Customer Mining

Diunggah oleh

Sam Frentzel-BeymeDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Customer Mining

Diunggah oleh

Sam Frentzel-BeymeHak Cipta:

Format Tersedia

NiccL/i ac/NNseN

is an engagement

manager in

McKinseys Hamburg

ofce, sircif kcNic

is a principal in

the Berlin ofce,

and ueNNc v/N

biak is a director

in the Amsterdam

ofce. Copyright

McKinsey &

Company. All rights

reserved.

Customer-Sentiment Mining

Whats All the Buzz About?

nicolai johannsen, birgit knig, menno van dijk

Flippin Awesome Car!

It looks drop dead gorgeous! Performance: best that I have ever

experienced. The handling of the car on winding roads literally

puts a smile on your face. Bi-turbo engine is amazing with plenty

of horsepower and torque. Beautiful interior with leather covering

all surfaces and sport seats that hug you in spirited driving.

www.cargurus.com

Hate the Run Flats

Beautiful car: I get compliments everywhere I go. It handles well,

cruises like nothing else, and gets good mileage. However, I hate

the run at tires. They are hard and noisy and I am paranoid to

take a road trip due to stories I have heard.

www.carreviews.net

Mining the Web

for customer

responses may be

less hazardous to

the health than more

traditional mining

activities, but it can

be just as hard.

H

A

R

R

Y

G

R

U

Y

A

E

R

T

/

M

A

G

N

U

M

P

H

O

T

O

S

8 | the journal of problem solving

customer-sentiment mining | 9

W

ord of mouth has always been an important inuence on

consumer behavior. But now, the asynchronous nature of blogs

and reviews on the Internet lets consumers obtain a profusion

of opinions en masse, without having to converse directly with their peers.

A consumer can review thousands of comments on just about any possible

product whenever he or she needs the information. Today, more than 700

million people worldwide say they use blogs and reviews to make buying

decisions.1 And this group is no longer just teens and twenty-somethings.

According to two major recent surveys, Web usage among those in the

5564 age range is now 75 percent approaching the 91 percent gure for

those 1829.2

What makes online reviews persuasive? Research suggests that the most

trusted source of information about a product or service is a person

like me. A recommendation from fellow consumers tends to beat an

ad with regard to the level of trust inspired.3 When judging whether an

online reviewer is a person like me, people respond to a variety of cues:

language, personal context, expressed preferences, and so on. What makes

a review credible and interesting are these details and items of personal

information specics that an ad cannot replicate rather than the rat-

ing per se.

Online reviews are generally unprompted communications. People write

for fellow consumers, not for a market research agency and not for the man-

ufacturer. And because they are acting on their own initiative rather than,

say, responding to a set of questions on a product or service they only

discuss those features that come to mind. Here then, nally, is a source of

customer insights in which the observer does not inuence the opinions

articulated in any way. It has been a long-standing challenge to marketers

that the context in which interviews, focus groups, and other forms of inter-

active discovery take place biases peoples responses. Online reviews are a

rare case where this seems not to be a problem.

Admittedly, objections have been made to the value of these online

sources. Some ask whether companies are seeding review sites with fake

reviews. There have been isolated cases of companies attempting to create

buzz by paying people to oer apparently objective endorsements. But our

impression is that seeding is rare, because the downside of embarrassment

when such eorts are exposed far exceeds the upside of success. Regular

bloggers appear to be very good at detecting specious posts and are ruthless

about outing them.

A second objection is that the consumers who write detailed reviews

online are not representative. It is probably the case that such reviewers are

deep enthusiasts on the given topic and thus not typical of the enormous

online population. But this is also precisely what makes them credible and

why their opinions spill over into the choices of a much larger audience.

1 World Internet

usage and popula-

tion statistics 2008,

Nielsen online

global consumer

study 2007, Deloitte

& Touche online

marketing report

2007.

2 Forrester Internet

usage report 2008,

Pew/Internet report

2008. Part of what is

driving this develop-

ment is that the bias

in Internet usage

toward those with

more education and

higher incomes is

intensifying. Almost

all households with

a yearly income of

more than $75,000

use the Internet,

whereas only one in

two of those with

an income below

$30,000 is online.

Overall, this skews

usage to a higher age

bracket.

3 Nielsen online

global consumer

study 2007.

10 | the journal of problem solving

Full of information but hard to get at

Online reviews are full of a kind of detail that makes them powerful inu-

encers of consumer behavior. As such, they represent a potential goldmine

to companies. Among other benets, they highlight which of a products

features consumers most often discuss and how the focus of consumer

discussion shifts in response to a new ad campaign.

Customer reviews also identify the pros and cons of a given product

compared with the competition and allow companies to determine how

their R&D eorts pay o from one product or product series to the next.

Unfortunately, however, it is precisely the qualities that make customer

reviews so powerful that also make them hard to mine for the sentiments

they contain. There are usually thousands of posts on any given topic. This

obviously increases the statistical reliability of the information they yield,

but it also means much more data to plough through. Detailed discussions

of which features consumers like and why provide a trove of fantastic infor-

mation but that information is embedded in the prose of endless pages of

online postings. None of this material is available by count; little of it oers

quantitative ratings. There is no simple way to aggregate these opinions, and

reading through thousands of posts would clearly prove impractical.

Various commercial applications are currently available or are being

developed in response. The challenges that these applications try to resolve

include dening which sites provide the greatest wealth of information,

developing topic-specic natural-language algorithms that interpret the

data correctly, and building user interfaces that allow companies to synthe-

size ndings into the results needed for business decisions (rather than an

overload of nice-to-have data charts).

The World Wide

Web offers an

unusual challenge:

so much specic

information, so hard

to aggregate.

R

Y

A

N

M

C

V

A

Y

customer-sentiment mining | 11

A Firm solution

The Firm has developed a response to these obstacles that provides access to

a tool that generates close to 80 percent quality, along with all the data cuts

a team might need and the analysis to go with them. We worked with Bing

Liu, a professor at the University of Chicago, to dene the types of analyses

and the data format we need, as well as mechanisms that allow teams to

input industry and client data. Professor Bing, perhaps the most prominent

gure in the world of customer-sentiment mining, has spent the past ve

years developing algorithms for sentiment classication.

The software crawls the Web, extracts English-language posts, disag-

gregates them into statements about a products individual features, and

determines the sentiment of each statement. A typical analysis generates a

pictorial representation such as that shown in Exhibit 1.4

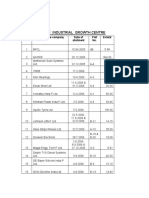

Exhibit 1: Feature comparison of three automobiles

Exhibit 1 oers a comparative analysis of three midsize cars based on a

variety of dierent features. The bars provide the number of counts by

brand and feature. The part of the bar above the line indicates the number

of positive opinions; the part below the line, the negative ones. Clearly

visible are strengths and weaknesses by brand. For instance, the BMW 3

series notches up 300 opinions that it is fun to drive but also garners 60

negative remarks about its tires. More detail on what exactly appears to

be wrong with the tires is accessible by clicking on the column for tires,

which reveals the actual statements underlying the numerical analysis

(Exhibit 2). Another click takes you to a post itself, which allows you to

assess the context in which a given statement was made useful both

for checking the quantitative evaluation and for providing illustrative

quotes for an analysis.

4 The customer-

sentiment research

conducted for this

article was carried

out by a specialized

vendor with which

the Firm has an

exclusive consulting

relationship. It was

not conducted by the

Firm in the context

of client service or

client development.

12 | the journal of problem solving

Exhibit 2: Underlying quotes for negative tires rating

The tool oers several other data cuts. You can assess the overall number

of mentions by feature or by brand, and you can see how posting activity

develops over time in response to new campaigns or new product introduc-

tions. Exhibit 3 plots the relative intensity of positive responses to the intro-

duction of the new BMW 3 series in fall 2007 against positive responses to

the Audi A4.

Exhibit 3: Comparison of positive responses

Finally, as noted, the tool allows for experimentation with dierent cuts of

product data. You can aggregate product information into summary data

about product lines and compare sentiment about dierent product lines

among competitors.

The analysis is fast and cost ecient. A typical analysis requires about

eight working days to compare, say, ten dierent brands or products across

customer-sentiment mining | 13

20 dierent features or categories of features. No traditional brand analysis

we know of can match this level of eciency and eectiveness.

How to proceed

To get started on an analysis of the kind described here, please contact the

MCAPS team at mcaps@mckinsey.com. After discussion to clarify the pre-

cise process that will yield the desired results, the rst step is to determine

whether there are enough information-rich comments on the Web that

cover the area of interest. Review sites usually work better than blogs and

forums. As a rule of thumb, 1,000 posts or more are needed.

The MCAPS team will work with you to identify which URL or URLs

to mine for each brand you need to analyze. We program the software to

crawl the URLs and extract all posts that discuss the brands selected. We

then work together to annotate a group of random sentences from the

resulting data set. This annotation step, which identies attributes or nouns

of interest to the client, is crucial to customizing the algorithm. It generally

takes a few hours and requires a good understanding of the specic product

or market category.

The annotation can be created at any level of aggregation. For one com-

pany, for example, customer service may be suciently precise, whereas

another company may want to dierentiate among call center, warranty,

and after-sales service.

The resulting list of attributes or nouns allows the software algorithm

to tabulate references across the whole data set by category. Because the

software uses a proprietary thesaurus rather than relying on a standard one,

results are properly tailored to individual needs.

Customer-sentiment

mining sorts

and aggregates

communications

rather like the post

ofce does.

C

O

M

S

T

O

C

K

/

C

O

R

B

I

S

14 | the journal of problem solving

The algorithm has been benchmarked as best in class, but it is still dou-

ble-checked manually in an internal editing step. Once this nal quality-

control step is complete, the results are provided online. All the data can be

exported to Excel for further processing, such as cluster analysis or correla-

tion analysis, as well as to facilitate transfer into Think-Cell for presentation

graphically.

W

e are still in the early days of uncovering what customer-sentiment

mining can do. For instance, there is a great deal of work under way

on the analysis of the emotional content of posts, along with many other

applications not discussed here.

Nevertheless, we hope we have provided a gateway to what is, in fact, a

kind of marketers utopia: quick, easy, inexpensive access to an enormous

data set of unbiased input on products.

For further information on this topic, visit:

http://mcaps.intranet.mckinsey.com

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Crane 2Dokumen2 halamanCrane 2ALIRIO NUÑEZBelum ada peringkat

- E1.50 2.00xms en (3c7)Dokumen6 halamanE1.50 2.00xms en (3c7)Tomy Abad AbadBelum ada peringkat

- Account ListDokumen20 halamanAccount ListamrikatBelum ada peringkat

- BMW AG. - The Rover CompanyDokumen2 halamanBMW AG. - The Rover CompanySindhu SinghBelum ada peringkat

- Sipcot Oragadam PDFDokumen3 halamanSipcot Oragadam PDFSK Business group100% (1)

- Product Life Cycle Management: Week 4 Week 4 Topic OutlineDokumen3 halamanProduct Life Cycle Management: Week 4 Week 4 Topic OutlineSartika CahyasariBelum ada peringkat

- Heijunka ThesisDokumen72 halamanHeijunka ThesisIrshad AliBelum ada peringkat

- Mira ES InfoDokumen2 halamanMira ES InfoNasir Masood50% (2)

- Scientific American v100 n03 1909 01 16 PDFDokumen44 halamanScientific American v100 n03 1909 01 16 PDFShreyas SinghBelum ada peringkat

- Auburn Trader - August 14, 2013Dokumen11 halamanAuburn Trader - August 14, 2013GCMediaBelum ada peringkat

- Autoexel - Motor Vehicle Level 3 - Cost CardDokumen2 halamanAutoexel - Motor Vehicle Level 3 - Cost CardDavid TerryBelum ada peringkat

- Honda x8rs Tuning GuideDokumen2 halamanHonda x8rs Tuning GuideCarlos Garrido RegateroBelum ada peringkat

- Off The Road TiresDokumen64 halamanOff The Road TiresJuliusBelum ada peringkat

- A Project Report On Marketing Strategies Followed by Bellad Motors and Its CompetitorsDokumen66 halamanA Project Report On Marketing Strategies Followed by Bellad Motors and Its CompetitorsBabasab Patil (Karrisatte)100% (1)

- 02 S85 EngineDokumen59 halaman02 S85 EngineJohn Hancock100% (1)

- May Jun 2014Dokumen60 halamanMay Jun 2014doyoxer0% (1)

- 2015 Prius C QRGDokumen23 halaman2015 Prius C QRGbuddhikasatBelum ada peringkat

- Lamborghini HuracánEVORWDSpyder AIKBI7 23.03.24Dokumen18 halamanLamborghini HuracánEVORWDSpyder AIKBI7 23.03.24Varun PatilBelum ada peringkat

- Tds Turbine Oil 560 EngDokumen2 halamanTds Turbine Oil 560 EngJerome Cardenas TablacBelum ada peringkat

- ROAD Rear Derailleur: Dealer's ManualDokumen24 halamanROAD Rear Derailleur: Dealer's ManualCBelum ada peringkat

- Recoil USADokumen232 halamanRecoil USADennis Shongi100% (3)

- A VinodDokumen8 halamanA VinodRajan Cheruvathoor RajanBelum ada peringkat

- 460 Mr. Abhijit GadekarDokumen4 halaman460 Mr. Abhijit GadekarAbhishekSengaokarBelum ada peringkat

- SAG Series: Motor GradersDokumen2 halamanSAG Series: Motor GradersBalajiBelum ada peringkat

- TWR - THPDokumen0 halamanTWR - THPduongpndngBelum ada peringkat

- SM - Kymco Vitality 50 - Chapter 05 (Engine Installation)Dokumen11 halamanSM - Kymco Vitality 50 - Chapter 05 (Engine Installation)jose sousa oliveiraBelum ada peringkat

- Juken Technology Limited FY2009 Net Profit Soars To S$1,173,000 From S$46,000 in FY2008 - 230210Dokumen3 halamanJuken Technology Limited FY2009 Net Profit Soars To S$1,173,000 From S$46,000 in FY2008 - 230210WeR1 Consultants Pte LtdBelum ada peringkat

- Chevrolet Competitor AnalysisDokumen3 halamanChevrolet Competitor AnalysisAtul Dureja50% (2)

- IB Question 9 - Sanjay AjayakumarDokumen2 halamanIB Question 9 - Sanjay AjayakumarSanjay K ABelum ada peringkat

- Wrench ProjectDokumen2 halamanWrench Projectapi-246176233Belum ada peringkat