Punjab National Bank Result Updated

Diunggah oleh

Angel BrokingDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Punjab National Bank Result Updated

Diunggah oleh

Angel BrokingHak Cipta:

Format Tersedia

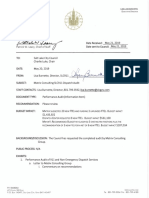

2QFY2012 Result Update | Banking

November 2, 2011

Punjab National Bank

Performance Highlights

Particulars (` cr) NII Pre-prov. profit PAT

Source: Company, Angel Research

ACCUMULATE

CMP Target Price

% chg (qoq) 10.8 2.2 9.0 2QFY11 2,977 2,100 1,075 % chg (yoy) 16.0 20.4 12.1

`979 `1,106

12 Months

2QFY12 3,453 2,528 1,205

1QFY12 3,115 2,474 1,105

Investment Period

Stock Info Sector Market Cap (` cr) Beta 52 Week High / Low Avg. Daily Volume Face Value (`) BSE Sensex Nifty Reuters Code Bloomberg Code

Banking 31,000 0.9 1,395/872 35,559 10 17,465 5,258 PNBK.BO PNB@IN

For 2QFY2012, PNB posted modest net profit growth of 12.1% yoy to `1,205cr, well ahead of our estimate, on account of considerably better-than-expected NII and lower-than-expected provisioning expenses. The key positive takeaways from the results were the sequential improvement in NIM as well as slippages remaining under check despite completion of migration to system-based NPA recognition platform. We maintain our Accumulate view on the stock. Lower slippages but considerably higher restructuring: For 2QFY2012, the banks business momentum remained moderate, with advances growing by 19.3% yoy (up 2.5% qoq) and deposits increasing by 25.0% yoy (5.5% qoq). With the persistence of higher FD interest rates, growth in CASA deposits moderated further to 11.7% yoy. Consequently, reported CASA ratio declined by 100bp qoq and a sharp 420bp yoy to 37.1%. Reported NIM of the bank improved by 11bp qoq to 4.0% on the back of a 54bp increase in yield on advances. Fee income growth was muted as fresh loans declined considerably on a yoy basis. On the asset-quality front, the bank surprised positively with slippages rate coming in at the lowest in eight quarters at 1.6%, despite completion of migration to system-based NPA recognition platform. However, the bank proactively restructured loans of ~`4,050cr during the quarter (`4,563cr in 1HFY2012), which were considerably higher than the run-rate witnessed over the past few quarters. More than half of the restructured loans pertained to the power sector, including `1,750cr restructuring done for loan to Tamil Nadu SEB. Management indicated that almost all restructuring was in the form of extension of loan term and there was no sacrifice made on the interest rates. Provision coverage ratio (including technical write-offs) remained at healthy 75.1%. The bank made `110cr higher than the required provisions for investment depreciation considering the sharp spike in G-Sec yields post September 30, 2011. Outlook and valuation: At the CMP, the stock is trading at 1.1x FY2013E ABV vs. its five-year range of 1.1-1.6x and median of 1.4x. We maintain our Accumulate recommendation on the stock with a target price of `1,106 (`1,085).

Shareholding Pattern (%) Promoters MF / Banks / Indian Fls FII / NRIs / OCBs Indian Public / Others 58.0 17.8 18.8 5.4

Abs. (%) Sensex PNB

3m (3.6) (10.5)

1yr (14.2) (25.5)

3yr 78.4 132.9

Key financials

Y/E March (` cr) NII % chg Net profit % chg NIM (%) EPS (`) P/E (x) P/ABV (x) RoA (%) RoE (%)

Source: Company, Angel Research

FY2010 8,478 20.6 3,905 26.4 3.2 123.9 7.9 1.9 1.4 26.6

FY2011 11,807 39.3 4,434 13.5 3.6 139.9 7.0 1.6 1.3 24.4

FY2012E 13,821 17.1 4,813 8.5 3.4 151.9 6.4 1.3 1.2 21.9

FY2013E 15,929 15.3 5,351 11.2 3.3 168.9 5.8 1.1 1.1 20.6

Vaibhav Agrawal

022 3935 7800 Ext: 6808 vaibhav.agrawal@angelbroking.com

Shrinivas Bhutda

022 3935 7800 Ext: 6845 shrinivas.bhutda@angelbroking.com

Varun Varma

022 3935 7800 Ext: 6847 varun.varma@angelbroking.com

Please refer to important disclosures at the end of this report

Punjab National Bank | 2QFY2012 Result Update

Exhibit 1: 2QFY2012 performance

Particulars (` cr) Interest earned - on Advances / Bills - on investments - on balance with RBI & others - on others Interest Expended Net Interest Income Other income Other income excl. treasury - Fee Income - Treasury Income incl. MF Div. - Recov. from written off a/cs - Others Operating income Operating expenses - Employee expenses - Other Opex Pre-provision Profit Provisions & contingencies - Provisions for NPAs - Other Provisions PBT Provision for Tax PAT Effective Tax Rate (%)

Source: Company, Angel Research

2QFY12 1QFY12 % chg (qoq) 2QFY11 % chg (yoy) 8,952 7,045 1,852 48 7 5,499 3,453 889 784 473 105 80 231 4,341 1,814 1,240 573 2,528 710 319 391 1,817 612 1,205 33.7 8,315 6,576 1,686 34 20 5,200 3,115 1,084 910 598 174 109 203 4,199 1,725 1,213 512 2,474 894 566 328 1,580 475 1,105 30.1 7.7 7.1 9.9 43.6 (67.2) 5.8 10.8 (18.0) (13.8) (20.9) (39.7) (26.6) 13.9 3.4 5.1 2.3 11.9 2.2 (20.5) (43.6) 19.5 15.0 28.8 9.0 362bp 6,455 5,035 1,397 20 3 3,479 2,977 718 658 474 60 89 95 3,695 1,595 1,113 482 2,100 516 359 157 1,584 510 1,075 32.2 38.7 39.9 32.6 136.4 150.2 58.1 16.0 23.8 19.1 (0.2) 75.0 (10.1) 142.4 17.5 13.7 11.4 19.0 20.4 37.7 (11.1) 149.2 14.7 20.2 12.1 153bp

Exhibit 2: 2QFY2012 Actual vs. Angel estimates

Particulars (` cr) Net interest income Other income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Company, Angel Research

Actual 3,453 889 4,341 1,814 2,528 710 1,817 612 1,205

Estimates 3,167 933 4,100 1,756 2,344 815 1,529 496 1,033

Var. (%) 9.0 (4.7) 5.9 3.3 7.9 (12.8) 18.9 23.5 16.7

November 2, 2011

Punjab National Bank | 2QFY2012 Result Update

Exhibit 3: 2QFY2012 performance analysis

Particulars Advances (` cr) Deposits (` cr) Credit-to-Deposit Ratio (%) Current deposits (` cr) Saving deposits (` cr) CASA deposits (` cr) Reported CASA ratio (%) CAR (%) Tier 1 CAR (%) Profitability Ratios (%) Cost of deposits Yield on advances Yield on investments Yield on funds Cost of funds Reported NIM Cost-to-income ratio Asset quality Gross NPAs (` cr) Gross NPAs (%) Net NPAs (` cr) Net NPAs (%) Provision Coverage Ratio (%) Slippage ratio (%) Credit cost (%)

Source: Company, Angel Research

2QFY12

1QFY12

% chg (qoq)

2QFY11 % chg (yoy) 19.3 25.0 (350)bp (0.7) 15.1 11.7 (420)bp (37)bp 33bp 156bp 137bp 50bp 86bp 115bp (11)bp (139)bp 28.0 14bp 46.5 15bp (205)bp (31)bp (13)bp

249,020 242,908 341,783 324,097 72.9 23,531 100,491 37.1 12.2 8.4 6.5 11.9 7.8 9.0 5.5 4.0 41.8 5,150 2.1 2,089 0.8 75.1 1.6 0.3 74.9 26,384 94,875 38.1 12.4 8.5 6.3 11.4 7.7 8.7 5.4 3.8 41.1 4,894 2.0 2,091 0.9 74.3 1.9 0.6

2.5 208,764 5.5 273,394 (209)bp (10.8) 5.9 (100)bp (17)bp (14)bp 24bp 54bp 13bp 31bp 10bp 11bp 69bp 5.2 5bp (0.1) (4)bp 81bp (30)bp (27)bp 76.4 23,687 87,296 41.3 12.6 8.0 5.0 10.6 7.3 8.2 4.4 4.1 43.2 4,025 1.9 1,426 0.7 77.1 2.0 0.4

124,022 121,259

2.3 110,983

Business growth moderates

For 2QFY2012, the banks business growth momentum remained moderate, in-line with peers. Advances increased by 19.3% yoy (up 2.5% qoq). On a yoy basis, advances growth was driven by loans to medium and large corporates (up 24.9% yoy) and overseas advances (up by robust 66.7% yoy). Even on a sequential basis, advances growth was primarily on the back of medium and large corporates and overseas advances. Growth of the retail segments advances was muted at 2.4% qoq and 9.5% yoy. Overseas advances growth was partly aided by the recent sharp depreciation in the INR vis--vis the USD. However, share of overseas advances in the banks loan book remained relatively small at 6.6%. Among industrial advances, infrastructure credit continued to drive growth apart from loans to the metal and metal products sector. Infra loans grew by 23.5% yoy, in which the power sectors loans increased by 26.0% yoy. With strong growth in infra loans, its share in advances has risen to 14.5% in 2QFY2012 from 14.0% in 2QFY2011. Loans to the metal sector grew by healthy 44.8% yoy (9.4% qoq) and accounted for 21.0% of incremental loans over the past one year.

November 2, 2011

Punjab National Bank | 2QFY2012 Result Update

Deposits growth was healthy on a yoy basis at 25.0% (up 5.5% qoq). However, deposits growth on a yoy basis was largely driven by bulk deposits and certificate of deposits (CDs), which increased substantially by 45.9% yoy. This resulted in the share of bulk deposits to total deposits rising to 23.7% in 2QFY2012 from 20.3% in 2QFY2011. CASA deposits growth was relatively lower at 11.7% yoy due to a marginal 0.7% decline in current account deposits. Saving account deposit growth was reasonable at 15.1% yoy. Overall, reported CASA ratio declined by 100bp qoq and 420bp yoy to 37.1%.

Exhibit 4: MSME and retail loans show healthy traction yoy

Particulars (` cr) Agri Retail MSME Medium and large corporates Comm. real estate Services and others Domestic non-food credit Food credit Domestic credit Overseas advances Global gross credit

Source: Company, Angel Research

2QFY12 35,076 24,732 27,643 90,760 10,353 42,415 4,214 16,511

1QFY12 % chg (qoq) 34,153 24,154 27,336 87,576 10,434 42,482 4,806 14,318 2.7 2.4 1.1 3.6 (0.8) (0.2) (12.3) 15.3

2QFY11 % chg (yoy) 32,274 22,596 23,472 72,657 9,870 36,644 3,436 9,907 8.7 9.5 17.8 24.9 4.9 15.7 16.9 22.6 17.0 66.7 19.4

230,979 226,135 235,193 230,941 251,704 245,259

2.1 197,513 1.8 200,949 2.6 210,856

Exhibit 5: CD ratio comes off further

Adv. qoq chg (%) 10.0 8.0 6.0 4.0 72.9 76.4 76.6 Dep. qoq chg (%) 77.4 74.9 CDR (%, RHS) 78.0 76.0 74.0

Exhibit 6: Moderation in CASA deposits growth continues

Calculated CASA ratio (%) 42.0 24.9 22.0 18.1 16.2 11.7 36.0 10.0 20.0 CASA yoy growth (%, RHS) 30.0

39.0

40.6

39.1

38.5

37.4

6.0 7.1

6.0 5.7

9.4 8.3

0.3 3.6

2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

Source: Company, Angel Research

2.5 5.5

2.0

70.0

33.0 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

Source: Company, Angel Research

36.3

72.0

NIM improves on the back of better loan yields

The banks reported NIM improved by 11bp qoq to 4.0% on the back of a sharp 54bp qoq rise in yield on advances. Cost of deposits increased by 24bp qoq due to a lower CASA ratio and higher share of bulk deposits. The bank was able to improve its NIM in spite of the 209bp qoq decline in credit-to-deposit ratio to 72.9% (76.4% in 2QFY2011).

November 2, 2011

Punjab National Bank | 2QFY2012 Result Update

Exhibit 7: Better yield on advances...

(%) 12.00 11.50 11.00 10.50 10.00 9.50 9.00 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 10.55 10.59 10.83 11.38 11.92

Exhibit 8: ...leads to an 11bp qoq expansion in NIM

(%) 4.20 4.00 3.80 3.60 3.40 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12 4.06 4.13 3.91 3.95 3.84

Source: Company, Angel Research

Source: Company, Angel Research

Fee income sluggish; Forex and treasury drive other income

Fee income growth was sluggish as fresh credit-linked fees (processing fees) declined by 27.4% yoy because of slower credit offtake. Even growth in LC/BG income was moderate at 12.4% yoy. On the other hand, income from bills and remittance increased by healthy 52.0% yoy and income from ATM operations rose by 33.4% yoy. Management is targeting to grow its fee income in-line with advances growth. Recoveries from written-off accounts were sluggish, declining by 10.1% yoy. Even income from investments (treasury+dividend from MFs) rose by healthy 75.0% yoy.

Exhibit 9: Treasury and forex income drive other income growth

Particulars (` cr) CEB Treasury incl. MF Dividend Forex Recoveries Others Other income Other income excl. treasury

Source: Company, Angel Research

2QFY12 1QFY12 473 105 133 80 98 889 784 598 174 131 109 72 1,084 910

% chg (qoq) 2QFY11 (20.9) (39.7) 1.5 (26.6) 36.1 (18.0) (13.8) 474 60 31 89 65 719 659

% chg (yoy) (0.2) 75.0 329.0 (10.1) 50.8 23.6 19.0

Slippages rate declines; considerably higher restructuring

On the asset-quality front, the bank surprised positively with slippages rate declining to the lowest in eight quarters at 1.6% in spite of completion of the switchover to system-based NPA recognition system. Even credit costs halved sequentially to 30bp from 60bp witnessed in 1QFY2012. However, slippages were largely offset by stronger recoveries and higher upgradations. Consequently, the rise in gross NPAs was contained at 5.2% qoq. Net NPAs remained largely flat sequentially at `2,089cr as compared to `2,091cr in 1QFY2012. Provision coverage ratio (including technical write-offs) improved by 81bp qoq to healthy 75.1% (77.1% in 2QFY2011).

November 2, 2011

Punjab National Bank | 2QFY2012 Result Update

Exhibit 10: Slippages rate declines to 8-quarter low

Slippages (%) 3.0 2.4 1.8 1.2 0.4 0.3 0.6 0.6 Credit cost (%, RHS) 0.8 0.6 0.6 0.4 0.2

Exhibit 11: Largely stable asset quality

Gross NPAs (%) 2.5 2.0 1.5 1.0 77.1 77.2 73.2 74.3 75.1 75.0 70.0 65.0 Net NPAs (%) PCR (%, RHS) 80.0

2.0

2.1

2.7

1.9

1.6

1.9 0.7

2.0 0.7

1.8 0.9

2.0 0.9

2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

2.1 0.8

60.0

0.6

0.5

Source: Company, Angel Research

Source: Company, Angel Research; Note: PCR including tech. write-offs

On the flip side, the bank restructured loans worth `4,051cr, which were considerably higher than the run-rate witnessed over the past few quarter. In fact, in 1QFY2012, the bank had restructured loans of just ~`500cr. Majority of the loan restructuring was carried out for exposure to the power sector. Loans of `2,150cr to the power sector were restructured during 1HFY2012, out of which `1,750cr pertained to the Tamil Nadu SEB. Other major sectoral exposures, which were restructured in 1HFY2012 include iron and steel (`650cr) and drilling (`635cr). Management indicated that there was no sacrifice made on the interest rates on almost all of the restructured loans during the quarter. The bank increased the tenure of the loan to Tamil Nadu SEB from one year to five years.

Opex under control

Overall operating expenses for the bank were largely under control with the cost-to-income ratio remaining at sub-42% levels and opex-to-average assets remaining sequentially stable at 1.8%. The bank continued with its modest network expansion by adding 51 branches in 2QFY2012 (154 in 1HFY2012). The bank also added 244 ATMs during 2QFY2012 (569 ATMs in 1HFY2012). As of 1HFY2012, the banks network comprises 5,315 branches and 5,619 ATMs.

Exhibit 12: Network expansion at steady pace

Branches 5,400 5,200 5,000 4,042 4,400 5,050 ATMs (RHS) 5,375 5,619 6,000 4,500 3,000

Exhibit 13: Cost ratios remain stable sequentially

Cost-to-income ratio (%) 44.0 42.0 40.0 2.0 1.9 1.8 1.8 1.8 Opex to average assets (%, RHS) 2.1 1.9 1.7

4,969

4,987

5,161

5,264

43.2

42.1

39.9

41.1

4,600 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

Source: Company, Angel Research

36.0 2QFY11 3QFY11 4QFY11 1QFY12 2QFY12

Source: Company, Angel Research

41.8

4,800

5,315

1,500

38.0

1.5 1.3

November 2, 2011

Punjab National Bank | 2QFY2012 Result Update

Comfortable capital adequacy

Post the recent capital infusion in the bank by the central government, the governments shareholding in the bank has increased to 58%, which provides headroom of 7% for equity capital raising without any support from the government. The bank is not immediately looking to raise tier-I capital as it is adequately capitalized for now with tier-I CAR of 9.3% (including profits of 1HFY2012). The banks total CAR stood at 12.2% at the end of 2QFY2012, with tier-I ratio of 8.4%.

Investment arguments

Strong CASA legacy, but losing market share

PNB has a structural advantage of having relatively better CASA ratio of 37.1%, which is driven by strong rural and semi-urban presence, especially in North India (total of 5,315 branches and 5,619 ATMs). This should act as a strong cushion in the current higher interest rate environment, and we have accordingly factored in a relatively lower decline (~20bp) in calculated NIM in FY2012E to 3.4% from 3.6% in FY2011. That said, the bank is losing its market share like most other public sector banks on account of slow branch expansion and competition from private banks savings market share declined by 50bp to 7.4% during FY2008-11.

Investment concerns

Persistent asset-quality pressures

During FY2011, slippage ratio for the bank was the highest in the last four years at 2.3%. Provisions for NPAs had also more than doubled to `2,004cr (from `994cr in FY2010) to compensate for high slippages witnessed in FY2011. Even in 1HFY2012, though the slippage rate moderated, it was relatively higher than its peers at 1.8%. Going forward, the completion of migration to the system-based NPA recognition platform is likely to reduce incremental slippages. Management expects the strong performance on the recoveries and upgradations front seen in 1HFY2012 to continue in 2HFY2012 as well. However, taking into account the aggressive restructuring carried out in 2QFY2012 (1.6% of total loan book), the banks relatively higher exposure to risky sectors and the overall deteriorating macroeconomic environment, we remain cautious on the incremental asset-quality pressures. Having said that, we believe it was a prudent step on the part of the management to carry out a proactive restructuring in case of accounts (especially power loans) where it was expecting some stress. More importantly, management indicated that it had not made any sacrifice on the interest rates on almost all of the loans restructured during the quarter and the restructuring was carried out only in the form of extension of loan term.

November 2, 2011

Punjab National Bank | 2QFY2012 Result Update

Outlook and valuation

We have tweaked our estimates for factoring in better-than-expected NIM trajectory witnessed in 1HFY2012 and a slower fee income growth due to slower credit offtake. At the CMP, the stock is trading at 1.1x FY2013E ABV vs. its five-year range of 1.1-1.6x and median of 1.4x. We maintain our Accumulate recommendation on the stock with a target price of `1,106 (`1,085).

Exhibit 14: Key assumptions

Particulars (%) Credit growth Deposit growth CASA ratio NIMs Other income growth Growth in staff expenses Growth in other expenses Slippages Treasury gain/(loss) (% of investments)

Source: Angel Research

Earlier estimates FY2012 16.0 21.0 36.6 3.2 11.0 10.0 15.0 2.2 0.2 FY2013 19.0 20.0 35.1 3.0 12.3 13.0 15.0 2.2 0.2

Revised estimates FY2012 16.0 22.0 36.3 3.4 6.8 12.0 19.0 2.2 0.3 FY2013 19.0 20.0 34.8 3.3 10.6 13.0 15.0 2.4 0.2

Exhibit 15: Change in estimates

FY2012 Particulars (` cr) NII Non-interest income Operating income Operating expenses Pre-prov. profit Provisions & cont. PBT Prov. for taxes PAT

Source: Angel Research

FY2013 Earlier estimates 14,470 4,504 18,974 8,062 10,912 3,376 7,536 2,445 5,091 Revised Var. (%) estimates 15,929 4,268 20,197 8,250 11,947 4,025 7,922 2,570 5,351 10.1 (5.2) 6.4 2.3 9.5 19.2 5.1 5.1 5.1

Earlier estimates 12,856 4,011 16,867 7,096 9,771 3,259 6,512 2,113 4,399

Revised Var. (%) estimates 13,821 3,857 17,678 7,261 10,417 3,293 7,124 2,311 4,813 7.5 (3.8) 4.8 2.3 6.6 1.0 9.4 9.4 9.4

November 2, 2011

Punjab National Bank | 2QFY2012 Result Update

Exhibit 16: P/ABV band

Price (`) 2,000 1,600 1,200 800 400 0

Oct-09 Nov-06 May-10 Dec-10 Aug-08 Mar-09 Feb-12 Jun-07 Jan-08 Apr-06 Jul-11

0.5x

0.9x

1.3x

1.7x

2.1x

Source: Company, Angel Research

Exhibit 17: Recommendation summary

Company AxisBk FedBk HDFCBk ICICIBk* SIB YesBk AllBk AndhBk BOB BOI BOM CanBk CentBk CorpBk DenaBk IDBI IOB J&KBk OBC PNB SBI* SynBk UcoBk UnionBk UtdBk VijBk

#

Reco. Buy Accumulate Neutral Buy Neutral Buy Neutral Neutral Accumulate Accumulate Accumulate Accumulate Neutral Buy Neutral Neutral Neutral Accumulate Neutral Accumulate Accumulate Buy Buy Neutral Accumulate Accumulate Neutral

CMP (`) 1,128 412 483 887 23 308 161 118 800 333 50 482 101 428 82 115 215 100 823 286 979 1,909 107 74 225 71 60

Tgt. price (`) 1,414 444 1,114 355 881 362 55 510 498 107 314 1,106 2,239 123 238 82 -

Upside (%) 25.4 7.9 25.6 15.4 10.1 8.7 10.9 5.9 16.3 7.3 9.8 13.0 17.3 15.3 5.8 14.8 -

FY2013E P/ABV (x) 1.8 1.1 3.3 1.6 1.1 1.9 0.8 0.8 1.1 0.9 0.7 0.9 0.7 0.7 0.6 0.7 0.9 0.6 0.9 0.7 1.1 1.4 0.7 0.9 0.9 0.6 0.8

FY2013E Tgt P/ABV (x) 2.3 1.2 2.0 2.3 1.2 1.0 0.7 1.0 0.8 0.7 0.7 1.3 1.7 0.8 0.9 0.7 -

FY2013E P/E (x) 9.9 8.4 16.8 13.0 6.8 10.2 4.5 5.3 5.7 5.5 4.3 5.6 5.0 4.4 4.0 5.4 5.5 4.0 5.7 5.0 5.8 7.3 4.7 4.6 5.1 4.3 7.3

#

FY2011-13E EPS CAGR (%) 17.7 19.5 30.5 23.3 15.6 19.9 8.9 (0.9) 14.2 15.2 38.1 (3.0) (14.6) 1.5 5.8 12.3 0.2 20.0 6.7 5.4 9.9 41.4 11.8 14.0 5.2 11.7 (3.2)

FY2013E RoA (%) 1.5 1.2 1.7 1.4 1.0 1.3 0.9 0.9 1.2 0.7 0.6 0.9 0.5 0.8 0.8 0.7 1.1 0.6 1.2 0.8 1.1 1.0 0.7 0.6 0.8 0.6 0.4

FY2013E RoE (%) 20.0 14.0 20.9 15.4 18.2 20.8 17.7 15.8 20.7 17.1 16.5 17.2 14.2 16.6 16.2 14.0 17.4 15.9 16.4 13.9 20.6 21.9 16.3 16.5 17.0 13.8 10.5

IndBk

Source: Company, Angel Research; Note:*Target multiples=SOTP Target Price/ABV (including subsidiaries), Without adjusting for SASF

November 2, 2011

Punjab National Bank | 2QFY2012 Result Update

Income statement

Y/E March (` cr) Net Interest Income - YoY Growth (%) Other Income - YoY Growth (%) Operating Income - YoY Growth (%) Operating Expenses - YoY Growth (%) Pre - Provision Profit - YoY Growth (%) Prov. & Cont. - YoY Growth (%) Profit Before Tax - YoY Growth (%) Prov. for Taxation - as a % of PBT PAT - YoY Growth (%) FY08 5,534 0.4 1,998 15.4 7,532 4.0 3,525 6.0 4,006 2.2 710 (59.4) 3,296 52.0 1,247 37.8 2,049 33.0 FY09 7,031 27.0 2,920 46.2 9,951 32.1 4,206 19.3 5,744 43.4 981 38.1 4,763 44.5 1,673 35.1 3,091 50.9 FY10 8,478 20.6 3,610 23.6 12,088 21.5 4,762 13.2 7,326 27.5 1,422 44.9 5,905 24.0 1,999 33.9 3,905 26.4 FY11 11,807 39.3 3,613 0.1 15,420 27.6 6,364 33.6 9,056 23.6 2,492 75.3 6,564 11.2 2,130 32.5 4,434 13.5 FY12E 13,821 17.1 3,857 6.8 17,678 14.6 7,261 14.1 10,417 15.0 3,293 32.1 7,124 8.5 2,311 32.4 4,813 8.5 FY13E 15,929 15.3 4,268 10.6 20,197 14.3 8,250 13.6 11,947 14.7 4,025 22.2 7,922 11.2 2,570 32.4 5,351 11.2

Balance sheet

Y/E March (` cr) Share Capital Reserve & Surplus Deposits - Growth (%) Borrowings Tier 2 Capital Other Liab. & Prov. Total Liabilities Cash Balances Bank Balances Investments Advances - Growth (%) Fixed Assets Other Assets Total Assets - Growth (%) FY08 315 12,003 166,457 19.0 5,447 6,165 8,633 199,020 15,258 3,573 53,992 119,502 23.7 2,316 4,381 199,020 22.5 FY09 315 14,338 209,761 26.0 4,374 8,085 10,045 246,919 17,058 4,355 63,385 154,703 29.5 2,397 5,020 246,919 24.1 FY10 315 17,408 249,330 18.9 8,572 10,690 10,318 296,633 18,328 5,146 77,724 186,601 20.6 2,513 6,320 296,633 20.1 FY11 317 21,192 312,899 25.5 20,399 11,190 12,328 378,325 23,777 5,914 95,162 242,107 29.7 3,106 8,259 378,325 27.5 FY12E 317 24,992 381,736 22.0 23,806 12,981 14,676 458,508 24,813 11,463 127,728 280,844 16.0 3,651 10,010 458,508 21.2 FY13E 317 29,183 458,084 20.0 28,499 15,447 17,361 548,891 29,775 13,722 154,966 334,204 19.0 4,239 11,983 548,891 19.7

November 2, 2011

10

Punjab National Bank | 2QFY2012 Result Update

Ratio analysis

Y/E March Profitability ratios (%) NIMs Cost to Income Ratio RoA RoE B/S ratios (%) CASA Ratio Credit/Deposit Ratio CAR - Tier I Asset Quality (%) Gross NPAs Net NPAs Slippages Loan Loss Prov. /Avg. Assets Provision Coverage Per Share Data (`) EPS ABVPS (75% cover.) DPS Valuation Ratios PER (x) P/ABVPS (x) Dividend Yield DuPont Analysis NII (-) Prov. Exp. Adj. NII Treasury Int. Sens. Inc. Other Inc. Op. Inc. Opex PBT Taxes RoA Leverage RoE 3.1 0.4 2.7 0.2 2.9 0.9 3.8 2.0 1.8 0.7 1.1 17.3 19.6 3.2 0.4 2.7 0.3 3.0 1.0 4.0 1.9 2.1 0.8 1.4 18.6 25.8 3.1 0.5 2.6 0.3 2.9 1.0 3.9 1.8 2.2 0.7 1.4 18.5 26.6 3.5 0.7 2.8 0.1 2.8 1.0 3.8 1.9 1.9 0.6 1.3 18.6 24.4 3.3 0.8 2.5 0.1 2.6 0.9 3.4 1.7 1.7 0.6 1.2 19.1 21.9 3.2 0.8 2.4 0.0 2.4 0.8 3.2 1.6 1.6 0.5 1.1 19.4 20.6 15.1 2.9 1.3 10.0 2.3 2.0 7.9 1.9 2.2 7.0 1.6 2.2 6.4 1.3 2.8 5.8 1.1 3.2 65.0 342.0 13.0 98.0 416.7 20.0 123.9 514.8 22.0 139.9 628.1 22.0 151.9 752.4 27.5 168.9 884.7 31.5 2.7 0.6 2.0 0.2 77.3 1.6 0.2 1.4 0.4 89.5 1.7 0.5 1.8 0.4 81.2 1.8 0.8 2.3 0.6 73.2 2.9 1.0 2.2 0.7 75.0 3.8 1.2 2.4 0.7 75.0 43.0 71.8 13.0 8.5 38.8 73.8 11.7 7.5 40.8 74.8 13.0 8.4 38.5 77.4 11.5 7.8 36.3 73.6 12.2 8.3 34.8 73.0 12.1 8.1 3.2 46.8 1.1 19.6 3.3 42.3 1.4 25.8 3.2 39.4 1.4 26.6 3.6 41.3 1.3 24.4 3.4 41.1 1.2 21.9 3.3 40.8 1.1 20.6 FY08 FY09 FY10 FY11 FY12E FY13E

November 2, 2011

11

Punjab National Bank | 2QFY2012 Result Update

Research Team Tel: 022 - 39357800

E-mail: research@angelbroking.com

Website: www.angelbroking.com

DISCLAIMER

This document is solely for the personal information of the recipient, and must not be singularly used as the basis of any investment decision. Nothing in this document should be construed as investment or financial advice. Each recipient of this document should make such investigations as they deem necessary to arrive at an independent evaluation of an investment in the securities of the companies referred to in this document (including the merits and risks involved), and should consult their own advisors to determine the merits and risks of such an investment. Angel Broking Limited, its affiliates, directors, its proprietary trading and investment businesses may, from time to time, make investment decisions that are inconsistent with or contradictory to the recommendations expressed herein. The views contained in this document are those of the analyst, and the company may or may not subscribe to all the views expressed within. Reports based on technical and derivative analysis center on studying charts of a stock's price movement, outstanding positions and trading volume, as opposed to focusing on a company's fundamentals and, as such, may not match with a report on a company's fundamentals. The information in this document has been printed on the basis of publicly available information, internal data and other reliable sources believed to be true, but we do not represent that it is accurate or complete and it should not be relied on as such, as this document is for general guidance only. Angel Broking Limited or any of its affiliates/ group companies shall not be in any way responsible for any loss or damage that may arise to any person from any inadvertent error in the information contained in this report. Angel Broking Limited has not independently verified all the information contained within this document. Accordingly, we cannot testify, nor make any representation or warranty, express or implied, to the accuracy, contents or data contained within this document. While Angel Broking Limited endeavours to update on a reasonable basis the information discussed in this material, there may be regulatory, compliance, or other reasons that prevent us from doing so. This document is being supplied to you solely for your information, and its contents, information or data may not be reproduced, redistributed or passed on, directly or indirectly. Angel Broking Limited and its affiliates may seek to provide or have engaged in providing corporate finance, investment banking or other advisory services in a merger or specific transaction to the companies referred to in this report, as on the date of this report or in the past. Neither Angel Broking Limited, nor its directors, employees or affiliates shall be liable for any loss or damage that may arise from or in connection with the use of this information. Note: Please refer to the important `Stock Holding Disclosure' report on the Angel website (Research Section). Also, please refer to the latest update on respective stocks for the disclosure status in respect of those stocks. Angel Broking Limited and its affiliates may have investment positions in the stocks recommended in this report.

Disclosure of Interest Statement 1. Analyst ownership of the stock 2. Angel and its Group companies ownership of the stock 3. Angel and its Group companies' Directors ownership of the stock 4. Broking relationship with company covered

Punjab National Bank No No No No

Note: We have not considered any Exposure below ` 1 lakh for Angel, its Group companies and Directors

Ratings (Returns):

Buy (> 15%) Reduce (-5% to 15%)

Accumulate (5% to 15%) Sell (< -15%)

Neutral (-5 to 5%)

November 2, 2011

12

Anda mungkin juga menyukai

- To the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioDari EverandTo the Moon Investing: Visually Mapping Your Winning Stock Market PortfolioBelum ada peringkat

- Axis Bank: Performance HighlightsDokumen13 halamanAxis Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Corporation Bank Result UpdatedDokumen11 halamanCorporation Bank Result UpdatedAngel BrokingBelum ada peringkat

- Canara Bank Result UpdatedDokumen11 halamanCanara Bank Result UpdatedAngel BrokingBelum ada peringkat

- IDBI Bank: Performance HighlightsDokumen13 halamanIDBI Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Dena BankDokumen11 halamanDena BankAngel BrokingBelum ada peringkat

- South Indian Bank Result UpdatedDokumen13 halamanSouth Indian Bank Result UpdatedAngel BrokingBelum ada peringkat

- Axis Bank 1QFY2013 Result Update | Net Profit Up 22% YoYDokumen13 halamanAxis Bank 1QFY2013 Result Update | Net Profit Up 22% YoYRahul JagdaleBelum ada peringkat

- IDBI Bank Result UpdatedDokumen13 halamanIDBI Bank Result UpdatedAngel BrokingBelum ada peringkat

- State Bank of IndiaDokumen16 halamanState Bank of IndiaAngel BrokingBelum ada peringkat

- Indian Overseas BankDokumen11 halamanIndian Overseas BankAngel BrokingBelum ada peringkat

- Yes Bank: Performance HighlightsDokumen12 halamanYes Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Dena Bank Result UpdatedDokumen10 halamanDena Bank Result UpdatedAngel BrokingBelum ada peringkat

- Bank of India Result UpdatedDokumen12 halamanBank of India Result UpdatedAngel BrokingBelum ada peringkat

- Axis Bank Result UpdatedDokumen13 halamanAxis Bank Result UpdatedAngel BrokingBelum ada peringkat

- IDBI Bank Result UpdatedDokumen13 halamanIDBI Bank Result UpdatedAngel BrokingBelum ada peringkat

- UCO Bank: Performance HighlightsDokumen11 halamanUCO Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Oriental Bank, 1Q FY 2014Dokumen11 halamanOriental Bank, 1Q FY 2014Angel BrokingBelum ada peringkat

- Jammu and Kashmir Bank: Performance HighlightsDokumen10 halamanJammu and Kashmir Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- ICICI Bank Result UpdatedDokumen16 halamanICICI Bank Result UpdatedAngel BrokingBelum ada peringkat

- Vijaya Bank Result UpdatedDokumen11 halamanVijaya Bank Result UpdatedAngel BrokingBelum ada peringkat

- Federal Bank: Performance HighlightsDokumen11 halamanFederal Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Andhra Bank: Performance HighlightsDokumen11 halamanAndhra Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Allahabad Bank Result UpdatedDokumen11 halamanAllahabad Bank Result UpdatedAngel BrokingBelum ada peringkat

- IDBI Bank: Performance HighlightsDokumen13 halamanIDBI Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Union Bank of India Result UpdatedDokumen11 halamanUnion Bank of India Result UpdatedAngel BrokingBelum ada peringkat

- Vijaya Bank, 1Q FY 2014Dokumen11 halamanVijaya Bank, 1Q FY 2014Angel BrokingBelum ada peringkat

- Yes Bank: Performance HighlightsDokumen12 halamanYes Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- ICICI Bank Result UpdatedDokumen15 halamanICICI Bank Result UpdatedAngel BrokingBelum ada peringkat

- Axis Bank Result UpdatedDokumen13 halamanAxis Bank Result UpdatedAngel BrokingBelum ada peringkat

- Bank of Baroda Result UpdatedDokumen12 halamanBank of Baroda Result UpdatedAngel BrokingBelum ada peringkat

- Bank of Maharashtra: Performance HighlightsDokumen11 halamanBank of Maharashtra: Performance HighlightsAngel BrokingBelum ada peringkat

- State Bank of India: Performance HighlightsDokumen14 halamanState Bank of India: Performance HighlightsAngel BrokingBelum ada peringkat

- Syndicate Bank: Performance HighlightsDokumen11 halamanSyndicate Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Jammu and Kashmir Bank: Performance HighlightsDokumen11 halamanJammu and Kashmir Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Dena Bank Result UpdatedDokumen11 halamanDena Bank Result UpdatedAngel BrokingBelum ada peringkat

- Central Bank of India Result UpdatedDokumen10 halamanCentral Bank of India Result UpdatedAngel BrokingBelum ada peringkat

- HDFC Bank Result UpdatedDokumen13 halamanHDFC Bank Result UpdatedAngel BrokingBelum ada peringkat

- Bank of Baroda, 7th February, 2013Dokumen12 halamanBank of Baroda, 7th February, 2013Angel BrokingBelum ada peringkat

- Bank of Baroda, 1Q FY 2014Dokumen12 halamanBank of Baroda, 1Q FY 2014Angel BrokingBelum ada peringkat

- Canara Bank Result UpdatedDokumen11 halamanCanara Bank Result UpdatedAngel BrokingBelum ada peringkat

- Union Bank of India Result UpdatedDokumen11 halamanUnion Bank of India Result UpdatedAngel BrokingBelum ada peringkat

- Union Bank of India: Performance HighlightsDokumen11 halamanUnion Bank of India: Performance HighlightsAngel BrokingBelum ada peringkat

- Allahabad Bank, 1Q FY 2014Dokumen11 halamanAllahabad Bank, 1Q FY 2014Angel BrokingBelum ada peringkat

- Bank of Maharashtra Result UpdatedDokumen11 halamanBank of Maharashtra Result UpdatedAngel BrokingBelum ada peringkat

- Syndicate Bank, 1Q FY 2014Dokumen11 halamanSyndicate Bank, 1Q FY 2014Angel BrokingBelum ada peringkat

- Bank of India: Performance HighlightsDokumen12 halamanBank of India: Performance HighlightsAngel BrokingBelum ada peringkat

- Indian Overseas Bank: Performance HighlightsDokumen11 halamanIndian Overseas Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Bank of BarodaDokumen12 halamanBank of BarodaAngel BrokingBelum ada peringkat

- Allahabad Bank Result UpdatedDokumen11 halamanAllahabad Bank Result UpdatedAngel BrokingBelum ada peringkat

- Andhra Bank: Performance HighlightsDokumen10 halamanAndhra Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Corporation Bank 4Q FY 2013Dokumen11 halamanCorporation Bank 4Q FY 2013Angel BrokingBelum ada peringkat

- PNB, 4th February, 2013Dokumen12 halamanPNB, 4th February, 2013Angel BrokingBelum ada peringkat

- Axis Bank: Performance HighlightsDokumen13 halamanAxis Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- Reliance Communication: Performance HighlightsDokumen11 halamanReliance Communication: Performance HighlightsAngel BrokingBelum ada peringkat

- Sib 4Q Fy 2013Dokumen12 halamanSib 4Q Fy 2013Angel BrokingBelum ada peringkat

- Indian Bank: Performance HighlightsDokumen11 halamanIndian Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- ICICI Bank Result UpdatedDokumen15 halamanICICI Bank Result UpdatedAngel BrokingBelum ada peringkat

- UCO Bank: Performance HighlightsDokumen11 halamanUCO Bank: Performance HighlightsAngel BrokingBelum ada peringkat

- WPIInflation August2013Dokumen5 halamanWPIInflation August2013Angel BrokingBelum ada peringkat

- Technical & Derivative Analysis Weekly-14092013Dokumen6 halamanTechnical & Derivative Analysis Weekly-14092013Angel Broking100% (1)

- Daily Metals and Energy Report September 16 2013Dokumen6 halamanDaily Metals and Energy Report September 16 2013Angel BrokingBelum ada peringkat

- Daily Agri Report September 16 2013Dokumen9 halamanDaily Agri Report September 16 2013Angel BrokingBelum ada peringkat

- Oilseeds and Edible Oil UpdateDokumen9 halamanOilseeds and Edible Oil UpdateAngel BrokingBelum ada peringkat

- Commodities Weekly Outlook 16-09-13 To 20-09-13Dokumen6 halamanCommodities Weekly Outlook 16-09-13 To 20-09-13Angel BrokingBelum ada peringkat

- Metal and Energy Tech Report November 12Dokumen2 halamanMetal and Energy Tech Report November 12Angel BrokingBelum ada peringkat

- Special Technical Report On NCDEX Oct SoyabeanDokumen2 halamanSpecial Technical Report On NCDEX Oct SoyabeanAngel BrokingBelum ada peringkat

- Ranbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertDokumen4 halamanRanbaxy Labs: Mohali Plant Likely To Be Under USFDA Import AlertAngel BrokingBelum ada peringkat

- International Commodities Evening Update September 16 2013Dokumen3 halamanInternational Commodities Evening Update September 16 2013Angel BrokingBelum ada peringkat

- Daily Agri Tech Report September 16 2013Dokumen2 halamanDaily Agri Tech Report September 16 2013Angel BrokingBelum ada peringkat

- Daily Agri Tech Report September 14 2013Dokumen2 halamanDaily Agri Tech Report September 14 2013Angel BrokingBelum ada peringkat

- Commodities Weekly Tracker 16th Sept 2013Dokumen23 halamanCommodities Weekly Tracker 16th Sept 2013Angel BrokingBelum ada peringkat

- Currency Daily Report September 16 2013Dokumen4 halamanCurrency Daily Report September 16 2013Angel BrokingBelum ada peringkat

- Derivatives Report 16 Sept 2013Dokumen3 halamanDerivatives Report 16 Sept 2013Angel BrokingBelum ada peringkat

- Market Outlook: Dealer's DiaryDokumen13 halamanMarket Outlook: Dealer's DiaryAngel BrokingBelum ada peringkat

- Sugar Update Sepetmber 2013Dokumen7 halamanSugar Update Sepetmber 2013Angel BrokingBelum ada peringkat

- Daily Technical Report: Sensex (19733) / NIFTY (5851)Dokumen4 halamanDaily Technical Report: Sensex (19733) / NIFTY (5851)Angel BrokingBelum ada peringkat

- Technical Report 13.09.2013Dokumen4 halamanTechnical Report 13.09.2013Angel BrokingBelum ada peringkat

- Market Outlook 13-09-2013Dokumen12 halamanMarket Outlook 13-09-2013Angel BrokingBelum ada peringkat

- TechMahindra CompanyUpdateDokumen4 halamanTechMahindra CompanyUpdateAngel BrokingBelum ada peringkat

- Derivatives Report 8th JanDokumen3 halamanDerivatives Report 8th JanAngel BrokingBelum ada peringkat

- MarketStrategy September2013Dokumen4 halamanMarketStrategy September2013Angel BrokingBelum ada peringkat

- IIP CPIDataReleaseDokumen5 halamanIIP CPIDataReleaseAngel BrokingBelum ada peringkat

- MetalSectorUpdate September2013Dokumen10 halamanMetalSectorUpdate September2013Angel BrokingBelum ada peringkat

- Daily Agri Tech Report September 06 2013Dokumen2 halamanDaily Agri Tech Report September 06 2013Angel BrokingBelum ada peringkat

- Press Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressDokumen1 halamanPress Note - Angel Broking Has Been Recognized With Two Awards at Asia Pacific HRM CongressAngel BrokingBelum ada peringkat

- Metal and Energy Tech Report Sept 13Dokumen2 halamanMetal and Energy Tech Report Sept 13Angel BrokingBelum ada peringkat

- Tata Motors: Jaguar Land Rover - Monthly Sales UpdateDokumen6 halamanTata Motors: Jaguar Land Rover - Monthly Sales UpdateAngel BrokingBelum ada peringkat

- Jaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechDokumen4 halamanJaiprakash Associates: Agreement To Sell Gujarat Cement Unit To UltratechAngel BrokingBelum ada peringkat

- Medical Insurance Premium Receipt 2019-20Dokumen4 halamanMedical Insurance Premium Receipt 2019-20Himanshu Tater43% (7)

- Sample Deed of Partnership for IT FirmDokumen5 halamanSample Deed of Partnership for IT FirmAsif SadiqBelum ada peringkat

- Core Banking PDFDokumen255 halamanCore Banking PDFCông BằngBelum ada peringkat

- PsychographicsDokumen12 halamanPsychographicsirenek100% (2)

- O2C Cycle in CloudDokumen24 halamanO2C Cycle in Cloudmani100% (1)

- Bakels Acquires Aromatic EngDokumen2 halamanBakels Acquires Aromatic EngMishtar MorpheneBelum ada peringkat

- General Mcqs On Revenue CycleDokumen6 halamanGeneral Mcqs On Revenue CycleMohsin Kamaal100% (1)

- Technical Analysis GuideDokumen3 halamanTechnical Analysis GuideQwerty QwertyBelum ada peringkat

- A Dissertation Project Report On Social Media Marketing in IndiaDokumen62 halamanA Dissertation Project Report On Social Media Marketing in IndiashaikhfaisalBelum ada peringkat

- Customs RA ManualDokumen10 halamanCustoms RA ManualJitendra VernekarBelum ada peringkat

- Solved in A Manufacturing Plant Workers Use A Specialized Machine ToDokumen1 halamanSolved in A Manufacturing Plant Workers Use A Specialized Machine ToM Bilal SaleemBelum ada peringkat

- 09 - Chapter 2 PDFDokumen40 halaman09 - Chapter 2 PDFKiran PatelBelum ada peringkat

- Sample Income StatementDokumen1 halamanSample Income StatementJason100% (34)

- TVSM 2004 2005 1ST InterimDokumen232 halamanTVSM 2004 2005 1ST InterimMITCONBelum ada peringkat

- GEAR 2030 Final Report PDFDokumen74 halamanGEAR 2030 Final Report PDFAnonymous IQlte8sBelum ada peringkat

- Delhi Bank 2Dokumen56 halamanDelhi Bank 2doon devbhoomi realtorsBelum ada peringkat

- QSP 7.1. Control of Personnel (Preview)Dokumen3 halamanQSP 7.1. Control of Personnel (Preview)Centauri Business Group Inc.Belum ada peringkat

- Cabanlit - Module 2 SPDokumen2 halamanCabanlit - Module 2 SPJovie CabanlitBelum ada peringkat

- Umjetnost PDFDokumen92 halamanUmjetnost PDFJuanRodriguezBelum ada peringkat

- Hire PurchaseDokumen16 halamanHire PurchaseNaseer Sap0% (1)

- CF Wacc Project 2211092Dokumen34 halamanCF Wacc Project 2211092Dipty NarnoliBelum ada peringkat

- Icade Annual Report 2012 Reference DocumentDokumen470 halamanIcade Annual Report 2012 Reference DocumentIcadeBelum ada peringkat

- Israel SettlementDokumen58 halamanIsrael SettlementRaf BendenounBelum ada peringkat

- Moneyback and EndowmentDokumen14 halamanMoneyback and EndowmentSheetal IyerBelum ada peringkat

- Cyber Security Assignment - Patent BasicsDokumen6 halamanCyber Security Assignment - Patent BasicsTatoo GargBelum ada peringkat

- Econ 201 MicroeconomicsDokumen19 halamanEcon 201 MicroeconomicsSam Yang SunBelum ada peringkat

- 21PGDM177 - I&E AssignmentDokumen6 halaman21PGDM177 - I&E AssignmentShreya GuptaBelum ada peringkat

- Business Continuity Plan 2023Dokumen8 halamanBusiness Continuity Plan 2023asdasdBelum ada peringkat

- 911 AuditDokumen163 halaman911 AuditAlyssa RobertsBelum ada peringkat

- Filipino Terminologies For Accountancy ADokumen27 halamanFilipino Terminologies For Accountancy ABy SommerholderBelum ada peringkat