Axis Bank

Diunggah oleh

Mansur RangwalaDeskripsi Asli:

Judul Asli

Hak Cipta

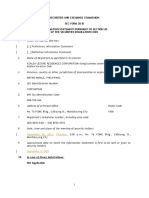

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Axis Bank

Diunggah oleh

Mansur RangwalaHak Cipta:

Format Tersedia

Retail Banking & Evaluation of Financial Performance of Axis Bank (Summer Internship Report) From 30th June To 10th

August Submitted to: Submitted by:Training Supervisor: Ashish Jain Mr. Nishpap Shridhonkar PGDM (07-09) ~2~ Sales Manager (07-II711) Axis Bank Limited, Gwalior ACKNOWLEDGEMENT Summer training is one of the most vital and active part of the curriculum of management students. Its basic idea behind this is to strengthen the students concept through practical training and make them acquainted with actual method and procedures. I did the work as a management trainee at AXIS Ba nk Limit ed for a period of six weeks starting from 30th June, 2008. I would like to extend my heartfelt gratitude to Mr. Nishp ap Sh ri dho nk ar Branch Sales Manager, for her proper guidance throughout the project. Without her support and cooperation I would have failed in my endeavors and targets in the summer training. I would also like to thank my Senior Placement Executive Prof . P.N. Rath who helped me a lot in my project. ~3~ EXECUTIVE SUMMARY The financial year 2007-08 will be remembered as a year of transformation in the history of the Bank, when the name of the Ba nk cha ng ed to Axis Ban k from UTI Bank . The conviction that it was worthwhile to invest in building a brand that would solely be our own, he lpe d to crea te a disti nct id entity . The name Axis Bank connotes solidity and transcends geographical boundaries as we seek to become a multinational bank. The Bank was successful in establishing a new identity in the market in a short span of time. The Bank once again met with considerable success over the past year and achieved all its key objectives. This encouraging performance not only underscored the sust ain ability of the Ba nk' s high tempo of gro wth , but also helped to move closer to its objective of being one of the more cu stom er -fo cu se d ba nk s in the cou ntr y. This is reflected in the robust growth in both business and revenue during 2007-08 and in various financial parameters. During 2007-08, the Bank's business and earnings con tinu ed to show hi gh growth, in dic ative of a cl ea r st rat eg ic foc us , the communication of corporate priorities to branches across the country, and finally the execution of these goals through intensive efforts. The Bank reported a ne t pr ofit of Rs . 1,071.03 cr ores during the year ended 31st March 2008, up 62.52%, from Rs. 659.03 crores in the previous year. Diluted earnings per share (EP S) wer e Rs . 31.31 pe r sh ar e, up 37.38 % from Rs . 22.79 pe r sh ar e a ye ar earli er . Return on Equity (ROE) was 16.09% compared to 21.84% a year earlier. The decline in ROE was primarily on account of the raising of fresh equity capital during the financial year. Return on Average Assets was 1.24% , co mpa re d to 1.10% in th e

pr evi ous y ea r. ~4~ In 2007-08, the Bank achieved a tota l inc ome of Rs. 8,800.80 crores, up 60.84 % from 2006-07. During this period, op er ati ng rev en ue was Rs. 4,380.84 crores, up 76 .76% from the previous year, while op er ati ng pro fit was up by 76.12% to reach Rs. 2,225.92 crores. The strong growth in income was largely driven by a strong inc re as e in both ne t int er es t incom e by 76.07% to Rs. 2,585.35 crores, and fee and other income by 77.75% to Rs. 1,795.49 crores. The str ong inc ome growth ref le cts the so li d busi ne ss growth acro ss al l ba nki ng se gments and th e su cc es sfu l exec utio n of growth initiativ es . The strong growth in incomes was partly offset by an increase in operating expenses, including depreciation, by 77.42% to Rs. 2,154.92 crores. The increase in operating expenses primarily reflects the higher costs incurred as a result of increased business levels that include additional sales and service personnel and higher variable compensation. Additional expenses incurred to support the growth initiatives of the Bank (including network expansion as well as the re-branding exercise) also contributed to the increase in operating expenses. As a conscious strategy of building an organic growth engine during the year, the Bank continued to ex pa nd it s dist ri butio n network , in both domesti c an d ov ers ea s geo gra phie s, to enlarge its reach and accelerate its business momentum. The Bank has developed a branch network which is built on customer-convenience and service, helping it particularly in the acquisition of low-cost retail deposits, retail assets, lending to agriculture, SME and midcorporates and facilitating the cross-selling of third-party products. ~5~ CONTENTS S.no. Particulars. Page no. 1. Banking in India --------------------------------------------------------7 - Early History -------------------------------------------------- 8 - Nationalized Bank In India ---------------------------------- 10 - Private Banks -------------------------------------------------- 11 2. Axis Bank --------------------------------------------------------------- 13 - Company Description ---------------------------------------- 14 - Profile ---------------------------------------------------------- 16 - Board of Directors -------------------------------------------- 18 3. Retail Banking ---------------------------------------------------------- 20 - Introduction --------------------------------------------------- 20 - Segmentation of the saving Bank--------------------------- 24 - Wealth Management ----------------------------------------- 46 - Strategic Tie-ups ---------------------------------------------- 49 - Internet Banking Channels ---------------------------------- 49 - Mobile Banking ----------------------------------------------- 51 - Cards ------------------------------------------------------------ 53 - Bancassurance ------------------------------------------------- 62 - Others ----------------------------------------------------------- 64 - Retail at Glance ------------------------------------------------ 65 - Retail Assets --------------------------------------------------- 67 4. Loans ---------------------------------------------------------------------71 5. Corporate Banking ----------------------------------------------------- 76 ~6~ - Current Accounts --------------------------------------------- 79 - Types of Current Accounts ---------------------------------- 80

- Interest Rates -------------------------------------------------- 84 6. Financial Performance -------------------------------------------------85 - Highlights ------------------------------------------------------ 85 - Overview ------------------------------------------------------- 86 - Capital Management ------------------------------------------ 87 - Balance Sheet -------------------------------------------------- 89 - Profit & Loss Account ---------------------------------------- 90 - Cash Flow ------------------------------------------------------ 91 7. Data Analysis & Interpretation --------------------------------------- 92 8. Findings ----------------------------------------------------------------- 111 9. Glossary Banking ------------------------------------------------------ 113 10. Bibliography ------------------------------------------------------------ 119 ~7~ Banking In India: Overview ~8~ BANKING IN INDIA Banking in India originated in the first decade of 18th century. The first banks were The General Bank of India, which started in 1786, and Bank of Hindustan, both of which are now defunct. The oldest bank in existence in India is the State Bank of India, which originated in the "The Bank of Bengal" in Calcutta in June 1806. This was one of the three presidency banks, the other two being the Bank of Bombay and the Bank of Madras. The presidency banks were established under charters from the British East India Company. They merged in 1925 to form the Imperial Bank of India, which, upon India's independence, became the State Bank of India. For many years the Presidency banks acted as quasi-central banks, as did their successors. The Reserve Bank of India formally took on the responsibility of regulating the Indian banking sector from 1935. After India's independence in 1947, the Reserve Bank was nationalized and given broader powers. Early history The first fully Indian owned bank was the Allahabad Bank, established in 1865. However, at the end of late-18th century, there were hardly any banks in India in the modern sense of the term. The American Civil War stopped the supply of cotton to Lancashire from the Confederate States. Promoters opened banks banks to finance trading in Indian cotton. With large exposure to speculative ventures, most of the banks opened in India during that period failed. The depositors lost money and lost interest in keeping deposits with banks. Subsequently, banking in India remained the exclusive domain of Europeans for next several decades until the beginning of the 20th century. Foreign banks too started to arrive, particularly in Calcutta, in the 1860s. The Comptoire d'Escompte de Paris opened a branch in Calcutta in 1860, and another ~9~ in Bombay in 1862; branches in Madras and Pondichery, then a French colony, followed. Calcutta was the most active trading port in India, mainly due to the trade of the British Empire, and so became a banking center. The Bank of Bengal, which later became the State Bank of India. Around the turn of the 20th Century, the Indian economy was passing through a relative period of stability. Around five decades had elapsed since the Indian Mutiny, and the social, industrial and other infrastructure had improved. Indians had established small banks, most of which served particular ethnic and religious communities. The presidency banks dominated banking in India. There were also some exchange banks and a number of Indian joint stock banks. All these banks operated in different segments of the economy. The exchange banks, mostly owned by Europeans, concentrated on financing foreign trade. Indian joint stock banks were generally under capitalized and lacked the experience and maturity to compete

with the presidency and exchange banks. This segmentation let Lord Curzon to observe, "In respect of banking it seems we are behind the times. We are like some old fashioned sailing ship, divided by solid wooden bulkheads into separate and cumbersome compartments." By the 1900s, the market expanded with the establishment of banks such as Punjab National Bank, in 1895 in Lahore and Bank of India, in 1906, in Mumbai - both of which were founded under private ownership. Punjab National Bank is the first Swadeshi Bank founded by the leaders like Lala Lajpat Rai, Sardar Dyal Singh Majithia. The Swadeshi movement in particular inspired local businessmen and political figures to found banks of and for the Indian community. A number of banks established then have survived to the present such as Bank of India, Corporation Bank, Indian Bank, Bank of Baroda, Canara Bank and Central Bank of India. ~ 10 ~ Nationalized Banks in India Banking System in India is dominated by nationalized banks. The nationalization of banks in India took place in 1969 by Mrs. Indira Gandhi the then prime minister. The major objective behind nationalization was to spread banking infrastructure in rural areas and make available cheap finance to Indian farmers. Fourteen banks were nationalized in 1969. Before 1969, State Bank of India (SBI) was the only public sector bank in India. SBI was nationalized in 1955 under the SBI Act of 1955. The second phase of nationalization of Indian banks took place in the year 1980. Seven more banks were nationalized with deposits over 200 crores. List of Public Sector Banks in India is as follows: Allahabad Bank . Andhra Bank . Bank of Baroda . Bank of India . Bank of Maharashtra . Canara Bank . Central Bank of India . Corporation Bank . Dena Bank . Indian Bank . Indian Overseas Bank . Oriental Bank of Commerce . Punjab and Sind Bank . Punjab National Bank . State Bank of Bikaner & Jaipur . State Bank of Hyderabad . ~ 11 ~ State Bank of India (SBI) . State Bank of Indore . State Bank of Mysore . State Bank of Patiala . State Bank of Saurashtra . State Bank of Travancore . Syndicate Bank . UCO Bank . Union Bank of India . United Bank of India s . Vijaya Bank . Private Banks in India All the banks in India were earlier private banks. They were founded in the preindependence era to cater to the banking needs of the people. But after

nationalization of banks in 1969 public sector banks came to occupy dominant role in the banking structure. Private sector banking in India received a fillip in 1994 when Reserve Bank of India encouraged setting up of private banks as part of its policy of liberalization of the Indian Banking Industry. Housing Development Finance Corporation Limited (HDFC) was amongst the first to receive an 'in principle' approval from the Reserve Bank of India (RBI) to set up a bank in the private sector. Private Banks have played a major role in the development of Indian banking industry. They have made banking more efficient and customer friendly. In the process they have jolted public sector banks out of complacency and forced them to become more competitive. Major Private Banks in India is: Bank of Rajasthan . Bharat Overseas Bank . Axis Bank . Catholic Syrian Bank . ~ 12 ~ Centurion Bank of Punjab . Dhanalakshmi Bank . Federal Bank . HDFC Bank . ICICI Bank . IDBI Bank . IndusInd Bank . ING Vysya Bank . Jammu & Kashmir Bank . Karnataka Bank . Karur Vysya Bank . Kotak Mahindra Bank . SBI Commercial and International Bank . South Indian Bank . United Western Bank . UTI Bank . YES Bank . ~ 13 ~ ~ 14 ~ COMPANY DESCRIPTION Axis Bank was the first new generation private sector bank to be established in India under the overall reform programme initiated by the Government of India in 1991, under which nine new banking licenses were granted. The Bank was promoted by Unit Trust of India, the largest mutual fund in India, holding 87% of the equity. Life Insurance Corporation of India (LIC), General Insurance Corporation Ltd and its four subsidiaries who were the co-promoters held the balance 13%. The Bank started its operations in 1994. Axis Banks first capital raising post inception was in 1998 through a public offering of primary shares and in subsequent years through equity allotment to a few other investors like CDC. Citicorp Banking Corporation, Bahrain, Karur Vysya Bank and Chrys Capital leading to a dilution in UTIs shareholding in the Bank. Further dilution of Promotors shareholding happened during Q4 ended of 2004, when the Bank raised US$ 239.30 Million of Capital through a GDR issue. The Bank today is capitalized to the extent of Rs. 358.56 crores with the public holding (other than promoters) at 57.60%. The Bank's Registered Office is at Ahmedabad and its Central Office is located at Mumbai. Presently, the Bank has a very wide network of more than 701 branch offices and Extension Counters. The Bank has a network of over 2854 ATMs providing 24 hrs a day banking convenience to its customers. This is one of the largest ATM networks in the country.

Anda mungkin juga menyukai

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Additional Subscription by Way of Shares of StockDokumen3 halamanAdditional Subscription by Way of Shares of Stockregine rose bantilanBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- 128574361X 459054 PDFDokumen23 halaman128574361X 459054 PDFPines MacapagalBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Quiz AKLDokumen3 halamanQuiz AKLKevin AntoniusBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- IDFC-AMC 2021 Annual-ReportDokumen63 halamanIDFC-AMC 2021 Annual-ReportvinitBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- 13 Flist 1996 Q 4Dokumen314 halaman13 Flist 1996 Q 4doodle bobBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- NSE HandbookDokumen158 halamanNSE HandbookNdungu GitongaBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Module1-Assignment 3 - 2017ABPS1332HDokumen14 halamanModule1-Assignment 3 - 2017ABPS1332HNamitBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Title 1 - REVISED CORPORATION CODEDokumen9 halamanTitle 1 - REVISED CORPORATION CODEDan RyanBelum ada peringkat

- Merger of Icici Bank and Bank of RajasthanDokumen7 halamanMerger of Icici Bank and Bank of RajasthanmeenalBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- AUDI Table of ContentsDokumen2 halamanAUDI Table of ContentsDanica TanuecozBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- 2013 B. Sibanda - Corporate Governace Notes PDFDokumen67 halaman2013 B. Sibanda - Corporate Governace Notes PDFMoatasemMadianBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Obligations and Contracts: Table ofDokumen10 halamanObligations and Contracts: Table ofGIANNE DENISE ROQUEBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Walmart Company ProfileDokumen2 halamanWalmart Company ProfileThe GentlemanBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Alrc 2021 PisDokumen38 halamanAlrc 2021 PisMariel YanogacioBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- ACTIVITY CHAPTER 10 Business LawDokumen2 halamanACTIVITY CHAPTER 10 Business Lawjoel bentulanBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Accounting For Companies I: Learning ObjectivesDokumen11 halamanAccounting For Companies I: Learning ObjectivesHongWei TeoBelum ada peringkat

- OIAL High Yld and Distressed Pricing - 30 Apr '19Dokumen19 halamanOIAL High Yld and Distressed Pricing - 30 Apr '19SSBelum ada peringkat

- G. M. Breweries Limited: 35th Annual Report 2017-2018Dokumen68 halamanG. M. Breweries Limited: 35th Annual Report 2017-2018kishore13Belum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Accn. Lockdown Worksheet 1Dokumen3 halamanAccn. Lockdown Worksheet 1Wonder Bee NzamaBelum ada peringkat

- Cla 10Dokumen2 halamanCla 10Von Andrei MedinaBelum ada peringkat

- Libro 1Dokumen76 halamanLibro 1MARIO PADILLABelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- 71206Dokumen6 halaman71206Pandian KBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- TickersDokumen200 halamanTickerskapilBelum ada peringkat

- 2023 Case Syllabus For Obligations and ContractsDokumen5 halaman2023 Case Syllabus For Obligations and ContractsMinervaBelum ada peringkat

- Mutual Fund: Prof. Shriram NerlekarDokumen167 halamanMutual Fund: Prof. Shriram Nerlekarhimanshu sikarwarBelum ada peringkat

- Confirmed List - MentorsDokumen1 halamanConfirmed List - MentorsSuraj sBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Case Study-CSR & CNR Merged Into CRRC in ChinaDokumen24 halamanCase Study-CSR & CNR Merged Into CRRC in Chinasita deliyana FirmialyBelum ada peringkat

- Case Studies PDFDokumen0 halamanCase Studies PDFrahul8480375% (8)

- TOPIC 6 Acquisitions, Corporate RestructuringDokumen29 halamanTOPIC 6 Acquisitions, Corporate RestructuringLeon MushiBelum ada peringkat

- ASEAN Future Generation Business ForumDokumen7 halamanASEAN Future Generation Business ForumDevita Eka LestariBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)