Steel Industry Update #265

Diunggah oleh

Michael LockerHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Steel Industry Update #265

Diunggah oleh

Michael LockerHak Cipta:

Format Tersedia

Steel Industry Update/265

August 2011

Locker Associates, 225 Broadway, Suite 2625 New York NY 10007

Tel: 212-962-2980

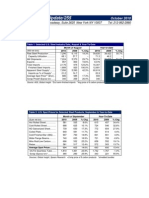

Table 1: Selected U.S. Steel Industry Data, June & Year-to-Date, 2011

Month of June

2011

2010

7,987

7,816

(000 net tons)

Raw Steel Production ...............

% Chg

2.2%

2011

47,054

Year-to-Date

2010

45,038

% Chg

4.4%

Capacity Utilization .................

76.2

75.4

--

74.4

72.1

--

Mill Shipments ..........................

7,639

7,292

4.8%

44,780

42,233

6.0%

Exports .....................................

1,095

1,048

4.5%

6,408

6,222

3.0%

Total Imports.............................

2,706

2,035

33.0%

14,645

11,706

25.1%

Finished Steel Imports ............

2,145

1,563

37.2%

11,092

9,189

20.7%

Apparent Steel Supply*.............

8,689

7,807

11.3%

49,464

45,200

9.4%

Imports as % of Supply* .........

24.7

20.0

--

22.4

20.3

--

Average Spot Price** ($/ton) ......

$898

$735

22.2%

$917

$720

27.3%

Scrap Price# ($/gross ton) ..........

$440

$317

38.8%

$440

$346

27.3%

Sources: AISI, SteelBenchmarker

*Excl semi-finished imports

**Avg price of 4 carbon products

#shredded

Table 2: U.S. Spot Prices for Selected Steel Products, August & Year-to-Date, 2011

($ per net ton)

Hot Rolled Band....

Cold Rolled Coil.......

Coiled Plate..................

Month of August

2011

2010

% Chg

664

581

14.3%

778

690

12.8%

1,021

775

31.7%

Average Spot Price....

821

682

OCTG.

1,963

#1 Heavy Melt...

Scrap Steel-Shredded.

#1 Busheling.

406

436

481

2011

794

889

1,011

Year-to-Date

2010

631

737

766

% Chg

25.8%

20.6%

32.0%

20.4%

898

711

1,823

7.7%

1,859

1,716

8.4%

311

345

399

30.5%

26.4%

20.6%

404

440

475

310

341

413

30.4%

29.0%

14.9%

Sources: World Steel Dynamics SteelBenchmarker, Spears Research; OCTG data is July, 2011

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

26.2%

Steel Industry Update/265

Table 3: World Crude Steel Production, July & Year-to-Date, 2011

Month of June

Year-to-Date

(000 metric tons)

Region

2011

2010

% Chg

2011

2010

European Union.

14,579

13,763

5.9%

108,008

103,509

Other Europe.

3,068

2,595

18.2%

21,167

17,471

8,617

9.7%

66,106

62,035

% Chg

4.3%

21.2%

C.I.S.

9,450

6.6%

North America

10,540

9,486

11.1%

69,858

65,672

6.4%

South America...

4,297

3,835

12.0%

28,746

25,071

14.7%

Africa...

1,207

1,303

-7.3%

8,168

9,684

-15.7%

Middle East.

1,587

1,297

22.3%

11,943

10,880

9.8%

Asia..

82,187

72,738

13.0%

568,329

520,176

9.3%

Oceania......

561

736

-23.8%

4,569

4,710

-3.0%

Total

127,477

114,372

11.5%

886,893

819,209

8.3%

China.......

Japan...

59,300

9,108

51,348

9,223

15.5%

-1.2%

410,364

63,180

372,060

63,800

10.3%

-1.0%

United States..

7,457

6,764

10.2%

50,143

47,662

5.2%

India(e).

6,160

5,794

6.3%

41,796

39,788

5.0%

Country

Russia(e).

5,950

5,505

8.1%

40,692

38,357

6.1%

South Korea....

5,659

4,649

21.7%

39,525

33,236

18.9%

Germany..

3,669

3,472

5.7%

26,865

26,217

2.5%

Brazil..

3,121

2,885

8.2%

20,948

19,264

8.7%

Turkey..

2,858

2,396

19.3%

19,262

15,917

21.0%

Ukraine(e)....

2,730

2,476

10.3%

20,432

19,158

6.6%

All Others....

24,195

22,336

8.3%

174,118

162,908

6.9%

Source: World Steel Association, 8/11; e=estimate

Graph 1: World Crude Steel Production

Source: World Steel Association, 8/11; in million metric tons

-2-

Steel Industry Update/265

Graph 2: World Steel Capacity Utilization Ratio

Source: World Steel Association, 8/11; in million metric tons

Table 4: Worlds Total Metallics for Steelmaking, 2006-2010

Crude Steel Production

of which Oxygen (BOF)

Electric (EAF)

(Share EAF of Crude Steel) in %

2006

1,247

820

395

31.7

2007

1,347

901

416

30.9

2008

1,327

890

409

30.8

2009

1,230

863

342

27.8

2010

1,412

988

405

28.7

% Chg

14.8%

14.5%

18.5%

Pig Iron

(Ratio Pig Iron/Crude Steel) in %

880

70.6

961

71.4

935

70.4

914

74.4

1,028

72.8

12.5%

Steel Scrap

(Ratio Steel Scrap/Crude Steel) in %

500

40.1

540

40.1

530

39.9

460

37.6

530

37.5

15.2%

60

4.8

67

5.0

68

5.1

64

5.1

65

4.6

1.6%

1,440

115.5

1,568

116.5

1,533

115.4

1,438

116.9

1,623

114.9

12.9%

(in million tonnes)

DRI

(Ratio DRI/Crude Steel) in %

Total Metallics

(Ratio Total Metallics/Crude Steel) in %

Source: Bureau of Intl Recyclings World Steel Recycling Report, August, 2011; % Chg is 2010-2009

Steel Industry Update (ISSN 1063-4339) published 12 times/year by Locker Associates, Inc. Copyright 2011 by Locker Associates, Inc. All

rights reserved. Reproduction in any form forbidden w/o permission. Locker Associates, Inc., 225 Broadway Suite 2625 New York NY 10007.

-3-

Steel Industry Update/265

Table 5: Worlds Top Steel Scrap Importers, 2006-2010

2006

2007

2008

(in 000 tonnes)

Turkey

15,100

17,141

17,415

South Korea

5,621

6,887

7,319

China

5,386

3,395

3,590

India

3,359

3,041

4,579

Taiwan

4,459

5,418

5,539

EU

7,294

5,142

4,809

USA

4,814

3,692

3,571

Canada

1,476

1,435

1,674

Malaysia

2,941

3,688

2,293

Indonesia

1,063

1,260

1,899

Thailand

1,373

1,805

3,142

2009

15,665

7,800

13,692

5,336

3,912

3,270

2,986

1,408

1,683

1,484

1,323

2010

19,194

8,091

5,848

3,211*

5,364

3,629

3,773

2,227

2,292

1,642

1,282

% Chg

22.5%

3.7%

-57.3%

-24.6%

37.1%

9.7%

26.4%

58.1%

36.2%

10.6%

-3.1%

Source: Bureau of Intl Recyclings World Steel Recycling Report, August, 2011; *Jan-Sep 2010

Table 6: Worlds Top Steel Scrap Exporters, 2006-2010

(in 000 tonnes)

USA

EU

Japan

Canada

Russia

Australia

South Africa

2006

13,978

10,083

7,654

4,000

9,797

1,335

555

2007

16,642

10,566

6,449

4,100

7,855

1,501

752

2008

21,712

12,799

5,344

4,084

5,128

1,708

1,271

2009

22,439

15,779

9,398

4,792

1,202

1,925

1,144

2010

20,557

18,970

6,472

5,154

2,390

1,636

1,225

% Chg

-8.4%

20.2%

-31.1%

7.6%

98.9%

-15.0%

7.0%

Source: World Steel Recycling Report, Bureau of International Recycling, August, 2011

Table 7: US Exports of Ferrous Scrap by Destination, June 2011

(in 000 tonnes)

Country

Canada

China

Hong Kong

India

Japan

Malaysia

Mexico

South Korea

Taiwan

Thailand

Turkey

Others

Totals

June 11

109

336

9

129

11

116

54

190

258

5

739

356

2,313

Month

May 11

148

362

10

140

86

72

22

337

323

75

660

346

2,580

April 11

149

427

13

81

11

176

30

445

312

119

361

130

2,254

Source: American Metal Market, 8/16/11

-4-

2011

806

2,078

64

458

163

586

297

1,672

1,597

445

2,683

1,317

12,166

Year-to-Date

2010

717

1,544

47

493

94

587

366

1,720

1,139

246

1,696

994

9,643

% Chg

12.5%

34.6%

35.6%

-7.2%

74.2%

-0.1%

-18.8%

-2.8%

40.2%

80.7%

58.2%

32.4%

26.2%

Steel Industry Update/265

Table 8: Steel Dynamics Long Product Shipments, 2Q 2011

(in tons)

Structural and rail

Special-bar quality

Roanoke

Steel of West Virginia

Total

2Q11

213,368

144,280

152,906

74,882

585,436

2Q10

159,252

128,802

109,393

52,720

450,167

% Chg

1H11

34.0%

404,029

12.0%

303,295

39.8%

274,211

42.0%

146,938

30.0% 1,128,473

11H10

314,601

253,861

218,579

106,125

893,166

% Chg

28.4%

19.5%

25.5%

38.5%

26.3%

1H11

0.88

4.42

5.30

1.84

5.68

7.52

11H10

0.89

4.23

5.12

1.82

5.32

7.14

% Chg

-2%

4%

3%

1%

7%

5%

Q2 '10

20,154

2,809

1,603

127

1,706

1.13

12.8

6.9

24.3

22.3

126

H1 '11

47,310

5,995

3,683

461

2,604

1.68

24.9

12.9

47.9

44.1

136

Source: AMM 7/20/11

Table 9: Severstal Production of Hot Metal and Crude Steel, 2Q 2011

(in million tonnes)

North America

Russian Steel

Total Hot Metal

North America

Russian Steel

Total Crude Steel

2Q11

0.45

2.21

2.66

0.92

2.95

3.87

2Q10

0.43

2.20

2.64

0.91

2.74

3.65

% Chg

4%

0%

1%

1%

8%

6%

Source: AMM 7/20/11

Table 10: ArcelorMittal Financial Results, 2Q 2011

Item

Q2 '11

Q1 '11

Sales

25,126

22,184

EBITDA

3,413

2,582

Operating income

2,252

1,431

Income from discontinued operations

461

Net income

1,535

1,069

Basic EPS (USD)

0.99

0.69

Own iron ore production (Mt)

13.1

11.8

Iron ore shipment (Mt)

7

5.9

Crude steel output (Mt)

24.4

23.5

Steel shipments (Mt)

22.2

22

EBITDA/tonne (USD/t)

154

118

Source: Steel Guru, 7/28/11

-5-

H1 '10

37,582

4,510

2,180

179

2,346

1.55

23.4

12.3

46.8

43.3

104

Steel Industry Update/265

Locker Associates Steel Track: Spot Prices

U.S. Flat-Rolled Prices

U.S. Scrap Prices

($ per ton)

($ per ton)

500

1100

#1 Busheling

Plate

1000

450

900

400

#1 Heavy Melt

800

Shredded Scrap

350

Rebar

CR Coil

700

300

600

HR Band

250

500

200

400

'06 '07 '08 '09 1q 2q J

S O N D

F M A M

'07 '08 '09 1q 2q

Locker Associates Steel Track: Performance

U.S. Raw Steel Production

10.0

(mil net tons)

9.0

2011

80%

7.0

70%

6.0

60%

5.0

50%

4.0

40%

2010

90%

8.0

3.0

U.S. Capacity Utilization

100%

2011

2010

30%

2011 7.9 7.4 8.1 7.8 7.9 8.0

2011 73% 75% 75% 74% 73% 76%

2010 6.9 6.9 7.8 7.7 8.0 7.8

2010 64% 71% 73% 74% 75% 75%

Steel Mill Products: US Imports, June & Year-to-Date

Imports: Country of Origin

(000 net tons)

Canada..

Mexico

Other W. Hemisphere..

European Union

Other Europe*..

Asia.

Oceania.

Africa..

Total

Imports: Customs District

Atlantic Coast

Gulf Coast/Mexican Border

Pacific Coast.

Gr Lakes/Canadian Border.

Off Shore

Month of June

2011

2010

% Chg

526

527

-0.2%

211

253

-16.6%

268

190

41.1%

371

341

8.8%

368

201

83.1%

848

451

88.0%

86

56

53.6%

92.9%

27

14

2,705

2,035

32.9%

312

1,235

471

679

8

231

646

487

662

8

Source: AISI; *includes Russia

Update

- 6 -#265

35.1%

91.2%

-3.3%

2.6%

0.0%

2011

3,108

1,615

1,519

2,201

1,499

4,075

533

96

14,645

1,874

6,238

2,831

3,597

105

Year-to-Date

2010

3,521

1,535

546

2,018

1,047

2,641

349

49

11,706

1,631

3,776

2,201

3,994

104

% Chg

-11.7%

5.2%

178.25

9.1%

43.2%

54.3%

52.7%

95.9%

25.1%

14.9%

65.2%

28.6%

-9.9%

1.0%

Locker Associates, Inc.

LOCKER ASSOCIATES is a business-consulting firm that specializes in enhancing the

competitiveness of businesses and industries on behalf of unions, corporate and government

clients. By combining expert business and financial analysis with a sensitivity to labor issues,

the firm is uniquely qualified to help clients manage change by:

leading joint labor/management business improvement initiatives;

facilitating ownership transitions to secure the long-term viability of a business;

conducting strategic industry studies to identify future challenges and opportunities;

representing unions in strategic planning, workplace reorganization and bankruptcy

formulating business plans for turnaround situations; and

performing due diligence for equity and debt investors.

Over the last 28 years, the firm has directed over 225 projects spanning manufacturing,

transportation, distribution and mining industries. Typical projects involve in-depth analysis of a

firms market, financial and operating performance on behalf of a cooperative labormanagement effort. Locker Associates also produces a widely read monthly newsletter, Steel

Industry Update that circulates throughout the U.S. and Canadian steel industry.

MAJOR CLIENTS

United Steelworkers

Bank of Boston

Congress Financial

Santander Investment Securities

AEIF-IAM/AK Steel Middletown

Prudential Securities

US Steel Joint Labor-Mgmt Comm

LTV Steel Joint Labor-Mgmt Committee

Intl Union of Electrical Workers

Bethlehem Joint Labor-Mgmt Comm

Inland Steel Joint Labor-Mgmt Comm

Northwestern Steel and Wire

Boilermakers

American Federation of Musicians

USS/KOBE

Sysco Food Services of San Francisco

International Brotherhood of Teamsters

Development Bank of South Africa

J&L Structural Steel

Air Line Pilots Association/Delta Air Lines MEC

Sharpsville Quality Products

IPSCO

International Association of Machinists

CSEA/AFSCME

United Auto Workers

Service Employees International Union

American Fed of Television & Radio Artists

Supervalu

United Mine Workers

Algoma Steel

North American Refractories

UNITE/HERE

AFL-CIO George Meany Center

Watermill Ventures

Wheeling-Pittsburgh Steel

Canadian Steel Trade & Employment Congress

Minn Gov's Task Force on Mining

Special Metals

RECENT PROJECTS

Business Plan for High-Tech Startup (2009-present): drafted detailed business plan to

raise capital and promote a new hydrogen battery technology

IBT-Supervalu (2010): assist union and management to identify major operational problems

impacting warehouse performance and provide recommendations for joint improvement

Institute of Scrap Recycling Industries (2010): presented a status report on the U.S. steel

market before the Institute of Scrap Recycling Industries Commodities roundtable

Save the World Air-Marketing (2009-present): developed a marketing plan to help drive

sales of a green technology product, ELEKTRA, an electronic fuel device for trucks that

increases fuel economy (mpg's), reduces exhaust emissions and improves engine performance

Email: lockerassociates@yahoo.com | Website: www.lockerassociates.com

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Steel Industry Update #269Dokumen8 halamanSteel Industry Update #269Michael LockerBelum ada peringkat

- Steel Industry Update #255Dokumen7 halamanSteel Industry Update #255Michael LockerBelum ada peringkat

- Steel Industry Update #254Dokumen8 halamanSteel Industry Update #254Michael LockerBelum ada peringkat

- Steel Industry Update #252Dokumen8 halamanSteel Industry Update #252Michael LockerBelum ada peringkat

- Steel Industry Update #250Dokumen6 halamanSteel Industry Update #250Michael LockerBelum ada peringkat

- Steel Industry Update #241Dokumen6 halamanSteel Industry Update #241Michael LockerBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- CAPI Suggested June 2014Dokumen25 halamanCAPI Suggested June 2014Meghraj AryalBelum ada peringkat

- Kindleberger Has Discussed Eight Effects of Tariff On The Imposing CountryDokumen4 halamanKindleberger Has Discussed Eight Effects of Tariff On The Imposing Countryappajinarasimham100% (1)

- GFO-17-607 Cost Effectiveness Model Battery Electric School BusesDokumen10 halamanGFO-17-607 Cost Effectiveness Model Battery Electric School BusesRob NikolewskiBelum ada peringkat

- Wage Order No. Rbiii-23: Wage Rationalization Act", To Periodically Assess Wage Rates and ConductDokumen5 halamanWage Order No. Rbiii-23: Wage Rationalization Act", To Periodically Assess Wage Rates and ConductECMH ACCOUNTING AND CONSULTANCY SERVICESBelum ada peringkat

- LSJ Exceeding Sat 041219 ApprovedDokumen5 halamanLSJ Exceeding Sat 041219 ApprovedJustin RohrlichBelum ada peringkat

- Cost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisDokumen59 halamanCost Allocation, Customer-Profitability Analysis, and Sales-Variance AnalysisHarold Dela Fuente100% (1)

- SWOT Analysis For HospitalDokumen13 halamanSWOT Analysis For HospitalkhinsumyinthlaingBelum ada peringkat

- Export Pricing StrategiesDokumen14 halamanExport Pricing StrategiesHarmanjit DhillonBelum ada peringkat

- True False and MCQ Demand and Supply.Dokumen2 halamanTrue False and MCQ Demand and Supply.Nikoleta TrudovBelum ada peringkat

- Strategic Performance Measurement: Transfer PricingDokumen2 halamanStrategic Performance Measurement: Transfer Pricingtaxathon thaneBelum ada peringkat

- Stream#2 - Assignment Submission Week 12 - Net Present ValueDokumen10 halamanStream#2 - Assignment Submission Week 12 - Net Present ValueSergant PororoBelum ada peringkat

- Investment AppraisalDokumen29 halamanInvestment Appraisalsk tanBelum ada peringkat

- Add Maths Project 2022Dokumen4 halamanAdd Maths Project 2022TANG POH YAP KPM-GuruBelum ada peringkat

- Housing Loan AgreementDokumen5 halamanHousing Loan AgreementVADeleon100% (1)

- Sources of Financial InformationDokumen13 halamanSources of Financial InformationSanjit SinhaBelum ada peringkat

- International Financial MarketsDokumen168 halamanInternational Financial Marketsmustapha moncefBelum ada peringkat

- Cy and JoyDokumen6 halamanCy and JoyAlexander GreatBelum ada peringkat

- Accounting MCQsDokumen29 halamanAccounting MCQsmastermind_asia9389Belum ada peringkat

- Ch16 09Dokumen5 halamanCh16 09Umer Shaikh50% (2)

- Economic Measures, The Bottom Line and CompetitionDokumen9 halamanEconomic Measures, The Bottom Line and CompetitionSunny GoyalBelum ada peringkat

- Varun Beverages IPODokumen3 halamanVarun Beverages IPODynamic LevelsBelum ada peringkat

- Bahrain Economic YearbookDokumen136 halamanBahrain Economic YearbookNiketanGawadeBelum ada peringkat

- Annuity DueDokumen21 halamanAnnuity Duedame wayne100% (1)

- MCQ On Final AccountDokumen5 halamanMCQ On Final AccountAnonymous b4qyne73% (11)

- Turtle SoupDokumen1 halamanTurtle Soupmuhafani129Belum ada peringkat

- Lista de Objetos SAPB1Dokumen9 halamanLista de Objetos SAPB1marcojanBelum ada peringkat

- Contestable MarketsDokumen8 halamanContestable Marketsman downBelum ada peringkat

- IFT CFA Level I Facts and Formula Sheet 2018 SAMPLEDokumen2 halamanIFT CFA Level I Facts and Formula Sheet 2018 SAMPLETapan BhattBelum ada peringkat

- REPORT - VIETNAM FACEMASKS - MicroeconomicDokumen1 halamanREPORT - VIETNAM FACEMASKS - MicroeconomicLại Trúc AnhBelum ada peringkat