Economic Growth I - Motivation and Stylized Facts

Diunggah oleh

Jiří ZajícDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Economic Growth I - Motivation and Stylized Facts

Diunggah oleh

Jiří ZajícHak Cipta:

Format Tersedia

OVS452 Intermediate Economics II VSE NF, Spring 2008 Lecture Notes #6 Eva Hromdkov

7

7.1

Economic Growth I - Motivation

Introduction

Importance of sustained economic growth: Great absolute dierences in the standards of living measured by GDP per capita: 1 GDP p.c. of USA in 2007 (in 1996 prices) was $42, 897 (10th highest in the world) Russia - $13, 401, South Africa - $10, 483, China - $8, 511, India - $3, 825, Dem. republic of Congo - $390, Liberia - $386 (i.e. $1.06 a day) corresponding dierences in nutrition, literacy, infant mortality, life expectancy and other measures of well-being Czech Republic - $21, 929, Slovak Republic - $17, 284 Small dierential in growth rates implies huge dierences in nal outcomes when compounded over long periods of time (centuries): With GDP p.c $3, 300 in 1870, US was growing at average rate 1.886% per year in period 1870 - 20072 Though experiment 1: If the growth rate would be 0.886%, then GDP p.c. would be $11, 049 (i.e. 26% of the actual value) similar GDP p.c. level to Cuba, Mexico and Turkmenistan Though experiment 2: If the growth rate would be 2.886%, then GDP p.c. would be $162, 664 (i.e. 3.8 times the actual value)

Data are from version 6.3 of Penn World Tables, http://pwt.econ.upenn.edu. Let y0 be the GDP p.c. at year 0, yT the GDP p.c. at year T , and x the average annual growth rate over that period. Then, yT = (1 + x)T y0 . We can compute x by taking logarithms, getting ln yT ln y0 = T ln(1 + x) T x, or x (ln yT ln y0 )/T .

2

Even in the horizon of 2 generations, growth rates matter: If the Czech Republic would grow at the same average rate as throughout the period 2000-2007 (i.e. 3.9%), in 30 years it would triple its real GDP p.c. However, if the Slovak Republic would grow at the same average rate as throughout the period 2000-2007 (i.e. 4.7%), in 30 years it would attain 4 times its real GDP p.c. and it would "catch on" the Czech Republic.

7.2

World Distribution of Income and Growth Rates

High cross-country dispersion in the level of income - GDP p.c., persistent with time Figure 1 distribution of GDP p.c. in 1960 across 113 countries from the Penn World Tables 6.1. richest country - Switzerland ($15, 000), poorest - Tanzania ($381) wealthiest countries: OECD + Latin America (Venezuela, Argentina); poorest countries: Africa (Tanzania, Uganda) and Asia (China, India, Indonesia) Figure 2 - distribution of GDP p.c. in 2000 across 150 countries from the Penn World Tables 6.1. richest country - Luxembourg ($44, 000), poorest - Tanzania ($482) wealthiest countries: OECD + East Asia (Taiwan, Japan, Singapore); poorest countries: sub-Saharan Africa (Tanzania, Uganda); Latin America + Asia: mid-range Comparison: similar cross-country dispersion of income over this period mean of GDP p.c. in 2000 was 2.5 higher than in 1960 (compare $8, 490 and $3, 390) change of relative position of countries (drop of Argentina, Venezuela, Israel or RSA; rise of China, India, Singapore) due to dierences in the rate of economic growth Figure 3 - distribution of growth rate of GDP p.c. from 1960 - 2000. range from 3.2% for the Democratic Republic of Kongo to 6.4% for Taiwan growth miracles: Singapore (6.2%), South Korea (5.9%), Hong Kong (5.4%), Thailand, Japan (after WWII), China, Ireland growth disasters: sub-Saharan Africa (Niger, Angola, Madagascar, Nigeria, Rwanda) + Latin America (Venezuela, Bolivia, Peru, Argentina) 2

7.2.1

Convergence: Do the poor countries catch up rich countries, i.e. do they tend to grow faster?

(+ rationale) Unconditional convergence: ln y20001960 = + ln y1960 Figure 4, based on Penn World Tables data, shows that average growth rate over the period 1960-2000 has little (and slightly positive) correlation with initial level of GDP p.c. Conditional convergence: ln y20001960 = + ln y1960 + X1960 , where X1960 is a set of country-specic controls (education, scal and monetary policy, competition level, etc.) - we compare countries with similar starting characteristics After conditioning on the underlying characteristics, the countries with lower initial income tend to grow faster than their rich counterparts. For illustration, see Figure 5 for evidence of convergence within OECD countries and Figure 6 for the convergence among US states (both with apparent negative correlation). What are the factors behind the dierences in economic growth, and how can we control them? government policies with eects on long-term growth evaluation framework = models

7.3

Stylized Facts - Building Blocks of Models

Kaldor (1963) - balanced growth in the long run 1. Output per worker Y /L (GDP p.c.) grows over time and the growth rate does not tend to diminish 2. Physical capital per worker K/L grows over time 3. The capital to output ratio K/Y is nearly constant capital and output grow at the same rate 4. The return to capital (r) is roughly constant 5. The income shares of labor and capital (wL/Y and rK/Y ) stay roughly constant 6. The level as well as the growth rate of output per worker diers substantially across countries. applies to developed countries explained by Solow model 3

7.4

Figures

Figure 1: Histogram for GDP p.c. in 1960 (reproduced from Barro, 2003). The data for 113 countries are taken from Penn World Tables 6.1. Representative countries within each group are labeled.

Figure 2: Histogram for GDP p.c. in 2000 (reproduced from Barro, 2003). The data for 150 countries are taken from Penn World Tables 6.1. Representative countries within each group are labeled.

Figure 3: Histogram for growth rates of GDP p.c. from 1960-2000 (reproduced from Barro, 2003). The data for 150 countries are computed from the values of GDP p.c. shown in Figures 1 and 2. Representative countries within each group are labeled.

Figure 4: Convergence of GDP across countries: Growth rate from 1960 to 2000 over the initial level of real GDP p.c. for 114 countries (reproduced from Barro, 2003).

Figure 5: Convergence of GDP across OECD countries: Growth rate from 1960 to 2000 over the initial level of real GDP p.c. for 18 countries (reproduced from Barro, 2003).

Figure 6: Convergence of personal income across US states: Growth rate of personal income from 1880 to 2000 over the initial level of personal income for 47 states (reproduced from Barro, 2003).

Economic Growth II - Solow model

3 main sources of growth - capital, people, technolog. progress SOLOW: how these three interact and aect national output; build up in steps

8.1

8.1.1

STEP 1: Accumulation of capital

Assumptions of the model:

Neoclassical production function: Y = F (K, AL) rms hire people (L) and capital (K) to produce good (Y ) by production technology (F ()) have access to knowledge (A) that makes the production more eective (laboraugmenting or Harrod-neutral technological change) lets assume (for a while) that both labor force and eciency of production are constant over time Ass.1: Constant returns to scale - i.e. zY = F (zK, zAL) - allows us to analyze the per capita quantities: output per eective worker y = Y /AL and capital per eective worker k = K/AL - take z = 1/AL => Y /AL(=: y) = F (K/AL, 1)(=: f (k) Ass.2: Marginal product is positive and diminishing - applies also for transformed function - f (k) > 0, f (k) < 0 Ass.3: Inada conditions + essentiality output is divided between consumption and investment: y = c + i HHs save a constant fraction of their income s (0, 1): i = sy, c = (1 s)y 8.1.2 Basic analysis:

capital stock of economy changes over time increases due to investment - new plants and equipment decreased due to depreciation - wearing out of capital Investment: i = sf (k) Depreciation: fraction of capital stock "disappears" k

change of capital stock = investment - depreciation k = sf (k) k

STEADY STATE: there exist single capital stock k for which amount of depreciation equals the invested amount !k : k = 0 or sf (k) = k 8

if economy is in steady-state, it will stay there if economy starts with any other level of capital, it will converge to steady state (stable equilibrium) Prediction of model: in the long run, all economies will converge to their respective steady state if country starts from relatively lower level of capita per person, it will grow faster (Japan, Germany after WWII) Eect of savings: as key determinant of capital stock higher saving rate => higher steady state level of capital and output per capita increase in saving rate => temporary increase in growth rate of economy

8.1.3

Golden Rule level of capital:

dierent saving rates lead to dierent steady states - with corresponding steady state level of capital, output and consumption. Questions: How do we compare these dierent steady states? What is optimal from HHs point of view? Answer: Choose saving rate (and corresponding capital level) that maximizes the consumption.

Computation: y =c+i in the steady state: i = sf (k ) = k therefore, consumption can be expressed as c = f (k ) k

10

Maximum: c =0 k Intuition:

k =kgold

f (kgold ) = 0

small s => small k => small y => small consumption high s => high k => high y and high depreciation k => high investment needed to cover for depreciation => small consumption

Transition: what are the costs of transition to optimal steady state? A. starting with too much capital=> POLICY = reduce saving rate investment drops immediately consumption jumps up - keeps over the initial level over all transition time B. starting with too low capital => POLICY = increase saving rate investment partially jumps up consumption jumps down - rst lower than initial level => then increases tradeo among welfare of dierent generations - decision depends on the weight that policy makers put on dierent generations

11

8.2

STEP 2: Population growth

capital accumulation alone cannot explain sustained growth eventually converge to steady state => capital and output p.c. are constant with ass. on constant labor force => constant total output and capital assumption: population grows at constant rate n 8.2.1 Eect of population growth:

with increasing population, capital per worker is decreasing capital is distributed among larger population of workers similar eect as depreciation new condition for steady state: investment = replacement of depreciation + capital for new workers k = sf (k) ( + n)k k = 0 sf (k ) = ( + n)k

1. partial explanation of sustained economic growth output and capital per worker is constant total output and capital grow at rate n 2. higher population growth => lower level of GDP per capita 12

consistent with empirical data possible reverse causation 3. new equation for Golden Rule level of capital M P K = f (k) = + n

8.3

8.3.1

STEP 3: Technological growth

Eciency of labor

Assumption: technological growth causes the eciency A to grow at constant rate g labor-augmenting technological progress number of eective workers grows approx. at rate n + g 8.3.2 Eects of technological growth

analogous to population growth k = sf (k) ( + n + g)k k = 0 sf (k ) = ( + n + g)k

1. explanation of sustained economic growth 13

total output and capital grow at rate n + g (like eective workers) output and capital per worker is growing at rate g 2. new equation for Golden Rule level of capital M P K = f (k) = + n + g

8.4

Endogenous growth models

Y /L Y /L

Solow-Swan model: s.s. growth rate of Y /L =

=g

g - rate of technological progress, EXOGENOUSLY given + assumed to be positive and constant want to have growth ENDOGENOUS, i.e. we are able to explain it as the outcome of the decisions of agents within the model Possible solutions: AK models - abandon diminishing returns to capital (DRC) broad denition of capital (physical + human) 1 sector: production of goods - basic model 2 sectors: production of both goods and (human) capital - education learning-by-doing + spillovers of knowledge 14

individual rms - DRC, aggregate level - CRC/IRC R&D models Advances in technology level determined by purposeful activity (explicitly model determinants of g) expanding variety of products quality improvements of existing products 8.4.1 Basic AK model Y = AK => M P K = A > 0

production function:

abolished diminishing product of capital - A is positive constant => constant return to capital (CRC) accumulation of capital: K = sY K K Y = = sA K Y as long as sA > , economy grows forever saving decision alone leads to permanent growth Is CRC reasonable assumption? NO, if we assume classical denition of capital - stock of plants and equipment. YES, if we consider broad denition of capital - including knowledge (knowhow). 8.4.2 2 sector model of Human capital

2 sectors: production of output (rms) and production of education or human capital (universities) production function - CRS Y = F (K, (1 )EL) accumulation of capital (physical + human): E = g()E K = sY K 15

- fraction of labor force in universities g - production of new knowledge, dependent on share of labor force in that sector persistent growth attained endogenously - production of knowledge on universities will explain g - otherwise similar to Solow two societal decision variables - s and

16

Anda mungkin juga menyukai

- IAS 107 Midterm #2 Answers 2016Dokumen11 halamanIAS 107 Midterm #2 Answers 2016Carol YaoBelum ada peringkat

- Midterm Solow model practice questionsDokumen3 halamanMidterm Solow model practice questionsCaíque MeloBelum ada peringkat

- Development NotesDokumen125 halamanDevelopment NotesAndre EzeBelum ada peringkat

- CH06 Economic GrowthDokumen56 halamanCH06 Economic GrowthNickBelum ada peringkat

- Economics 448: September 13, 2012Dokumen18 halamanEconomics 448: September 13, 2012ykaya11Belum ada peringkat

- Neoclassical Growth Theory: Solow Model & Kaldor FactsDokumen16 halamanNeoclassical Growth Theory: Solow Model & Kaldor FactsxeniachrBelum ada peringkat

- Macroeconomics International 5th Edition Williamson Solutions ManualDokumen10 halamanMacroeconomics International 5th Edition Williamson Solutions Manualadeleiolanthe6zr1100% (27)

- Problem Set 1 SolutionsDokumen10 halamanProblem Set 1 Solutions归叶Belum ada peringkat

- Eco 302 The Fundamentals of Economic Growth Notes 1Dokumen16 halamanEco 302 The Fundamentals of Economic Growth Notes 1lubisithembinkosi4Belum ada peringkat

- Lecture 05 - 06 Notes - Spring 2009 PDFDokumen6 halamanLecture 05 - 06 Notes - Spring 2009 PDF6doitBelum ada peringkat

- CH 2 Capital Accumulation in Economic DevelopmentDokumen58 halamanCH 2 Capital Accumulation in Economic DevelopmentአንዋርጀማልBelum ada peringkat

- ECF511E Lecture 2 - TWO PP Presentation On LG 5.2 (20 Feb 2023)Dokumen24 halamanECF511E Lecture 2 - TWO PP Presentation On LG 5.2 (20 Feb 2023)zuko 01Belum ada peringkat

- 14.06 Lecture Notes Intermediate Macroeconomics: George-Marios Angeletos MIT Department of Economics Spring 2004Dokumen15 halaman14.06 Lecture Notes Intermediate Macroeconomics: George-Marios Angeletos MIT Department of Economics Spring 2004pareekBelum ada peringkat

- Solution To ECON100B Fall 2023 Midterm 2 PDFDokumen19 halamanSolution To ECON100B Fall 2023 Midterm 2 PDFmaobangbang21Belum ada peringkat

- Introduction and Growth FactsDokumen14 halamanIntroduction and Growth FactsSehrish KayaniBelum ada peringkat

- 200Dokumen92 halaman200Daniel Bogiatzis GibbonsBelum ada peringkat

- In Class ExercisesDokumen20 halamanIn Class ExercisesThong Wei MingBelum ada peringkat

- Barro, Sala I Martin - 1992Dokumen47 halamanBarro, Sala I Martin - 1992L Laura Bernal HernándezBelum ada peringkat

- Solow S Model and Growth AccountingDokumen12 halamanSolow S Model and Growth AccountingAndrea RudanBelum ada peringkat

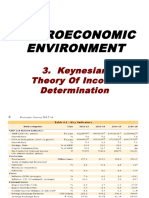

- Macroeconomic Environment: 3. Keynesian Theory of Income DeterminationDokumen26 halamanMacroeconomic Environment: 3. Keynesian Theory of Income DeterminationAnimesh ChoudharyBelum ada peringkat

- Handout3 PDFDokumen1 halamanHandout3 PDFagonza70Belum ada peringkat

- Lista 1 Macro IIIDokumen14 halamanLista 1 Macro IIIraphael guimaraesBelum ada peringkat

- 7. Theories of Economic Growth_Solow Model Technical Progress_contd[1]Dokumen46 halaman7. Theories of Economic Growth_Solow Model Technical Progress_contd[1]resourcesficBelum ada peringkat

- Udviklingsøkonomi - Grundfag: Convergence?Dokumen13 halamanUdviklingsøkonomi - Grundfag: Convergence?Bruno SaturnBelum ada peringkat

- Notes CH 1 and 2 PDFDokumen74 halamanNotes CH 1 and 2 PDFJorge AgüelaBelum ada peringkat

- Solow Model Steady State SolutionsDokumen5 halamanSolow Model Steady State SolutionsWinnie WongBelum ada peringkat

- Name: Dinh Tien Thinh ID: 20187650 Ex1Dokumen5 halamanName: Dinh Tien Thinh ID: 20187650 Ex1Tiến ThịnhBelum ada peringkat

- Growth Theory and Application: The Case of South Africa: Dave LiuDokumen30 halamanGrowth Theory and Application: The Case of South Africa: Dave LiuEduBelum ada peringkat

- Homework 1 Master FES Part 1-1Dokumen3 halamanHomework 1 Master FES Part 1-1xbdrsk6fbgBelum ada peringkat

- Classical Theories of Economic Growth and DevelopmentDokumen65 halamanClassical Theories of Economic Growth and DevelopmentstudentBelum ada peringkat

- 2022 Midterm - SolutionDokumen6 halaman2022 Midterm - SolutionwannafadedBelum ada peringkat

- Chap 3Dokumen25 halamanChap 3Leonardo HenryBelum ada peringkat

- Growth Data SLDokumen36 halamanGrowth Data SLPeter FinzellBelum ada peringkat

- Economic Growth (1st Part)Dokumen58 halamanEconomic Growth (1st Part)LilaBelum ada peringkat

- Models of Economic Growth and DevelopmentDokumen34 halamanModels of Economic Growth and DevelopmentHari SharmaBelum ada peringkat

- Assignment 2 Answer Key F17Dokumen2 halamanAssignment 2 Answer Key F17JamesBelum ada peringkat

- FIN 30220: Macroeconomic Analysis: Long Run GrowthDokumen57 halamanFIN 30220: Macroeconomic Analysis: Long Run GrowthAhmed RonaldoBelum ada peringkat

- Theories Lec 3Dokumen23 halamanTheories Lec 3Nesma HusseinBelum ada peringkat

- Pike Tty Afe P 06072012Dokumen62 halamanPike Tty Afe P 06072012Kartik AvanaBelum ada peringkat

- Long Run Growth: Understanding Sources of Economic GrowthDokumen57 halamanLong Run Growth: Understanding Sources of Economic GrowthajaiswalcoolBelum ada peringkat

- Unit 1 MFG Part 1Dokumen12 halamanUnit 1 MFG Part 1phillis zhaoBelum ada peringkat

- Chapter 9 Economic Growth II. Technology, Empirics, and PolicyDokumen7 halamanChapter 9 Economic Growth II. Technology, Empirics, and PolicyJoana Marie CalderonBelum ada peringkat

- Lecture 202-03 Solow ModelDokumen4 halamanLecture 202-03 Solow ModeljaffinkBelum ada peringkat

- RevisionDokumen8 halamanRevisionPhan Hà TrangBelum ada peringkat

- Quiz 3 AnswerDokumen5 halamanQuiz 3 Answerozinho19Belum ada peringkat

- Economic Growth I: Economics 331 J. F. O'ConnorDokumen34 halamanEconomic Growth I: Economics 331 J. F. O'ConnorThanhTuyenNguyenBelum ada peringkat

- Meade's Model of Economic Growth and DeterminantsDokumen18 halamanMeade's Model of Economic Growth and DeterminantsHasanah Ameril100% (1)

- Theory of Economic GrowthDokumen40 halamanTheory of Economic GrowthISSA FLOOFBelum ada peringkat

- Lecture Notes 8: Income Distribution and Income InequalityDokumen37 halamanLecture Notes 8: Income Distribution and Income InequalityMansab Raja KhanBelum ada peringkat

- Week 2: An Overview of Long-Run Economic GrowthDokumen43 halamanWeek 2: An Overview of Long-Run Economic GrowthRonit BhatiaBelum ada peringkat

- 2 An Overview of Long Run Economic Growth MergedDokumen358 halaman2 An Overview of Long Run Economic Growth MergedRonit BhatiaBelum ada peringkat

- Addis Ababa University College of Business and Economics Department of Economics Macroeconomics I (Econ 2031) WorksheetDokumen4 halamanAddis Ababa University College of Business and Economics Department of Economics Macroeconomics I (Econ 2031) WorksheetProveedor Iptv España100% (3)

- Growth and DistributionDokumen41 halamanGrowth and DistributionJessica de AbreuBelum ada peringkat

- Chapter-3 Meade's ModelDokumen16 halamanChapter-3 Meade's ModelDenaw AgimasBelum ada peringkat

- The World Distribution of Income - Falling Poverty And... Convergence, Period.Dokumen48 halamanThe World Distribution of Income - Falling Poverty And... Convergence, Period.skywardsword43Belum ada peringkat

- Neoclassical Growth Theory P 2Dokumen8 halamanNeoclassical Growth Theory P 2Matthew Marcus FongBelum ada peringkat

- Stages of Economic Development TheoriesDokumen60 halamanStages of Economic Development TheoriesHannah Mae TubalinalBelum ada peringkat

- Growth Models Slides For Students 3Dokumen19 halamanGrowth Models Slides For Students 3mbibachrisBelum ada peringkat

- Macro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsDari EverandMacro Economics: A Simplified Detailed Edition for Students Understanding Fundamentals of MacroeconomicsBelum ada peringkat

- Basic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyDari EverandBasic Income and Sovereign Money: The Alternative to Economic Crisis and Austerity PolicyBelum ada peringkat

- Chapter 11Dokumen3 halamanChapter 11Marvin StrongBelum ada peringkat

- Summary Balance of Payments: Current Account - Services Current Account - GoodsDokumen8 halamanSummary Balance of Payments: Current Account - Services Current Account - Goodsmunirhussain75Belum ada peringkat

- Mankiw Taylor PPT002Dokumen36 halamanMankiw Taylor PPT002Jan KranenkampBelum ada peringkat

- Concept of Economic Development and Its MeasurementDokumen27 halamanConcept of Economic Development and Its Measurementsuparswa88% (8)

- IMF Inflation Dynamics in The CEMAC RegionDokumen30 halamanIMF Inflation Dynamics in The CEMAC RegioncameroonwebnewsBelum ada peringkat

- Quiz 1 - SolutionsDokumen4 halamanQuiz 1 - Solutionsabijith taBelum ada peringkat

- Real Exchange Rate DeterminantsDokumen55 halamanReal Exchange Rate DeterminantsM Kaderi KibriaBelum ada peringkat

- Solución Cap 21Dokumen16 halamanSolución Cap 21Rosy100% (1)

- Big Mac Index Worldwide 2017 - StatistaDokumen1 halamanBig Mac Index Worldwide 2017 - Statistaismun nadhifahBelum ada peringkat

- Collier - EditanDokumen210 halamanCollier - EditanHachi JazuliBelum ada peringkat

- Vigor PM 2991 Exercise 1Dokumen2 halamanVigor PM 2991 Exercise 1Alyana Vee Ednalig VigorBelum ada peringkat

- NSCB - Sexy Statistics - Understanding Income As Measured From GDP, GNI and NDIDokumen23 halamanNSCB - Sexy Statistics - Understanding Income As Measured From GDP, GNI and NDIJustin NicolasBelum ada peringkat

- Consumer Price Index: Significance of CPIDokumen10 halamanConsumer Price Index: Significance of CPInitish kumar twariBelum ada peringkat

- Alexander V. Avakov - Two Thousand Years of Economic Statistics - World Population, GDP and PPP (2010)Dokumen403 halamanAlexander V. Avakov - Two Thousand Years of Economic Statistics - World Population, GDP and PPP (2010)ARIANA SCHNEIDERBelum ada peringkat

- Future of Outbound Travel in Asia PacificDokumen44 halamanFuture of Outbound Travel in Asia PacificAnonymous P1dMzVxBelum ada peringkat

- 1-Handout One-An Overview of Descriptive Statistics-Chapter 1&2Dokumen22 halaman1-Handout One-An Overview of Descriptive Statistics-Chapter 1&2Ahmed rafiqBelum ada peringkat

- Portfolio Balance ModelDokumen19 halamanPortfolio Balance ModelaporunBelum ada peringkat

- Rate of ContributionsDokumen2 halamanRate of ContributionsYuri ChanBelum ada peringkat

- PWT 91Dokumen1.129 halamanPWT 91Cesar JvBelum ada peringkat

- Explain GDP As A Measure of Economic PerformanceDokumen3 halamanExplain GDP As A Measure of Economic PerformanceGerald MatthewBelum ada peringkat

- CAPE Economics 2017 U2 P2 PDFDokumen13 halamanCAPE Economics 2017 U2 P2 PDFIsmadth2918388Belum ada peringkat

- Teaching PowerPoint Slides - Chapter 1Dokumen23 halamanTeaching PowerPoint Slides - Chapter 1Zaza AfizaBelum ada peringkat

- Chapter 11: Index NumberDokumen7 halamanChapter 11: Index NumberHayati Aini AhmadBelum ada peringkat

- Additional Mathematics Index Number GuideDokumen12 halamanAdditional Mathematics Index Number GuideYk TayBelum ada peringkat

- Measuring A Nation's IncomeDokumen3 halamanMeasuring A Nation's IncomehasnaBelum ada peringkat

- Measures of National Income and OutputDokumen10 halamanMeasures of National Income and OutputMohammed YunusBelum ada peringkat

- Environment and Sustainable Development Indicators For CanadaDokumen92 halamanEnvironment and Sustainable Development Indicators For CanadaNational Round Table on the Environment and the EconomyBelum ada peringkat

- 30 Years Comparative Chart On Gold and Sensex Adjusted For Inflation4Dokumen2 halaman30 Years Comparative Chart On Gold and Sensex Adjusted For Inflation4Hanees MohammedBelum ada peringkat

- Indicators of Economic Development - Full VersionDokumen20 halamanIndicators of Economic Development - Full Versionapi-3825580100% (2)

- NSCB 2009 Annual Report Highlights ProgressDokumen54 halamanNSCB 2009 Annual Report Highlights ProgressgracegganaBelum ada peringkat

![7. Theories of Economic Growth_Solow Model Technical Progress_contd[1]](https://imgv2-1-f.scribdassets.com/img/document/719528830/149x198/08b398289d/1712115840?v=1)