Reliance SIP Insure Presentation

Diunggah oleh

varshneyrk@rediffmail.comDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Reliance SIP Insure Presentation

Diunggah oleh

varshneyrk@rediffmail.comHak Cipta:

Format Tersedia

Reliance SIP Insure

A unique facility to Save, Grow & Insure

What Rs 1000 p m can get you p.m you.

A dinner for your family

Watching movie with your spouse

Buy clothes for your kids

Make you a Millionaire & also get you free life insurance on your SIP Millionaire* installments

*please refer slide 3 for more details

Confidential Slide

What does it take to create wealth wealth

Investing Rs 1477 per month @ 15% p.a for 15 yrs makes you a Millionaire

Rate of Return Value /Yrs 5,00,000 10,00,000 25,00,000 , , 50,00,000 100,00,000 10 2,715 5,430 13,575 , 27,150 54,300

8% 15 1,435 2,871 7,177 , 14,354 28,707 20 843 1,686 4,216 , 8,432 16,865 10 1,794 3,589 8,972 , 17,943 35,886

15% 15 739 1,477 3,694 , 7,387 14,774 20 330 660 1,649 , 3,298 6,597

The table shows the SIP amount required to be invested per month for achieving the target amount in the specified time period. The hypothetical rate of return on the investments is assumed at 8% & 15% p.a respectively

This is just an illustration, explaining the power of compounding concept and should not be assumed as a promise, guarantee or forecast on minimum returns and safeguard of capital. SIP does not assure a profit or guarantee protection against loss in a declining market. The calculation shows the outcome of investing a specified amount at a certain assumed rate of interest per annum.

Confidential Slide

Most likely reasons to invest invest..

Childs Education

Childs Marriage Housing Retirement Safety

Everyone has one or more of the above reasons to invest for!

Confidential Slide

7 Successful habits of investing

Start early Dont time the market Prudent Asset allocation Invest regularly Understand the risk reward ratio Have a set investment objective Invest for long term

Would you like to t guess the th 8th habit that we got for you?

Confidential

Slide

Insure your financial goals.. I fi i l l

Before we know more about this product.let us understand the investment climate around us!

Confidential Slide

Value of Money over time

Impact of Inflation on monthly expenses of Rs 20,000

60,000 Mon nthly Exps in Rs 50,000 40,000 30,000 20,000 20,000 20 000 10,000 Today 25,526 32,578 53,066 41,579

Value of Inflation A Devil we need to Rs 1 lac over time Devil, beat it! Period

120,000 100,000 100,000 Value of Money y 80,000 80 000 60,000 40,000 20,000 78,353 61,391 48,102 37,689

5 years

10 years

15 years

20 years

Inflation @ 5% p.a

This is an hypothetical illustration to explain the concept of Power of Compounding. Past Performance may or may not be sustained in future.Today

Confidential

5 years

10 years Period

15 years

20 years

Slide

Where do people save their money?

Real Estate, 5 Equity market, 1.1 Mutual Fund, 1.2 Life insurance, 32.8 Chit fund/NBFC, 9.4 Gold, 5.8

Banks, 44.9 Postal Savings Savings, 11.6

Source: Invest India Incomes and Savings Survey 2007**

Mutual Fund as an Asset Class has a very low penetration

Confidential Slide

Long Term Investing Case Studies

Invest Systematically..

Its not the timing but the time in the market which matters

Confidential Slide

Invest Long term term

Money grows over a period of time Rs 1000 invested at 8%p.a every month for %p y

Power of Compounding 592,947 600,000 500,000 400,000 400 000 300,000 200,000 100,000 Amount after a compound ding 348,345 60,000 73,967 5 yrs 184,166 120,000 180,000 240,000

10 yrs Period Principal

15 yrs

20yrs

Amount

just like a rolling snowball gathers snow & grows.

This is an hypothetical illustration to explain the concept of Power of Compounding. Past Performance may or may not be sustained in future.

Confidential Slide

It always pays to start early & save for retirement

A holds for 30 years

Am mount at the Age of A 60

Start Early 1,488,603

B holds for 20 years

1,500,000 1,000,000 500,000 A People Who have invested B 120,000 120,000 689,511

A & B invest Rs. 2000 every month, earning interest @ 8% p.a. on a monthly p g compounding basis A starts at the age of 25 yrs, while B starts investing at the age of 35 yrs Both of them invest for 5 yrs ( Rs. 1.2 lacs) and hold their investments till 60 yrs. of age As investment appreciated to over Rs.14,88,603 while Bs investment grew to only Rs. 6,89,511 6 89 511

Only an illustration to explain the power of compounding.

Confidential Slide

Past Performance of SIP in Reliance Growth Fund

SIP Installment /Yrs 1,000 1 000 3,000 5,000 10,000 15,000 3 47,384 45,635 45 635 142,153 136,905 236,921 228,175 473,843 456,350 710,764 684,525 5 85,310 77,664 77 664 255,930 232,993 426,551 388,321 853,101 776,643 1,279,652 1,164,964 10 711,113 334,587 334 587 2,133,340 1,003,762 3,555,567 1,672,937 7,111,135 3,345,874 10,666,702 5,018,811 Since Inception 2,804,629 720,548 720 548 8,413,886 2,161,644 14,023,144 3,602,739 28,046,288 7,205,479 42,069,432 10,808,218

RGF BSE 100

Inception Date: 8th Oct 1995. Returns are of Retail Plan- Growth Plan Growth option as on 31st May 2011. Past Performance may or may not be sustained in future. The above table shows the historical SIP performance of Reliance Growth Fund (Retail Plan Growth Plan Growth option) vis its benchmark BSE 100. For example; A person who had made an SIP of Rs 1000 p.m in the above fund since inception on 8th Oct 1995 would have invested Rs 1.88 lacs by 31st May 2011 and have earnt a total amount of Rs 28.04 lacs. Disclaimer: Returns on SIP and Benchmark are annualised and cumulative investment return for cash flows resulting out of uniform and regular monthly subscriptions have been worked out on excel spreadsheet function known as XIRR. Calculations assume that all payouts during the period have been reinvested in the units of the scheme at then prevailing NAV. It is assumed that a SIP of Rs. 1000/- each executed on 10th of every month has been taken into consideration including the first installment. It may please be noted that load has not been taken into consideration. The amounts invested in SIP and the market values of such investments at respective periodic intervals thereof are simulated f illustrative purposes f understanding the concept of S f for for f SIP. This illustration should not be construed as a promise, guarantee on or a forecast of any minimum returns. The Mutual Fund or the Investment Manager does not assure any safeguard of capital and the illustrated returns are not necessarily indicative of future results and may not necessarily provide a basis for comparison with other investments. SIP does not guarantee or assure any protection against losses in declining market conditions.

Confidential Slide

Make the right choice. choice

Simple, straightforward way to create long term wealth Understand and embrace risk Put time on your side Invest systematically Dont worry about market timing A tried & tested method The alternative is to :

Follow markets very closely Time your entry and exit very

The choice is yours to make.. Well

Select your stocks judiciously And hope that you get it right more often than not!

Confidential

Slide

Systematic Investment Plan (SIP) & its benefits

SIP is a long term investment technique under which you invest a fixed sum of money on a monthly or quarterly basis in a mutual fund scheme at the prevailing NAV.

This allows you to save and invest regularly while you are earning.

Inculcates savings habit

Confidential

Eliminates need for g timing markets

Helps averaging cost of investment

Protects against market volatility

Improves probability of better f b tt returns

Slide

Here comes the most sought after product product..

Do you want an investment technique which can make you invest regularly??

Are you looking at investing for the long term??

Choose Reliance R li thenSIP Insure

Do D you want a f free life insurance cover??

Do you want your planned investments to be completed after your unforeseen death??

Slide

Confidential

A unique facility to Save, Grow & Insure

Confidential

Slide

Investor Benefits- Save Grow & Insure Benefits Save, Insure

Free Life Insurance CoverEnjoy Insurance on SIPs Ensuring that the planned investments are completed p Market Linked NAV based maturity proceeds Why Reliance SIP Insure ? Eliminates need for timing markets Helps averaging cost of investment

Inculcates savings g habit

Confidential

Slide

Reliance SIP Insure- What is it? Insure

An add-on feature of life insurance cover under a Group Term Insurance provided to individual investors with a view to encourage individual investors to save and invest regularly through Systematic Investment Plan (SIP) and help them achieve their financial objective without any extra cost.

Objective: In the f t I th unfortunate event of th d i of an i t t f the demise f investor d i th t t during the tenure of th SIP f the SIP, the insurance cover will take care of the unpaid installments. Thus, the nominee* would be able to continue in the scheme without having to , g make any further contribution. Investors long term financial planning and objective of investing through SIP could still be fulfilled as per the targeted time horizon, even if he/she dies prematurely.

*Nominee account would mean nominee in case of single holding & second or joint holder in case of Joint Holding

Confidential Slide

Reliance SIP Insure Product Features

All individual investors enrolling for investments via SIP and opting for Reliance SIP

Eligibility

Insure Only individual investors whose completed age is between 18 years & 45 years (inclusive of both) at the time of investment In case of multiple holders in the any scheme, only the first unit holder will be eligible for the insurance cover.

Investment Details

Minimum Investment per installment : Rs.1000 per month. (Except for Reliance Tax Saver (ELSS) Fund where it is Rs 1000 p.m and in multiples of Rs 500 thereafter). There is no upper limit. Minimum Period of Contribution : 3 years and in multiples of 1 month thereafter. Maximum Period of Contribution for SIP: No upper limit for SIP tenure. The investor can opt for Perpetual SIP also. However the insurance cover ceases when the investor attains 55 years of age or the completion of the SIP insure tenure whichever is earlier. Mode of payment of SIP installments is only through Direct Debit & ECS ( Post Dated Cheques shall not be accepted )

Confidential

Slide

Reliance SIP Insure Product Features

Load Structure There will an Exit Load of 2%, if the accumulated units acquired or allotted under Reliance SIP Insure are redeemed or switched out or the SIP Insure is discontinued or it is defaulted before the maturity of committed SIP I t it f itt d Insure t tenure or b f before completion of 55 l ti f 55yrs of age whichever i earlier f hi h is li as opted in the respective scheme either by the SIP-Insure unitholder or by the nominee, as the case may be. Upon completion of 55 years of age, if th U l ti f f there are still b l till balance unpaid SIP i t ll id installments, th t those will ill be treated as Normal SIP with the relevant exit load as may be existing from time to time. The following exit load structure is applicable for all kinds of redemptions in the following schemes as on d t viz : R li date i Reliance G Growth F d - R t il Pl th Fund Retail Plan, R li Reliance Vi i F d - R t il Pl Vision Fund Retail Plan, R li Reliance Equity Opportunities Fund - Retail Plan, Reliance Equity Fund - Retail Plan, Reliance Equity Advantage Fund- Retail Plan, Reliance Regular Savings Fund Equity option, Reliance Regular Savings Fund Balanced option, Reliance Banking Fund Retail Plan, Reliance Pharma Fund, Reliance M di & E t t i R li Media Entertainment F d R li t Fund, Reliance Di Diversified P ifi d Power S t F d R t il Pl Sector Fund Retail Plan, Reliance Natural Resources Fund Retail Plan, Reliance Quant Plus Fund Retail Plan, Reliance Long Term Equity Fund and Reliance Infrastructure Fund Retail Plan. -1% if redeemed/switched out on or before 1% completion of 1 year from the date of allotment of units. Nil if redeemed/switched after completion of 1 year from the date of allotment of units.

Confidential Slide

Reliance SIP Insure Product Features

Load Structure: While Reliance Small Cap Fund has the following exit load; 2% If redeemed or switched out on or before completion of 12 months from the date of p allotment of units 1% If redeemed or switched out after 12 months but on or before completion of 24 months from the date of allotment of units Nil If redeemed or switched out after the completion of 24 months from the date of allotment p of units While nil load in Reliance Tax Saver (ELSS) Fund Notes: 1. There will be Nil exit load (For the units acquired under SIP Insure before the age of 55 years), if the SIP Insure is discontinued before the maturity of committed SIP Insure tenure or before completion of 55 yrs of age whichever is earlier and redeemed after completion of p y g p 55 yrs of age either by the SIP-Insure unit holder or by the nominee, as the case may be. 2. In the event of the death of the investor and the redemption by the nominee, before completion of SIP Insure Tenure or before attaining 55 yrs of age, there shall be an an exit p load of 2% on the repurchase units.

Confidential

Slide

Reliance SIP Insure Product Features

Commencement of Insurance Cover: The Insurance cover shall commence after waiting period of 90 days from the commencement of SIP installments. However the waiting period will not be applicable in respect of accidental deaths. Amount of Life Insurance Cover Available

The Life Insurance Cover under SIP Insure facility will be revised as per the following clauses; An amount equivalent to the aggregate balance of unpaid SIP installments subject to a installments, maximum of Rs.10 lakhs per investor across all schemes / plans and folios will be invested in the Nominees* account

Confidential

Slide

Reliance SIP Insure Product Features

The Life Insurance amount will be invested in the Nominees account, in the same scheme* under which the deceased investor has enrolled for SIP. The investment will be at the applicable price based on the closing NAV on the date on which the cheque for insurance claim settlement is received by the AMC from the insurance company, subject to completion of requisite procedure for transmission of units in favour of the nominee. * N t applicable f R li Not li bl for Reliance T S Tax Saver (ELSS) F d F R li Fund. For Reliance T S Tax Saver (ELSS) F d Fund; Investors are requested to note that there will be a lock - in period of 3 years for each SIP Insure installment under Reliance Tax Saver (ELSS) Fund as per the Government Notification of 2005 and in the event of demise of the unitholder, the nominee would be able to withdraw the investment amount only after the completion of one year from the date of y y allotment of the units or anytime thereafter without any exit load. The insurance amount as per the sum assured clause in earlier slides subject to a maximum of Rs. 10 lakhs in a lumpsum in cash will be paid to the nominee in case of death of the unitholder ( lik other schemes, wherein th i ith ld (unlike th h h i the insurance amount will b compulsorily i t ill be l il invested t d in the respective scheme and the nominee is allotted the units.)

Confidential

Slide

Reliance SIP Insure How does this work? Insure

An investor does a monthly SIP of Rs. 10,000 for 5 y y years in Reliance Growth Fund

If he dies after a period of 3 y , then his p yrs, Sum Assured= Unpaid SIP installments = 2 yrs ( 5 yrs-3 yrs) X 12 months X 10, 000 = Rs 2 40 000 2,40,000

This amount will be paid by life insurance company to SIP investors nominee account * with investor s Reliance Mutual Fund and will be invested in Reliance Growth Fund (in the same scheme in which the deceased has earlier invested)

*Nominee account would mean nominee in case of single holding & second or joint holder in case of Joint Holding

Confidential Slide

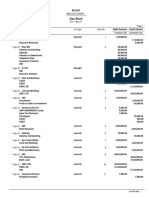

Reliance SIP Insure Product Features

One can aim to have a target insurance cover as per ones requirement by referring to the matrix attached below

Life Insurance Cover/Yrs 1,000,000 900,000 900 000 800,000 700,000 600,000 500,000 400,000 300,000 200,000 100,000 3 27,778 25,000 25 000 22,222 19,444 16,667 13,889 11,111 8,333 5,556 2,778 5 16,667 15,000 15 000 13,333 11,667 10,000 8,333 6,667 5,000 3,333 1,667 10 8,334 7,500 7 500 6,667 5,833 5,000 4,167 3,333 2,500 1,667 833 15 5,556 5,000 5 000 4,444 3,889 3,333 2,778 2,222 1,667 1,111 556 20 4,167 3,750 3 750 3,333 2,917 2,500 2,083 1,667 1,250 833 417 25 3,333 3,000 3 000 2,667 2,333 2,000 1,667 1,333 1,000 667 333

Cells in yellow would not be applicable under Minimum SIP amount category under Reliance SIP Insure Facility

The table shows the SIP amount per month to be invested for the required combination of Eligible Insurance Cover & Tenure. For example, to have a maximum cover of Rs 10 lacs at the time of registration in Reliance SIP Insure Facility, one can invest Rs 5,556 p.m for a period of 15 yrs as per the cell highlighted in pink.

Confidential Slide

Reliance SIP Insure Product Features

Eligible schemes

Reliance Growth Fund - Retail Plan Reliance Vision Fund - Retail Plan Reliance Equity Opportunities Fund - Retail Plan Reliance Equity Fund - Retail Plan Reliance Equity Advantage Fund- Retail Plan Reliance Regular Savings Fund Equity option Reliance Regular Savings Fund Balanced option Reliance Banking Fund- Retail Plan Reliance Pharma Fund Reliance Media & Entertainment Fund Reliance Diversified Power Sector Fund Retail Plan Reliance Natural Resources Fund- Retail Plan Reliance Quant Plus Fund Retail Plan Reliance Tax Saver (ELSS) Fund Reliance Long Term Equity Fund Reliance Infrastructure Fund- Retail Plan Reliance Small Cap Fund

Confidential Slide

Reliance SIP Insure Expiry of the policy

The insurance cover shall cease upon occurrence of any of the following: At the end of mandated Reliance SIP Insure tenure. i.e., upon completion of payment of all the monthly installments as registered or till attaining 55 years of age whichever is earlier Discontinuation of SIP installments midway by the investor i.e., before completing the opted SIP tenure /installments or till attaining 55 years of age whichever is earlier Redemption / switch-out of units purchased under Reliance SIP Insure before completion the mandated SIP tenure / installments or till attaining 55 years of age whichever is earlier In case of default in payment of two consecutive monthly SIP installments or four separate occasions of such defaults during the tenure of the SIP duration chosen or till attaining 55 years of age whichever is earlier

Note -There is no provision for revival of insurance cover, once the insurance cover ceases as stated above. The Cost of the Insurance premia will continue to be borne by RCAM. Confidential Slide

Reliance SIP Insure Exclusions for Insurance cover

No SIP Insure cover shall be admissible in respect of death of the SIP-Insure unitholder (the insured person) on account of Death due to suicide Death within 90 days from the commencement of SIP installments except for death due to accident. Death due to pre-existing illness, disease(s) or accident which has occurred prior to the start of cover.

Confidential

Slide

Reliance SIP Insure Documentation

It is mandatory for each investor to sign and submit the following documents under this facility; Application Form ECS/ Direct Debit Form Personal Statement of Health

For our existing investors there is no need to give the first SIP cheque

Confidential Slide

Invest India Incomes and Savings Survey 2007 **The Survey consisted of two components: 1. Complete household listing (over one million households) from randomly selected 1815 wards covering 852 towns and 931 villages, and 2. 96,088 representative individual respondent interviews (urban sample 72,979 respondents and rural sample of 23,109 respondents) carried out in the same locations. Respondents were drawn mainly from earning members of the Indian workforce who derive cash incomes from salaries, wages, profits and earnings from self employment and business activities (approximately 321 million persons nationally). The 321 million figure is the base figure from which they have done about over a million households and 96,088 in depth interviews. Data Source for this presentation This presentation is drawn from the data of the Invest India Incomes and Savings Survey which was completed in June 2007. This is based on in-depth interviews with 1 lakh respondents aged 18-59 yrs with cash incomes and supported by a household listing sample of 1 million. The figures projected refer to the 321 million paid work force of India in the presentation.

Source: IIMS Data Works survey

Confidential Slide

The views expressed herein constitute only the opinions and do not constitute any guidelines or recommendation on any course of action to be followed by the reader. This information is meant for general reading purposes only and is not meant to serve as a professional guide for the readers. Certain factual and statistical (both historical and projected) industry and market data and other information was obtained by RCAM from independent, third-party sources that it deems to be reliable, some of which have been cited above. However, RCAM has not independently verified any of such data or other information, or the reasonableness of the assumptions upon which such data and other information was based, and there can be no assurance as to the accuracy of such data and other information. Further, many of the statements and assertions contained in these materials reflect the belief of RCAM, which belief may be based in whole or in part on such data and other information. The Sponsor, th I Th S the Investment M t t Manager, th T t or any of th i respective di t the Trustee f their ti directors, employees, affiliates or representatives d not assume any responsibility f or l ffili t t ti do t ibilit for, warrant the accuracy, completeness, adequacy and reliability of such information. Whilst no action has been solicited based upon the information provided herein, due care has been taken to ensure that the facts are accurate and opinions given are fair and reasonable. This information is not intended to be an offer or solicitation for the purchase or sale of any financial product or instrument. Recipients of this information should rely on information/data arising out of their own investigations. Readers are advised to seek independent professional advice, verify the contents and arrive at an informed investment decision before making any investments. None of the Sponsor, the Investment Manager, the Trustee, their respective directors, employees, affiliates or representatives shall be liable for any direct, indirect, special, incidental, consequential, punitive or exemplary damages, including lost profits arising in any way from the information contained in this material. The Sponsor the Investment Manager the Trustee any of their respective directors employees including the fund managers affiliates representatives including Sponsor, Manager, Trustee, directors, managers, affiliates, persons involved in the preparation or issuance of this material may from time to time, have long or short positions in, and buy or sell the securities thereof, of company(ies) / specific economic sectors mentioned herein. Reliance Growth Fund (An Open ended Equity Growth Scheme): The primary investment objective of the scheme is to achieve long term growth of capital by investing in equity and equity related securities through a research based investment approach. Reliance Vision Fund (An Open ended Equity Growth Scheme): The primary investment objective of the scheme is to achieve long-term growth of capital by investment in equity and equity related securities through a research based investment approach. Reliance Equity Opportunities Fund (An Open ended Diversified Equity Scheme): The primary investment objective of the scheme is to seek to generate capital appreciation & provide long term growth opportunities by investing in a portfolio constituted of equity securities & equity related securities long-term and the secondary objective is to generate consistent returns by investing in debt and money market securities. Reliance Equity Fund (An Open ended Diversified Equity Scheme): The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio constituted of equity & equity related securities of top 100 companies by market capitalization & of companies which are available in the derivatives segment from time to time and the secondary objective is to generate consistent returns by investing in debt and money market securities. Reliance Equity Advantage Fund (An Open ended Diversified Equity Scheme): The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in a portfolio predominately of equity & equity related instruments with investments generally in S & P CNX Nifty stocks and the secondary objective is to generate consistent returns by investing in debt and money market securities Reliance Regular Savings Fund (An open ended Scheme) Equity securities. Option: The primary investment objective of this Option is to seek capital appreciation and/or to generate consistent returns by actively investing in equity / equity related securities. Balanced Option: The primary investment objective of this Option is to generate consistent return and appreciation of capital by investing in mix of securities comprising of Equity, Equity related Instruments & Fixed income instruments. Reliance Banking Fund (An Open ended Banking Sector Scheme): The primary investment objective of the scheme is to generate continuous returns by actively investing in equity and equity related or fixed income securities of companies in the banking sector.

Confidential

Slide

Reliance Pharma Fund (An Open ended Pharma Sector Scheme): The primary investment objective of the scheme is to seek to generate consistent returns by investing in equity and equity related securities or fixed income securities of Pharma and other associated companies. Reliance Media & Entertainment Fund (An Open ended Media & Entertainment Sector Scheme): The primary investment objective of the scheme is to generate continuous returns by investing in equity and equity related or fixed income securities of Media & Entertainment and other associated companies. Reliance Diversified Power Sector Fund (An Open ended Power Sector Scheme): The primary investment objective of the scheme is to seek to generate continuous returns by actively investing in equity and equity related or fixed income securities of Power and other associated companies. Reliance Natural Resources Fund (An Open Ended Equity Scheme): The primary investment objective of the scheme is to seek to generate capital appreciation & provide long-term growth opportunities by investing in companies principally engaged in the discovery, d di development, production, or di t ib ti of natural resources and th secondary objective i t generate consistent returns b i l t d ti distribution f t l d the d bj ti is to t i t t t by investing i d bt and money ti in debt d market securities. Reliance Quant Plus Fund (An Open ended Equity Scheme): The investment objective of the Scheme is to generate capital appreciation through investment in equity and equity related instruments. The Scheme will seek to generate capital appreciation by investing in an active portfolio of stocks selected from S & P CNX Nifty on the basis of a mathematical model. Reliance Long Term Equity Fund (An open ended diversified equity Scheme): The primary investment objective of the scheme is to seek to generate long term capital appreciation & provide long-term growth opportunities by investing in a portfolio constituted of equity & equity related securities and Derivatives and the secondary objective is to generate consistent returns by investing in debt and money market securities. Reliance Infrastructure Fund (An open ended Equity Scheme): The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of companies engaged in infrastructure and infrastructure related sectors and which are incorporated or have their area of primary activity, in India and the secondary objective is to generate consistent returns by investing in debt and money market securities. Reliance Small Cap Fund (An Open Ended Equity Scheme): The primary investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity related instruments of small cap companies and the secondary objective is to generate consistent returns by investing in debt and money market securities. Reliance Tax Saver (ELSS) Fund (An Open ended Equity Linked Savings Scheme): The primary objective of the scheme is to generate long-term capital appreciation from a portfolio that is invested predominantly in equity and equity related instruments. Statutory Details: Reliance Mutual Fund has been constituted as a trust in accordance with the provisions of the Indian Trusts Act, 1882. Sponsor: Reliance Capital Limited. Limited Trustee: Reliance Capital Trustee Company Limited Investment Manager: Reliance Capital Asset Management Limited (Registered Office of Trustee & Limited. Investment Manager: Reliance House Nr. Mardia Plaza, Off. C.G. Road, Ahmedabad 380 006). The Sponsor, the Trustee and the Investment Manager are incorporated under the Companies Act 1956. The Sponsor is not responsible or liable for any loss resulting from the operation of the Scheme beyond their initial contribution of ` 1 lakh towards the setting up of the Mutual Fund and such other accretions and additions to the corpus. Terms of issue: The NAV of all the Schemes will be calculated and declared on every Working Day. All the Schemes provide sale / switch in & repurchase /switch out facility on all Business Days at NAV based prices except for Reliance Tax Saver (ELSS) Fund. The units in Reliance Tax Saver (ELSS) Fund are subject to lock in period of three years. Risk Factors: Mutual Funds and securities investments are subject to market risks and there is no assurance and no guarantee that the Scheme objective will be achieved. As with investments in any securities, the NAV of the units issued under the Scheme can go up or down depending on the factors and forces affecting the securities market. Reliance Growth Fund, Reliance Vision Fund, Reliance Equity Opportunities Fund, Reliance Equity Fund, Reliance Equity Advantage Fund, Reliance Regular Savings Fund, Reliance Banking Fund, Reliance Pharma Fund, Reliance Media & Entertainment Fund, Reliance Diversified Power Sector Fund, Reliance Natural Resources Fund, Reliance Quant Plus Fund, Reliance Long Term Equity Fund, Reliance Infrastructure Fund, Reliance Small Cap Fund, Reliance Tax Saver (ELSS) Fund are only the name of the Schemes and do not in any manner indicate either the quality of the Scheme, its future prospects or returns. Past performance of the Sponsor/AMC/Mutual Fund is not indicative of future performance of the Scheme. The NAV of , p p p p p the Scheme may be affected, interalia, by changes in the market conditions, interest rates, trading volumes, settlement periods and transfer procedures. Please read the Scheme Information Document and Statement of Additional Information carefully before investing.

Confidential

Slide

Thank You

Anda mungkin juga menyukai

- Vedic MathsDokumen65 halamanVedic MathsRagavanBelum ada peringkat

- Wires PDFDokumen4 halamanWires PDFvarshneyrk@rediffmail.comBelum ada peringkat

- Wires PDFDokumen5 halamanWires PDFvarshneyrk@rediffmail.comBelum ada peringkat

- Vastu PDFDokumen43 halamanVastu PDFvarshneyrk@rediffmail.comBelum ada peringkat

- Bronchotab PDF PDFDokumen2 halamanBronchotab PDF PDFvarshneyrk@rediffmail.comBelum ada peringkat

- Wires PDFDokumen3 halamanWires PDFvarshneyrk@rediffmail.comBelum ada peringkat

- Wires PDFDokumen2 halamanWires PDFvarshneyrk@rediffmail.comBelum ada peringkat

- Wire & Cables PDFDokumen6 halamanWire & Cables PDFvarshneyrk@rediffmail.comBelum ada peringkat

- Vastu PDFDokumen43 halamanVastu PDFvarshneyrk@rediffmail.comBelum ada peringkat

- Durga PujaDokumen137 halamanDurga Pujavarshneyrk@rediffmail.com100% (1)

- 5 Star Hotel Standards Thailand PDFDokumen29 halaman5 Star Hotel Standards Thailand PDFvarshneyrk@rediffmail.com50% (2)

- Green Habitat - December 2012 PDFDokumen4 halamanGreen Habitat - December 2012 PDFvarshneyrk@rediffmail.comBelum ada peringkat

- Npti CT FanDokumen17 halamanNpti CT Fanrashm006ranjanBelum ada peringkat

- 100 Windows 8 Keyboard ShortcutsDokumen4 halaman100 Windows 8 Keyboard ShortcutsneurraBelum ada peringkat

- 4 Consumption of Materials 167-174 PDFDokumen8 halaman4 Consumption of Materials 167-174 PDFSheezan KhanBelum ada peringkat

- Gsip Brochure FinalDokumen5 halamanGsip Brochure FinalMd IslamBelum ada peringkat

- The HavanDokumen8 halamanThe Havanvarshneyrk@rediffmail.comBelum ada peringkat

- The HavanDokumen8 halamanThe Havanvarshneyrk@rediffmail.comBelum ada peringkat

- Concrete, Mortar and PlasterDokumen4 halamanConcrete, Mortar and Plasterdox4printBelum ada peringkat

- The Dhaatri HavanaDokumen6 halamanThe Dhaatri Havanavarshneyrk@rediffmail.com100% (1)

- Candle and Home Fragrance Gift Sets with PricesDokumen26 halamanCandle and Home Fragrance Gift Sets with Pricesvarshneyrk@rediffmail.comBelum ada peringkat

- Your AHU Project TeamDokumen2 halamanYour AHU Project Teamvarshneyrk@rediffmail.comBelum ada peringkat

- Ifsc-Code of Icici Bank Branches in IndiaDokumen10.725 halamanIfsc-Code of Icici Bank Branches in IndiaVenkatachalam KolandhasamyBelum ada peringkat

- ISLE Newsletter July 2011Dokumen36 halamanISLE Newsletter July 2011varshneyrk@rediffmail.comBelum ada peringkat

- Car Park Systems 2011-08 en E4081 KleinDokumen16 halamanCar Park Systems 2011-08 en E4081 Kleinvarshneyrk@rediffmail.comBelum ada peringkat

- Cooling TowersDokumen19 halamanCooling Towersvarshneyrk@rediffmail.comBelum ada peringkat

- AIRAH Heat Load Fact SheetDokumen3 halamanAIRAH Heat Load Fact Sheetvarshneyrk@rediffmail.comBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- IATF Internal Auditor 2019Dokumen1 halamanIATF Internal Auditor 2019Prakash kumarTripathiBelum ada peringkat

- Pt. Shantui Indonesia: InvoiceDokumen5 halamanPt. Shantui Indonesia: InvoiceTOBI RIANTOBelum ada peringkat

- QA System KMC AS7Dokumen76 halamanQA System KMC AS7Rayudu VVSBelum ada peringkat

- Swot Analysi S: Output Process I NputDokumen20 halamanSwot Analysi S: Output Process I Nputchobiipiggy26Belum ada peringkat

- Bharti Realty Report - FinalDokumen89 halamanBharti Realty Report - FinalArnob G MazumdarBelum ada peringkat

- Maternity Benefit Act AmendmentsDokumen2 halamanMaternity Benefit Act AmendmentsYogesh BBelum ada peringkat

- Spring Interview QuestionsDokumen10 halamanSpring Interview QuestionsCvenBelum ada peringkat

- 05 - GI-23.010-2 - QualityDokumen18 halaman05 - GI-23.010-2 - QualityHernanBelum ada peringkat

- Synopsis of Derivative ProjectDokumen11 halamanSynopsis of Derivative ProjectSHAIK YASINBelum ada peringkat

- "Brands Aren't Just Names On Packages!": Executive PerspectiveDokumen5 halaman"Brands Aren't Just Names On Packages!": Executive PerspectiveMeray George Wagih EbrahimBelum ada peringkat

- SMART DISHA ACADEMY CAPITAL MARKET AND DERIVATIVE MARKET MODULE TESTDokumen7 halamanSMART DISHA ACADEMY CAPITAL MARKET AND DERIVATIVE MARKET MODULE TESTVaghela RavisinhBelum ada peringkat

- Business Plan For Fashion&YouDokumen40 halamanBusiness Plan For Fashion&YouAnoop Kular100% (1)

- TCF Equipment Finance Credit AppDokumen1 halamanTCF Equipment Finance Credit Appjasonparker80Belum ada peringkat

- Unit 13Dokumen28 halamanUnit 13Tinh NguyenBelum ada peringkat

- Scribd Robert KuokDokumen3 halamanScribd Robert KuokRavi Kumar Nadarashan0% (2)

- PSMDokumen62 halamanPSMzamijakaBelum ada peringkat

- Economic Growth TheoriesDokumen10 halamanEconomic Growth TheoriesHarpreet Singh PopliBelum ada peringkat

- Is Wal-Mart Too Powerful - BusinessweekDokumen5 halamanIs Wal-Mart Too Powerful - BusinessweekDavid TanBelum ada peringkat

- Bcom 4 Sem Entrepreneurship Development and Project Management 21100877 Mar 2021Dokumen2 halamanBcom 4 Sem Entrepreneurship Development and Project Management 21100877 Mar 2021Vimal AnilkumarBelum ada peringkat

- PHA Training - Day 2Dokumen75 halamanPHA Training - Day 2ahmad jamalBelum ada peringkat

- Week 1 (MGMT 4512) Exercise Questions (Excel)Dokumen4 halamanWeek 1 (MGMT 4512) Exercise Questions (Excel)Big DripBelum ada peringkat

- G.O. 361-I&prDokumen3 halamanG.O. 361-I&prBalu Mahendra SusarlaBelum ada peringkat

- Jigs and Fixture Sem III FinalDokumen127 halamanJigs and Fixture Sem III Finalnikhil sidBelum ada peringkat

- Theories Chapter 6-12Dokumen13 halamanTheories Chapter 6-12u got no jamsBelum ada peringkat

- Business LetterDokumen6 halamanBusiness LetterGlory Mae OraaBelum ada peringkat

- Day Book 2Dokumen2 halamanDay Book 2The ShiningBelum ada peringkat

- MCQDokumen4 halamanMCQAjaySharmaBelum ada peringkat

- An Introduction To Integrated Marketing CommunicationsDokumen21 halamanAn Introduction To Integrated Marketing CommunicationsMEDISHETTY MANICHANDANABelum ada peringkat

- CHED New Policies On Tuiton and Other School FeesDokumen13 halamanCHED New Policies On Tuiton and Other School FeesBlogWatch100% (2)

- Responsibilities ChitfundsDokumen11 halamanResponsibilities ChitfundsRanjith ARBelum ada peringkat