2009 FPPC Matter of Michael Malik He Reported $0.00 But Contributed $26,500

Diunggah oleh

Archive ItJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

2009 FPPC Matter of Michael Malik He Reported $0.00 But Contributed $26,500

Diunggah oleh

Archive ItHak Cipta:

Format Tersedia

EXHIBIT 1

INTRODUCTION Respondent Michael J. Malik, Sr., (Respondent Malik) is an individual residing in the state of Michigan. Respondent Michael J. Malik, Sr., Trust (Respondent Trust) is a Michigan estate planning entity in which Respondent Malik is the trustor, trustee and beneficiary. Respondent Malik controls Respondent Trust. Respondent MJM Manistee, Inc. (Respondent MJM) is a casino development corporation based in Detroit, Michigan. Respondent Malik is the President and Respondent Trust is the sole shareholder of Respondent MJM. Respondent Malik controls Respondent MJM. Under the Political Reform Act (the Act), 1 Respondent Malik is affiliated with Respondent Trust and Respondent MJM for reporting and contribution aggregation purposes. This matter arose from a complaint and Respondents self-reporting of certain information regarding the below-stated Count. On May 18, 2006, the combination of Respondents Malik, Trust and MJM (collectively, Respondent Committee), made $20,000 in contributions to candidates or committees. Because Respondent Committees contributions totaled $10,000 or more, Respondents jointly qualified as a single major donor committee under the Act for calendar year 2006. As a major donor committee, Respondent Committee was required to file semi-annual campaign statements, commonly known as a major donor statements. During the six-month period of July 1 through December 31, 2006, Respondent Committee made 17 contributions in California totaling $26,500. Due to this campaign activity, Respondent Committee was required to but failed to disclose these 17 contributions on the initial major donor statement it filed for this period. For the purposes of this Stipulation, Respondents violation of the Political Reform Act is stated as follows: COUNT 1: Respondents Michael J. Malik, Sr., Michael J. Malik, Sr. Trust, and MJM Manistee, Inc., failed to disclose 17 contributions totaling $26,500 in a semi-annual campaign statement by the January 31, 2007 due date, for the reporting period of July 1 to December 31, 2006, in violation of Government Code Sections 84200, subdivision (b), and 84211, subdivision (k)(5).

The Political Reform Act is contained in Government Code Sections 81000 through 91014. All statutory references are to the Government Code, unless otherwise indicated. The regulations of the Fair Political Practices Commission are contained in Sections 18110 through 18997 of Title 2 of the California Code of Regulations. All regulatory references are to Title 2, Division 6 of the California Code of Regulations, unless otherwise indicated.

1

EXHIBIT 1 IN SUPPORT OF STIPULATION, DECISION AND ORDER FPPC NO. 07/195

SUMMARY OF THE LAW An express purpose of the Act, as set forth in Section 81002, subdivision (a), is to ensure that the contributions and expenditures affecting election campaigns are fully and truthfully disclosed to the public, so that voters may be better informed, and improper practices may be inhibited. The Act therefore establishes a comprehensive campaign reporting system. Duty to File Campaign Statements Under the Acts campaign reporting system, candidates and committees are required to file certain specified campaign statements and reports. Section 82013, subdivision (c), includes within the definition of committee any person or combination of persons who directly or indirectly makes contributions, including loans, totaling ten thousand dollars ($10,000) or more in a calendar year to, or at the behest of, candidates or committees. This type of committee is commonly referred to as a major donor committee. Section 84200, subdivision (b), requires a major donor committee to file a semi-annual campaign statement for any reporting period in which the committee made campaign contributions. The first semi-annual campaign statement covers the reporting period January 1 through June 30, and must be filed by July 31. The second semi-annual campaign statement covers the reporting period July 1 through December 31, and must be filed by January 31 of the following year. Section 84211, subdivision (k)(5), requires that in the case of an expenditure of one hundred dollars ($100) or more which is a contribution to a candidate, elected officer, or committee, the following information be disclosed: (1) the payees full name; (2) the payees street address; (3) the amount of each expenditure; (4) a brief description of the consideration for which each expenditure was made; (5) the date of the contribution; (6) the cumulative amount of contributions made to a candidate, elected officer, or committee; (7) the full name of the candidate, and the office and district for which he or she seeks nomination or election; and (8) the jurisdiction in which the candidate is voted upon.

SUMMARY OF THE FACTS Respondent Michael J. Malik, Sr., (Respondent Malik) is an individual residing in the state of Michigan. Respondent Michael J. Malik, Sr., Trust (Respondent Trust) is a Michigan estate planning entity in which Respondent Malik is the trustor, trustee and beneficiary. Thus, Respondent Malik controls Respondent Trust. Respondent MJM Manistee, Inc. (Respondent MJM) is a casino development corporation based in Detroit, Michigan. Respondent Malik is the President and Respondent Trust is the sole shareholder of Respondent MJM. Thus, Respondent Malik controls Respondent MJM. Under Act, Respondent Malik is affiliated with Respondent Trust and Respondent MJM for reporting and contribution aggregation purposes.

2

EXHIBIT 1 IN SUPPORT OF STIPULATION, DECISION AND ORDER FPPC NO. 07/195

On January 29, 2007, Respondent Committee timely filed its original major donor statement for the period of July 1 through December 31, 2006, disclosing that it had made no contributions during this period. In October 2008, Respondent Committee voluntarily submitted information to the Commission, without prior contact from the Enforcement Division. The Enforcement Divisions investigation revealed that Respondent Committee actually made 17 contributions during this reporting period totaling $26,500. In cooperation with the Enforcement Divisions investigation, Respondent Committee filed an amended major donor statement at all the appropriate locations between December 23 and 26, 2008, for this reporting period, disclosing contributions totaling $26,500. Count 1 (Failure to Disclose Contributions in a Semi-Annual Statement) On May 18, 2006, Respondents Malik, Trust and MJM (collectively, Respondent Committee), by making $20,000 in contributions to candidates or committees (Section 82013, subd. (c)), qualified as a single major donor committee. Thus, Respondent Committee was required to file semi-annual statements, commonly known as a major donor statements, disclosing all contributions made during 2006. Respondent Committee timely filed its original major donor statement for the six-month period of July 1 through December 31, 2006, on January 29, 2007, disclosing that it had made no contributions during this period. However, Respondent Committee actually made 17 contributions during this reporting period totaling $26,500, as follows: Date Made 08/10/2006 08/10/2006 08/10/2006 08/10/2006 08/10/2006 10/18/2006 10/18/2006 10/18/2006 10/18/2006 10/18/2006 10/18/2006 10/18/2006 10/18/2006 10/18/2006 10/18/2006 10/18/2006 10/18/2006 Recipient Aghazarian 2006 Friends of Wesley Chesbro Alberto Torrico For Assembly 2006 Maze for Assembly 2006 Dennis Mountjoy For State Senate 29th District Alberto Torrico For Assembly 2006 Friends of Patty Berg Friends of Fabian Nunez 2006 Taxpayers for Perata Dr. Ed Hernandez, OD for Assembly 2006 Friends of Pat Wiggins Democratic State Central Committee of CA Padilla for Senate 2006 Roy Asburn Senate Committee Friends of Kevin de Leon Lou Correa for Senate Ronald Calderon for Senate Total Contributions Made During Period Amount $1,500 $1,000 $1,000 $1,000 $1,000 $2,000 $1,000 $3,300 $5,000 $1,000 $2,000 $1,700 $1,000 $1,000 $1,000 $1,000 $1,000 $26,500

3

EXHIBIT 1 IN SUPPORT OF STIPULATION, DECISION AND ORDER FPPC NO. 07/195

By failing to timely disclose contributions made during the above named reporting period, Respondent Committee violated Government Code Sections 84200, subdivision (b), and 84211, subdivision (k)(5). As a condition of this settlement, Respondent Committee filed an amended major donor statement at all the appropriate locations between December 23 and 26, 2008, for the period of July 1 through December 31, 2006, which includes all of the previously undisclosed contributions. Though Respondent Committee has no prior enforcement history, Respondent Malik knew or should have known of Respondent Committees filing requirements as a major donor under the Act because of his past contact with the Enforcement Division. On August 16, 2006, Respondent Malik signed a stipulated settlement on behalf of Barwest, LLC, for Barwest, LLCs failure to disclose contributions as a major donor committee in a semi-annual statement for the reporting period of July 1 through December 31, 2004. Barwest, LLC, is a casino development company based in Detroit, Michigan. At the time of the prior enforcement action, Respondent Malik was a non-majority partner in Barwest, LLC, with some - but not full - decisionmaking authority.

CONCLUSION This matter consists of one count of violating the Act, which carries a maximum administrative penalty of Five Thousand Dollars ($5,000). In determining the appropriate penalty for a particular violation of the Act, the Enforcement Division considers the typical treatment of a violation in the overall statutory scheme of the Act, with an emphasis on serving the purposes and intent of the Act. The typical administrative penalty for failing to disclose required contribution information has been in the middle-to-high end of the penalty range, depending on the circumstances of the case. In this matter, Respondent Committee agrees to a high ranging penalty because: 1) Respondent Committee failed to make any of the required disclosures in the major donor statement for the reporting period of July 1 through December 31, 2006, despite making $26,500 in contributions, thereby depriving the public of disclosures required to be made timely and directly by Respondent Committee; and 2) Respondent Malik knew or should have known of Respondent Committees filing requirements as a major donor under the Act because of his involvement in the prior enforcement action against Barwest, LLC. Respondent Committee voluntarily submitted information regarding this matter to the Commission without prior contact from the Enforcement Division and cooperated with the investigation. Accordingly, the facts of this case justify a total imposition of an administrative penalty of Four Thousand Dollars ($4,000).

4

EXHIBIT 1 IN SUPPORT OF STIPULATION, DECISION AND ORDER FPPC NO. 07/195

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Phil Hogen Letter Re Lansing CasinoDokumen4 halamanPhil Hogen Letter Re Lansing CasinoArchive ItBelum ada peringkat

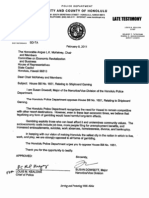

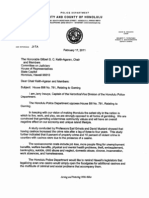

- Honolulu PD Opposes HB 1651 - Shipboard GamingDokumen1 halamanHonolulu PD Opposes HB 1651 - Shipboard GamingArchive ItBelum ada peringkat

- CFBW Hawaii Lobbying Expenditures Ended 2011.04.30Dokumen2 halamanCFBW Hawaii Lobbying Expenditures Ended 2011.04.30Archive ItBelum ada peringkat

- Radcliffe & Assoc Hawaii Lobbying Expenses Ended 2011.04.30Dokumen2 halamanRadcliffe & Assoc Hawaii Lobbying Expenses Ended 2011.04.30Archive ItBelum ada peringkat

- Honolulu PD Opposes HB 1225 II - BingoDokumen2 halamanHonolulu PD Opposes HB 1225 II - BingoArchive ItBelum ada peringkat

- Term Sheet: Shinnecock Nation & Gateway Casino ResortsDokumen12 halamanTerm Sheet: Shinnecock Nation & Gateway Casino ResortsArchive ItBelum ada peringkat

- DRAFT Resolution To Adopt Shinnecock Nation Gaming Authority Charter and Reaffirm Shinnecock Nation Gaming AuthorityDokumen2 halamanDRAFT Resolution To Adopt Shinnecock Nation Gaming Authority Charter and Reaffirm Shinnecock Nation Gaming AuthorityArchive ItBelum ada peringkat

- Shinnecock Final Determination - Federal Record - Jun 18, 2010Dokumen6 halamanShinnecock Final Determination - Federal Record - Jun 18, 2010Archive ItBelum ada peringkat

- NIGC Review of Shinnecock Nation-Gateway Casino Resorts MGMT AgreementDokumen2 halamanNIGC Review of Shinnecock Nation-Gateway Casino Resorts MGMT AgreementArchive ItBelum ada peringkat

- Letter From The Shinnecock Nation Board of Trustees Re: Gaming AuthorityDokumen2 halamanLetter From The Shinnecock Nation Board of Trustees Re: Gaming AuthorityArchive ItBelum ada peringkat

- Shinnecock Nation and Ong Enterprises - 2003 Enabling AgreementDokumen6 halamanShinnecock Nation and Ong Enterprises - 2003 Enabling AgreementArchive ItBelum ada peringkat

- Honolulu PD Opposes SB 1528 - Shipboard GamingDokumen1 halamanHonolulu PD Opposes SB 1528 - Shipboard GamingArchive ItBelum ada peringkat

- Shinnecock Nation and Gateway Casino Resorts - DRAFT Non-Interference and Enabling AgreementDokumen18 halamanShinnecock Nation and Gateway Casino Resorts - DRAFT Non-Interference and Enabling AgreementArchive ItBelum ada peringkat

- Shinnecock Nation Gaming Authority Timeline 2001-2012Dokumen8 halamanShinnecock Nation Gaming Authority Timeline 2001-2012Archive ItBelum ada peringkat

- Shinnecock Nation Gaming Authority - Nov 2011 - Updated Info/Voting PacketDokumen56 halamanShinnecock Nation Gaming Authority - Nov 2011 - Updated Info/Voting PacketArchive ItBelum ada peringkat

- Honolulu PD Opposes HB 781 - Stand Alone CasinoDokumen2 halamanHonolulu PD Opposes HB 781 - Stand Alone CasinoArchive ItBelum ada peringkat

- Goldberg V Malik - Settlement Agreementt in Fraud Ponzi-Related CaseDokumen10 halamanGoldberg V Malik - Settlement Agreementt in Fraud Ponzi-Related CaseArchive ItBelum ada peringkat

- Honolulu PD Opposes HB 1225 - BingoDokumen2 halamanHonolulu PD Opposes HB 1225 - BingoArchive ItBelum ada peringkat

- CA FPPC V Michael J. Malik - 2009 Exhibit 1 - Case AgainstDokumen4 halamanCA FPPC V Michael J. Malik - 2009 Exhibit 1 - Case AgainstArchive ItBelum ada peringkat

- Malik Arrested For Child Abuse, Served ProbationDokumen2 halamanMalik Arrested For Child Abuse, Served ProbationArchive ItBelum ada peringkat

- CFBW Hawaii Lobbying Expenditures Ended 2011.04.30Dokumen2 halamanCFBW Hawaii Lobbying Expenditures Ended 2011.04.30Archive ItBelum ada peringkat

- Honolulu PD Opposes HB 1227 - Homelands GamingDokumen2 halamanHonolulu PD Opposes HB 1227 - Homelands GamingArchive ItBelum ada peringkat

- Radcliffe & Assoc Hawaii Lobbying Expenses Ended 2011.04.30Dokumen2 halamanRadcliffe & Assoc Hawaii Lobbying Expenses Ended 2011.04.30Archive ItBelum ada peringkat

- Michael Malik Firearms License Revocation - Civil AssessmentDokumen9 halamanMichael Malik Firearms License Revocation - Civil AssessmentArchive ItBelum ada peringkat

- News From The FPPC: California Fair Political Practices CommissionDokumen6 halamanNews From The FPPC: California Fair Political Practices CommissionArchive ItBelum ada peringkat

- CA FPPC Press Release - Key Enforcement Decisions - Feb 2009Dokumen3 halamanCA FPPC Press Release - Key Enforcement Decisions - Feb 2009Archive ItBelum ada peringkat

- Capitol Consultants of Hawaii, LLP - Limited Liability PartnershipDokumen1 halamanCapitol Consultants of Hawaii, LLP - Limited Liability PartnershipArchive ItBelum ada peringkat

- Capitol Consultants of Hawaii, LLP - Limited Liability PartnershipDokumen1 halamanCapitol Consultants of Hawaii, LLP - Limited Liability PartnershipArchive ItBelum ada peringkat

- Capitol Consultants of Hawaii, LLP - Limited Liability PartnershipDokumen1 halamanCapitol Consultants of Hawaii, LLP - Limited Liability PartnershipArchive ItBelum ada peringkat

- Capitol Consultants of Hawaii, LLP - Limited Liability PartnershipDokumen1 halamanCapitol Consultants of Hawaii, LLP - Limited Liability PartnershipArchive ItBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)