Ot 25002 Oa

Diunggah oleh

api-3774915Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ot 25002 Oa

Diunggah oleh

api-3774915Hak Cipta:

Format Tersedia

Scope and Potential of setting up a MFI

CHAPTER-1

BHORUKA CHARITABLE TRUST

1.1INTRODUCTION

Late Sri Prabhu Dayal Agarwal, the then chairman of the TCI (Transport Corporation of

India)- Bhoruka group of companies, had a vision of establishing a social service

institution dedicated towards the development of underprivileged and weaker section of

rural masses. To implement his ideas he established the Bhoruka Charitable Trust (BCT)

on May 23, 1962 under the Bombay Trust Act. Bhorugram (Nangal Badi) is the

birthplace of late Sri Prabhu Dayal Agarwal. The Trust is working in Churu district of

Rajasthan since 1973. The geo-climatic condition of this region is very harsh and hostile.

Being an integral part of the Thar Desert, it receives very scanty rainfall (325-350mm

annually) and there is wide variation in temperature (-3 degree Celsius in winter to 50

degree Celsius in summer). The underground water being deep and saline with high

fluoride contents, there is acute shortage of drinking water particularly in the time of

summer. This area is also remote and deprived of natural resource. By founding the BCT,

late Sri Prabhu Dayal Agarwal wanted to reduce some problems of this area and tried to

do some developmental activities for the people of Bhorugram.

1.2 MISSION

The Trust is dedicated to the socio- economic transformation of rural and remote areas of

India, especially the weaker socially underprivileged groups through physical, social,

cultural and economic development of rural people, groups and institutions.

1.3 AREA OF INTERVENTATION

The Trust is implementing various projects in Women and Child Development Services

(ICDS), Primary health care, Family Welfare, Reproductive and Child health, Prevention

of HIV-AIDS, Formal and Non-formal education, Famine relief, and Infrastructure

development. The SHG project is undertaken with the help of NABARD. The

microfinance programme is started in association with ICICI, SIDBI, and RMK.

1 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

1.4 ADMINISTRATIVE STRUCTURE

BCT has a simple hierarchical structure and line of command for the operations of the

trust activities. There are separate Project officers and Assistant Project officers for each

project and all other functionaries remain the same.

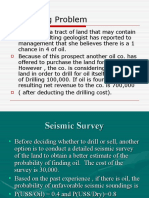

[Figure 1: Here]

1.5 EXPANSION PHASES

The activities of the trust have undergone changes in geographical coverage, the

programmes and also the budget. The expansion of activities was accompanied with the

broadening of the target population base.

[TABLE 1: Here]

1.6 PROJECTS RUN BY BCT

The major projects under operation are listed below. In the preceding financial year BCT

has been running a total of 37 programmes. The programmes are supported by

Government of India, Government of Rajasthan, International agencies like CARE India,

and other national funding agencies, and by the trusts own funds. At present the following

programmes are running:

A. Women and Child development programme

(1) Integrated child development Services (ICDS)

(2) Integrated Nutrition and health programme (CARE-INHP II)

B. Health Programme

(1) Maternal and child health center and Eye Camp at Bhorugram

(2) HAMARA Project (HIV-AIDS)

(3) Mother NGO project (RCH and ISM&H)

C. Income Generation Programme

(1) Carpet Weaving

(2) Self Help Groups

(3) Dairy project (upto 2004)

2 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

D. Education

(1) BRJD Public School

(2) Shivamba Shivir (For Girls deprived of formal education)

(3) Smt. Dhanwanti Devi Girls High School, Dhandal Lekhu

E. Management of Natural Resources

(1) Construction of Watershed

(2) Afforestation

F. District Poverty Initiative Program (DPIP)

G. Famine Relief (Fodder depots and drinking water arrangements are done with

the help of Rajasthan government and from the Trust’s own funds).

1.7 ORGANISATION EMBEDDING

BCT is working as a part of the society and is socially embedded to perform various

functions.

[Figure 2: Here]

1.8 CONCEPT FOR MICROFINANCE PROGRAMME

BCT people visited Bangladesh in 1997 in relation with a project on health, and also

visited some self help groups of ‘Grameen Bank.’ The ‘Grameen Bank’ people also

visited BCT sometime later. The concept that emerged in the minds of BCT officials

culminated into formation of some SHGs in the middle of 1999 in Rajgarh block of

Churu district. At that time 60 SHGs were formed. The objective was to inculcate saving

habits, bring rural poor out of the hands of moneylenders, development of village level

organizations, and to create their own capital from where they can easily get loan in a

very low interest. Towards the end of 1999, NABARD allocated to BCT a project to

form 250 SHGs. In 2003 BCT submitted proposals to ICICI, SIDBI, and RMK for acting

as a lending intermediary to the SHGs. Meanwhile BCT financed some SHGs on its own,

as some of the groups were facing difficulties in getting loans from of the banks.

3 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

1.8.1 Present Microfinance Programme of BCT

At present there are 506 SHGs, which have a saving figure of Rs. 37.0 Lakhs. Out of

these 506 groups, 363 groups have obtained a total loan of Rs. 66.72 Lakhs from banks

and Rs. 34.80 Lakhs from FIs through BCT intermediation. 83 groups have completed

their first loaning cycle. Microfinance has proved a powerful tool for expanding

economic opportunities for the entrepreneurial poor, and has certainly contributed to

decrease their vulnerability. BCT is looking for identification of income generation

activities suitable to this region, so that the linkages can be further strengthened. There is

enormous potential demand that exists for microfinance services. The microfinance

activity of BCT is in an incipient stage, while there is enormous latent demand that

exists for microfinance services (Savings, Credit, and Insurance) in this area. This

demand is huge even when the services are offered to clients at their full cost. This

demand applies as much to credit as to savings, and empirical evidence has shown that

poor people are capable of amassing impressive amount of savings when afforded simple

and flexible instruments. In the villages people still depend on informal sources and BCT

is trying to increase the reach of its programme across the Rajgarh and Taranagar blocks

by trying to engage the community in various developmental activities and income

generation programmes. BCT has already successfully completed formation of 250 SHGs

under a project allocated by NABARD for Rs. 3.84 Lakhs. Looking into the same

NABARD has allotted another project to the BCT for forming another 250 SHGs under

another project for Rs. 4.5 Lakhs.

[Table2: Here]

[Table3: Here]

1.8.2 Demand Estimate in Operational Area

The BCT has defined the initial geographical area of operation as the Rajgarh and

Taranagar blocks of Churu district. There are 18 branches of MKGB, 3 of Churu

District Cooperative bank, 2 of Land Development bank, and 9 of Commercial

4 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

banks. In case of MKGB the annual advances to rural sector (Farm and Non-Farm

activities) is Rs. 5.0 Crores in 3 blocks of Churu district namely Rajgarh,

Taranagar, and Sardarshahar. Out of this, Rs. 60.0 Lakhs is given to SHGs formed

by BCT. The total estimated yearly advances to rural sector in Rajgarh and

Taranagar blocks, based on triangulation of bankers estimate, come to Rs. 20

Crore.

1.8.3 Mission of Microfinance Programme

BCT wants to achieve a status where it is able to provide savings and credit

services to the rural poor in the Rajgarh and Taranagar blocks of Churu district,

with minimum spread, so that poor stand benefited in obtaining both the services.

BCT wants to link the people with sustainable IGAs so that they are able to

improve their standards of living.

1.8.4 Challenges in Upscaling of Microfinance Programme

a. For retention of the target group with the MF programme, BCT wants to

continue with the SHG model. It wants to exclude the better off and also

those who do not fit into the credit discipline of the SHG. BCT wants to

institutionalise the MF programme by drawing out a framework of

operational rules. At present there is a loan sanctioning committee, but till

now no loan application has been turned down. BCT need to develop

suitable loan appraisal procedures.

b. BCT wants to create a separate legal entity for MFI operations. For a

long time BCT has been working in this area on health, education, and

social issues. The programmes are funded by different agencies. The

operational issues in running a MF programme are different from the

present working of BCT. In this case the beneficiary has to generate output

out of the assets build up through the finance obtained by her. BCT

agrees that a major portion of the present loaning goes towards the

consumption and smoothening functions. There is an urgent need to

5 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

develop a sense of linking the finances with the present or prospective

enterprises of people.

c. Only a small percentage of the thousands of microfinance institutions

supported by outside funds have the capacity to become financially

sustainable. The price of sustainability is often under-estimated. Reaching

the stability stage involves taking unpopular decisions (such as charging

the full cost of services), and implies a tremendous effort to build reliable

information systems and maintain low delinquency rates. Although many

MFIs claim to aim for financial sustainability, few may be willing to pay

the price necessary to reach this objective. Moreover, outside technical

assistance and financial support have much less ability to turn around

MFIs into profitable and sustainable institutions as compared to the vision

and capacity of the MFI to become sustainable. BCT has this advantage of

having the vision and will to carry forward the MF activity. Initially when

it was in the process of getting support from FIs, it demonstrated the

conviction to finance some of the beneficiaries out of its own funds.

d. The demand for microfinance is huge even when the services are offered

to clients at their full cost. This demand applies as much to credit as to

savings, and empirical evidence has shown that poor people are capable of

amassing impressive amount of savings when afforded simple and flexible

instruments. Moreover, microfinance has proved a powerful tool for

expanding economic opportunities for the entrepreneurial poor, and has

certainly contributed to decrease their vulnerability. BCT has the challenge

to find suitable operational methods for delivery of the MF products. The

products also need to be devised as per the identification of current needs

and aspirations of the population. The BCT also need to introduce suitable

IGAs to people. (Source: UNCDF Working Paper on Microfinance)

6 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

CHAPTER-2

FRAMEWORK FOR PROJECT WORK

2.1 INTRODUCTION

The prelude to the framework was a study of the organization by understanding its

working procedures and interviews with the BCT personnel about their idea of a MFI.

The title of the project work is to study the scope and potential of setting a Micro-finance

Institution. Here the dictionary meaning of the word ‘Scope’ is ‘Sweep or reach possible

to range of opportunities.’ Similarly the word ‘Potential’ means ‘capable of coming into

being or action.’ In the present context ‘speeding up and enlargement of activities’ is the

‘Potential’ of BCT. Also the ‘scaling up of the operations from the present level across

the breadth and depth’ is the ‘Scope’ of the operations. Therefore the potential of

establishing a MFI is the need, viability and sustainability of the operations. The scope

also would include the measures and methods that would operationalise the MFI.

2.2 OBJECTIVES

i. To study the scope and potential of creating a microfinance institution to cater to

the needs of different SHGs engaged in rural micro-enterprise activities in the

villages of Churu district.

ii. To study the present MF operations of BCT and study the reporting procedures,

need for training and capacity building, and possible procedure for upscaling.

iii. To find a suitable structure for the proposed MFI, that is self-sustaining.

2.3 SCOPE OF THE STUDY

i. Study of potential, present operations, and suitable structure for viability of

present operations.

ii. Geographically the Rajgarh and Taranagar blocks of Churu district of Rajasthan

are covered.

2.4 METHODOLOGY AND DATA SOURCES

The study was approached using the base of the present MF operations of BCT. The

methods of the study included field visits, case studies, questionnaire, interviews and

informal discussions with BCT staff, interaction with bankers, focus group discussions

7 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

with SHG members, and interaction with non-beneficiaries. Literature from IRMA

workshop on ‘Governance Issues in Rural Finance,’ and Internet were also used. The

Primary data for the study was collected from the SHGs, BCT staff and other

stakeholders using the above methods. Secondary data was gathered from records of the

SHGs and BCT, and some published articles on BCT. The analysis pertains to description

of the present operations and comparison with standard procedures as gathered from

various sources.

2.5 RELEVANCE OF MICROFINANCE AT BCT

Any organization would like to conduct a feasibility study of its proposed programmes.

In this case the issue is related to the lives of the poor in this remote area of Rajasthan. It

is necessary that the pros and cons of the issue and the probable operational problems be

revealed to the extent possible. BCT is an organization that has the conviction to accept

the poor state of affairs of many of its SHGs. In spite of sustained efforts on the part of

the BCT, the SHGs could not be effectively linked to IGAs. The people here do not

calculate the opportunity costs of their time. When there is no work in the fields, the

people in the village can be seen, sleeping and playing cards. BCT is trying to create a

demonstration effect of successful IGAs in the region and therefore wants to promote

entrepreneurship among the people of the region. Many cases have showed positive

results and looking into the vast coverage area of BCT many more activities need to be

identified to enhance the choice and diversity.

2.6 FRAMEWORK USED FOR ASSESSMENT OF SCOPE AND POTENTIAL

OF SETTING UP A MICRO FINANCE INSTITUTION BY THE BCT

2.6.1 Reasons to take finance: The members of the SHGs need monetary support for

various needs. These include productive, social, consumption, smoothening,

and seasonal requirements. The banks are not able to provide loans in various

cases for a number of reasons.

2.6.2 Purpose to set up MF activity: Make available cheaper and hassle free credit

and improve the accessibility to loan.

8 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

2.6.3 Methods: The BCT has a present base of 506 SHGs and uses the SHG model

for providing micro-credit to the target group. They have already advanced

Rs. 37.64 Lakhs of money borrowed from 3 FIs namely RMK, ICICI, and

SIDBI at 8%, 9.1%, and 10% respectively. The purpose of loaning is

Agriculture, Cattle, Shops, Machinery, and Household activities. BCT has 4

branches, 22 number staff looking after the MF activity, 5173 SHG members

having total savings of Rs. 36.17 Lakhs, and 155 active borrowers. The credit

extended by the banks to the SHGs is Rs. 67 Lakhs.

2.6.4 Mission of the MF activity: Reduction in incidence of poverty and promotion

of IGAs through micro-credit for socio-economically underprivileged sections

of the society in rural areas of the Churu district. To raise their standards of

living so that they can lead a meaningful and dignified life. Here BCT also

feels that there is a considerable amount of optimism regarding the ability of

microfinance. Microfinance is however not the panacea for poverty

alleviation, even though it is true that it can be an efficient tool to combat

poverty through self-help.

2.6.5 Problems with present method:

a. BCT is also acting as an intermediary for bank linkages of the groups. The

banks are reluctant to provide credit to the SHGs for different reasons and

their procedure is cumbersome for the groups.

b. The person, who is looking after the MF activity at the executive level, is also

not able to devote his full time to the MF operations. BCT is not able to get

services of a full time MF professional and is in search of the same.

c. The area of operation is under drought for the last 6-7 years, and people do not

have a surplus to carry on any IGA. This also reduces the consumption levels

and repayment capacity of the people.

d. BCT is not able to achieve the loan disbursement levels of Rs.6-7 Crores per

annum as estimated before starting the operations. The age of SHGs is 4-5

years and the loan disbursement process has started for about 18 months now.

2.6.6 How the BCT want to carry the MF activity: In the long term the BCT wants

to accept deposits from the SHG members at 5-6 %, and lend at 9%. This will

9 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

provide a two-way benefit to the members as compared to the banks. The

present status is that the money is borrowed at 8 to 10% and is lent at 12%.

The on-time recovery rate is 95% and there are no bad debts. The BCT wants

to create a separate wing for working as an MFI and wants to work on a no

profit and no loss basis. The establishment cost and the initial losses are to be

borne with the resources of the Trust.

2.6.7 Member level assessment of performance of SHG:

a. Savings: The SHG has provided an opportunity to save money.

b. Loan: The interactions with SHG members revealed that the SHG has reduced

their dependence on moneylenders. The internal loans from the SHG are

available to them in 1 day and loans from bank or BCT in 30 to 45 days.

c. Insurance: The awareness level of the SHG members is low on the issue.

d. Adequacy of loan: The SHG is given loan upto Rs. 25000/- to distribute to its

members. The members have a tendency to inflate their demands and divert

the amount partly or fully for consumption purpose.

e. Timeliness: For loans of amount ranging from Rs. 10000/- to Rs. 25000/- the

loan from the BCT is given to the members for a period of 24 months. Other

members have to wait for these members to return the loan. Sometimes the

members are able to make a premature repayment, but at the same time some

other members delay the installments. Therefore other members are not able

to get loan from BCT.

f. Fulfillment of expectations: In many cases it is seen that the more aware

members, who also happen to be post holders, avail the loans. Other members

either are not capable to grasp the opportunity or do not need a loan.

g. Possible improvements: Interaction with the members showed that the

members are not having any perception of possible change in the present

system. Many of them are not even able to understand even the present system

of savings and loaning.

10 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

2.6.8 Organisation level assessment of performance of SHG:

a. Savings: The SHGs have shown satisfactory performance in savings as they

have started from a situation where members did not have a habit of saving.

However further momentum is to be maintained.

b. Loan: The BCT has distributed loans as per the needs of the members. There

is no case of rejection of loan application till now.

c. Insurance: There is no urgent demand by the people on this issue at present;

however the BCT wants to include rural insurance products in its MF

portfolio. It is felt to be in the interest of the loanee and the BCT both.

d. Adequacy of loan: No shortage of funds is felt at any stage to provide credit

to SHGs. Further the operations are to be upscaled.

e. Timeliness: BCT perceives that the delay in initial loan disbursements to the

groups is mainly on account of factors external to BCT. These are incomplete

documentation by the groups or the procedural formalities of the FI. There is

shortage of staff and that also accounts for some delays. It has been observed

that due to inadequacy of trained staff, BCT attends to the deficiency in loan

applications with an average time lag of one month. The banking channel also

takes substantial time. This however was defended by the bankers. BCT

however charges interest to SHG members from the date of issue of cheque,

rather than the date of realization or debit from the BCT account.

f. Fulfillment of expectations: At present the mobilization of people towards the

IGAs is low and credit could be extended only to a small number. Some

people were given loans for Dairy project and others under DPIP. The

utilization level of these loans was satisfactory to the BCT. The people have a

fix of mindset of minimum wages and want to get an equivalent benefit from

any IGA from the very beginning.

g. Possible improvements: Cheaper and timely credit, coupled with opportunities

of linkages with suitable IGAs.

2.6.9 Assessment of banks and other institutions about the performance of SHG:

11 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

a. Savings: The SHGs are regular in depositing their savings in the bank and

some of them have savings in excess of Rs. 10000/-. This is considered by the

bankers as a good amount of saving by the SHG.

b. Loan: The banks are willing to extend credit to the SHGs. The ratio of credit

as compared to savings of the SHGs has been increased from 1:4 to 1:10.

c. Insurance: The awareness level of the SHG members is low on the issue and

not many loans are covered against insurance policies.

d. Adequacy of loan: The banks have no clear idea on the adequacy of the loans

to the members. The banks adhere to the maximum limits specified for the

purpose. However not all groups have utilized the facility to the maximum

possible limit. The banks feel that the smaller needs of the members are

fulfilled by internal loaning and that the BCT is also distributing loan to SHG

members. The hassles created in the banking system is accepted by the

bankers and also stressed by the BCT. In case of MKGB the annual advances

to rural sector (Farm and Non-Farm activities) is Rs. 5.0 Crores in 3 blocks of

Churu district, Rajgarh, Taranagar, and Sardarshahar. Out of this Rs. 60.0

Lakhs is given to SHGs formed by BCT, which comes to 12%.

e. Timeliness: The loans are disbursed on completion of documents, which

include a recommendation from the NGO and also on the spot credit rating by

the bank officers. The process inadvertently causes delay and also an

increased transaction cost for the members.

f. Fulfillment of expectations: In terms of the number of groups linked to the

bank, the expectations are partially met. All the banks that were visited

showed interest towards increasing the SHG accounts in the bank.

g. Possible improvements: The banks are constrained by their roles and cannot

form the groups at their own. They look forward to the NGO’s for increased

support. Mr., D.D. Agarwal, Area Manager MKGB, told that the bank has a

running loss of Rs.59.0 Crores and therefore charges 13% interest, while

admitting that other banks are charging between 10-12%. The idea is to cover

the losses, which the bank has already incurred, mostly because of earlier

government schemes.

12 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

2.6.10 Operational scenario for BCT to carry forward the MF activity: The

information was gathered mostly from the correspondence made by the BCT

with various financial institutions.

a. Priority areas for operations: The BCT primarily wants to deal in savings and

credit business.

b. Operational Parity: BCT want to accept savings and extend credit in the rural

areas keeping a lower spread and a not for profit character. However the

legal framework for NGO’s in Rajasthan, unlike other states like Andhra

Pradesh, inhibits acceptance of deposits. Further the present level of

operations needs a gradual upscaling and therefore the idea of accepting

savings at this stage may have to be reconsidered by BCT.

c. Upscaling the operations: By obtaining external credit and making a turnover

of 6-7 Crores.

d. Carrying forward the operations: BCT wants to avail external credit from FIs

and is also willing to bear the establishment cost of the new wing alongwith

the initial operational losses. BCT is willing to bring in promoters contribution

of 30-35 Lakhs for starting the operations.

e. Institutionalisation of operations: BCT want to create a separate wing for MFI

operations and get registered appropriately. One of the considerations at

present is getting registered under section 25 of the companies act as a non-

profit organization.

2.6.11 Future of the MF operations: BCT has already extended credit worth Rs. 34

Lakhs by borrowing from ICICI, SIDBI, and RMK. As the BCT is thinking to

work as a full-fledged MFI and also continue its social activities, it plans to

separate the MFI business by way of creating a separate wing. The working

manual of the institution and a manual to standardize the SHG loaning

procedure are to be codified. The BCT also want to develop an MIS system

for efficient monitoring of the operations.

2.6.12 How BCT wants to scale: BCT wants to operate regionally in the Rajgarh and

Taranagar blocks of Churu district of Rajasthan. The present SHG credit from

banks is Rs. 67 Lakhs and from BCT is Rs. 34 Lakhs. The repayments are

13 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

95% and there are no bad debts. BCT is obtaining funds from ICICI, SIDBI,

and RMK. The MKGB may also extend credit to BCT at 9%. The resources

needed for the upscaling up of the operations include the establishment cost,

trained staff, MIS, working manuals for loaning and working manual for the

staff.

2.6.13 Challenges in promoting an MFI

a. Getting funds: BCT had initial talks with SIDBI and also approached ICICI

and RMK while the matter with SIDBI was in the pipeline. There were some

initial difficulties like providing collateral guarantee from the parent

organisation. As BCT accepted all the three proposals, it could not fully utilize

the amount sanctioned by any agency. The funds are obtained by BCT at an

average cost of 9% and lending is done at 12%.

b. Formation of appropriate groups: The groups are not always showing

cohesiveness and proper utilization of credit. The illiteracy of the group

members is a big inhibiting factor to develop the group concept. The SHG

accounts are not maintained properly. Mismatch of cashbook, ledger and

passbooks is commonly seen. The field staff is shared with other projects.

There was an incentive of Rs.25/- per for formation of one SHG, but the same

has been withdrawn as the BCT felt that the quality of groups formed is not

good. In many groups there is more than one member from the same family or

close relatives. In most of the groups the key person is Aanganwadi worker,

who also is a BCT employee under ICDS project and also she herself has

availed the loan.

c. Linkage of SHGs with IGAs: The groups are generally not linked to any IGA.

In 15 villages wage employment has been provided for Carpet making. Some

individuals have gone for Buffaloes, Goats, and sewing machines. In one

group a cheque of Rs. 25000/- was given before us for ‘Medical store.’ On

asking the member it emerged that her husband is a quack and Rs. 20,000/- of

the loan amount will go for making campus wall of the house.

14 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

d. Monitoring of the groups: As of no there is no standard procedure for

operation of the groups, group meetings, loaning, utilization monitoring,

recovery, MIS or employee manual.

e. Timely disbursement of credit: BCT feels that documentation for obtaining

loan is not proper on the part of SHGs, owing to illiteracy of the members.

The BCT staff visiting the groups for getting the documents is shared with

other projects and is not properly trained. The incomplete documents are not

completed in subsequent visits of the same staff. In some cases the A.P.O. of

SHG project approaches the groups to complete the documents. After passing

the loan an account payee cheque drawn on RRB at village Bhorugram

(Project office of BCT) is delivered to the SHGs, which might take 7-10 days.

The banks take anything upto 45 to 60 days to collect the cheque. The

borrower has to pay the interest from the date of the cheque. BCT has no

policy to monitor the utilization of the sanctioned amount.

f. Operational costs: The spread obtained is only 3%, which may not sustain a

separate infrastructure. For getting cheaper credit, BCT may have to look for

alternate sources, which again may demand a bigger turnover. For achieving

the same, the BCT will have to establish linkages with more borrowers by

involving them into IGAs and thus build their capacity to repay.

2.6.14 Policy approach: At present there is no loaning manual and till now no one has

been refused loan. There is no prioritization for sanctioning the loans. No

verification of loan utilisation is done. The present situation is that of surplus

loans as BCT accepted offers of all the three FIs and was unable to meet the

enlarged targets. As the operations move towards a mature phase the

organization will be required to show more prudence towards the distribution

of loans. Development of a proper MIS will reduce the reporting delays and

will perpetuate to enforce a better credit discipline.

2.6.15 Willingness of institutions: NABARD has the target to cover one third of the

rural population in Rajasthan and therefore will most likely extend its support.

Already BCT has some talks with NABARD for obtaining another project of

forming 250 SHGs for Rs. 4.5 Lakhs. The banks have recently extended credit

15 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

ceiling of the SHGs ten times their savings, in place of four times hitherto.

This step might reduce the pressure on BCT to extend credit. However this

challenge may be overcome by providing better services. FIs may also provide

support in the form of providing 5% operational costs as envisaged by BCT.

The FIs are ready to extend credit support for enlarged operations of BCT.

The Union Budget 2005-06 has several positives for the Indian microfinance

sector. The initiatives to promote microfinance institutions (MFI) are a step in

the right direction in channeling credit to the economically challenged.

Qualified NGO-MFIs may now be eligible to access external commercial

borrowings (ECBs), enabling them to diversify their funding profile. This will

restore the position that prevailed before September 2002, when the ECB

window was closed for NGOs. Prior to that, a number of MFIs and NGO-

MFIs in India were able to access attractive long-term subsidised funds from

several social funds from the USA, Europe and other countries. The reopening

of this funding avenue will enable additional flow of funds to the sector,

which critically needs low-cost funds to reach out to the economically

challenged in rural and semi-urban areas. At the same time, this would allow

in foreign microfinance investment funds that are keen to increase their

exposure to Indian MFIs.

2.6.16 The move to allow commercial banks to appoint MFIs as "banking

correspondents" is expected to strengthen bank-MFI relationships and enable

MFIs to reach out to more rural people. Over the years, successful MFIs have

demonstrated their appreciation of local dynamics, enabling them to offer

customised services tailored to local needs. In a situation where an estimated

70 per cent of the rural poor do not have a bank account and 87 percent have

no access to credit from a formal source, this move will enhance the access of

the rural populace to formal sources of finance.

2.6.17 While some large MFIs are already channeling insurance for their customers,

the proposal to invite MFIs, NGO-MFIs and other entities as micro insurance

agents will translate into benefits such as improving insurance density and

16 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

mitigating credit risk for MFIs. It will enable MFIs and NGO-MFIs to

generate fee income.

2.6.18 BCTs own assessment for forming an MFI: BCT has made up its mind to

create a separate wing for MF operations and also to rectify the present

operational problems. It pursues that initially the demonstration effect takes

some time and the awareness of the public towards developing an additional

source of income will take both time and faith in the process. However the

BCT believes that they will be able to identify IGAs that will engage the

people of this area. The proposed structure of MFI with separate establishment

brings a running cost of about Rs. 20 Lakhs, which demands a turnover of Rs.

8 Crores.

2.7 INPUTS RECEIVED

2.7.1 Issues Identified By the Project Director Mr. Amitava Banerjee

a. Problems with present activities: There is no consistency in performance of

SHGs; they are classified as very good, average and not so good. The

documentation part is not satisfactory because of illiteracy of members. It is

difficult to find and retain a full time micro finance specialist and qualified staff in

this remote area.

b. Purpose of setting MFI wing and Expectations from it: BCT wants to provide

wide services of savings, loans, and insurance. The purpose is to empower

people by increasing their supplementary income through micro enterprises and

other IGAs. The Trust wants to build a larger outreach and provide easy access to

loan looking into the urgent needs of the people. They also want to include

micro-insurance products in their portfolio.

c. Challenges: The literacy levels of the target group (women of 40-45years age) are

low. There is need for their training and proper monitoring. At present many loans

are taken for social obligations and non-productive purposes. There is also a need

to identify IGAs like handicrafts, where upper end buyers might be available, and

establish market linkages with them.

17 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

d. Scaling up: All stake holders in the process, the FIs, Government system, banks

should partner in the process. The Trust is expecting support for enhanced

operations from SIDBI, ICICI, and ABN-AMRO. With the increase in SHG

loaning to ten times their savings, the competition is seen from the Commercial

banks. The necessary resource support is seen as managerial staff, trained field

staff, and a proper MIS for effective monitoring. The Trust also wants to consider

loaning for short term immediate needs, alongwith present system of 24 months.

They also want to link the loans with appropriate insurance product to safeguard

the family. The premium can be adjusted by charging a processing fee on the

loans.

2.7.2 Points Emerged In Discussion with Project Manager Dr. R.P. Bisht

a. BCT was mostly dealing with social issues till now and could not pay full

attention to the MFI activities. Financial trends of the MFI business are normally

confusing. BCT is under dilemma between the SHG and the individual loaning

models. There is an urgent need to standardize the loaning process and to develop

an operating manual for SHG by consolidation and revision of existing

regulations. For system development and improvement, the grading system of

SHG is to be revised and consolidated to suit the local needs. MIS is needed to

reduce the transaction cost of the BCT. MF operations emerged as a reaction to

the resistance of banks to lend to SHGs. MFI operations have a goal to increase

outreach to poor, by accepting savings at 5-6%, as compared to 3-4% by banks

and to provide cheaper funds than the present rate of 12% at about 9%. The future

plans are to leverage fixed cost by scaling the operations and attain sustainability.

Also there are plans to provide seasonal loans to farmers for agriculture

operations, which can be repaid in one single installment at the time of harvest.

b. There is need of a marketing expert to develop forward and backward linkages to

markets, some of the projects identified are Embroidery, Ready-made garments,

Carpet making, and dairy which was operational programme in the past in

association with RCDF. This is still seen as a potential IGP.

c. In case of micro-insurance specially designed products suitable to local needs can

also be designed. Earlier under the ICDS project ‘Raj-rajeshwari’ and ‘Jan-Shree’

18 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

schemes were introduced as group insurance. Also the changing needs of the SHG

members can be ascertained for better understanding.

d. For better interaction with SHGs there could be a concept of a ‘Resource center’

between 10-12 villages. This can serve as a contact point to the outside world,

where village level trainings can be arranged and any material meant for

distribution can also be placed there to save the transportation cost.

e. The orientation and mindset of the staff will have to be changed to carry forward

the MFI operations. The schedule of SHG meetings is not available ion the BCT

office and it is with the lady supervisor who visits them. The BCT only has the

movement details of the supervisor. The skill set required for an employee is

i. Command over local language

ii. Exposure to process of group formation

iii. Orientation towards NGO work

iv. Training for continuous motivation

v. Understanding of financial management of SHG (for P.O. level)

f. MFI to operate initially for the SHG members and later on individuals can also be

added. The plan is to spread the MFI operations to Rs. 3-4 Crore. At an average

loan level of Rs. 25000/- this would mean 1200-1600 beneficiary households. The

leakage of loan is understood even by the NABARD and the Commercial banks.

At least a part of the productive loan goes towards consumption and therefore the

value of loan can be proportionately enhanced to ensure asset building. At present

there is no strict provision of asset verification at the NGO level and it is assumed

that the loan is utilized for the purpose that it was taken. ICICI and SIDBI are

already partners in the present MFI operations. There continued support is

expected for the up-scaled level of operations. There is an ongoing NABARD

project for SHG formation and another project may be granted to BCT after

achieving the present target. The area of operations will be mainly Rajgarh and

Taranagar blocks.

g. Based on the present achievements the speeding up and enlargement of activities

has the ‘Potential’ (capable of coming into being or action). Scaling up of the

19 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

operations from the present level across the breadth and depth is the ‘Scope’

(Sweep or reach possible to range opportunities) of the operations.

h. The causes of SHG failure are

i. Lack of dissemination of proper information about group procedures at the

time of group formation.

ii. Apprehensions about the fate of deposits.

iii. Disparity in socio-economic status of group members.

iv. Improper and inadequate guidance and monitoring of groups.

v. Meetings of the groups are not held on timely basis.

vi. About 25 groups have become defunct by now.

2.7.3 Views of Mr. Balwan Singh Project Coordinator of BCT and Project

Officer of SHG Project

a. BCT already acquainted with SHG system. There are differences in

attitudes of banks. RRBs are friendlier than commercial banks. Although

SBBJ is the lead bank in the region, most of the accounts of BCT

promoted SHGs are in MKGB. Banks pay less attention to the customers

and there are long queues on the bank counter. Therefore BCT wants to

work as MFI to serve the poor. BCT wants to get registered as MFI and

looking for suitable from and method of registration. Target for next one

year is distribution of Rs.2.0 Crore. However no policy is developed and is

at the in-house discussion stage.

b. Reporting system is poor. BCT needs proper HR planning for specifying

job roles and work allocation. There is a requirement of manpower

planning for taking the business to Rs. 2.0 Crores in one year time frame.

BCT needs consultancy for a period of 2 years with a frequency of 1-2

months. In 1999 BCT formed 150-200 groups by themselves. In Later

part of 1999 BCT got a project from NABARD to form 250 groups. The

same has been completed and the second phase of another 250 groups in

under process. BCT is forming groups from generally well-off section, as

they perceive non-sustenance of BPL groups. NABARD has now

20 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

sanctioned a grant of Rs. 1000/- to each SHG. In future also BCT is

willing to carry on group formation, even without outside assistance.

2.7.4 Points Emerged In Focused Group Discussion with Ms. Darshana Poonia, Ms.

Kanta and Ms. Samjho Devi

a. In village ‘Neema,’ SHG members are active on social issues. They successfully

intervened in the family of a member, where the husband used to drink and beat

his wife. In village ‘Mithi Redu’ other members of the group are emerging as

second line of leadership. The SHG members in general are not aware about non-

life insurance schemes. The revived groups are able to retain 50% of the

members. Whenever a new member joins an existing group, she has to deposit an

amount equal to the present savings status of other members. Marriage

ceremonies of a boy or a girl make a spending of Rs.50000 to Rs. 60000. An

agriculture loan for sowing or a consumption loan amounts in the range of Rs.

1000 to Rs. 1500/-. Around ‘Makar Sakranti’ (mid January), there is shortage of

food and therefore members need a loan at that time. The cooperation and

cohesion among the SHG members is low and therefore only individual economic

activity is possible. Further the women do not find any free time from their

routine HH activities.

b. Till now BCT has organized 2-3 exposure visits with 25- 30 members on each

trip. The loan is given to a member in accordance with her paying capacity. One

working as agri-labour will be getting upto Rs.2000-Rs.3000. Similarly Daily

wager having regular permanent employment gets Rs. 5000/-. The lady

supervisors (13 nos.) of the ICDS programme are also looking to the SHGs.

Below them in the hierarchy are ‘Sathin’ at Panchayat level. Next at the village

level are the Aanganwadi worker, Sahayika, and Sahyogini in that order.

Normally one of the village level workers is a member of a SHG in the village

and is also the key person and post holder in SHG.

2.7.5 Field Visit With Mr. Rakesh Dubey (Cashpor-Varanasi), Mr.Neeraj Verma

(Aravali), Ms. Darshana Poonia (BCT) And Mr. Roshan Ali (BCT).

a. Conversion to full-fledged MFI needs an orientation to delink from social issues.

There is a need to provide an institution and a MIS for proper working of MF

21 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

operations. In rural areas the MFI loan portfolio normally contains 40-50%

exposure to AH, 20-25% to trading activities, and 10-20% for artisans. There is a

need to promote livelihood programmes in the operational area of BCT, alongwith

the wage employment schemes like Carpet weaving being promoted in the area.

For proper coordination there can be a resource center between 10-12 villages

having 6-10 field workers. Default in loan repayments arise due to inefficient staff

(slack in monitoring) and no utilization of loans for the actual productive purpose.

b. Problems with SHG model as compared with CASHPOR operational area

i. Demonstration effect is low as maximum of 2-3 members get the loan and

others wait for their turn. It usually comes after 2nd cycle of loan. Their

mental faculties are tied to the opportunity of loaning and they fail to

conceptualise suitable IG activity in absence of loan. Groups that are

formed for namesake and for the benefit of select individual tend to

default, as there is morally no shared peer guarantee to repayment.

Recovery of loans is 95%. The spread obtained is averaged at 3% and

thereby it is difficult to obtain sustainability of operations.

ii. No incentive is given to staff for group formation, linkages or loaning.

Focus is needed on HR policies and legacy issues in the organisation.

SHGs are used to carry different programmes run by BCT. The field staff

is not exclusive to SHG programme and is not properly acquainted with

the accounting procedures and record keeping of SHGs. Delegation of

responsibilities is required in BCT. For better working efficiency officers

and the staff should be at the same wavelength of thought process.

iii. Grading procedure had some mistakes like allocation of more marks to

improve the grading and thus enabling disbursement of loan. When the

targets for disbursement are to be met the staff is under heavy pressure of

work. It was pointed in discussion with Ms. Darshana Poonia that the

grading norms may be changed according to actual field conditions like

the number of members in a group may be less and therefore the

attendance in absolute number terms will always be less. The average time

for processing of loan request is two months. The minimum time for group

22 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

loan is 20 days. Sometimes the processing and disbursement is very fast

like in individual loan the amount is delivered the same day.

iv. Sub-loaning to Field Level NGO (FNGO) at Mithi Redu has been done at

12%. The FNGO might lend at 15% to the end user. They were forced to

take money from BCT due to onward commitment and instant shortage of

funds. The actual agreement was not present in the file.

v. Discussion with Dr. Vimla Sahoo, Project Officer, and SHG Project

indicated that the loan is to the individuals through the group. There is no

joint income generation activity by the groups, which might prevent

filtering out of very poor from the process. Therefore the comparatively

well off are repeatedly getting chance to avail the loan. Also discussion

with Ms. Darshana brought the fact that more aware and initiative seeking

members avail the loan more frequently.

vi. The accounting procedure does not reflect the bifurcation of the principal

and the interest amount in the books. This was seen in the case of

‘Bhaboota Sidha’ SHG from the village ‘Jor Ji Ka Was.’ The Yuva Ekta

SHG of village Lalpura has taken loan in February 2005, but deposited the

1st installment in July only.

2.8 FOCUS GROUP DISCUSSION

A Focus Group Discussion with 35 members of various SHGs was conducted in village

Nangal Badi on July 12, 2005. The members join an SHG for different purposes like

savings, awareness, and desire to come out of traditional way of life. The changes that

they perceive because of their association with SHG are opportunity to save, increased

awareness, and putting signatures in place of thumb impression. Some members need

another loan for Rs. 20,000/- to start an IGA like Flour Mill. They perceive that any IGA

would require an amount of that order. They also listed some other activities like Sewing

Machine, Carpet making, Dari making, Soap making, and horticulture. However they are

not aware on the success rate of these ventures. The activity of Soap making was taken up

in one village, but it could not be sustained because of low quality product and lack of

expertise. The members are able to get loans from the savings of the SHG itself within 1

23 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

day. The time required to get the same from BCT or bank is anywhere between 10 days to

1 month under normal circumstances. As of now the members do not perceive any delay

beyond 1-2 days in getting loan from SHG. In case of BCT sometimes the delay is upto

75 days counting from the day application is made to the SHG to actually getting money

in hand. This includes paper formalities and loan sanctioning at the BCT to the delay in

clearing of cheques. For loan disbursement the formalities required at the bank includes

an agreement on stamp paper of Rs.50/-, the copy of SHG meeting recommending loan to

that member, and a recommendation letter from the BCT. Thus for availing a loan of Rs.

10,000/- the member has to spend upto Rs. 300/- on formalities and travel. Here the

opportunity cost of the lost man-days and also that of lost IGA is not quantified or added.

The priority of members as a source of loan is to SHG, BCT, bank, and moneylender in

that order. They feel comfortable paying interest rates of 24% per annum, given a hassle

free loan. There are various difficulties in getting loan from the moneylender. He

charges interest rates of 24% to 36%, which might further increase as per the urgency of

the loan and creditworthiness of the loanee. The moneylender may additionally insist on

an agreement on stamp paper, and keep the documents of the agriculture land or house as

an assurance of repayment. In case of default in timely repayment he will give threats to

summon them in the village ‘Panchayat’ on the issue. Also the moneylender may go in

for forcefully lifting the agriculture produce from the field itself after harvesting of the

crop. He may also force the loanee to enter into a selling agreement for the agri-produce

at a price lower by 6-7%. For example ‘Grams’ that sell at Rs. 1500 to Rs. 1600 per

quintal, will be taken at a rate, which will be lower by Rs. 100 per quintal. The members

felt that unlike moneylenders, the BCT does not pester them with repayment demands.

They are having a faith that BCT will provide them a lease of time, if they happen to be

in a difficult situation. The members find that many people in the village, other than the

SHG members are in need of loan for productive purpose. Some people have purchased

Goats or other livestock by borrowing money from moneylenders. It is felt from the

discussion that BCT has an opportunity to enhance its role in providing credit, but at the

same time it is desirable to enforce credit discipline in practice and in the minds if the

SHG members. The members are willing to pay interest upto 24% per annum if the BCT

provides ease of documentation and early disbursements, to the SHG.

24 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

[TABLE 4: Here]

2.9 INERVIEWS

2.9.1 Interview with Branch Manager of Marudhar Kshetriya Gramin Bank (RRB),

Sadulpur, Churu, on 14.07.05.

Discussion with Mr. K.K. Khandelwal, Branch Manager of Marudhar Kshetriya Gramin

bank, focused on the needs and priorities of SHGs, their repayment performance, and role

of BCT. He told that the bank is giving loans to SHGs for the last 5 years and the present

rate of interest is 13% per annum. The loan is given upto 4 times the SHG funds,

irrespective of whether it is lying with the bank or used for lending by the group. Thus

effectively the SHG has an access to 5 times its savings. The branch has 19 accounts of

the groups promoted by BCT, and the loan advanced to them is Rs. 2.14 Lakhs. He said

that sometimes the loan is repaid by the members much earlier than the schedule, and in

other cases the monthly installments are deposited quarterly of half yearly. Although till

now no amount has fallen into bad debt. The SHG members are mostly illiterate making

the operation of bank accounts difficult for them and also for the bank. He said that the

bank personnel have to go to the different villages for grading of the groups. In the

process of grading they also take the help of BCT, as BCT form the groups and as such

are better informed about the groups than the bank. Regarding the distance of the branch

from the villages and possibilities of opening extension counters, he said that the people

have to come to the town for various reasons and therefore do not have to take any

additional efforts to operate the bank account. The members either themselves or through

some other person of the village, are able to operate the account. Also he told that the

bank procedures and operational difficulties, does not allow the bank to go for such

ventures. Discussing on the issue of BCT decentralizing the distribution of loan, he told

that if the BCT wants to transfer the funds across their branches the charges levied by the

bank are the following.

[TABLE 5: Here]

25 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

2.9.2 Interview with Branch Manager of Bank of Baroda, Sadulpur, Churu, on

14.07.05.

Mr. V.K. Jain, Branch Manager was available in his office and shared his views on the

working of the groups, their dealings with the bank, and the causes of default in a SHG.

According to him the prerequisite for proper functioning of the groups is the formation of

groups as per the established norms. If the group is heterogeneous, the possibility of

malfunctioning and consequent defaults also increases. In case the formation of the group

is based on vested interest of some members and others are acting as sleeping partners,

and do not want to utilize the facilities, the group will not persist beyond the first loaning

cycle. He said that there are instances when more than one member in the group is from

the same family. This puts the repayment burden on one family and also reduces the peer

pressure for recovery of loan amount. The cohesion in the group will be better if there is a

joint activity like dairy farming. Discussing on the advances extended by the bank, he

said that as the thrift of the group increases, the bank also extends the loaning exposure to

the group. He said that the SHG should have norms for delay in repayment and the group

can charge to the members a fine of Rs.5 to Rs.10 per day. This will help to inculcate

credit discipline among the members. Talking on the interaction of the groups with the

bank he said that the SHGs are better than the other customers to deal with, however

there are some defaults made by the groups and the present recovery rate is 90%.

2.9.3 Interview with Branch Manager of State Bank of Bikaner and Jaipur,

Sadulpur, Churu, on 14.07.05.

Mr. B.L. Agarwal, Branch Manager was present in his office and talked about the

performance of the SHGs and the loaning procedure to them. He said that there are nine

accounts, of BCT sponsored SHGs in the bank, and out of which loan is given to 7

groups. One account is dysfunctional after the default made by the group. He said that

the group members should be of similar socio-economic status for proper functioning of

the group. He said that the recovery of the groups is not timely, and the bank faces

difficulty, as there is no security of the money being lended. He said that if the groups are

formed of members with low economic status and they are not pursuing any income

generation activity, it becomes difficult to recover the loans. He added that the bank staff

26 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

is heavily loaded with work and therefore could not form any SHGs at its own even there

is a provision of incentive to the branch on making 100 SHGs.

2.9.4 Interview with Area Manager (Rajgarh, Taranagar, Sardarshahar) of

Marudhar Kshetriya Gramin Bank (RRB), at Bhorugram on 14.07.05.

Mr. D.D. Agarwal was on a tour to village Nangal Badi (Bhorugram) on July 22, 2005.

The branches of MKGB are spread within an average distance of 13 Kms and therefore

they have a good reach to the villagers. He told that the bank is happy with the

performance of the SHGs formed by BCT as the repayment rate is 90-95%, and there are

no bad debts. He told that the lending rate of the bank to the SHGs is 13%, which is on

the higher side as other banks are charging between 10-12%. The RRB has a running loss

of Rs. 59 Crores and therefore wants to cover up the losses. In case of MKGB the annual

advances to rural sector (Farm and Non-Farm activities) is Rs. 5.0 Crores in 3 blocks of

Churu district, Rajgarh, Taranagar, and Sardarshahar. Out of this Rs. 60.0 Lakhs is given

to SHGs formed by BCT, which comes to 12% of the rural business of MKGB. The bank

can also lend to BCT at 9% for onward lending to SHGs. Mr. Agarwal was

uncomfortable to know that the cheques of loan disbursement issued by BCT take upto

45 days for collection between branches. He stood firm on his estimate of one week for

the same.

2.9.5 Interviews and Discussions

Interviews and discussions with SHG members, non-members, and BCT employees

provided valuable inputs. Informal discussions and observations were also used. Various

staff meetings of BCT, training programmes for employees and SHG members,

inspection visits by CARE team, exposure visit by CAPART team, and Orientation by

CASHPOR team were also attended.

2.10 LIMITATIONS OF STUDY

The study was constrained by the interpretation of problem definition at the two ends.

The organization was initially of the opinion that it has access to sufficient funds to make

onward disbursements and therefore is interested only in a baseline survey of credit need

assessment at the village level. Also that it does not want to include operational issues of

MFI into the study. In fact beginning March 2004 the cumulative loan disbursements are

27 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

to the tune of Rs.34.0 Lakhs only while the initial estimates of BCT was to extend credit

of Rs.6-7 Crores in a year. For the same reason BCT felt that there is no need to seek

opinions of funding agencies or NABARD, and therefore the same are not included in the

study. As far the opinions of non-members of SHGs, BCT had an opinion that the people

in the area are not very much aware to talk on the issue and therefore the same may be

conducted with the members of the CIG formed by BCT under the DPIP scheme.

However this could not be conducted and the researcher has included the opinions of

some villagers (Females) on the issue. The financial data on microfinance operations

could not be obtained and is therefore based on triangulated opinions.

2.11 CHAPTER SCHEME

The report is divided in four chapters. The first chapter is about the host organization,

Bhoruka Charitable Trust (BCT), and serves as an introduction to the present activities of

the trust. This includes the developmental activities of the trust, as also its present

microfinance activities.

The second chapter deals with a framework developed to study the scope and potential of

setting up a microfinance institution by BCT. This incorporates various tools of theory as

applied to the particular circumstance.

The chapter three is about the Potential of SHG intervention on community. It includes

the understanding and involvement of the community with the programme. There are

some interesting case studies in the chapter on some SHGs and also interviews and

opinions of stakeholders. The present operations of microfinance taken up by BCT are

also detailed here.

The concluding chapter four of the report deals with the challenges and operational issues

in carrying forward the microfinance programme by BCT. Also included in this chapter

are the recommendations to the BCT for smoothening there operations under the

microfinance programme.

CHAPTER-3

28 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

POTENTIAL OF SHGS INTERVENTION ON COMMUNITY

3.1 INTRODUCTION

SHG movement opened up a new vista in the country to address poverty and especially

the women empowerment issues. The concept has provided banking facility at the

doorsteps of the underprivileged and served, as a means to address their credit needs. It

provides the flexibility of operations, both by way of timing and the amount. With the

major emphasis in the program on forming the women groups, the dependency of women

on their male counterparts for small sums of money has been reduced. The SHG concept

has gone beyond the concept of mere savings and credit, and acted as an influencing

group in the social circles of the villages. It has also tried to balance the social equation to

some extent and has provided an identity to the women. This way the formation of SHGs

has given a platform to the developmental agencies for making other interventions. There

are various agencies involved in the process with different mandates like promotion,

financing, capacity building, implementation, and facilitation at different levels.

(Teaching Notes of H.S. Shylendra: 2004)

In the Churu district of Rajasthan, Bhoruka charitable Trust (BCT) adopts an approach

that considers SHG as 'Developmental Unit,’ to fully capture the potential of the SHG

movement. The Trust states its objective behind promotion of SHG as to promote

savings, facilitate micro-credit, and income generation activities. The SHGs are running

in co-ordination with the ICDS and NFE workers. The formation of SHG helps to

generate funds within the group. Each group consists of 10 -20 members. A self-help

group promoted by the Trust has an optimum number of 12-13. The Trust finds that

taking the group size to 20 will make it difficult to ensure full attendance in the meetings,

which are held on a monthly basis. Also keeping the number at minimum of 10 will make

it difficult to complete the quorum. The members themselves decide the amount of

monthly contribution. More than 90% of the groups have all women members who

belong to poor families and are illiterate. Every group holds monthly meeting regularly

and each member contributes up to Rs. 50 per month. Involvement in the group activities

make every member self sufficient by inculcating the habit of saving. Loans are

29 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

sanctioned in the group meetings and the amount is determined according to the need and

the repaying capacity of the member. In each groups there are three posts, President,

Secretary and Cashier who are authorized to deal with the bank on behalf of the

members. Most of the members do not have proper knowledge of the SHG activities.

SHGs get loan from banks as well as BCT at 12 to 13%. The members are charged at

18% and non-members at 24%. Loans are taken mainly for household activities rather

than for the income generation activities. According to the Trust some of the justifiable

needs are marriage, purchase of animals and illness. The Trust believes that a group also

aims at improving health standards and developing educational activities for the

community.

3.2 THE COMMUNITY

Most of the villages are in remote area, but have electricity facility. The shortage of

drinking water is now met through Apni Yojna for the last 4 years and the project is in the

process of covering more villages. Most of the villagers have large un-irrigated land

holdings and have ‘Pucca’ houses. The ‘Purdah’ system is prevalent among women. The

women bear the double burden of household chores as well as the work in the fields. The

males who enjoy the decision making power in the family are mostly seen playing cards

and gossiping. The girl child is socially restrained as can be seen from restrain on joining

HIV-AIDS rallies. The rate of migration is high and so is the prevalence of HIV-AIDS.

People of this area have faith on the activities of the Trust and provide support it at the

community level. The Trust has helped to improve the economic as well as the social

status of the region and particularly the women through various interventions.

3.3 PRESENT STATUS OF SHGS (UP TO MAY 2005)

BCT got approval of NABARD for forming 250 groups in the year 2000. NABARD

assistance given in the project was Rs. 3.84 Lakhs. Another proposal of 250 groups is

now accepted, with a grant of Rs. 4.5 Lakhs.

[Figure 3: Here]

30 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

[TABLE 6: Here]

3.4 FUNDING AGENCIES

These agencies are evaluating and monitoring the progress of the projects and the

expenses made on the project at regular intervals. Different funding organizations have

different conditions for funding, which are as follows:

a. NABARD: It provides incentive to the NGO for successfully

implementing different stages of SHG. The incentive for formation of

SHG is Rs.460 per group, for bank linkage including loan Rs 616, for

recovery of loan per group Rs 39 approx. After successful implementation

of first project of 250 groups for Rs. 3.84 Lakhs, BCT has been awarded a

project to form another 250 groups for Rs. 4.5 Lakhs by NABARD.

b. RMK: It laid down conditions for loaning is that 2% of total amount can

be given for household activities and other 98% for income generation

activities. There is a cap of charging not more than 12% interest from the

SHGs. BCT has deposited a cash security of 5% of the amount sanctioned

to it.

c. SIDBI: Loan should be given for micro enterprises or for the development

of small-scale industries. The loans can be given to individuals also.

SIDBI has given a capacity building assistance of Rs. 9.74 Lakhs, to be

used for training, computers, and motorcycle purchase.

d. ICICI: 98% of the amount has to be given for productive purposes. A cash

deposit of 10% of disbursements by way of fixed deposit is made at

5.75%. The role of BCT is of intermediation with the loanee, and to

provide a counter guarantee to cover any default in repayment.

[TABLE 7:Here]

3.5 REPORTING SYSTEM OF SHGS

31 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

a. SHGs have their own reporting system, and normally the SHG members prepare their

own records with the help of field workers, especially for making entries of financial

transactions. The records include:

o Minutes Register for meeting,

o Cashbook,

o Individual Pass Book,

o Ledger Book,

o Bank's Pass Book

b. BCT has the separate reporting system. It has two parts, Field level File, and Project

File (all the correspondence with the Funding Organisations and as well as with the

Government).

c. In field level every supervisors have to submit their monthly reports to the APO or

PO (Project Officer). PO makes the compilation report of the whole project and

submits to the Project Coordinator (PC). PC discusses the whole reports to APO and

PO and also gives report to the higher authority and as well as Funding Organisation

as per their requirements.

d. Although this reporting system is same for all the projects in BCT, but it may vary for

different funding organizations. For example BCT submits monthly and quarterly

reports to RMK (Rashtriya Mahila Kosh). In NABARD project, apart from the

regular reports there is a Project Implementation and Monitoring Committee (PIMC)

meeting held every month. Here the chairman of various banks, representative from

NABARD, Lead bank officer and BCTs project Coordinator jointly make the project

evaluation and discuss the problems faced during the implementation. The Micro

finance activities of the Trust are also expanded with the NABARD assisted SHG

project.

[Table 8: Here]

[Table 9: Here]

3.6 MICRO FINANCE OUTREACH

32 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

BCT is carrying its MF operations with an aim to reach maximum number of

beneficiaries. BCT wants to increase member exposure to loans by way of savings

generation.

[Table 10: Here]

3.7 CASE STUDIES

3.7.1 Case Study of Laxmi Bai SHG at Village Radwa:

a. Started 06.01.2001 with 13 members, at present the number of members is 11.

Treasurer and key person of the group is Ms. Nirmala.

b. Loan given to 4 members of the group till now. One member availed loan of

Rs.5000/- for tailoring. She gets stitching for two dresses on an average, and is

now getting Rs. 60/- per day. Other members of the group also want to avail

loans. Angoori and Sunita want loan for house building.

c. Monthly meeting lasts for 2-3 hours but the proceedings is written down in 5-6

lines only. The women find no time for a weekly meeting owing to household

work like fetching water. Only 4 members are attending the group meetings

regularly. These are those members who have taken loans.

3.7.2 Case Study of Shyamji SHG at Village Achhapur:

a. There are 10 members in the group. The President of the group is Ms. Rajwanti

was delivered a cheque of Rs 25000/- by BCT staff in our presence for the loan

availed by her name from the SHG. Husband of Rajwanti is a ‘Jhola’ doctor

(Bare-foot doctor). The loan is availed in the name of medical store. She told that

Rs. 5000-7000/- would go towards purchase of medicines and the remaining Rs.

18000-20000/- would go into building the campus wall of the house. She is

already having a Pucca house, telephone, air coolers, and a fairly good standard of

living. All this indicates poor selection process. Earlier one member took a loan of

Rs.11000/- to repay her installment of loan on tractor.

b. From the joint family of Ms. Rajwanti, 4 are SHG members. Another one has

taken a loan of Rs. 35000/- to open a general store that actually cost them Rs. 1.5

33 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

Lakhs. At present these are the 2 live loans. Initially the group members were

reluctant to deposit Rs. 20/- per month. It was suggested to the group during the

interaction to increase the number of members in their group.

3.7.3 Case Study of Jai Shiv Shankar SHG at Village Kanjan:

Out of 11 members only one was present for interaction on July 06, 2005.She was

Ms. Reshma who is the key person and the treasurer of the group. The age of the

group is one year. Monthly contribution per member is Rs. 10 per month and

saving of the group is Rs. 900/-. Meeting is held on 6th of every month, but today

the group members were busy, probably in sowing operations. Motivation of

group formation is probable need of loan. The broader objective of group

formation and SHG movement are not clear to members.

3.7.4 Case Study of Srimati Santoshi Mata SHG at Village Ghanau:

a. The group has 15 members from Rajput and Swami Community. The meeting is

held at Carpet center of BCT as intermingling between the groups is low. The

Rajput members do not want to go to the houses of Swami Caste members. The

key person is the treasurer Ms. Pritam Kaur who is also the Aanganwadi worker.

She was not present not being in the village at that moment. 8 members of the

group were present for interaction. Pritam Kaur has taken a loan for Rs. 15000/-

for STD-PCO booth. 3 other members have taken loans of Rs.1000/- each, 1 for

household purpose and two for Goatary. There was no deposit of member

contribution amount in the bank. It was found that the amount has been utilized

for internal loaning in the group. The saving of the group is Rs. 4000/- and the

monthly contribution is Rs. 20/- per member per month. There are 2 internal loans

of Rs. 300/- each for which no repayment installment is received even after 4

months of loaning. This indicates absence of group norms.

b. The accounting system is not proper and the cashbook does not have matching

entries of interest amount received from members, while the same exists in the

individual loan account. The amount of on interest not entered in cashbook falls

under cash in hand and the members have no knowledge about its utilization. This

indicates low financial transparency in the group.

3.7.5 Case Study of Jai Bajrangbali SHG at Village Hansiawas:

34 OTS, Alok Modi 25002

Scope and Potential of setting up a MFI

a. Hansiawas village has 475 households and a population of 2700. There are 16

SHGs in the village including some male SHGs. There are 11 members in the ‘Jai

Bajrangbali’ group. 8 members of the group interacted with us. 3 members of

another group named ‘Santoshi Mata’ group were also present in the meeting. The

group is running from 2002 and the members have monthly savings of Rs. 20 per

member. The group got its first loan of Rs.6000 from the RRB (Marudhar

Regional Rural Bank). The group provides credit of maximum Rs.25, 000 to its

members for 1 year and at 18% p.a. The group has not taken up any income

generation activity. There are no influential members in the group and all of them

belong to the same socio-economic strata. During the interaction of the group

with the BCT personal from time to time the members have been informed about

the hygiene, Vaccination and the education of the girl child. One-month back a

fine of Rs. 20 was collected for the first time in the group. It was for delay in loan

repayment. There is a provision for imposing a fine of Rs.2 for non-attendance in

case of ordinary members and Rs. 5 for post holders.

b. The group members were aware about their surroundings and the day-to-day

happenings in the village. The group members told that there are 2 Aanganwadi’s

in the village for children of age more than 5 years. The children are given food

but no education is given there. The pregnant and lactating mothers are given

uncooked Wheat, Rice and Soya-Oil every 15 days. There are 2 Sewika’s and 2

Dai’s in the village and 80% of the children are born at home. The awareness

about immunization of the children of age group 0-6 years is low in the village,

except that of Polio vaccination.