0304 Crossing of Cheques

Diunggah oleh

Jitendra VirahyasDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

0304 Crossing of Cheques

Diunggah oleh

Jitendra VirahyasHak Cipta:

Format Tersedia

JVIRAHYAS@GMAIL.

COM

CROSSING OF CHEQUES

A cheque is an unconditional order, drawn on a specified banker and is always payable on demand. The drawer of a cheque cannot attach any condition thereto. He may, however, give specific instruction to the paying banker regarding the mode of payment of the cheque. Ordinarily, the payee of a cheque is entitled to encash the cheque at the counter of the paying banker by presenting it within the specified banking hours on any working day of the bank. In case of a bearer cheque, the paying banker need not seek the identification of the holder of the cheque. An order cheque is paid by the paying banker on being satisfied about the true identity of the presenter of the cheque. However, even in the latter case, there is some risk involved. The cheque might have fallen in the hands of a wrong person, who might have taken payment from the banker. To avoid such risks, or at least to detect payment made to wrong persons, the drawer may give a direction to the paying banker through certain words marked on the cheque itself, which constitute crossing. Crossing is an instruction given to the paying banker to pay the amount of the cheque through a banker only and not directly to the person presenting it at the counter. A cheque bearing such an instruction is called a crossed cheque; others without such crossing are open cheques which may be encashed at the counter of the paying banker as well. The crossing on a cheque is intended to ensure that its payment is made to the right payee. Sections 123 to 131 of the Negotiable Instruments Act contain provisions relating to crossing. According to Section 131-A, these Sections are also applicable in case of drafts. Thus not only cheque but bank drafts also may be crossed. Crossing is normally by two parallel traverse lines on the left corner of the cheque, It can also be two vertical lines on the centre of the cheque.

TYPES OF CROSSING Crossing on cheques is of two types General Crossing and Special Crossing General Crossing According to Section 123, Where a cheque bears across its face an addition of the words and company or any abbreviation thereof, between two parallel transverse lines, or two parallel transverse line simply, either with or without the words not negotiable that addition shall be deemed a crossing, and the cheque shall be deemed to be crossed generally.

It is to be noted from the above that drawing of two parallel transverse lines on the face of the cheque constitutes general crossing, The lines must be (i) on the face of the cheque, (ii) parallel to each other, and (iii) in cross direction (i.e. transverse), Inclusion of the words and company is immaterial and of no special consequence. The effect of general crossing is that the cheque must be presented to the paying banker through any banker and not by the payee himself at the counter. The collecting banker credits the proceeds to the account of the payee or the holder of the cheque. The latter may thereafter withdraw the money. Special Crossing According to Section 124. Where a cheque bears across its face an addition of the name of a banker, either with or without the words not negotiable, that addition shall be deemed a crossing and the cheque shall be deemed to be crossed specially and to be crossed to that banker. The addition of the name of a banker across the face of a cheque constitutes special crossing. Drawing of two parallel lines on the face of the cheque is not essential in case of special crossing. Special crossing. Special crossing differs from general crossing because in case of the former inclusion of the name of a banker is essential whereas in general crossing drawing of two parallel transverse lines is a must. It should be noted that in addition to these minimum statutory requirements for two types of crossing, addition of words or lines may also be included, e.g., in case of Special Crossing the name of a banker may be written within two parallel transverse lines or with the words and Company or Account Payee only or Not negotiable. The inclusion of these words has become rather customary. The Special Crossing on the cheque is a direction to the paying banker to honour the cheque only when it is presented through the bank mentioned in the crossing and no other bank. The cheque crossed specially thus becomes more safe than the generally crossed cheque. The banker, to whom a cheque is crossed specially, may appoint another banker as his agent for the collection of such cheque. What does not constitute Crossing? Sections 123 and 124 define the two types of crossing in very clear terms. The specific lines or words which constitute general or special crossings respectively are spelt out very categorically. The inclusion of any other word/words, without the essential ingredients of crossing on the face of a cheque does not constitute crossing. Examples . (1) A cheque bears the words not negotiable or account payee without two parallel lines or the name of any bank. This is not deemed to be a crossed cheque because the words not negotiable within two parallel transverse lines on the face of the cheque constitutes a general crossing (Section 123). The two transverse lines are essential in case of general crossing. The name of a bank without two parallel lines is a must for Special Crossing. (2) If a cheque bears a single line across its face or simply an X mark, the cheque is not treated as a crossed cheque. (3) The inclusion of any other word/words within two parallel lines is irrelevant and the cheque is still deemed to be a crossed.

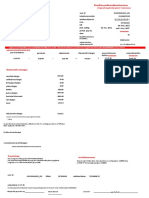

Under Rupees one hundred & Co Lucknow

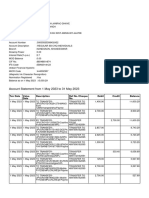

Specimen of Crossing The words written behind the parallel traverse lines General Crossing (1) and Company (1) Kotak Mahindra Bank (2) Kotak Mahindra Bank Special Crossing

& Co.

(3) Account Payee only Kotak Mahindra Bank (4) Not Negotiable Kotak Mahindra Bank

Not Negotiable Account Payee only

Persons who can Cross a Cheque Crossing is an instruction or a direction to the paying banker. Obviously, the drawer of a cheque is competent to cross it generally or specially. Section 125, however, permits the following persons also to cross the cheque.

1.

The holder of a cheque may cross it generally or specially, if it is uncrossed; or may cross it specially if it is crossed generally or may add the words not negotiable in case of both types of crossing. The banker to whom the cheque is crossed specially may again cross it specially to another banker, his agent, for collection. This is called Double Special Crossing and will be discussed later in this chapter. It is to be noted that a general crossing may be converted into a special crossing by a holder by adding the name of a banker to make the payment of the cheque more safe. But the reverse is not possible, i.e. a holder cannot convert a special crossing into a general crossing, because such alteration amounts to a material alteration and needs confirmation by the drawer.

2.

3.

Liability of the Paying Banker on Crossed Cheques The paying banker on whom a crossed cheque is drawn must make payment thereof in accordance with the crossing. Section 126 lays down this duty of the paying banker as follows :

Where a cheque is crossed generally, the banker on whom it is drawn shall not pay it otherwise than to a banker and where a cheque is crossed specially, the banker on whom it is drawn shall not pay it otherwise than to the banker to whom it is crossed or his agent for collection. Thus the payment of a crossed cheque is to be made to a banker only. If it is presented for payment at the counter of the paying bank, the latter will be justified in refusing its payment. If the payee or the holder of a crossed cheque has an account with the paying banker and presents a crossed cheque for payment at the counter, the banker should not comply with such request and the cheque should be paid through his account. If the paying banker defaults in making payment of a crossed cheque as stated in Section 126, he shall bear the liability specified in Section 129 as follows : Any banker paying a cheque crossed generally, otherwise than to a banker, or a cheque crossed specially, otherwise than to the banker to whom the same is crossed, or his agent for collecting being a banker, shall be liable to the true owner of the cheque for any loss he may sustain owing to the cheque having been so paid. The paying banker shall be liable to the true owner of the cheque and to the drawer as follows : Liability to the true owner of the cheque The paying banker is not normally responsible to the payee or the holder of a cheque, as there is no contract between the two, but if the paying banker makes payment of a crossed cheque in contravention of the direction of the drawer conveyed through the crossing, the banker shall be liable to the true owner of the cheque for any loss sustained by him as a result of such payment. If a crossed cheque is lost by the true owner and its finder gets its payment at the counter of the paying banker, the true owner will be entitled to recover the amount of the cheque from the person who received its payment from the bank. Whatever is the loss suffered by the true owner or are the expenses incurred by him will be reimbursed by the banker. Liability to the drawer If the banker fails to make payment of a crossed cheque in accordance with Section 126, the payment is not deemed to be made as per the mandate of the customer. The banker will, therefore, not be entitled to debit his customers account with the amount of such cheque, if the payment happens to be made to a wrong person. Moreover, the paying banker shall lose the statutory protection granted to him under Section 128, as such payment is not deemed to be payment in due course. Not Negotiable Crossing As already noted, Sections 123 and 124 permit that the words not negotiable may be included in the general and special crossing respectively. The inclusion of the words not negotiable in the crossing has great practical significance. These words do not make the cheque non-transferable but their inclusion in the crossing takes away one of the important characteristics of a negotiable instrument. An important characteristic of negotiability is that holder for value acquires absolute title to the instrument even if the trasnferors title was defective and the holder was unaware

about it. The inclusion of the words not negotiable in the crossing on the cheque obliterates this important characteristic of a negotiable instrument and the transferee of the cheque cannot have title better than that of the transferor. However, if the cheque is transferred for consideration and there is no defect in the title of any transferor, the cheque with not negotiable crossing remains a valid instrument. Section 130 states : A person taking a cheque crossed generally or specially, bearing in either case the words not negotiable shall not have and shall not be capable of giving a better title to the cheque than that which the person from whom he took it had. The effect of the words not negotiable in the crossing will be clear from the following examples : (1) A draws a crossed cheque on his banker in favour of B without the words not negotiable therein. C steals it from the house of B and endorses it to D who receives it for value (i.e., for valid consideration) and in good faith (i.e., without the knowledge of the fact that C had no title to the cheque) D will be its holder in due course and will have valid title, though his transferor (endorser) had no title thereto. If in the above example the cheque bears the words not negotiable in the crossing, it will make a material difference in the title of the parties. As the title of C is defective, he cannot transfer to D title better than what he himself possesses. In other words, D cannot be its holder in due course and cannot have absolute title to the cheque, even if he has acquired it for valid consideration and in good faith. It is to be noted from Section 130 that the words not negotiable shall have the aforesaid effect only when they are put on a crossed cheque. An open or uncrossed cheque with the words not negotiable shall not have above-mentioned legal effect. The primary objective of not negotiable crossing is to safeguard the interest of the true owner of the cheque. It is in reality a warning to the payee or endorsee or the holder of the cheque to accept it only if he knows the endorser well and is convinced that the latter has good title thereto, because, in its absence, his own title to the cheque will become defective and he himself will be liable to the true owner of the cheque even if he has acquired it for consideration. The Paying Bankers Position. The paying banker does not bear any liability or risk in case of a crossed cheque with not negotiable crossing provided he makes payment (i) in due course, and (ii) in accordance with the crossing. He can make payment of such a cheque even if it bears endorsement. Not negotiable crossing is a caution to the holder and his collecting banker. Account Payee Crossing The words Account Payee or Account Payee only in the crossing have special significance because the intent is to make the cheque very safe. These words are not recognized by the Negotiable Instruments Act but are in usage due to the practice prevalent in the business community. These words constitute an instruction to the collecting banker that he should collect the amount of the cheque for the benefit of the payees account only, i.e. to credit the amount to the account of the payee only and nobody else. Account Payee crossing does not restrict transferability of the cheque, which can be endorsed further, but in practice such endorsements shall not

prove to be effective because the collecting banker is being directed by drawer to credit the proceeds to the account of the payee only. If he ignores this instruction, he will lose the statutory protection granted to him as a collecting banker. The paying banker need not take any special precaution except to confirm from the collecting banker that the payment is being received for the benefit of the payee only, if the cheque bears any endorsement. He himself cannot ensure that the amount is credited to the payees account only. Hence he does not suffer as a result of payment of cheques with account payee crossing. Reserve Banks Directive on Account Payee Cheque The Reserve Bank of India has issued a circular to the banks emphasizing the following points regarding Account Payee cheques. (1) Crediting of proceeds of account payee cheques to parties other than that clearly delineated in the instructions of the issuers of the cheques is unauthorized and should not be done in any circumstances. If any bank credits the account of a constituent who is not the payee named in the cheque without proper mandate of the drawer, it would do so at its own risk and would be responsible for the unauthorized payment. Reserve Bank has also warned that banks which indulge in any deviation from the above instructions would invite severe penal action. In case of an account payee cheque where a bank is a payee, the payee bank should always ensure that there are clear instructions for disposal of proceeds of the cheques from the drawer of the cheque. If there are no such instructions, the cheque should be returned to the drawer.

(2)

(3)

Double Crossing A cheque bearing a special crossing is to be collected through the banker specified therein. It cannot therefore, be crossed specially again to another banker, i.e., cheque cannot have two special crossings, as the very purpose of the first special crossing is frustrated by the second one. However, there is one exception to this rule for a specific purpose. If the banker, to whom a cheque is specially crossed, does not have a branch at the place of the paying banker, or if he, otherwise, feels the necessity, he may cross the cheque specially to another banker, who acts as his agent fro the purpose of collection of the cheque. In such a case, the latter crossing must specify that the banker to whom it has been specially crossed again shall act as the agent of the first banker for the purpose of collection of the cheque, e.g., ________________________ Kotak Mahindra Bank To Bank of Mumbai as agent for collection _________________________ It is essential that words as agent for collection must be included in the special crossing, subsequent endorsement or discharge. Section 127 provides that where a cheque is crossed specially to more than one banker except when crossed to an agent for the purpose of collection, the banker on whom it is drawn shall refuse

payment thereof. Thus a cheque bearing a double special crossing as given below shall not be honoured by the paying banker. The collecting banker on his part cannot refuse to collect such a cheque _______________________ Kotak Mahindra Bank Bank of Mumbai _______________________

Obliterating a crossing Sometimes the crossing on a cheque is obliterated or erased by a dishonest person so cleverly and skillfully that the paying banker is unable, despite utmost efforts on his part, to detect such obliteration and pays the cheque as an open cheque. Section 89 provides protection to the paying banker under such circumstances as follows . Where a cheque is presented for payment which does not at the time of presentation appear to be crossed or to have had a crossing which has been obliterated, payment thereof by a banker liable to pay and paying the same according to the apparent tenor thereof at the time of payment and otherwise in due course, shall discharge such banker from all liability thereon and such payment shall not be questioned by reason of the cheque having been crossed. This section provides statutory protection to the paying banker, provided the following conditions are fulfilled. (a) The cheque does not appear to be a crossed one at the time of presentation or the obliteration of the crossing is not apparent; and (b) The payment is made according to the apparent tenor of the cheque and in due course (under Section 10). The paying banker is discharged from his liability if such cheque is paid at the counter on presentment. He can debit the amount of the cheque to the drawers account. Opening of Crossing If the crossing on a cheque is cancelled, it is called opening of the crossing. The cheque thereafter becomes an open cheque. Only the drawer of the cheque is entitled to open the crossing of the cheque by writing the words Pay Cash and canceling the crossing along with his full signature. His initials are not sufficient for this purpose. The paying banker must be very careful in ascertaining the validity or genuineness of the drawers signature opening the crossing. If the drawers signature (already on the cheque) is forged by the holder in order to pen the crossing and the payment is obtained at the counter, the banker will remain liable to the true owner of the cheque. The banker is under an obligation to pay the cheque according to the direction of the drawer conveyed through the crossing on the cheque.

Anda mungkin juga menyukai

- Crossing of ChequesDokumen29 halamanCrossing of ChequesQurrat AneesBelum ada peringkat

- Crossing of ChequesDokumen14 halamanCrossing of ChequesRanvids100% (1)

- Cheques: Features of A ChequeDokumen12 halamanCheques: Features of A ChequebushrajaleelBelum ada peringkat

- Dishonour of ChequesDokumen17 halamanDishonour of Chequeschirag78775% (4)

- Cheque Paying and Collecting BankDokumen5 halamanCheque Paying and Collecting BankSyed RedwanBelum ada peringkat

- Presentation On Cheques: by Subrahmanya GSDokumen12 halamanPresentation On Cheques: by Subrahmanya GSChaitra GsBelum ada peringkat

- Banker Customer RelationshipDokumen7 halamanBanker Customer RelationshipPadmasree HarishBelum ada peringkat

- Banker Customer RelationshipDokumen7 halamanBanker Customer RelationshipJitendra VirahyasBelum ada peringkat

- Negotiable Instruments ActDokumen22 halamanNegotiable Instruments Actshivam007Belum ada peringkat

- Dishonour of NIDokumen36 halamanDishonour of NISugato C MukherjiBelum ada peringkat

- Bankruptcy ActDokumen15 halamanBankruptcy Actaparajita promaBelum ada peringkat

- Business and Environment Laws: Negotiable Instrument Act 1881 MBA Sem:3Dokumen41 halamanBusiness and Environment Laws: Negotiable Instrument Act 1881 MBA Sem:3UtsavBelum ada peringkat

- Consumer Credit CardsDokumen32 halamanConsumer Credit CardsMuhammad Mazhar YounusBelum ada peringkat

- The Declaration of Independence: A Play for Many ReadersDari EverandThe Declaration of Independence: A Play for Many ReadersBelum ada peringkat

- CHAPTER VII - Bank GuaranteesDokumen12 halamanCHAPTER VII - Bank Guaranteespriya guptaBelum ada peringkat

- Demand DraftDokumen5 halamanDemand DraftSmartKevalBelum ada peringkat

- Was Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependenceDari EverandWas Frankenstein Really Uncle Sam? Vol Ix: Notes on the State of the Declaration of IndependenceBelum ada peringkat

- Deposit and Borrowing OperationsDokumen5 halamanDeposit and Borrowing OperationsCinBelum ada peringkat

- Meaning of Banker and Customer Meaning of Banker and CustomerDokumen14 halamanMeaning of Banker and Customer Meaning of Banker and CustomerSaiful IslamBelum ada peringkat

- Bank Is An Agent, Trustee, Executor, Administrator For CustomersDokumen5 halamanBank Is An Agent, Trustee, Executor, Administrator For Customersgazi faisalBelum ada peringkat

- Negotiable InstrumentsDokumen22 halamanNegotiable InstrumentsPrince Mittal100% (1)

- International Settlement Letter of CreditDokumen80 halamanInternational Settlement Letter of CreditveroBelum ada peringkat

- Banking LawDokumen18 halamanBanking LawUdisha SinghBelum ada peringkat

- Banking Terms: SR - No. Terms Definition/MeaningDokumen6 halamanBanking Terms: SR - No. Terms Definition/Meaninghoney30389100% (1)

- Security and Advances PPT by SurbhiDokumen12 halamanSecurity and Advances PPT by SurbhiSV100% (1)

- Garnishee OrderDokumen3 halamanGarnishee OrderPrasad DurgeBelum ada peringkat

- Institute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingDokumen3 halamanInstitute of Managment Studies, Davv, Indore Finance and Administration - Semester Iv Credit Management and Retail BankingS100% (2)

- Module 2 - Negotiable Instrument ActDokumen62 halamanModule 2 - Negotiable Instrument ActVK GamerBelum ada peringkat

- Banking Instruments: Indira Selvam. RDokumen10 halamanBanking Instruments: Indira Selvam. RSriramBelum ada peringkat

- Law and Practice of BankingDokumen106 halamanLaw and Practice of BankingArvind RaviBelum ada peringkat

- Collecting BankerDokumen15 halamanCollecting Bankeranusaya1988100% (2)

- Definition of The Maxim: Where There Is A Right There Is A RemedyDokumen2 halamanDefinition of The Maxim: Where There Is A Right There Is A RemedyAnonymous 3zoxlTjxvBelum ada peringkat

- Banker and CustomerDokumen23 halamanBanker and CustomerAnkan Pattanayak100% (1)

- Protecting Your Credit Score ActDokumen4 halamanProtecting Your Credit Score ActLashon SpearsBelum ada peringkat

- CHAPTER 5 Determination of Banker Customer ContractDokumen12 halamanCHAPTER 5 Determination of Banker Customer ContractCarl AbruquahBelum ada peringkat

- Letter of CreditDokumen3 halamanLetter of CreditRakesh_Kumar_A_8181Belum ada peringkat

- The Balance SheetDokumen7 halamanThe Balance Sheetsevirous valeriaBelum ada peringkat

- U.S. Bank Online Banking Terms and Conditions: Effective July 6, 2012Dokumen28 halamanU.S. Bank Online Banking Terms and Conditions: Effective July 6, 2012Monkees LabsBelum ada peringkat

- Knowledge Bank - Advances Against DepositsDokumen4 halamanKnowledge Bank - Advances Against DepositsKajeev KumarBelum ada peringkat

- Titles Webinar HandoutsDokumen26 halamanTitles Webinar HandoutsbigwupBelum ada peringkat

- Types of Cheque PDFDokumen5 halamanTypes of Cheque PDFRicha Nandy0% (1)

- Mortage PDFDokumen83 halamanMortage PDFnilofer shallyBelum ada peringkat

- Right of Lien by BankersDokumen13 halamanRight of Lien by Bankersgeegostral chhabraBelum ada peringkat

- Privacy ActDokumen62 halamanPrivacy ActMarkMemmottBelum ada peringkat

- The Banker-Customer RelationshipDokumen31 halamanThe Banker-Customer RelationshipStefan Adrian VanceaBelum ada peringkat

- Banker Customer RelationshipDokumen45 halamanBanker Customer RelationshipRajat SharmaBelum ada peringkat

- The Missing Assignment DilemmaDokumen5 halamanThe Missing Assignment Dilemmarhouse_1100% (1)

- Marking of ChecksDokumen11 halamanMarking of ChecksPavel LahaBelum ada peringkat

- Bankers' ObligationsDokumen9 halamanBankers' ObligationsAnmoldeep DhillonBelum ada peringkat

- CLearing HouseDokumen23 halamanCLearing HouseNitin KapoorBelum ada peringkat

- Commercial BanksDokumen5 halamanCommercial BankssnehaBelum ada peringkat

- Banking Awareness ImportantDokumen30 halamanBanking Awareness ImportantThirrunavukkarasu R RBelum ada peringkat

- Relationship of Debtor and CreditorDokumen15 halamanRelationship of Debtor and CreditorAndualem GetuBelum ada peringkat

- My Banking Law NotesDokumen14 halamanMy Banking Law NotesarmsarivuBelum ada peringkat

- Law 307 - Topic 2D - Subrogation and ContributionDokumen20 halamanLaw 307 - Topic 2D - Subrogation and ContributionMoshiul TanjilBelum ada peringkat

- Explanation.-For The Purposes of The Sub-Clause (I), "Commercial Purpose" Does Not Include UseDokumen21 halamanExplanation.-For The Purposes of The Sub-Clause (I), "Commercial Purpose" Does Not Include UsePrajwal KottawarBelum ada peringkat

- Banker Customer RelationshipDokumen7 halamanBanker Customer RelationshipJitendra VirahyasBelum ada peringkat

- Persons of Indian OriginDokumen2 halamanPersons of Indian OriginJitendra VirahyasBelum ada peringkat

- Who Is A BankerDokumen1 halamanWho Is A BankerJitendra VirahyasBelum ada peringkat

- Banking System in IndiaDokumen4 halamanBanking System in IndiaJitendra VirahyasBelum ada peringkat

- History of BankingDokumen2 halamanHistory of BankingJitendra VirahyasBelum ada peringkat

- 0303 Micr ChequeDokumen1 halaman0303 Micr ChequeJitendra VirahyasBelum ada peringkat

- Certificates of DepositDokumen3 halamanCertificates of DepositJitendra VirahyasBelum ada peringkat

- 0306 Collection of ChequesDokumen17 halaman0306 Collection of ChequesJitendra Virahyas100% (1)

- Account OpeningDokumen3 halamanAccount OpeningJitendra VirahyasBelum ada peringkat

- History's Greatest Financial FallDokumen8 halamanHistory's Greatest Financial FallJitendra VirahyasBelum ada peringkat

- Customer AccountsDokumen32 halamanCustomer AccountsJitendra VirahyasBelum ada peringkat

- Annexure To KycDokumen5 halamanAnnexure To KycJitendra VirahyasBelum ada peringkat

- Pepsico Performance Appraisal and Induction PolicyDokumen114 halamanPepsico Performance Appraisal and Induction PolicyJitendra Virahyas100% (5)

- J.K.cemeNT LTD Manufacturing Process and Financial ActivitiesDokumen102 halamanJ.K.cemeNT LTD Manufacturing Process and Financial ActivitiesJitendra VirahyasBelum ada peringkat

- Motilal Oswal Securities Limited Analysis of Derivative and Stock MarketDokumen104 halamanMotilal Oswal Securities Limited Analysis of Derivative and Stock MarketJitendra Virahyas100% (3)

- Birla Corporation Limited Promotional SchemeDokumen101 halamanBirla Corporation Limited Promotional SchemeJitendra VirahyasBelum ada peringkat

- PEPSICO Selection and Salary Wages PolicyDokumen129 halamanPEPSICO Selection and Salary Wages PolicyJitendra Virahyas67% (3)

- Saras Recruitment ProcedureDokumen99 halamanSaras Recruitment ProcedureJitendra Virahyas0% (1)

- Fee Circular 2023 24Dokumen1 halamanFee Circular 2023 24Archana SinghBelum ada peringkat

- Account Summary Payment Information: New Balance: $261.55Dokumen6 halamanAccount Summary Payment Information: New Balance: $261.55AriadnaUrsachi100% (2)

- Transfer PricingDokumen98 halamanTransfer PricingMAHESH JAINBelum ada peringkat

- Isla Lipana & Co., ITAD BIR Ruling No. 041-21 Dated September 29, 2021Dokumen8 halamanIsla Lipana & Co., ITAD BIR Ruling No. 041-21 Dated September 29, 2021Carlota VillaromanBelum ada peringkat

- BoB MITC A4 Booklet Ver-6.0 01AUG23Dokumen4 halamanBoB MITC A4 Booklet Ver-6.0 01AUG23rjlover24Belum ada peringkat

- No Name T1 2022Dokumen42 halamanNo Name T1 2022Indo -CanadianBelum ada peringkat

- Payroll Accounting PowerpointDokumen13 halamanPayroll Accounting PowerpointMr. CrustBelum ada peringkat

- Centrifuge Machine - InvoiceDokumen1 halamanCentrifuge Machine - InvoiceArindam HaldarBelum ada peringkat

- SAP FI NotesDokumen2 halamanSAP FI NotesvinodnagarajuBelum ada peringkat

- Account Statement From 1 May 2023 To 31 May 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokumen10 halamanAccount Statement From 1 May 2023 To 31 May 2023: TXN Date Value Date Description Ref No./Cheque No. Debit Credit Balanceavinashdeshmukh7027Belum ada peringkat

- Atm QuestionnaireDokumen3 halamanAtm Questionnaireyuvashankar100% (3)

- Daily Sales Recapitulation Report - 20230518093914Dokumen6 halamanDaily Sales Recapitulation Report - 20230518093914muhammad imamBelum ada peringkat

- Module2 AE26 ITDokumen7 halamanModule2 AE26 ITJemalyn PiliBelum ada peringkat

- Taxation - Ins 3010: Group 2Dokumen10 halamanTaxation - Ins 3010: Group 2nguyễnthùy dươngBelum ada peringkat

- STFCS 2022-11-05 1667702284229Dokumen7 halamanSTFCS 2022-11-05 1667702284229Charles GoodwinBelum ada peringkat

- Account Statement: Msatools N No 12 O No 18 Sowrastra Nagar 1St Street Choolaimedu Ambattur ChennaiDokumen2 halamanAccount Statement: Msatools N No 12 O No 18 Sowrastra Nagar 1St Street Choolaimedu Ambattur ChennaiChandru ChristurajBelum ada peringkat

- Tax Management SyllabusDokumen2 halamanTax Management Syllabusbs_sharathBelum ada peringkat

- Solutions To Chapter 13 Problems 1Dokumen3 halamanSolutions To Chapter 13 Problems 1Hira ParachaBelum ada peringkat

- Income Tax - Sridhar Reddy MannemalaDokumen34 halamanIncome Tax - Sridhar Reddy MannemalaSrilakshmi MBelum ada peringkat

- Azure InvoiceDokumen2 halamanAzure InvoiceAnkit SambhareBelum ada peringkat

- Manila Mandarin Hotels Vs CommissionerDokumen2 halamanManila Mandarin Hotels Vs CommissionerEryl Yu100% (1)

- GST Compensation CessDokumen2 halamanGST Compensation CessPalak JioBelum ada peringkat

- Taxguru - in-TaxGuru Consultancy Amp Online Publication LLPDokumen7 halamanTaxguru - in-TaxGuru Consultancy Amp Online Publication LLPsamratsom1947Belum ada peringkat

- P1 1.3CashBasisAccrualBasisSingleEntryZETADokumen3 halamanP1 1.3CashBasisAccrualBasisSingleEntryZETASophia AprilBelum ada peringkat

- Invoice - 1Dokumen1 halamanInvoice - 1Toney KurianBelum ada peringkat

- Sales Quotation: Jl. Nias 3 No. 33 Lingk. Tegalboto Kidul, Kel. Sumbersari, Kec. Sumbersari Kab. Jember, Jawa TimurDokumen1 halamanSales Quotation: Jl. Nias 3 No. 33 Lingk. Tegalboto Kidul, Kel. Sumbersari, Kec. Sumbersari Kab. Jember, Jawa TimurAde HerdiansyahBelum ada peringkat

- Article 1 - Taxation and Its Negative Impact On Business Investment ActivitiesDokumen6 halamanArticle 1 - Taxation and Its Negative Impact On Business Investment ActivitiesceistBelum ada peringkat

- Forwarding Data DictionaryDokumen214 halamanForwarding Data DictionaryRohit JainBelum ada peringkat

- User Id 012439461813 - DSL Telephonenumber 01244823150Dokumen6 halamanUser Id 012439461813 - DSL Telephonenumber 01244823150NAVEEN SLBelum ada peringkat

- Income Tax StatementDokumen2 halamanIncome Tax StatementgdBelum ada peringkat