PPI - Natural Gas Bridge To A Clean Energy Future - Alston 2003

Diunggah oleh

ppiarchiveDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

PPI - Natural Gas Bridge To A Clean Energy Future - Alston 2003

Diunggah oleh

ppiarchiveHak Cipta:

Format Tersedia

Policy Report

June 2003

Natural Gas

Bridge to a Clean Energy Future

by Chuck Alston

Ask a question about Americas energy future, and the likely answer is natural gasfor generating electricity, heating homes and businesses, fueling clean vehicles, and even making the much-vaunted hydrogen future possible. Even fossil fuel skeptics acknowledge natural gas as an important bridge to a renewable energy future. But tight supplies and higher prices are raising new questions about natural gas. The nation has immense untapped natural gas reserves, but they are just that, untapped. And so a recent front-page Wall Street Journal article warned: Once thought plentiful, the United States is now facing a shortage of natural gas that could last for years, and the impact is just beginning to ripple through an already ailing economy.1 Demand for natural gas is growing because it is relatively cheap, it is efficient, it is the cleanest burning fossil fuel, and the United States largely meets its needs with domestic sources. These traits make it vital not only to the nations energy future, but also to the challenge of reducing harmful emissions from power plants, including carbon dioxide (CO2), the chief culprit in global warming. A series of price spikes over the last two years have focused attention on the growing economic importance of natural gas, its significant environmental benefits, and the need to better police the markets that trade it. This has produced a predictable political clash as Congress considers energy legislation. One side, led by the Bush administration, favors supply-side solutions above all others, virtually ignoring commonsense efficiency measures to get more energy bang for the buck from the appliances and heating and cooling systems we use at home and work, and downplaying legitimate environmental concerns as unwelcome barriers to economic growth. The other side, led by environmental groups, emphasizes efficiency, places environmental values ahead of economic concerns, only begrudgingly accepts new extraction or pipeline projects, and acknowledges as an afterthought the important environmental values that are driving natural gas demand and thus the need for abundant supplies. PPI believes a Third Way approach should recognize the important nexus between sound environmental and energy policy, give due consideration both to supply- and demand-side solutions, and press for a more transparent and competitive marketplace. This report focuses on natural gas as an important case in point for how public policy can realize a clean growth strategy that is consistent with progressive goals of abundant and affordable energy, economic prosperity, and across-the-board improvements in environmental quality. Based on this balanced approach, the following policy brief recommends policies to: ! Improve efficiency and reduce demand; ! Make markets more transparent and more competitive; ! Construct a natural gas pipeline from Alaska to the lower 48 states, built and operated according to strict environmental standards; ! Promote drilling in the central and western Gulf of Mexico;

Progressive Policy Institute

www.ppionline.org

! Support efforts to tap unconventional gas reserves in the Rocky Mountains in an environmentally sound manner; ! Increase funding for environmental reviews, land management planning, and inspection and enforcement of production facilities on federal lands; ! Support research and development for improved extraction techniques and for technologies to get stranded gas to market; ! Set a national renewable portfolio standard (RPS) for electric utilities to lessen dependence on all fossil fuels, including natural gas; and ! Support the development of liquefied natural gas (LNG) in the Western Hemisphere.

The Fallout From Recent Price Shocks

Spot prices for natural gas soared briefly in February, increasing more than 500 percent to $18 per thousand cubic feet (Mcf) and focusing attention on the markets volatility. Prices have since settled back into a $5 to $6 trading range. Still, that is a long way from the stable $2 to $2.25 per Mcf prices that largely prevailed for more than a decade. This price volatility threatens scenarios calling for relatively cheap natural gas to fire more power plants, heat more homes and businesses, fuel more clean cars, trucks and buses, and even make the much-vaunted hydrogen future possible. It is also wreaking havoc with industries such as petrochemicals and fertilizers that use gas as a feedstock. The Energy Information Administration (EIA) projects total demand for natural gas will increase at an average annual rate of 1.8 percent through 2025, from 22.7 trillion cubic feet to 34.9 trillion cubic feet.2 The chief reason is that electric generators are building gas-fired plants to meet peak load demands. This is good news for efforts to improve public health and slow global warming.

Compared to coal-fired plantsthe predominant source of electricityon a kilowatt-hour basis of output, natural gas-fired plants emit virtually no mercury, 99 percent less sulfur dioxide, 80 percent less nitrogen oxide, and 50 percent less CO2, the chief greenhouse gas. Little wonder that EIA estimates natural gas will fire 80 percent of the new generating plants to come online between now and 2025.3 But, as recent hot summers and cold winters have demonstrated, the inelastic demand for natural gasexacerbated by what is largely a just-in-time delivery system, especially when natural gas storage levels are lowmeans that minor bumps in demand can lead to disproportionately large price spikes. In the short term, there is little government policy can do. As a General Accounting Office (GAO) analysis of the price gyrations of 2001 put it: Natural gas supply is relatively fixed in the short-term; it is limited to available storage and production and cannot be quickly increased to meet increased demand.4 And in the next few years prices could remain high. The increased use of natural gas to meet summers peak electricity needs has upset the traditional pattern for managing storage. Typically, gas suppliers refilled storage in summer, when demand and prices once were low, to meet heating needs for the following winter. This is why it is all the more alarming that production is falling. Despite higher prices, U.S. production fell 5 percent last year from 2001 levels and 2003 production is expected to lag behind 2002. 5 Higher prices have prompted greater exploration, as the number of drilled wells increases, but companies are not making up for the depletion of existing wells and fields. Moreover, independent gas producers are now responsible for a significant majority of exploration activity here at home, while the major companies are largely investing abroad where they see better returns on their investment. They are betting on meeting Americas gas needs with cheap gas produced abroad, liquefied, and shipped to America via tankers.

Progressive Policy Institute

www.ppionline.org

Why Natural Gas?

Despite these challenges, natural gas remains an important answer to the question of how to best meet Americas need for clean energy growth. According to EIA, there are nearly 1,300 trillion cubic feet of technically recoverable gas reserves available (economic viability is another issue) in the United States alone.6 The National Petroleum Council pegs reserves at even higher levels. This is cause for optimism. The challenge for public policy is to encourage production of economically viable domestic natural gas without unnecessarily tilting the marketplace or compromising important environmental laws and values. The challenge for progressives concerned about the environment is to recognize the balancing act: to avoid reflexive opposition to efforts to tap new natural gas reserves, including those on public lands, and the new pipelines necessary to meet the demand for clean energy. Previously, PPI has previously stated three principles for a clean growth energy policy: 1) abundant and affordable energy, 2) economic prosperity, and 3) across-the-board improvements in environmental quality. These principles require ensuring a diverse fuel mix, including alternatives to fossil fuels, and raising energy productivity by making every BTU more efficient with commonsense measures to ease the rate of demand growth.7 In addition, recent events have given Americans a new sense of the adverse consequences related to an inordinate dependence on foreign energy sources, as is the case with Persian Gulf oil. To date, America has met its natural gas needs with North American supplies; roughly 84 percent of natural gas consumed by the United States is produced in the United States, with the balance from Canada. Only 1 percent, in the form of liquefied natural gas (LNG), comes from outside North America.8 Thus, the American market is insulated from external supply disruptions, a situation that could change as demand outstrips domestic supply and LNG imports become a significant factor in the domestic market. For all these reasons, ample and affordable domestic natural gas is clearly in the nations

best interest. Until the day fossil fuel alternatives are widely available and competitively priced and policy should seek to hasten that dayit is imperative that the environmental and health concerns for higher quality air that are helping drive natural gas demands are met by efforts to ensure adequate supply. Despite the resistance of the Bush administration, sound environmental policy should place a premium on cleaning up the air and focus squarely on the threat CO2 emissions pose to global warming. If enacted, the leading proposals for controlling CO2even the Bush administrations weak voluntary approach could put greater pressure on utilities to build more natural gas plants than current projections now foresee, to meet new CO2 emission standards. Although a well-constructed, marketbased cap-and-trade system for controlling CO2 would also provide incentives for utilities to develop cleaner-burning technologies for coalfired plants, techniques to sequester CO2 emissions, reforestation projects to absorb CO2, and alternatives to fossil fuels period, natural gas will remain a primary fuel choice. Hence, environmentalists must recognize the inescapable policy trade-off that comes with making the air cleaner and arresting global warming: more drilling for natural gas and more pipelines to get the gas to market. It is inconsistent to support the former and reflexively oppose the latter. As the Natural Resources Defense Council (NRDC) has recognized, natural gas must be regarded as an important bridge fuel to a future energy system that relies on renewables and environmentally friendly sources of energy.9 At the same time, those who advocate only aggressive supply solutions must recognize that garnering broader support for increased drilling and more pipelines means: 1) pursuing commonsense smart strategies to improve energy productivity and manage demand to extend production of domestic natural gas, lest we fall prey to the very trap we now face with oil imports; and 2) acknowledging the importance of proper stewardship of our public lands and recognizing that energy policy must be consistent with other important environmental values.

Progressive Policy Institute

www.ppionline.org

What to Do Immediately

As illustrated above, the inelastic nature of the gas marketplace gives policymakers few short-term levers to ease prices. Indeed, shortterm price management is not the proper role for government, so long as markets are competitive and transparent and thus not subject to manipulation. Hindsight now tells us they were not in California in 2001. Nonetheless, Californias 2001 power crisis teaches two important lessons with short-term policy applications for natural gas. The first is the power of determined efforts to reduce demand. Spurred by soaring prices for electricity, during the first seven months of 2001, California consumed 8 percent less electric energy than in the same period of 2000.10 While high prices, crisis mentality, and exhortations of state government make this feat hard to duplicate elsewhere, particularly in states with low electricity prices, the demand reduction is illustrative of what can occur where there is the will. When residents and businesses take commonsense measures to adjust thermostats, buy energy efficient appliances, light bulbs, and heating and cooling units, and just turn off lights that arent needed, results can be remarkable. The Alliance to Save Energy estimates that if the nation could reduce demand by 5 percent, it would eliminate the need for about 110 new power plants.11 In the absence of a national conservation campaign conjuring up the wool sweaters of the Carter administration, there are nonetheless measures government can and should take not only to reduce current energy demand but also to slow growth. Previously, PPI has endorsed smart building-control technologies, green designs, and time-varying electric prices that help customers reduce power costs as some of the proven, market-friendly policy tools to accelerate the introduction and use of energy technologies that improve productivity and comfort as they reduce electricity and gas bills.12 Given the increased reliance on natural gas to supply peak electricity demand, these and other conservation and efficiency steps make more sense than ever.

As PPI concluded: If our long-term energy strategy should stand for anything, it should stand for the creation of a highly productive, highly intelligent, and environmentally superior end-use sector. Particularly in times of projected price increases, and an overstressed delivery infrastructure, end-use improvements that increase productivity, reduce energy use and operating costs, and reduce emissions constitute a win-win for the U.S. economy.13 The second lesson from California is the need for better informed, more transparent, and more competitive markets. As GAO noted in its analysis, The lack of timely and accurate data about the overall natural gas market adds to the uncertainty about supply and demand conditions, further exacerbating price volatility.14 In the case of the California crisis of 2001, it is now clear that energy traders were using this very lack of transparency to manipulate markets to their advantage. Further, wash trades and other ploys have now been exposed as efforts to jack up prices by creating a false picture of demand on top of the real seasonal demands. The lack of timely, accurate information on trading, supplies, and storage breeds fear in the marketplace and pressures prices. Thus, there is a need for better data about what is really happening in the marketplace, both to support trading decisions in the spot market based on sound information and to preserve a record for regulatory review. The staff of the Federal Energy Regulatory Commission, in its report on the manipulation of Western energy markets in 2000 and 2001, issued a series of recommendations to prevent traders from submitting false data to manipulate price indices that policymakers should pursue.15

Bringing New Gas to Market

Beyond these short-term considerations of improving efficiency, conservation, and markets, national policy should recognize the need to tap new gas reserves and bring

Progressive Policy Institute

www.ppionline.org

untapped gas reserves to market in an environmentally sound manner and without undue interference in the marketplace. These steps include supporting: ! A natural gas pipeline from Alaska to the lower 48 states, constructed and operated according to strict environmental standards. There are nearly 32 trillion cubic feet of natural gas stranded in Alaska because there is no pipeline system. To date, low gas prices have not made a pipeline economically viable, and the decision to build a pipeline must remain market driven. The federal government should not mandate a route, except to ensure that careful attention is paid to environmental considerations. If the state of Alaska wants to drive the route decision, it should consider financial participation. The federal government should not guarantee a minimum price for Alaskan gas, as has been proposed. ! Gas drilling in the central and western Gulf of Mexico with incentives where appropriate. Offshore drilling has been ruled out on the Atlantic and Pacific coasts, and now in the eastern Gulf of Mexico. (It is worth noting that the Clinton administration approved the controversial Area 181 lease sale in the natural gas-prone eastern Gulf, a decision that was overturned by the Bush administration at the request of Florida Gov. Jeb Bush.) Thus, drilling should be aggressive where there is consensus in the Gulf, in both deep and shallow waters. If higher gas prices do not spur adequate drilling, then incentives such as royalty relief in under-leased and under-explored waters are in order; ! Efforts to tap unconventional gas reserves in an environmentally sound manner.16 The largest category of unproved reserves, estimated at 445 trillion cubic feet, is unconventional natural gas, the EIA report says. 17 Much of this gas is marginally economical. But where unconventional sources such as coalbed natural gas are viable, or will prove viable, such as in the Powder River Basin in Wyoming and Montana and other areas of the Rocky

Mountains, policy should support leasing and explorationbut only with careful consideration and mitigation of the environmental consequences. The Powder River Basin, for instance, is an important new source of natural gas, but the extraction technique, which initially removes significant quantities of water trapped in coal seams to release the gas, has potentially significant environmental consequences for how best to manage the produced water. The cost of bringing such gas to market must also reflect the cost of protecting the water resources; ! Increases in funding for the Bureau of Land Management and United States Forest Service for environmental reviews, land management planning, and inspection and enforcement of natural gas and oil production facilities on federal lands; ! Research and development of improved extraction techniques for onshore, offshore, conventional, and unconventional reserves, and also for technologies such as liquefaction to get gas to market that is stranded by its lack of proximity to a pipeline network; ! A national renewable portfolio standard (RPS) for electric utilities to lessen dependence on all fossil fuels, including natural gas. A good starting point is the RPS provision in the Senates 2002 energy bill that would require that an additional 1 percent of the electricity generated in the United States come from new renewable energy sources by 2005, and 10 percent by 2020. A credit trading system should be developed to help utilities meet the standard; and ! The development of LNG in the Western Hemisphere. The LNG technology enables the United States to tap overseas gas reserves. By cooling and liquefying the gas, it can be shipped and then reconverted into natural gas for delivery into the U.S. pipeline system. Importing LNG would make natural gas, like oil, subject to a global marketplace and, depending on its

Progressive Policy Institute

www.ppionline.org

country of origin, subject to similar geopolitical concerns. At the same time, LNG is far too important a resource to ignore, especially in areas of the country underserved by the interstate pipeline system. The investment in infrastructure to support LNG should be borne by the private sector alone and with adequate environmental safeguards.

Conclusion

Energy policy poses enormous challenges for the United States on several fronts economic growth, environmental quality, and

national security. Our policy must dream big about a different future, and tap American ingenuity to make what now seems impossiblecleaner, safer, and more secure sources at affordable pricespossible. That future may lie in abundant renewable sources from the wind, the sun, or plants; in technologies that make dirty but abundant coal burn clean or deliver nuclear energy without adverse environmental consequences; or in an energy system based on hydrogen fuel cells. But until that day arrives, an abundant domestic supply of natural gas is critical. And to the extent that the United States can meet its needs for natural gas domestically, the better off well be.

Chuck Alston is executive director of the Progressive Policy Institute and leads its ad hoc energy group. He would like to acknowledge the valuable assistance of group members David Hayes, Melanie Kenderdine, Peter Fox-Penner, Ron Minsk, Walker Nolan, Jan Mazurek, and John Northington on this brief.

For further information about this or any other PPI publications, please call the publications department at 202/ 547-0001, write the Progressive Policy Institute, 600 Pennsylvania Ave., S.E., Suite 400, Washington, DC, 20003, or visit PPIs Web site at http://www.ppionline.org.

Progressive Policy Institute

www.ppionline.org

Endnotes

Gold, Russell and Rebecca Smith, Effects of Gas Shortage Rip Through Economy, The Wall Street Journal, February 28, 2003. 2 Energy Information Administration, Department of Energy, Annual Energy Outlook 2003 With Projections to 2025, Overview, January 2003, http://www.eia.doe.gov. 3 Ibid, p. 68. 4 United States General Accounting Office, Report to Congressional Committees and Members of Congress, Natural Gas: Analysis of Changes in Market Price, December 2002. 5 Bear Stearns, and Co., Inc., Natural Gas Outlook, April 2003, http://www.bearstearns.com/bscportal/pdfs/research/analyst/ hannan/natural_gas_outlook_0403.pdf. 6 Energy Information Administration, op. cit., p. 34. 7 Fox-Penner, Peter, Clean Growth: A Balanced Energy Policy for the 21st Century, Progressive Policy Institute, October 2001, http://www.ppionline.org/ppi_ci.cfm?contentid=3833&knlgAreaID=144&subsecid=900007. 8 Energy Information Administration, op. cit., p. 138. 9 Lashof, Daniel and Patricio Silva, A Responsible Energy Policy for the 21st Century, Natural Resources Defense Council, p. 25, March 2001. 10 Shogren, Elizabeth, California Orchestrating Energy Efficiency, But Its a One-Man Band, The Los Angeles Times, August 19, 2001. 11 Ibid. 12 PPI has previously explored criteria to guide extraction on public lands: Hayes, David J., Domestic Oil and Gas Production: Pursuing a Principled Approach, Progressive Policy Institute, June 13, 2002, http://www.ppionline.org/ ppi_ci.cfm?contentid=250515&knlgAreaID=144&subsecid=304. 13 Ibid. 14 United States General Accounting Office, op.cit. 15 Federal Energy Regulatory Commission, Final Report on Price Manipulation in Western Markets, p. 6, Executive Summary, March 2003. 16 See the recommendations to guide drilling on public lands in Hayes, David J., Domestic Oil and Gas Production: Pursuing a Principled Approach, Progressive Policy Institute, June 13, 2002, http://www.ppionline.org/ ppi_ci.cfm?contentid=250515&knlgAreaID=144&subsecid=304. 17 Energy Information Administration, op. cit., p. 35.

1

Anda mungkin juga menyukai

- Understanding Natural Gas MarketsDokumen32 halamanUnderstanding Natural Gas MarketsJoseph AnnanBelum ada peringkat

- Critical Energy Choices For The Next AdministrationDokumen20 halamanCritical Energy Choices For The Next AdministrationThe American Security ProjectBelum ada peringkat

- Research Paper Gas PricesDokumen6 halamanResearch Paper Gas Pricesafnhemzabfueaa100% (1)

- MIT-NaturalGas Chapter 1 ContextDokumen16 halamanMIT-NaturalGas Chapter 1 Contextbrook-porter-176Belum ada peringkat

- Worldwatch Gas Paper April 2010Dokumen23 halamanWorldwatch Gas Paper April 2010daleramlakhan5714Belum ada peringkat

- Statistical Energy PerspectiveDokumen9 halamanStatistical Energy PerspectiveJoel Diamante Gadayan Jr.Belum ada peringkat

- McGinn: Be BullishDokumen1 halamanMcGinn: Be BullishmpenningerBelum ada peringkat

- Fossil Fuel Emissions Thesis StatementDokumen4 halamanFossil Fuel Emissions Thesis Statementangelagibbsdurham100% (1)

- Facts About Shale GasDokumen2 halamanFacts About Shale GasRahul MaratheBelum ada peringkat

- Gas Fired Recovery - Frequently Asked QuestionsDokumen3 halamanGas Fired Recovery - Frequently Asked QuestionsBen EwaldBelum ada peringkat

- Sources of Information On Natural Gas SupplyDokumen3 halamanSources of Information On Natural Gas SupplyBrokn AngelBelum ada peringkat

- Plenty of Natural Gas To Go Around-It Just Needs A MarketDokumen14 halamanPlenty of Natural Gas To Go Around-It Just Needs A MarketAlan CoutoBelum ada peringkat

- Sustainable Development of North America's Oil and Natural GasDokumen12 halamanSustainable Development of North America's Oil and Natural GasKerron RekhaBelum ada peringkat

- Natural Gas ArticleDokumen3 halamanNatural Gas ArticleZsco96Belum ada peringkat

- Writing Paper RevisionDokumen15 halamanWriting Paper Revisionapi-463767715Belum ada peringkat

- Green Investing: A Guide to Making Money through Environment Friendly StocksDari EverandGreen Investing: A Guide to Making Money through Environment Friendly StocksPenilaian: 3 dari 5 bintang3/5 (2)

- Energy Economics: Don Maxwell, Zhen ZhuDokumen10 halamanEnergy Economics: Don Maxwell, Zhen Zhubauhitut008Belum ada peringkat

- Natural Gas Outlook The Future of Natural GasDokumen4 halamanNatural Gas Outlook The Future of Natural GasPjay CorderoBelum ada peringkat

- Cee Guide To LNGDokumen2 halamanCee Guide To LNGNatalia Magaia CambaBelum ada peringkat

- CarbonSequestrationExec - Summary ColoradoClimateChangeMarketsActDokumen6 halamanCarbonSequestrationExec - Summary ColoradoClimateChangeMarketsActJanitha BatagodaBelum ada peringkat

- API Climate Fact SheetDokumen2 halamanAPI Climate Fact Sheetlmogablog100% (2)

- Shale Gas Market USA - Sample ReportDokumen3 halamanShale Gas Market USA - Sample Reportneeteesh_nautiyalBelum ada peringkat

- Gas Prices Research PaperDokumen5 halamanGas Prices Research Paperafeaynwqz100% (1)

- Wake Up Pickens - Natural Gas May Not Be PanaceaDokumen5 halamanWake Up Pickens - Natural Gas May Not Be PanaceaDeissy BautistaBelum ada peringkat

- The Bad Science and Bad Policy of Obama?s Global Warming AgendaDari EverandThe Bad Science and Bad Policy of Obama?s Global Warming AgendaBelum ada peringkat

- Power Engineering May 2013Dokumen95 halamanPower Engineering May 2013Portal studentesc - EnergeticaBelum ada peringkat

- Cal Berkeley-Pramanik-Sergent-Leventhal-1AC-2AC-1AR-Northwestern-Round4Dokumen42 halamanCal Berkeley-Pramanik-Sergent-Leventhal-1AC-2AC-1AR-Northwestern-Round4Ben CrossanBelum ada peringkat

- Energy Policy: Energy Policy of US. Energy Policy of Turkey. Energy Policy of PakistanDokumen11 halamanEnergy Policy: Energy Policy of US. Energy Policy of Turkey. Energy Policy of PakistanAli SherBelum ada peringkat

- Pro CardsDokumen8 halamanPro CardsJamesBelum ada peringkat

- With Help From Andrew Restuccia, Erica Martinson and Darius DixonDokumen4 halamanWith Help From Andrew Restuccia, Erica Martinson and Darius DixonCREWBelum ada peringkat

- NETL - Clean Power GenerationDokumen3 halamanNETL - Clean Power GenerationShankar JhaBelum ada peringkat

- Powering Out of Pandemic:: Unleashing The Potential of GasDokumen42 halamanPowering Out of Pandemic:: Unleashing The Potential of GasAndrew ThompsonBelum ada peringkat

- Is Natural Gas A Climate Change Solution For CanadaDokumen58 halamanIs Natural Gas A Climate Change Solution For CanadaLeonBelum ada peringkat

- Energy Crisis Require Actions The Economist 2022Dokumen3 halamanEnergy Crisis Require Actions The Economist 2022Alexis StillgerBelum ada peringkat

- Anwroped PDFDokumen1 halamanAnwroped PDFdsouzad12Belum ada peringkat

- Advantage Counterplans NDI 2011Dokumen27 halamanAdvantage Counterplans NDI 2011AtraSicariusBelum ada peringkat

- Energy Policy: E P Us. E P O C - E P F PDokumen14 halamanEnergy Policy: E P Us. E P O C - E P F PAli SherBelum ada peringkat

- CEP Shale Gas ReviewDokumen0 halamanCEP Shale Gas Reviewruano25Belum ada peringkat

- The Green Collar Economy: How One Solution Can Fix Our Two Biggest ProblemsDari EverandThe Green Collar Economy: How One Solution Can Fix Our Two Biggest ProblemsPenilaian: 3.5 dari 5 bintang3.5/5 (32)

- 2007 Gasification Technologies Conference Gasification Industry Roundtable Oct. 15, 2007 Major Developments & Emerging TrendsDokumen8 halaman2007 Gasification Technologies Conference Gasification Industry Roundtable Oct. 15, 2007 Major Developments & Emerging TrendssadiqBelum ada peringkat

- Warming GoodDokumen321 halamanWarming GoodDavidZeitlinBelum ada peringkat

- Conventional Energy in North America: Current and Future Sources for Electricity GenerationDari EverandConventional Energy in North America: Current and Future Sources for Electricity GenerationBelum ada peringkat

- 189 Getting Gas Right ReportDokumen49 halaman189 Getting Gas Right ReportaadhamBelum ada peringkat

- Natural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferenceDokumen11 halamanNatural Gas/ Power News: Middle East Can Expect 'Dash For Gas', Shell Exec Tells Oman ConferencechoiceenergyBelum ada peringkat

- Global Natural Gas A Growing Resource, December 22, 2010Dokumen23 halamanGlobal Natural Gas A Growing Resource, December 22, 2010Chuck AchbergerBelum ada peringkat

- Iii - Energy and Climate Global Energy Demand and Supply-Present and FutureDokumen5 halamanIii - Energy and Climate Global Energy Demand and Supply-Present and Futureandrei CalloBelum ada peringkat

- Round 2 SpeechDokumen6 halamanRound 2 SpeechIanBelum ada peringkat

- GasTIPS Winter04 PDFDokumen36 halamanGasTIPS Winter04 PDFmelvincabeBelum ada peringkat

- 12-11-2012 CoalDokumen4 halaman12-11-2012 CoalJames BradleyBelum ada peringkat

- Renewable Energy: Not Cheap, Not " Green", Cato Policy AnalysisDokumen53 halamanRenewable Energy: Not Cheap, Not " Green", Cato Policy AnalysisCato Institute100% (1)

- Win-Win Opportunity For Climate Prosperity and Life Op-Ed 07-01-08Dokumen4 halamanWin-Win Opportunity For Climate Prosperity and Life Op-Ed 07-01-08Michael P TottenBelum ada peringkat

- Oded Rae Tal 2005 World GasDokumen17 halamanOded Rae Tal 2005 World GasAz RexBelum ada peringkat

- The Assault On Coal and American ConsumersDokumen12 halamanThe Assault On Coal and American Consumersmdmorgan88Belum ada peringkat

- Shift From Fossil Fuel To Clean EnergyDokumen5 halamanShift From Fossil Fuel To Clean Energybhavesh.dprBelum ada peringkat

- Article Energy SecurityDokumen1 halamanArticle Energy SecurityVikram SaiBelum ada peringkat

- Achieving Energy SecurityDokumen54 halamanAchieving Energy SecurityGeorge LernerBelum ada peringkat

- Natural Gas Report From Sen. Ed Markey's OfficeDokumen24 halamanNatural Gas Report From Sen. Ed Markey's OfficeMassLiveBelum ada peringkat

- Energy ConservationDokumen28 halamanEnergy ConservationGajendra TeliBelum ada peringkat

- 4.should Energy Be SubsidizedDokumen16 halaman4.should Energy Be SubsidizedHari DasBelum ada peringkat

- PPI - Universal Paid Leave - Atkinson (2003)Dokumen9 halamanPPI - Universal Paid Leave - Atkinson (2003)ppiarchiveBelum ada peringkat

- PPI - Making Work Pay - Family Tax Credit (2007)Dokumen10 halamanPPI - Making Work Pay - Family Tax Credit (2007)ppiarchiveBelum ada peringkat

- PPI - Inequality in The New Knowledge Economy - AtkinsonDokumen17 halamanPPI - Inequality in The New Knowledge Economy - AtkinsonppiarchiveBelum ada peringkat

- PPI - Workforce Investment ActDokumen20 halamanPPI - Workforce Investment ActppiarchiveBelum ada peringkat

- PPI - Welfare-To-Work and Child Care 10 State Survey - Waller 1997Dokumen8 halamanPPI - Welfare-To-Work and Child Care 10 State Survey - Waller 1997ppiarchiveBelum ada peringkat

- PPI - Ripples of Innovation - Minnesota Charter Schools (Schroeder 2004)Dokumen53 halamanPPI - Ripples of Innovation - Minnesota Charter Schools (Schroeder 2004)ppiarchiveBelum ada peringkat

- PPI - Family Friendly Tax Reform (Weinstein 2005)Dokumen13 halamanPPI - Family Friendly Tax Reform (Weinstein 2005)ppiarchiveBelum ada peringkat

- Sample Story StartersDokumen7 halamanSample Story StartersmahfuzkhanBelum ada peringkat

- VerbalDokumen64 halamanVerbalShakeeb Aslam RajputBelum ada peringkat

- Last Cloudia EN - Farming Spots - More Farming Spots (Normal Only)Dokumen6 halamanLast Cloudia EN - Farming Spots - More Farming Spots (Normal Only)Sikas Wanda100% (1)

- Manual Makita hr2510Dokumen8 halamanManual Makita hr2510Burlacu MadalinBelum ada peringkat

- Chiller Testing Procedure Rev 1Dokumen15 halamanChiller Testing Procedure Rev 1Ali AimranBelum ada peringkat

- Dencroft Garages BrochureDokumen12 halamanDencroft Garages BrochureSkBelum ada peringkat

- Fourth SealDokumen10 halamanFourth SealHmt NmslBelum ada peringkat

- Ketchup Clouds by Annabel PitcherDokumen24 halamanKetchup Clouds by Annabel PitcherOrion Publishing GroupBelum ada peringkat

- Тема 4 Academic Style Components of academic style Avoiding repetitionDokumen13 halamanТема 4 Academic Style Components of academic style Avoiding repetitionСергей ТерентьевBelum ada peringkat

- Tulip CultivationDokumen10 halamanTulip CultivationSofi MehrajBelum ada peringkat

- 4.2 Grammar Practice - Superlative AdjectivesDokumen2 halaman4.2 Grammar Practice - Superlative Adjectivesjojobizarreadventure49Belum ada peringkat

- Refrigerant Types, Issues, Trends and Future OptionsDokumen47 halamanRefrigerant Types, Issues, Trends and Future OptionsSelvaraji MuthuBelum ada peringkat

- Ref ET V3.1 Users ManualDokumen99 halamanRef ET V3.1 Users ManualGUSNARANJOTBelum ada peringkat

- Direction: Encircle The Letter of The Correct Answer.: Lapg EnglishDokumen7 halamanDirection: Encircle The Letter of The Correct Answer.: Lapg EnglishFelbert PalaoBelum ada peringkat

- 48pg 5pdDokumen210 halaman48pg 5pdWilliam.Parris3256Belum ada peringkat

- CE 313-Lecture-2 (Concepts in Structural Steel Design)Dokumen23 halamanCE 313-Lecture-2 (Concepts in Structural Steel Design)Yasser Alghrafy100% (1)

- Read The Following Passage and Mark The Letter A, B, C or D On Your Answer Sheet To Indicate The Correct Answer To Each of The QuestionsDokumen67 halamanRead The Following Passage and Mark The Letter A, B, C or D On Your Answer Sheet To Indicate The Correct Answer To Each of The QuestionsQuynhBelum ada peringkat

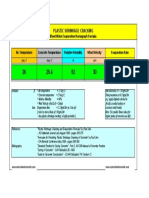

- Plastic Shrinkage Cracking: Bleed Water Evaporation Nomograph FormulaDokumen1 halamanPlastic Shrinkage Cracking: Bleed Water Evaporation Nomograph FormulaBesmir BeqiriBelum ada peringkat

- Natural Disaster Scenario Cards: All Images Courtesy of Microsoft Word Office Clip ArtDokumen3 halamanNatural Disaster Scenario Cards: All Images Courtesy of Microsoft Word Office Clip ArtUyen VuBelum ada peringkat

- English SBADokumen6 halamanEnglish SBANikishaBelum ada peringkat

- Chapter 4 Heat Exchangers With High-Finned Trufin TubesDokumen0 halamanChapter 4 Heat Exchangers With High-Finned Trufin TubesManuel ArroyoBelum ada peringkat

- Climateofindia-House Design Analysis PDFDokumen10 halamanClimateofindia-House Design Analysis PDFProf. Vandana Tiwari SrivastavaBelum ada peringkat

- The SLI EffectDokumen55 halamanThe SLI EffectDanavoBelum ada peringkat

- A Kiss As Long As EternityDokumen7 halamanA Kiss As Long As EternityBeatrice TecuBelum ada peringkat

- UPDokumen166 halamanUPAnh Vu NguyenBelum ada peringkat

- AAR 78th Armored Field Artillery Battalion, 2nd Armored Division, 24 June 1943 Thru 31 August 1943Dokumen52 halamanAAR 78th Armored Field Artillery Battalion, 2nd Armored Division, 24 June 1943 Thru 31 August 1943Hauke KrapfBelum ada peringkat

- Patrick Rothfuss - King Killer Chronicle 02 - The Wise Mans FearDokumen633 halamanPatrick Rothfuss - King Killer Chronicle 02 - The Wise Mans FearLuis Vazquez17% (6)

- Ashrae Dar Es Salaam 2017Dokumen2 halamanAshrae Dar Es Salaam 2017FrankBelum ada peringkat

- Metrotile Installation ManualDokumen42 halamanMetrotile Installation ManualJapheth Areso100% (1)

- Pakistan, Land, People and SocietyDokumen13 halamanPakistan, Land, People and SocietyM Raheel Akram75% (4)