Journal 8

Diunggah oleh

Siv VejayDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Journal 8

Diunggah oleh

Siv VejayHak Cipta:

Format Tersedia

Banking Acquisitions: Acquirer and Target Shareholder Returns Author(s): Walter P. Neely Source: Financial Management, Vol.

16, No. 4 (Winter, 1987), pp. 66-74 Published by: Blackwell Publishing on behalf of the Financial Management Association International Stable URL: http://www.jstor.org/stable/3666110 . Accessed: 20/10/2011 10:18

Your use of the JSTOR archive indicates your acceptance of the Terms & Conditions of Use, available at . http://www.jstor.org/page/info/about/policies/terms.jsp JSTOR is a not-for-profit service that helps scholars, researchers, and students discover, use, and build upon a wide range of content in a trusted digital archive. We use information technology and tools to increase productivity and facilitate new forms of scholarship. For more information about JSTOR, please contact support@jstor.org.

Blackwell Publishing and Financial Management Association International are collaborating with JSTOR to digitize, preserve and extend access to Financial Management.

http://www.jstor.org

Banking Target

Acquisitions: Acquirer

Shareholder

Returns

and

Walter P. Neely

WalterP. Neely is Professor of Finance in the Else School of Management,Millsaps College, Jackson, Mississippi.

of the Therelaxation antitrust enforcement, removal of geographic and barriers, the increasedvolatilityof financialmarketshave contributed an increasein to andacquisitions. addition, failIn the mergers banking ureof theJusticeDepartment the courtsto support and and upholdthe "potential has competitiondoctrine" influencedthe FederalReserve's guidelines for apbankmergers,andmoremergers haveresulted proving Winer[16]). (see Previouslymost bankingmergersand acquisitions of involvedthe acquisition relativelysmallbanksthat hadno publiclytradedstock. However,the increasing numberof large acquisitionsin recentyears now allows the studyof theireffects on publicshareholders.

M

Thispaper examinesthe effects on shareholder returns of merger acquisition or announcements individual for banksand bankholdingcompanies.The stockholder returns matchedbankingacquirers targetsare of and to determine abnormal returns result whether analyzed fromthese announcements.

I. Background

Most studiesof individualbank and bank holding companymergersand acquisitionshave employeda or univariate a multivariate analysis of the financial Frieder Apilado[6] and ratiosof merginginstitutions. an excellent review of the literature bank on provide conclude that holding company acquisitions. They there is insufficientevidence of improvedprofitsor risk; therefore,valuationeffects need to be studied. banksandbankholding (Forconvenience,individual are hereafterreferredto collectively as companies banks.) activSeveralfactorsmakethe studyof acquisition banksdifferentfromthatamongnonfinanity among cial corporations.Banking studies that employ ac66

thanksJanBickerstaff,JosephRein, PutnamStainback,and The author Steve Ezell for valuable research assistance on this project. Beverly Hadawayof the Universityof Texas at Austin, Nikhill Variyaof Southern Methodist University, and Robert Taggart and the reviewers of Financial Management have provided especially helpful comments. Fundingfor this projectwas providedby the Millsaps College Faculty Development Program.

RETURNS NEELY/BANKING ACQUISITIONSAND SHAREHOLDER

67

countingdata use samplebanks, many of which are very small andin which stock is closely held. Larger bankstocksare tradedmoreactively, andmost larger banks' sharesare listed on the OTC market,while a of number mostlymoneycenterbanksharesaretraded on organizedexchanges. However, even nationally OTCtradedmergingbanks'stock price datamay not to merging correspond thatavailablefor nonfinancial firmsbecausetradingvolume in OTCbankingstocks is often light. Anotherdifferenceis the approvalrequiredfrom stateandfederalbankregulatory agencies.Theneeded and the delays depend upon whetherthe approvals the and bankis stateor federallychartered, on whether of staterequiresapproval any bankholdingcompany in merger.The regulatory approvals required banking consummate to acquisitions lengthenthe timerequired mergersof bankscomparedto the time requiredfor firms. mergersof nonfinancial A furtherdifference is the paucity of unfriendly tender offersforbanksrelativeto otherfirms.Banking is a service business, highly dependenton personal contactwhereinunfriendly takeoversmay antagonize bank personneland alienate bank customers.Other offersaretheregureasonsforfewerunfriendly tender of and latoryapprovals required the closely heldnature the stock of many OTC banks. Nonfinancialmergersand acquisitionshave been thoroughly analyzedusing the Fama, Fisher,Jensen, whichisolatesaverandRoll [5] eventstudytechnique model.Jensen fromthe market residuals age abnormal and Ruback[10] reviewedthe evidence of abnormal returns(calculatedwith monthly, weekly, or daily data)for nonfinancial mergersandtenderoffers. They return determined thecumulative abnormal that (CAR) for successfultargetfirmsfromthe announcement date to the outcomedateaverages20.15%for mergersand somewhat higherfor tenderoffers. Moststudiesfound firmsto be very small abnormal returns acquiring for or nearzero. Fourrelevantstudiesuse the eventmethodology for research.The Eisenbeis,Harris,andLakonibanking shok [4] study is important becauseof its use of the residual technique.The studydid not deal with mergers butwiththe effectsof regulatory changeson shareholders'returns.Insteadof using the marketmodel, calculated residua Eisenbeis,Harris,andLakonishok al as a simple (weekly) differencebetweenthe return on a controlindexof stocksandthe actualreturn the on bank.Desai andStover[2] examined abnormal returns of 18 acquiring bankholdingcompanies.Theircontrol

portfoliowas an equally weightedmarketportfolio. date, They testedthreeevent days:the announcement theFederal ReserveBoardapproval date,andthecompletiondate.The announcement andthe day after day andthe two days around werethe approval regulatory abnormal returns. thatevidencedsignificant only days Thesmallpositivereturns reflectpositiveinformation to acquirers' shareholders. andTrifts[14] examined22 banksthatacPettway quiredfailed banksin purchasesarranged federal by Residualswere generated both authorities. regulatory a bankholdingcompanyindex and a value by using weightedNYSE-Amexmarketportfolio.Positiveabnormalreturnswere noted for ten days before the were shownfor fifty days event, andnegativereturns afterthe event. The results suggest that the market does not react positively to acquisitionsof failing banks. Jamesand Wier [9] examined60 bankingacquisitions occurring between 1972 and 1982 to determine the sources of acquirergains. The averageacquirer CARfor days - 1 and0 was 1.07%,andthe CARfor days - 15 to + 15 was 0.81%. They foundthatgains to acquirers positively relatedto the numberof are alternative and to targets negativelyrelated thenumber of potentialbidders. They caution against applying of generalizations theirbankingresultsto nonbanking restrictions covbecauseof the regulatory acquisitions eringbank acquisitions. Some features fromstudiesof nonfinancial mergers shouldalso be noted. Severalsuch studiesexamined the longer time periods surrounding merger event. Mandelker[13] used event methodology to study mergereffects on targetsand acquiringfirms for 40 monthsbefore stockholderapprovalof the merger. abnormal returns were foundfor acquirInsignificant firms. Targetfirms' abnormal returnsdisplayed ing some positive abnormal returns 30 monthswith a for dramatic increase duringthe seven monthspriorto the stockholder date. The abnormal returns were approval for the last five monthswhich statistically significant includedthe announcement date. DoddandRuback[3], Asquith[1], andKeownand Pinkerton ] foundsomeevidenceof positiveabnor[1 mal returnsfor nonfinancialfirms well before the Dodd and Ruback newspaper mergerannouncement. [3] founda positiveCAR of 8.8% for successfultargets for the 12 monthsbeforeannouncement. Asquith [1] found a positive CAR of 13.3% for the 20 days beforepressday for successfultargetfirms.He attributedthese positive abnormal returnsbeforethe press

68

FINANCIAL MANAGEMENT/WINTER 1987

to announcement a leakageof information. Keownand Pinkerton[11] found positive abnormalreturnsof 13.3% for a group of target firms for the 25 days the that preceding announcement. Theyconcluded the useof insideinformation resulted theexcessreturns. in returns Other for explanations the positiveabnormal beforeannouncement includethatof Madden 12] who [ found a positive abnormalreturnof 5.8% for one monthand a positiveCAR for severalmonthsbefore the filing of 13-D statements,which indicatea purchaseby some investorof at least5%of the sharesof a firm. Harrisand Risk [7] examinedpublicannouncementof 13-D filings andfoundevidenceof abnormal returnsof 2.5% for one week before announcement. The acquiring firmstend to engage in stock purchase of programs priorto publicannouncement theirintentions to acquire.Madden[12] concludedthatbuying returns couldproduce pressure prior positiveabnormal to announcement stock acquisition. of Asquith[1] examinedreturnsfor 480 days before the 240 days after announcement acquirersand for for returns targets targets.He foundpositiveabnormal before announcement and for the period after announcement before the outcomedate. The postbut announcement returns frominformation resulted about the ultimatesuccess of the mergerbid accordingto Asquith.In some cases, bids for targetsare raisedin to or response otheracquirers, bidsareraisedto satisfy management oppositionto the initialbid. Bankingreturnsfollowing announcement may be of affectedby the approvals required stateandfederal conexamineantitrust regulators. Bankingregulators cerns as well as other public interestfactorssuch as communityconvenience, financial and managerial strength,and operatingefficiency of separateversus combined banks.Desai andStover[2] founda slightly positive impacton acquirers'CAR on the regulatory approval date, but only at the 10% level of significance. Anotherfactor that may affect bankingabnormal returns the type of bankingorganization, is i.e., bank or individualbank. Most holding company (BHC) public banking acquisitionsinvolve BHCs because BHCstendto be largerthanindividual banks.Banking activitiesare defined as takingdemanddepositsand loans. A BHC may engagein remakingcommercial lated activitiesnecessaryto carryon the activitiesof banking,for example,mortgage bankingandleasing. BHCshave proliferated statesthatcontrolbranchin ing, because multibankholding companiesmay be able to achievenumerous offices in statesthatdo not

allow branching. Whiletherearedifferencesbetween individual banksandBHCs,bothtypesof organization allow for the practiceof banking.Therehave been no studies of differencesbetween individualbank and BHC acquisition returns. Sincenonfinancial firmshaveevidencedsignificant abnormal returnsboth before and after merger announcements,it is naturalto ask if similar returns occurin banking.Thinlytradedsecurities,like many OTCbankstocks,may show these effects in exaggerated form. The returneffects of banking(including banksandBHCs)acquisition regulatory and approval announcements bothtargetsandacquirers anafor are in this paperto examinelongertermeffects that lyzed have not previouslybeen studied.The aim is to describestock marketreactionto acquisition announcements for predominantly OTC traded banking acquirers and successful targets of mergers and acquisitions.

II. Data

The sampleincludes26 successfullyacquiredand acquiringbankingfirms for the 1979 throughearly 1985period.Five of the targetbanking firmsareorganizedas banksand21 arebankholdingcompanies.All the acquirersare bank holding companies.Included firmslistedon areOTClistedbanksas well as banking and are exchanges.The mergers acquisitions' listedin

various issues of Mergers and Acquisitions. To be

includedin the sample,acquiring acquired and banks' stockpriceshadto be publiclyreported at least 120 for weeks before the announcement. Targetssubjectto withinan acquisition analysispemultiple acquisitions riodarenot included.No forcedor regulatory mergers met areincluded.Twenty-sixacquisitions thesequalificationsand comprisethe sample. The announcement dateswereverifiedby examination of news reportsfrom the Wall Street Journal Index and the New York Times Index. When there are com-

bid petingbidsfortargets,the earlier dateis used. The date of the mergeris the last tradingdate completion for the stock. This date was verifiedby news reports

from the Wall Street Journal Index. The regulatory approval date was found for 18 of the 26 acquisitions from reports in The Wall Street Journal Index. Of the 26 acquirers, 24 were initially traded on the national OTC market and two were tradedon the New York Stock Exchange. One of the OTC banks was later

'Nineteen targets were acquired and seven were merged. From this will point, the term"acquisition" referto both mergersandacquisitions.

NEELY/BANKING RETURNS ACQUISITIONSAND SHAREHOLDER

69

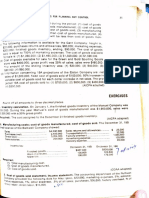

Exhibit 1. Characteristics the Acquirers Tarof and gets

Acquirers Targets

of 8j = the slopecoefficient,a measure systematic risk. ej,is the residual. Positive(negative)residuals wouldindicatea return return higher(lower)thanexpected,i.e., an abnormal (AR). The measureof the marketportfolio, is a Rmt, bankstockreturn index.Thebankreturn indexis comfrom the posed of the OTC Bank MarketIndicators dividend and yield fromthe Standard Poors'Analysts' Handbookfor banks outside New York City. This bankstock returnindex is constructed becausethere are no readilyavailablemeasuresof total returnsof bank stocks. The bankingindex should remove any effects of changesin the underlying return generation mechanism to changesin law andregulatory due structureover the periodstudied.2 The abnormal returns,e,,, based on an estimation banksto produce aged acrossN targetand acquiring and the averageresidualsfor averageresiduals,AR,, each week, t, may be summedto form cumulative averageresiduals,CAR.3The cumulative averageresidualis calculatedfor each week - 10 to + 30 with week 0 the week of acquisition announcement. a For separate analysisof regulatory effects, week approval 0 is re-designated theregulatory as week. The approval same estimationperiodis used, however, to exclude announcement effects. acquisition

period from week - 119 throughweek - 11, are averStandard and Poors' Daily Stock Price Index plus a

Mean AssetSize(mil.) $10,164 $119,995 Largest Smallest $653 Standard Deviation Asset of Size $22,511 (mil.) Index Coefficients: Banking Beta Median 1.21 Mean 1.16

$1,629 $10,028 $189 $1,974 0.76 0.80

listed on the AmericanStock Exchange,and another was subsequently listedon a regionalexchangeduring of the analysisperiod. The acquiringand target part banks'weekly closing bid prices were obtainedfrom

the Standard and Poors' Daily Stock Price Index or

fromnewspapers the periodof 120 weeks priorto for the announcement the acquisition.Post-announceof mentdatawereobtained the of through completion the stock returns (including diviacquisition. Weekly for firms. dends)arecalculated the sampleof banking A description the bankingfirmsis shownin Exof hibit 1. The sampleincludespubliclytradedacquirers andtheirpubliclytradedtargets.The ratioof acquirer to targetasset size is smallerthanfor studiesthatinclude only acquirers. The requirement targetsbe that publiclytradedmeansthatthe targetsare largerthan fortheaverage bankacquisition. meanbetacoeffiThe cient of the acquirersis greaterthan one, while the targets'beta is less thanone on average.These beta coefficientsarecalculated each acquirer target for and beforethe effects of the acquisition.It is likely thatan acquirer'sbeta coefficient will change following a as largeacquisition shownin Swary[15]. Swaryconsideredreturns mortgagefirm acquirers over a of for year after regulatoryapproval.In this research,the post-acquisition periodis not evaluated.

IV. Results

A. Acquirers The effects of acquisitionannouncements acon stockreturns shownin Exhibit2. For the are quirers' sampleof 26 bankingfirms, the significant(positive andnegative)abnormal returns for appear weeks - 10 0 (negative),and for week + 2 (positive). (positive), The CAR has a positive trendfor the entire41 week period,butthe CAR is significant only for weeks + 1 week abnormal rethrough+ 2.4 The announcement turnis negative,at - 1.23 percent,but the following

2Anoverallvalue weightedmarketindexof returnswas tested. It did not describe the bank returnsas well as the bank index. 3The statisticaltest is similar to tests used by Hite and Owers [8] (pp. 418-419 and footnote 14). 4The levels and timing of abnormalreturnsfrom the bank index are similar to those of the overall marketindex (not shown) for both acquirersand targets.

Ill. Methodology

The stockreturn is performance examinedwith the marketmodel: following

Rjt = aj + PjRmt+ ejt

where Rjt = rateof returnon securityj over periodt; on = rateof return a market portfoliooverperiRmt aj od t; = the intercept;

70

FINANCIAL 1987 MANAGEMENT/WINTER

Residualsfrom Week - 10 through Exhibit 2. Acquirers'Percentage Week + 30

All Banking FirmAcquisitions AR Week Number CAR - 10 -9 -8 -7 -6 -5 -4 -3 -2 - 1 0 1 2 3 4 5 6 7 8 9 10 20 30 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 25 24 21 0.76* -0.12 0.59 -0.51 -0.52 0.97 -0.25 0.19 0.82 0.55 - 1.23* 0.67 0.90* 0.23 0.11 -0.50 -0.78 -0.46 0.72 0.51 0.47 -0.57 -0.55 0.76 0.64 1.23 0.72 0.20 1.17 0.92 1.11 1.93 2.48 1.25 1.92a 2.82a 3.05 3.16 2.66 1.88 1.42 2.14 2.65 3.12 0.72 0.63 of Acquisitions BHCS Number AR CAR 21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 20 19 17 1.33** -0.02 0.51 -0.42 -0.90 1.12 -0.12 0.25 1.13* 0.71 - 1.75** 0.70 1.10* 0.37 -0.04 0.22 -0.58 0.49 0.35 0.27 0.45 -0.22 -0.34 1.33 1.31 1.82 1.40 0.50 1.62 1.50 1.75 2.88 3.59 1.84 2.54a 3.64a 4.01 3.97 4.19 3.61 4.10 4.45 4.72 5.17 3.53 5.21 of Banks Acquisitions Individual Number AR CAR 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 4 -1.65 - 0.54* 0.95** -0.92** 1.03* 0.36 -0.79 -0.09 -0.49 -0.11"* 0.93** 0.53 0.05 -0.36 0.73* -3.50 - 1.64 -4.20 2.30 1.53 0.52 -1.91 - 1.45 -1.65 -2.19 -1.24 -2.16 -1.13 -0.77 -1.56 - 1.65 -2.14 -2.25 -1.32 -0.79 -0.74 -1.10 -0.37 -3.87 -5.51 -9.71 -7.41 -5.88 -5.36 - 10.73 -17.89

*ARsignificant the .05 level (twotailedtest). at **ARsignificant the .01 level (two tailedtest). at aCARsignificant at the .05 level (two tailed test) for week + 1 throughweek + 2.

two weeks are sufficientlypositive to make up the announcement week losses. There appearsto be no return the acquirers theperiodcoverfor for significant the acquisition announcement the subsequent ing plus two weeks. These resultsare consistentwith findingsfrom the nonfinancial The mergerliterature. averageof the results of these studies shows small positive abnormal returns tenderoffers and no abnormal for returnsfor of nonfinancial firms. Research nonfinanon mergers cial acquirers shown very small to no abnormal has returns the acquisitionannouncement at date. The Desai and Stover [2] study of bank holding foundsmall positive abnormal recompanyacquirers date and one day later. turnson the announcement JamesandWier[9] founda CARof 1.77%for the five of days leadingto the announcement the acquisition. The presentstudy shows slightlypositive cumulative returnsfor the 41 week period, and for the weeks

The announcement. negativereturndursurrounding week conflicts with resultsof the announcement ing the Desai andStoverandthe JamesandWierstudies. There are some differencesaccordingto type of acquired,i.e., BHC or individbankingorganization ual bank. All of the acquirers BHCs. The small are bankacquisitions makes of onlyfive individual sample to inferencetenuous,but it is interesting exploreany differencesaccordingto organization type. Thereare four weeks of significantreturns(threepositive and of one negative)for the 21 acquirers BHCs. Thereare two weeks of positive and no negativesignificantreturnsfor acquirers banks. of to trendof returns the cumulative However, appears be positive for BHC acquirers,and negativefor acquirersof individualbanks. A test of differencesin CAR from announcement week + 10 and to week to + 30 indicates a significantdifferencebetween the CARsof banksandBHCs(z = 1.98 forweek0 through

RETURNS ACQUISITIONSAND SHAREHOLDER NEELY/BANKING

71

Week + 30 for All BankingFirms,Individual ResidualsfromWeek - 10 through Exhibit 3. Targets'Percentage Banks, and BHCs

Week Number FirmTargets All Banking AR CAR Number BHCTargets AR CAR Individual BankTargets AR Number CAR

- 10 -9

-8 -7 -6 -5 -4 -3 -2 - 1 0 1 2 3 4 5 6 7 8 9 10 20 30

26 26

26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 26 25 24 21

0.23 1.47

0.29 2.03** -0.52 1.80* 2.54 0.07 3.31** 5.14** 15.04** 0.87** 0.35 -0.01 -0.10 1.21* --0.22 0.20 0.81 1.95** -0.10 -0.39 0.27

0.23 1.70

1.99 4.02a 3.50a 5.30a 7.84a 7.91a 11.22a 16.36a 31.26a

32.13ab

21 21

21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 21 20 19 17

0.45 0.12

-0.16 1.82* - 1.17 1.38* 1.36 - 0.26 4.52** 5.00** 16.95** 1.03 0.17 0.18 -0.25 1.24 --0.11 0.46 0.66 2.29 0.20 -0.06 0.44

0.45 0.57

0.41 2.23 1.06 2.44 3.80 3.54 8.06 13.06 30.01 31.04 31.21 31.39 31.14 32.38 32.27 32.73 33.39 35.68 35.88 36.72 40.22

5 5

5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 5 4

-0.68 7.17*

2.19** 2.90** 2.20* 3.60 7.50 1.46 1.77 5.78** 6.99** 0.20 1.15 --0.80 0.52* 1.08 --0.69 --0.90 1.43 0.53 - 1.26 - 1.67 -0.46

-0.68 6.49

8.68 11.58 13.78 17.38 24.88 26.34 28.11 33.89 40.88 41.08 42.23 41.43 41.95 43.03 42.34 41.44 42.87 43.40 42.14 34.19 34.69

32.48ab 32.47ab 32.37ab 33.58ab 33.36a 33.56a 34.37a 36.32a 36.22a 36.15 38.24

*ARsignificant the .05 level (two tailedtest). at **ARsignificant the .01 level (two tailedtest). at aCARsignificant at the .01 level (two tailed test) for week -7 throughweek 10. bCARsignificant at the .01 level (two tailed test) for week 1 throughweek 5.

to do week + 10).5Overall,returns acquirers not apto be significantlydifferentfrom zero, although pear theremaybe somepositivetrendin returns, particularof ly for acquirers BHCs. of Thetrendof the CARafterthe announcement the of for the 18 acquirers BHCs and for the acquisition, entire sample, is slightly positive. The cause of the positiveCAR may be relatedto news such as regulafor The return regulatoryapproval. averageabnormal of date for acquirers - 1.06% is announcement tory differentfromzero (z = - 2.26). For the significantly threeweek period(- 1, 0, + 1) surrounding regulathe toryapproval CARof - 0.85%is not significantly different fromzero (z = - 1.32). Regulatory approval or to convey unimportant even slightlynegaappears

for tive information acquirers' shareholders as acjust announcement quisition appearto have very little effect on acquiringshareholders' returns. B. Targets The target firms' abnormalreturnsare shown in Exhibit Therearelargepositiveabnormal 3. for returns the entire sample of banking firms during the announcement week and duringthe weeks before and afterannouncement. abnormal The returns statistiare for pre-announcement weeks - 7, cally significant - 5, - 2, and - 1, forthe announcement week, 0, and for post-announcement + 1, + 5, and + 9. The weeks announcement weekreturn 15.04%.Thecumulative is abnormal return weeks - 1 and - 2 is 8.45%, and for the week + 1 abnormalreturnis 0.87%. The CAR from week -7 throughweek + 10 is significantly differentfrom zero at the .01 level. There are significantcumulativereturnsof over

from two test in 5The of differences CARassumes samples independent normal variance. populations havingthe sameunknown

72

FINANCIAL MANAGEMENT/WINTER 1987

15.1% for the seven weeks before newspaperannouncement.A likely cause of many of the pre-announcement abnormal returnsis the buying pressure created purchases targetstockby acquirers of by prior to publicannouncement the bid. Information of leakageby insiders mayhaveplayeda rolein the abnormal returns.If information leaked, this does not mean is thatinformation aboutall of the acquisitions leaked. is Information abouta few mergersmay be leaked and this could cause the CAR for the entiresampleto be announcement.6 positivebefore the newspaper The announcement week abnormal return is 15.04%.Forthe fourweekspriorto the announcement week the CAR is 11.06%.The week -4 through announcement CARis 26.10%,whichcorresponds the to averageabnormalreturnsfor one month announcement effects of 15.90%for mergersand 29.09% for tenderoffers reported Jensenand Ruback[10] for by successfultargetsof nonfinancial mergers. Forthe periodafterannouncement, targetCAR the is a statistically 20%for the announcement significant week 0 through week + 10. Progresstowardcompletion of the acquisitionshould cause the CAR to increase. By week + 30, 5 of the 26 acquisitionshad been completed.Althoughnot shown, the CAR continuesto grow for the remaining targetsas regulatory occursand as they approach consummation approval of theacquisition. lengthof timeto consummation The (a medianof 33 weeks) is greaterthan that of most nonfinancial mergers. is Forbankingfirms, regulatory approval moreuncertain thanfor nonfinancial firms,whicharein many cases, not subjectto regulation.For bankingfirms, therefore,regulatory approvalcould producesignificant abnormal returnsfor targets. However, the tarof return announcement regulatory on gets' abnormal week)is not (of approval 0.63%for the announcement differentfromzero (z = .042). The CAR significantly of 1.79%is not significantly different fromzeroforthe threeweekperiod, - 1,0, and + 1 (z = 0.68). Eightof the 18 abnormal returnsfor the approvalannouncementweek are negative, while the other 10 are positive. The largestapproval announcement week abnor6Anotherpotential cause of pre-announcementreturns is regulatory change. However, that does not appearto be the case in the current sample. For example, six of the acquisitionsoccurredin Pennsylvania duringthe studyperiodduringwhich there was a change in a statuteto allow expansionof BHCs. The 20 non-Pennsylvania targetsdisplayed the samepre-announcement returnpatternas did the full sampleof 26. It appearsthat the regulatorychange was anticipatedwell before the acquisitions were announced.

malreturn any singletargetbanking for firmis 12.8%. can Regulatory approval cause highly positiveabnormal returnsfor individualcases. In other cases, approval appearsto be discountedby the market.On does not appear affect to average,regulatory approval the CARof targetsduring threeweeks surrounding the announcement. regulatory In two cases, increasedbid prices by alternative biddersappearto be the cause of the positive target CARs afterannouncement. These additional bids occurred the two weeks followingthe acquisition during announcement the initial bidders. The abnormal by returns the during two weeks followingannouncement areaffectedby the increased of thesetwo bidders. bids The abnormal returns weeks + 3 to + 30 are not for affectedby the increasedbid prices. Thereare some differencesbetweenthe patterns of returns BHC targetsand individual of banktargetsas shown in Exhibit 3. BHC targetsdisplay abnormal returns similar thoseof all banking to firms,since21 of the 26 targets are BHCs. The announcement week abnormal return 16.95%for BHCtargetscompared is to 6.99% for individualbank targets. The CAR for week - 10through is week0 for BHCtargets 30.01%, and by week + 30 the 41 week CAR is 40.22%. The abnormalreturnsfor individualbank targets to appear occurduringthe 10 weeks beforeannouncement and duringthe announcement week. The five are targetbanks'returns significantly positive during weeks -9 through -6, with less impactduringthe announcement week. Insidertrading,buyingpressure on the target stock, and regulatorychanges are the kindsof factorsthatarecapableof causingthese preNo announcement abnormal returns. publicannouncementsduringthis periodexplainthis return behavior. Thereappears be a declinefromweek + 10 to week to + 20 in theCARof targets areorganized banks, that as the although reasonis not clear. Since the sampleof targetbanksis so small,conclusionsabouttheirreturn behaviorare premature. Overall,the 41 week CARs for individual banksandfor BHCsare similarto each other,andtheyaresimilarto the CARsof nonfinancial targets.

V. Summary and Conclusions

Acquisitions appearto affect bankingshareholders to the way they affect nonfinancialfirms, similarly for returns except in a few respects. Small abnormal bothacquirers targetsoccuras earlyas 10 weeks and and 7 weeks, respectively,before public announcementof bankacquisitions.For the two weeks before

RETURNS NEELY/BANKING ACQUISITIONSAND SHAREHOLDER

73

is announcement targetreturn over9%.Theearlier the thanexpectedabnormal returns may be due to a leakof acquisitioninformation,to buying pressure age causedby earlypurchases targetstockby theacquirof imor to otherfactors such as anticipated ing bank, in operationsor regulatorychanges, alprovements though no public announcementsappear to have affectedreturns. The targetbankingfirms in this sample are large to compared typicaltargetbanksbecausetheyarepubto traded.However,compared mostnonfinancial licly the targetsaresmallandthey genstudies, acquisition erally exhibit light tradingvolume as they are often makeit morelikelythat closelyheld. Theseconditions leakages acquirer buyingpressureand/orinformation returns priorto publicannouncemay causeabnormal mentof an acquisition. occurfortargetsduring returns Verylargeabnormal return the announcement week. The large abnormal week is followed by a sigduringthe announcement nificantreturn week + 1, andthereis a smallposifor tive cumulativeabnormal returnfor ten weeks after driftin to announcement. Thereappears be an upward returnsduringthe period between targets'abnormal as and announcement consummation theeventsunfold the of thatleadto completion the acquisition, although to eventdoes not appear affectthe regulatory approval abnormal returnsof targets. Acquirers'returnsare slightly negativeduringthe announcement week, but the CAR for the acquisition is two weeks following announcement slightly positive. A similarpattern returns of resultsfromthe reguannouncement. Neitherevent appears latoryapproval to cause significanteffects on acquirer returns. Future shouldcenteron the reasonsacquirresearch ing bankingfirms engage in mergerand acquisition. on Research targetandacquiring banksshouldfurther the extentandthe causes of abnormal returns explore of beforeand afterthe announcement an acquisition. Anothertopic deservingfutureattentionis the BHC responseto acquisitionannouncements comparedto thatof an individualbank.

References

1. P. Asquith, "MergerBids, Uncertainty,and Stockholder

Returns,"Journal of Financial Economics (April 1983), pp. 51-83. 2. A. S. Desai and R. D. Stover, "Bank Holding Company Acquisitions, StockholderReturnsand RegulatoryUncertainty," Journal of Financial Research (Summer 1985), pp. 145-156. 3. P. Dodd and J. B. Warner,"OnCorporateGovernance:A Studyof Proxy Contests,"Journal of Financial Economics (April 1983), pp. 401-438. 4. R. A. Eisenbeis, R. S. HarrisandJ. Lakonishok,"Benefits of Bank Diversification:The Evidence from Shareholder Returns,"Journal of Finance (July 1984), pp. 881-892. 5. E. F. Fama, L. Fisher, M. C. Jensen and R. Roll, "The InternaAdjustmentof Stock Prices to New Information," tional Economic Review (February1969), pp. 1-21. 6. L. A. FriederandV. P. Apilado, "BankHoldingCompany Research:Classification, Synthesis, and New Directions," Journal of Bank Research (Summer 1982), pp. 80-95. 7. R. S. Harrisand J. L. Risk, "ToeholdAcquisitionsin U. S. An Corporations: Examinationof Stock Returns,"prelimidraftat the 1983 meetingof the FinancialManagement nary Association, Atlanta, GA, 1983. 8. G. L. Hite and J. Owers, "SecurityPriceReactionsAround Journal of Financial Corporate Spinoff Announcements," Economics (December 1983), pp. 409-436. 9. C. JamesandP. Wier, "Returns Acquirersand Competito tion in the Acquisition Market: The Case of Banking," Journal of Political Economy (April 1987), pp. 355-370. 10. M. C. Jensen and R. S. Ruback, "The Marketfor Corporate Control, the Scientific Evidence," Journal of Financial Economics (April 1983), pp. 5-50. 11. A. J. Keown and J. M. Pinkerton, "MergerAnnouncements and InsiderTradingActivity: An EmpiricalInvestigation," Journal of Finance (September 1981), pp. 855-869. 12. G. P. Madden,"Potential TakeoversandMarket Corporate Efficiency:A Note,"JournalofFinance (December1981), pp. 1191-1197. 13. G. Mandelker, "Risk and Return:The Case of Merging Firms,"JournalofFinancial Economics(December1974), pp. 303-335. 14. R. H. Pettwayand J. W. Trifts, "Do Banks OverbidWhen Acquiring Failed Banks?"Financial Management (Summer 1985), pp. 5-15. 15. I. Swary, "Bank Acquisitions of Mortgage Firms and ShareholderWealth: An EmpiricalAnalysis," Journal of Banking and Finance (June 1981), pp. 201-215. 16. A. S. Winer, "Applying the Theory of Probable Future FederalReserveBulletin(September1982), Competition," pp. 527-533.

74

FINANCIAL 1987 MANAGEMENT/WINTER

Appendix. List of Acquirersand Targets Acquirer SoutheastBanking Target

Appendix. List of Acquirersand Targets Acquirer MellonNationalCorp. NationalCorp. Philadelphia Target

FirstBankshares of Florida FloridaBankshares FlagshipBanks ShawmutCorp. Worchester Bancorp BarnettBanksof Florida First State Bank Hartford NationalCorp. Connecticut National Bank Allied Bancshares LakewoodBank & TrustCo. NationalBankshares New Virginia Virginia Bancorp Union Commerce Bankshares Huntington Corp. CBT Corp. State National Bancorp NationalCorp. Provident National Pittsburg Corp. Interfirst FirstUnited Corp. Bancorporation NCNB Corp. ExchangeBancorp ThirdNationalCorp. AncorpBancshares

GirardCorp. NationalCentral FinancialCorp. Fidelcore SoutheastNational of Bankshares Pennsylvania AmericanBancorp Central Pennsylvania NationalCorp. NorstarBancorp Northeast Bancshares Association FirstNationalState Bancorp FirstNationalBank of New Jersey SeafirstCorp. Bankamerica Corp. Midatlantic Banks Greater JerseyBanks Bank of the Comercia Commonwealth Commerce Bankshares CountyTower Corp. FloridaCoast Bank BarnettBanksof Florida Northeastern PNC FinancialCorp. Bancorp Charter BoatmansBankshares Corp.

ARESANNUALMEETING

will Real of Annual TheFourth Society(ARES) be heldApril13-16, 1988in Meeting theAmerican Estate interested detailsandfurther For San Francisco. program information, personsshouldcontact: Theron Nelson R. of Business College Dept. of Management of University NorthDakota Grand Forks,ND 58202-5085 (701) 777-3631

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Law Express Company Law 4th Edition PDFDokumen185 halamanLaw Express Company Law 4th Edition PDFeffa100% (1)

- ACC501-Short Notes Lec 23-45Dokumen39 halamanACC501-Short Notes Lec 23-45dani73% (11)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Module 9 - Substantive Proc - Class Q - 23 JulyDokumen47 halamanModule 9 - Substantive Proc - Class Q - 23 JulyLindiweBelum ada peringkat

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Dokumen4 halamanPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Jayr BV100% (1)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Midterm Quiz 104Dokumen8 halamanMidterm Quiz 104Sky SoronoiBelum ada peringkat

- Financial Analysis of Unilever PakistanDokumen7 halamanFinancial Analysis of Unilever Pakistanzainab malikBelum ada peringkat

- Chapter 11 - She Part 2Dokumen4 halamanChapter 11 - She Part 2XienaBelum ada peringkat

- Bus 145 Assignment 2Dokumen18 halamanBus 145 Assignment 2Urvashi AroraBelum ada peringkat

- Maharashtra LLPDokumen139 halamanMaharashtra LLPindusingh6880Belum ada peringkat

- SIFMA Capital Markets Fact Book - 2020 DataDokumen186 halamanSIFMA Capital Markets Fact Book - 2020 DataÂn TrầnBelum ada peringkat

- Total Death Benefit Under SRS Vitality Protect: 2,00,00,000Dokumen6 halamanTotal Death Benefit Under SRS Vitality Protect: 2,00,00,000Anvi MahajanBelum ada peringkat

- Notes On Group Financial Statements 18th Ed FullDokumen533 halamanNotes On Group Financial Statements 18th Ed FullVeron Govender100% (1)

- The Booboo Division: Sample Problems On Financial RatiosDokumen2 halamanThe Booboo Division: Sample Problems On Financial RatiosBryan BallesterosBelum ada peringkat

- The Karur Vysya Bank Limited: OfkeDokumen6 halamanThe Karur Vysya Bank Limited: OfkejigarchhatrolaBelum ada peringkat

- Fulbari - 6 Kavre: Cash Flow StatementDokumen21 halamanFulbari - 6 Kavre: Cash Flow StatementSudeep RegmiBelum ada peringkat

- Cash and Marketable Securities ManagementDokumen12 halamanCash and Marketable Securities ManagementAlexandra TagleBelum ada peringkat

- This Study Resource Was: BS Accountancy ISAP Chapter Practical Accounting 1 ReviewerDokumen9 halamanThis Study Resource Was: BS Accountancy ISAP Chapter Practical Accounting 1 ReviewerDes BalinoBelum ada peringkat

- Fin Model Class4 Step1 Step2 Frozen Catfish Cash Flow Analysis HomeworkDokumen6 halamanFin Model Class4 Step1 Step2 Frozen Catfish Cash Flow Analysis HomeworkGel viraBelum ada peringkat

- Becker Exam ReviewDokumen2 halamanBecker Exam ReviewPetraBelum ada peringkat

- Accenture PLC Memorandum and Articles of AssociationDokumen51 halamanAccenture PLC Memorandum and Articles of AssociationdollywaghBelum ada peringkat

- Udin GuidelinesDokumen3 halamanUdin GuidelinesVandanaBelum ada peringkat

- Apollo Global Management LLC 2013 Form 10KDokumen720 halamanApollo Global Management LLC 2013 Form 10KsmieherBelum ada peringkat

- ACCT 3110 CH 4 Homework E 2 9 10 P 5 6Dokumen7 halamanACCT 3110 CH 4 Homework E 2 9 10 P 5 6John JobBelum ada peringkat

- Solution Manual For Horngrens Accounting 11th Edition Miller Nobles 013385678X 9780133856781Dokumen71 halamanSolution Manual For Horngrens Accounting 11th Edition Miller Nobles 013385678X 9780133856781michaelBelum ada peringkat

- Islamic Finance & ACCA-KPMG PDFDokumen24 halamanIslamic Finance & ACCA-KPMG PDFqasimgreenBelum ada peringkat

- Corporate Valuation of Saas Companies: A Case Study Of: ISM International School of Management, Paris, FranceDokumen15 halamanCorporate Valuation of Saas Companies: A Case Study Of: ISM International School of Management, Paris, FranceМаксим ЧернышевBelum ada peringkat

- Financial and Corporate ReportingDokumen257 halamanFinancial and Corporate Reportinganon_636625652100% (1)

- CC and CSDokumen45 halamanCC and CSIsaack MgeniBelum ada peringkat

- Company: ManufacturingDokumen8 halamanCompany: Manufacturingzain khalidBelum ada peringkat

- Kelompok 4 BI (Tampil) - Ch19 Ch20Dokumen37 halamanKelompok 4 BI (Tampil) - Ch19 Ch20iyudBelum ada peringkat