Fin Col 1 Daily Trust IFin General

Diunggah oleh

ifisac6311Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Fin Col 1 Daily Trust IFin General

Diunggah oleh

ifisac6311Hak Cipta:

Format Tersedia

By Shaikh Ziyaad Mahomed (ziyaadm@ifisa.co.

za)

Shaikh Ziyaad is a well-known South African Islamic Scholar specializing in Islamic Finance. He is a consultant and trainer to banks in Africa, Europe and the Middle East.

Islamic finance ? Whats all the hype about ? Islamic finance & banking has become the buzz of the decade, not only in the Islamic sphere, but also in the conventional, interest-based banking system. The success story of Islamic banking has introduced a new sector to the global financial industry and has with the aid of Shariah Scholars and other experts in the field, developed into one of the most dynamic and fastest growing sectors in the world. The underlying principles of the Islamic economics are relevant and applicable in any era: medieval or modern. Islamic economics follows universal moral precepts that can be applied to all aspects of financial life. But doesnt it seem that Islamic Banking has only been around for the last thirty to forty years ? ! In fact, if one were to review the historical background, conventional(interest-based) banking in its modern form has only been in existence for the last three hundred years. Islamic economics has of course been around since the advent of Islam, almost 1,500 years ago. The Islamic Commercial Law that governs trade is extracted from the sources of law in Islam, viz : The Quran, the Sunnah or example of the Prophet Muhammad(Peace be upon him), Consensus amongst the Scholars and through Analogy and Logical Reasoning. The latter sources keep Islamic Commercial Law dynamic, adaptable and sophisticated whilst the former sources set the parameters. Muslim traders in the 11th century AD began trading throughout the ever-expanding Islamic empire. Traders of caravans laden with silk and embroidery from the far corners of Persia and Samarkand trekked across the Middle East and North Africa to sell their wares in the new Islamic region of Andalusia(modern-day Spain). These sales naturally generated a substantial value of gold that was used as a medium of exchange. On the other hand, traders from the Cordoba and the rest of Muslim Spain intended to trade in unexplored territories of North Africa and the East. How did they resolve the issue of having to carry vast loads of gold and risk attack by bandits along the way ? Simple really : They invented the Sakk or the cheque that was a certificate of deposit that could be used to claim from gold deposits in Samarkand or Cordoba. In the last five years, the Sakk (plural Sukuk) has become the most popular Islamic investment instrument in modern banking history. It has been used to expand the Dubai International Airport and large governmental projects in a Shariah acceptable manner. An underlying principle of Islamic economics is the issue of interest or riba. The concept of riba is often misunderstood and the prohibited form is argued to be in reference to an excessive demand on a loan, for example : a loan of NGN10,000 attracts

a 20% interest in the first six months. However, the concept of riba has a wide reach. Any excess or addition as a condition of a loan is considered riba, no matter how large or small. The devastation that riba has had on individuals, communities and nations, is wellknown. The most powerful tool for the success of capitalism has been interest in various forms. President Obasanjo of Nigeria speaking in the year 2000, commented on his countrys debt to international creditors, saying : All that we had borrowed up to 1985 or 1986 was around $5 billion and we have paid about $16 billion yet we are still being told that we owe about $28 billion. That $28 billion came about because of the injustice in the foreign creditors' interest rates. If you ask me what is the worst thing in the world, I will say it is COMPOUND INTEREST. (Vanguard, (2000)) What sort of interest is prohibited in Islam? What then are the alternatives to interest for Muslim consumers? All this and more will be covered in the following weeks. Dont miss this article in the next issue . . .

Contributed by Shaikh Ziyaad Muhammad of IFISA, Islamic Finance Institute of Southern Africa (www.ifisa.co.za

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Method Statement For LVAC Panel TestingDokumen9 halamanMethod Statement For LVAC Panel TestingPandrayar MaruthuBelum ada peringkat

- Node NO Slot NO CH No. Tag Name Address Signal Description: All Valve Fault Take From LogicDokumen103 halamanNode NO Slot NO CH No. Tag Name Address Signal Description: All Valve Fault Take From Logicash_captchajobsBelum ada peringkat

- Should Always: Exercise 1-1. True or FalseDokumen7 halamanShould Always: Exercise 1-1. True or FalseDeanmark RondinaBelum ada peringkat

- SS Corrosion SlidesDokumen36 halamanSS Corrosion SlidesNathanianBelum ada peringkat

- Demecio Flores-Martinez Petition For Review of Enforcement of Removal OrderDokumen9 halamanDemecio Flores-Martinez Petition For Review of Enforcement of Removal OrderBreitbart NewsBelum ada peringkat

- Festo Process Control - CatalogDokumen3 halamanFesto Process Control - Cataloglue-ookBelum ada peringkat

- Steam Turbine and Governor (SimPowerSystems)Dokumen5 halamanSteam Turbine and Governor (SimPowerSystems)hitmancuteadBelum ada peringkat

- Capital Asset Pricing ModelDokumen11 halamanCapital Asset Pricing ModelrichaBelum ada peringkat

- Demoversion IWE 2011Dokumen47 halamanDemoversion IWE 2011Burag HamparyanBelum ada peringkat

- ITC Report and Accounts 2016Dokumen276 halamanITC Report and Accounts 2016Rohan SatijaBelum ada peringkat

- Financial Audit NotesDokumen11 halamanFinancial Audit NotesMamunoor RashidBelum ada peringkat

- West Systems Fiberglass Boat Repair & MaintenanceDokumen91 halamanWest Systems Fiberglass Boat Repair & MaintenanceDonát Nagy100% (2)

- Fin 464 Chapter-03Dokumen18 halamanFin 464 Chapter-03Shantonu Rahman Shanto 1731521Belum ada peringkat

- Operations Management For Competitive Advantage 11Th Edition Solutions Manual PDFDokumen2 halamanOperations Management For Competitive Advantage 11Th Edition Solutions Manual PDFLouis DodsonBelum ada peringkat

- Chapter 6 Performance Review and Appraisal - ReproDokumen22 halamanChapter 6 Performance Review and Appraisal - ReproPrecious SanchezBelum ada peringkat

- Agro Chems MrRGAgarwalDokumen17 halamanAgro Chems MrRGAgarwalapi-3833893Belum ada peringkat

- A Study of Factors Influencing The Consumer Behavior Towards Direct Selling Companies With Special Reference To RCM Products1Dokumen79 halamanA Study of Factors Influencing The Consumer Behavior Towards Direct Selling Companies With Special Reference To RCM Products1Chandan SrivastavaBelum ada peringkat

- Cis285 Unit 7Dokumen62 halamanCis285 Unit 7kirat5690Belum ada peringkat

- Pic32mx1xx2xx283644-Pin Datasheet Ds60001168lDokumen350 halamanPic32mx1xx2xx283644-Pin Datasheet Ds60001168lR khanBelum ada peringkat

- Distribution Requirements PlanningDokumen8 halamanDistribution Requirements PlanningnishantchopraBelum ada peringkat

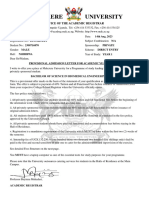

- Makerere University: Office of The Academic RegistrarDokumen2 halamanMakerere University: Office of The Academic RegistrarOPETO ISAACBelum ada peringkat

- Product Models Comparison: Fortigate 1100E Fortigate 1800FDokumen1 halamanProduct Models Comparison: Fortigate 1100E Fortigate 1800FAbdullah AmerBelum ada peringkat

- Environmental Pollution and Need To Preserve EnvironmentDokumen3 halamanEnvironmental Pollution and Need To Preserve EnvironmentLakshmi Devar100% (1)

- Jurisdiction of The Supreme CourtDokumen1 halamanJurisdiction of The Supreme CourtAnshul Yadav100% (1)

- Chapter 2 FlywheelDokumen24 halamanChapter 2 Flywheelshazwani zamriBelum ada peringkat

- Variant Configuration Step by Step ConfigDokumen18 halamanVariant Configuration Step by Step Configraghava_83100% (1)

- Conflict of Laws (Summary Paper)Dokumen13 halamanConflict of Laws (Summary Paper)Anonymous CWcXthhZgxBelum ada peringkat

- E4PA OmronDokumen8 halamanE4PA OmronCong NguyenBelum ada peringkat

- DX DiagDokumen31 halamanDX DiagJose Trix CamposBelum ada peringkat

- Accounts - User Guide: Release R15.000Dokumen207 halamanAccounts - User Guide: Release R15.000lolitaferozBelum ada peringkat