Joseph E Irenas Financial Disclosure Report For 2010

Diunggah oleh

Judicial Watch, Inc.Deskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Joseph E Irenas Financial Disclosure Report For 2010

Diunggah oleh

Judicial Watch, Inc.Hak Cipta:

Format Tersedia

I

AO 10 Rev. 1/2011

FINANCIAL DISCLOSURE REPORT FOR CALENDAR YEAR 2010

2. Court or Organization United States District Court

5a. Report Type (check appropriate type) ] Nomination, [] Initial Date [] Annual [] Final

Report Required by the Ethics in Government Act ofl978 (5 U.S.C. app. f 101-111)

I. Person Reporting (last name, first, middle initial) Irenas, Joseph E.

4. Title (Article III judges indicate active or senior status; magistrate judges indicate full- or part-time)

3. Date of Report 05/17/201 6. Reporting Period 01/01/2010 to 12/31/2010

U.S. District Judge-Senior

5b. [] Amended Report

7. Chamber~ or Office Address P.O. Box 2097 Camden, N.J. 08101

8. On the basis of the information contained in this Report and any modifications pertaining thereto, it is, in my opinion, in compliance ~th applicable laws and regulations. Revie~ng Officer Dale

IMPORTANT NOTES: The instructions accompanying this form must be followe4 Complete all parts,

checking the NONE box for each part where you have no reportable information. Sign on last page.

I. POSITIONS. (R,Vorting individual only; seepp. 9-13 of filing instructions.)

~] NONE (No reportable positions.) POSITION

NAME OF ORGANIZATION/ENTITY

2. 3. 4. 5.

II. AGREEMENTS. (Reporting individual only; seepp. 14-16 of filing instructio.x)

NONE (No reportable agreements.) DATE

1. 2. 3.

PARTIES AND TERMS

Irenas, Josel h E.

FINANCIAL DISCLOSURE REPORT Page 2 of 11

Name of Person Reporting lrenas, Joseph E.

Dale of Report 05/17/201 I

IlL NON-INVESTMENT INCOME. :Repo,ing indi,.idual anaspause; see pp. 17-24 of filing instructions.)

A. Filers Non-Investment Income ~ NONE (No reportable non-investment income.) DATE SOURCE AND TYPE INCOME

(yours, not spouses)

2. 3. 4.

B. Spouses Non-lnvestment Income - if you were married during any portion of the reporting year, complete this section.

(Dollar amount not required except for honoraria.)

NONE (No reportable non-investment income.)

DATE

I. 2. 3. 4.

SOURCE AND TYPE

IV. REIMBURSEMENTS -,ra~sporta,ion, lodging, food, entertainment.

(Includes those to spouse and dependent children; see pp. 25-27 of filing instructions.)

NONE (No reportable reimbursements.) SOURCE

I. 2. 3. 4. 5.

DATES

LOCATION

PURPOSE

ITEMS PAID OR PROVIDED

FINANCIAL DISCLOSURE REPORT Page 3 of I l

Name of Person Reporting Irenas, Joseph E.

Date of Report 05/17/2011

V. GIFTS. ancludes ,hose,o spouse und dependen, children; see pp. 28-31 of filing instructions.) [~] NONE (No reportable girls.)

SOURCE

I. 2. 3. 4. 5.

DESCRIPTION

VALUE

VI. LIABILITIES. a.cl.des ,hose olspo.se ~nd depe.de.t children; see pp. 32-33 of filing instructions)

NONE (No reportable liabilities.) CREDITOR

I. 2. 3. 4. 5.

DESCRIPTION

VALUECODE

FINANCIAL DISCLOSURE REPORT Page 4 of I 1

Name of Person Reporting lrenas, Joseph E.

Date of Report 05/I 7/2011

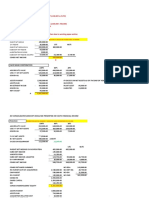

VII. 1 NVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period O) Amount Code I (A-H) (2) Type (e.g., div., rent, or int.) Gross value at end of reporting period (i) (2) Value Value Code 2 Method

(J-P) Code 3

Transactions during reporting period

(1) Type (e.g., buy, sell, redemption)

(2) Date mm/dd/yy

(3) (4) Value Gain Code 2 Code I (J-P) (A-H)

O)

Identity of

(Q-W) I. 2. 3. 4. 5. 6. 7. 8. 9. 10. I I. 12. 13. 14. 15. 16. 17. Bank of America Checking Account J.P. Morgan Chase Savings Account J.P. Morgan Chase Checking Account Shares in Corp./Princeton, N.J.,Building Wachovia (now Wells Fargo) Bank IRA Wachovia (now Wells Fargo) Bank IRA Smith Barney Money Market Rhodia Inc.~ Sensivida Med. Tech~ Amgen~! Bank of America 7% subordinated bond Bank of America 6.9% subordinated bond Oppenheimer NJ Muni FUnd Class A Bank of America Invest. Serv. Money Market NJ EDA State Lease Ref. 03/15/2022 Middletown Twp. NJ Bd. Ed. T/O Dated02/l 5/01 ; Due 08/01/27 Fidelity IRA;; See Comment A

B A C A A

buyer/seller (if private transaction)

Interest Interest None

K K J 0 J J J J J J J J K J J

T T T W T T T T T T T T T T T Redeemed 108/02/10 J Buy 05/14/I0

E A A A

Rent Interest Interest Interest None None None Interest Interest Interest Dividend Interest Interest lnt./Div.

A E

I. Income Gain Codes: (See Columns BI and 2. Value Codes |.Y~.e Columns CI and D3) 3. Value Mcthod Codes IScc Column C2)

A =$1,000 or less F =$50,0~1 - $100,000 J =$15.000 or less N =$250.001 - $500.000 P3 =$25,000,0~1 - $50.000.000 O Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 - $1.000,000 K =$15,001 - $50,000 O =$500.001 - $I .000.000 R Cost (Real Eslale Only) V =Other

C =$2,501 - $5.000 H I =$ 1,00~.001 - $5.000.000 L -$50.001 - $100.000 PI =$1,00~.001 - $5,0~0,090 P4 =More than $50,000,0~0 S =Assessment W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,000 M :$100,001 - $250,000 P2 =$5.000,001 - $25,000,000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 5 of 11

Name of Person Reporting lrenas, Joseph E.

Date of Report 05/I 7/2011

VII. INVESTMENTS and TRUSTS - income, value, transactions (lncl.de$ tho$ of spo.~e and dependent children; see pp. 34-60 of filing inslruction~)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure Income during reporting period 0) (2) Amount Type (e.g., Code I div., rent, (A-H) or inl.) Gross value at end of reporting period Transactions during reporting period

(I)

Value Code 2 (J-P)

(2)

Value Method Code 3 (Q-W)

(I) Typ~ (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code I (J-P) (A-H)

(5)

Identity of buyer/seller (if private transaction)

18. 19. 20. 21. 22. 23. 24. 25. 26. 27. 28. 29. 30. 31. 32. 33. 34.

-Fidelity Retirement Money Maket -Fidelity Magellan -Fidelity Contrafund -FidelityOTC Portfolio -Fidelity Overseas Goldman Sachs Bk.4%CD Metropolitan Life Annujity; See Comment E 6 I/2% interest in music publishing business in Europe Insurance Trust; See Comment C John Hancock Whole Life Policy Mass Mutual Whole life Policy Bank of America Savings Certificate D D F E A A B Interest Interest Dividend Dividend Dividend Dividend Interest M O N K J M T W T T T T Redeemed 12/03/10 M

I. Income Gain Codes: (See Columns B I and D4) 2. Value Codes (See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F ~$50.001 - $100,0~0 J $15,0~ or less N =$250.001 - $500.000 P3 =$25,000,001 - $50.000.000 Q =Apprai.,al U =Book Value

B =$1,0~1 - $2,500 G =$100,001 - $1,000,000 K =$15,001 - $50.000 O =$500.001 - $1,000,000 R =Cosl (Real Estale Only) V =Other

C =$2,501 - $5,000 HI =$1,000,001 - $5,000,000 L =$50,001 - $100.000 PI =$1,000,001 - $5,000,000 P4 =More than S =Assessment W =Estimated

D =$5.001 - $15,0~0 H2 =More Ihan M =$100,001 - $250,000 P2 =$5.000,001 - $25,000.000 T =Cash Market

E =$15.0OI - S50,000

FINANCIAL DISCLOSURE REPORT Page 6 of I I

Name of Person Reporting Irenas, Joseph E.

Dale of Report 05/I 7/201 I

VII. INVESTMENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; seepp. 34-60 of fillng imtructiong)

NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assetS) Place "(X)" after each asset exempt from prior disclosure Income during reporting period Gross value at end of reporting period Transactions during reporting period

0)

Amount Code I (A-H)

(2)

Type (e.g., div., rent, or int.)

(1)

Value Code 2 (J-P)

(2)

Value Method Code 3 (Q-W)

0)

Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mnddd/yy Code 2 Code 1 (J-P) [ (A-H)

(5)

ldenlity of buyer/seller (if private transaclion)

35. 36. 37. 38. 39. 40. 41. 42. 43. 44. 45. 46. 47. 48. 49. 50. 51.

I. Income Gain Codes: (S Columns BI and D-l) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (.See Column C2)

A =$1,000 or less F ~$50,091 - $10(I,000 J =$15,000 or less N =$250.001 - $500,00~ P3 $25,000,001 - $50.000,000 Q =Appraisal U =Book Value

B =$1,001 - $2,500 G =$100,001 -$1,1300.000 K -$15,001 o $50,000 O =$500,001 - $1.00~,000 R -Cost (Real Estate Only) V =Other

(" =$2,501 - $5,000 HI =$1,000,001 - $5.003,000 L =$50,001 - $100,000 PI =$1,0OO,001 - $5,000,000 p4 = More thart $50,000.000 S -As~zssmcnt W =Estimated

D =$5.0OI - $15,000 H2 -/.lore than $5.000,000 M -$100,0OI - $250.000 P2 =$5.000,0~1 - $25.000.000 T =Cash Market

E =$15.0OI - $50.000

FINANCIAL DISCLOSURE REPORT Page 7 of 11

Name of Person Reporting Irenas, Joseph E.

Date of Report 05117/2011

VII. INVESTM ENTS and TRUSTS - income, ,blue, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

D NONE

(No reportable

income, assets, or transactions.)

B. Income during reporting period (1) Amount Code 1 (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (I) Value Code 2 (J-P) (2) Value Method Code 3 (Q-W)

Type (e.g., buy, sell, redemption)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure

Transactions during reporting period

(2) (3) (4) Date Value Gain m~rddd/yy Code 2 Code I (J-P) (A-H)

(5)

Identity of buyer/seller (if private transaction)

52. 53. 54. 55. 56. 57. 58. 59. 60. 61. 62. 63. 64. 65. 66. 67. 68.

1. Income Gain Codes: (See Columns BI and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (see Column C2)

A =$1,000 or less F =$50,0~1 - $100,00~ J =$15,0~0 or less N =$250,001 - $500,000 P3 -$25,0~0,001 . $50.0~O,000 Q =Appraisal U =Book Value

B =$1.001 - $2,500 G =$100,001 - $1,00~,000 K =$15,001 - $ 50.000 O =$ 500.001 . $1,0~9,13~0 R -Cost (Real Estate Only) V =Olhcr

C =$2,501 - $5,000 H 1 =$1,0~0.001 - $5,0~).0~) L =$50.001 - $ 100,000 p I -$1,0~0,001 - $5.0~K1,0~0 P4 =More than $50,0~0.00~ S =As~ssment W =Estimated

D =$5.001 - $15.0~0 tt2 =More ~han $5.0~0.0~0 M =$ I 0~.001 - $250,000 P2 $5.090.001 - $25.0~0.000 T -Cash Markcl

E =$15,001 - $50,0~0

FINANCIAL DISCLOSURE REPORT Page 8 of 11 VII. INVESTMENTS and TRUSTS - i ....

D

Name of Person Reporting Irenas, Joseph E.

Date of Report 05/17/2011

e, value, transactions (Includes those of spouse and dependent children; see pp. 34-60 of filing instructions.)

NONE (No reportable income, assets, or transactions.)

A. Description of Assets (including trust assets) Place "(X)" after each asset exempt from prior disclosure B. Income during reporting period (1) Amount Code I (A-H) (2) Type (e.g., div., rent, or int.) C. Gross value at end of reporting period (I) Value Code 2 (J-P) (2) Value Method Code 3 Transactions during reporting period

(1) Type (e.g., buy, sell, redemption)

(2) Date mm/dd/yy

(3) (4) Value Gain Code 2 Code I (J-P) (A-H)

(5)

Identity of buyer/seller (if private transaction)

(Q-W)

69. 70. 71. 72. 73. 74. 75. 76. 77. 78. "/9. 80. 81. 82. 83. 84. 85.

1. Income Gain Codes: (see Colunms 131 and D4) 2. Value Codes (See Columns CI and D3) 3. Value Method Codes (See Column C2)

A =$1,000 or less F =$50,001 - $100,000 J =$15.000 or less N =$250.0OI - $500.000 p3 = $25,000.001 . $50.000,000 Q =Appraisal U =Book Value

B =$1.001 - $2,500 G -$100,001 - $1.000.000 K = $15,001 - $50.000 O -$500.001 - $1.0OO.000 R =Cosl (Real Estate Only) V -Othcr

C -$2,501 - $5,000 HI =$1.0~XL001 - $5,000,000 L =$50,001 - $ 100,0OO PI $1,000.001 - $5.000,000 P4 More than $50.000,000 S =Asscssmcnl \V =Estimated

D =$5,001 - $15,000 H2 =More than $5.000.000 M =$ 100,001 - $250,000 P2 =$5,000,001 - $25,000.000 T =Cash Market

E =$15,001 - $50.000

FINANCIAL DISCLOSURE REPORT Page 9 of 11

Name of Person Reporting Irenas, Joseph E.

Date of Report 05/17/201 I

VII. INVESTM ENTS and TRUSTS - income, value, transactions (Includes those of spouse and dependent children; seepp. 34-60 of filing instructions.)

[~] NONE (No reportable income, assets, or transactions.)

Description of Assets (including trust assets} Place "(X)" after each asset exempt from prior disclosure Income during reporting period Gross value at end of reporting period Transactions during reporting period

(I)

Amount Code I (A-H)

(2)

Type (e.g., div., rent, or int.)

O)

Value Code 2 (J-P)

(2)

Value Method Code 3

(~)

Type (e.g., buy, sell, redemption)

(2) (3) (4) Date Value Gain mm/dd/yy Code 2 Code 1 (J-P) (A-H)

O)

Identify of buyer/seller (if private transaction)

(Q-W)

86.

87.

88. 89. 90.

91.

92. 93.

94.

95. 96.

I. Income Gain Codes: (See Columns B I and 1)4) 2. Value Codes ( See Columns C I and D3) 3. Value Method Codes (See Column C2)

A =$ 1,000 or less F =$50.001 - $100.000 J = $15.000 or less N =$250.001 - $ 500.000 P3 =$25.000.001 - $50.000.000 Q =Apprai~l U =Book Value

B =$1.001 - $2,500 G =$100.001 - $1.0(~.090 K = $15,001 - $ 50.00~ O -$500.001 - $ 1,00~,000 R =Cost (Real Estate Only) V =Other

C =$2,501 - $5,000 HI =$1.0~0.001 - $5,000.000 L =$ 50,001 - $ 100,000 P I = $1,00~.0~ I - $5,000,000 P4 -More than $50,0~0,000 S =As~essmcnl W =Estimated

D =$5,001 - $15,000 H2 =More than $5,000,0~O M -$ 100.001 - $250,000 P2 = $5.000,001 - $25,000.000 T =Cash Market

E =$15,001 - $50,000

FINANCIAL DISCLOSURE REPORT Page 10 of 11

Name of Person Reporting lrenas, Joseph E.

Dale of Repor~ 05/17/201 I

VIII. ADDITIONAL INFORMATION OR EXPLANATIONS.

A. (Items 17 through 24) McCarter & English maintained a KEOGH Retiremenet Plan for all partners of the firm. When I withdrew from the firm in 1992, my interest in the plan was segregated into a separate account so that it is managed at my sole discretion distinctly apart from th~ firms general retirement plan. Effective January I, 1996, all participants in the plan were required to invest their accounts on one often mutual funds offered by Fidelity Investments, Boston Massachusetts. Each fund participant was permitted to switch back and forth between any ofthese funds, but could not otherwise choose other investments. As with all mutual funds, actual investments are controlled by fund managers.. Effective May 8, 2002, I withdrew from the McCarter & English plan and rolled over my entire account into an individual IRA where I was permitted to choose investments other ~han Fidelity funds. However, 1 made no change in the parficular Fidelity Funds in which I have been invested, though from time to time I did tranfer Money Market funds into specific iinvestments selected by me. In Part VII, I have listed values for the IRA as a whole and below that I have listed the specific funds or assets in which I am invested. I am doing that pursuant to the instructions given in correpondence from the Committee dated Alugust 6, 2002. Item No. 17 represents the value for the entire IRA. Items 18-24 represent component parts of the IRA. 1 gather it is not required to complete Columns B and C for the individual component parts which are mutual funds where I do not control the investments. However, I have provided individual information for Nos. 23 and 2 4, even though these amounts are also included in the entire IRA total in item No. 17. B. (Item 24). Item 24 was acquired on 01113/09 but inadvertently omitted from my 2009 Report. However, this item was included in the total IRA value in item 20 of the 2009 Report. C. (Item 26) Before I became a Judge, I had created a life insurance trust to which I transferred four policies, Depending on circumsmnces,~ ~i:. " ~ 3;~1 will be the baeneficiaries of the trust when I die. The Trustee is an individual attorney I have been paying the premiums to the Trustee bu ~ are the beneficial owners of the trust, these payments to the Trustee for premiums are treated a gifts to the beneficial owners. All four policies are whole life policies whic have cash values. The value code in Column B(I ) reflects all dividends received by the Trustee whether or not paid out in cash or used to reduce premiums. The value code in Column C(I) reflects the combined cash value of the four policies in the Trust. Dividends not used to reduce premiums are paid by the Trustee to[S~.~"] as beneficial owner of the trust. In prior years, policy loans were made on some policies to pay a portion of the premiums. Dividends have also been used to pay interest on policy loans. i

FINANCIAL DISCLOSURE REPORT Page 11 of 11 IX. CERTIFICATION.

Name of Person Reporting lrenas, Joseph E.

Date of Report 05/I 7/201 I

1 certify that all information given above (including information pertaining to my spouse and minor or dependent children, if any) is accurate, true, and complete to the best of my knowledge and belief, and that any information not reported was withheld because it met applicable statutory provisions permitting non-disclosure. 1 further certify that earned income from outside emplo)anent and honoraria and the acceptance of gifts which have been reported are in compliance with the provisions of 5 U.S.C. app. 501 et. seq., 5 U.S.C. 7353, and Judicial Conference regulations.

Signature: S/Joseph E. Irenas

NOTE: ANY INDIVIDUAL WHO KNOWINGLY AND WILFULLY FALSIFIES OR FALLS TO FILE THIS REPORT MAY BE SUBJECT TO CIVIL AND CRIMINAL SANCTIONS (5 U.S.C. app. 104)

Committee on Financial Disclosure Administrative Office of the United States Courts Suite 2-301 One Columbus Circle, N.E. Washington, D.C. 20544

Anda mungkin juga menyukai

- Jeffrey S Sutton Financial Disclosure Report For 2010Dokumen8 halamanJeffrey S Sutton Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Richard L Nygaard Financial Disclosure Report For 2010Dokumen7 halamanRichard L Nygaard Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- William J Ditter JR Financial Disclosure Report For 2010Dokumen7 halamanWilliam J Ditter JR Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Daniel L Hovland Financial Disclosure Report For 2010Dokumen7 halamanDaniel L Hovland Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Richard A Schell Financial Disclosure Report For 2010Dokumen7 halamanRichard A Schell Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Stephen Anderson Financial Disclosure Report For 2010Dokumen7 halamanStephen Anderson Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- David S Doty Financial Disclosure Report For 2010Dokumen7 halamanDavid S Doty Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- John R Smoak Financial Disclosure Report For 2010Dokumen7 halamanJohn R Smoak Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Berle M Schiller Financial Disclosure Report For 2010Dokumen7 halamanBerle M Schiller Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Robert B Propst Financial Disclosure Report For 2010Dokumen7 halamanRobert B Propst Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- John P Bailey Financial Disclosure Report For 2010Dokumen7 halamanJohn P Bailey Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Henry L Adams Financial Disclosure Report For 2010Dokumen7 halamanHenry L Adams Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Norma L Shapiro Financial Disclosure Report For 2010Dokumen8 halamanNorma L Shapiro Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Samuel Conti Financial Disclosure Report For 2010Dokumen7 halamanSamuel Conti Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Ancer L Haggerty Financial Disclosure Report For 2010Dokumen7 halamanAncer L Haggerty Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Leonard D Wexler Financial Disclosure Report For 2010Dokumen6 halamanLeonard D Wexler Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Bobby E Shepherd Financial Disclosure Report For 2010Dokumen7 halamanBobby E Shepherd Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Procter R Hug JR Financial Disclosure Report For 2010Dokumen8 halamanProcter R Hug JR Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Delwen L Jensen Financial Disclosure Report For 2010Dokumen6 halamanDelwen L Jensen Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- William R Furgeson Financial Disclosure Report For 2010Dokumen9 halamanWilliam R Furgeson Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Rosemary S Pooler Financial Disclosure Report For 2010Dokumen7 halamanRosemary S Pooler Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Henry F Floyd Financial Disclosure Report For 2010Dokumen6 halamanHenry F Floyd Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- William B Enright Financial Disclosure Report For 2010Dokumen6 halamanWilliam B Enright Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Alan D Lourie Financial Disclosure Report For 2010Dokumen7 halamanAlan D Lourie Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Alan B Johnson Financial Disclosure Report For 2010Dokumen7 halamanAlan B Johnson Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Paul J Barbadoro Financial Disclosure Report For 2010Dokumen7 halamanPaul J Barbadoro Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Robert C Jones Financial Disclosure Report For 2010Dokumen6 halamanRobert C Jones Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- James C Turk Financial Disclosure Report For 2010Dokumen7 halamanJames C Turk Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Susan O Mollway Financial Disclosure Report For 2010Dokumen7 halamanSusan O Mollway Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Joseph A Greenaway JR Financial Disclosure Report For 2010Dokumen7 halamanJoseph A Greenaway JR Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Kermit E Bye Financial Disclosure Report For 2006Dokumen7 halamanKermit E Bye Financial Disclosure Report For 2006Judicial Watch, Inc.Belum ada peringkat

- Vanessa D Gilmore Financial Disclosure Report For 2010Dokumen6 halamanVanessa D Gilmore Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Raymond J Dearie Financial Disclosure Report For 2010Dokumen7 halamanRaymond J Dearie Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Robert L Vining JR Financial Disclosure Report For 2010Dokumen7 halamanRobert L Vining JR Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Lee R West Financial Disclosure Report For 2010Dokumen6 halamanLee R West Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- JR Louis Guirola Financial Disclosure Report For 2010Dokumen6 halamanJR Louis Guirola Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Clarence A Beam Financial Disclosure Report For 2010Dokumen7 halamanClarence A Beam Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Charlene E Honeywell Financial Disclosure Report For Honeywell, Charlene EDokumen8 halamanCharlene E Honeywell Financial Disclosure Report For Honeywell, Charlene EJudicial Watch, Inc.Belum ada peringkat

- Tanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MDokumen7 halamanTanya M Walton Pratt Financial Disclosure Report For Walton Pratt, Tanya MJudicial Watch, Inc.Belum ada peringkat

- Loretta A Preska Financial Disclosure Report For 2010Dokumen14 halamanLoretta A Preska Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Joan B Gottschall Financial Disclosure Report For 2010Dokumen10 halamanJoan B Gottschall Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- William C Lee Financial Disclosure Report For 2010Dokumen6 halamanWilliam C Lee Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Ivan L Lemelle Financial Disclosure Report For Lamelle, Ivan L 2010Dokumen6 halamanIvan L Lemelle Financial Disclosure Report For Lamelle, Ivan L 2010Judicial Watch, Inc.Belum ada peringkat

- Patricia A Seitz Financial Disclosure Report For 2010Dokumen7 halamanPatricia A Seitz Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Janis L Sammartino Financial Disclosure Report For Sammartino, Janis LDokumen6 halamanJanis L Sammartino Financial Disclosure Report For Sammartino, Janis LJudicial Watch, Inc.Belum ada peringkat

- Gerard E Lynch Financial Disclosure Report For 2010Dokumen9 halamanGerard E Lynch Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- JR Ewing Werlein Financial Disclosure Report For 2010Dokumen20 halamanJR Ewing Werlein Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Eric F Melgren Financial Disclosure Report For 2010Dokumen6 halamanEric F Melgren Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Gilbert S Merritt Financial Disclosure Report For 2010Dokumen28 halamanGilbert S Merritt Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Lawrence H Silberman Financial Disclosure Report For 2010Dokumen7 halamanLawrence H Silberman Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Harry Lee Hudspeth Financial Disclosure Report For 2010Dokumen7 halamanHarry Lee Hudspeth Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Robert S Lasnik Financial Disclosure Report For 2010Dokumen7 halamanRobert S Lasnik Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- James E Gritzner Financial Disclosure Report For 2010Dokumen10 halamanJames E Gritzner Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Steven J McAuliffe Financial Disclosure Report For 2010Dokumen15 halamanSteven J McAuliffe Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Robert R Beezer Financial Disclosure Report For 2010Dokumen9 halamanRobert R Beezer Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Bernard A Friedman Financial Disclosure Report For 2010Dokumen15 halamanBernard A Friedman Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Lacey A Collier Financial Disclosure Report For 2010Dokumen6 halamanLacey A Collier Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Harold D Vietor Financial Disclosure Report For 2010Dokumen6 halamanHarold D Vietor Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Dolly M Gee Financial Disclosure Report For Gee, Dolly MDokumen9 halamanDolly M Gee Financial Disclosure Report For Gee, Dolly MJudicial Watch, Inc.Belum ada peringkat

- Opinion - JW V NavyDokumen7 halamanOpinion - JW V NavyJudicial Watch, Inc.100% (1)

- Stamped ComplaintDokumen4 halamanStamped ComplaintJudicial Watch, Inc.Belum ada peringkat

- 1488 09032013Dokumen262 halaman1488 09032013Judicial Watch, Inc.100% (1)

- 2161 DocsDokumen133 halaman2161 DocsJudicial Watch, Inc.83% (12)

- 1878 001Dokumen17 halaman1878 001Judicial Watch, Inc.100% (5)

- Holder Travel Records CombinedDokumen854 halamanHolder Travel Records CombinedJudicial Watch, Inc.Belum ada peringkat

- CC 081213 Dept 14 Lapp LDokumen38 halamanCC 081213 Dept 14 Lapp LJudicial Watch, Inc.Belum ada peringkat

- 11 1271 1451347Dokumen29 halaman11 1271 1451347david_stephens_29Belum ada peringkat

- State Dept 13-951Dokumen4 halamanState Dept 13-951Judicial Watch, Inc.Belum ada peringkat

- Stamped ComplaintDokumen4 halamanStamped ComplaintJudicial Watch, Inc.Belum ada peringkat

- Stamped Complaint 2Dokumen5 halamanStamped Complaint 2Judicial Watch, Inc.Belum ada peringkat

- Stamped ComplaintDokumen4 halamanStamped ComplaintJudicial Watch, Inc.Belum ada peringkat

- Gitmo Freezer Inspection ReportsDokumen4 halamanGitmo Freezer Inspection ReportsJudicial Watch, Inc.Belum ada peringkat

- Gitmo Freezer Inspection ReportsDokumen4 halamanGitmo Freezer Inspection ReportsJudicial Watch, Inc.Belum ada peringkat

- JTF GTMO Water Safety App W ExhDokumen13 halamanJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Belum ada peringkat

- Navy Water Safety ProductionDokumen114 halamanNavy Water Safety ProductionJudicial Watch, Inc.Belum ada peringkat

- CVR LTR SouthCom Water Safety ProductionDokumen2 halamanCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Belum ada peringkat

- Gitmo Water Test ReportDokumen2 halamanGitmo Water Test ReportJudicial Watch, Inc.Belum ada peringkat

- Visitor Tent DescriptionDokumen3 halamanVisitor Tent DescriptionJudicial Watch, Inc.Belum ada peringkat

- SouthCom Water Safety ProductionDokumen30 halamanSouthCom Water Safety ProductionJudicial Watch, Inc.Belum ada peringkat

- JW Cross Motion v. NavyDokumen10 halamanJW Cross Motion v. NavyJudicial Watch, Inc.Belum ada peringkat

- SouthCom Water Safety ProductionDokumen30 halamanSouthCom Water Safety ProductionJudicial Watch, Inc.Belum ada peringkat

- JTF GTMO Water Safety App W ExhDokumen13 halamanJTF GTMO Water Safety App W ExhJudicial Watch, Inc.Belum ada peringkat

- Cover Letter To Requester Re Response Documents130715 - 305994Dokumen2 halamanCover Letter To Requester Re Response Documents130715 - 305994Judicial Watch, Inc.Belum ada peringkat

- December 2005Dokumen7 halamanDecember 2005Judicial Watch, Inc.Belum ada peringkat

- CVR LTR SouthCom Water Safety ProductionDokumen2 halamanCVR LTR SouthCom Water Safety ProductionJudicial Watch, Inc.Belum ada peringkat

- May 2007 BulletinDokumen7 halamanMay 2007 BulletinJudicial Watch, Inc.Belum ada peringkat

- July 2007 BulletinDokumen23 halamanJuly 2007 BulletinJudicial Watch, Inc.Belum ada peringkat

- Model UNDokumen2 halamanModel UNJudicial Watch, Inc.Belum ada peringkat

- Schoolboard PowerpointDokumen2 halamanSchoolboard PowerpointJudicial Watch, Inc.Belum ada peringkat

- 35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc MsDokumen90 halaman35 Financial Management FM 71 Imp Questions With Solution For CA Ipcc Msmysorevishnu75% (8)

- Gamboa vs. TevesDokumen4 halamanGamboa vs. TevesAustine Clarese VelascoBelum ada peringkat

- Macroeconomics Canadian 15th Edition Ragan Solutions ManualDokumen13 halamanMacroeconomics Canadian 15th Edition Ragan Solutions Manualmabelleonardn75s2100% (30)

- Substabtive Test of CashDokumen14 halamanSubstabtive Test of CashWyler AkiBelum ada peringkat

- Accounting For Manufacturing FirmDokumen13 halamanAccounting For Manufacturing Firmnadwa dariahBelum ada peringkat

- CA51024 - Quiz 2 (Solutions)Dokumen6 halamanCA51024 - Quiz 2 (Solutions)The Brain Dump PHBelum ada peringkat

- Nepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Dokumen61 halamanNepal Bank Limited: Summer Training Project Report ON "Deposit Schemes of Nepal Bank"Aditya VermaBelum ada peringkat

- Ecs Mandate Idbi1Dokumen4 halamanEcs Mandate Idbi1lotusnotesjct9497Belum ada peringkat

- Startups - Financial PrudenceDokumen12 halamanStartups - Financial PrudenceNeelajit ChandraBelum ada peringkat

- ReceiptDokumen3 halamanReceiptAhsan KhanBelum ada peringkat

- Problem 1Dokumen4 halamanProblem 1Live LoveBelum ada peringkat

- Annexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeDokumen1 halamanAnnexure-B: Format - Daily Margin Statement To Be Issued To Clients Client Code: Clientname: ExchangeenamsribdBelum ada peringkat

- 07 Murtiningsih Bab 26 Money Demand and The Equilibrium Interest RateDokumen20 halaman07 Murtiningsih Bab 26 Money Demand and The Equilibrium Interest RateMademoiselleMitha ZhamzamiBelum ada peringkat

- Doing Business in BrazilDokumen164 halamanDoing Business in BrazilVarupBelum ada peringkat

- PDFDokumen19 halamanPDFRam SriBelum ada peringkat

- Capital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsDokumen2 halamanCapital Gains Tax For Onerous Transfer of Real Property Classified As Capital AssetsJyasmine Aura V. AgustinBelum ada peringkat

- Partnership & ClubsDokumen8 halamanPartnership & ClubsGary ChingBelum ada peringkat

- Yasin Yousouf Bahemia J15020141: Student Name: Student IDDokumen22 halamanYasin Yousouf Bahemia J15020141: Student Name: Student IDKhaled KalamBelum ada peringkat

- SFM Volume 1Dokumen161 halamanSFM Volume 1Joy Krishna DasBelum ada peringkat

- 2012 05 - Project Finance Newswire - May 2012Dokumen56 halaman2012 05 - Project Finance Newswire - May 2012api-165049160Belum ada peringkat

- Houzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceDokumen4 halamanHouzit Pty LTD: 1st Quarter Ended Sept - 2012 Actual Results Budget Q1 Actual Q1 $ VarianceHamza Anees100% (1)

- ACCT 251 Practice Set 2021 - 1Dokumen28 halamanACCT 251 Practice Set 2021 - 1Earl Justine FerrerBelum ada peringkat

- Citi Card Pay PDFDokumen1 halamanCiti Card Pay PDFShamim KhanBelum ada peringkat

- AdmissionDokumen23 halamanAdmissionPawan TalrejaBelum ada peringkat

- KSIE OsDokumen73 halamanKSIE OsAnush PrasannanBelum ada peringkat

- Taslima - InternshipDokumen22 halamanTaslima - InternshipEasy Learning AcademyBelum ada peringkat

- Bzu, Bahadur Sub-Campus Layyah: Submitted To: Mr. Muhammad Saleem Student GroupDokumen23 halamanBzu, Bahadur Sub-Campus Layyah: Submitted To: Mr. Muhammad Saleem Student GroupMuhammad Ihsan ToorBelum ada peringkat

- Affirm Buy Now Pay Later Case StudyDokumen9 halamanAffirm Buy Now Pay Later Case StudyTrader CatBelum ada peringkat

- Fin 4600 Practice Mid Term Exam 1 Robert UptegraffDokumen12 halamanFin 4600 Practice Mid Term Exam 1 Robert UptegraffNguyễn Thanh TùngBelum ada peringkat

- Internship Report On ZahidJee Textile Mills LimitedDokumen81 halamanInternship Report On ZahidJee Textile Mills LimitedDoes it Matter?100% (11)