Accounts Journal

Diunggah oleh

Ratika GuptaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Accounts Journal

Diunggah oleh

Ratika GuptaHak Cipta:

Format Tersedia

Lesson-3 Journalizing Transactions-I Learning Objectives To understand the recording of transactions To know what are the advantages of journal

nal To learn about the classification of accounts and its rules

Introduction Accounting is the art of recording, classifying and summarizing the financial transactions and interpreting the results thereof. Thus, the accounting cycle involves the following four major phases: 1. 2. 3. 4. Recording of transactions-- This is done in a book called journal. Classifying the transactions-- This is done in a book called ledger. Summarizing the transactions-- This includes preparation of trial balance, profit and loss account and balance sheet of the business. Interpreting the results-- This involves computation of various accounting ratios etc. to know about the liquidity, solvency and profitability of the business.

Journal A journal records all daily transactions of a business in the order of their occurrence. A journal may, therefore, be defined as a book containing a chronological record of transactions. It is a book in which transactions are recorded first of all under the double entry system. Thus, journal is a book of the original records. A journal does not replace but precedes the ledger. The process of recording transactions on the basis of rules of double entry system in a journal is termed as journalizing. The record of a business transaction in journal is called journal entry. The performa of a journal is as follows: Date (1) Particulars (2) L.F. (3) Debit (Rs.) (4) Credit (Rs.) (5)

Advantages of Journal The recording of business transactions in journal book on the basis of double entry system has following advantages:

1.

Complete Information about the Business

The journal gives complete information about business transactions in a chronological order. Accounts to be debited and credited are recorded at once in one place. 2. Explanation of the Transaction

An entry in the journal book includes a brief explanation of the transaction called narration. 3. Minimum Errors

Double entry system used for recording is clearly visible in journal as both debit and credit aspects are recorded at one place. It also makes posting into ledger accounts easier. This ultimately reduces possibility of errors. Rules of Debit and Credit All transactions in the journal are recorded on the basis of rules of debit and credit. For this purpose, transactions have been classified into three categories: i. ii. iii. Transactions relating to persons Transactions relating to properties and assets Transactions relating to incomes and expenses

On the basis of above rules, it is necessary to keep the accounts in respect of the following: i. ii. iii. Each person with whom it deals (customer, suppliers) Each property or asset which it owns (building, machinery etc.) Each item of income and expense (commission, rent, salary etc.)

Classification of Accounts Accounts can be classified into personal, real and nominal accounts. Personal Accounts Personal accounts include the accounts of persons with whom the business deals. These accounts can be further classified into three categories: a. Natural Personal Account Natural personal account means persons who are creations of God. For example, Vijays a/c, Shubhams a/c etc. b. Artificial Person Account

Artificial person account includes accounts of corporate bodies or institutions which are recognized as persons in business dealings. For example, government, club, limited company, cooperative society etc. c. Representative Personal Account Representative personal account is the account which represents a person or a group of persons. For example, when the rent is due to landlord, an outstanding rent account represents the account of a landlord to whom the rent is payable. Real Accounts Real accounts may be of the following types: a. Tangible Real Account Tangible real accounts are those which relate to such things that can be touched, felt and measured. For example, cash a/c, building a/c, furniture a/c etc. b. Intangible Real Account These accounts represent such things which cannot be touched but, however, can be measured in terms of money. For example, patent a/c, goodwill a/c etc. Nominal Accounts Nominal accounts are opened in the books of accounts to simply explain the nature of the transactions. They do not really exist. For example, salary paid to employee, rent paid to landlord etc. Nominal accounts mainly include accounts of expense, losses, income and gains. Rules of Accounting Type of Account Personal Account Real Account Nominal Account Rules for Accounting Debit the receiver, credit the giver Debit what comes in, credit what goes out Debit all expenses (losses), credit all incomes (gains)

Examples of Journal Entries 1. A commences business with capital of Rs. 1,00,000 on 1.1.2001. In this case, two accounts are involved, i.e. As a/c who is the proprietor and cash a/c. As a/c is of personal nature and cash a/c is a tangible asset. Applying the above rules, A is the giver of cash. Therefore, As capital a/c should be credited and cash is coming in the business. Cash being the real account, the account will be debited. The journal entry should be passed as follows: Date 1.1.2001 Cash a/c Particulars Dr. L.F. Debit (Rs.) 1,00,000 Credit (Rs.)

To Capital a/c (Being commencement of business)

1,00,000

The words in the bracket are called narration which describe the nature of transaction. 2. A pays rent of Rs. 5,000 of premises to landlord L on 01.01.2001. Date Particulars L.F. Debit (Rs.) 5,000 Credit (Rs.) 5,000

1.1.2001 Real a/c Dr. To Cash a/c (Being rent paid for January 2001)

In this case, real account is nominal account and being an expense for the business it is debited as per the above-mentioned rule. Since the rent is paid by way of cash, the cash balance will go down and hence the cash account is credited. 3. Goods purchased worth Rs. 20,000 on credit from S on 01.01.2001. Date Particulars L.F. Debit (Rs.) 20,000 Credit (Rs.) 20,000

1.1.2001 Goods A/c Dr. To S A/c (Being purchase of goods on credit)

Goods account is real account, being an asset. Since goods are coming in, goods account is debited. Account of S, who is the supplier and giver of goods, is credited, being personal account. Example Show the classification of the following accounts according to the traditional approach: a. b. c. d. e. f. g. h. i. j. k. l. m. n. Building account Purchases account Sales account Bank deposits account Rent account Rent outstanding account Cash account Adjusted purchases account Closing stock account Investments account Debtors account Sales tax payable account Discount allowed account Bad debts account

o. p. q. r. s. t. u. v. w. x. y. z.

Capital account Drawings account Provision for depreciation account Interest receivable account Rent received in advance account Prepaid salary account Provision for bad and doubtful debts account Bad debts recovered account Depreciation account. Personal income tax account Stock reserve account Provision for discount on creditors account

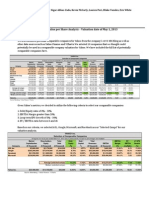

Also classify the above-mentioned accounts according to accounting equation approach. Solution Nature of Account S. No. (a) (b) (c) (d) (e) (f) (g) (h) (i) (j) (k) (l) (m) (n) (o) (p) (q) (r) (s) (t) (u) (v) (w) (x) Title of Account Building Purchases Sales Bank Deposits Rent Rent Outstanding Cash Adjusted Purchases Closing Stock Investments Debtors Sales Tax Payable Discount Allowed Bad Debts Capital Drawings Provision for Depreciation Interest Receivable Rent Received in Advance Prepaid Salary Provision for Bad and Doubtful debts Bad Debts Recovered Depreciation Personal Income Tax Traditional Approach Real Real Nominal (Revenue) Personal Nominal (Expense) Personal Real Nominal (Expense) Real Real Personal Personal Nominal (Expense) Nominal (Expense) Personal Personal Valuation (Real) Personal Personal Personal Valuation (Personal) Nominal (Gain) Nominal (Expense) Personal (Drawing) Accounting Equation Approach Asset Asset Temporary Capital (Revenue) Asset Temporary Capital (Expense) Liability Asset Temporary Capital (Expense) Asset Asset Asset Liability Temporary Capital (Expense) Temporary Capital (Expense) Capital Temporary Capital (Drawings) Asset Asset Liability Valuation (Asset) Valuation (Asset) Temporary Capital (Gain) Temporary Capital (Expense) Temporary Capital (Drawings)

(y) (z)

Stock Reserve Provision for Discount on Creditors

Valuation (Real) Valuation (Personal)

Valuation (Asset) Valuation (Liability)

Summary 1. Primary book is the book of accounts where transactions and events are recorded in the first instance. 2. Primary books are called journals. 3. There are eight types of primary books. 4. It is necessary to follow a ground rule to record entries in journals. 5. A cash book is journal as well as ledger. 6. A journal proper is a book of residual entries. Questions 1. Give an example of business transaction affecting only the following: Assets Liabilities Capital

2. Differentiate between the following: Temporary capital accounts and nominal accounts Trade discount and cash discount

3. Do you agree with the following statements: a. b. c. d. e. f. g. h. i. Sales day book is a part of ledger. Opening stock account is a nominal account. Purchase day book records all credit purchases of goods. Drawings account is a temporary capital account. A transaction can increase an asset and decrease a liability. Discount account records trade discount. Patent rights made for prompt payment is called trade discount. The allowance made for prompt payment is called trade discount. Capital + Long Term Liabilities = Fixed Assets + Current Assets + Cash Current Liabilities.

4. What are the rules of debit and credit for the following: Assets Liabilities Capital Revenue Expenses

Valuation accounts

Anda mungkin juga menyukai

- Chapter 3 - Class 11 NCERT Accounts Recording of Transaction 1Dokumen8 halamanChapter 3 - Class 11 NCERT Accounts Recording of Transaction 1Arvind KumarBelum ada peringkat

- IllustrationDokumen3 halamanIllustrationFantayBelum ada peringkat

- Accounting CycleDokumen16 halamanAccounting CycleBekanaBelum ada peringkat

- Rules of Debit and CreditDokumen11 halamanRules of Debit and CreditnasiraryannBelum ada peringkat

- Technopreneurship: - Module 5Dokumen33 halamanTechnopreneurship: - Module 5Joseph AgcaoiliBelum ada peringkat

- AccountingDokumen13 halamanAccountingMae AroganteBelum ada peringkat

- Accountancy/Introduction To AccountancyDokumen16 halamanAccountancy/Introduction To AccountancyfaceandmaskBelum ada peringkat

- Session - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFDokumen27 halamanSession - 2 & 3 - Recording in Primary Books and Posting in Secondary Books - Reading - Material PDFShashank Pandey100% (1)

- Course Pack (FOA)Dokumen114 halamanCourse Pack (FOA)Ghufran KhanBelum ada peringkat

- Chapter 7 - Journal (Part 1)Dokumen30 halamanChapter 7 - Journal (Part 1)ANNA AGARWAL100% (1)

- Fundamental Accounting I: Chapter Two Accounting Cycle For Service-Giving BusinessDokumen14 halamanFundamental Accounting I: Chapter Two Accounting Cycle For Service-Giving BusinessMahlet MehariBelum ada peringkat

- The Different and Interrelated Stages of The Accounting Cycle Will Be PresentedDokumen15 halamanThe Different and Interrelated Stages of The Accounting Cycle Will Be PresentedHussen AbdulkadirBelum ada peringkat

- Basic NoteDokumen8 halamanBasic Noteworld2learnBelum ada peringkat

- Acc CH 2Dokumen10 halamanAcc CH 2Tajudin Abba RagooBelum ada peringkat

- Why Is The Evidence Provided by Source Documents Important To Accounting?Dokumen75 halamanWhy Is The Evidence Provided by Source Documents Important To Accounting?Raj KumarBelum ada peringkat

- Accounting ProcessDokumen5 halamanAccounting Process23unnimolBelum ada peringkat

- InventoryDokumen9 halamanInventorychippBelum ada peringkat

- Acc CH 3 and CH 4Dokumen7 halamanAcc CH 3 and CH 4elonreevemusk2kBelum ada peringkat

- 21 Process Financial Transactions and Extract Interim ReportDokumen22 halaman21 Process Financial Transactions and Extract Interim Reportembaendo27uBelum ada peringkat

- Accounting UNIT 2Dokumen20 halamanAccounting UNIT 2newaybeyene5Belum ada peringkat

- Unit .2 The Accounting Cycle For Service Giving BusinessDokumen21 halamanUnit .2 The Accounting Cycle For Service Giving BusinessNikki100% (1)

- JournalDokumen9 halamanJournalchippBelum ada peringkat

- Accounting in BanksDokumen27 halamanAccounting in BankssaktipadhiBelum ada peringkat

- One Full Accounting Cycle Process ExplainedDokumen11 halamanOne Full Accounting Cycle Process ExplainedRiaz Ahmed100% (1)

- Fundamental of Acc-Ch 2 RegularDokumen27 halamanFundamental of Acc-Ch 2 RegularNasir Ahmed YusufBelum ada peringkat

- Fa Unit 2Dokumen28 halamanFa Unit 2VTBelum ada peringkat

- What Is A Journal Entry in AccountingDokumen20 halamanWhat Is A Journal Entry in AccountingIc Abacan100% (1)

- Accounts Theory (Examination)Dokumen12 halamanAccounts Theory (Examination)kaashvi dubeyBelum ada peringkat

- Fabm2 LC1 4Dokumen32 halamanFabm2 LC1 4gabezarate071Belum ada peringkat

- Grade 11, Accounting, Chapter 3 Recording of Transaction IDokumen75 halamanGrade 11, Accounting, Chapter 3 Recording of Transaction Ihum_tara1235563100% (1)

- Accounting in BanksDokumen27 halamanAccounting in BankssaktipadhiBelum ada peringkat

- Answer: Book-Keeping Is Mainly Concerned With Record Keeping orDokumen7 halamanAnswer: Book-Keeping Is Mainly Concerned With Record Keeping orRisha RoyBelum ada peringkat

- MEFA - 4th UnitDokumen24 halamanMEFA - 4th UnitP.V.S. VEERANJANEYULUBelum ada peringkat

- Tally Lesson 1Dokumen13 halamanTally Lesson 1kumarbcomca100% (1)

- Befa Unit IVDokumen12 halamanBefa Unit IVNaresh Guduru93% (15)

- Chapter 3-The Recording Process and Accounting CycleDokumen7 halamanChapter 3-The Recording Process and Accounting CycleParvez TuhenBelum ada peringkat

- Chapter 1Dokumen5 halamanChapter 1palash khannaBelum ada peringkat

- 15 Financial AccountsDokumen111 halaman15 Financial AccountsRenga Pandi100% (1)

- What Is AccountsDokumen9 halamanWhat Is AccountsRishi_Sachdev_6020Belum ada peringkat

- MBA SEM.1 Recording of TransactionsDokumen24 halamanMBA SEM.1 Recording of Transactionsprashantmis452Belum ada peringkat

- Co Chapter 2 Accounting Cycle RevisedDokumen19 halamanCo Chapter 2 Accounting Cycle RevisedmikeBelum ada peringkat

- Mba Faaunit - IIDokumen15 halamanMba Faaunit - IINaresh GuduruBelum ada peringkat

- What Do You Mean by Accounting PrinciplesDokumen13 halamanWhat Do You Mean by Accounting PrinciplesJosh Ch100% (2)

- Chapter 2 Fundamental 1Dokumen28 halamanChapter 2 Fundamental 1samita2721Belum ada peringkat

- Balance Sheet BasicsDokumen24 halamanBalance Sheet Basicsnavya sreeBelum ada peringkat

- Basics of Accounting PDFDokumen10 halamanBasics of Accounting PDFBenhur Leo0% (1)

- Double Entry Book Keeping SystemDokumen14 halamanDouble Entry Book Keeping SystemVisakh Vignesh100% (1)

- Journal EntriesDokumen7 halamanJournal Entriesmanthansaini8923Belum ada peringkat

- Lec 3 Financial StatementsDokumen60 halamanLec 3 Financial StatementsAyanChatterjee100% (1)

- Introduction To AccountingDokumen5 halamanIntroduction To Accountingorda55555Belum ada peringkat

- Journe LDokumen8 halamanJourne LBhasker KharelBelum ada peringkat

- Introduction To AccountsDokumen8 halamanIntroduction To AccountsSuraj MahantBelum ada peringkat

- Notes of Double Entry System and Journal EntryDokumen35 halamanNotes of Double Entry System and Journal Entryjune100% (1)

- ACCT1002 U2-20150826nprDokumen15 halamanACCT1002 U2-20150826nprSaintBelum ada peringkat

- Accounting Financial: General LedgerDokumen8 halamanAccounting Financial: General LedgerSumeet KaurBelum ada peringkat

- CH 2 FAcc1@2013-1Dokumen19 halamanCH 2 FAcc1@2013-1tamebirhanu696Belum ada peringkat

- Accounting CycleDokumen12 halamanAccounting CycleHarjinder Singh100% (1)

- Cambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersDari EverandCambridge Made a Cake Walk: IGCSE Accounting theory- exam style questions and answersPenilaian: 2 dari 5 bintang2/5 (4)

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthDari EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthBelum ada peringkat

- Course 3rd SemDokumen14 halamanCourse 3rd SemRatika GuptaBelum ada peringkat

- Course 3rd SemDokumen14 halamanCourse 3rd SemRatika GuptaBelum ada peringkat

- Girl Child and Women EmpowermentDokumen4 halamanGirl Child and Women EmpowermentRatika GuptaBelum ada peringkat

- Sobc NewDokumen1 halamanSobc NewameyjadhavBelum ada peringkat

- MIB, Semester 1 Accounting and Finance Luvnica Rastogi: Amity International Business SchoolDokumen25 halamanMIB, Semester 1 Accounting and Finance Luvnica Rastogi: Amity International Business SchoolRatika GuptaBelum ada peringkat

- National Income: Amity International Business SchoolDokumen13 halamanNational Income: Amity International Business SchoolRatika GuptaBelum ada peringkat

- Yahoo! Inc. Valuation ProjectDokumen8 halamanYahoo! Inc. Valuation ProjectNigar_AbbasBelum ada peringkat

- Tutorial 6 Valuation - SVDokumen6 halamanTutorial 6 Valuation - SVHiền NguyễnBelum ada peringkat

- SBI - Significant Accounting Policies - 16-17Dokumen7 halamanSBI - Significant Accounting Policies - 16-17Madhura Venkateswara SarmaBelum ada peringkat

- Horizon Kinetics Study of Owner OperatorsDokumen18 halamanHorizon Kinetics Study of Owner OperatorsCanadianValueBelum ada peringkat

- Trading StrategyDokumen2 halamanTrading StrategyJamison CarsonBelum ada peringkat

- Term Sheet ELSDokumen20 halamanTerm Sheet ELSGregory BieberBelum ada peringkat

- Request For Proposal (RFP) 2020 PDFDokumen26 halamanRequest For Proposal (RFP) 2020 PDFSanjay SahBelum ada peringkat

- Proforma Appointment of ValuerDokumen2 halamanProforma Appointment of ValuerKrishnaa LaxmiNarasimhaa AnanthBelum ada peringkat

- CA Final Financial Reporting NotesDokumen14 halamanCA Final Financial Reporting NotesB GANAPATHYBelum ada peringkat

- FNCE 625-12ChairApprovedDokumen8 halamanFNCE 625-12ChairApprovedAjay TankBelum ada peringkat

- Lecture 6: The Greeks and Basic Hedging: Sources Avellaneda and Laurence J HullDokumen20 halamanLecture 6: The Greeks and Basic Hedging: Sources Avellaneda and Laurence J HullJBelum ada peringkat

- Importance and Uses of Weighted Average Cost of Capital (WACC)Dokumen2 halamanImportance and Uses of Weighted Average Cost of Capital (WACC)Lyanna MormontBelum ada peringkat

- The Dark Side of ValuationDokumen63 halamanThe Dark Side of ValuationMiguel Vega OtinianoBelum ada peringkat

- DCF ModelDokumen6 halamanDCF ModelKatherine ChouBelum ada peringkat

- Capital Gains Sec 45 To 55aDokumen34 halamanCapital Gains Sec 45 To 55aBeing HumaneBelum ada peringkat

- FIN924 Workshop Topic 1Dokumen37 halamanFIN924 Workshop Topic 1Yugiii YugeshBelum ada peringkat

- CSL and EEA Esports Fan Survey Analysis 2020-12.9.20Dokumen28 halamanCSL and EEA Esports Fan Survey Analysis 2020-12.9.20NIKISWARBelum ada peringkat

- Citn New Professional Syllabus - Indirect TaxationDokumen95 halamanCitn New Professional Syllabus - Indirect TaxationtwweettybirdBelum ada peringkat

- PicoStocks Business PlanDokumen17 halamanPicoStocks Business PlanJignesh ChaudharyBelum ada peringkat

- MMPC 014Dokumen6 halamanMMPC 014Pawan ShokeenBelum ada peringkat

- Fcffsimpleginzu CoronaDokumen58 halamanFcffsimpleginzu CoronaUmangBelum ada peringkat

- FNCE 100 Syllabus Spring 2016Dokumen12 halamanFNCE 100 Syllabus Spring 2016kahwahcheongBelum ada peringkat

- Swap RatioDokumen24 halamanSwap RatioRajesh SharmaBelum ada peringkat

- Case Book - Esade 2011Dokumen108 halamanCase Book - Esade 2011PablojkbBelum ada peringkat

- Academyof Acctg Financial Ratio PaperDokumen354 halamanAcademyof Acctg Financial Ratio PaperOre.ABelum ada peringkat

- Group 18 Session 4 Assignment Kraft-Heinz MergerDokumen6 halamanGroup 18 Session 4 Assignment Kraft-Heinz MergerAishwarya Yadav BJ20064Belum ada peringkat

- Risk Management The ERM Guide From AFP, James Lam PDFDokumen18 halamanRisk Management The ERM Guide From AFP, James Lam PDFRoro2191Belum ada peringkat

- HHIF Lecture Series: Financial Statement AnalysisDokumen19 halamanHHIF Lecture Series: Financial Statement AnalysisalexanderremBelum ada peringkat

- HRA - Definition, Objectives, Advantages & DisadvantagesDokumen4 halamanHRA - Definition, Objectives, Advantages & DisadvantagesArghya D Punk100% (1)

- Smart FinancialsDokumen49 halamanSmart FinancialsDebasmita NandyBelum ada peringkat