New York State Consumer Real Estate Sentiment Scores: Siena Research Institute

Diunggah oleh

jspectorDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

New York State Consumer Real Estate Sentiment Scores: Siena Research Institute

Diunggah oleh

jspectorHak Cipta:

Format Tersedia

SIENA RESEARCH INSTITUTE

SIENA COLLEGE, LOUDONVILLE, NY

WWW.SIENA.EDU/SRI

Siena College Research Institute & New York State Association of REALTORS

New York State Consumer Real Estate Sentiment Scores

3rd Quarter 2011

For Immediate Release: Wednesday, October 19, 2011 For information/comment: Dr. Don Levy 518-783-2901 For data summary, or charts, visit www.nysar.com or www.siena.edu/sri

Consumer Appraisal of Real Estate Market Hits 2-Year Low

Most New Yorkers Now Anticipate Down Market to Persist through 2012 Albany, Rochester, Buffalo, NYC Expect Rebound; Hard-hit LI, Mid-Hudson See None

Albany, NY -- New Yorkers assessment of current real estate conditions hit a new low this quarter, registering the weakest number in the seven quarter history of this measure, according to Dr. Don Levy, SRIs Director. Only one in six residents think the market has improved at all in the last year and less than one in three believe we will see conditions improve in the year ahead. While it remains a great time to buy, New Yorkers say that it is an unfortunate time to put the for sale sign up in front of your home. Eighty-two percent say selling prospects have not improved and two-thirds expect no change to come soon.

3rd Quarter 2011 Real Estate Sentiment:

3rd Quarter 2011 -39.3 (-8.4) -1.1 (-10.9) -47.0 (-5.7) -0.3 (-9.4) 31.5 (0.8) 13.2 (-1.7)

NYC -32.6 (-7.7) 4.1 (-9.2) -40.1 (-1.8) 7.1 (-9.5) 26.1 (-2.6) 10.6 (-3.9)

Suburbs

-49.1 (-7.1) -4.6 (-9.4) -56.8 (-8.4) -6.7 (-9.2) 42.4 (0.6) 25.1 (2.4)

Upstate -40.5 (-9.0) -6.0 (-14.3) -49.2 (-8.7) -6.7 (-10.4) 31.0 (4.9) 9.4 (-0.7)

Overall Current Overall Future Sell Current Sell Future Buy Current Buy Future

( ) reflects change from previous quarter

The overall current Real Estate Sentiment score among New Yorkers in the third quarter of 2011 is -39.3 well below the point where equal percentages of citizens feel optimistic and pessimistic about the housing market and it is down 8.4 points from last quarter. Looking forward, the overall future Real Estate Sentiment score is -1.1 (down from 9.8 last quarter) indicating that New Yorkers expect the overall real estate market and the value of property to remain virtually unchanged over the next year. Consumers see now as a poor time to sell with a score significantly below breakeven at -47.0, but as a very good time to buy with a high positive score of 31.5.

Overall Current -39.3 -32.6 -49.1 -40.5 -40.3 -35.8 -31.2 -39.4 -39.2 -41.0 -34.0 Overall Future -1.1 4.1 -4.6 -6.0 -1.5 -2.2 3.7 -6.9 3.9 -3.1 2.9 Sell Current -47.0 -40.1 -56.8 -49.2 -47.0 -46.3 -42.3 -47.0 -47.0 -51.2 -36.2 Sell Future -0.3 7.1 -6.7 -6.7 -1.7 0.0 4.4 -1.2 0.5 -1.9 1.3 Buy Current 31.5 26.1 42.4 31.0 21.7 35.6 45.3 34.4 29.0 38.9 18.6 Buy Future 13.2 10.6 25.1 9.4 6.2 14.4 20.1 15.2 11.3 17.3 6.8

NEW YORK STATE NYC Suburbs Upstate Less than $50,000 $50,000-$100,000 $100,000 or more Male Female Homeowner Renter

It is not unexpected that confidence in housing would be low given that the current and projected economic outlooks are quite negative, said Duncan MacKenzie, NYSAR CEO. Media reports about a potentially looming double-dip recession and continued high unemployment numbers are certainly root causes of the gloomy consumer view of housing. Consumer response to the economy has resulted in a reduction of purchases across many sectors and housing is no exception. Despite these poll numbers, the reality is a down, but certainly not a devastated housing market. Owning a home remains a solid long-term financial investment and provides myriad quality of life benefits.

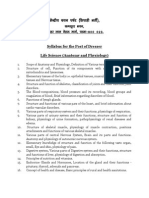

Current Sentiment Scores

2010 - 2011

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 1Q10 2Q10 3Q10 4Q10 1Q11 2Q11 3Q11 Buy Current Sell Current

35.3

32.5

35.1

33.1

31.4

30.7

31.5

Overall Current

-18.8 -28.3 -38.9 -30.0 -31.0 -40.1 -26.6 -32.0 -42.2 -30.9 -36.7 -41.3 -39.3 -47.0

Thriving

Similar to consumer confidence numbers that of late have declined, falling real estate collective sentiment, while a valid indicator of the overall mood, does not mean that some New Yorkers arent buying products or in this case, homes. They are. Still the deteriorating sentiment scores underline the need for good economic news including declining unemployment as well as productive political initiatives in order to turn around the battleship that is negative consumer sentiment, Dr. Levy said.

Each Real Estate Sentiment score is derived through statistical diffusion weighted to consider response intensity. A sentiment score of zero (0) in any category, reflects a breakeven point at which equal levels of optimism and pessimism among the population have been measured relative to the overall market, or buying or selling real estate. Scores can range from an absolute low of -100 to a high of 100 but scores below -50 or above +50 are both rare and extreme. If 100 percent of people describe the overall market or either buying or selling as greatly improved the sentiment score would equal 100. Conversely, universal extreme pessimism would score -100. Scores measure and reflect the collective sentiment of residents of New York State. Current scores report recent change in consumer sentiment while future scores measure consumers projected change in sentiment as they approach the coming year. In reviewing the Sentiment Scores look first at the relationship within each category Overall, Sell, and Buy between current and future. Current scores measures sentiment towards the present relative to the recent past while future projects change in sentiment from the current to one year from now. An increase from a current score to a future score denotes a positive change in sentiment relative to the present. In every case when considering any of the six sentiment scores, a net positive number indicates that the collective sentiment is such that people sense improvement while a negative net score predicts or measures a collective recognition of worsening. Todays six scores including both negative current sentiment in two cases and positive future scores is indicative of a changing market.

Although every area of the state receives floundering grades, residents of Albany, Rochester, Buffalo, New York City and to some degree Syracuse do expect the market to uptick over the next twelve months. Other areas, most notably Long Island, Mid-Hudson, Binghamton and Utica unfortunately not only cite recent declining conditions but as a whole, do not expect any rally in the coming year, notes Dr. Levy.

The SRI survey of Consumer Real Estate Sentiment was conducted throughout July, August and September 2011 by random telephone calls to 2,407 New York State residents over the age of 18. A minimum of 400 additional respondents were surveyed in each MSA except NYC and Long Island. The NYC sample was obtained as part of the statewide survey and the Long Island sample was primarily obtained through the statewide survey and augmented so as to guarantee a minimum of 400 respondents. As the sentiment scores are developed through a series of calculations, margin of error does not apply. For more information or comments, please call Dr. Don Levy at 518.783.2901. Data and charts can be found at www.siena.edu/sri/ . SRI is an independent, non-partisan research institute. SRI subscribes to the American Association of Public Opinion Research (AAPOR) Code of Professional Ethics and Practices.

Region Charts & Graphs

Overall Current -36.7 (-9.4) -44.1 (-3.6) -25.8 (-5.6) -46.9 (-8.5) -55.9 (-16.8) -27.5 (-14.1) -27.8 (-6.6) -37.5 (-16.5) Overall Future 15.1 (-0.3) -3.4 (-6.6) 10.2 (-4.3) 0.6 (-6.1) -1.6 (-12.7) 11.5 (-1.4) 4.6 (-12.6) -4.0 (-18.2) Sell Current -44.2 (-6.3) -54.4 (-5.1) -35.3 (-3.2) -54.8 (-9.2) -61.9 (-12.1) -39.9 (-14.7) -43.8 (-4.6) -52.7 (-13.1) Sell Future 12.7 (-5.1) -2.4 (-4.0) 8.5 (-0.2) -5.6 (-10.3) -10.2 (-25.9) 6.5 (-4.3) 3.0 (-10.5) -7.0 (-15.9) Buy Current 42.3 (9.6) 26.7 (-3.5) 28.4 (-7.3) 46.0 (-0.9) 45.5 (-1.5) 36.8 (8.0) 38.8 (7.1) 34.1 (7.5) Buy Future 29.1 (14.0) 9.5 (3.9) 19.1 (-4.5) 24.6 (-1.3) 30.9 (5.2) 19.1 (3.6) 13.8 (-7.8) 16.7 (-2.3)

Albany MSA Binghamton MSA Buffalo MSA Long Island MSA Mid-Hudson MSA Rochester MSA Syracuse MSA Utica MSA

( ) reflects change from previous quarter

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 New York City 3rd Quarter 2011

26.1 4.1

Overall Current Overall Future

7.1

10.6

Current Sell Future Sell Current Buy Future Buy

-32.6 -40.1

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 Albany 3rd Quarter 2011

42.3 29.1 15.1

12.7

Overall Current

Overall Future

Current Sell Future Sell Current Buy Future Buy

-36.7

-44.2

Consumer Real Estate Sentiment

Binghamton 3rd Quarter 2011 55.0 45.0 35.0 25.0 15.0 5.0 -5.0 -15.0 -25.0 -35.0 -45.0 -55.0

26.7 9.5

Overall Current

Overall Future

Current Sell Future Sell Current Buy Future Buy

-2.4

-3.4

-44.1

-54.4

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 Buffalo 3rd Quarter 2011

28.4

19.1

10.2 8.5

Overall Current

Overall Future

Current Sell Future Sell Current Buy Future Buy

-25.8 -35.3

Consumer Real Estate Sentiment

55.0 45.0 35.0 25.0 15.0 5.0 -5.0 -15.0 -25.0 -35.0 -45.0 -55.0 Long Island 3rd Quarter 2011

46.0 24.6

0.6

Overall Current Overall Future Current Sell Future Sell Current Buy Future Buy

-5.6

-46.9

-54.8

Consumer Real Estate Sentiment

55.0 45.0 35.0 25.0 15.0 5.0 -5.0 -15.0 -25.0 -35.0 -45.0 -55.0 -65.0 Mid-Hudson 3rd Quarter 2011

45.5 30.9

Overall Current

Overall Future

Current Sell Future Sell Current Buy Future Buy

-10.2

-1.6

-55.9

-61.9

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 Rochester 3rd Quarter 2011

36.8

19.1 11.5 6.5

Current Sell Future Sell Current Buy Future Buy

Overall Current

Overall Future

-27.5 -39.9

Consumer Real Estate Sentiment

50.0 40.0 30.0 20.0 10.0 0.0 -10.0 -20.0 -30.0 -40.0 -50.0 Syracuse 3rd Quarter 2011

38.8

13.8 4.6

Overall Current Overall Future

3.0

Current Sell Future Sell Current Buy Future Buy

-27.8 -43.8

Consumer Real Estate Sentiment

55.0 45.0 35.0 25.0 15.0 5.0 -5.0 -15.0 -25.0 -35.0 -45.0 -55.0 Utica 3rd Quarter 2011

34.1 16.7

Overall Current

Overall Future

Current Sell Future Sell Current Buy Future Buy

-7.0

-4.0 -37.5 -52.7

Anda mungkin juga menyukai

- New York State Consumer Real Estate Sentiment Scores: Siena Research InstituteDokumen7 halamanNew York State Consumer Real Estate Sentiment Scores: Siena Research InstitutejspectorBelum ada peringkat

- 1Q12RealEstateRelease FinalDokumen2 halaman1Q12RealEstateRelease FinalLeigh Hornbeck TrombleyBelum ada peringkat

- 3Q13RealEstateRelease FinalDokumen2 halaman3Q13RealEstateRelease FinalJon CampbellBelum ada peringkat

- Siena Research Institute: Stock Market Roller Coaster Leaves Consumer Confidence Low and FlatDokumen4 halamanSiena Research Institute: Stock Market Roller Coaster Leaves Consumer Confidence Low and FlatNick ReismanBelum ada peringkat

- Siena Research Institute: National Confidence Frighteningly Low NY S Better But Lowest Since Feb 09Dokumen4 halamanSiena Research Institute: National Confidence Frighteningly Low NY S Better But Lowest Since Feb 09Robert TranBelum ada peringkat

- 2016 NAR Research Resource GuideDokumen9 halaman2016 NAR Research Resource GuideNational Association of REALTORS®50% (2)

- May 2012 RCI ReportDokumen24 halamanMay 2012 RCI ReportNational Association of REALTORS®Belum ada peringkat

- MSARelease 4Q12 FinalDokumen2 halamanMSARelease 4Q12 Finalcara12345Belum ada peringkat

- 1Q12 MSARelease FinalDokumen2 halaman1Q12 MSARelease FinaljspectorBelum ada peringkat

- Big Sur Coast Homes Market Action Report Real Estate Sales For June 2011Dokumen3 halamanBig Sur Coast Homes Market Action Report Real Estate Sales For June 2011Nicole TruszkowskiBelum ada peringkat

- Carmel Highlands Homes Market Action Report For Real Estate Sales June 2011Dokumen3 halamanCarmel Highlands Homes Market Action Report For Real Estate Sales June 2011Nicole TruszkowskiBelum ada peringkat

- Realtors Confidence IndexDokumen25 halamanRealtors Confidence IndexNational Association of REALTORS®Belum ada peringkat

- Siena Research Institute: NY Consumer Sentiment Flat, Trails Nation, Down 5% From A Year AgoDokumen4 halamanSiena Research Institute: NY Consumer Sentiment Flat, Trails Nation, Down 5% From A Year AgojspectorBelum ada peringkat

- Are Indias Cities in A Housing BubbleDokumen9 halamanAre Indias Cities in A Housing BubbleAshwinBhandurgeBelum ada peringkat

- Carmel Highlands Homes Market Action Report For Real Estate Sales July 2011Dokumen3 halamanCarmel Highlands Homes Market Action Report For Real Estate Sales July 2011Nicole TruszkowskiBelum ada peringkat

- Zillow Q3 Real Estate ReportDokumen4 halamanZillow Q3 Real Estate ReportLani RosalesBelum ada peringkat

- Union City Full Market Report (Week of February 10, 2014)Dokumen6 halamanUnion City Full Market Report (Week of February 10, 2014)Harry KharaBelum ada peringkat

- Beverly-Hanks & Associates: Second Quarter Market Report 2011Dokumen20 halamanBeverly-Hanks & Associates: Second Quarter Market Report 2011ashevillerealestateBelum ada peringkat

- Carmel Highlands Homes Market Action Report Real Estate Sales For May 2011Dokumen3 halamanCarmel Highlands Homes Market Action Report Real Estate Sales For May 2011Nicole TruszkowskiBelum ada peringkat

- Pacific Grove Homes Market Action Report Real Estate Sales For June 2011Dokumen3 halamanPacific Grove Homes Market Action Report Real Estate Sales For June 2011Nicole TruszkowskiBelum ada peringkat

- Pebble Beach Homes Market Action Report Real Estate Sales For June 2011Dokumen3 halamanPebble Beach Homes Market Action Report Real Estate Sales For June 2011Nicole TruszkowskiBelum ada peringkat

- Nest Report Charlottesville: Q4 2011Dokumen9 halamanNest Report Charlottesville: Q4 2011Jonathan KauffmannBelum ada peringkat

- Siena Research Institute: Consumer Sentiment in NY Reaches Five Year HighDokumen4 halamanSiena Research Institute: Consumer Sentiment in NY Reaches Five Year Highcara12345Belum ada peringkat

- Deloitte Corporate Finance Retail and Consumer Update q4 2011Dokumen8 halamanDeloitte Corporate Finance Retail and Consumer Update q4 2011KofikoduahBelum ada peringkat

- Week of Oct 31 - Market Update For Single Family Homes - North Miami Beach, FLDokumen6 halamanWeek of Oct 31 - Market Update For Single Family Homes - North Miami Beach, FLSoraya E. CaciciBelum ada peringkat

- The Pensford Letter - 12.12.11Dokumen3 halamanThe Pensford Letter - 12.12.11Pensford FinancialBelum ada peringkat

- Monterey Homes Market Action Report Real Estate Sales For July 2011Dokumen3 halamanMonterey Homes Market Action Report Real Estate Sales For July 2011Nicole TruszkowskiBelum ada peringkat

- Consumer Confidence Poll 06-12Dokumen4 halamanConsumer Confidence Poll 06-12cara12345Belum ada peringkat

- Residential Economic Issues & Trends ForumDokumen56 halamanResidential Economic Issues & Trends ForumNational Association of REALTORS®Belum ada peringkat

- Siena Research Institute: NY Consumer Sentiment Slips Falls To 20 Month LowDokumen4 halamanSiena Research Institute: NY Consumer Sentiment Slips Falls To 20 Month LowjspectorBelum ada peringkat

- Case-Shiller August 2011Dokumen5 halamanCase-Shiller August 2011Nathan MartinBelum ada peringkat

- Oct 2014 RCI ReportDokumen27 halamanOct 2014 RCI ReportNational Association of REALTORS®Belum ada peringkat

- CBRE Los Angeles Retail Marketview Q1 2014Dokumen5 halamanCBRE Los Angeles Retail Marketview Q1 2014Robert AbelsonBelum ada peringkat

- Siena Research Institute: Consumer Sentiment Strengthens Current Confidence Hits 8-Year HighDokumen3 halamanSiena Research Institute: Consumer Sentiment Strengthens Current Confidence Hits 8-Year HighjspectorBelum ada peringkat

- REMAX National Housing Report - July 2012 FinalDokumen2 halamanREMAX National Housing Report - July 2012 FinalSheila Newton TeamBelum ada peringkat

- Pacific Grove Homes Market Action Report Real Estate Sales For May 2011Dokumen3 halamanPacific Grove Homes Market Action Report Real Estate Sales For May 2011Nicole TruszkowskiBelum ada peringkat

- Nest Report: Charlottesville Area Real Estate Market Report Q3 2012Dokumen9 halamanNest Report: Charlottesville Area Real Estate Market Report Q3 2012Jonathan KauffmannBelum ada peringkat

- Carmel Ca Homes Market Action Report For Real Estate Sales June 2011Dokumen3 halamanCarmel Ca Homes Market Action Report For Real Estate Sales June 2011Nicole TruszkowskiBelum ada peringkat

- Creating An Index To Measure Perceived Economic OpportunityDokumen5 halamanCreating An Index To Measure Perceived Economic OpportunityDhananjaya HathurusingheBelum ada peringkat

- The Reader: Furman Center Releases 2008 "State of New York City's Housing and Neighborhoods" ReportDokumen12 halamanThe Reader: Furman Center Releases 2008 "State of New York City's Housing and Neighborhoods" ReportanhdincBelum ada peringkat

- Case-Shiller October 2011Dokumen5 halamanCase-Shiller October 2011Nathan MartinBelum ada peringkat

- Carmel Highlands Homes Market Action Report For Real Estate Sales November 2011Dokumen3 halamanCarmel Highlands Homes Market Action Report For Real Estate Sales November 2011Nicole TruszkowskiBelum ada peringkat

- Monterey Homes Market Action Report Real Estate Sales For November 2014Dokumen4 halamanMonterey Homes Market Action Report Real Estate Sales For November 2014Nicole TruszkowskiBelum ada peringkat

- Coldwell Banker Luxury Market ReportDokumen18 halamanColdwell Banker Luxury Market ReportFrank VyralBelum ada peringkat

- 2015 04 Realtors Confidence Index 2015-05-21Dokumen31 halaman2015 04 Realtors Confidence Index 2015-05-21National Association of REALTORS®Belum ada peringkat

- Union City-Full ReportDokumen6 halamanUnion City-Full ReportHarry KharaBelum ada peringkat

- Monterey Homes Market Action Report Real Estate Sales For October 2014Dokumen4 halamanMonterey Homes Market Action Report Real Estate Sales For October 2014Nicole TruszkowskiBelum ada peringkat

- MassINC Trend Monitor Q2-2013Dokumen5 halamanMassINC Trend Monitor Q2-2013The Republican/MassLive.comBelum ada peringkat

- Weekly Economic Commentary 3-26-12Dokumen6 halamanWeekly Economic Commentary 3-26-12monarchadvisorygroupBelum ada peringkat

- Weekly Economic Commentary 3-26-12Dokumen11 halamanWeekly Economic Commentary 3-26-12monarchadvisorygroupBelum ada peringkat

- 2014 11 Realtors Confidence Index 2014-12-22Dokumen26 halaman2014 11 Realtors Confidence Index 2014-12-22National Association of REALTORS®Belum ada peringkat

- Salinas Monterey Highway Homes Market Action Report For Real Estate Sales For June 2011Dokumen3 halamanSalinas Monterey Highway Homes Market Action Report For Real Estate Sales For June 2011Nicole TruszkowskiBelum ada peringkat

- Union City Market ReportDokumen6 halamanUnion City Market ReportHarry KharaBelum ada peringkat

- REALTORS® Confidence Index: August 2014Dokumen26 halamanREALTORS® Confidence Index: August 2014National Association of REALTORS®Belum ada peringkat

- ColumbiaDokumen2 halamanColumbiaEllie McIntireBelum ada peringkat

- Carmel Highlands Homes Market Action Report For Real Estate Sales September 2011Dokumen3 halamanCarmel Highlands Homes Market Action Report For Real Estate Sales September 2011Rebekah SchroederBelum ada peringkat

- Carmel Highlands Homes Market Action Report For Real Estate Sales August 2011Dokumen3 halamanCarmel Highlands Homes Market Action Report For Real Estate Sales August 2011Rebekah SchroederBelum ada peringkat

- Pacific Grove Homes Market Action Report Real Estate Sales For July 2011Dokumen3 halamanPacific Grove Homes Market Action Report Real Estate Sales For July 2011Nicole TruszkowskiBelum ada peringkat

- Summary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterDari EverandSummary of Simon Constable & Robert E. Wright's The WSJ Guide to the 50 Economic Indicators That Really MatterBelum ada peringkat

- Joseph Ruggiero Employment AgreementDokumen6 halamanJoseph Ruggiero Employment AgreementjspectorBelum ada peringkat

- Cornell ComplaintDokumen41 halamanCornell Complaintjspector100% (1)

- IG LetterDokumen3 halamanIG Letterjspector100% (1)

- NYSCrimeReport2016 PrelimDokumen14 halamanNYSCrimeReport2016 PrelimjspectorBelum ada peringkat

- State Health CoverageDokumen26 halamanState Health CoveragejspectorBelum ada peringkat

- Pennies For Charity 2018Dokumen12 halamanPennies For Charity 2018ZacharyEJWilliamsBelum ada peringkat

- Inflation AllowablegrowthfactorsDokumen1 halamanInflation AllowablegrowthfactorsjspectorBelum ada peringkat

- Hiffa Settlement Agreement ExecutedDokumen5 halamanHiffa Settlement Agreement ExecutedNick Reisman0% (1)

- Abo 2017 Annual ReportDokumen65 halamanAbo 2017 Annual ReportrkarlinBelum ada peringkat

- Opiods 2017-04-20-By Numbers Brief No8Dokumen17 halamanOpiods 2017-04-20-By Numbers Brief No8rkarlinBelum ada peringkat

- 2017 School Bfast Report Online Version 3-7-17 0Dokumen29 halaman2017 School Bfast Report Online Version 3-7-17 0jspectorBelum ada peringkat

- SNY0517 Crosstabs 052417Dokumen4 halamanSNY0517 Crosstabs 052417Nick ReismanBelum ada peringkat

- Activity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017Dokumen4 halamanActivity Overview: Key Metrics Historical Sparkbars 1-2016 1-2017 YTD 2016 YTD 2017jspectorBelum ada peringkat

- p12 Budget Testimony 2-14-17Dokumen31 halamanp12 Budget Testimony 2-14-17jspectorBelum ada peringkat

- 2016 Statewide Elections ReportDokumen32 halaman2016 Statewide Elections ReportWNYT NewsChannel 13Belum ada peringkat

- 2016 Local Sales Tax CollectionsDokumen4 halaman2016 Local Sales Tax CollectionsjspectorBelum ada peringkat

- The Results of This Question Are Based Only On Those That Answered With An Amount (N 745) - Margin of Error For This Question: +/-7.4%Dokumen3 halamanThe Results of This Question Are Based Only On Those That Answered With An Amount (N 745) - Margin of Error For This Question: +/-7.4%jspectorBelum ada peringkat

- Essay Rough Draft 19Dokumen9 halamanEssay Rough Draft 19api-549246767Belum ada peringkat

- Chronic Kidney DiseaseDokumen15 halamanChronic Kidney Diseaseapi-270623039Belum ada peringkat

- Lesson 6 ComprogDokumen25 halamanLesson 6 ComprogmarkvillaplazaBelum ada peringkat

- Career Essay 1Dokumen2 halamanCareer Essay 1api-572592063Belum ada peringkat

- Chemistry Form 4 Daily Lesson Plan - CompressDokumen3 halamanChemistry Form 4 Daily Lesson Plan - Compressadila ramlonBelum ada peringkat

- Decision Making and The Role of Manageme PDFDokumen20 halamanDecision Making and The Role of Manageme PDFRaadmaan RadBelum ada peringkat

- PM CH 14Dokumen24 halamanPM CH 14phani chowdaryBelum ada peringkat

- Ob NotesDokumen8 halamanOb NotesRahul RajputBelum ada peringkat

- LEIA Home Lifts Guide FNLDokumen5 halamanLEIA Home Lifts Guide FNLTejinder SinghBelum ada peringkat

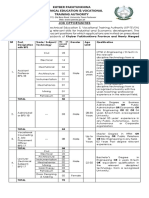

- KP Tevta Advertisement 16-09-2019Dokumen4 halamanKP Tevta Advertisement 16-09-2019Ishaq AminBelum ada peringkat

- LTE Networks Engineering Track Syllabus Overview - 23 - 24Dokumen4 halamanLTE Networks Engineering Track Syllabus Overview - 23 - 24Mohamed SamiBelum ada peringkat

- Tribal Banditry in Ottoman Ayntab (1690-1730)Dokumen191 halamanTribal Banditry in Ottoman Ayntab (1690-1730)Mahir DemirBelum ada peringkat

- Dokumen - Pub - Bobs Refunding Ebook v3 PDFDokumen65 halamanDokumen - Pub - Bobs Refunding Ebook v3 PDFJohn the First100% (3)

- Business Plan 3.3Dokumen2 halamanBusiness Plan 3.3Rojin TingabngabBelum ada peringkat

- German Atv-Dvwk Rules and StandardsDokumen25 halamanGerman Atv-Dvwk Rules and StandardsMehmet Emre Bastopcu100% (1)

- Space Hulk - WDDokumen262 halamanSpace Hulk - WDIgor Baranenko100% (1)

- 1.technical Specifications (Piling)Dokumen15 halaman1.technical Specifications (Piling)Kunal Panchal100% (2)

- 3 ALCE Insulators 12R03.1Dokumen12 halaman3 ALCE Insulators 12R03.1Amílcar Duarte100% (1)

- Syllabus DresserDokumen2 halamanSyllabus DresserVikash Aggarwal50% (2)

- Richardson Heidegger PDFDokumen18 halamanRichardson Heidegger PDFweltfremdheitBelum ada peringkat

- Famous Russian PianoDokumen10 halamanFamous Russian PianoClara-Schumann-198550% (2)

- Grade 7 ExamDokumen3 halamanGrade 7 ExamMikko GomezBelum ada peringkat

- Evaluation TemplateDokumen3 halamanEvaluation Templateapi-308795752Belum ada peringkat

- Presentation 11Dokumen14 halamanPresentation 11stellabrown535Belum ada peringkat

- Shostack ModSec08 Experiences Threat Modeling at MicrosoftDokumen11 halamanShostack ModSec08 Experiences Threat Modeling at MicrosoftwolfenicBelum ada peringkat

- Hdfs Default XML ParametersDokumen14 halamanHdfs Default XML ParametersVinod BihalBelum ada peringkat

- Anatomy Anal CanalDokumen14 halamanAnatomy Anal CanalBela Ronaldoe100% (1)

- Career Level Diagram - V5Dokumen1 halamanCareer Level Diagram - V5Shivani RaikwarBelum ada peringkat

- Gemini Dollar WhitepaperDokumen7 halamanGemini Dollar WhitepaperdazeeeBelum ada peringkat

- UTP Student Industrial ReportDokumen50 halamanUTP Student Industrial ReportAnwar HalimBelum ada peringkat