Results Tracker: Tuesday, 01 Nov 2011

Diunggah oleh

Mansukh Investment & Trading SolutionsDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Results Tracker: Tuesday, 01 Nov 2011

Diunggah oleh

Mansukh Investment & Trading SolutionsHak Cipta:

Format Tersedia

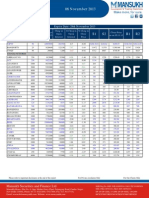

Results Tracker

Tuesday, 01 Nov 2011

make more, for sure.

Q2FY12

Results to be Declared on 1st Nov 2011

COMPANIES NAME

Aanjaneya Lifecare

Divis Lab

Insilco

Merck

Sona Koyo

Abbott India

EIH Associated

Integra Engg

Orchid Chem

Sukhjit Star

ACC

Entertainment Netw

JUBILANT

Patspin India

Suven Life

Aditya Birla Nuv

Essar Oil

KANCO ENTER

PNB

TCI Developers

Ambuja Cements

FDC

Kartik Invest

PODDARDEV

Transport Corp

Amrit Banaspati

Ashiana Hous

Flex Foods

Galaxy Agri

Kavveri Telecom

KBS INDIA

Polychem

Rolta India

Tuticorin Alk

Uniflex Cables

Bajaj Elect

GTN Textiles

KDDL

Rubber Prod

Williamson Fin

Caprihans India

HPCL

Kesar Terminals

Safari Inds

Williamson Magor

Central Bank

Chemplast Sanmar

DIC India

IKF Tech

Indiaco Vent

Indokem

Kohinoor Broad

Madhusudan Inds

Mcleod Russel

Shasun Pharma

Shreyas Ship

SKF India

Results Announced on 31st Oct 2011 (Rs Million)

Wipro

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

78048

2067

17211

2298

14913

1912

13001

2495

0

10506

65569

1384

15013

0

15013

1394

13619

1898

0

11721

Equity

PBIDTM(%)

4915

22.05

4904

22.9

% Var

19.03

Year ended

201109

201009

49.35

14.64

0

-0.67

37.16

-4.54

31.45

0

-10.37

151161

4171

34719

3087

31632

3652

27980

5281

0

22699

125391

2672

30208

755

29453

2755

26698

3877

0

22821

0.22

-3.69

4915

22.97

4904

24.09

% Var

20.55

201103

201003

56.1

14.93

308.87

7.4

32.56

4.8

36.21

0

-0.53

263407

6405

64416

1360

63056

6001

57055

8618

0

48437

231776

5113

62684

0

62684

5796

56888

7908

0

48980

0.22

-4.66

4909

24.45

2936

27.05

% Var

13.65

25.27

2.76

0

0.59

3.54

0.29

8.98

0

-1.11

67.2

-9.58

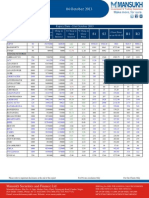

The September 2011 quarter revenue stood at Rs. 78048.00 millions, up 19.03% as compared to Rs. 65569.00 millions during the

corresponding quarter last year.Net profit declined -10.37% to Rs. 10506.00 millions from Rs. 11721.00 millions.Operating profit for the

quarter ended September 2011 rose to 17211.00 millions as compared to 15013.00 millions of corresponding quarter ended September

2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

ICICI Bank

Quarter ended

Year to Date

Year ended

201109

201009

% Var

201109

201009

% Var

201103

201003

% Var

Interest Earned

81576.2

63091

29.3

157761.4

121216.4

30.15

259740.5

257069.3

1.04

Other Income

17395.5

15779.3

10.24

33824.4

32584.4

3.81

66479

74776.5

-11.1

Interest Expended

56511.8

41047.2

37.68

108587.8

79262.1

37

169571.5

175925.7

-3.61

Operating Expenses

18922.4

18922.4

20.5

37120.2

30538.6

21.55

66172.5

58598.3

12.93

17801.7

Prov.& Contigencies

3187.9

6411.4

-50.28

7726.5

14389.6

-46.3

22868.4

43868.6

-47.87

Tax

5317.7

3345.3

9797.4

6988

13203.4

15031.9

12362.7

28353.9

22622.5

40.2

25.33

16093.3

PAT

58.96

21.59

51513.8

40249.8

21.89

27.99

Equity

11524.7

11508.3

11524.7

11508.3

11148.9

28.85

35.06

29.08

36.3

0.14

-19.89

11518.2

OPM

34.83

37.86

Operating Profit

0.14

-17.7

3.31

-7.99

The Sales for the quarter ended September 2011 of Rs. 81576.20 millions rose by 29.30% from Rs. 63091.00 millions.Profit saw a slight

increase of 21.59%to Rs. 15031.90 millions from Rs. 12362.70 millions.

Canara Bank

Quarter ended

201109

Interest Earned

76144.7

Year to Date

201009

% Var

55464.8

37.28

201109

Year ended

201009

% Var

201103

201003

% Var

147952.2

107073.6

38.18

230640.2

187519.6

23

Other Income

8282.6

5305.8

56.1

13551

12645.5

7.16

27030.3

28579

-5.42

Interest Expended

56527.8

35741.4

58.16

110404.5

70071.9

57.56

152407.4

130714.3

16.6

Operating Expenses

11846.2

11846.2

8.97

22341.4

20656.1

8.16

44193.1

34776.2

27.08

5531.1

1578.9

250.31

8976.6

3778.6

137.56

10811.1

12393.8

-12.77

Tax

2000

2500

4000

5000

8000

15780.7

20212.5

-20

-21.93

10000

PAT

-20

-15.44

40258.9

30214.3

25

33.24

4430

4100

19.44

27.08

Operating Profit

Prov.& Contigencies

8522.2

10078.8

Equity

4430

4100

OPM

21.08

25.53

8.05

-17.41

8.05

-28.21

4430

4100

26.48

26.99

8.05

-1.89

The sales for the September 2011 quarter moved up 37.28% to Rs. 76144.70 millions as compared to Rs. 55464.80 millions during the

corresponding quarter last year.Net profit declined -15.44% to Rs. 8522.20 millions from Rs. 10078.80 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Bank Of Baroda

Quarter ended

Interest Earned

Year to Date

Year ended

201109

201009

% Var

201109

201009

% Var

201103

201003

% Var

72514.4

51586.6

40.57

138832.1

98856.2

40.44

218859.2

166983.4

31.07

Other Income

7343.4

6813

7.79

13752.1

12985.4

5.9

28091.8

27249.1

3.09

Interest Expended

46845.3

31205.2

50.12

90191.1

59894.9

50.58

130836.6

107588.6

21.61

Operating Expenses

11612.8

11612.8

9.28

22680.6

20100.6

12.84

46298.3

38105.8

21.5

Prov.& Contigencies

4833.5

1854.9

160.58

8744

4368.2

100.17

13312.9

6972

90.95

Tax

4775.4

4519.5

8719.1

8693.3

11797.3

11660.8

10193

21989.3

18784.6

0.3

17.06

14086.4

PAT

5.66

14.4

42416.8

30583.3

19.4

38.69

Equity

3928.1

3655.3

3928.1

3655.3

3655.3

29.51

32.12

28.6

32.21

7.46

-11.21

3928.1

OPM

31.9

29.07

Operating Profit

7.46

-8.11

7.46

9.74

A decent increase of about 40.57% in the sales to Rs. 72514.40 millions was observed for the quarter ended September 2011. The sales

figure stood at Rs. 51586.60 millions during the year-ago period.The Company has registered profit of Rs. 11660.80 millions for the

uarter ended September 2011, a growth of 14.40% over Rs. 10193.00 millions millions achieved in the corresponding quarter of last year.

J&K Bank

Quarter ended

201109

Interest Earned

11556

Year to Date

201009

% Var

8989.2

28.55

201109

22115.1

Year ended

201009

% Var

201103

201003

% Var

17646.1

25.33

37131.3

30568.8

21.47

Other Income

712.2

744.8

-4.38

1382.2

1681.7

-17.81

3647.6

4162.3

-12.37

Interest Expended

7213.3

5262.9

37.06

13400.4

10262.1

30.58

21694.7

19375.4

11.97

Operating Expenses

1927.2

1927.2

18.47

3805.4

3338.5

13.99

7589.3

5773.7

31.45

Prov.& Contigencies

223.3

388.4

-42.51

668.1

1088.7

-38.63

2151

1665.9

29.12

Tax

907.9

823.2

1804

1550.9

2792.3

1996.5

1632.7

3819.4

3087.6

16.32

23.7

3191.9

PAT

10.29

22.28

6152

5123.8

14.31

20.07

Equity

484.9

484.9

484.9

484.9

484.9

484.9

OPM

27.07

31.64

28.45

32.46

0

-12.35

30.96

31.35

Operating Profit

0

-14.46

0

-1.24

The sales moved up 28.55% to Rs. 11556.00 millions for the September 2011 quarter as compared to Rs. 8989.20 millions during the yearago period.A slim rise of 22.28% was recorded in the Net profit for the quarter ended September 2011 to Rs. 1996.50 millions From Rs.

1632.70 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Indian Bank

Quarter ended

Year to Date

Year ended

201109

201009

% Var

201109

201009

% Var

201103

201003

% Var

Interest Earned

30348.15

22756.23

33.36

58162.56

43749.49

32.94

93610.28

77143.7

21.35

Other Income

3423.17

2836.61

20.68

5916.18

6615.8

-10.57

11818.89

13164.08

-10.22

Interest Expended

18994.5

12924.04

46.97

36508.85

24875.42

46.77

53249.16

45531.84

16.95

Operating Expenses

5568.04

5568.04

5.47

10549.9

9722.26

8.51

19263.16

17302.46

11.33

Prov.& Contigencies

2203.39

1329.69

65.71

3972.97

4768.72

-16.69

6572.24

3957.41

66.07

Tax

2318.47

1901.99

4290.79

3159.67

7966.2

4686.92

4157.74

8756.23

7839.23

35.8

11.7

9203.86

PAT

21.9

12.73

17140.75

15549.87

15.54

10.23

Equity

4297.7

4297.7

4297.7

4297.7

4297.7

30.34

32.47

0

-6.55

4297.7

OPM

29.26

36.04

35.16

35.61

Operating Profit

0

-18.81

0

-1.26

The sales figure stood at Rs. 30348.15 millions for the September 2011 quarter. The mentioned figure indicates a growth of about 33.36%

as compared to Rs. 22756.23 millions during the year-ago period.A humble growth in net profit of 12.73% reported in the quarter ended

September 2011 to Rs. 4686.92 millions from Rs. 4157.74 millions.

UCO Bank

Quarter ended

201109

Interest Earned

Other Income

35279.9

Year to Date

201009

% Var

27352.3

28.98

201109

69294.5

Year ended

201009

% Var

201103

201003

% Var

54080.8

28.13

113708

95263.2

19.36

2028

2293.1

-11.56

4782.2

4191.9

14.08

9254.1

9659.3

-4.19

Interest Expended

25178.8

17336.6

45.23

51106.9

34695.4

47.3

75258.9

72022

4.49

Operating Expenses

5023.5

5023.5

-4.62

9746.6

10079.3

-3.3

20753.6

15844.2

30.99

4748.8

5800.2

-18.13

7846.2

9539.3

-17.75

17504

6564.7

166.64

49.3

50

144.2

164.7

369.8

2307.5

1191.9

-12.45

37.92

380.2

PAT

-1.4

93.6

2.81

-10.44

Equity

6275.18

5493.6

OPM

20.14

25.75

Operating Profit

Prov.& Contigencies

Tax

14.23

-21.77

5232.8

3794

6275.18

5493.6

19.08

24.96

14.23

-23.54

9065.4

10121.8

6275.18

5493.6

23.7

17.9

14.23

32.37

The sales moved up 28.98% to Rs. 35279.90 millions for the September 2011 quarter as compared to Rs. 27352.30 millions during the year-

ago period.Net profit surges 93.60% to Rs. 2307.50 millions from Rs. 1191.90 millions in the quarter ended September 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Corporation Bank

Quarter ended

Interest Earned

Year to Date

Year ended

201109

201009

% Var

201109

201009

% Var

201103

201003

% Var

30907.42

21387.19

44.51

60690.63

41262.23

47.09

91352.48

69876.87

30.73

Other Income

3987.28

2455.21

62.4

6884.21

5518.73

24.74

13243.7

14933.39

-11.31

Interest Expended

23471.42

14428.68

62.67

46179.03

27730.31

66.53

61955.05

50843.47

21.85

Operating Expenses

4421.96

4421.96

20.2

8630.39

7111.88

21.35

16417.1

12599.53

30.3

Prov.& Contigencies

2047.52

976.33

109.72

3720.08

2242.45

65.89

6887.65

4744.25

45.18

Tax

942.69

1241.2

1519.7

2841.2

4920.5

4011.11

3517.34

7525.62

6855.14

-46.51

9.78

5203.7

PAT

-24.05

14.04

14132.68

11702.51

5.76

20.77

Equity

1481.31

1434.38

1481.31

1434.38

1481.31

1434.38

OPM

22.65

26.81

21.03

28.93

28.71

30.58

Operating Profit

3.27

-15.52

3.27

-27.3

3.27

-6.12

The sales surged to Rs. 30907.42 millions, up 44.51% for the September 2011 quarter as against Rs. 21387.19 millions during the

corresponding quarter previous year.Net profit stood at Rs. 4011.11 millions compared to Rs. 3517.34 millions in the corresponding

previous quarter,high by 14.04%.

Oriental Bank

Quarter ended

201109

Interest Earned

38010.9

Year to Date

201009

% Var

29919.3

27.04

201109

73976.1

Year ended

201009

% Var

201103

201003

% Var

58227.5

27.05

120878.1

102571.2

17.85

Other Income

2773.9

2141.1

29.55

6012.3

4288.3

40.2

9600.7

12000.5

-20

Interest Expended

28116.2

19148.1

46.84

53898.6

36883.9

46.13

79102.6

73496.9

7.63

Operating Expenses

5086.5

5086.5

4.82

10494

9349.3

12.24

18924.8

16859.8

12.25

Prov.& Contigencies

4853.4

2263.1

114.46

7996.1

4542.9

76.01

12065.3

8159.8

47.86

Tax

1051.3

1819.9

2375.3

4130.1

4708.4

1677.4

3976.5

5224.4

7609.6

-42.49

-31.34

5357.4

PAT

-42.23

-57.82

15028.7

11346.8

13.78

32.45

Equity

2917.6

2505.4

2917.6

2505.4

2917.6

2505.4

OPM

19.95

26.94

16.45

-25.95

21.08

27.96

26.85

23.61

Operating Profit

16.45

-24.61

16.45

13.72

A decent increase of about 27.04% in the sales to Rs. 38010.90 millions was observed for the quarter ended September 2011. The sales

figure stood at Rs. 29919.30 millions during the year-ago period.The Net Profit of the company slipped to Rs. 1677.40 millions from Rs.

3976.50 millions, a decline of -57.82% on QoQ basis.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Dena Bank

Quarter ended

201109

Year to Date

201009

% Var

201109

Year ended

201009

% Var

201103

201003

% Var

31620

23361.5

35.35

50335.3

40103.6

25.51

Interest Earned

16338.2

12214.7

33.76

Other Income

1133.7

1189.1

-4.66

2377.2

2260.1

5.18

5338.4

5886.3

-9.31

Interest Expended

11189.3

7562

47.97

22005.6

15103.9

45.69

32701.6

29103.3

12.36

Operating Expenses

2762.5

2762.5

6.85

5394.1

4875.3

10.64

10734.2

8480.8

26.57

813.3

728.5

11.64

1468.2

1156.8

26.92

3252

1537.9

111.46

-16.34

20.51

1512.6

1491.4

1755.4

2994.2

1.42

20.79

2869.6

3616.7

6116.3

5112.5

63.47

19.63

16.24

-19.18

3333.9

2868.2

3333.9

2868.2

20.86

24.15

16.24

-13.61

24.31

20.96

Operating Profit

Prov.& Contigencies

Tax

771

921.6

PAT

1935.8

1606.3

Equity

3333.9

2868.2

OPM

21.55

26.66

16.24

16

The sales for the September 2011 quarter moved up 33.76% to Rs. 16338.20 millions as compared to Rs. 12214.70 millions during the

corresponding quarter last year.Profit saw a slight increase of 20.51%to Rs. 1935.80 millions from Rs. 1606.30 millions.

Vijaya Bank

Quarter ended

201109

Year to Date

201009

% Var

201109

Year ended

201009

% Var

201103

201003

% Var

37776.2

27527.7

37.23

58440.6

52006.5

12.37

-4.96

5331.8

6794.5

-21.53

Interest Earned

19926.6

14032.4

42

Other Income

1056.7

1176.8

-10.21

2741.1

2884.1

Interest Expended

14793.1

9160.2

61.49

28412.5

18206.5

56.06

38972.9

37515.7

3.88

Operating Expenses

2792.8

2792.8

-9.63

5452.3

6104.2

-10.68

14332.8

10715.7

33.76

Operating Profit

Prov.& Contigencies

958.7

1015.4

-5.58

3271.6

1623.2

101.55

3628.5

3558.2

1.98

-19.32

41.04

623.4

1300

1938.5

3177.9

-52.05

-13.23

1600

2757.5

5238.2

5072.9

-17.46

3.26

4726.7

4335.2

4726.7

4335.2

17.61

22.16

17.91

20.32

Tax

403.4

500

PAT

2035.3

1443.1

Equity

4726.7

4335.2

OPM

17.05

21.08

9.03

-19.13

9.03

-20.54

9.03

-11.88

The sales for the September 2011 quarter moved up 42.00% to Rs. 19926.60 millions as compared to Rs. 14032.40 millions during the

corresponding quarter last year.A good growth in profit of 41.04% reported to Rs. 2035.30 millions over Rs. 1443.10 millions of

corresponding previous quarter.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

United Bank

Quarter ended

Interest Earned

Year to Date

Year ended

201109

201009

% Var

201109

201009

% Var

201103

201003

% Var

19395

15059.1

28.79

37778.2

29431.4

28.36

63414.6

52489.4

20.81

14.02

Other Income

1620.1

1516

6.87

3318.7

2722

21.92

6370.5

5587.4

Interest Expended

13159.8

9796.8

34.33

25853.4

19083.3

35.48

41721.1

38577.2

8.15

Operating Expenses

3351.1

3351.1

3.66

6566.1

6117.6

7.33

12994.1

10741.2

20.97

Operating Profit

2596.5

2178.1

19.21

4775.2

3876.5

23.18

8380.2

4653.3

80.09

Tax

660

270

1330

900

881.6

1247.7

1097.4

47.78

18.21

1450

PAT

144.44

13.7

5239.7

3223.5

64.47

62.55

Equity

3444.2

3164.3

3444.2

3164.3

OPM

23.22

23.54

23.76

16.69

Prov.& Contigencies

8.85

-1.36

2572.2

2176

3444.2

3164.3

22.97

23.62

8.85

-2.77

8.85

42.42

The sales figure stood at Rs. 19395.00 millions for the September 2011 quarter. The mentioned figure indicates a growth of about 28.79%

as compared to Rs. 15059.10 millions during the year-ago period.Modest increase of 13.70% in the Net Profit was reported from. 1097.40

millions to Rs. 1247.70 millions.

Greenply Industries

Quarter ended

Year to Date

Year ended

Sales

201109

4135.98

201009

2890.62

% Var

43.08

201109

7662.81

201009

5514.32

% Var

38.96

201103

12178.87

201003

8732.57

% Var

39.46

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

0.02

367.16

132.49

234.67

115.32

119.35

18.38

18.38

100.97

0.01

224.85

88.41

136.44

101.98

34.46

18.62

18.62

15.84

100

63.29

49.86

72

13.08

246.34

-1.29

-1.29

537.44

0.02

747.28

252.98

494.3

228.79

265.51

34.97

34.97

230.54

63.35

531.66

175.85

355.81

200.61

155.2

35.45

35.45

119.75

-99.97

40.56

43.86

38.92

14.05

71.08

-1.35

-1.35

92.52

0.01

1096.39

377.82

718.58

409.94

308.63

57.74

57.74

250.89

72.84

1026.93

236.87

790.06

220.25

569.81

74.15

63.42

495.67

-99.99

6.76

59.51

-9.05

86.12

-45.84

-22.13

-8.96

-49.38

Equity

PBIDTM(%)

120.68

8.51

110.48

7.42

9.23

14.67

120.68

9.75

110.48

9.64

9.23

1.15

120.68

8.61

110.48

11.28

9.23

-23.66

The sales for the September 2011 quarter moved up 43.08% to Rs. 4135.98 millions as compared to Rs. 2890.62 millions during the

corresponding quarter last year.The company almost doubled its revenue to Rs. 100.97 millions from Rs. 15.84 millions in the quarter

ended September 2011.Operating profit surged to 367.16 millions from the corresponding previous quarter of 224.85 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Century Textile &Ind

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

10989.5

55.8

652.2

320.7

279

600.6

-321.6

0

0

-321.6

11105

62

1616.7

297.5

1490.8

585.3

905.5

245

7.5

660.5

Equity

PBIDTM(%)

930.4

5.4

930.4

13.24

% Var

-1.04

Year ended

201109

201009

-10

-59.66

7.8

-81.29

2.61

-135.52

0

0

-148.69

22749.8

81.6

1792.2

666.3

1073.4

1201.2

-127.8

-45.2

-45.2

-82.6

22401.4

89.5

3866.4

514.9

3523.1

1167.3

2355.8

691

41

1664.8

0

-59.24

930.4

7.88

930.4

17.26

% Var

1.56

201103

201003

% Var

5.2

-8.83

-53.65

29.4

-69.53

2.9

-105.42

-106.54

-210.24

-104.96

47649.3

345.1

7028.5

1155.6

5835.1

2396.6

3438.5

1063.6

126

2374.9

45293.3

138.5

9421.1

961.4

7578.1

2344.7

5233.4

1838.7

-387.4

3394.7

149.17

-25.4

20.2

-23

2.21

-34.3

-42.15

-132.52

-30.04

0

-54.36

930.4

13.46

930.4

19.19

0

-29.85

A slight decline in the revenue of Rs. 10989.50 millions was seen for the September 2011 quarter as against Rs. 11105.00 millions during

year-ago period.The Net Loss for the quarter ended September 2011 is Rs. -321.60 millions as compared to Net Profit of Rs. 660.50

millions of corresponding quarter ended September 2010Operating Profit reported a sharp decline to 652.20 millions from 1616.70

millions in the corresponding previous quarter.

SJVN

Quarter ended

Year to Date

201109

201009

Sales

6220.2

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

578.4

6390.2

293.5

6096.7

1112.7

4984

873

-124.2

4111

Equity

PBIDTM(%)

41366.3

102.73

Year ended

201109

201009

5253.9

% Var

18.39

201103

201003

10503.7

% Var

11.92

18126.7

17697.4

% Var

2.43

11755.9

407

5284.3

348.3

4936

1086.5

3849.5

653.6

-113.7

3195.9

42.11

20.93

-15.73

23.51

2.41

29.47

33.57

9.23

28.63

1104.5

11982.7

571.9

11410.8

2213.6

9197.2

1604.1

-236.1

7593.1

634.9

10250.6

738.1

9512.5

2173.8

7338.7

1235.2

-227.5

6103.5

73.96

16.9

-22.52

19.96

1.83

25.32

29.87

3.78

24.41

1431.5

17587.8

1583.7

16004.1

4442.1

11562

2440.7

-500.3

9121.3

1389.9

16236.8

1729.3

14507.5

4332.8

10174.7

447.3

-196.7

9727.4

2.99

8.32

-8.42

10.32

2.52

13.63

445.65

154.35

-6.23

41366.3

100.58

0

2.14

41366.3

101.93

41366.3

97.59

0

4.45

41366.3

97.03

41088.1

91.75

0.68

5.76

The revenue for the September 2011 quarter is pegged at Rs. 6220.20 millions, about 18.39% up against Rs. 5253.90 millions recorded

during the year-ago period.Net Profit recorded in the quarter ended September 2011 rise to 28.63% to Rs. 4111.00 millions compared to

R. 3195.90 millions in corresponding previous quarter.Operating profit surged to 6390.20 millions from the corresponding previous

quarter of 5284.30 millions.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Ipca Laboratories

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

6235

26.4

1335.3

117.6

1217.7

175.8

1041.9

262.3

0

779.6

5182.9

315.5

1495.5

81.6

1413.9

136.8

1277.1

337

0

940.1

Equity

PBIDTM(%)

251.4

20.79

250.4

27.91

% Var

20.3

Year ended

201109

201009

-91.63

-10.71

44.12

-13.88

28.51

-18.42

-22.17

0

-17.07

11534

143.9

2404.6

200.9

2203.7

329.9

1873.8

477.5

0

1396.3

9362.7

340.6

2203.6

149.5

2054.1

265.6

1788.5

460

0

1328.5

0.4

-25.51

251.4

20.85

250.4

23.54

% Var

23.19

201103

201003

-57.75

9.12

34.38

7.28

24.21

4.77

3.8

0

5.1

18811

517.8

4302.7

311.4

3891.7

554.3

3337.4

783.7

0

2553.7

15527.4

185.5

3504.4

323.8

3180.6

463.3

2717.3

625.4

0

2091.9

0.4

-11.42

251.4

22.22

250.4

21.96

% Var

21.15

179.14

22.78

-3.83

22.36

19.64

22.82

25.31

0

22.08

0.4

1.21

The September 2011 quarter revenue stood at Rs. 6235.00 millions, up 20.30% as compared to Rs. 5182.90 millions during the

corresponding quarter last year.The Company's Net profit for the September 2011 quarter have declined marginally to Rs. 779.60

millions as against Rs. 940.10 millions reported during the corresponding quarter ended.A decline of 1335.30 millions was observed in

the OP in the quarter ended September 2011 from 1495.50 millions on QoQ basis.

Hindustan Unilever

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

56104.8

776.7

9043.5

5.4

9482.3

571

8911.3

2022.1

0

6889.2

47646.7

768.2

7237.1

0.7

7640.8

553.7

7087.1

1425.9

0

5661.2

Equity

PBIDTM(%)

2161

16.12

2182.1

15.19

% Var

17.75

Year ended

201109

201009

1.11

24.96

671.43

24.1

3.12

25.74

41.81

0

21.69

111898.4

1282.7

17092.2

5.6

18118.3

1133

16985.3

3824.5

0

13160.8

96408.8

1189.5

14467.8

1.5

15055.7

1088.7

13967

2973.7

0

10993.3

-0.97

6.12

2161

15.27

2182.1

15.01

% Var

16.07

201103

201003

7.84

18.14

273.33

20.34

4.07

21.61

28.61

0

19.72

197128.7

2742.7

29512.5

2.4

31578.4

2208.3

29370.1

6310.4

0

23059.7

177816.6

1481.1

28980.8

69.8

29465.5

1840.3

27625.2

6163.7

0

21461.5

-0.97

1.79

2159.5

14.97

2181.7

16.3

% Var

10.86

85.18

1.83

-96.56

7.17

20

6.32

2.38

0

7.45

-1.02

-8.14

The revenue zoomed 17.75% to Rs. 56104.80 millions for the quarter ended September 2011 as compared to Rs. 47646.70 millions during

the corresponding quarter last year.The Company has registered profit of Rs. 6889.20 millions for the quarter ended September 2011, a

growth of 21.69% over Rs. 5661.20 millions millions achieved in the corresponding quarter of last year.OP of the company witnessed a

marginal growth to 9043.50 millions from 7237.10 millions in the same quarter last year.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Dabur India

Quarter ended

Year to Date

201109

201009

Sales

8808.2

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

126.5

1867.5

13.8

1853.7

91.6

1762.1

375.5

0

1386.6

Equity

PBIDTM(%)

1742

21.05

Year ended

201109

201009

8002.5

% Var

10.07

201103

201003

15543.9

% Var

11.23

32876.7

28745.9

% Var

14.37

17289.9

66.5

1709.1

26.1

1683

95

1588

326.5

0

1261.5

90.23

9.27

-47.13

10.14

-3.58

10.96

15.01

0

9.92

271.5

3180

79.4

3100.6

183.4

2917.2

619.6

0

2297.6

139.2

2944.6

42.3

2902.3

183.7

2718.6

561.9

0

2156.7

95.04

7.99

87.71

6.83

-0.16

7.31

10.27

0

6.53

261.6

6469.3

129.3

6340

377.3

5962.7

1248.4

0

4714.3

230

5724.2

134.9

5589.3

319.1

5270.2

938.8

0

4331.4

13.74

13.02

-4.15

13.43

18.24

13.14

32.98

0

8.84

1740.7

21.16

0.07

-0.54

1742

18.39

1740.7

18.94

0.07

-2.91

1740.7

19.49

869

19.75

100.31

-1.3

The revenue for the September 2011 quarter is pegged at Rs. 8808.20 millions, about 10.07% up against Rs. 8002.50 millions recorded

during the year-ago period.A slim rise of 9.92% was recorded in the Net profit for the quarter ended September 2011 to Rs. 1386.60

millions From Rs. 1261.50 millions.Operating Profit saw a handsome growth to 1867.50 millions from 1709.10 millions in the quarter

ended September 2011.

Subros

Quarter ended

Year to Date

201109

201009

Sales

2410.1

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

0

194.6

62.3

132.3

109.2

23.1

-8.1

-9.4

31.2

Year ended

201109

201009

2787.1

% Var

-13.53

201103

201003

5129.6

% Var

-3.64

10911.1

9066.2

% Var

20.35

4942.9

0

192.1

43.2

148.9

101.6

47.3

-1.4

5.5

48.7

0

1.3

44.21

-11.15

7.48

-51.16

478.57

-270.91

-35.93

0

454.8

122.4

332.4

214.4

118

6.7

5.4

111.3

0

406.6

80.4

326.2

196.5

129.7

9.8

2.9

119.9

0

11.85

52.24

1.9

9.11

-9.02

-31.63

86.21

-7.17

1.2

900.7

175

725.7

405.5

320.2

34.7

33.8

285.5

0.2

940.1

160.3

779.8

384.7

395.1

114.2

-4.8

280.9

500

-4.19

9.17

-6.94

5.41

-18.96

-69.61

-804.17

1.64

Equity

120

120

0

120

120

0

120

120

0

17.59

16.08

-21.69

PBIDTM(%)

7.31

6.22

9.2

7.93

7.47

9.54

The sales for the September 2011 quarter moved down to Rs. 2410.10 millions as compared to Rs. 2787.10 millions during the year-ago

period.A big decline of -35.93% was reported for the quarter ended September 2011 to Rs. 31.20 millions from Rs. 48.70 millions of

corresponding previous quarter.Operating Profit saw a handsome growth to 194.60 millions from 192.10 millions in the quarter ended

September 2011.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Novartis

Quarter ended

Year to Date

201109

201009

Sales

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

2150.7

183

659

1.8

657.2

7.2

650

218.2

-9.8

431.8

1960.4

155.6

601.7

0.6

601.1

5.3

595.8

190.2

-3.9

405.6

Equity

PBIDTM(%)

159.8

30.64

159.8

30.69

% Var

9.71

Year ended

201109

201009

17.61

9.52

200

9.33

35.85

9.1

14.72

151.28

6.46

4128.5

350.4

1223.4

2.6

1220.8

11.5

1209.3

401.8

-13.2

807.5

3732.1

276.4

1081.9

1.2

1080.7

10

1070.7

349.8

-6.3

720.9

0

-0.17

159.8

29.63

159.8

28.99

% Var

10.62

201103

201003

26.77

13.08

116.67

12.96

15

12.94

14.87

109.52

12.01

7460.4

631.9

2215.7

2.8

2212.9

23.8

2189.1

722.4

-2.7

1466.7

6582.3

438.3

1823.7

3.2

1820.5

22.5

1798

638.1

-16.1

1159.9

0

2.22

159.8

29.7

159.8

27.71

% Var

13.34

44.17

21.49

-12.5

21.55

5.78

21.75

13.21

-83.23

26.45

0

7.19

A fair growth of 9.71% in the revenue at Rs. 2150.70 millions was reported in the September 2011 quarter as compared to Rs. 1960.40

millions during year-ago period.Net profit stood at Rs. 431.80 millions compared to Rs. 405.60 millions in the corresponding previous

quarter,high by 6.46%.Operating Profit saw a handsome growth to 659.00 millions from 601.70 millions in the quarter ended September

2011.

BPCL

Quarter ended

Year to Date

201109

201009

Sales

423018.6

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

3787.3

-23160.7

4531.6

-27692.3

4600.4

-32292.7

0

0

-32292.7

Equity

PBIDTM(%)

3615.4

-5.21

Year ended

201109

201009

354347.7

% Var

19.38

201103

201003

696672.9

% Var

26.95

1516251.9

1223598.8

% Var

23.92

884414.7

5335.9

30200.9

2779.8

27421.1

4018.9

23402.2

1980

0

21422.2

-29.02

-176.69

63.02

-200.99

14.47

-237.99

0

0

-250.74

8060.5

-40529.7

7880.8

-48410.5

9501.1

-57911.6

0

0

-57911.6

8544.7

19350.8

5103.3

14247.5

8026.3

6221.2

1980

0

4241.2

-5.67

-309.45

54.43

-439.78

18.37

-1030.88

0

0

-1465.45

16748.4

51688.3

11007.8

40680.5

16554

24126.5

8659.7

0

15466.8

21563.1

46193.2

10109.5

36083.7

12423.2

23660.5

8284.3

0

15376.2

-22.33

11.9

8.89

12.74

33.25

1.97

4.53

0

0.59

3615.4

7.94

0

-165.61

3615.4

-4.58

3615.4

2.78

0

-264.99

3615.4

3.17

3615.4

3.51

0

-9.84

The Revenue for the quarter ended September 2011 of Rs. 423018.60 millions grew by 19.38 % from Rs. 354347.70 millions.The Net Loss

for the quarter ended September 2011 is Rs. -32292.70 millions as compared to Net Profit of Rs. 21422.20 millions of corresponding

quarter ended September 2010Operating profit Margin for the quarter ended September 2011 slipped to -23160.70% as compared to

30200.90% of corresponding quarter ended September 2010.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Jindal Drilling&Inds

Quarter ended

Year to Date

Year ended

201109

201009

201009

201003

2756.2

5228

5263.1

% Var

-0.67

201103

2723.7

% Var

-1.18

201109

Sales

10526

11953.7

% Var

-11.94

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

19.4

405.3

6

399.3

28

371.3

123.6

-1.1

247.7

19.4

362.3

2.6

359.7

27.7

332

110.1

-3.5

221.9

0

11.87

130.77

11.01

1.08

11.84

12.26

-68.57

11.63

39.4

742.9

8

734.9

54.8

680.1

223

-8.3

457.1

38.8

809.2

5.2

804

55.4

748.6

249.4

-6.7

499.2

1.55

-8.19

53.85

-8.59

-1.08

-9.15

-10.59

23.88

-8.43

109.3

1622.1

9.3

1612.8

110.9

1501.9

493.5

-13.3

1008.4

54.4

1420.8

18.7

1402.1

121

1281.1

439.7

16.8

841.4

100.92

14.17

-50.27

15.03

-8.35

17.24

12.24

-179.17

19.85

Equity

PBIDTM(%)

114.7

14.88

114.7

13.14

0

13.2

114.7

14.21

114.7

15.37

0

-7.58

114.7

15.41

114.7

11.89

0

29.65

The revenue declined to Rs. 2723.70 millions for the quarter ended September 2011 as compared to Rs. 2756.20 millions during the

corresponding quarter last year.Modest increase of 11.63% in the Net Profit was reported from. 221.90 millions to Rs. 247.70 millions.The

company reported a good operating profit of 405.30 millions compared to 362.30 millions of corresponding previous quarter.

Century Plyboards(I)

Quarter ended

Year to Date

201109

201009

Sales

2878.46

Other Income

PBIDT

Interest

PBDT

Depreciation

PBT

TAX

Deferred Tax

PAT

7.89

362.15

37.66

117.46

64.39

53.08

-18.05

-0.93

71.13

Year ended

201109

201009

2227.38

% Var

29.23

201103

201003

4242.08

% Var

31.94

9317

7083.29

% Var

31.53

5597.21

13.35

301.52

25.64

275.89

59.65

216.24

-3.08

-7.93

219.32

-40.9

20.11

46.88

-57.43

7.95

-75.45

486.04

-88.27

-67.57

13.66

717.58

63.02

447.53

125.73

321.81

19.41

-7.82

302.4

18.73

573.58

48.13

525.46

106.03

419.43

29.34

-7.66

390.09

-27.07

25.11

30.94

-14.83

18.58

-23.27

-33.84

2.09

-22.48

152.17

1099.47

99.89

999.58

241.76

757.82

12.73

-19.15

745.08

446.48

1261.42

107.49

1153.93

189.16

964.77

155.3

13.47

809.47

-65.92

-12.84

-7.07

-13.38

27.81

-21.45

-91.8

-242.17

-7.95

Equity

222.53

222.53

0

222.53

222.53

0

222.53

222.53

0

-7.14

-5.18

-34.62

PBIDTM(%)

11.74

12.65

12.82

13.52

11.08

16.94

A decent increase of about 29.23% in the sales to Rs. 2878.46 millions was observed for the quarter ended September 2011. The sales figure

stood at Rs. 2227.38 millions during the year-ago period.Profit after Tax for the quarter ended September 2011 saw a decline of -67.57%

from Rs. 219.32 millions to Rs. 71.13 millions.The company reported a good operating profit of 362.15 millions compared to 301.52

millions of corresponding previous quarter.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Results Tracker

Q2FY12

make more, for sure.

Data Source : ACE Equity

NAME

DESIGNATION

Varun Gupta

Head - Research

varungupta@moneysukh.com

Pashupati Nath Jha

Research Analyst

pashupatinathjha@moneysukh.com

Vikram Singh

Research Analyst

vikram_research@moneysukh.com

This report is for the personal information of the authorized recipient and does not construe to be any investment, legal or taxation advice to you.

Mansukh Securities and Finance Ltd (hereinafter referred as MSFL) is not soliciting any action based on it. This report is not for public distribution and

has been furnished to you solely for your information and should not be reproduced or redistributed to any person in any form.

The report is based upon information that we consider reliable, but we do not represent that it is accurate or complete. MSFL or any of its affiliates or

employees shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information

contained in this report. MSFL or any of its affiliates or employees do not provide, at any time, any express or implied warranty of any kind, regarding

any matter pertaining to this report, including without limitation the implied warranties of merchantability, fitness for a particular purpose, and noninfringement. The recipients of this report should rely on their own investigations.

MSFL and/or its affiliates and/or employees may have interests/positions, financial or otherwise in the securities mentioned in this report. This

information is subject to change without any prior notice. MSFL reserves the right to make modifications and alterations to this statement as may be

required from time to time. Nevertheless, MSFL is committed to providing independent and transparent recommendations to its clients, and would be

happy to provide information in response to specific client queries.

Please refer to important disclosures at the end of this report

For Private circulation Only

Mansukh Securities and Finance Ltd

Office: 306, Pratap Bhavan, 5, Bahadur Shah Zafar Marg, New Delhi-110002

Phone: 011-30123450/1/3/5 Fax: 011-30117710 Email: research@moneysukh.com

Website: www.moneysukh.com

For Our Clients Only

SEBI Regn No. BSE: INB010985834 /

NSE: INB230781431

PMS Regn No. INP000002387

Anda mungkin juga menyukai

- Results Tracker: Wednesday, 02 Nov 2011Dokumen8 halamanResults Tracker: Wednesday, 02 Nov 2011Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Thursday, 03 Nov 2011Dokumen6 halamanResults Tracker: Thursday, 03 Nov 2011Mansukh Investment & Trading SolutionsBelum ada peringkat

- Q2FY12 - Results Tracker 28.10.11Dokumen7 halamanQ2FY12 - Results Tracker 28.10.11Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Wednesday, 19 Oct 2011Dokumen6 halamanResults Tracker: Wednesday, 19 Oct 2011Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Tuesday, 25 Oct 2011Dokumen5 halamanResults Tracker: Tuesday, 25 Oct 2011Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Friday, 21 Oct 2011Dokumen8 halamanResults Tracker: Friday, 21 Oct 2011Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Thursday, 26 July 2012Dokumen7 halamanResults Tracker: Thursday, 26 July 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Tuesday, 07 Aug 2012Dokumen7 halamanResults Tracker: Tuesday, 07 Aug 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Tuesday, 18 Oct 2011Dokumen4 halamanResults Tracker: Tuesday, 18 Oct 2011Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Thursday, 02 Aug 2012Dokumen7 halamanResults Tracker: Thursday, 02 Aug 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Thursday, 20 Oct 2011Dokumen6 halamanResults Tracker: Thursday, 20 Oct 2011Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker 22.10.11Dokumen14 halamanResults Tracker 22.10.11Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Wednesday, 08 Aug 2012Dokumen4 halamanResults Tracker: Wednesday, 08 Aug 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Saturday, 14 July 2012Dokumen4 halamanResults Tracker: Saturday, 14 July 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Saturday, 28 July 2012Dokumen13 halamanResults Tracker: Saturday, 28 July 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Tuesday, 24 July 2012Dokumen7 halamanResults Tracker: Tuesday, 24 July 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Saturday, 21 July 2012Dokumen10 halamanResults Tracker: Saturday, 21 July 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Q1FY12 Results Tracker 17th August-Mansukh Investment and TradingDokumen5 halamanQ1FY12 Results Tracker 17th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker: Friday, 20 July 2012Dokumen7 halamanResults Tracker: Friday, 20 July 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Financial Modeling of TCS LockDokumen62 halamanFinancial Modeling of TCS LocksharadkulloliBelum ada peringkat

- Important Highlights of PT Intiland Development Tbk Annual Report 2010Dokumen2 halamanImportant Highlights of PT Intiland Development Tbk Annual Report 2010adityahrcBelum ada peringkat

- Results Tracker: Thursday, 16 Aug 2012Dokumen8 halamanResults Tracker: Thursday, 16 Aug 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Quarterly Results Quarterly Results Q3 FY 2012: The Banker To Every Indian The Banker To Every IndianDokumen44 halamanQuarterly Results Quarterly Results Q3 FY 2012: The Banker To Every Indian The Banker To Every IndianAmreen KhanBelum ada peringkat

- New Listing For PublicationDokumen2 halamanNew Listing For PublicationAathira VenadBelum ada peringkat

- Q2FY12 Results Tracker 13.10.11Dokumen2 halamanQ2FY12 Results Tracker 13.10.11Mansukh Investment & Trading SolutionsBelum ada peringkat

- Audited Financial Results March 2009Dokumen40 halamanAudited Financial Results March 2009Ashwin SwamiBelum ada peringkat

- Results Tracker: Saturday, 04 Aug 2012Dokumen7 halamanResults Tracker: Saturday, 04 Aug 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Consolidated Balance Sheet: As at 31st December, 2011Dokumen21 halamanConsolidated Balance Sheet: As at 31st December, 2011salehin1969Belum ada peringkat

- Oil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)Dokumen16 halamanOil and Natural Gas Corporation Limited (2007 Fortune Most Admired Companies)ravi198522Belum ada peringkat

- Karishma WorkDokumen14 halamanKarishma WorkApoorva MathurBelum ada peringkat

- Press ReleaseDokumen3 halamanPress Releasesat237Belum ada peringkat

- Results Tracker: Tuesday, 15 Nov 2011Dokumen12 halamanResults Tracker: Tuesday, 15 Nov 2011Mansukh Investment & Trading SolutionsBelum ada peringkat

- Six Years Financial SummaryDokumen133 halamanSix Years Financial Summarywaqas_haider_1Belum ada peringkat

- Hosoku e FinalDokumen6 halamanHosoku e FinalSaberSama620Belum ada peringkat

- Lakh RS, Y/e June FY09 FY08 FY07Dokumen10 halamanLakh RS, Y/e June FY09 FY08 FY07gaurav910Belum ada peringkat

- Working Sheet Rahima Food CorporationDokumen8 halamanWorking Sheet Rahima Food CorporationMirza Tasnim NomanBelum ada peringkat

- Atlas Honda LimitedDokumen10 halamanAtlas Honda LimitedUnza TabassumBelum ada peringkat

- HDFC Bank AnnualReport 2012 13Dokumen180 halamanHDFC Bank AnnualReport 2012 13Rohan BahriBelum ada peringkat

- HDFC Bank Capital Computation and Key FinancialsDokumen46 halamanHDFC Bank Capital Computation and Key FinancialsJhonny BoyeeBelum ada peringkat

- Results Tracker: Friday, 03 Aug 2012Dokumen4 halamanResults Tracker: Friday, 03 Aug 2012Mansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker 18 August 2011Dokumen3 halamanResults Tracker 18 August 2011Mansukh Investment & Trading SolutionsBelum ada peringkat

- Q1FY12 Results Tracker 13th August-Mansukh Investment and TradingDokumen16 halamanQ1FY12 Results Tracker 13th August-Mansukh Investment and TradingMansukh Investment & Trading SolutionsBelum ada peringkat

- EIH DataSheetDokumen13 halamanEIH DataSheetTanmay AbhijeetBelum ada peringkat

- Profit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Dokumen11 halamanProfit and Loss Account For The Year Ended March 31, 2010: Column1 Column2Karishma JaisinghaniBelum ada peringkat

- Power Engineering Consulting Firm AnalysisDokumen3 halamanPower Engineering Consulting Firm AnalysishotransangBelum ada peringkat

- CompanyDokumen19 halamanCompanyMark GrayBelum ada peringkat

- CTC - Corporate Update - 10.02.2014Dokumen6 halamanCTC - Corporate Update - 10.02.2014Randora LkBelum ada peringkat

- SR DM 05Dokumen42 halamanSR DM 05Sumit SumanBelum ada peringkat

- KSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutDokumen2 halamanKSE-100 Index Companies (Earnings & Announcements) : Book Closure PayoutInam Ul Haq MinhasBelum ada peringkat

- Competitors in Millions of TL 2012 2011 2010 2009 2008 Iş BankDokumen2 halamanCompetitors in Millions of TL 2012 2011 2010 2009 2008 Iş BankAnum CharaniaBelum ada peringkat

- Financial Management Assignment: MarchDokumen8 halamanFinancial Management Assignment: MarchSurya KiranBelum ada peringkat

- EV CalcDokumen11 halamanEV CalcDeepak KapoorBelum ada peringkat

- Bank DataDokumen9 halamanBank DataAnonymous KvNac2YIkBelum ada peringkat

- Profitability Enhancement Strategy Through Capacity Expansion and Market Export DiversificationDokumen30 halamanProfitability Enhancement Strategy Through Capacity Expansion and Market Export DiversificationAnandita Ade PutriBelum ada peringkat

- AFS Agriculture Sector: by Ankit Chudawala-70 Jason Misquitta-88 Vikas Sarnobat-102 Mayur Sonawane-110 Swapnil Khot-120Dokumen7 halamanAFS Agriculture Sector: by Ankit Chudawala-70 Jason Misquitta-88 Vikas Sarnobat-102 Mayur Sonawane-110 Swapnil Khot-120Mayur SonawaneBelum ada peringkat

- 2009 24446 ArDokumen60 halaman2009 24446 ArnnasikerabuBelum ada peringkat

- Central Bank of India Half-Year Results and InitiativesDokumen27 halamanCentral Bank of India Half-Year Results and InitiativesamritabhosleBelum ada peringkat

- HAL Annual ReportDokumen103 halamanHAL Annual ReportAnirudh A Damani0% (1)

- BhartiAndMTN FinancialsDokumen10 halamanBhartiAndMTN FinancialsGirish RamachandraBelum ada peringkat

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioDari EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioBelum ada peringkat

- Results Tracker 08.11.2013Dokumen3 halamanResults Tracker 08.11.2013Mansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker 09.11.2013Dokumen3 halamanResults Tracker 09.11.2013Mansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 08 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Results Tracker 07.11.2013Dokumen3 halamanResults Tracker 07.11.2013Mansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 07 November 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 07 November 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 07 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 08 November 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 08 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 06 November 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 06 November 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 06 November 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 06 November 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 28 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 31 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 31 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 30 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 31 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 29 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 30 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 30 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 08 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 08 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 25 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 25 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 25 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 28 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 28 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 24 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- F&O Report 04 October 2013 Mansukh Investment and Trading SolutionDokumen5 halamanF&O Report 04 October 2013 Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Derivative 24 October 2013 by Mansukh Investment and Trading SolutionDokumen3 halamanDerivative 24 October 2013 by Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Equity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionDokumen3 halamanEquity Morning Note 23 October 2013-Mansukh Investment and Trading SolutionMansukh Investment & Trading SolutionsBelum ada peringkat

- Dea 5.1 Karta Indramat Manual PDFDokumen132 halamanDea 5.1 Karta Indramat Manual PDFVasileSpireaBelum ada peringkat

- 97.extracting Spread-Spectrum Hidden Data From Digital MediaDokumen5 halaman97.extracting Spread-Spectrum Hidden Data From Digital MediaPonnam Ditendra GoudBelum ada peringkat

- 2021 ZX10R KMDokumen77 halaman2021 ZX10R KMefrain100% (2)

- Tax Invoice: Plot No.E1-E2, Riico Industr-Ial Ajmer Gstin/Uin: 08AACCT2953Q1ZQ State Name: Rajasthan, Code: 08Dokumen1 halamanTax Invoice: Plot No.E1-E2, Riico Industr-Ial Ajmer Gstin/Uin: 08AACCT2953Q1ZQ State Name: Rajasthan, Code: 08SHIV SHAKTI TRUCKSBelum ada peringkat

- Fluid Power Formulas GuideDokumen4 halamanFluid Power Formulas GuidemahaveenBelum ada peringkat

- Allegation of Plagiarism Against Filipino PersonalitiesDokumen2 halamanAllegation of Plagiarism Against Filipino PersonalitiesAlex DabanBelum ada peringkat

- JAIPURIA Recruitment Guide 2013 15Dokumen104 halamanJAIPURIA Recruitment Guide 2013 15Nitish RaiBelum ada peringkat

- G.R. No. 107846 April 18, 1997 LEOVILLO C. AGUSTIN, Petitioner, Court of Appeals and Filinvest Finance Corp., RespondentsDokumen5 halamanG.R. No. 107846 April 18, 1997 LEOVILLO C. AGUSTIN, Petitioner, Court of Appeals and Filinvest Finance Corp., RespondentsLordy Jessah AggabaoBelum ada peringkat

- Lah3701 Compulsory Assignment For 2023 Term 1 FinalDokumen4 halamanLah3701 Compulsory Assignment For 2023 Term 1 FinalHellboundBelum ada peringkat

- What Every Engineer Should Know About Software Engineering, 2nd Edition (Phillip A. Laplante, Mohamad Kassab)Dokumen395 halamanWhat Every Engineer Should Know About Software Engineering, 2nd Edition (Phillip A. Laplante, Mohamad Kassab)ML GoreBelum ada peringkat

- United States v. Sanders, 196 F.2d 895, 10th Cir. (1952)Dokumen4 halamanUnited States v. Sanders, 196 F.2d 895, 10th Cir. (1952)Scribd Government DocsBelum ada peringkat

- ISO/IEC 17021-1 Requirement MatrixDokumen6 halamanISO/IEC 17021-1 Requirement MatrixMohamed Abbas100% (1)

- Key Officers On This ProjectDokumen6 halamanKey Officers On This ProjectNnaa Kalu NtoBelum ada peringkat

- Rowley ReportDokumen242 halamanRowley ReportJames WardBelum ada peringkat

- Graphical Method Linear ProgramDokumen5 halamanGraphical Method Linear ProgramDaleyThomasBelum ada peringkat

- Accreditation at Proficient Teacher ProceduresDokumen23 halamanAccreditation at Proficient Teacher Proceduresapi-420013337Belum ada peringkat

- Either Silent or Switched OffDokumen67 halamanEither Silent or Switched OffPankaj Kumar Singh100% (1)

- RICS New Rules of Detailed MeasurementDokumen6 halamanRICS New Rules of Detailed MeasurementmkjailaniBelum ada peringkat

- Importance of flat filesDokumen52 halamanImportance of flat filesLuiz RamosBelum ada peringkat

- (Prelim 1ST Lesson) Fundamentals in Food Service OperationsDokumen30 halaman(Prelim 1ST Lesson) Fundamentals in Food Service OperationsLiza MaryBelum ada peringkat

- Psoriasis and Dermatitis AtopicDokumen11 halamanPsoriasis and Dermatitis AtopicsayasajaBelum ada peringkat

- The Contemporary World (Reviewer) : Important Terms - Guide DefinitionDokumen4 halamanThe Contemporary World (Reviewer) : Important Terms - Guide DefinitionJoseph M. MarasiganBelum ada peringkat

- Challenges Students Face in Conducting A Literature ReviewDokumen6 halamanChallenges Students Face in Conducting A Literature ReviewafdtunqhoBelum ada peringkat

- Elementary Unit 12bDokumen3 halamanElementary Unit 12bEna Enciso100% (1)

- Term Paper Topics For High School StudentsDokumen6 halamanTerm Paper Topics For High School Studentsafmzwasolldhwb100% (1)

- Programming: Hardware & SoftwareDokumen18 halamanProgramming: Hardware & SoftwaresantoshBelum ada peringkat

- Five Approaches To Organizational DesignDokumen6 halamanFive Approaches To Organizational DesignDolly ParhawkBelum ada peringkat

- 8085 Microprocessor ALP (12 and 13)Dokumen7 halaman8085 Microprocessor ALP (12 and 13)Yogendra KshetriBelum ada peringkat

- In The Chancery Court For Washington County, Tennessee at JonesboroughDokumen9 halamanIn The Chancery Court For Washington County, Tennessee at JonesboroughJessica FullerBelum ada peringkat

- Investor and Analyst Perceptions of Improving Audit Quality with Auditor TenureDokumen28 halamanInvestor and Analyst Perceptions of Improving Audit Quality with Auditor TenureAndersonMonteiroBelum ada peringkat