Supplement Scientific Glass

Diunggah oleh

Drew ShepherdDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Supplement Scientific Glass

Diunggah oleh

Drew ShepherdHak Cipta:

Format Tersedia

4210, Revised 01/04/2011

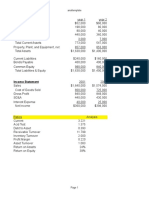

Exhibit 1: Select Income Statement and Balance Sheet Values ($MM) Income Statement Accounts Net sales Expenses Cost of goods sold Sales, general and administrative Research and development Depreciation Other expenses Operating expenses Interest expense Taxes Net earnings Balance Sheet Accounts Assets Cash Receivables Inventory Prepaid expenses Current assets Plant property and equipment Other long term assets Total long term assets Total assets Liabilities & Equity Short term debt Accounts payable Accrued liabilities Current liabilities Long term debt Owners equity Total capitalization Total liabilities & equity Months of inventory Cost of goods sold / sales Long term debt / total capital 2008 65.0 29.0 10.1 13.5 2.9 0.6 56.1 2.4 2.0 4.5 2008 3.2 3.0 4.9 4.8 15.9 28.5 2.7 31.2 47.1 2.7 2.3 0.4 5.4 17.2 24.5 41.7 47.1 2.028 0.446 0.412 2009 3.4 4.0 8.7 6.1 22.2 32.9 4.3 37.2 59.4 3.2 3.0 0.5 6.7 21.7 31.0 52.7 59.4 2.690 0.451 0.412 2009 86.3 38.9 14.0 17.0 3.1 1.0 74.0 3.0 2.9 6.5

Exhibit 2: 2009 Sales by product category Product category Containers (bottles, flasks) Measuring devices (beakers, pipettes, cylinders) Fittings (stoppers, adapters) Funnels Handlers (stirrers, forceps, trays) Tubes Other Total Number of orders Average number of units per order Average sales per order Average weight per order (pounds) Units sold (000's) 2,321 1,283 442 185 1,732 4,420 18 10,401 119,855 87 720.36 9.8 Average price ($) 15.89 8.98 11.01 12.63 5.89 4.55 23.41 8.30 Sales ($ 000's) 36,881 11,521 4,866 2,337 10,201 20,111 421 86,339

% of total sales 43% 13% 6% 3% 12% 23% 0% 100%

Exhibit 3: Information on Representative Products Griffin 500ml Erlenmeyer Beaker 500ml Flask 11,268 3,389 0.1% 0.03% 14% 14% $ 8.80 $ 9.50 $ 3.96 $ 4.56 $ 0.48 $ 0.49 $ 0.021 $ 0.025 95.8% 95.3% 54.2 16.3 21.4 10.9 216.7 65.2 38.3 19.5 433.4 130.3 51.0 26.0

2009 units sold Percent of all units sold Annual carrying cost (%) Unit price Unit cost Cost of underage Cost of overage Optimal service level Average bi-weekly demand (8 warehouses) Standard deviation of bi-weekly demand (8 warehouses) Average bi-weekly demand (2 warehouses) Standard deviation of bi-weekly demand (2 warehouses) Average bi-weekly demand (1 warehouse) Standard deviation of bi-weekly demand (1 warehouse)

Exhibit 5: Weight and shipping costs for typical products (2009) Average Pounds/case Units/case price/case 3.00 12 190.7 0.75 6 53.9 1.88 20 220.2 1.88 12 151.6 0.94 20 117.8 1.25 20 91.0 0.13 1 23.4 Total pounds shipped in 2009 580,250 160,375 41,438 28,906 81,188 276,250 2,250 1,170,656 Forecast pounds shipped in 2010 696,300 192,450 49,725 34,688 97,425 331,500 2,700 1,404,788

Product category Containers (bottles, flasks) Measuring devices (beakers, pipettes, cylinders) Fittings (stoppers, adapters) Funnels Handlers (stirrers, forceps, trays) Tubes Other Total Shipping costs for Global Logistics and Winged Fleet Global Logistics (3-day rates) Weight (pounds) 2.5 5 10 20 Winged Fleet

3-day rates are calculated using region, fixed fee and weight fees

Southeast $ 6.45 $ 10.28 $ 16.69 $ 27.38

Northeast $ 7.31 $ 11.65 $ 18.91 $ 31.03

Delivery from Atlanta to: Central Southwest $ 8.60 $ 9.46 $ 13.70 $ 15.07 $ 22.25 $ 24.48 $ 36.50 $ 40.15

$ $ $ $

Northwest 9.89 15.76 25.59 41.98

The regions are West (equivalent to Northwest and Southwest regions for Global Logistics), Central, and East (equivalent to Northeast and Southeast regions for Global Logistics)

Within region fee Across 1 region fee Across 2 regions fee Weight fee Shipping Comparison Centralized warehousing in Waltham Winged Fleet: Waltham warehouse to Dallas customer Total Decentralized warehousing Bulk transport: Waltham to Dallas warehouse Winged Fleet: Dallas warehouse to Dallas customer Total Centralized warehousing in Atlanta with Global Bulk transport: Waltham to Atlanta Global Logistics: Atlanta to Dallas customer Total

$5.00 $12.00 $16.00 $1.16 per pound

$ $

23.60 23.60

$ $ $

4.00 16.60 20.60

$ $ $

4.00 22.25 26.25

Notes Cost for bulk shipments $0.40 per pound Aside from the capital cost to carry inventory in Atlanta, SG would not have any operating costs for Atlanta. Global Logistics rates cover warehousing, insurance and delivery costs. Regional warehousing costs are 15% of annual inventory in the regional warehouses

Exhibit 6: Inventory Balance Detail ($MM) Raw materials / work in process inventory Finished goods inventory Manufacturing site North American warehouses and in transit Overseas warehouses and in transit Total finished goods Total inventory December 2009 2.18 0.20 4.44 1.90 6.54 8.72

Anda mungkin juga menyukai

- Pumps World Summary: Market Values & Financials by CountryDari EverandPumps World Summary: Market Values & Financials by CountryBelum ada peringkat

- Waste Collection Lines World Summary: Market Values & Financials by CountryDari EverandWaste Collection Lines World Summary: Market Values & Financials by CountryBelum ada peringkat

- Scientific Glass - SolutionsDokumen29 halamanScientific Glass - SolutionsShirsendu Bikash Das100% (1)

- Student SpreadsheetDokumen7 halamanStudent SpreadsheetTyag RajanBelum ada peringkat

- Problems 1-30: Input Boxes in TanDokumen24 halamanProblems 1-30: Input Boxes in TanSultan_Alali_9279Belum ada peringkat

- Financial Ratio Calculator: (Complete The Yellow Cells Only, The Spreadsheet Does The Rest)Dokumen4 halamanFinancial Ratio Calculator: (Complete The Yellow Cells Only, The Spreadsheet Does The Rest)tasleemshahzadBelum ada peringkat

- W5 Team C Case StudiesDokumen10 halamanW5 Team C Case Studiestk12834966100% (1)

- Module 3Dokumen53 halamanModule 3prabhakarnandyBelum ada peringkat

- Cash Flow Statement - Common Size - RatiosDokumen15 halamanCash Flow Statement - Common Size - RatiosAnshul GargBelum ada peringkat

- Ch03 P15 Build A ModelDokumen2 halamanCh03 P15 Build A ModelHeena Sudra77% (13)

- Ch13 P11 Build A Model 1Dokumen24 halamanCh13 P11 Build A Model 1walabuBelum ada peringkat

- Ch03 17Dokumen3 halamanCh03 17Md Emamul HassanBelum ada peringkat

- Kellogg Company and SubsidiariesDokumen7 halamanKellogg Company and SubsidiariesAlejandra DiazBelum ada peringkat

- Bmo 8.1.13 PDFDokumen7 halamanBmo 8.1.13 PDFChad Thayer VBelum ada peringkat

- Excel Solutions - CasesDokumen25 halamanExcel Solutions - CasesJerry Ramos CasanaBelum ada peringkat

- Excel Solutions - CasesDokumen26 halamanExcel Solutions - CasesFitrahwansyah Al Amien50% (2)

- Class 1Dokumen46 halamanClass 1Parina AhluwaliaBelum ada peringkat

- Financial Statement AnalysisDokumen53 halamanFinancial Statement Analysisremon4hrBelum ada peringkat

- Campbell Soup FInancialsDokumen39 halamanCampbell Soup FInancialsmirunmanishBelum ada peringkat

- Ts Breakeven Analysis RyneDokumen2 halamanTs Breakeven Analysis Ryneapi-287799883Belum ada peringkat

- Case 21 Aurora Textile Company 0Dokumen17 halamanCase 21 Aurora Textile Company 0nguyen_tridung250% (2)

- BofA Investor PresentationDokumen30 halamanBofA Investor PresentationZerohedgeBelum ada peringkat

- Excel Solutions - CasesDokumen33 halamanExcel Solutions - CasesChris DeconcilusBelum ada peringkat

- CH 07Dokumen29 halamanCH 07varunragav85Belum ada peringkat

- ButlerDokumen8 halamanButlerHadi KhawajaBelum ada peringkat

- Ts Breakeven Analysis BlankDokumen2 halamanTs Breakeven Analysis Blankapi-287799567Belum ada peringkat

- Chapter 5Dokumen59 halamanChapter 5mokeBelum ada peringkat

- Chapter - 3Dokumen58 halamanChapter - 3habtamuBelum ada peringkat

- Butler Excel Sheets (Group 2)Dokumen11 halamanButler Excel Sheets (Group 2)Nathan ClarkinBelum ada peringkat

- Monmouth Group4Dokumen18 halamanMonmouth Group4Jake Rolly0% (1)

- McDonalds Financial AnalysisDokumen11 halamanMcDonalds Financial AnalysisHooksA01Belum ada peringkat

- Chapter 6Dokumen45 halamanChapter 6Ishan Kapoor100% (1)

- Technical Finance Prep AnswersDokumen28 halamanTechnical Finance Prep Answersajaw267Belum ada peringkat

- LEK ValuationDokumen10 halamanLEK Valuationmmitre2100% (1)

- Macys 2011 10kDokumen39 halamanMacys 2011 10kapb5223Belum ada peringkat

- Master Budget Assignment CH 9Dokumen4 halamanMaster Budget Assignment CH 9api-240741436Belum ada peringkat

- Sears Vs Walmart - v01Dokumen37 halamanSears Vs Walmart - v01chansjoy100% (1)

- Analys TemplateDokumen1 halamanAnalys TemplateJack SanchezBelum ada peringkat

- Common Size AnalysisDokumen25 halamanCommon Size AnalysisYoura DeAi0% (1)

- Financial Statement Analysis: Cucumber Industries' December 31 Balance SheetsDokumen3 halamanFinancial Statement Analysis: Cucumber Industries' December 31 Balance Sheetsveda20Belum ada peringkat

- SCH 10Dokumen28 halamanSCH 10Hemali Mehta100% (1)

- Financial RatiosDokumen1 halamanFinancial RatiosAbhishek RampalBelum ada peringkat

- Hansson Private Label FinalDokumen13 halamanHansson Private Label Finalrohan pankar67% (3)

- 5.manual CaseDokumen124 halaman5.manual CaseAli Sarim Khan BalochBelum ada peringkat

- Financial Statement AnalysisDokumen50 halamanFinancial Statement AnalysisRishin Suresh S100% (1)

- Company 1: October 2004 Profit and LossDokumen2 halamanCompany 1: October 2004 Profit and LossAry BenzerBelum ada peringkat

- Blanchard Importing and Distributing Co. Inc.: Production Planning and ControlDokumen24 halamanBlanchard Importing and Distributing Co. Inc.: Production Planning and ControlJo James100% (1)

- Woolworths Analyst Presentation Feb 2005Dokumen45 halamanWoolworths Analyst Presentation Feb 2005rushabBelum ada peringkat

- Ejercicios Resueltos InventarioDokumen9 halamanEjercicios Resueltos InventarioAlexandrahegaBelum ada peringkat

- Swan-Davis Inc. (1) FinalDokumen12 halamanSwan-Davis Inc. (1) FinalRomina Isa Losser100% (1)

- Fin Model Practice 1Dokumen17 halamanFin Model Practice 1elangelang99Belum ada peringkat

- Corporate Finance Presentation EditorialDokumen96 halamanCorporate Finance Presentation EditorialtozammelBelum ada peringkat

- Horniman Horticulture CaseDokumen6 halamanHorniman Horticulture Case3happy3100% (1)

- FM BrewpubDokumen16 halamanFM BrewpubRaphael BloiseBelum ada peringkat

- 2.6 Summary of Financial RatiosDokumen5 halaman2.6 Summary of Financial RatiosHazel TanongBelum ada peringkat

- Ch02 P14 Build A Model AnswerDokumen4 halamanCh02 P14 Build A Model Answersiefbadawy1Belum ada peringkat

- Wiley Revenue Recognition: Understanding and Implementing the New StandardDari EverandWiley Revenue Recognition: Understanding and Implementing the New StandardBelum ada peringkat

- Wholesalers Electronic Markets & Agents & Brokers Revenues World Summary: Market Values & Financials by CountryDari EverandWholesalers Electronic Markets & Agents & Brokers Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- The Little Book of Valuation: How to Value a Company, Pick a Stock, and ProfitDari EverandThe Little Book of Valuation: How to Value a Company, Pick a Stock, and ProfitPenilaian: 4 dari 5 bintang4/5 (7)

- Finance for IT Decision Makers: A practical handbookDari EverandFinance for IT Decision Makers: A practical handbookBelum ada peringkat

- Aligning Training With Corporate StrategyDokumen8 halamanAligning Training With Corporate StrategyRudrakshi RazdanBelum ada peringkat

- Credit Risk Management in Uk Banks DissertationDokumen7 halamanCredit Risk Management in Uk Banks DissertationPayToWriteAPaperUK100% (1)

- Crisil 5000921214Dokumen189 halamanCrisil 5000921214eepBelum ada peringkat

- Accounting Textbook Solutions - 62Dokumen18 halamanAccounting Textbook Solutions - 62acc-expertBelum ada peringkat

- WebinarDokumen13 halamanWebinarAnirudh SrikantBelum ada peringkat

- Product ComparisonDokumen1 halamanProduct ComparisonHarsha ReddyBelum ada peringkat

- Shareholders' Equity - : Measure of The Consideration ReceivedDokumen3 halamanShareholders' Equity - : Measure of The Consideration ReceivedChinchin Ilagan DatayloBelum ada peringkat

- AtcpDokumen2 halamanAtcpnavie VBelum ada peringkat

- Mini Project On NseDokumen19 halamanMini Project On Nsecharan tejaBelum ada peringkat

- Annamalai University Solved AssignmentsDokumen10 halamanAnnamalai University Solved AssignmentsAiDLo50% (2)

- Yes We Khan: Pakistan Plots Dollar Bonds As It Freezes Paris Club DebtDokumen50 halamanYes We Khan: Pakistan Plots Dollar Bonds As It Freezes Paris Club DebtPop ManuBelum ada peringkat

- ABM - BF12 IVm N 24Dokumen4 halamanABM - BF12 IVm N 24Raffy Jade SalazarBelum ada peringkat

- Your Palletizing SolutionDokumen8 halamanYour Palletizing SolutionKien Nguyen TrungBelum ada peringkat

- Title: Determinants of Capital Structure of Oromia International BankDokumen2 halamanTitle: Determinants of Capital Structure of Oromia International BankHabtamu Hailemariam AsfawBelum ada peringkat

- Term Paper On APEX FOODS LTD. Samina Sultana-8451Dokumen45 halamanTerm Paper On APEX FOODS LTD. Samina Sultana-8451pranta senBelum ada peringkat

- Advance Test Schedule CS Executive Dec-23Dokumen22 halamanAdvance Test Schedule CS Executive Dec-23Gungun ChetaniBelum ada peringkat

- CFA Level 2 TipsDokumen2 halamanCFA Level 2 TipsgregdebickiBelum ada peringkat

- Wellfleet Bank - All That Glitters Is Not GoldDokumen9 halamanWellfleet Bank - All That Glitters Is Not Goldfklakjdkjfla100% (1)

- Lonzame vs. AmoresDokumen3 halamanLonzame vs. Amoresvanessa_3Belum ada peringkat

- Cost Accounting and ManagementDokumen25 halamanCost Accounting and ManagementRavi shankarBelum ada peringkat

- CDDCDokumen27 halamanCDDCSamyak JainBelum ada peringkat

- Project ReportDokumen9 halamanProject ReportYod8 TdpBelum ada peringkat

- HDCDokumen30 halamanHDCKaran SinghBelum ada peringkat

- Annual Report 2018 2019Dokumen272 halamanAnnual Report 2018 2019Nishita AkterBelum ada peringkat

- Market Outlook: Dealer's DiaryDokumen16 halamanMarket Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- Greencrest Financial Services Limited - Queries ListDokumen2 halamanGreencrest Financial Services Limited - Queries Listabhishek shuklaBelum ada peringkat

- Grp02 S07 - Toyota in France Qn01Dokumen1 halamanGrp02 S07 - Toyota in France Qn01api-3695734Belum ada peringkat

- Chapter 7 MCQDokumen4 halamanChapter 7 MCQcik sitiBelum ada peringkat

- Fair and Equitable Treatment Under Int. LawDokumen41 halamanFair and Equitable Treatment Under Int. LawAnkit Anand100% (1)

- Marktano'S Personal Reviewer 2018 ©: Foreign CorporationDokumen8 halamanMarktano'S Personal Reviewer 2018 ©: Foreign CorporationMark TanoBelum ada peringkat