CNMC IPO Prospectus

Diunggah oleh

Hl LimDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

CNMC IPO Prospectus

Diunggah oleh

Hl LimHak Cipta:

Format Tersedia

OFFER DOCUMENT DATED 18 OCTOBER 2011

(Registered by the Singapore Exchange Securities Trading Limited (the SGX-ST), acting as agent on behalf of the Monetary Authority of Singapore (the Authority) on

18 October 2011)

This offer is made in or accompanied by an Offer Document (the Offer Document) that has been registered by the SGX-ST, acting as agent on behalf of the Authority

on 18 October 2011. The registration of this Offer Document by the SGX-ST, acting as agent on behalf of the Authority does not imply that the Securities and Futures Act

(Chapter 289) of Singapore, or any other legal or regulatory requirements, or requirements under the SGX-STs listing rules, have been complied with.

This document is important. If you are in any doubt as to the action you should take, you should consult your legal, financial, tax or other professional

adviser(s).

PrimePartners Corporate Finance Pte. Ltd. (the Sponsor) has made an application to the SGX-ST for permission to deal in, and for quotation of, all the ordinary shares

(the Shares) in the capital of CNMC Goldmine Holdings Limited (the Company) already issued (including the Vendor Shares (as defined herein), the new Shares

which are the subject of this Placement (the New Shares (as defined herein) and together with the Vendor Shares, collectively the Placement Shares), the new Shares

to be issued to PPCF (the PPCF Shares) pursuant to the Management Agreement (as defined herein), the Employee Shares (as defined herein) and the new Shares

which may be issued pursuant to the CNMC Performance Share Plan (the Award Shares) to be listed for quotation on Catalist. The Sponsor has submitted this Offer

Document to the SGX-ST. Acceptance of applications will be conditional upon, inter alia, issue of the New Shares and permission being granted by the SGX-ST for the

listing and quotation of all our existing issued Shares, the New Shares, the PPCF Shares, the Employee Shares and the Award Shares on Catalist. Monies paid in

respect of any application accepted will be returned if the admission and listing do not proceed. The dealing in and quotation of the Shares will be in Singapore dollars.

Companies listed on Catalist may carry higher investment risk when compared with larger or more established companies listed on the SGX-ST Main Board. In

particular, companies may list on Catalist without a track record of profitability and there is no assurance that there will be a liquid market in the shares or units of shares

traded on Catalist. You should be aware of the risks of investing in such companies and should make the decision to invest only after careful consideration and, if

appropriate, consultation with your professional adviser(s).

Neither the Authority nor the SGX-ST has examined or approved the contents of this Offer Document. Neither the Authority nor the SGX-ST assumes any responsibility

for the contents of this Offer Document, including the correctness of any of the statements or opinions made or reports contained in this Offer Document. The SGX-ST

does not normally review the application for admission but relies on the Sponsor confirming that the Company is suitable to be listed and complies with the Catalist Rules

(as defined herein). Neither the Authority nor the SGX-ST has in any way considered the merits of the Shares or units of Shares being offered for investment.

We have not lodged this Offer Document in any other jurisdiction.

INVESTING IN OUR SHARES INVOLVES RISKS WHICH ARE DESCRIBED IN THE SECTION ENTITLED RISK FACTORS OF THIS OFFER DOCUMENT. IN

PARTICULAR, YOU SHOULD NOTE THAT BASED ON THE PLANNED PRODUCTION SCHEDULE FOR OUR MINING OPERATIONS, IT IS EXPECTED THAT THE

MINING OF OUR CURRENT GOLD ORE RESERVES (AS DEFINED HEREIN) WILL BE COMPLETED IN 2012. PLEASE REFER TO THE FOLLOWING RISKS

FURTHER DESCRIBED IN THIS OFFER DOCUMENT: (1) OUR GROUP (AS DEFINED HEREIN) MAY NOT BE ABLE TO DISCOVER NEW GOLD RESERVES TO

MAINTAIN A COMMERCIALLY VIABLE MINING OPERATION; (2) OUR GROUP HAS A LIMITED OPERATING HISTORY; AND (3) OUR GROUPS BUSINESS,

REVENUES AND PROFITS ARE AFFECTED BY THE VOLATILITY OF PRICES FOR GOLD AND THE GLOBAL ECONOMY.

After the expiration of six (6) months from the date of registration of this Offer Document, no person shall make an offer of securities, or allot, issue or sell

any securities, on the basis of this Offer Document; and no officer or equivalent person or promoter of the Company will authorise or permit the offer of any

securities or the allotment, issue or sale of any securities, on the basis of this Offer Document.

(Company Registration Number: 201119104K)

(Incorporated in Singapore on 11 August 2011)

Placement of 41,000,000 Placement Shares comprising 23,900,000 New Shares and 17,200,000 Vendor Shares

at S$0.40 for each Placement Share, payable in full on application

PRIMEPARTNERS CORPORATE FINANCE PTE. LTD.

(Company Registration No.: 200207389D)

(Incorporated in the Republic of Singapore)

Manager and Sponsor and Joint Placement Agent Joint Placement Agent

ASIASONS WFG SECURITIES PTE LTD

(Company Registration No.: 200300646M)

(Incorporated in the Republic of Singapore)

* The above newspaper articles have been extracted from Nanyang Business Daily, Sin Chew Daily and China Press. Nanyang Business Daily, Sin Chew Daily and China Press have not

consented to the inclusion of the newspaper articles in this Offer Document for the purpose of Section 249 of the Securities and Futures Act (Chapter 289) of Singapore (SFA) and are

therefore not liable for the relevant information of the newspaper articles under Sections 253 and 254 of the SFA and while the directors of the Company have taken reasonable action to

ensure that the information of the newspaper articles is extracted accurately and fairly, and has been included in this Offer Document in its proper form and context, they have not

independently verified the accuracy of the relevant information in the newspaper articles.

OFFER DOCUMENT DATED 18 OCTOBER 2011

(Registered by the Singapore Exchange Securities Trading Limited (the SGX-ST), acting as agent on behalf of the Monetary Authority of Singapore (the Authority) on

18 October 2011)

This offer is made in or accompanied by an Offer Document (the Offer Document) that has been registered by the SGX-ST, acting as agent on behalf of the Authority

on 18 October 2011. The registration of this Offer Document by the SGX-ST, acting as agent on behalf of the Authority does not imply that the Securities and Futures Act

(Chapter 289) of Singapore, or any other legal or regulatory requirements, or requirements under the SGX-STs listing rules, have been complied with.

This document is important. If you are in any doubt as to the action you should take, you should consult your legal, financial, tax or other professional

adviser(s).

PrimePartners Corporate Finance Pte. Ltd. (the Sponsor) has made an application to the SGX-ST for permission to deal in, and for quotation of, all the ordinary shares

(the Shares) in the capital of CNMC Goldmine Holdings Limited (the Company) already issued (including the Vendor Shares (as defined herein), the new Shares

which are the subject of this Placement (the New Shares (as defined herein) and together with the Vendor Shares, collectively the Placement Shares), the new Shares

to be issued to PPCF (the PPCF Shares) pursuant to the Management Agreement (as defined herein), the Employee Shares (as defined herein) and the new Shares

which may be issued pursuant to the CNMC Performance Share Plan (the Award Shares) to be listed for quotation on Catalist. The Sponsor has submitted this Offer

Document to the SGX-ST. Acceptance of applications will be conditional upon, inter alia, issue of the New Shares and permission being granted by the SGX-ST for the

listing and quotation of all our existing issued Shares, the New Shares, the PPCF Shares, the Employee Shares and the Award Shares on Catalist. Monies paid in

respect of any application accepted will be returned if the admission and listing do not proceed. The dealing in and quotation of the Shares will be in Singapore dollars.

Companies listed on Catalist may carry higher investment risk when compared with larger or more established companies listed on the SGX-ST Main Board. In

particular, companies may list on Catalist without a track record of profitability and there is no assurance that there will be a liquid market in the shares or units of shares

traded on Catalist. You should be aware of the risks of investing in such companies and should make the decision to invest only after careful consideration and, if

appropriate, consultation with your professional adviser(s).

Neither the Authority nor the SGX-ST has examined or approved the contents of this Offer Document. Neither the Authority nor the SGX-ST assumes any responsibility

for the contents of this Offer Document, including the correctness of any of the statements or opinions made or reports contained in this Offer Document. The SGX-ST

does not normally review the application for admission but relies on the Sponsor confirming that the Company is suitable to be listed and complies with the Catalist Rules

(as defined herein). Neither the Authority nor the SGX-ST has in any way considered the merits of the Shares or units of Shares being offered for investment.

We have not lodged this Offer Document in any other jurisdiction.

INVESTING IN OUR SHARES INVOLVES RISKS WHICH ARE DESCRIBED IN THE SECTION ENTITLED RISK FACTORS OF THIS OFFER DOCUMENT. IN

PARTICULAR, YOU SHOULD NOTE THAT BASED ON THE PLANNED PRODUCTION SCHEDULE FOR OUR MINING OPERATIONS, IT IS EXPECTED THAT THE

MINING OF OUR CURRENT GOLD ORE RESERVES (AS DEFINED HEREIN) WILL BE COMPLETED IN 2012. PLEASE REFER TO THE FOLLOWING RISKS

FURTHER DESCRIBED IN THIS OFFER DOCUMENT: (1) OUR GROUP (AS DEFINED HEREIN) MAY NOT BE ABLE TO DISCOVER NEW GOLD RESERVES TO

MAINTAIN A COMMERCIALLY VIABLE MINING OPERATION; (2) OUR GROUP HAS A LIMITED OPERATING HISTORY; AND (3) OUR GROUPS BUSINESS,

REVENUES AND PROFITS ARE AFFECTED BY THE VOLATILITY OF PRICES FOR GOLD AND THE GLOBAL ECONOMY.

After the expiration of six (6) months from the date of registration of this Offer Document, no person shall make an offer of securities, or allot, issue or sell

any securities, on the basis of this Offer Document; and no officer or equivalent person or promoter of the Company will authorise or permit the offer of any

securities or the allotment, issue or sale of any securities, on the basis of this Offer Document.

(Company Registration Number: 201119104K)

(Incorporated in Singapore on 11 August 2011)

Placement of 41,000,000 Placement Shares comprising 23,900,000 New Shares and 17,200,000 Vendor Shares

at S$0.40 for each Placement Share, payable in full on application

PRIMEPARTNERS CORPORATE FINANCE PTE. LTD.

(Company Registration No.: 200207389D)

(Incorporated in the Republic of Singapore)

Manager and Sponsor and Joint Placement Agent Joint Placement Agent

ASIASONS WFG SECURITIES PTE LTD

(Company Registration No.: 200300646M)

(Incorporated in the Republic of Singapore)

* The above newspaper articles have been extracted from Nanyang Business Daily, Sin Chew Daily and China Press. Nanyang Business Daily, Sin Chew Daily and China Press have not

consented to the inclusion of the newspaper articles in this Offer Document for the purpose of Section 249 of the Securities and Futures Act (Chapter 289) of Singapore (SFA) and are

therefore not liable for the relevant information of the newspaper articles under Sections 253 and 254 of the SFA and while the directors of the Company have taken reasonable action to

ensure that the information of the newspaper articles is extracted accurately and fairly, and has been included in this Offer Document in its proper form and context, they have not

independently verified the accuracy of the relevant information in the newspaper articles.

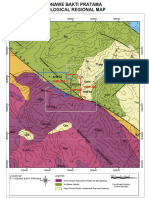

Competitive Strengths

Availability of high grade gold-bearing ore in

Sokor Block

z Based on the BDA Technical Report, supergene

enrichment of gold is widespread at Sokor Block

z Near-surface high grade gold

Exploration upside potential

z Considerable exploration upside potential within

Sokor Block to locate additional gold resources

where to date only limited reconnaissance

exploration has taken place

Close proximity to urban facilities

z Proximity to land and air transport

z Availability of existing infrastructure and

communication access helps to minimize

investment costs

Strong working relationships with Chinese

contractors and/or consultants

z Consultants such as CSU, Sinomine and CGRI

are leading players in the PRC in their respective

niche markets, their expertise in mining

operations helps to ensure greater cost

efficiencies and economic benefits

z Services and technical support provided at

competitive prices

Strong relationships with stakeholders and local

communities

z Good working relationship with Kelantan State

Government and KSEDC

z Professor Lin Xiang Xiong (Executive Chairman)

is Kelantans Chief Advisor on Kelantan-China

International Trade for the Kelantan State

Government

z Participation in community development projects

Use of Proceeds

Further resource definition and continuing

exploration activities

Construction of a heap leach facility

Working Capital

Expenses incurred in connection with the

Placement

Prospects

World demand for Gold

z Gold as a hedge against currency risks and

remains a sought-after asset especially in light

of sovereign debt crisis in Europe

z Gold as an alternative investment and a

hedge against inflationary pressures

Price Outlook

z Analysts at BNP Paribas forecasted the

average price of gold to be US$1,500/oz for

2011 and US$1,600/oz in 2012

z Investment product for portfolio diversification

and risk management strategies

z Supportive environment for gold investment in

2011, revived demand in jewellery and

industrial sector provide further scope for

growth

Business Strategies and Future Plans

Expansion of gold extraction facilities

Further resource definition and continuing

exploration activities

Feasibility study to construct a gold

carbon-in-leach plant

Exploration and possible mining for other

minerals such as silver, lead and zinc

Expansion through acquisitions, joint ventures

and strategic alliances

Price of gold

Comp t etit itiive St Strength ths Us

TABLE 1 CNMC MINERAL RESOURCES, JUNE 2010

JORC Code

Class

Tonnes Grade g/t

Au

Gold (oz)

Measured 659,000 3.4 71,700

Indicated 803,000 2.0 50,900

Inferred 720,000 2.6 60,900

TOTAL 2,182,000 2.6 183,500

Note: The total gold resources of 2,182,000 tonnes includes gold ore reserves of

989,000 tonnes

TABLE 2 CNMC ORE RESERVES, JUNE 2010

JORC Code

Class

Tonnes Grade g/t

Au

Gold (oz)

Proved 204,000 3.6 23,900

Probable 785,000 1.8 46,400

TOTAL 989,000 2.2 70,300

g

The above chart sets forth monthly average London Fix gold price from January 2008 to August 2011.

Source: World Gold Council

0

200

400

600

800

1000

1200

1400

1600

1800

2000

J

a

n

u

a

r

y

2

0

0

8

F

e

b

r

u

a

r

y

2

0

0

8

M

a

r

c

h

2

0

0

8

A

p

r

i

l

2

0

0

8

M

a

y

2

0

0

8

J

u

n

e

2

0

0

8

J

u

l

y

2

0

0

8

A

u

g

u

s

t

2

0

0

8

S

e

p

t

e

m

b

e

r

2

0

0

8

O

c

t

o

b

e

r

2

0

0

8

N

o

v

e

m

b

e

r

2

0

0

8

D

e

c

e

m

b

e

r

2

0

0

8

J

a

n

u

a

r

y

2

0

0

9

F

e

b

r

u

a

r

y

2

0

0

9

M

a

r

c

h

2

0

0

9

A

p

r

i

l

2

0

0

9

M

a

y

2

0

0

9

J

u

n

e

2

0

0

9

J

u

l

y

2

0

0

9

A

u

g

u

s

t

2

0

0

9

S

e

p

t

e

m

b

e

r

2

0

0

9

O

c

t

o

b

e

r

2

0

0

9

N

o

v

e

m

b

e

r

2

0

0

9

D

e

c

e

m

b

e

r

2

0

0

9

J

a

n

u

a

r

y

2

0

1

0

F

e

b

r

u

a

r

y

2

0

1

0

M

a

r

c

h

2

0

1

0

A

p

r

i

l

2

0

1

0

M

a

y

2

0

1

0

J

u

n

e

2

0

1

0

J

u

l

y

2

0

1

0

A

u

g

u

s

t

2

0

1

0

S

e

p

t

e

m

b

e

r

2

0

1

0

O

c

t

o

b

e

r

2

0

1

0

N

o

v

e

m

b

e

r

2

0

1

0

D

e

c

e

m

b

e

r

2

0

1

0

J

a

n

u

a

r

y

2

0

1

1

F

e

b

r

u

a

r

y

2

0

1

1

M

a

r

c

h

2

0

1

1

A

p

r

i

l

2

0

1

1

M

a

y

2

0

1

1

J

u

n

e

2

0

1

1

J

u

l

y

2

0

1

1

A

u

g

u

s

t

2

0

1

1

P

r

i

c

e

o

f

G

o

l

d

U

S

$

p

e

r

o

z

Competitive Strengths

Availability of high grade gold-bearing ore in

Sokor Block

z Based on the BDA Technical Report, supergene

enrichment of gold is widespread at Sokor Block

z Near-surface high grade gold

Exploration upside potential

z Considerable exploration upside potential within

Sokor Block to locate additional gold resources

where to date only limited reconnaissance

exploration has taken place

Close proximity to urban facilities

z Proximity to land and air transport

z Availability of existing infrastructure and

communication access helps to minimize

investment costs

Strong working relationships with Chinese

contractors and/or consultants

z Consultants such as CSU, Sinomine and CGRI

are leading players in the PRC in their respective

niche markets, their expertise in mining

operations helps to ensure greater cost

efficiencies and economic benefits

z Services and technical support provided at

competitive prices

Strong relationships with stakeholders and local

communities

z Good working relationship with Kelantan State

Government and KSEDC

z Professor Lin Xiang Xiong (Executive Chairman)

is Kelantans Chief Advisor on Kelantan-China

International Trade for the Kelantan State

Government

z Participation in community development projects

Use of Proceeds

Further resource definition and continuing

exploration activities

Construction of a heap leach facility

Working Capital

Expenses incurred in connection with the

Placement

Prospects

World demand for Gold

z Gold as a hedge against currency risks and

remains a sought-after asset especially in light

of sovereign debt crisis in Europe

z Gold as an alternative investment and a

hedge against inflationary pressures

Price Outlook

z Analysts at BNP Paribas forecasted the

average price of gold to be US$1,500/oz for

2011 and US$1,600/oz in 2012

z Investment product for portfolio diversification

and risk management strategies

z Supportive environment for gold investment in

2011, revived demand in jewellery and

industrial sector provide further scope for

growth

Business Strategies and Future Plans

Expansion of gold extraction facilities

Further resource definition and continuing

exploration activities

Feasibility study to construct a gold

carbon-in-leach plant

Exploration and possible mining for other

minerals such as silver, lead and zinc

Expansion through acquisitions, joint ventures

and strategic alliances

Price of gold

Comp t etit itiive St Strength ths Us

TABLE 1 CNMC MINERAL RESOURCES, JUNE 2010

JORC Code

Class

Tonnes Grade g/t

Au

Gold (oz)

Measured 659,000 3.4 71,700

Indicated 803,000 2.0 50,900

Inferred 720,000 2.6 60,900

TOTAL 2,182,000 2.6 183,500

Note: The total gold resources of 2,182,000 tonnes includes gold ore reserves of

989,000 tonnes

TABLE 2 CNMC ORE RESERVES, JUNE 2010

JORC Code

Class

Tonnes Grade g/t

Au

Gold (oz)

Proved 204,000 3.6 23,900

Probable 785,000 1.8 46,400

TOTAL 989,000 2.2 70,300

g

The above chart sets forth monthly average London Fix gold price from January 2008 to August 2011.

Source: World Gold Council

0

200

400

600

800

1000

1200

1400

1600

1800

2000

J

a

n

u

a

r

y

2

0

0

8

F

e

b

r

u

a

r

y

2

0

0

8

M

a

r

c

h

2

0

0

8

A

p

r

i

l

2

0

0

8

M

a

y

2

0

0

8

J

u

n

e

2

0

0

8

J

u

l

y

2

0

0

8

A

u

g

u

s

t

2

0

0

8

S

e

p

t

e

m

b

e

r

2

0

0

8

O

c

t

o

b

e

r

2

0

0

8

N

o

v

e

m

b

e

r

2

0

0

8

D

e

c

e

m

b

e

r

2

0

0

8

J

a

n

u

a

r

y

2

0

0

9

F

e

b

r

u

a

r

y

2

0

0

9

M

a

r

c

h

2

0

0

9

A

p

r

i

l

2

0

0

9

M

a

y

2

0

0

9

J

u

n

e

2

0

0

9

J

u

l

y

2

0

0

9

A

u

g

u

s

t

2

0

0

9

S

e

p

t

e

m

b

e

r

2

0

0

9

O

c

t

o

b

e

r

2

0

0

9

N

o

v

e

m

b

e

r

2

0

0

9

D

e

c

e

m

b

e

r

2

0

0

9

J

a

n

u

a

r

y

2

0

1

0

F

e

b

r

u

a

r

y

2

0

1

0

M

a

r

c

h

2

0

1

0

A

p

r

i

l

2

0

1

0

M

a

y

2

0

1

0

J

u

n

e

2

0

1

0

J

u

l

y

2

0

1

0

A

u

g

u

s

t

2

0

1

0

S

e

p

t

e

m

b

e

r

2

0

1

0

O

c

t

o

b

e

r

2

0

1

0

N

o

v

e

m

b

e

r

2

0

1

0

D

e

c

e

m

b

e

r

2

0

1

0

J

a

n

u

a

r

y

2

0

1

1

F

e

b

r

u

a

r

y

2

0

1

1

M

a

r

c

h

2

0

1

1

A

p

r

i

l

2

0

1

1

M

a

y

2

0

1

1

J

u

n

e

2

0

1

1

J

u

l

y

2

0

1

1

A

u

g

u

s

t

2

0

1

1

P

r

i

c

e

o

f

G

o

l

d

U

S

$

p

e

r

o

z

TABLE OF CONTENTS

1

CORPORATE INFORMATION .......................................................................................................... 4

DEFINITIONS .................................................................................................................................... 6

GLOSSARY OF TECHNICAL TERMS .............................................................................................. 15

CAUTIONARY NOTE ON FORWARD-LOOKING STATEMENTS.................................................... 20

SELLING RESTRICTIONS................................................................................................................ 22

DETAILS OF THE PLACEMENT ...................................................................................................... 23

LISTING ON CATALIST .......................................................................................................... 23

INDICATIVE TIMETABLE FOR LISTING .......................................................................................... 27

PLAN OF DISTRIBUTION ................................................................................................................ 28

INTERESTS OF PPCF, THE MANAGER AND SPONSOR AND JOINT PLACEMENT

AGENT .................................................................................................................................... 29

INTERESTS OF ASIASONS WFG, THE JOINT PLACEMENT AGENT ................................ 29

OFFER DOCUMENT SUMMARY...................................................................................................... 30

OUR COMPANY ...................................................................................................................... 30

OUR BUSINESS...................................................................................................................... 30

SUMMARY OF OUR FINANCIAL INFORMATION.................................................................. 30

OUR COMPETITIVE STRENGTHS ........................................................................................ 31

OUR PROSPECTS.................................................................................................................. 31

OUR BUSINESS STRATEGIES AND FUTURE PLANS ........................................................ 32

OUR CONTACT DETAILS........................................................................................................ 32

THE PLACEMENT ............................................................................................................................ 33

EXCHANGE RATES .......................................................................................................................... 34

RISK FACTORS ................................................................................................................................ 35

RISKS RELATING TO OUR BUSINESS OR THE INDUSTRY................................................ 35

RISKS RELATING TO OUR OPERATIONS IN MALAYSIA .................................................... 44

RISKS RELATING TO AN INVESTMENT IN OUR SHARES.................................................. 46

ISSUE STATISTICS .......................................................................................................................... 48

USE OF PROCEEDS AND LISTING EXPENSES............................................................................ 50

DIVIDEND POLICY............................................................................................................................ 52

SHARE CAPITAL .............................................................................................................................. 53

SHAREHOLDERS ............................................................................................................................ 57

SHAREHOLDING AND OWNERSHIP STRUCTURE.............................................................. 57

SIGNIFICANT CHANGES IN PERCENTAGE OF OWNERSHIP ............................................ 59

VENDORS................................................................................................................................ 60

MORATORIUM ........................................................................................................................ 60

CAPITALISATION AND INDEBTEDNESS........................................................................................ 62

WORKING CAPITAL.......................................................................................................................... 64

DILUTION .......................................................................................................................................... 66

RESTRUCTURING EXERCISE ........................................................................................................ 68

GROUP STRUCTURE ...................................................................................................................... 71

SELECTED COMBINED FINANCIAL INFORMATION .................................................................... 72

MANAGEMENTS DISCUSSION AND ANALYSIS OF RESULTS OF OPERATIONS AND

FINANCIAL POSITION...................................................................................................................... 75

OVERVIEW.............................................................................................................................. 75

PRINCIPAL COMPONENTS OF OUR INCOME STATEMENT .............................................. 75

REVIEW OF RESULTS OF OPERATIONS ............................................................................ 79

REVIEW OF PAST OPERATING PERFORMANCE................................................................ 79

REVIEW OF PAST FINANCIAL POSITION OF OUR GROUP .............................................. 82

LIQUIDITY AND CAPITAL RESOURCES................................................................................ 85

MATERIAL CAPITAL EXPENDITURES AND DIVESTMENTS................................................ 86

FOREIGN EXCHANGE MANAGEMENT ................................................................................ 87

SEASONALITY ........................................................................................................................ 88

INFLATION .............................................................................................................................. 88

SIGNIFICANT CHANGES IN ACCOUNTING POLICIES........................................................ 88

GENERAL INFORMATION ON OUR COMPANY AND OUR GROUP ............................................ 89

HISTORY.................................................................................................................................. 89

OUR SUBSIDIARIES .............................................................................................................. 92

INDEPENDENT VALUATION .................................................................................................. 92

BUSINESS OVERVIEW .......................................................................................................... 93

BUSINESS ACTIVITIES .......................................................................................................... 96

QUALITY ASSURANCE .......................................................................................................... 103

OUR MAJOR CUSTOMERS.................................................................................................... 103

OUR MAJOR SUPPLIERS ...................................................................................................... 104

CREDIT POLICY...................................................................................................................... 104

INVENTORY MANAGEMENT.................................................................................................. 105

SALES AND MARKETING ...................................................................................................... 105

INSURANCE............................................................................................................................ 105

INTELLECTUAL PROPERTY .................................................................................................. 105

LICENCES, PERMITS, APPROVALS AND GOVERNMENT REGULATIONS........................ 106

KEY CONTRACTORS AND CONSULTANTS.......................................................................... 109

STAFF TRAINING.................................................................................................................... 110

ENVIRONMENTAL PROTECTION AND COMMUNITY DEVELOPMENT.............................. 110

INFRASTRUCTURE ................................................................................................................ 114

SAFETY POLICY .................................................................................................................... 114

RESEARCH AND DEVELOPMENT ........................................................................................ 115

COMPETITION ........................................................................................................................ 115

COMPETITIVE STRENGTHS.................................................................................................. 115

PROPERTIES AND FIXED ASSETS ...................................................................................... 117

INDUSTRY OVERVIEW .......................................................................................................... 118

PROSPECTS .......................................................................................................................... 121

BUSINESS STRATEGIES AND FUTURE PLANS .................................................................. 123

ORDER BOOK ........................................................................................................................ 124

TREND INFORMATION .......................................................................................................... 124

DIRECTORS, MANAGEMENT AND STAFF .................................................................................... 125

DIRECTORS ............................................................................................................................ 125

KEY EXECUTIVE OFFICERS ................................................................................................ 128

MANAGEMENT REPORTING STRUCTURE.......................................................................... 130

EMPLOYEES .......................................................................................................................... 131

TABLE OF CONTENTS

2

REMUNERATION OF DIRECTORS, EXECUTIVE OFFICERS AND RELATED

EMPLOYEES .......................................................................................................................... 132

SERVICE AGREEMENTS........................................................................................................ 132

CNMC PERFORMANCE SHARE PLAN .......................................................................................... 134

CORPORATE GOVERNANCE.......................................................................................................... 143

INTERESTED PERSON TRANSACTIONS ...................................................................................... 148

PAST INTERESTED PERSON TRANSACTIONS .................................................................. 148

PRESENT AND ON-GOING INTERESTED PERSON TRANSACTIONS .............................. 150

GUIDELINES AND REVIEW PROCEDURES FOR ON-GOING AND FUTURE

INTERESTED PERSON TRANSACTIONS ............................................................................ 153

POTENTIAL CONFLICTS OF INTEREST .............................................................................. 155

INTERESTS OF EXPERTS .................................................................................................... 155

INTERESTS OF PPCF, THE MANAGER AND SPONSOR AND JOINT PLACEMENT

AGENT .................................................................................................................................... 155

INTERESTS OF ASIASONS WFG, THE JOINT PLACEMENT AGENT ................................ 156

DESCRIPTION OF ORDINARY SHARES ........................................................................................ 157

EXCHANGE CONTROLS.................................................................................................................. 162

TAXATION.......................................................................................................................................... 163

CLEARANCE AND SETTLEMENT .................................................................................................. 169

GENERAL AND STATUTORY INFORMATION ................................................................................ 170

APPENDIX A INDEPENDENT AUDITORS REPORT ON THE COMBINED FINANCIAL

STATEMENTS FOR THE YEARS ENDED 31 DECEMBER 2008, 2009 AND

2010 ...................................................................................................................... A-1

COMBINED FINANCIAL STATEMENTS FOR THE YEARS ENDED

31 DECEMBER 2008, 2009 AND 2010 ................................................................ A-3

APPENDIX B REVIEW REPORT ON THE UNAUDITED CONDENSED INTERIM COMBINED

FINANCIAL INFORMATION FOR THE THREE MONTHS ENDED

31 MARCH 2011 .................................................................................................. B-1

UNAUDITED CONDENSED INTERIM COMBINED FINANCIAL INFORMATION

FOR THE THREE MONTHS ENDED 31 MARCH 2011 ...................................... B-2

APPENDIX C SELECTED EXTRACTS OF OUR ARTICLES OF ASSOCATION ...................... C-1

APPENDIX D ABRIDGED DUE DILIGENCE REPORT .............................................................. D-1

APPENDIX E LEGAL OPINION FROM SKRINE ........................................................................ E-1

APPENDIX F BDA TECHNICAL REPORT.................................................................................. F-1

APPENDIX G INDEPENDENT VALUATION REPORT ................................................................ G-1

APPENDIX H RULES OF THE CNMC PERFORMANCE SHARE PLAN .................................. H-1

APPENDIX I TERMS, CONDITIONS AND PROCEDURES FOR APPLICATION AND

ACCEPTANCE ...................................................................................................... I-1

TABLE OF CONTENTS

3

BOARD OF DIRECTORS : Professor Lin Xiang Xiong @ Lin Ye (Executive Chairman)

Choo Chee Kong (Executive Vice Chairman)

Lim Kuoh Yang (Executive Director and Chief Executive Officer)

Kuan Cheng Tuck (Independent Director)

Tan Poh Chye Allan (Independent Director)

Lim Yeok Hua (Independent Director)

COMPANY SECRETARY : Vincent Lim Bock Hui, LLB (Hons)

REGISTERED OFFICE : 5 Shenton Way

#11-03 UIC Building

Singapore 068808

MANAGER AND SPONSOR : PrimePartners Corporate Finance Pte. Ltd.

AND JOINT PLACEMENT 20 Cecil Street

AGENT #21-02 Equity Plaza

Singapore 049705

JOINT PLACEMENT AGENT : Asiasons WFG Securities Pte Ltd

5 Shenton Way

#28-01 UIC Building

Singapore 068808

INDEPENDENT AUDITORS : KPMG LLP

AND REPORTING 16 Raffles Quay

ACCOUNTANTS #22-00 Hong Leong Building

Singapore 048581

Partner-in-charge: Tan Huay Lim

(a practising member of the Institute of Certified Public Accountants

of Singapore)

SOLICITORS TO THE : Shook Lin & Bok LLP

PLACEMENT AND LEGAL 1 Robinson Road

ADVISER TO OUR COMPANY #18-00 AIA Tower

ON SINGAPORE LAW Singapore 048542

LEGAL ADVISER TO OUR : Skrine

COMPANY ON MALAYSIA 8th Floor, Wisma UOA Damansara

LAW No. 50 Jalan Dungun, Damansara Heights

50490 Kuala Lumpur

Malaysia

LEGAL ADVISER TO OUR : Ha and Ho Solicitors

COMPANY ON HONG KONG Rooms 1109-10A

LAW Wing Tuck Commercial Centre

177-183 Wing Lok Street

Sheung Wan

Hong Kong

INDEPENDENT GEOLOGIST : Behre Dolbear Australia Pty Limited

Level 9, 80 Mount Street

North Sydney, NSW 2060

Australia

CORPORATE INFORMATION

4

INDEPENDENT VALUER : Jones Lang LaSalle Sallmanns Limited

6/F Three Pacific Place

1 Queens Road East

Hong Kong

SHARE REGISTRAR : Boardroom Corporate & Advisory Services Pte. Ltd.

50 Raffles Place

#32-01 Singapore Land Tower

Singapore 048623

PRINCIPAL BANKERS : The Bank of East Asia, Limited

60 Robinson Road

Bank of East Asia Building

Singapore 068892

CIMB Bank Berhad

Lot 522, Jalan Dato Nik Mustapha

17500 Tanah Merah, Kelantan

Malaysia

Standard Chartered Bank

Marina Bay Financial Centre (Tower 1)

8 Marina Boulevard, Level 24

Singapore 018981

RECEIVING BANKER : The Bank of East Asia, Limited

60 Robinson Road

Bank of East Asia Building

Singapore 068892

VENDORS : Messiah Limited

P.O. Box 957

Offshore Incorporations Centre

Road Town Tortola

British Virgin Islands

EP Capital Inc.

P.O. Box 957

Offshore Incorporations Centre

Road Town Tortola

British Virgin Islands

Caravel Holdings Group Ltd

Portcullis TrustNet Chambers

P.O. Box 3444

Road Town Tortola

British Virgin Islands

Ng Eng Tiong

1 Shenton Way

#16-11

Singapore 068803

CORPORATE INFORMATION

5

In this Offer Document and the accompanying Application Forms, unless the context otherwise requires,

the following definitions apply throughout where the context so admits:

Companies within our Group

Company : CNMC Goldmine Holdings Limited, a company incorporated in

Singapore on 11 August 2011

CNMC : CNMC Goldmine Limited, a company incorporated in Hong Kong

on 28 October 2006 and a wholly-owned subsidiary of our

Company

CMNM : CMNM Mining Group Sdn. Bhd., a company incorporated in

Malaysia on 27 December 2006 and a 81% owned subsidiary of

CNMC

Group or Group Companies : Our Company and our subsidiaries as at the date of this Offer

Document

MCS : MCS Mining Group Sdn. Bhd., a company incorporated in

Malaysia on 4 October 2004 and a 80%

(1)

owned subsidiary of

CNMC

CNMC-Nalata : CNMC-Nalata Mining Sdn. Bhd., a company incorporated in

Malaysia on 24 January 2008 and a 80% owned subsidiary of

CNMC

Other Companies, Organisations and Agencies

ACRA : Accounting and Corporate Regulatory Authority of Singapore

Asiasons WFG : Asiasons WFG Securities Pte Ltd

Authority : Monetary Authority of Singapore

BDA : Behre Dolbear Australia Pty Limited

CDP or Depository : The Central Depository (Pte) Limited

CGRI : Changchun Gold Research Institute

CMNM-JY : CMNM-Juyuan Mining Service Sdn. Bhd., a joint venture company

incorporated in Malaysia on 13 March 2011 pursuant to the Joint

Venture Agreement which is proposed to be 51% owned by

CMNM and 49% owned by Xiamen Shenkun

CPF : Central Provident Fund

CSU : Central South Universitys School of Geo-science and

Environmental Engineering

DOE : The Department of Environment of Kelantan

IRAS : Inland Revenue Authority of Singapore

JLLS : Jones Lang LaSalle Sallmanns Limited

DEFINITIONS

6

(1) CNMC is the registered holder of 87.5% interest in MCS. CNMC has an arrangement with the Kelantan State Government to

hold 7.5% interest in MCS for the Kelantan State Government, and such interest will be transferred from CNMC in due course.

The effective percentage interest of CNMC in MCS is therefore 80% as at the Latest Practicable Date.

KSEDC : Kelantan State Economic Development Corporation

Manager, Sponsor or PPCF : PrimePartners Corporate Finance Pte. Ltd.

Joint Placement Agent(s) : PPCF and Asiasons WFG

MIDA : Malaysian Industrial Development Authority

Receiving Banker : The Bank of East Asia, Limited

SCCS : Securities Clearing & Computer Services (Pte) Ltd

SGX-ST : Singapore Exchange Securities Trading Limited

Share Registrar : Boardroom Corporate & Advisory Services Pte. Ltd.

SIC : Securities Industry Council of Singapore

Sinomine : Sinomine Resource Exploration and Sinomine Resource

(Malaysia)

Sinomine Resource Exploration : Sinomine Resource Exploration Co., Ltd

Sinomine Resource (Malaysia) : Sinomine Resource (Malaysia) Sdn Bhd

Solicitors to the Placement : Shook Lin & Bok LLP

Xiamen Shenkun : Xiamen Shenkun Group Co., Ltd.

General

1Q : The three (3) months financial period ended or ending 31 March,

as the case may be

Application Form : The printed application form to be used for the purpose of the

Placement and which form part of this Offer Document

Application List : The list of applications for the subscription and/or purchase of the

Placement Shares

Articles or Articles of : The articles of association of our Company, as amended,

Association supplemented or modified from time to time

Associate : (a) in relation to any director, chief executive officer, substantial

shareholder or controlling shareholder (being an individual)

means:

(i) his immediate family;

(ii) the trustees, acting in their capacity as such trustees,

of any trust of which he or his immediate family is a

beneficiary or, in the case of a discretionary trust, is a

discretionary object; or

(iii) any company in which he and his immediate family

together (directly or indirectly) have an interest of

30% or more of the total votes attached to all the

voting shares;

DEFINITIONS

7

(b) in relation to a substantial shareholder or a controlling

shareholder (being a company) means any other company

which is its subsidiary or holding company or is a fellow

subsidiary of any such holding company or one in the equity

of which it and/or such other company or companies taken

together (directly or indirectly) have an interest of 30% or

more of the total votes attached to all the voting shares

Associated Company : In relation to a corporation, means:

(a) any corporation in which the corporation or its subsidiary

has, or the corporation and its subsidiary together have, a

direct interest of not less than 20% but not more than 50%

of the aggregate of the total votes attached to all the voting

shares; or

(b) any corporation, other than a subsidiary of the corporation

or a corporation which is an associated company by virtue

of paragraph (a), the policies of which the corporation or its

subsidiary, or the corporation together with its subsidiary, is

able to control or influence materially

Audit Committee : The audit committee of our Company as at the date of this Offer

Document, unless otherwise stated

Awards : The contingent awards of Shares granted or which may be

granted pursuant to the CNMC Performance Share Plan

Award Shares : The Shares which are the subject of the Awards under the CNMC

Performance Share Plan

BDA Technical Report : The technical report dated 12 August 2011 prepared by BDA

relating to the Sokor Gold Project and Sokor Gold Zone set out in

Appendix F of this Offer Document

Board or Board of Directors : The board of Directors of our Company as at the date of this Offer

Document, unless otherwise stated

Catalist : The sponsor-supervised listing platform of the SGX-ST

Catalist Rules : Any or all of the rules in the SGX-ST Listing Manual Section B:

Rules of Catalist, as the case may be

CNMC Performance Share : The share plan of our Company known as CNMC Performance

Plan Share Plan which was approved on 14 October 2011, particulars

of which are set out in the section entitled CNMC Performance

Share Plan of this Offer Document

Companies Act : Companies Act (Chapter 50) of Singapore, as amended,

supplemented or modified from time to time

Controlling Shareholder : In relation to a corporation, means:

(a) a person who has an interest in the voting shares of a

corporation and who exercises control over the corporation;

or

DEFINITIONS

8

(b) a person who has an interest of 15% or more of the total

votes attached to all the voting shares in a corporation,

unless he does not exercise control over the corporation

Convertible Loans : The convertible loans of an aggregate value of approximately

US$3.10 million issued by CNMC to Lim Chee Hoong, Lim Peng

Liang David Llewellyn and Grande Pacific which were converted

into shares of CNMC pursuant to the Restructuring Exercise

Director : A director of our Company as at the date of this Offer Document

Employee Shares The 2,022,000 new Shares to be issued to Chen Yan, the Chief

Financial Officer of our Company

Entity at Risk : (a) The Company; (b) a subsidiary of the Company that is not

listed on the SGX-ST or an approved exchange; or (c) an

Associated Company that is not listed on the SGX-ST or an

approved exchange, provided that our Group or our Group and

our Interested Person(s), has control over the Associated

Company

EPS : Earnings per Share

Executive Directors : The executive Directors of our Company as at the date of this

Offer Document, unless otherwise stated

Executive Officers : The executive officers of our Company as at the date of this Offer

Document, who are also key executives as defined under the

Securities and Futures (Offers of Investments) (Shares and

Debentures) Regulations 2005, unless otherwise stated

FY : Financial year ended or, as the case may be, ending 31

December

Hong Kong : The Hong Kong Special Administrative Region of the PRC

Independent Directors : The independent Directors of our Company as at the date of this

Offer Document, unless otherwise stated

Independent Valuation Report : The valuation report dated 1 September 2011 prepared by JLLS

relating to the independent valuation of the fair market value of the

Sokor Gold Project as set out in Appendix G of this Offer

Document

Interested Person : (a) a director, chief executive officer or Controlling Shareholder

of the Company; or

(b) an Associate of any such director, chief executive officer or

Controlling Shareholder

Interested Person Transaction : Means a transaction between an Entity at Risk and an Interested

Person

Joint Venture Agreement : A joint venture agreement dated 28 January 2011 entered into

between CMNM and Xiamen Shenkun to incorporate a joint

venture company to be 51% owned by CMNM and 49% owned by

Xiamen Shenkun

DEFINITIONS

9

JORC Code : Australasian Code for Reporting of Exploration Results, Mineral

Resources and Ore Reserves promulgated by the Joint Ore

Reserves Committee of the Australasian Institute of Mining and

Metallurgy, Australian Institute of Geoscientists and Minerals

Council of Australia, 2004 Edition

Kelantan : A state in the Federation of Malaysia

Latest Practicable Date or LPD : 16 September 2011, being the latest practicable date before the

lodgement of this Offer Document with the SGX-ST

Listing : The listing of the Shares on Catalist

Management Agreement : The full sponsorship and management agreement entered into

between our Company, the Vendors and PPCF pursuant to which

PPCF shall sponsor and manage the Listing, details as described

in the sections entitled Plan of Distribution and General and

Statutory Information Management and Placement

Arrangements of this Offer Document

Market Day : A day on which the SGX-ST is open for trading in securities

Memorandum : The memorandum of association of our Company, as amended,

varied or supplemented from time to time

Mineral Enactment : Kelantan Mineral Enactment 2001

NAV : Net asset value

New Shares : The 23,900,000 new Shares for which our Company invites

applications to subscribe for pursuant to the Placement, subject to

and on the terms and conditions set out in this Offer Document

Nominating Committee : The nominating committee of our Company as at the date of this

Offer Document, unless otherwise stated

Non-Executive Directors : The non-executive Directors of our Company (including the

Independent Directors) as at the date of this Offer Document,

unless otherwise stated

NTA : Net tangible assets

Offer Document : This Offer Document dated 18 October 2011 issued by our

Company in respect of the Placement

PER : Price earnings ratio

period under review : The period which comprises FY2008, FY2009, FY2010 and

1Q2011

Placement : The placement of the Placement Shares by the Joint Placement

Agents on behalf of our Company and the Vendors for

subscription and/or purchase at the Placement Price, subject to

and on the terms and conditions as set out in this Offer Document

DEFINITIONS

10

Placement Agreement : The placement agreement entered into between our Company, the

Vendors and the Joint Placement Agents pursuant to which the

Joint Placement Agents agreed to procure subscriptions and/or

purchases for the Placement Shares at the Placement Price as

described in the sections entitled Plan of Distribution and

General and Statutory Information Management and Placement

Arrangements of this Offer Document

Placement Price : S$0.40 for each Placement Share

Placement Shares : The 41,100,000 Shares which are the subject of the Placement,

comprising 23,900,000 New Shares and 17,200,000 Vendor

Shares

PPCF Shares : The 3,771,000 new Shares to be issued and allotted to PPCF by

our Company as part of PPCFs management fee as the Manager

and Sponsor

PRC : The Peoples Republic of China

Pre-Placement Investors : Lim Chee Hoong, Lim Peng Liang David Llewellyn, Grande Pacific

Limited and Yu Long Fei

Refining Agreement : Refining agreement dated 7 April 2009 entered into between

CMNM and AGR Matthey pursuant to which CMNM engages AGR

Matthey to refine gold and silver produced by CMNM and as

varied by a novation deed dated 29 March 2010

Remuneration Committee : The remuneration committee of our Company as at the date of

this Offer Document, unless otherwise stated

Restructuring Exercise : The corporate restructuring exercise implemented in connection

with the Placement, more fully described in the section entitled

Restructuring Exercise of this Offer Document

Securities Account : The securities account maintained by a Depositor with CDP but

does not include a securities sub-account

Securities and Futures Act or : The Securities and Futures Act (Chapter 289) of Singapore, as

SFA amended, supplemented or modified from time to time

Service Agreements : The service agreements entered into between our Company and

our Executive Directors, as described in the section entitled

Directors, Management and Staff Service Agreements of this

Offer Document

SFR : The Securities and Futures (Offers of Investments) (Shares and

Debentures) Regulations 2005 of Singapore, as amended,

supplemented or modified from time to time

SGXNET : Singapore Exchange Network, a system network used by listed

companies in sending information and announcements to the

SGX-ST or any other system networks prescribed by the SGX-ST

Share(s) : Ordinary share(s) in the capital of our Company

DEFINITIONS

11

Shareholder(s) : Registered holders of Shares, except where the registered holder

is CDP, the term Shareholder shall, in relation to such Shares

mean the Depositors whose Securities Accounts are credited with

Shares

Share Swap Agreement : The share swap agreement dated 9 October 2011 entered into

between our Company and the shareholders of CNMC to acquire

the entire issued share capital of CNMC pursuant to the

Restructuring Exercise

Singapore : The Republic of Singapore

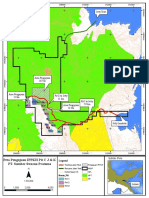

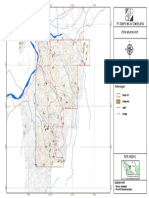

Sokor Block : Mining area covering approximately 10 sq km within Sungai

Amang and Sungai Sejana, Mukim Sokor, Sokor, Tanah Merah,

Kelantan, Malaysia

Sokor Gold Project : The exploration and mining of gold at the Sokor Block pursuant to

the contractual rights granted to CMNM by KSEDC as the holder

of the mining lease for the Sokor Block via an agreement dated 16

May 2007 entered into between CNMC and KSEDC and

supplemented by a tripartite agreement dated 21 April 2011

entered into between CNMC, CMNM and KSEDC

Sokor Gold Zone : An area covering approximately 62.8 sq km within the Districts of

Kuala Krai, Jeli and Tanah Merah, Kelantan, Malaysia

Substantial Shareholder(s) : Persons who have an interest in one or more voting shares, and

the total votes attaching to that share or those shares, represent

not less than 5% of the total votes attaching to all the voting

shares in our Company

USA : United States of America

VALMIN Code : Code for the Technical Assessment and Valuation of Mineral and

Petroleum Assets and Securities for Independent Expert Reports

2005 Edition, prepared by the VALMIN Committee, a joint

committee of the Australasian Institute of Mining and Metallurgy,

the Australian Institute of Geoscientists and the Mineral Industry

Consultants Association with the participation of the Australian

Securities and Investment Commission, the Australian Stock

Exchange Limited, the Minerals Council of Australia, the

Petroleum Exploration Society of Australia, the Securities

Association of Australia and representatives from the Australian

finance sector

Vendors : Messiah Limited, EP Capital Inc., Caravel Holdings Group Ltd and

Ng Eng Tiong

Vendor Shares : The 17,200,000 issued and fully paid-up Shares for which the

Vendors invite applications to purchase pursuant to the

Placement, subject to and on the terms and conditions of this

Offer Document

DEFINITIONS

12

Currencies, Units and Others

HK$ : Hong Kong dollars

MYR or Ringgit : Malaysian ringgit

RMB : PRC Renminbi

S$ and cents : Singapore dollars and cents, respectively

US$ or USD and US cents : USA dollars and cents, respectively

g : grams

kg : Kilograms

km : Kilometres

koz : Kilo ounces

kt : Kilo tonnes

m : Metres

m

3

: Cubic metres

mm : Millimetres

oz : Troy ounces

sq ft : Square feet

sq km : Square kilometres

sq m : Square metres

t : tonnes

% or per cent. : Per centum or percentage

Any capitalised terms relating to the CNMC Performance Share Plan which are not defined in this section

of this Offer Document shall have the meanings ascribed to them as stated in Appendix H of this Offer

Document.

The expression subsidiary shall have the meaning ascribed to it in the SFR and the Companies Act.

The expression business trust has the same meaning ascribed to it in Section 2 of the Business Trusts

Act (Chapter 31A) of Singapore.

The expression Entity includes a corporation, an unincorporated association, a partnership and the

government of any state, but does not include a trust.

The expressions Depositor, Depository Agent and Depository Register shall have the meanings

ascribed to them respectively in Section 130A of the Companies Act.

DEFINITIONS

13

References in this Offer Document to Appendix or Appendices are references to an appendix or

appendices respectively in this Offer Document.

Any discrepancies in tables included herein between the total sum of amounts listed and the totals shown

thereof are due to rounding. Accordingly, figures shown as totals in certain tables may not be an

arithmetic aggregation of the figures which precede them.

Words importing the singular shall, where applicable, include the plural and vice versa and words

importing the masculine gender shall, where applicable, include the feminine and neuter genders and

vice versa. References to persons shall include corporations.

Certain names with Chinese characters have been translated into English names for the convenience of

Shareholders. Such translations may not be recognised with the relevant PRC authorities and should not

be construed as representing the Chinese characters. In the event of any inconsistency between the

official Chinese names and the translated English names, the official Chinese names shall prevail.

Any reference in this Offer Document and the Application Forms to any statue or enactment is a

reference to that statue or enactment as for the time being amended or re-enacted.

Any word defined under the Companies Act, the SFA, SFR or any statutory modification thereof and used

in this Offer Document and the Application Forms shall, where applicable, have the meaning ascribed to

it under the Companies Act, the SFA, SFR or any statutory modification thereto, as the case may be.

Any reference in this Offer Document and the Application Forms to Shares being allotted to an applicant

includes allotment to CDP for the account of that applicant.

Any reference to a time of day in this Offer Document and the Application Forms is a reference to

Singapore time unless otherwise stated.

Any reference in this Offer Document to the Group, we, our, us or their other grammatical variations

is a reference to our Company, or Group, or any member of our Group, as the context requires.

Any reference to Professor Lin Xiang Xiong in this Offer Document is a reference to Professor Lin Xiang

Xiong @ Lin Ye.

DEFINITIONS

14

To facilitate a better understanding of the business of our Group, the following glossary provides a

description of some of the technical terms and abbreviations commonly used in our industry. The terms

and their assigned meanings may not correspond to standard industry or common meanings or usage of

these terms:

Ag : The chemical symbol for silver

alluvial gold : Gold that is found in the soil or sediments deposited by a river,

stream, or other running water and usually takes the form of dust,

thin flakes or nuggets

ALS method ME-OG62 : This method of analysis incorporates hydrofluoric acid to provide a

near total digestion of the sample, with the final determination

being made by inductively coupled plasma atomic emission

spectrometry or flame atomic absorption mass spectrometry. This

procedure may be used for the analysis of sulfide ores and is

particularly suited for the analysis of skarn deposits and ores

containing chrysacolla and willemite. It is also useful when

knowledge of the major gangue elements is required

assay sample preparation : Method by which drill core or other soil/rock samples are reduced in

size in order to enable a small sample to be tested in a laboratory

to determine the grade of the mineral of interest; preparation

methods ensure that the small sample that is ultimately tested is

representative of the original whole sample

atomic absorption mass : A spectroanalytical technique for the qualitative and quantitative

spectrometry chemical elements analysis of ore material

Au : The chemical symbol for gold

backhoe : A piece of excavating equipment consisting of a digging bucket on

the end of a two-part articulated arm

carbon-in-leach : A method of recovering gold and silver from ore by simultaneous

dissolution and absorption of the precious metals onto fine carbon

in an agitated tank of ore solids/solution slurry

carbon re-generation : Regeneration of spent activated carbon in an enclosed thermal

treatment device

Central Belt : The Central Belt of Peninsular Malaysia which extends from

Malaysias borders to Thailand to Johore in the south of the

peninsula and contains base metal and gold mineralisation

channel samples : A sample composed of pieces of vein or mineral deposit that have

been cut out of a small trench or channel, usually about 10

centimetres wide and 2 centimetres deep

concentrate : A powdery product containing an upgraded mineral content

resulting from initial processing of mined ore to remove some waste

materials. A concentrate is an intermediary product, which would

still be subject to further processing, such as smelting, to effect

recovery of metal

core : The long cylindrical piece of rock, about an inch in diameter,

brought to surface by diamond core drilling

GLOSSARY OF TECHNICAL TERMS

15

cut-off : The lowest grade or assay value of ore in a deposit that will recover

mining costs; the cut-off grade which determines the workable

tonnage of an ore

deposit or mineral deposit : A body of mineralisation containing a sufficient average grade of

metal or metals to warrant further exploration and/or development

expenditure

diamond core drilling : A drilling method where the rock is cut with a diamond bit to extract

a core of the rock

drill anomaly targets : An indication of concentrations of magnetic minerals for further

exploration drilling

eluvial gold : Gold freed up from the gold source by erosion/weathering and

moved by gravity down slope

enhanced thematic mapper : An eight-band multispectral scanning radiometer onboard the

satellite that is capable of providing high-resolution imaging

information of the earths surface

exploration : An activity to prove the location, volume and quality of an ore body

fire assay method : A type of analytical procedure that involves the heat of a furnace

and a fluxing agent to fuse a sample to collect any precious metals

(such as gold) in the sample. The collected material is then

analysed for gold or other precious metals by weight or

spectroscopic methods

geochemical : Pertaining to the chemical composition of the Earth

geological : Pertaining to the materials of the Earth and structure of those

materials

geological mapping : A tool to communicate or decode information relating to the surface

of the earth. It is mainly used for the interpretation of the structure,

mineralogy, stratigraphy, and paleontology of the earth crust. It is

also used in locating energy resources like petroleum, coal, natural

gas, and geothermal resources and is used for the exploration of

mineral deposits like gold, copper, iron, and construction aggregate

geological surveying : It is a modern technology that utilizes the technological

advancement of several disciplines of engineering. The geology

survey techniques include geological and topographic mapping with

the employment of robotic lasers, GPS, laser beams, and other

modern systems

geophysical : Matters concerning the physics of the earth and its environment,

including the physics of fields such as meteorology, oceanography,

and seismology

GPS : Global Positioning System; a navigational system involving satellites

and computers that can determine the latitude and longitude of a

receiver on earth by computing the time difference for signals from

different satellites to reach the receiver

gold bullion : Refined gold in the form of bars

GLOSSARY OF TECHNICAL TERMS

16

gold dor : A crude gold, silver bullion, usually produced at the mine site and

sent to a refiner where the silver and gold are parted and the gold

is refined to commercial-grade gold bullion

gold-bearing ore dressing : The cleaning of gold-bearing ore by the removal of certain

valueless portions

heap leaching : A method of extracting precious metals from ore. The mined ore is

usually crushed into small chunks and heaped on an impermeable

plastic and/or clay lined leach pad where it can be irrigated with a

leach solution to dissolve the valuable metals. The solution then

percolates through the heap and reaches both the target and other

minerals. The leach solution containing the dissolved minerals is

then collected, treated in a process plant to recover the target

mineral and in some cases precipitate other minerals, and then

recycled to the heap after reagent levels are adjusted

indicated resources : According to the JORC Code, is such part of mineral resource for

which tonnage, densities, shape, physical characteristics, grade and

mineral content can be estimated with a reasonable level of

confidence. It is based on exploration, sampling and testing

information gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill holes. The

locations are too widely or inappropriately spaced to confirm

geological and/or grade continuity but are spaced closely enough

for continuity to be assumed

induced polarisation : A method of geophysical prospecting carried out by passing an

electrical current through the ground and measuring the effect of

rocks and minerals in its path

inductively coupled plasma : An analytical technique that uses the inductively coupled plasma to

atomic emission spectrometry produce excited atoms and ions that emit electromagnetic radiation

at wavelengths characteristic for the detection of trace metals

inferred resources : According to the JORC Code, is such part of mineral resource for

which tonnage, grade and mineral content can be estimated with a

low level of confidence. It is inferred from geological evidence and

assumed but not verified geological and/or grade continuity. It is

based on information gathered through appropriate techniques from

locations such as outcrops, trenches, pits, workings and drill holes

which may be limited or of uncertain quality and reliability

ISO : International Organisation for Standardisation, a worldwide

federation of national standard bodies

ISO 9000 : A series of international standards primarily concerned with quality

management and quality assurance

ISO 9001 : A constituent part of the ISO 9000 series which specifies the

requirements for a quality management system for any organisation

that needs to demonstrate its ability to consistently provide

products that meet customer and applicable requirements and aim

to enhance customer satisfaction

GLOSSARY OF TECHNICAL TERMS

17

ISO/IEC 17025 : A main standard used by testing and calibration laboratories. It

specifies the general requirements for the competence to carry out

tests and/or calibrations, including sampling and covers testing and

calibration performed using standard methods, non-standard

methods, and laboratory-developed methods. Laboratories use

ISO/IEC 17025 to implement a quality system aimed at improving

their ability to consistently produce valid results. It is also the basis

for accreditation from an accreditation body and is a formal

recognition of a demonstration of competence in accuracy and

reliability of the tests and calibrations performed in laboratory

leaching vat : A vat containing gold extraction solution used for separating the

desired metals from the ore

measured resources : According to the JORC Code, is such part of mineral resource for

which tonnage, densities, shape, physical characteristics, grade and

mineral content can be estimated with a high level of confidence. It

is based on detailed and reliable exploration, sampling and testing

information gathered through appropriate techniques from locations

such as outcrops, trenches, pits, workings and drill holes. The

locations are spaced closely enough to confirm geological and

grade continuity

metallurgy studies : The science and technology of metals; usually pertaining to the

processing and extraction of metals and minerals from ores in

mining

mineral processing : The treatment of mineral products into concentrate

mineral resource : A concentration or occurrence of material of intrinsic economic

interest in and on the earths crust in such form, quality and

quantity that there are reasonable prospects for economic

extraction. The location, quantity, grade, geological characteristics

and continuity of a resource are known, estimated or interpreted

from specific geological evidence and knowledge.

mineralisation : Any single mineral or combination of minerals occurring in a mass,

or deposit, of economic interest. It covers all forms in which

mineralisation might occur, whether by class of deposit, mode of

occurrence, genesis or composition

mining dilution : The reduction of grade for mined ore due to the inclusion of waste

material in the mined ore

ore : A type of rock that contains mineral that can be mined for sale