The Day Trade Forex System

Diunggah oleh

John BestDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

The Day Trade Forex System

Diunggah oleh

John BestHak Cipta:

Format Tersedia

The Day Trade Forex System:

Set up your charts:

1. Choose EUR/USD (or whatever currency pair you like) , 5 min, line. 2. Now we will add the Moving Averages to the chart. We will be using: a. Exponential Moving Average 10 b. Bollinger Band Exponential Set at 20 c. Exponential Moving Average 50. Set your first MA to 10, close, exponential and you can make it red. Click on Moving Average again and add your MA 50, close, exponential and make this line blue. Select Bollinger Bands and set them to 20,2, close exponential. Make the middle band green. 3. Add Parabolic SAR to your chart and use the default settings. Now add these studies to your charts. Add MACD Histogram and use the default settings (9,Exponential, 12, 26, Close, Exponential). Add Relative Strength Index and set it to 14. Add Slow Stochastic and set it to (5,3,3, Exponential) and make the %K line blue and the %D line red.

Your chart should now look like this:

When to Enter and Exit Your Trades:

We will be looking at 3 different ways to day trade the Forex Markets. In a trading session, you may look for 1 or more of these approaches. The 3 techniques are as follows: 1. Trade the Breakout 2. Trade the Trend 3. Trading Tops and Bottoms When is the best time to trade? The three major trading sessions are as follows (all in Eastern Standard Time): 1. New York open 8:00 AM to 4:00 PM 2. Japanese/Australian open 7:00 PM to 3:00 AM 3. London open 3:00 AM to 8:00 AM **Often, the best times to trade is at the beginning 3-5 hours of the above mentioned opening times, because the major currency pairs tend to move the most in a particular direction.

1. Trade the Breakout You can use the 5, 10 or 15 minute charts for this method. The indicators on the 5 minute charts are the fastest.

In the above BUY example, EUR/USD 5 min chart, notice how the Bollinger Bands tighten and squeeze together. When this happens you know that there is a Breakout coming. As soon as the exchange rate line (brown), breaks out of the outside Bollinger Bands, it signals your entry buy/sell. Notice the confirming indicators: The exchange rate line (brown) is above the EMA 10 (red), the middle BB line (green) and the EMA 50 blue. The Parabolic SAR dots are on the bottom. The MACD Histogram is above 0 signaling upward momentum. The RSI is above 50 signaling upward momentum, and the Slow Stochastic blue line is above the red line signaling bullish momentum.

Here is an example of EUR/USD 5 minute breakout SELL. Notice the confirming indicators: The exchange rate line is below the EMA 10 (red), the middle BB line (green) and the EMA 50 blue. The Parabolic SAR dots are on the top. The MACD Histogram is below 0 signaling downward momentum. The RSI is below 50 signaling downward momentum, and the Slow Stochastic blue line is below the red line signaling bearish momentum.

2. Trade the Trend This trading method is best traded on the 5 or 10 min charts, but can be applied to the 1 minute charts. Trading the trend is just like trading the breakout, except in less volatile market conditions. Start with going to the 15 minute chart of the currency pair of your choice and ask yourself this question: Is the exchange rate line (brown) above or below the EMA 50 (blue)? **If the price line is currently below the EMA 50, and the EMA 10 and BB 20 are also below the EMA 50, then you will be looking at Selling opportunities in the trading session. If the price line is currently above the EMA 50, and the EMA 10 and BB 20 are above the EMA 50, then you will be looking at buying opportunities in the trading session. Often, when you are trading the trend, you will notice that the price line will bounce off the EMA 10 or the middle BB line or the EMA 50. These lines sometimes act as supports and resistances in a trading session. Therefore you can look to sell shorts when the price line bounces down off the EMA 10, BB 20 or EMA 50, or buy longs when the price line bounces up off the EMA 10 BB 20 or EMA 50. When you trade the trend, it is important to trade with the Parabolic SAR, MACD, RSI and Slow Stochastic all signaling together.

The above example is a 5 minute EUR/USD chart. The first thing to look for is the EMA 50 blue line. Notice that it has been above the price line and the EMA 10 and BB 20. You will now be looking to SELL. Notice how the price line bounced down off of the EMA 10 and BB 20 right before I circled the chart. Now look at your other indicators: The MACD Histogram turned down below zero, RSI turned down below 50 and Slow Stochastic blue line turned down under the red line. This would have been a good signal to Sell Shortyou could have profited at least 20 pips on this trade.

The above example is a 10 minute EUR/USD chart. The first thing to look for is the EMA 50 blue line. Notice that it has been below the price line and the EMA 10 and BB 20. You will now be looking to BUY. Notice how the price line crossed down through the EMA lines prior to the circles. This would have been a false signal to sell because the EMA 10 and BB 20 were above the EMA 50. If you were looking at buying opportunities then you could have entered when the price continued to rise where I circled on the chart. Now look at your other indicators: The MACD Histogram turned up above zero, RSI turned up above 50 and Slow Stochastic blue line turned up above the red line. This would have been a

good signal to Buy longyou could have profited at least 30 pips on this trade.

3. Trading Tops and Bottoms Trading tops and bottoms can be more risky that the other two strategies because you are trading against the trend anticipating the market is overbought/oversold and might turn in the other direction. It is best to use the 10 or 15 minute charts for this method. It is more risky using the 5 min charts, but you still can apply the same techniques.

Here is an example of a EUR/USD 15min chart, bottom buy. Notice how the MACD histogram is starting to rise, and the RSI is turning up from being oversold and the slow stochastic blue line crossed the red line and is turning up from oversold.

Here is a 5 minute chart example with EUR/USD. Notice the MACD, RSI and Slow Stochastic move up from oversold at 8:30. At 10:30 you could have sold short for a small profit. Trading tops and bottoms is best in ranging markets.

Here is an example of a breakout SELL and a Bottom BUY in a trading session watching the USD/JPY 10 minute charts. This bottom BUY is a great example of oversold indicators with RSI and with Slow Stochastic. When to EXIT trades The goal of this day trading guide is to teach traders to take 5-20 pip profits at a time. You can set profit LIMIT orders to achieve this, or you may want to move your stops as your position becomes more and more profitable. **Make sure that you dont let a winning trade become a losing one, by using trailing stop orders. 32

Anda mungkin juga menyukai

- Forex Never Lose Trade: DisclaimerDokumen7 halamanForex Never Lose Trade: DisclaimerSinclair ForexBelum ada peringkat

- Profitability of simple fixed strategies in sport betting: Soccer, Spain Primera Division (LaLiga), 2009-2019Dari EverandProfitability of simple fixed strategies in sport betting: Soccer, Spain Primera Division (LaLiga), 2009-2019Belum ada peringkat

- IndicatorsDokumen22 halamanIndicatorsManda Satyanarayana ReddyBelum ada peringkat

- Best Indicators For TradingDokumen11 halamanBest Indicators For TradingMAKE THE MEGA KNIGHT GREAT AGAIN SUPERCELL PLSBelum ada peringkat

- FxKeys $1000 Forex PlanDokumen2 halamanFxKeys $1000 Forex PlanIon BorceaBelum ada peringkat

- THE SECRET MEANING OF JAPANESE CANDLESTICKS PART 1 (tsmjcp1)Dokumen16 halamanTHE SECRET MEANING OF JAPANESE CANDLESTICKS PART 1 (tsmjcp1)Lenx PaulBelum ada peringkat

- Money Management CalculatorDokumen3 halamanMoney Management CalculatorjpamcicBelum ada peringkat

- Divergence3 PDFDokumen15 halamanDivergence3 PDFDrBipin DevaniBelum ada peringkat

- Forex Growth ModelDokumen100 halamanForex Growth Modeledmun7766Belum ada peringkat

- RSI BasicDokumen93 halamanRSI BasicDinesh C0% (1)

- Make Profitable Trading Strategy Using MACD Histogram PDFDokumen12 halamanMake Profitable Trading Strategy Using MACD Histogram PDFElizabeth John RajBelum ada peringkat

- Mrunal (Aptitude) Concepts of Marked Price and Successive Discounts (Profit-Loss) Without (Stupid) FormulasDokumen9 halamanMrunal (Aptitude) Concepts of Marked Price and Successive Discounts (Profit-Loss) Without (Stupid) FormulasayslaksBelum ada peringkat

- The Ultimate Forex Trade Entry Trick You Need To MasterDokumen8 halamanThe Ultimate Forex Trade Entry Trick You Need To MasterFitz100% (1)

- An Introduction To Price Action Trading Strategies - ImpDokumen3 halamanAn Introduction To Price Action Trading Strategies - Impanwar uddinBelum ada peringkat

- Trading SystemDokumen2 halamanTrading SystemMayank Meher100% (1)

- The Moving Target StrategyDokumen6 halamanThe Moving Target Strategyl100% (1)

- Drain The Banks!! TherumpledoneDokumen11 halamanDrain The Banks!! TherumpledoneLuis VicenteBelum ada peringkat

- Average Down StrategyDokumen11 halamanAverage Down StrategyThines KumarBelum ada peringkat

- Trading MethodDokumen3 halamanTrading MethodkanannnBelum ada peringkat

- For Ex CalculatorDokumen5 halamanFor Ex CalculatorArvind ChaudharyBelum ada peringkat

- Asian Handicap CalculatorDokumen3 halamanAsian Handicap Calculatorjaren2Belum ada peringkat

- Arbitrage Calculator 3Dokumen4 halamanArbitrage Calculator 3Eduardo MontanhaBelum ada peringkat

- Forexsignal30 ExtremeDokumen6 halamanForexsignal30 ExtremeefitroniBelum ada peringkat

- Formula: Day Amount Per Trade (10%) Total Trade Per Day Total Trade Amount Per DayDokumen2 halamanFormula: Day Amount Per Trade (10%) Total Trade Per Day Total Trade Amount Per DayinayathBelum ada peringkat

- Money ManagementDokumen7 halamanMoney ManagementAubie Maope100% (1)

- Hedging Lot StrategyDokumen7 halamanHedging Lot StrategycorryntBelum ada peringkat

- Colen SoccerDokumen93 halamanColen Soccerpaaraib-1Belum ada peringkat

- Jadual Pelaburan ForexDokumen1 halamanJadual Pelaburan Forexmr_dzahhirBelum ada peringkat

- 4 SMA Rocket Forex Trading StrategyDokumen7 halaman4 SMA Rocket Forex Trading StrategyMilionarieBelum ada peringkat

- Trading Volatility IndexDokumen22 halamanTrading Volatility IndexSimon GandamasunguBelum ada peringkat

- Hendrik Willem Van Loon-Istoria Omenirii-Humanitas (2017)Dokumen93 halamanHendrik Willem Van Loon-Istoria Omenirii-Humanitas (2017)Remus BoldeaBelum ada peringkat

- 1.0 Prelude:: Edge Swing Trading (Bounce)Dokumen4 halaman1.0 Prelude:: Edge Swing Trading (Bounce)Zhuang Hao TanBelum ada peringkat

- Easy StrategyDokumen3 halamanEasy StrategyKoketso MatlalaBelum ada peringkat

- SwingArm ATR Trend Indicator by VSNFNDDokumen3 halamanSwingArm ATR Trend Indicator by VSNFNDM BabaBelum ada peringkat

- Price Breaks ThroughDokumen34 halamanPrice Breaks Throughpb41Belum ada peringkat

- 32# Trading System, ADR (Average Day Range) StrategyDokumen3 halaman32# Trading System, ADR (Average Day Range) StrategymysticblissBelum ada peringkat

- Bet Angel Reference GuideDokumen189 halamanBet Angel Reference GuideBet Angel100% (1)

- Forex GrailDokumen17 halamanForex GrailVeeraesh MSBelum ada peringkat

- Crypto Trading: The Crypto Expert Crypto Signals Https://T.Me/CryptoexpertsignalsDokumen46 halamanCrypto Trading: The Crypto Expert Crypto Signals Https://T.Me/CryptoexpertsignalsLudwig VictoryBelum ada peringkat

- Trading The Cable Swings Via Averages by Nala66, Aka Alan Key Posts From November 18, 2018 To December 13, 2018Dokumen39 halamanTrading The Cable Swings Via Averages by Nala66, Aka Alan Key Posts From November 18, 2018 To December 13, 2018TruongTan DuyBelum ada peringkat

- Report-Parabolic SAR Trading StrategyDokumen20 halamanReport-Parabolic SAR Trading StrategySalman MunirBelum ada peringkat

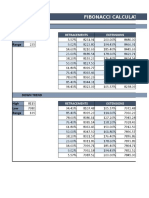

- Fibonacci CalculatorDokumen2 halamanFibonacci CalculatorKumarappan SambamurthyBelum ada peringkat

- OrderblockDokumen8 halamanOrderblockankit1844Belum ada peringkat

- 1-Support and ResistanceDokumen14 halaman1-Support and ResistanceBonnieBelum ada peringkat

- MT5 IndicatorsV3Dokumen100 halamanMT5 IndicatorsV3golgongroup100% (1)

- Simple Scalping StrategyDokumen2 halamanSimple Scalping StrategyhenryraymondBelum ada peringkat

- 3X5EMADokumen57 halaman3X5EMAAkash NathBelum ada peringkat

- Off Hours Scalping Strategy TemplateDokumen12 halamanOff Hours Scalping Strategy TemplateSURAJ KUMARBelum ada peringkat

- Indicator Manual: Ealtime Upply and EmandDokumen19 halamanIndicator Manual: Ealtime Upply and EmandAgus Forex100% (1)

- Bet FairDokumen37 halamanBet Fairpcraft1Belum ada peringkat

- Day Trading The Forex Market ProfitablyDokumen4 halamanDay Trading The Forex Market ProfitablyPanayiotis PeppasBelum ada peringkat

- FirstStrike PlusDokumen5 halamanFirstStrike Plusartus14Belum ada peringkat

- Gamble On Betfair and WinDokumen0 halamanGamble On Betfair and WindffdfBelum ada peringkat

- 1000 Usd Trading PlanDokumen1 halaman1000 Usd Trading PlanM Reza FauziBelum ada peringkat

- Manual Trade For Never Loss AgainDokumen2 halamanManual Trade For Never Loss Againpaparock34Belum ada peringkat

- Happy Trading RuleDokumen5 halamanHappy Trading RuleSunil SoniBelum ada peringkat

- Forex Indicators Guide PDFDokumen2 halamanForex Indicators Guide PDFMike NgBelum ada peringkat

- Full Guide On Support and Resistance: by Crypto VIP SignalDokumen11 halamanFull Guide On Support and Resistance: by Crypto VIP SignalBen AdamteyBelum ada peringkat

- Technical Trading StrategyDokumen2 halamanTechnical Trading StrategyTommy LohBelum ada peringkat

- Amibroker AFL Writing Zigzag SignalDokumen4 halamanAmibroker AFL Writing Zigzag SignalSeshi JonnalaBelum ada peringkat

- Sample QuestionsDokumen25 halamanSample QuestionsSneha KheskaniBelum ada peringkat

- Moving Average ExponentialDokumen10 halamanMoving Average ExponentialFranky SimanjuntakBelum ada peringkat

- Trading PatternsDokumen8 halamanTrading PatternsJR 18067% (3)

- Pivot PointDokumen4 halamanPivot Pointv_mangaloreBelum ada peringkat

- Pizzottaite Journal Technical Analysis Article-297-315Dokumen19 halamanPizzottaite Journal Technical Analysis Article-297-315Financial Management by Dr MujahedBelum ada peringkat

- Analisis Rasio Keuangan: Rasio Profitabilitas Rasio SolvencyDokumen11 halamanAnalisis Rasio Keuangan: Rasio Profitabilitas Rasio SolvencyFrans KristianBelum ada peringkat

- Technical Analysis PresentationDokumen73 halamanTechnical Analysis Presentationparvez ansariBelum ada peringkat

- Pengurusan Kewangan (Kumpulan 6)Dokumen42 halamanPengurusan Kewangan (Kumpulan 6)Wai ChongBelum ada peringkat

- Script Pano TorcidoDokumen7 halamanScript Pano TorcidoGAME CRAFT vitorBelum ada peringkat

- IchimokuDokumen11 halamanIchimokuvsrb240Belum ada peringkat

- Technical and Graphical AnalysisDokumen66 halamanTechnical and Graphical AnalysisAhmet Selçuk ARSLAN100% (4)

- Technical ResearchDokumen30 halamanTechnical Researchamit_idea1Belum ada peringkat

- Market Structure and Entry SetupDokumen153 halamanMarket Structure and Entry SetupMochamad Adhitya Ray98% (128)

- Price Action Volumetric Order Blocks & Trend StrengthDokumen8 halamanPrice Action Volumetric Order Blocks & Trend StrengthRonald TadiwanasheBelum ada peringkat

- Technical Analysis of The Financial MarketsDokumen26 halamanTechnical Analysis of The Financial Marketsmcjn.commercialBelum ada peringkat

- Volume Spread Analysis by Kartik MararDokumen47 halamanVolume Spread Analysis by Kartik MararNam Chun Tsang100% (3)

- FLUXODokumen2 halamanFLUXOjhonesjnsBelum ada peringkat

- Technical+and+Graphical+Analysis+eBook+ +copy+Dokumen52 halamanTechnical+and+Graphical+Analysis+eBook+ +copy+Achraf Semlali (centent)87% (30)

- Book Name 01Dokumen11 halamanBook Name 01Tanvir AhmedBelum ada peringkat

- Script Candlestick Scanner Iqoption ComprimidoDokumen2 halamanScript Candlestick Scanner Iqoption ComprimidoIndigo GraficosBelum ada peringkat

- Bollinger BandsDokumen27 halamanBollinger Bandsspmltechnologies67% (6)

- Uts Manajemen KeuanganDokumen8 halamanUts Manajemen KeuangantntAgstBelum ada peringkat

- Elliott Wave Analysis Spreadsheet 1Dokumen2 halamanElliott Wave Analysis Spreadsheet 1mohanBelum ada peringkat

- List of IndicatorsDokumen2 halamanList of IndicatorsafernsBelum ada peringkat

- The Evening Star PatternDokumen4 halamanThe Evening Star PatternFranciscoBelum ada peringkat

- 10 Chart Pattan Traders Should KnowDokumen24 halaman10 Chart Pattan Traders Should Knowstephen briggsBelum ada peringkat

- FX Scalping - Forex Strategies - Forex Resources - Forex Trading-Free Forex Trading Signals and FX FDokumen6 halamanFX Scalping - Forex Strategies - Forex Resources - Forex Trading-Free Forex Trading Signals and FX FJames LiuBelum ada peringkat

- Nitin Intraday Nifty Banknifty Trend FinderDokumen11 halamanNitin Intraday Nifty Banknifty Trend Finderbalaji_resourceBelum ada peringkat