Pgallp

Diunggah oleh

kcsekar77Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Pgallp

Diunggah oleh

kcsekar77Hak Cipta:

Format Tersedia

Limited Liability Partnerships in ndia

This This PPT PPT is is prepared prepared by by PP.. GAMBHR GAMBHR && ASSOCATES ASSOCATES (PGA) (PGA) to to provide provide foreign foreign companies companies a a general general information information about about the the options options available available for for setting setting LLP LLP in in ndia ndia and and brief brief introduction introduction

of of its its regulatory regulatory and and tax tax aspects aspects.. t t contains contains relevant relevant rules rules prevailing prevailing in in ndia ndia in in March, March, 2009 2009..

The The information information contained contained in in this this article article is is not not our our comprehensive comprehensive or or exhaustive exhaustive study study but but for for the the general general information information of of the the readers readers.. t t is is not not meant meant to to address address any any particular particular set set of of

circumstances circumstances.. We We strongly strongly recommend recommend readers readers to to seek seek professional professional advice advice before before taking taking any any decision decision..

For any further information, please visit PCA at www.pgaindia.inor mail us at pargambhir@hotmail.comor info@pgaindia.in

lnLroducLlon

To stimulate growth of ndian economy, the

Government of ndia has recently introduced a new

form of Corporate Business Entity called the Limited

LiabiIity Partnership (LLP) by enacting the Limited

Liability Partnership Act, 2008 based on

UK/Singapore Models.

LLP is a new commercial vehicle that does away with the limitations of traditional

partnerships and combines the advantages of both partnership and company form of

organization. t is a statute based governed structure that provides flexibility in organizing

the internal affairs based on mutual agreement and at the same time provides corporate

shield of limited liability. LLP is a body corporate with perpetual succession and separate

legal entity, where the liability of partners is limited. ndividuals residing outside ndia and

Companies/LLP incorporated outside ndia may also form and become partners in ndian

LLP. Rules are being formulated, permitting foreign LLPs to establish business in ndia.

CA. Parveen Cambhir

2 P. CANBH!R S ASSOC!ATES 2003

overnlng Laws

LLPs in ndia are governed by the Limited Liability Partnership Act, 2008 that

confers powers on the Central Government to apply the provisions of the

Companies Act, 1956 to LLPs. t has been clarified that the provisions of the

ndian Partnership Act, 1932 shall not apply to LLPs. Ministry of Corporate

Affairs of Government of ndia shall administer the law.

P. CANBH!R S ASSOC!ATES 2003

eaLures of LL

O LLP is a body corporate.

O LLP has perpetual succession.

O LLP has a separate legal entity.

O Partners can manage the entity.

O For the purpose of business, partner is an agent of LLP but not of other

partners.

O Change in partners shall not affect the existence, rights or duties of LLP.

P. CANBH!R S ASSOC!ATES 2003

LL name name 8eservaLlon

LLP Name

O LLP has the right to select its name but need to satisfy name guidelines.

O Name should reflect the business.

O LLP is required to get its name approved.

O LLP needs to have words 'Limited Liability Partnership' or 'LLP' as last

words of its name.

Name Reservation

O A foreign LLP or company can apply to the Registrar for the reservation

of a name.

O Such reservation is initially granted for three years which can be

renewed.

P. CANBH!R S ASSOC!ATES 2003

LL 8eglsLered Cfflce

LL AgreemenL/CharLer

LLP Registered Office

O LLP needs to have a registered office in ndia.

O LLP may change its registered office.

LLP Agreement/Charter

O Like partnership, LLP may have an agreement defining its name,

registered office, names of partners, designated partners, profit sharing

arrangement, rights and duties of partners, etc.

O n the absence of such an agreement, the provisions of Schedule 1 to the

LLP Act shall apply.

O Partners may amend the agreement as per rules.

P. CANBH!R S ASSOC!ATES 2003

arLners

O Needs to have at least two partners that may be individuals or body

corporate.

O No limit on maximum number of partners.

O Partners may consist of:

O Companies incorporated in or outside ndia.

O LLP incorporated in or outside ndia.

O ndividuals residing in or outside ndia.

O LLP shall have at least two individuals as Designated Partners; at least

one of them should be a resident in ndia.

O Designated Partners should obtain Designated Partner dentification

Number (DPN) from the Ministry of Corporate Affairs, Government of

ndia.

O At least one of the designated partners should have Digital Signature

Certificate (DSC) as forms relating to incorporation and thereafter are to

be filed online after being digitally signed.

P. CANBH!R S ASSOC!ATES 2003

LlablllLy of arLners

O Liability of partners is limited to their agreed contribution that may be

tangible or intangible in nature or both.

O Liability of LLP is not the liability of the partners.

O No partner is liable for an unauthorized act of other partners or their

misconduct.

O A partner acting to defraud others or for fraudulent purposes shall have

unlimited liability.

Jlndlng up

The winding up of LLP may be either voluntarily or by the order of the

Tribunal, to be established. Till the Tribunal is established, the powers shall

vest with the jurisdictional High Courts.

P. CANBH!R S ASSOC!ATES 2003

Nanagement S Control

Conversion of Existing Entities

anagement & ControI

W Shall be governed by LLP agreement, if no such agreement, Schedule 1 of

the Act will apply.

WLLP may appoint any partner as 'Managing/Executive Partner(s)'.

WOther partners may also join the management.

WDesignated partners have no implied authority to manage the affairs of LLP.

WDesignated partners are responsible for regulatory compliances.

Conversion of Existing Entities

WFirms, private limited companies and unlisted public limited companies are

allowed to be converted into LLP.

WCompromise and other arrangements possible like merger, amalgamations,

etc.

3 P. CANBH!R S ASSOC!ATES 2003

AccounLs AudlL

O Every LLP is to maintain proper books of account.

O Required to follow financial year from 1

st

April of a year to 31

st

March of the following

year.

O Required to prepare a Statement of Account and Solvency for every financial year in

the prescribed manner within six months from the end of each financial year and

such statement is to be signed by the designated partners.

O LLP to file the Statement of Account and Solvency with the Registrar.

O LLP accounts are required to be audited, if its turnover exceeds 4 Million NR, in any

financial year or shareholders contribution exceed 2.5 Million NR.

O Required to file an annual return with the Registrar of Companies.

O All accounts and other documents shall be available to public for inspection.

0 P. CANBH!R S ASSOC!ATES 2003

@ax Laws

O The Government of ndia is to notify applicability of various tax laws. The

coming budget should bring necessary notifications. Till such time, we need

to wait and watch how LLP and its partners are taxed.

O To our mind:

O LLP would be liable to pay Service Tax (presently @10.3%) on the value

of taxable services provided by it.

O t would be liable to pay income tax on its income at the rates, as may be

announced, including Minimum Alternate Tax (MAT) that is paid on the

book profits.

O t would be liable to pay Fringe Benefit Tax on the value of specified and

deemed fringe benefits provided by it to its employees.

O Rules relating to tax deduction and withholding taxes shall also apply to

LLPs.

O Rules relating to Transfer Pricing on cross border transactions between

associated concerns would also be applicable.

P. CANBH!R S ASSOC!ATES 2003

AdvanLages

O Separate legal entity with perpetual succession.

O Liability of members is limited.

O Easy to form and wind up in comparison to subsidiaries.

O Partners can manage the affairs of LLP.

O Flexibility in operations.

O Partner not an agent of other partners.

O No requirement of minimum capital contribution.

O No limit on maximum number of partners.

O Thin Capital Rule applies.

O Personal assets of partners not exposed.

O Simple regulations.

2 P. CANBH!R S ASSOC!ATES 2003

.5<A

For further information, please visit

PGA at www.pgaindia.in

or E-mail: pargambhir@hotmaiI.com0r info@pgaindia.in

or contact us at:

87-B, Masjid Moth , DDA Flats, Greater Kailash -

New Delhi - 110 048 (NDA)

Tel/Fax: +91 11 2922 3838, +91 98112 52946

P. CANBH!R S ASSOC!ATES 2003

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Law of Agency ExplainedDokumen23 halamanThe Law of Agency ExplainedNobert Trebon NobyBelum ada peringkat

- The Constitutional CommissionsDokumen4 halamanThe Constitutional CommissionsJilliane Oria75% (8)

- Malaysian Legal Will KitDokumen13 halamanMalaysian Legal Will KitDavid PalashBelum ada peringkat

- Practice Case Brief - Marbury v. MadisonDokumen1 halamanPractice Case Brief - Marbury v. MadisonJay HauserBelum ada peringkat

- Planters Products vs Fertiphil Corp CaseDokumen3 halamanPlanters Products vs Fertiphil Corp CaseZy AquilizanBelum ada peringkat

- Legal Forms in Criminal Procedure FinalDokumen81 halamanLegal Forms in Criminal Procedure FinalJasfher CallejoBelum ada peringkat

- Chicago Residential LeaseDokumen12 halamanChicago Residential LeaseNarendra333100% (1)

- The Ideas of Equality and Non-Discrimination, Formal and Substantive EqualityDokumen7 halamanThe Ideas of Equality and Non-Discrimination, Formal and Substantive EqualityMERCY LAWBelum ada peringkat

- Estipona vs. LobrigoDokumen13 halamanEstipona vs. LobrigoRocky MagcamitBelum ada peringkat

- Manju j4Dokumen7 halamanManju j4kcsekar77Belum ada peringkat

- Paper 6Dokumen7 halamanPaper 6kcsekar77Belum ada peringkat

- Internet Data CollectionDokumen7 halamanInternet Data Collectionkcsekar77Belum ada peringkat

- International MarketingDokumen171 halamanInternational MarketingGoodluck Savutu Lucumay100% (1)

- 67 286 1 PBDokumen31 halaman67 286 1 PBkcsekar77Belum ada peringkat

- Flower PointDokumen28 halamanFlower Pointkcsekar77Belum ada peringkat

- Executive Order No 67Dokumen4 halamanExecutive Order No 67Ishiel ReturnBelum ada peringkat

- Corporate Governance and Social ResponsibilityDokumen59 halamanCorporate Governance and Social Responsibilitysmith rulesBelum ada peringkat

- Vasudeva Pillai murder case analysisDokumen16 halamanVasudeva Pillai murder case analysisMuthu KumaranBelum ada peringkat

- Letter To Swedish Ambassador May 2013Dokumen2 halamanLetter To Swedish Ambassador May 2013Sarah HermitageBelum ada peringkat

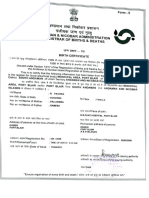

- Pavithra Birth CertificateDokumen1 halamanPavithra Birth CertificateG ElumalaiBelum ada peringkat

- Draft BIS conformity regulationsDokumen29 halamanDraft BIS conformity regulationsShamanthKumarBelum ada peringkat

- Juan-Marcelo vs. Go Kim Pah, 22 SCRA 309, No. L-27268 Jan 29, 1968Dokumen6 halamanJuan-Marcelo vs. Go Kim Pah, 22 SCRA 309, No. L-27268 Jan 29, 1968Galilee RomasantaBelum ada peringkat

- Obtain Occupational Driver's LicenseDokumen10 halamanObtain Occupational Driver's LicenseDonnyBrockBelum ada peringkat

- Ramirez V BaltazarDokumen15 halamanRamirez V BaltazarNicole Ann Delos ReyesBelum ada peringkat

- A Critical Analysis On The Composition of The Parliament Wiith The Special Focus On: Reserved Seats, Seat Distribution and The Election ProcedureDokumen9 halamanA Critical Analysis On The Composition of The Parliament Wiith The Special Focus On: Reserved Seats, Seat Distribution and The Election ProcedurePrasamBelum ada peringkat

- The Housing DevelopmentDokumen6 halamanThe Housing DevelopmentsaiyosBelum ada peringkat

- POEA's Authority to Issue Search and Seizure WarrantsDokumen9 halamanPOEA's Authority to Issue Search and Seizure WarrantsMigsBelum ada peringkat

- Mandatory Continuing Legal EducationDokumen6 halamanMandatory Continuing Legal EducationSam B. PinedaBelum ada peringkat

- Andrew Bradley, Positive Rights, Negative Rights and Health CareDokumen5 halamanAndrew Bradley, Positive Rights, Negative Rights and Health CareBonBelum ada peringkat

- Week-4 Pre A-1Dokumen2 halamanWeek-4 Pre A-1Cristian Romero FloresBelum ada peringkat

- Case Comment On Palani v. EmperorDokumen10 halamanCase Comment On Palani v. EmperorvidhiBelum ada peringkat

- Aurora Loan Services, LLC V Weisblum NY App 2nd Dept 2011Dokumen13 halamanAurora Loan Services, LLC V Weisblum NY App 2nd Dept 2011William A. Roper Jr.Belum ada peringkat

- Alu-Tucp v. NLRC Ryan MendezDokumen1 halamanAlu-Tucp v. NLRC Ryan MendezRyan Mendez100% (2)

- Kaalinta Xafiiska Xeer Ilaaliyaha Guud Ee Hagidda Baarista Iyo Socodsiinta Dacwadaha Ciqaabta1Dokumen48 halamanKaalinta Xafiiska Xeer Ilaaliyaha Guud Ee Hagidda Baarista Iyo Socodsiinta Dacwadaha Ciqaabta1Suuban MohamuudBelum ada peringkat

- Chen Wei A Paper Tiger Credit Hire NewsletterDokumen8 halamanChen Wei A Paper Tiger Credit Hire NewsletterHogiwanBelum ada peringkat

- CCS Pension Rules 2021 English 29 39Dokumen11 halamanCCS Pension Rules 2021 English 29 39LEGAL SECTIONBelum ada peringkat

- On What Grounds A Second Appeal Lies In IndiaDokumen14 halamanOn What Grounds A Second Appeal Lies In IndiaGAURAV SINGHBelum ada peringkat