Comparing Online Retail Sales Growth

Diunggah oleh

supriyauDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Comparing Online Retail Sales Growth

Diunggah oleh

supriyauHak Cipta:

Format Tersedia

Comparing OnIine RetaiI SaIes Growth : US Vs Europe

L-commerce is one of the fastest growing markets in Lurope. 1he statistics are problematic as state

statistical research organisations teno to unoerestimate the size of the sector. Baseo on CRR

research commissioneo by Kelkoo, 2010 online sales in the UK were E44 billion [52 billion or 10.7%

of UK retail traoe [+16% on 2008.

or Lurope [incluoing UK, the total market was worth E145,600 million in 2010 [up from E102,v00

million in 2008. Online retailers in only three countries, UK, Cermany ano rance accounteo for 71%

of Luropean online sales.

Online sales in Cermany were E33.2 billion [3v.2 billion, 8.0% of retail sales [+14% over 200v. ln

rance, where online retailers grew at one of the fastest rates in Lurope, 2010 online sales were

E26.4 billion [3v.2 billion or 6.0% of retail sales [+26% over 200v.

14.0% increase in online sales to reach E50.3 billion [5v.4 billion. 1his means that the UK will be

the first Luropean country with online sales of more than 12.0% [against 10.7% in 2010. Last year

we forecast that UK online woulo rise to a 10.5% market share in 2010, it was actually 10.7%.

ln 2011, online sales in Lurope are forecast by CRR to grow by 18.7% to a new total of E171.8 billion

[202.v billion.

e expect the rate of growth of online retailing in the UK, rance, Spain ano ltaly to be slightly lower

in 2011 than 2010, but Cerman online to grow slightly faster. But with Luropean average growth

expecteo to be 18.7% this year, it is still a cracking pace.

US Online Sales

1he Once annual sales growth of more than 25%, growth online in the US has oiminisheo. However

retail sales through conventional shops have slumpeo baoly ano in comparison online sales have not

oone too baoly.. Online retail sales in the US have a market share somewhere between 8% ano v%.

But 1his may inoicate that online sales in the US as a percentage of retail sales may soon fall below

the level of several Luropean countries.

E-reta|| sa|es r|se 137 |n 03

Online shoppers in the United States spent $36.3

billion in Q3, comScore says.

Thcd Rueter

Senor Edtor

Online shoppers in the United States spent $36.3 billion in the third quarter, up 13.1% from the $32.1 billion spent for

the same period a year ago, according to figures released today by comScore nc.

The web measurement firm says the third quarter marks the eight consecutive quarter of year-over-year growth for e-

commerce spending, and the fourth consecutive quarter of double-digit growth. n the second quarter of 2011, e-

commerce spending increased 14% compared with the same period a year ago.

ComScore says most of the growth in the third quarter came from a 22% increase in the number of online buyers.

The firm adds that 74% of all web users made at least one online purchase in the third quarter.

"The third quarter of 2011 saw a continuation of the year's strength in U.S. retail e-commerce spending, even in the

face of renewed economic headwinds and uncertainty facing the U.S. consumer, says comScore chairman Gian

Fulgoni. "As we approach the critical holiday shopping season, we are optimistic about the continued health of the e-

commerce sector despite other factors, including stubbornly high unemployment and volatile financial markets. More

consumers than ever before are relying on the online channel for product and pricing information, which along with

the nternet's fundamental appeal of convenience and attractive pricing, are contributing to the sustained upward

momentum in e-commerce spending.

For the third quarter, the top-performing online categories includes digital content and subscriptions, event tickets,

jewelry and watches, consumer electronics (but not computer peripherals) and computer software. Spending in each

of those categories increased at least 15% compared with the third quarter of 2010.

The comScore report also notes that 40% of online purchases in the third quarter of 2011 included free shipping.

That's down from a peak of 49% for the fourth quarter of 2010, though comScore anticipates an increase in free

shipping offers in the fourth quarter of 2011.

The U.S. online retail market looks solid as the busy holiday shopping season gets under way,

although economic uncertainty remains, according to a study from comScore.

SMLAR ARTCLES:

O Holiday Related Online Sales Grew 15 Percent in 2009

O PayPal Users Beware of Holiday Phishing Scam

O Cyber Monday is a Joke, but Online Shopping sn't

O 5 Unique Ways to Make Money Online

O Black Friday Sales Gains Higher Online Than in Stores

O Apple Cuts Prices on iPads, iPods, Macs for Black Friday

U.S. retailers' online sales grew 13 percent in the third quarter, compared with the same quarter last

year, marking the eighth consecutive quarter of year-on-year growth, comScore said on Wednesday.

A key factor in the market's growth was an increase of 22 percent in the number of buyers -- 74

percent of all nternet users made at least one online purchase during the quarter, the company said.

"As we approach the critical holiday shopping season, we are optimistic about the continued health

of the e-commerce sector despite other factors," said comScore Chairman Gian Fulgoni in

a statement.

Despite high unemployment and financial-market turbulence, e-retail has grown as people, more and

more, use online stores, search engines and other sites to research products, find deals and benefit

from the conveniences of shopping online, according to comScore.

The most popular product categories during the quarter were digital content and subscriptions; event

tickets; jewelry and watches; consumer electronics; and computer software. Each category grew at

least 15 percent year on year.

The study doesn't include travel-related sales, items bought at auctions, cars or large corporate

purchases.

Juan Carlos Perez covers search, social media, online advertising, e-commerce, web application

development, enterprise cloud collaboration suites and general technology breaking news for The

DG News Service. Follow Juan on Twitter at @JuanCPerezDG.

E-tailing in India

chillibreeze writer - Shaila Rao

During the dotcom boom - Ecommerce was the sunrise industry, the

one that would change the face of the world. While Ebay and Amazon

- the twin pillars of Ecommerce in US did bring about paradigm shift in

USA, the tech pundits in India are still a bit iffy about Ecommerce in

India.

The Ecommerce market is expected to touch 9210 Crore INR in 2007-

08, E Tailing or E RE-tailing market is only about 1150 Crore INR

according to a survey conducted by Internet and Mobile Association of

India and Indian Market Research Bureau (IMRB).

For the purpose of this article E-tailing is defined as Ecommerce sites

including auction sites that sell groceries, apparel, CDs, books,

electronic items, gifting item etc but exclude travel, digital downloads

and online classifieds sites.

The top E-tailers in India are indiatimes.com, fabmart.com, rediffshopping.com. They have managed

to retain their lead due to innovative business strategies, supply chain model and changing urban

lifestyles

is Ecommerce so important?

E commerce and ETailing, from a business perspective offer an opportunity to cater to consumers

across geographies, no operational timings, unlimited shelf space - and all this with miniscule quantity

of infrastructure. For a country like India, this business model is a good way of growing the

consumption driven economy.

Growt Drivers

The growth in the E-tailing market is driven by the need to save time by urban India. Besides with

over 2.5 billion internet users, access to internet has also played an important role in growing the

markets. Changing demographics (youthful India), changing lifestyles and exposure to the developed

markets sure give a fillip to this fledgling industry. The soaring real estate costs in India have certainly

inspired many an online venture. Also E-tailers have developed many innovative promotions to lure

customers and there by growing the market.

Barriers to Growt

But then all is not well in the E-tailers paradise. The cost of customer acquisition is pretty high in

India - about 1100 INR/customer which eats into the margins, as most goods retailed are low value

items such as books, CDs and electronic gadgets. High margin goods such as apparel are not very

popular because of the touch and feel factor. Most Indians are not comfortable using their credit cards

for shopping and there is always a fear of "what you see may not be what you get. There may be a

>> read more

problem with complaint resolution, especially after receipt of wrong goods or delayed delivery.

%e Real Issues

The Indian Retail industry has always thrived on personalization. The grocer, tailor or even the mom n

shop apparel store owner knows the preferences, remembers customers taste, budget and previous

purchases. They sense the customers mood too - which no CRM software can claim to do.

Trying to personalize each customers experience - might be one way to grow.

The Indian consumer is still very need oriented, not very impulse or deal oriented like the American

counterparts. Hence it might make sense to create real consumer centric promotions constantly that

provide real value to the Indian consumer. Slowly but surely this is happening in India.

There have been horror stories about receipt of bad or wrong goods, delayed deliveries, no response

from the company - which adds up to not trusting the online retailers. Through this changing - albeit

slowly, thanks to automation and technical integration.

%ouc points to focus on

1. Customer is te King - A good 24/7 customer service through email, chat and toll free phone is

what the E-tailers are providing. Customer complaint resolution - whether, delayed delivery, product

quality, wrong product delivered will certainly work towards long term customer relationship, retention

and acquisition.

2. Suppl Cain

Most customer complaints and delivery returns can be traced to the supply chain vendors or

merchants. They are in fact the most important internal customers. It is important to have the supply

chain vendors or merchants well integrated into the system - both technically and strategically.

3. New Business Models

E-tailers always search new and innovative business models. Case in point being US based Power

Reviews - where it provides free review technology to E-tailers and all it asks in return is that the

reviews collected on the retailers web site are syndicated, which is then aggregated on the

Buzzillions.com, its sister website. Some Indian sites simply collect orders over a period of time say a

week, order in bulk from the vendor and finally ship it to customer at a discounted rate. The customer

is told beforehand about the delivery date, of course.

4. Comparison Sopping and Customer Reviews

All the E-tailers are present on comparison shopping sites is of paramount importance - especially

since people now visit these sites before they place the order. Being present on well known sites such

as compareindia.com andwize.com is a very good idea. Also they encourage customer to write the

product reviews - nothing authenticates their offering to an undecided customers like a good product

review.

%e Conclusion

Though much is yet to be achieved, remember E-tailing is a new industry in India. With broadband

internet access still accessible to entire population, this industry may see an explosive growth. Most

growth drivers are in Indias favor - demographics, economy, changing lifestyle, exposure to new

ideas. It is just a question of creating a sustainable eco system for E-tailing, which is at an inflection

point. Time to fasten the seat belts!

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Lingua Franca Online - English Lessons For Professionals and Business PeopleDokumen1 halamanLingua Franca Online - English Lessons For Professionals and Business Peoplejoysedan03Belum ada peringkat

- List of Commercial Properties of Gurugram Zone For Auction Dated 06.08.2022Dokumen5 halamanList of Commercial Properties of Gurugram Zone For Auction Dated 06.08.2022Yogesh MittalBelum ada peringkat

- Chase Credit Card ApplicationDokumen4 halamanChase Credit Card ApplicationJames McguireBelum ada peringkat

- Harden V. Benguet Consolidated Mining Company (G.R. No. L-37331, March 18, 1933)Dokumen7 halamanHarden V. Benguet Consolidated Mining Company (G.R. No. L-37331, March 18, 1933)Rizza TagleBelum ada peringkat

- SAP PRESS CollectionDokumen10 halamanSAP PRESS CollectionMarcusMouses0% (1)

- 02 Drillmec HH SeriesDokumen13 halaman02 Drillmec HH Seriessaysamajo100% (2)

- Choon's Design v. LaRose Industries Et. Al.Dokumen9 halamanChoon's Design v. LaRose Industries Et. Al.PriorSmartBelum ada peringkat

- AMULDokumen39 halamanAMULmohitBelum ada peringkat

- Corinna: Benchmarking of Cross-Border Innovation Policy in The Core Alpe Adria Region - Interreg Project CorinnaDokumen28 halamanCorinna: Benchmarking of Cross-Border Innovation Policy in The Core Alpe Adria Region - Interreg Project CorinnaB.v. SwethaBelum ada peringkat

- Tax Invoice: GEEVEE GAS AGENCIES (0000117520)Dokumen1 halamanTax Invoice: GEEVEE GAS AGENCIES (0000117520)EaswarBelum ada peringkat

- Document Custody Services: Leadership in The IndustryDokumen1 halamanDocument Custody Services: Leadership in The IndustryNye LavalleBelum ada peringkat

- Performance Comparison of Midcap Mutual FundsDokumen103 halamanPerformance Comparison of Midcap Mutual Fundsswatisabherwal100% (3)

- Unilever: AssignmentDokumen8 halamanUnilever: AssignmentVishal RajBelum ada peringkat

- Test Bank For Business Statistics For Contemporary Decision Making 7th Edition by BlackDokumen33 halamanTest Bank For Business Statistics For Contemporary Decision Making 7th Edition by Blacka2430110010% (1)

- PAGCOR Site Regulatory ManualDokumen4 halamanPAGCOR Site Regulatory Manualstaircasewit4Belum ada peringkat

- MBA 507 ReportDokumen19 halamanMBA 507 ReportSifatShoaebBelum ada peringkat

- Food For Thought 2014 11 M&a LTM 2014Dokumen32 halamanFood For Thought 2014 11 M&a LTM 2014lauraBelum ada peringkat

- CSR of GoogleDokumen28 halamanCSR of GooglePooja Sahani100% (1)

- Melissa Schilling: Strategic Management of Technological InnovationDokumen25 halamanMelissa Schilling: Strategic Management of Technological Innovation143himabinduBelum ada peringkat

- Introduction To NAV 2013 PDFDokumen57 halamanIntroduction To NAV 2013 PDFMorning FlowerBelum ada peringkat

- Ultralift Corp Manufactures Chain Hoists The Raw Materials Inventories OnDokumen3 halamanUltralift Corp Manufactures Chain Hoists The Raw Materials Inventories OnAmit PandeyBelum ada peringkat

- Client Representation LetterDokumen5 halamanClient Representation LetterPuspita NingtyasBelum ada peringkat

- 914 1Dokumen40 halaman914 1Lovena RaichandBelum ada peringkat

- Ajay Singh Rawat, 202101, Dehradun, 12 Yrs, B Tech-Mech, QualityDokumen1 halamanAjay Singh Rawat, 202101, Dehradun, 12 Yrs, B Tech-Mech, Qualitypeter samuelBelum ada peringkat

- Ghani Glass 2007Dokumen39 halamanGhani Glass 2007Muhammad BilalBelum ada peringkat

- ODC - Project - RITES Ltd. - 10P010 - 10P019 - 10P023Dokumen20 halamanODC - Project - RITES Ltd. - 10P010 - 10P019 - 10P023Sehgal AnkitBelum ada peringkat

- New Audit Report Format Including CARO 2016Dokumen8 halamanNew Audit Report Format Including CARO 2016CA Shivang SoniBelum ada peringkat

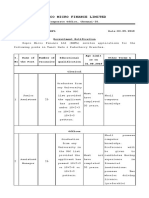

- Repco Micro Finance Limited: Corporate Office, Chennai-35Dokumen4 halamanRepco Micro Finance Limited: Corporate Office, Chennai-35Abaraj IthanBelum ada peringkat

- TOWS and BCG MatrixDokumen27 halamanTOWS and BCG MatrixSwati JainBelum ada peringkat

- Project Presentaa STUDY ON WORK LIFE BALANCE OF EMPLOYEES WITH REFERENCE TO RANE ENGINE VALVE LIMITEDtionDokumen111 halamanProject Presentaa STUDY ON WORK LIFE BALANCE OF EMPLOYEES WITH REFERENCE TO RANE ENGINE VALVE LIMITEDtionGaurav VermaBelum ada peringkat