Capital Market and The Coast of Capital

Diunggah oleh

Tudor IonutDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Capital Market and The Coast of Capital

Diunggah oleh

Tudor IonutHak Cipta:

Format Tersedia

CAPITAL MARKETS AND THE COST OF CAPITAL

Lect. Sanda Constantin Ph.D Transilvania University of Bra ov Faculty of Economics and Business Administration Bra ov, Romania Lect. Dana Adriana Lup a-T taru Ph. D Transilvania University of Bra ov Faculty of Economics and Business Administration Bra ov, Romania

Abstract: : The paper introduces the engrossing subject of the cost of capital obtained through the capital funds markets and helps to set off in bold relief the conditioning relationship of long-run operating decisions to short-run internal and external decision making. JEL classification: G10, M21 Key words: capital market; stock; financing; cost of capital

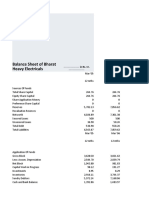

1. THE CAPITAL STRUCTURE Long-term internal and external financing is the source of funds for long-run operations. More specifically, is the source of funds for on and off-the-balance sheet capital expenditures, which indirectly affect long and short-run operations. Because of its direct association with capital expenditures, long-term financing may be called capital financing. In financial accounting it has a somewhat more restricted meaning: capital obligations with maturities of more than one year. Looking at capital financing from the balance sheet point of view, the amount on balance at a given time may include capital debts, capital stock and retained earnings; these collectively are called the capital structure. And at any given time the capital structure of a business is equal to its gross capital assets, which is the sum of working capital, investment securities, and fixed assets: Capital structure =Gross capital 1.Capital debts 1.Working capital 2.Capital stock 2.Investment securities 3.Retained earnings 3.Fixed assets Capital debts include all liabilities with maturities of more than one year. These are contracts that are formally negotiated with financial institutions. The debts may be due all at one time or in installments over several years. As a compromise to the installment debt, a sinking-fund investment plan may be used to retire the debt. Depending on the general credit of the business, the debts may or may not have to be supplemented with a security pledge on the companys fixed assets.

Evidence of the debts is contained in a signed promise to pay a certain sum of money on a given date, at a given place, and at a given rate of interest stipulated on the face of debt instrument. This debt instrument is a promissory note, or a trust certificate or bond. Not included, as capital debts are short-term instruments as accounts payable, demand notes and bills of exchange. Accompanying the debt instrument is another essential document called a loan agreement or indenture in which the financing relationships between the business and creditors are defined. Through this accompanying document, the creditors seek to exercise controls over internal-fund-management practices in order to protect his financial interests in the business. Capital stock is distinguished from the capital-debt form of financing because it has no maturity date and contains no fixed interest obligations and no prior claim to assets in case of dissolution of the business. For these reasons, capital stock is considered as a claim against the business and it represents ownership in the business. Capital stock financing, however, varies in quality depending on whether it is common or preferred. The latter is a compromise between financing with capital debts and with common stock. It is distinguished mainly by its contingent claim to cash dividends up to a fixed sum before dividends are paid to common stockholders. Preferred dividends are usually paid at a higher rate of return for the investor than the rate of interest on debts, but lower than the rate of return on common stock. Common stock is the true residual ownership interest in the business; the holders are the prime risk-takers and the prime beneficiaries of efficient financial management. Retained earnings are cumulative net-profit additions to the capital structure after allowances are made for dividends payable to common and preferred stockholders. They are the nonnegotiated or internal sources of capital-internal because they are generated by sales and other forms of income in the ordinary course of business. As a source of capital without formal external obligations, retained earnings pose a more subtle kind of problem in capital financing than the external-financing forms. One problem is whether to treat retained earnings as cheap financing since they contain no contractual obligations to outsiders. Another is the problem of accumulation, the rate at which they accumulate being affected by cash dividend payments. 2. THE SECONDARY CAPITAL MARKET The secondary market is one which the investing public exchanges capital funds and securities without directly affecting the inflow of capital to the business, since securities trading is the subject of first interest in the market, the secondary market is usually called the securities market; this term also helps to distinguish it from the primary market where the business gets its capital funds. The secondary market is a valuation facility for the business that provides a valuable guide to future capital stock and capital-debt-financing. The secondary market provides financial managers with an open market where the investing public comes to offer funds in demand for investment securities and to offer securities in demand for capital funds. The capital funds offered comprise the market supply of securities. The value of the securities at any given time is determined by the ratio of capital funds to capital securities. In general, an increase in the ratio tends to increase value and a decrease tends to decrease market values. But financial managers should

understand that this is a general tendency only, which may be influenced one way or other depending upon the market where the securities are traded. Securities are traded usually either in organized or over-the-counter markets. If our securities are traded in an organized market, they have to be listed; otherwise they are traded in other markets. They are called organized exchanges because they possess all of the characteristics of a business organization with charters and by-laws, governing bodies, officers, and rules and regulations for internal operations.We should note that these enterprises are places for carry-ing on securities trading, but that the organized exchange itself does not participate in securities buying and selling for its own investment portofolio. Examining the structure and operation of the organized exchanges may indicate good reasons for financial managers wanting to list rather than letting their companies securities be traded in other markets.The benefits that are realized from listing can be traced to the structure and operation of exchange facilities. First, the auction-market situation enables the supply and demand forces of capital and of capital securities to be quickly and accurately reflected in the exchange value of our securities. Second, the exchange is constructed and operated to allow the maximum freedom in trading our shares so that price fluctuations tend to be relatively small amounts at one time, and the exchange has a built in system of checks and balances that prevents extreme price fluctuations that would be harmful to future financing. Third, the transactions and services rendered by its members are geared to promoting the maximum participation by small and large investors alike, making it hard for any one group of investors to manipulate the market and allowing the market evaluations of the small holders to be reflected. Fourth, listed securities are always before the public in the daily newspapers. This enables management to keep in close touch with the investors evaluations of their business, and it gives the business a certain amount of free advertising. Fifth. Some investors, particularly some financial institutions, as a general policy matter will not buy unlisted securities because they are hard to market on short notice. 3. PRIMARY CAPITAL MARKET The primary market is the market in which new issues of stocks and bonds are offered to the public through investment banking firms. The sale of securities in a primary market is referred to as a primary offering. The issuer may be a business corporation, a government, or some other legal entity that needs to raise funds. If the securities are offered to the general public, the issue is called a public offering. If they are sold only to a single investor, such an insurance company, or to a small group of investors, the issue is referred to as a private placement. A primary capital market is any place that we can go to secure external capital. The general construction of this market resembles the over-the-counter facilities more than the organized exchange. The market place for these funds is any financial institution that participates in making direct-capital investments in business in exchange for capital debts and capital stock. The relationship of the primary market to the secondary markets should be noted.

First, day-to-day trading in organized and over-the-counter markets sets values on securities that determine the sale price for capital financing in the primary market. Second, the wholesale section of the over-the-counter market absorbs new capital issues from the primary market and from there they find their way into retail markets of the organized and unorganized exchanges. There are actually two divisions of market that financial managers have to consider before making capital-financing decisions; one is private placement market, and the other is underwriting or investment banking market. The private placement market is where complete capital-debts issues or capitalstock issues can be placed with one or a small number of investors for long-term holdings. The term private placement distinguishes this as a market where capital can be sought with the maximum speed, directness, and economy. While some stock is placed in this manner, it is such a small portion that it will be disregarded here.The underwriting market is where new capital debts and capital-stock issues are placed with one or a group of investment bankers for further public sale and distribution. Underwriting is a term that comes to us from the insurance business and means undertaking for another business the risks of financial loss, for a premium or what in this case is called the underwriting compensation or spread. Whereas in the private placement market we deal throughout the financing period with the original capital supplier, in the underwriting market the supplier is on the scene only temporarily. Much of the personal touch and local flavor of the private placement is absent in this market, but in return it offers other benefits. 4. THE COST OF CAPITAL The costs of capital are the losses in after-tax net profits to the present stockholders, resulting from external capital financing. If solvency risk factors were the same for all securities, we would seek as a guiding principle for decision-making the form of capital financing with the lowest cost of capital. Measuring and evaluating the costs of capital for decision-making is a feasible task. But other more theoretical and sophisticated applications of costs of capital need to be mentioned here even if we cannot resolve the issues that they raise. Cost of Capital as a Discounting Factor: Financial managers may be hardpressed in choosing a discount or reinvestment rate for bringing future inflows and outflows of funds back to present values. The rate might be based on our internal investment experience of the past. If the internal rate that we expect to earn is determined primarily with the common stockholders net capital in mind, our cost of common-stock capital may be a good figure to use for that discounting rate. But while this discounts net inflows of cash, it may not be logical for discounting outflows where capital expenditures are deferred payments on long-term debts, rentals on long-term leases, or some other fixed-cash commitment in long-run operations. It may be more reasonable in these cases to use an external debt or preferredstock rate. This means that we may want to use two discounting rates in making budgeting decisions, one for discounting relatively fixed-deferred payments on contractual obligations, and the other for discounting expected cash inflows that are relatively uncertain.

Cost of Capital as a Cutoff Rate: Another suggestion is that our cost of capital should be used as a cutoff rate for regulating capital expenditures. Thus, in the first step of budgeting where projects are screened on a rate-of-return basis, any proposal, except strategic projects, that cannot promise a rate of return larger than the cost of capital would be rejected. The funds would be budgeted then to the remaining projects in order of their rates of return above the cutoff rate. The cutoff idea for the cost of capital is also used in another more dynamic way in an internal capital expenditure theory. Assuming that unlimited quantities of capital are available for investment in the long run, then we would maximize the stockholders profit by continuing to finance and expand capital facilities just as long as the expected rate of return exceeded the cost of the capital. Looking at it in this way, the cost serves to promote new investment simultaneously while cutting off inefficient investment proposal. Nothing was said in discussing the two cutoff uses above about what cost of capital to use. Should it be the borrowing rate, the preferred-stock rate, or the commonstock rate, or some compromise rate? Another issue of some importance deals with prospects for controlling costs of capital. Capital costs in the primary markets are influenced by investors evaluation of securities and finally by their decisions to buy and sell in the secondary markets. But past financial experiences and plans of individual businesses affect their individual credit ratings, and in the last analysis they also have important effects on market demand for their securities. In the short run, these factors are given, but in the long run, financial managers can alter them. Related to this is the argument made by some that the percentage composition of the financial forms in the capital structure have precise, measurable effects on the cost of other capital forms. Thus, a structure made up largely of common stock indirectly tends to reduce the cost of preferred stock and capital. At the same time, a capital structure top-heavy with debts increases the cost of the other equity sources of capital. Thus, the risky debt forms of capital have a tendency to increase the future cost of equity capital, and the nonrisky equity forms tend to reduce costs of debt capital. Other would argue that the composition of the capital structure has some effect on the capital market; the cost of capital effect is not precisely measurable. Rationing Capital Financing: Should management have a plan to ration financing to the capital structure as capital expenditures are rationed, on the basis of the cost of capital? If so, the procedure might work something like this. Assuming that a given sum of capital will be raised, the financing would be rationed to the various external capital sources on the basis of their costs, using the lowest cost forms first until they increase to a certain cutoff rate, then moving to another form until its cutoff rate is reached, and so on until the financing is completed. Some financial managers use rationing plans of a general nature, such as this. But it is doubtful that costs of capital are the only factors determining the cutoff of one kind of financing and substitution of another. Even more important to decision making than costs in some cases is the solvency risk attending on increasing capital-debt financing. Financial managers may have a policy, for example, of not allowing capital debts or the sum of capital debts and preferred stock to exceed a certain percentage of the capital structure because of the solvency risks to the owners. Finally, the effect of certain security forms on internal and

external control may swing the decision in favor of high cost over low cost capital funds.

REFERENCES

1. Brandt, L. 2. Loeb, G. Business Finance: A Management Approach, Prentice-Hall, Englewood Cliffs, New Jersey.G. Eason, pp. 78 81, 1992 The battle for investment survival, Simon and Schuster, New York, pp 120-125, 1980. R., Investments, West Publishing Company, USA, pp. 93-97, 1992. D.,

3. Smith, Proffitt, Stephens, A. 4. Jonson, G., Exploring corporate strategy text and cases Prentice Hall Scholes, K. International Ltd , Englewood Cliffs, Great Britan, pp.281-284, 1993

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Dividend Policy and Retained Earnings: Foundations of Financial ManagementDokumen38 halamanDividend Policy and Retained Earnings: Foundations of Financial ManagementBlack UnicornBelum ada peringkat

- Fore X STR Ategies by Andre A Unger: The Purple Forex CompanyDokumen7 halamanFore X STR Ategies by Andre A Unger: The Purple Forex CompanyBruno0% (1)

- Industry Profile 2Dokumen5 halamanIndustry Profile 2piusadrien100% (2)

- Asahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Dokumen3 halamanAsahimas Flat Glass TBK.: Company Report: January 2019 As of 31 January 2019Abdur RohmanBelum ada peringkat

- 14 - Karan Singh - BHELDokumen12 halaman14 - Karan Singh - BHELrajat_singlaBelum ada peringkat

- Doubling, Nick Leeson's Trading StrategyDokumen24 halamanDoubling, Nick Leeson's Trading Strategyapi-3699016Belum ada peringkat

- Cost of Capital Questions FinalDokumen4 halamanCost of Capital Questions FinalMadhuram SharmaBelum ada peringkat

- Public Issue ManagementDokumen7 halamanPublic Issue ManagementthensureshBelum ada peringkat

- Pakistan Stock Exchange Limited: List of Trading Right Entitlement (Tre) Certificate HoldersDokumen36 halamanPakistan Stock Exchange Limited: List of Trading Right Entitlement (Tre) Certificate HoldersMuhammad AbidBelum ada peringkat

- Reliance Dual Advantage Fixed Tenure Fund - III - Plan D: BackgroundDokumen5 halamanReliance Dual Advantage Fixed Tenure Fund - III - Plan D: BackgroundOneCharuBelum ada peringkat

- "Comaprative Analysis of Angel Broking and Other Brokerage FirmDokumen79 halaman"Comaprative Analysis of Angel Broking and Other Brokerage FirmdevangjadavBelum ada peringkat

- The Measurement Approach To Decision UsefulnessDokumen33 halamanThe Measurement Approach To Decision UsefulnessDiny Fariha ZakhirBelum ada peringkat

- Mari Mengenal Swift Dan Standar SDokumen7 halamanMari Mengenal Swift Dan Standar SM. abdul MuizBelum ada peringkat

- Acct Statement - XX0575 - 21052022Dokumen23 halamanAcct Statement - XX0575 - 21052022shivji007Belum ada peringkat

- Sept 2014 - 230716 - 233727Dokumen22 halamanSept 2014 - 230716 - 233727mohddanialhanaffimustaffiBelum ada peringkat

- 8 Edit Finance Corporate FinanceDokumen101 halaman8 Edit Finance Corporate FinanceKhail Gooding0% (2)

- P Smallcap Ar EngDokumen27 halamanP Smallcap Ar EngxiaokiaBelum ada peringkat

- Microeconomics II - NoteDokumen59 halamanMicroeconomics II - NoteZeBelum ada peringkat

- Course Outline (Stock Market For Beginners)Dokumen3 halamanCourse Outline (Stock Market For Beginners)70061192 Bilal amjadBelum ada peringkat

- How To Calculate The Beta of A Private CompanyDokumen3 halamanHow To Calculate The Beta of A Private CompanyDuaa TahirBelum ada peringkat

- Trend Following With Managed TrendfuturesDokumen5 halamanTrend Following With Managed TrendfuturesekmoekmoBelum ada peringkat

- The Role of DSE in Safeguard Securities Investors in TanzaniaDokumen7 halamanThe Role of DSE in Safeguard Securities Investors in Tanzaniakuboja_joramBelum ada peringkat

- Dal Da ProspectusDokumen142 halamanDal Da ProspectusSyed Mustafa HussainBelum ada peringkat

- Functions of Asset Management CompanyDokumen4 halamanFunctions of Asset Management CompanyAayushi PatelBelum ada peringkat

- Mem (Monetary Policy)Dokumen9 halamanMem (Monetary Policy)Himanshu RatnaniBelum ada peringkat

- Infocus - Pros - and - Cons - of - Cryptocurrency - InvestmentDokumen7 halamanInfocus - Pros - and - Cons - of - Cryptocurrency - InvestmentAanchal aroraBelum ada peringkat

- MasterthesisDokumen64 halamanMasterthesisNet TeeramungcalanonBelum ada peringkat

- SecuritisationDokumen28 halamanSecuritisationChinmayee ChoudhuryBelum ada peringkat

- My Top 5 Rules For Successful Debit Spread TradingDokumen11 halamanMy Top 5 Rules For Successful Debit Spread Tradingd s reddyBelum ada peringkat

- Eclectica Absolute Macro Fund: Manager CommentDokumen3 halamanEclectica Absolute Macro Fund: Manager Commentfreemind3682Belum ada peringkat