Senior Accountant Position Description

Diunggah oleh

ptsgroupHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Senior Accountant Position Description

Diunggah oleh

ptsgroupHak Cipta:

Format Tersedia

Contact: Andy Post recruiter@ptsgroup.

com

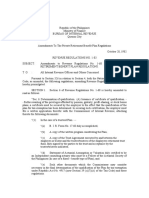

POSITION DESCRIPTION Functional Title: Title: Status: Department: Date Prepared: Senior Accountant Assistant Vice President Exempt Financial Administration October 17, 2011

Reports To: Senior Vice President Department Manager: Senior Vice President SUMMARY Ultimate goal is to develop into a full back-up to the Controller of the Bank. Develop an understanding of the Banks accounting policies and procedures; this includes all financial, regulatory, management information reporting and analysis, tax accounting and Parent Bank reporting for the Bank. Develop an understanding of all other accounting functions within the area (accounts payable, sub-custodian fees payable process, sub-custodian interest review, daily overdrafts position of the Banks customers). Help coordinate and understand the external/Parent bank auditors and regulatory examinations processes. Understand the Banks and the accounting areas internal controls. . JOB FUNCTIONS/DUTIES AND RESPONSIBILITIES 1. Maintains the Banks official financial records to ensure their accuracy and compliance with U.S. GAAP and applicable regulatory guidelines. Generates financial reports for regulatory agencies and submits them on an accurate and timely basis. The first goal will be to incorporate into the accounting area the financial reporting currently being done by the Operations area including the Call Report, and various Bank reporting. 2. Responsible for the Banks functions which include preparation of federal, state and local tax returns, preparation of the quarterly tax estimates and payments, tax planning and general tax inquiries. 3. Prepares monthly financial analysis and reporting, including parent bank consolidation reporting. 4. Reviews/prepares periodical regulatory reporting. 5. Analyzes accounting/general ledger system for improvement. SPECIFIC AUTHORIZATION Sign Banks Accounts on behalf of the Bank.

COMPLIANCE 1. General Compliance Responsibilities a. Be familiar with the latest Banks Regulatory Compliance Handbook and related policies. b. Attends all seminars that are conducted in connection with the Banks ongoing compliance-related training program, including all seminars relating to Bank Secrecy Act/Anti-Money Laundering (BSA/AML) requirements and the Office of Foreign Assets Control (OFAC) regulations and (b) takes and passes all tests that are administered in connection with the training program, including those relating to BSA/AML and OFAC-related issues. c. Monitors the business activities and operations of the Bank for potentially suspicious activities, and, utilizing the Suspicious Activity Reporting Form reports promptly to the Banks Secrecy Act Officer and Legal Department all potentially suspicious activities of which the employee becomes aware. RISK MANAGEMENT 1. General Risk Management Responsibilities: Has good knowledge of applicable risk management practices required to create a culture of risk management compliance for his or her group or department. Identifies, assesses, and monitors applicable risks based on the Banks risk management policies and procedures. Reviews work of subordinates for risk management purposes, if applicable. 2. Exhibits best practice risk management skills through effective internal risk controls, risk monitoring, risk assessment and improvement of risk management processes. 3. Specific type of risks applicable to the job function such as credit risk, market risk, liquidity risk, operational risk, legal/compliance risk, reputational risk and information security risk shall be discussed with the manager and senior manager of the area. REQUIREMENTS 1. CPA or Masters degree in Accounting. 2. 5 or more years experience in accounting and finance, Ideally in Corporate Commercial Banking

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- RevenueRegulations1 83Dokumen4 halamanRevenueRegulations1 83Ansherina Francisco100% (1)

- The Park Kolkata: Hotel Confirmation VoucherDokumen4 halamanThe Park Kolkata: Hotel Confirmation VoucherRanvijay AzadBelum ada peringkat

- How To Obtain An Original Certificate of TitleDokumen2 halamanHow To Obtain An Original Certificate of Titlessien100% (2)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Ong v. Roban Lending CorporationDokumen2 halamanOng v. Roban Lending CorporationShiela PilarBelum ada peringkat

- Risk Management OfficerDokumen1 halamanRisk Management OfficerptsgroupBelum ada peringkat

- Sales Trader PositionDescriptionDokumen1 halamanSales Trader PositionDescriptionptsgroupBelum ada peringkat

- Compliance AnalystDokumen1 halamanCompliance AnalystptsgroupBelum ada peringkat

- Position Title: Deputy Chief Compliance OfficerDokumen1 halamanPosition Title: Deputy Chief Compliance OfficerptsgroupBelum ada peringkat

- IT Security AdministratorDokumen1 halamanIT Security AdministratorptsgroupBelum ada peringkat

- AML Compliance InvestigatorDokumen3 halamanAML Compliance InvestigatorptsgroupBelum ada peringkat

- Manager Financial Planning and AnalysisDokumen1 halamanManager Financial Planning and AnalysisptsgroupBelum ada peringkat

- Bilingual Japanese FX Desk AssociateDokumen1 halamanBilingual Japanese FX Desk AssociateptsgroupBelum ada peringkat

- Trust AssociateDokumen1 halamanTrust AssociateptsgroupBelum ada peringkat

- Operations Assistant Securities LendingDokumen1 halamanOperations Assistant Securities LendingptsgroupBelum ada peringkat

- Global Custody ( Contract Temporary Position)Dokumen1 halamanGlobal Custody ( Contract Temporary Position)ptsgroupBelum ada peringkat

- Global Corporate Actions AdministratorDokumen1 halamanGlobal Corporate Actions AdministratorptsgroupBelum ada peringkat

- Applications Development ManagerDokumen1 halamanApplications Development ManagerptsgroupBelum ada peringkat

- Securities Lending Equity TraderDokumen1 halamanSecurities Lending Equity TraderptsgroupBelum ada peringkat

- Product Support SpecialistDokumen1 halamanProduct Support SpecialistptsgroupBelum ada peringkat

- Tax Reclaim Specialist - Corporate Actions DepartmentDokumen1 halamanTax Reclaim Specialist - Corporate Actions DepartmentptsgroupBelum ada peringkat

- IT Risk Manager - Information Security OfficerDokumen2 halamanIT Risk Manager - Information Security OfficerptsgroupBelum ada peringkat

- Global Custody Income AdministratorDokumen1 halamanGlobal Custody Income AdministratorptsgroupBelum ada peringkat

- IT Business Analyst - New York CityDokumen1 halamanIT Business Analyst - New York CityptsgroupBelum ada peringkat

- Middle Office Swaps TradingDokumen1 halamanMiddle Office Swaps TradingptsgroupBelum ada peringkat

- Global Custody Income AdministratorDokumen1 halamanGlobal Custody Income AdministratorptsgroupBelum ada peringkat

- Financial AnalystDokumen1 halamanFinancial AnalystptsgroupBelum ada peringkat

- Financial AnalystDokumen1 halamanFinancial AnalystptsgroupBelum ada peringkat

- Manager - Network SystemsDokumen3 halamanManager - Network SystemsptsgroupBelum ada peringkat

- Product Support SpecialistDokumen1 halamanProduct Support SpecialistptsgroupBelum ada peringkat

- Treasury Administration / Risk OfficerDokumen1 halamanTreasury Administration / Risk OfficerptsgroupBelum ada peringkat

- Bilingual Japanese Analyst (Credit Analyst)Dokumen1 halamanBilingual Japanese Analyst (Credit Analyst)ptsgroupBelum ada peringkat

- Relationships by Providing Status Updates, Leading Meetings and Creating and Maintaining PlansDokumen1 halamanRelationships by Providing Status Updates, Leading Meetings and Creating and Maintaining PlansptsgroupBelum ada peringkat

- Relationships by Providing Status Updates, Leading Meetings and Creating and Maintaining PlansDokumen1 halamanRelationships by Providing Status Updates, Leading Meetings and Creating and Maintaining PlansptsgroupBelum ada peringkat

- Global Settlements - Corporate Actions AdministratorDokumen1 halamanGlobal Settlements - Corporate Actions AdministratorptsgroupBelum ada peringkat

- VI InterpretationDokumen25 halamanVI Interpretationdoddamarg12Belum ada peringkat

- Mirasol vs. DPWHDokumen18 halamanMirasol vs. DPWHAlan TamBelum ada peringkat

- 5 (5), Art. VIII, Constitution)Dokumen17 halaman5 (5), Art. VIII, Constitution)RAINBOW AVALANCHEBelum ada peringkat

- Case Digest - Section 2GDokumen2 halamanCase Digest - Section 2Gquasideliks100% (1)

- 246 Vs DAWAYDokumen1 halaman246 Vs DAWAYNaiza De los SantosBelum ada peringkat

- Did The Divergent Political Perspectives From The "North" and "South" Lead To The American Civil War?Dokumen21 halamanDid The Divergent Political Perspectives From The "North" and "South" Lead To The American Civil War?Luqui BaronziniBelum ada peringkat

- 5049180316Dokumen127 halaman5049180316Siddharth ShekharBelum ada peringkat

- Iso 5167 2Dokumen54 halamanIso 5167 2farhanBelum ada peringkat

- Filed RPD Article 78 Memo of Law 002Dokumen11 halamanFiled RPD Article 78 Memo of Law 002News 8 WROCBelum ada peringkat

- RESP Citation MSDokumen21 halamanRESP Citation MSADAYSA HOTABelum ada peringkat

- Ancient Rome: Government and Laws: Roman Government's Three PhasesDokumen3 halamanAncient Rome: Government and Laws: Roman Government's Three PhasesClaudia BarquinBelum ada peringkat

- United States v. Twin City Power Co., 350 U.S. 222 (1956)Dokumen18 halamanUnited States v. Twin City Power Co., 350 U.S. 222 (1956)Scribd Government DocsBelum ada peringkat

- Adolf HitlerDokumen28 halamanAdolf HitlerDileep PankajBelum ada peringkat

- CD - 4. Zenith Insurance V CADokumen2 halamanCD - 4. Zenith Insurance V CAAlyssa Alee Angeles JacintoBelum ada peringkat

- Creating Change in The Blink of An EyeDokumen2 halamanCreating Change in The Blink of An EyesoriboBelum ada peringkat

- Body Worn Camera Pilot Program - Phase 1Dokumen7 halamanBody Worn Camera Pilot Program - Phase 1michaelonlineBelum ada peringkat

- Afi 32 1062Dokumen25 halamanAfi 32 1062José SánchezBelum ada peringkat

- Hahn v. CA PDFDokumen11 halamanHahn v. CA PDFApa MendozaBelum ada peringkat

- Voice Codes PDFDokumen12 halamanVoice Codes PDFErica CopelandBelum ada peringkat

- 4 Apo Fruits Corporation vs. Land Bank of The PhilippinesDokumen40 halaman4 Apo Fruits Corporation vs. Land Bank of The Philippinesericjoe bumagatBelum ada peringkat

- 2023.05.02 - Appellant Opening Brief (US v. Sastrom)Dokumen80 halaman2023.05.02 - Appellant Opening Brief (US v. Sastrom)Max RodriguezBelum ada peringkat

- Kane Removal ResolutionDokumen4 halamanKane Removal ResolutionPennLiveBelum ada peringkat

- Chapter 2 - ObliconDokumen35 halamanChapter 2 - ObliconHannah BarrantesBelum ada peringkat

- Sale and Purchase of ShipDokumen3 halamanSale and Purchase of ShipRoffBelum ada peringkat

- Election CasesDokumen22 halamanElection Caseseg_gemBelum ada peringkat

- Patungan Case & CAT Realty CaseDokumen4 halamanPatungan Case & CAT Realty CaseJen-ili TutayBelum ada peringkat