQuestions5 1. Capitalbudgeting 2. Costreduction.

SelfAssessmentQuestions6 1. Economicappraisal 2. Technicalappraisal 3. Financialviability 4. Demandfortheproductorservice.

SelfAssessmentQuestions7 1. Decisioncriteria 2. Sunkcost 3. Externalities. 4. Investmentelement. 5. Ignores.

SikkimManipalUniversity

145

FinancialManagement

Unit8

6. Profitabilityof

AnswerforTerminalQuestions. 1. Refertounit8.2 2. Refertounit8.5 3. Refertounit8.8.1 4. Refertounit8.8.2

SikkimManipalUniversity

146

Anda mungkin juga menyukai

- Benchmarking Best Practices for Maintenance, Reliability and Asset ManagementDari EverandBenchmarking Best Practices for Maintenance, Reliability and Asset ManagementBelum ada peringkat

- Capital Budgeting of Coca ColaDokumen7 halamanCapital Budgeting of Coca Colasomyajain2298_345069Belum ada peringkat

- Conventional Versus Non Conventional Cash4079Dokumen10 halamanConventional Versus Non Conventional Cash4079Amna SaeedBelum ada peringkat

- Understanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check QuestionsDokumen11 halamanUnderstanding Financial Management: A Practical Guide: Guideline Answers To The Concept Check Questionssalehin1969Belum ada peringkat

- Unit 6 EditedDokumen22 halamanUnit 6 Editedtibebu yacobBelum ada peringkat

- Corporate Finance: Capital BudgetingDokumen17 halamanCorporate Finance: Capital BudgetingpayataBelum ada peringkat

- Long Term Inv + FundamentalsDokumen13 halamanLong Term Inv + Fundamentalssamuel kebedeBelum ada peringkat

- 2015@FM I CH 6-Capital BudgetingDokumen16 halaman2015@FM I CH 6-Capital BudgetingALEMU TADESSEBelum ada peringkat

- ACF AssignmentDokumen27 halamanACF AssignmentAmod GargBelum ada peringkat

- CAPITAL BUDGETING Ultratech Cements 2015Dokumen87 halamanCAPITAL BUDGETING Ultratech Cements 2015Nair D Sravan50% (2)

- Capital BudgetingDokumen93 halamanCapital BudgetingKhadar100% (3)

- Chapter-3: Capital Budgeting Chapter-Three Capital Budgeting/Investment Decision 3.1. Definition of Capital BudgetingDokumen12 halamanChapter-3: Capital Budgeting Chapter-Three Capital Budgeting/Investment Decision 3.1. Definition of Capital Budgetingmalik macBelum ada peringkat

- Ajith ProjectDokumen89 halamanAjith ProjectAnonymous MhCdtwxQIBelum ada peringkat

- FM 1 CH 4 (Lti) My MLC ExtDokumen19 halamanFM 1 CH 4 (Lti) My MLC ExtMELAT ROBELBelum ada peringkat

- Capital Budgeting Project ReportDokumen24 halamanCapital Budgeting Project Reportnishiit92% (12)

- CHAPTER-1 Introduction: 1.1 Overview 1.2 Meaning of Capital BudgetingDokumen15 halamanCHAPTER-1 Introduction: 1.1 Overview 1.2 Meaning of Capital BudgetingPratibha NagvekarBelum ada peringkat

- Chapter 4Dokumen12 halamanChapter 4Tasebe GetachewBelum ada peringkat

- A Study On Capital Budgeting.Dokumen15 halamanA Study On Capital Budgeting.Kumar SwamyBelum ada peringkat

- 2 Financial PlanningDokumen19 halaman2 Financial Planningravic25Belum ada peringkat

- Topic 5. The Basics of Capital BudgetingDokumen10 halamanTopic 5. The Basics of Capital BudgetingCerf VintBelum ada peringkat

- Capital Budgeting NotesDokumen5 halamanCapital Budgeting NotesDipin LohiyaBelum ada peringkat

- Capital BudgetingDokumen17 halamanCapital BudgetingKristine HeizelleBelum ada peringkat

- Capital Budgeting-Research FinalDokumen22 halamanCapital Budgeting-Research FinalNour Fawaz100% (1)

- Capital Budgeting NotesDokumen46 halamanCapital Budgeting NotesShilpa Arora NarangBelum ada peringkat

- Cap Bud Ultratech 19Dokumen9 halamanCap Bud Ultratech 19feroz khanBelum ada peringkat

- Fundamentals of Capital Budgeting: Learning Packet 1Dokumen17 halamanFundamentals of Capital Budgeting: Learning Packet 1jenniferBelum ada peringkat

- Capital Budgeting ResearchDokumen21 halamanCapital Budgeting ResearchNour FawazBelum ada peringkat

- Unit 3 - Scoman2Dokumen10 halamanUnit 3 - Scoman2christian guile figueroaBelum ada peringkat

- MEFADokumen2 halamanMEFASiddarthModiBelum ada peringkat

- 54 Capital BudgetingDokumen4 halaman54 Capital BudgetingCA Gourav JashnaniBelum ada peringkat

- CHAPTER Four HandoutDokumen23 halamanCHAPTER Four HandoutNati AlexBelum ada peringkat

- Unit 03Dokumen69 halamanUnit 03Shah Maqsumul Masrur TanviBelum ada peringkat

- Financial Management 2Dokumen159 halamanFinancial Management 2Ivani Katal0% (2)

- Cap Bud - HeroDokumen13 halamanCap Bud - HeroMohmmedKhayyumBelum ada peringkat

- 19752ipcc FM Vol1 Cp6Dokumen0 halaman19752ipcc FM Vol1 Cp6M Waqas PkBelum ada peringkat

- Lession 0003Dokumen15 halamanLession 0003Dr Suman RamapatiBelum ada peringkat

- Significance of Capital BudgetingDokumen2 halamanSignificance of Capital BudgetingLJBernardo0% (1)

- Capital Budgeting Techniques and Real OptionDokumen57 halamanCapital Budgeting Techniques and Real OptionPimpim HoneyBee100% (1)

- Capital Budgeting HDFCDokumen68 halamanCapital Budgeting HDFCKasiraju Saiprathap43% (7)

- FM Unit 2Dokumen24 halamanFM Unit 2Tanmay PrajapatiBelum ada peringkat

- Capital Budgeting MethodsDokumen23 halamanCapital Budgeting Methodsjayant-212002100% (1)

- Raj FinalDokumen58 halamanRaj Finalraj1415Belum ada peringkat

- Chapter One: Capital Budgeting Decisions: 1.2. Classification of Projects Independent Verses Mutually Exclusive ProjectsDokumen25 halamanChapter One: Capital Budgeting Decisions: 1.2. Classification of Projects Independent Verses Mutually Exclusive ProjectsezanaBelum ada peringkat

- Capital Budgeting: A Project Report ONDokumen9 halamanCapital Budgeting: A Project Report ONMohmmedKhayyumBelum ada peringkat

- Capital BudgetingDokumen35 halamanCapital Budgetinggkvimal nathan100% (3)

- Report CCCCDokumen107 halamanReport CCCCUtkarsh BajpaiBelum ada peringkat

- Financial ManagementDokumen42 halamanFinancial Managementnimala maniBelum ada peringkat

- Define Capital Budgeting: Qualitative CriteriaDokumen12 halamanDefine Capital Budgeting: Qualitative Criteriastannis69420Belum ada peringkat

- KC Financial DecisionsDokumen111 halamanKC Financial DecisionsSatish PatilBelum ada peringkat

- Capital BudgetingDokumen64 halamanCapital BudgetingNiaz AhmedBelum ada peringkat

- Capital Budgeting KesoramDokumen66 halamanCapital Budgeting KesoramSridevi padamatiBelum ada peringkat

- Abstract CAPITAL BUDGETING UltratechDokumen12 halamanAbstract CAPITAL BUDGETING UltratechraghunathreddychallaBelum ada peringkat

- Treatise On Capital BudgetingDokumen6 halamanTreatise On Capital BudgetingRohit BajpaiBelum ada peringkat

- Individual Assignment BUAD 839Dokumen8 halamanIndividual Assignment BUAD 839Denis ClementBelum ada peringkat

- Corporate Finance ProjectDokumen31 halamanCorporate Finance ProjectKrishnendu SahaBelum ada peringkat

- Assignment FMDokumen10 halamanAssignment FMHams NcomBelum ada peringkat

- FM Group AssignmentDokumen11 halamanFM Group AssignmentHailemelekot TerefeBelum ada peringkat

- Capital Budgeting ProjcetDokumen86 halamanCapital Budgeting Projcettulasinad123Belum ada peringkat

- Unit 5 EEFMDokumen9 halamanUnit 5 EEFMGayathri Bhupathi rajuBelum ada peringkat

- How To Create A CompanyDokumen30 halamanHow To Create A CompanySamuel DwumfourBelum ada peringkat

- Handling Your Sex DriveDokumen9 halamanHandling Your Sex DriveSamuel DwumfourBelum ada peringkat

- Section 12 LymphaticsDokumen5 halamanSection 12 LymphaticsSamuel DwumfourBelum ada peringkat

- 1000 Most Common Words (SAT)Dokumen70 halaman1000 Most Common Words (SAT)grellian95% (20)

- Section 16 PoisonsDokumen60 halamanSection 16 PoisonsSamuel DwumfourBelum ada peringkat

- NewGRE WordsDokumen7 halamanNewGRE WordsMatt Daemon Jr.Belum ada peringkat

- Standard CostingDokumen8 halamanStandard CostingSamuel DwumfourBelum ada peringkat

- Section 2 SKINDokumen48 halamanSection 2 SKINSamuel DwumfourBelum ada peringkat

- Section 7 RespiratoryDokumen26 halamanSection 7 RespiratorySamuel DwumfourBelum ada peringkat

- Section 2 SKINDokumen48 halamanSection 2 SKINSamuel DwumfourBelum ada peringkat

- Section 1 General ProblemsDokumen44 halamanSection 1 General ProblemsSamuel DwumfourBelum ada peringkat

- Chapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsDokumen3 halamanChapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsSamuel DwumfourBelum ada peringkat

- Section 3 ExtremitiesDokumen19 halamanSection 3 ExtremitiesSamuel DwumfourBelum ada peringkat

- Section 6 UrinaryDokumen18 halamanSection 6 UrinarySamuel DwumfourBelum ada peringkat

- Ch17 AnsDokumen13 halamanCh17 AnsSamuel DwumfourBelum ada peringkat

- Break Even AnalysisDokumen18 halamanBreak Even AnalysisSamuel DwumfourBelum ada peringkat

- Chapter08 002 PricingDokumen71 halamanChapter08 002 PricingSamuel DwumfourBelum ada peringkat

- Chapter 16 Financial Assets and Liabilities: Answer 1Dokumen3 halamanChapter 16 Financial Assets and Liabilities: Answer 1Samuel DwumfourBelum ada peringkat

- Audit ReportsDokumen5 halamanAudit ReportsSamuel DwumfourBelum ada peringkat

- Receivable 1Dokumen4 halamanReceivable 1Samuel DwumfourBelum ada peringkat

- Ch17 HKAS12Dokumen23 halamanCh17 HKAS12Samuel DwumfourBelum ada peringkat

- Chapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsDokumen3 halamanChapter 19 Consolidated Statement of Financial Position With Consolidated AdjustmentsSamuel DwumfourBelum ada peringkat

- Ch18 AnsDokumen5 halamanCh18 AnsSamuel DwumfourBelum ada peringkat

- Liver Cleasing TherapyDokumen31 halamanLiver Cleasing TherapySamuel DwumfourBelum ada peringkat

- Chapter 16 Financial Assets and Liabilities: 1. ObjectivesDokumen13 halamanChapter 16 Financial Assets and Liabilities: 1. Objectivessamuel_dwumfourBelum ada peringkat

- Chapter 21 Associates: Answer 1Dokumen6 halamanChapter 21 Associates: Answer 1Samuel DwumfourBelum ada peringkat

- Chapter 21 Associates: Answer 1Dokumen6 halamanChapter 21 Associates: Answer 1Samuel DwumfourBelum ada peringkat

- Solution Public Sector Accounting May 2010Dokumen10 halamanSolution Public Sector Accounting May 2010Samuel DwumfourBelum ada peringkat

- Solution Corporate Reporting Strategy May 2007Dokumen10 halamanSolution Corporate Reporting Strategy May 2007Samuel DwumfourBelum ada peringkat

- Solution Financial Reporting May 2011Dokumen12 halamanSolution Financial Reporting May 2011Samuel DwumfourBelum ada peringkat

- Chapter 3 - Risks in CBDokumen59 halamanChapter 3 - Risks in CBDiptish RamtekeBelum ada peringkat

- Chapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 13e, Global Edition (Gitman)Dokumen33 halamanChapter 11 Capital Budgeting Cash Flows: Principles of Managerial Finance, 13e, Global Edition (Gitman)Statistics ABMBelum ada peringkat

- Excel SheetsDokumen4 halamanExcel SheetsVishal PereiraBelum ada peringkat

- NPVDokumen36 halamanNPVjohn onesmoBelum ada peringkat

- tb301 PDFDokumen60 halamantb301 PDFDarmin Kaye PalayBelum ada peringkat

- Chapter 11 Financial Preparation For Entrepreneurial VenturesDokumen27 halamanChapter 11 Financial Preparation For Entrepreneurial VenturesBlue StoneBelum ada peringkat

- Fin242 Lesson Plan March 2021Dokumen2 halamanFin242 Lesson Plan March 2021Hazieq AushafBelum ada peringkat

- Required: 1. Compute The Net Present Value (NPV) of This Investment Project 2. Should The Equipment Be Purchased According To NPV Analysis?Dokumen5 halamanRequired: 1. Compute The Net Present Value (NPV) of This Investment Project 2. Should The Equipment Be Purchased According To NPV Analysis?carinaBelum ada peringkat

- Afm102 Exam Aid FinalDokumen128 halamanAfm102 Exam Aid FinalFernando III PerezBelum ada peringkat

- Financial MathematicsDokumen5 halamanFinancial MathematicsTAFARA MAROZVABelum ada peringkat

- Bus 215 NotesDokumen18 halamanBus 215 Notesctyre34Belum ada peringkat

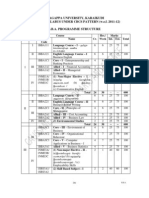

- Alagappa University, Karaikudi Revised Syllabus Under Cbcs Pattern (W.E.F. 2011-12) B.B.A. Programme StructureDokumen23 halamanAlagappa University, Karaikudi Revised Syllabus Under Cbcs Pattern (W.E.F. 2011-12) B.B.A. Programme StructureMathan NaganBelum ada peringkat

- Bethesda Mining CompanyDokumen8 halamanBethesda Mining CompanyKaushik KanumuriBelum ada peringkat

- pp13Dokumen65 halamanpp13Tejashree NirgudeBelum ada peringkat

- MW Petroleum Corporation (A)Dokumen6 halamanMW Petroleum Corporation (A)AnandBelum ada peringkat

- S. S. Jain Subodh P.G. Autonomous College: Scheme of Examination & Detailed Course StructureDokumen28 halamanS. S. Jain Subodh P.G. Autonomous College: Scheme of Examination & Detailed Course StructureVaibhav AroraBelum ada peringkat

- Tiong, Gilbert Charles - Decision MakingDokumen11 halamanTiong, Gilbert Charles - Decision MakingGilbert TiongBelum ada peringkat

- International Capital Budgeting and Cost of CapitalDokumen50 halamanInternational Capital Budgeting and Cost of CapitalGaurav Kumar100% (2)

- Chapter-14: Multinational Capital BudgetingDokumen14 halamanChapter-14: Multinational Capital BudgetingAminul Islam AmuBelum ada peringkat

- CHAPTER 2 - Investment AppraisalDokumen19 halamanCHAPTER 2 - Investment AppraisalMaleoaBelum ada peringkat

- What Is Weighted Average Cost of CapitalDokumen12 halamanWhat Is Weighted Average Cost of CapitalVïñü MNBelum ada peringkat

- Buena Terra Corporation Is Reviewing Its Capital Budget For The Upcoming YearDokumen2 halamanBuena Terra Corporation Is Reviewing Its Capital Budget For The Upcoming YearAmit PandeyBelum ada peringkat

- Kinney 8e - CH 15Dokumen22 halamanKinney 8e - CH 15Ashik Uz ZamanBelum ada peringkat

- Capital Budgeting Practice Set 2015Dokumen2 halamanCapital Budgeting Practice Set 2015Arushi AggarwalBelum ada peringkat

- BF Q3M7 PDFDokumen27 halamanBF Q3M7 PDFConeymae TulabingBelum ada peringkat

- CF Quize FinalDokumen4 halamanCF Quize FinalSangram PandaBelum ada peringkat

- Financial Management Chapter 09 IM 10th EdDokumen24 halamanFinancial Management Chapter 09 IM 10th EdDr Rushen SinghBelum ada peringkat

- Capital Budgeting Practices by Corporates in India PPTDokumen13 halamanCapital Budgeting Practices by Corporates in India PPTRVijaySai0% (1)

- Capital Budgeting - Adv IssuesDokumen21 halamanCapital Budgeting - Adv IssuesdixitBhavak DixitBelum ada peringkat