Exemption From Customs Duty

Diunggah oleh

Ravikumar PaDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Exemption From Customs Duty

Diunggah oleh

Ravikumar PaHak Cipta:

Format Tersedia

Presented By: Saniel D Almeida 0916067 EXEMPTION FROM CUSTOMS DUTY Some exemptions from duties are provided

in Customs Act, while some are provided in Customs Tariff Act. Besides, Central Government can grant partial or full exemption from duty under section 25 of Customs Act. Exemptions by Notification - Section 25(1) of Customs Act 1962 authorize Central Government to issue notifications granting exemptions from duty. Such exemption may be unconditional or subject to conditions. Such conditions may be required to be fulfilled before or after clearance. Government can also grant exemption by a special order in exceptional circumstances. The exemption notification should be published in gazette. The notification can be issued only in 'public interest'. Some provisions are similar to Central Excise provisions - Following provisions discussed under Central Excise are applicable under Customs Act too (a) Method of granting exemption is similar (b) Different Form and method is permitted under section 25(3) of Customs Act. (c) Notification should be in 'public interest' (d) Different exemptions to different categories or classes permissible (e) No exemption with retrospective effect (f) Notification to be placed before Parliament (g) Interpretation of notification (h) Effective date of exemption (i) Exemptions have full statutory force (j) Estoppel in exemption notification, (k) Exemption by special order can be under section 25(2) of Customs Act - similar to section 5 A(2) of Excise Act. All these are discussed in detail under Central Excise and hence are not reproduced here for sake of brevity. Exemption to minor amounts of customs duty - Customs duty is not payable if amount of duty is Equal to or less than Rs 100. [Section 25(6)]. Ad hoc exemptions Section 25(2) of Customs Act permits Government to issue ad hoc exemption from customs duty by issue of a special order in exceptional circumstances. The order should specify the exceptional circumstances for granting ad hoc exemption. [Similar provision in section 5A(2) of Central Excise Act]. - - It has been clarified that such exemption can be granted even after duty is paid. In such case, duty has to be refunded - MF(DR) circular No 12/97-Cus dated 12.5.1997. Exemption for past general practice If there was past general practice of exempting certain goods from customs duty, but later it is discovered that, in fact, customs duty was payable, Government can grant exemption with retrospective effect. - Section 28A of Customs Act.

Project Imports Heavy Customs duty on imported machinery for projects make the initial project cost very high and project may become unviable. Hence, concept of 'project Import' has been introduced to bring machinery etc. required for initial setup or substantial exemption at concessional customs duty. The goods are classified under heading 9801, though the machinery and its parts may actually fall under different tariff heading. This simple method is adopted, as otherwise, classifying each machinery and its parts in different heads and valuing them would have been cumbersome and would have delayed clearances, which would cause demurrages. - Chapter 5 Para 1 of CBE&C's Customs Manual, 2001. Duty payable on project Imports - Duty on project imports is basic 5% plus CVD plus education cess of customs and excise. Duty for mega power projects, nuclear power projects and water supply projects for agricultural & industrial use is Nil. General customs duty rate is 10%. Hence, project imports are attractive for large projects. Items eligible for Project Imports - The items eligible are specified in heading 9801 of Customs Tariff Act The projects eligible are: (1) Industrial Plant (2) Irrigation Project (3) Power Project (4) Mining Project (5) Project for oil or mineral exploration (6) Other projects as may be specified by Central Government. Registration of Contract - Contract for import has to be registered with Customs. Application for registration of Contract must be made before importation and contract must be registered before order for clearance of goods is made from Customs. The contract can be amended if required. Free Trade Agreements (FTA) India has free trade agreements (FTA) with various countries. FTA is an arrangement between two or more countries to reduce tariffs and non-tariff barriers on mutual agreement basis. Biggest FTA is EU (European Union) which consists of 27 European countries. Others are (a) Gulf Cooperation Council (GCC) of seven Gulf nations (b) Association of South-east Asian Countries (ASEAS) (c) MERCOSUR - Southern Common Market (Argentina, Brazil, Paraguay and Uruguay). Important regional groupings as far as India is concerned are as follows APTA - Asia Pacific Trade Agreement (APTA) consisting of Bangladesh, China, India, Republic of Korea and Sri Lanka

BIMSTEC - Bangladesh, India, Myanmar, Sri Lanka, Thailand Economic Cooptation (also includes Bhutan and Nepal) IBSA - India, Brazil and South Africa SAFTA - South Asia Free Trade Agreement (India, Pakistan, Nepal, Sri Lanka, Bangladesh, Bhutan and Maldives). Such FTAs are actually against basic principle of WTO but are being allowed under WTO Article XXIV with some conditions. In addition, India has FTA with Singapore, Sri Lanka, MERCOSUR, Afghanistan, Chile and South Korea. India has Treaty of Trade with Nepal and Bhutan. Preferential Rates of Customs Duty Some countries have been declared as 'preferential areas'. These are - Mauritius Seychelles and Tonga. Goods manufactured and produced in these countries are eligible for preferential rate of duty under section 4 of Customs Tariff Act. Customs Tariff Act provides two columns - one for 'Standard rate' and other for 'Preferential Area'. Control over end use exemptions Sometimes, concession or exemption from customs duty is subject to condition in respect of end use. Sometimes, the exemption or concession is subject to condition that the imported goods should be used for manufacture in India of an excisable commodity. In such cases, the control over the end use will be exercised by Assistant Commissioner of Cent Excise having jurisdiction over the factory of manufacturer. [These provisions are applicable only in respect of certain specified exemption notifications]. The manufacturer intending to avail the benefit has to register with jurisdictional Assistant Commissioner of Central Excise, by applying in prescribed form. He has to execute a bond a give an undertaking that the imported goods shall be used for the intended purpose. He has to submit a monthly return in prescribed form within 10 days of the following month to AC/DC. The manufacturer-importer has to maintain accounts of the imported goods received. If the goods are not used for intended purposes, he will take steps for recovery of the differential duty leviable. The differential duty is required to be paid along with interest at the rate fixed u/s 28AB of Customs Act. [Customs (Import of Goods at Concessional Rate of Duty for Manufacture of Excisable Goods) Rules, 1996]. References: Datey V.S (2010) Indirect Taxes, Taxman Publications, New Delhi.

Anda mungkin juga menyukai

- Objective and Scope of Industrial EmployDokumen9 halamanObjective and Scope of Industrial EmployLakshmi Narayan RBelum ada peringkat

- EPF & Miscellaneous Provisions Act 1952 SummaryDokumen7 halamanEPF & Miscellaneous Provisions Act 1952 SummaryMehak KaushikkBelum ada peringkat

- Labour Law-Ii Study MaterialDokumen29 halamanLabour Law-Ii Study MaterialAbdul MubeenBelum ada peringkat

- Maternity Benefit Act 1961Dokumen12 halamanMaternity Benefit Act 1961sachin100% (1)

- Santhanam CommitteeDokumen11 halamanSanthanam CommitteeRahul Vikram PathyBelum ada peringkat

- Project On Transfer and Transmission of SharesDokumen45 halamanProject On Transfer and Transmission of SharesRajviPatel50% (4)

- Classification of Public CorporationsDokumen3 halamanClassification of Public Corporationsgaming zone100% (1)

- Law of Taxation - Important QuestionsDokumen5 halamanLaw of Taxation - Important QuestionsMaybe 007Belum ada peringkat

- Meaning and Scope of Supply Under GSTDokumen5 halamanMeaning and Scope of Supply Under GSTGirish kBelum ada peringkat

- Standing Orders Labour Law ProjectDokumen12 halamanStanding Orders Labour Law ProjectanjumanBelum ada peringkat

- Equal Remuneration Act 1976 key provisionsDokumen11 halamanEqual Remuneration Act 1976 key provisionsHumanyu KabeerBelum ada peringkat

- Principles of Seniority Preference in Position of An Employee 3Dokumen10 halamanPrinciples of Seniority Preference in Position of An Employee 3kartikBelum ada peringkat

- Powers AND Duties OF Controller OF Design: Chanakya National LAW University, PatnaDokumen26 halamanPowers AND Duties OF Controller OF Design: Chanakya National LAW University, Patnaanon_455458658Belum ada peringkat

- Chapter10. (Self - Study) Sailent Features of WCA 1923 Minimum Wages Act, EPF Act Etc.Dokumen13 halamanChapter10. (Self - Study) Sailent Features of WCA 1923 Minimum Wages Act, EPF Act Etc.Adan HoodaBelum ada peringkat

- GrtituttyDokumen2 halamanGrtituttyNiranjani Duvva Jakkula100% (2)

- MRTP ACT - Monopolies and Restrictive Trade Practices ACT-1969Dokumen9 halamanMRTP ACT - Monopolies and Restrictive Trade Practices ACT-1969Gopalakrishnan SivaramBelum ada peringkat

- Labour Laws GuideDokumen14 halamanLabour Laws Guidesohel alamBelum ada peringkat

- Article 16 of Constitution of IndiaDokumen36 halamanArticle 16 of Constitution of IndiaRvi MahayBelum ada peringkat

- Manager, ICICI Bank V Prakash Kaur and OrsDokumen10 halamanManager, ICICI Bank V Prakash Kaur and Orsarunav_guha_royroyBelum ada peringkat

- Income Tax AuthoritiesDokumen3 halamanIncome Tax AuthoritiesANUP KUMAR100% (1)

- Agricultural Income DefinitionDokumen16 halamanAgricultural Income DefinitionVikram VermaBelum ada peringkat

- Fema (Foreign Exchange Management ActDokumen25 halamanFema (Foreign Exchange Management ActMayank GargBelum ada peringkat

- DEEPIKA SINGH Vs CATDokumen6 halamanDEEPIKA SINGH Vs CATtanyagupta09876543Belum ada peringkat

- Salient features of Bonus Payment Act 1965Dokumen3 halamanSalient features of Bonus Payment Act 1965Mab Mughal0% (1)

- Return of Income Section 139 Constitutional ValidityDokumen53 halamanReturn of Income Section 139 Constitutional ValidityTuneer Vijay100% (2)

- Income Tax Authorities Powers and DutiesDokumen16 halamanIncome Tax Authorities Powers and Dutiesnandan velankarBelum ada peringkat

- Delegated LegislationDokumen25 halamanDelegated LegislationNikhil BasantaniBelum ada peringkat

- Inter Corporate Loans, Investments, Gaurantees and SecuritiesDokumen29 halamanInter Corporate Loans, Investments, Gaurantees and SecuritiesManik Singh KapoorBelum ada peringkat

- The Case Analysis of Hydro (Engineers) (P) Ltd. V. WorkmenDokumen1 halamanThe Case Analysis of Hydro (Engineers) (P) Ltd. V. Workmenvijay0% (1)

- CRPC AssignmentDokumen16 halamanCRPC AssignmentOsho Moksha100% (1)

- Esi Act - Theory of Notional Extension IncludedDokumen15 halamanEsi Act - Theory of Notional Extension Includedrashmi_shantikumarBelum ada peringkat

- Chapter 05 - Industrial Disputes ActDokumen12 halamanChapter 05 - Industrial Disputes Actcharu2802Belum ada peringkat

- Recovery of Debts Act: Key Provisions and ProceduresDokumen42 halamanRecovery of Debts Act: Key Provisions and ProceduresAdhi ChakravarthyBelum ada peringkat

- Lay OffDokumen11 halamanLay Offnitin0010Belum ada peringkat

- Payment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalDokumen23 halamanPayment of Gratuity Act, 1972: Nishtha Sharma Puja Mittal Ritika Khanna Shivangi Verma Sonal AgarwalAdityaBelum ada peringkat

- Bannari Amman Sugars LTD Vs Commercial Tax Officer and OthersDokumen15 halamanBannari Amman Sugars LTD Vs Commercial Tax Officer and Othersvrajamabl100% (2)

- Industrial Employment (Standing Orders) Act 1946Dokumen17 halamanIndustrial Employment (Standing Orders) Act 1946supriyanairBelum ada peringkat

- Rights and PrivilegesDokumen2 halamanRights and PrivilegesKeerthi Shetty100% (1)

- Guide to India's Equal Remuneration Act of 1976Dokumen9 halamanGuide to India's Equal Remuneration Act of 1976Ayisha PatnaikBelum ada peringkat

- Babubhai Bhimabhai Bokhiria & Anr Vs State of Gujarat & Ors (2013) 9 SCC 500Dokumen17 halamanBabubhai Bhimabhai Bokhiria & Anr Vs State of Gujarat & Ors (2013) 9 SCC 500varun v s0% (1)

- Basis of Charge and Scope of TotalDokumen24 halamanBasis of Charge and Scope of TotalSujithBelum ada peringkat

- Employees' Provident Fund and Miscellaneous ActDokumen20 halamanEmployees' Provident Fund and Miscellaneous ActAnchal PundirBelum ada peringkat

- Amity University Rajasthan: Lock-Out Under Industrial Dispute ACT, 1947Dokumen6 halamanAmity University Rajasthan: Lock-Out Under Industrial Dispute ACT, 1947Sahida ParveenBelum ada peringkat

- Labour Law ProjectDokumen14 halamanLabour Law ProjectHrithik KaulBelum ada peringkat

- Factories Act, 1948 & COSHWC, 2019: 1. Ravi Shankar Sharma vs. State of RajasthanDokumen4 halamanFactories Act, 1948 & COSHWC, 2019: 1. Ravi Shankar Sharma vs. State of RajasthanVicky DBelum ada peringkat

- Industrial DisputesDokumen44 halamanIndustrial DisputesVikas SinghBelum ada peringkat

- TDM Infrastructure Pvt. Ltd v. UE Development India Pvt. Ltd. case analysisDokumen2 halamanTDM Infrastructure Pvt. Ltd v. UE Development India Pvt. Ltd. case analysisTosani LalBelum ada peringkat

- Application of Article 311Dokumen19 halamanApplication of Article 311Sanchit SinglaBelum ada peringkat

- Case Summary - Sheela BarseDokumen4 halamanCase Summary - Sheela BarsePragyaBelum ada peringkat

- Doctrine of ElectionDokumen5 halamanDoctrine of Electionricky kaurBelum ada peringkat

- Minimum Wages Act 1948Dokumen4 halamanMinimum Wages Act 1948NIHARIKA PARASHARBelum ada peringkat

- Composition, Function, Jurisdiction and Power of Corporation Under Employee State Insurance Act 1948Dokumen6 halamanComposition, Function, Jurisdiction and Power of Corporation Under Employee State Insurance Act 1948sparsh lalBelum ada peringkat

- Exploitation of Contract Workers and Policy of The StateDokumen16 halamanExploitation of Contract Workers and Policy of The StateM.Dinesh sharmaBelum ada peringkat

- Applicability of EPF ActDokumen13 halamanApplicability of EPF ActRajat0786Belum ada peringkat

- Labour Court, Tribunal and National TribunalDokumen13 halamanLabour Court, Tribunal and National TribunalAshwina NamtaBelum ada peringkat

- Bonded Labour SystemDokumen14 halamanBonded Labour SystemMG MaheshBabuBelum ada peringkat

- Labour Law Project On Workman: Prepared byDokumen31 halamanLabour Law Project On Workman: Prepared byrajeevrvs083Belum ada peringkat

- Human Rights: Previous Year's MCQs of Tripura University and Answers with Short ExplanationsDari EverandHuman Rights: Previous Year's MCQs of Tripura University and Answers with Short ExplanationsBelum ada peringkat

- ITX AssignmentDokumen4 halamanITX AssignmentDaniel_Solomon_9624Belum ada peringkat

- Introduction to Custom DutiesDokumen8 halamanIntroduction to Custom DutiesRanvids100% (1)

- Reasons for NPAs and recovery mechanisms in Indian banksDokumen8 halamanReasons for NPAs and recovery mechanisms in Indian banksRavikumar PaBelum ada peringkat

- Accounting For Managers 2002Dokumen9 halamanAccounting For Managers 2002Ravikumar PaBelum ada peringkat

- Colour TelevisionDokumen1 halamanColour TelevisionRavikumar PaBelum ada peringkat

- Explore ICICI Bank ConnectionsDokumen1 halamanExplore ICICI Bank ConnectionsRavikumar PaBelum ada peringkat

- Agriculture in India Is The Means of Livelihood of Almost Two Thirds of The Work Force in The CountryDokumen2 halamanAgriculture in India Is The Means of Livelihood of Almost Two Thirds of The Work Force in The CountryRavikumar PaBelum ada peringkat

- Contemporary Banking": Aloysius Institute of Management and Information TechnologyDokumen10 halamanContemporary Banking": Aloysius Institute of Management and Information TechnologyRavikumar PaBelum ada peringkat

- Singapore Foreign ReservesDokumen3 halamanSingapore Foreign ReservesRavikumar PaBelum ada peringkat

- Finance 2Dokumen98 halamanFinance 2kjpatelBelum ada peringkat

- RaviDokumen20 halamanRaviRavikumar PaBelum ada peringkat

- SWOT Analysis GuideDokumen14 halamanSWOT Analysis GuideShah JeeBelum ada peringkat

- New SSP SpreadsheetDokumen20 halamanNew SSP SpreadsheetAdhitya Dian33% (3)

- What is Monetary Policy? Explained in DetailDokumen9 halamanWhat is Monetary Policy? Explained in DetailHimanshu RatnaniBelum ada peringkat

- Module 1 - Defining GlobalizationDokumen4 halamanModule 1 - Defining GlobalizationTANAWAN, REA MAE SAPICOBelum ada peringkat

- Advanced Microeconomic Theory Fall 2021Dokumen2 halamanAdvanced Microeconomic Theory Fall 2021aBelum ada peringkat

- Ignou MS-11 2011Dokumen22 halamanIgnou MS-11 2011Ravichandra GowdaBelum ada peringkat

- Padem Final 2017 1Dokumen211 halamanPadem Final 2017 1Adolfo VidalBelum ada peringkat

- Government Polytechnic Civil Engineering Roll CallDokumen9 halamanGovernment Polytechnic Civil Engineering Roll Call1170 Jagdale AtharvBelum ada peringkat

- Nandini Milk-FinalDokumen19 halamanNandini Milk-Finalopalq100% (1)

- CRR & SLRDokumen17 halamanCRR & SLRParag Jain100% (1)

- Assets and Liabilities DeclarationDokumen2 halamanAssets and Liabilities DeclarationSai Satish Gubbala33% (3)

- Vat 59-92Dokumen8 halamanVat 59-92Danzki BadiqueBelum ada peringkat

- Lecture Note 3 - Globalization and Role of MNCSDokumen64 halamanLecture Note 3 - Globalization and Role of MNCSgydoiBelum ada peringkat

- Intermediaries in LogisticsDokumen29 halamanIntermediaries in LogisticsKoushik KoushiBelum ada peringkat

- Project Report On NPA (AMIT GHAWARI Vision School of Mgmt. ChittorgarhDokumen26 halamanProject Report On NPA (AMIT GHAWARI Vision School of Mgmt. Chittorgarhamit67% (3)

- Lecture 6 SUPPLY CHAIN MANAGEMENT IIDokumen51 halamanLecture 6 SUPPLY CHAIN MANAGEMENT IIabdulrhmanBelum ada peringkat

- Bilateral and Regional Trade AgreementsDokumen33 halamanBilateral and Regional Trade Agreementssanman_1988Belum ada peringkat

- Bank Audit ConfirmationDokumen4 halamanBank Audit ConfirmationSelva Bavani SelwaduraiBelum ada peringkat

- Tester 2Dokumen1.765 halamanTester 2bhavikBelum ada peringkat

- Competitor Analysis NotesDokumen11 halamanCompetitor Analysis NotesnoxaBelum ada peringkat

- M-201 Instructor Guide - Facilities ManagementDokumen196 halamanM-201 Instructor Guide - Facilities Managementthpvxhfi50% (2)

- Commercial Media Report Q2 2022 PropEquityDokumen25 halamanCommercial Media Report Q2 2022 PropEquityakshay giriBelum ada peringkat

- Carbon Emissions Pinch Analysis (CEPA) For Emissions ReductionDokumen6 halamanCarbon Emissions Pinch Analysis (CEPA) For Emissions ReductionCici MaarasyidBelum ada peringkat

- Third Degree Price DiscriminationDokumen34 halamanThird Degree Price DiscriminationMarie Adriano BadilloBelum ada peringkat

- Business Finance Assignment 1Dokumen10 halamanBusiness Finance Assignment 1Amar ChotaiBelum ada peringkat

- International Organizations and Their Headquarters GK Notes in PDF 1Dokumen4 halamanInternational Organizations and Their Headquarters GK Notes in PDF 1HafizAhmadBelum ada peringkat

- Running Head: Tourism in Costa RicaDokumen11 halamanRunning Head: Tourism in Costa RicaNdung'u JuniorBelum ada peringkat

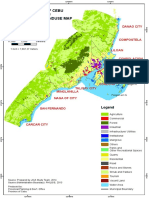

- Cebu Map - Existing Landuse - MetroCebuDokumen1 halamanCebu Map - Existing Landuse - MetroCebuiamfrancoiseBelum ada peringkat

- Tally Inventory Question 6 (Rice Mill)Dokumen2 halamanTally Inventory Question 6 (Rice Mill)Suraj BiswakarmaBelum ada peringkat

- Starbucks Corporation-Case StudyDokumen3 halamanStarbucks Corporation-Case StudyAyesha AnsBelum ada peringkat