Puttas It 2011-12

Diunggah oleh

Satish HMJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Puttas It 2011-12

Diunggah oleh

Satish HMHak Cipta:

Format Tersedia

Section Nature of Deduction Remarks

80CCC

Payment of premia for annuity The premium must plan of LIC or any

other insurer, be deposited to keep Deduction is available upto a in

force a contract for maximum of Rs. 10,000

The premium must be deposited to keep in force a

contract for an annuity plan of the LIC or any other

insurer for receiving pension from the fund

80D

Payment of medical insurance premia. Deduction is available upto

Rs. 10,000

The premium is to be paid by cheque and the insurance

scheme should be framed by the General Insurance

Corporation of India & approved by the Central Govt. or

any other insurer and approved by the regulatory

authority & Development authority.The premium should

be paid in respect of health insurance of the assessee

or his family members

Deduction of Rs. 40,000 in respect of a) expenditure incurred on

medical treatment, (including nursing), training and rehabi-litation

of a handicapped dependent relative.

The handicapped dependent should be a dependent

relative suffering a perma-nent disability (including

blindness) or mentally retarded, as certified by a

specified physician or psychiatrist.

b) Payment or deposit to specified scheme for maintenance of

dependent handicapped relative

Note : The new section 80DD replace the earlier

sections of 80DD and 80DDA which are now clubbed

together under the new section.

80DDB Deduction of Rs. 40,000 in respect of medical expenditure incurred

Expenditure must be actually incurred by resident

assessee on himself or dependant relative for medical

treatment of specified disease or ailment. The diseases

have been specified in Rule HDD. A certificate in form

10 i is to be furnished by the assessee from any

registered doctor

80E

Deduction in respect of repayment of loan taken upto Rs. 40,000 per

year.

This provision has been introduced to provide relief to

students taking loans for higher studies. The repayment

of the principal amount of loan and interest thereon will

be allowed as deduction upto Rs. 3.2 lakhs over a

period of 8 years.

80G Donations to certain funds,charitable institutions etc.

The various donations specified in Sec.80G are eligible

for deduction upto either 100% or 50% with or without

restriction as provided in Sec 80G

Deduction available is the least of

(i) Rent paid less 10% of total income

(ii) Rs. 2,000 per month

2) He should not be in receipt of house rent

allowance.

(iii) 25% of total income

3) He should not have a self occupied residential

premises in any other place

80L

Interest/Dividend/Income from :

a) any Govt. Security (Central or State)

b) NSC, VI, VII & VIII issues

c)Notified debentures of public sector undertakings,cooperative

societies/Land mortgage bank or land development bank.

d) Notified National Deposit Scheme

e) Any other deposit Scheme framed by Central Govt. and notified.

f)Deposit under Post Office Monthly Income Account rules,1987

g)Deposits with banking companies, banking co-op, societie, land

mortgage or land development bank.

h) deposits with banks established under any law made by

Parliament.

i) Deposits with financial corporations approved by Central

Government

j) Deposits with any authority constituted in India under any

law for planning,development or improvement of cities, towns

and villages etc.

k) Deposits with co-op. Societies.

1) Deposits, with any public companies providing long

term finance for construction or purchase of houses.

m) Income from U.T.I.

n) Income from Units of Mutual Fund specified under clause (23D) of

Sec. 10.

80U

Deduction of Rs. 40,000/- to an individual who suffers from a

physical disability (including blindness) or mental retardation

Certificate should be obtained from a Govt. Doctor. The

relevant rule is Rule 11D.

Main features of this new section and new notification is given below.

1 new secLlon can be avalled by lndlvldual or Pul only

2 8s20000/ can be lnvesLed ln a llnanclal year Lo avall deducLlon under secLlon 80CCl

3 8s20000/ LlmlL ls ln addlLlon Lo 8s100000/ LlmlL of secLlon 80C80CCC 80CCu

4 1enure of Lhe 8onds wlll be 10 ?ears

80GG

Rs. 9000 plus an addition deduction of Rs. 3000 allowed

in respect of interest on any Central/State Govt.

Securities

1) Assessee or his total spouse or minor child should

not own residential accommodation at the place of

employment.

Infrastructure bonds under Section 80CCF

80DD

CBDT has notified New infrastructure Bonds (noLlflcaLlon no 48/2010lno149/84/2010SC(1L) daLed 972010) u/s 80CCl An lndlvldual or Pul can

lnvesL ln Lhese new lnfrasLrucLure 8onds upLo 8s20000/ ln a llnanclal years

Powever Lock ln perlod ls years afLer years lnvesLor can wlLhdraw money from Lhe bonds

6 AfLer lock ln perlod lnvesLor can Lake loan agalnsL Lhese 8onds

7 lssuer of Lhe 8onds ls LlC llCl lulC and oLher n8lC classlfled as lnfrasLrucLure company

8 ermanenL accounL number ls musL Lo apply Lhese bonds

(a) name of Lhe bond 1he name of Lhe bond shall be LongLerm lnfrasLrucLure 8ond"

(b) lssuer of Lhe bond 1he bond shall be lssued by

(l) lndusLrlal llnance CorporaLlon of lndla

(ll) Llfe lnsurance CorporaLlon of lndla

(lll) lnfrasLrucLure uevelopmenL llnance Company LlmlLed

(lv) a non8anklng llnance Company classlfled as an lnfrasLrucLure llnance Company by Lhe 8eserve 8ank of lndla

(c) LlmlL on lssuance

(l) 1he bond wlll be lssued durlng flnanclal year 201011

(lll) 'lnvesLmenL' for Lhe purposes of Lhls llmlL lnclude loans bonds oLher forms of debL quaslequlLy preference equlLy and equlLy

(d) 1enure of Lhe bond (l) A mlnlmum perlod of Len years

(ll) Lhe mlnlmum lockln perlod for an lnvesLor shall be flve years

(e) ermanenL AccounL number (An) Lo be furnlshed lL shall be mandaLory for Lhe subscrlbers Lo furnlsh Lhere An Lo Lhe lssuer

(f) ?leld of Lhe bond 1he yleld of Lhe bond shall noL exceed Lhe yleld on governmenL securlLles of correspondlng resldual maLurlLy as reporLed by Lhe llxed

lncome Money MarkeL and uerlvaLlves AssoclaLlon of lndla (llMMuA) as on Lhe lasL worklng day of Lhe monLh lmmedlaLely precedlng Lhe monLh of Lhe lssue of

Lhe bond

(g) Lnduse of proceeds and reporLlng or monlLorlng mechanlsm (l) 1he proceeds shall be uLlllzes Lowards ' lnfrasLrucLure lendlng' as deflned by Lhe 8eserve

8ank of lndla ln Lhe Culdellnes lssued by lL

(ll) Lhe enduse shall be duly reporLed ln Lhe Annual 8eporLs and oLher reporLs submlLLed by Lhe lssuer Lo Lhe 8egulaLory AuLhorlLy concerned and speclflcally

cerLlfled by Lhe SLaLuLory AudlLor of Lhe lssuer

(lll) Lhe lssuer shall also flle Lhese along wlLh Lerm sheeLs Lo Lhe lnfrasLrucLure ulvlslon ueparLmenL of Lconomlc Affalrs MlnlsLry of llnance wlLhln Lhree

monLhs from Lhe end of flnanclal year

SecLlon 80CCl of Lhe lncomeLax AcL 1961 ueducLlon ln respecL of subscrlpLlon Lo longLerm lnfrasLrucLure bonds noLlfled longLerm lnfrasLrucLure bond

ln exerclse of Lhe powers conferred by secLlon 80CCl of Lhe lncomeLax AcL 1961 (43 of 1961) Lhe CenLral CovernmenL hereby speclfles bonds sub[ecL Lo Lhe

followlng condlLlons as longLerm lnfrasLrucLure bonds for Lhe purposes of Lhe sald secLlon namely

(ll) Lhe volume of lssuance durlng Lhe flnanclal year shall be resLrlcLed Lo LwenLyflve per cenL of Lhe lncremenLal lnfrasLrucLure lnvesLmenLs made by Lhe lssuer

durlng Lhe flnanclal year 200910

(lll) afLer Lhe lock ln Lhe lnvesLor may exlL elLher Lhrough Lhe secondary markeL or Lhrough a buyback faclllLy speclfled by Lhe lssuer ln Lhe lssue documenL aL

Lhe Llme of lssue

(lv) Lhe bond shall also be allowed as pledge or llen or hypoLhecaLlon for obLalnlng loans from Scheduled Commerclal 8anks afLer Lhe sald lockln perlod

9 ?leld of Lhe bond 1he yleld of Lhe bond shall noL exceed Lhe yleld on governmenL securlLles of correspondlng resldual maLurlLy as reporLed by Lhe llxed

lncome Money MarkeL and uerlvaLlves AssoclaLlon of lndla (llMMuA) as on Lhe lasL worklng day of Lhe monLh lmmedlaLely precedlng Lhe monLh of Lhe lssue of

Lhe bond

SAVINGS

Limit Section

Tuition Fee- Two ChiIdren 100,000 80C

NationaI Savings Certificates (NSC) 100,000 80C

Repayment of Home Loan PrincipIe 100,000 80C

LIC Insurance Premium- AnnuaI 100,000 80C

Unit Iinked Insurance PIan 100,000 80C

PubIic Provident Fund 100,000 80C

ULIP 100,000 80C

PLI 100,000 80C

Equity Iinked Savings Schemes (ELSS) 100,000 80C

5-Years fixed deposits with bank/post office 100,000 80C

Infrasture Bonds ( LIC, IDBI, IFCI,etc) 20,000 80CCF

LIC / UTI etc. Pension funds 10,000 80CCC

Name of the Employee

Place of Working :

Basic Pay as on

January,11

FPI 0 Add. 0 Others 0

Increment Month HMA

PHC

(CA)

Taken Promotion

HRA Received

E.L

Surrende

r

CCA Received 0 0 0

PF Type:

A/C

No.

PF Subscription

APGLIF Polocy No.:

Subcrs

iption

0 0

789 GIS 3600

Rs.

Rs. Mar,10 0

Rs. Apr,10 0

Rs. May,10 0

Rs. June,10 0

July,10 0

thers Rs. Aug,10 0

Sept,10 0

Name of the DDO

Programmed Developed By:

P

Oct,10 0

DDO Office Name

PUTTA SRINIVAS REDDY

R

Nov,10 0

DDO TAN No.

9890 2860

T

Dec,10 0

U

1an,11 0

!f any Change Nention Nonth

Changed CCA

2000 1000

AAS(6/12/18/2)Arrears

paid in cash if any

Employee PAN No. HYDM 0627 G

!f any Change mention Nonth

AAS(6/12/18/2)

Availed

If Yes Promotion Taken on

Promotion Fixation Option is

given to

Creditted in P.F if

any

0

ny Change mention Month

Children Education Fee

Concession

0 Other Arrears Creditted in PF

Changed

Subcrsiption

Leaving in

Interest on Educational Loan

Interest on Housing Loan Advance

Don't Enter Rent it's Calaculate

Atomatically

8260

If any Change Mention Month Changed Subscription

2200

0

0

0

Income Tax 2011-12 Accessment

Domakonda

Putta Srinivas Reddy Designation :

Mandal UPS Sitharampoor

.1302421

0

0

Rs.

Rs.

LIC Salary Savings Scheme(SSS)

Rs.

Rs.

7000

Medical treatment of

Handicapped/Dependent

Rs.

Rs.

0 Long Term Savings under 80CCF 20000

Advance Tax Paid

Changed to

Basic Pay as on

February,11

V.Sanjeeva Reddy

Mandal Educational Officer

HYDM 0627 G

0

0

0

SA (Naths) Sri.

ZP CPF

Dec,11

No Change

12310

Oct,11 No 0 Yes

No

10/12 12.S/14.S 1S Days Nov,11 No Change

No Change

30

Children Tution Fee

Repayement of Home Loan Premium

L!C Annual Premiums Paid by Hand

PL! Annual Premuim

S Years Fixed Deposits

Unit Linked !nsurance Plan

Nedical !nsurance PremiumS.Citizens

Rented House

Naintaince for 80 and above disabled Employee

12310

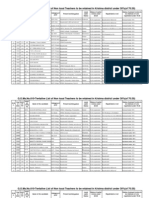

S.No Monlh Iay DA HRA HMA III AddI. Olhois CCA IHC Cioss TolaI ZI CII AICLII CIS IT LIC (SSS)

SWI &

LWI

TolaI

Doduclion

1 Maich,11 1291O 3868 1291 O O O O O 9OO 18969 1OOO 45O 3O O 789 2O 2289

2 ApiiI,11 1291O 3868 1549 O O O O O 69O 19O17 1OOO 45O 3O O 789 O 2269

3 May,11 1291O 3868 1549 O O O O O O 18327 1OOO 45O 3O O 789 O 2269

4 }uno,11 1291O 3868 1549 O O O O O 51O 18837 1OOO 45O 3O O 789 O 2269

5 }uIy,11 1291O 3868 1549 O O O O O 9OO 19227 1OOO 45O 3O O 789 O 2269

6 Aug,11 1291O 3868 1549 O O O O O 9OO 19227 1OOO 45O 3O O 789 O 2269

7 Sopl,11 1291O 3868 1549 O O O O O 9OO 19227 1OOO 45O 3O O 789 O 2269

8 Ocl,11 1327O 3976 1592 O O O O O 9OO 19738 1OOO 45O 3O O 789 O 2269

9 Nov,11 1327O 3976 1592 O O O O O 9OO 19738 1OOO 45O 3O O 789 O 2269

1O Doc,11 1327O 1592 O O O O O 9OO 2OOO 45O 3O O 789 O 3269

11 }an,12 1327O 1592 O O O O O 9OO 2OOO 45O 3O O 789 2O 3289

12 Iol,12 1327O 1592 O O O O O 9OO 2OOO 45O 3O O 789 O 3269

13

8urrender Leave

15 0ays - Nov,11

6635 1988 796 O O O O O O 9419 O O O O O O O

14

Modifiod AAS

Aiioais

O O O O O O O O O O O O O O O O O

15

0A Arrears

(Jar,11 lo Vay,11)

0 3315 O O O O O O O 3315 3315 O O O O O 3315

16

0A Arrears

(Ju|y,11 to Nov,11}

0 O O O O O O O O O O O O 43O6

17 o AA3 Arrears 0 0 0 O O O O O O O O O O O O O O

18 o Prorol|or 0 0 0 O O O O O O O O O O O O O O

19

Cr||drer Educal|or

Fee Corcess|or

0 O O O O O O O O O O O O O O O O

2O Olhoi Aiioais 543O O O O O O O O O 543O 543O O O O O O 543O

168785 5895O 19341 O O O O O 93OO 256376 28O51 54OO 36O O 9468 4O 43319

Signaluio of lho DDO

Iioginno dovoIopod ly vvv.pilunzl.vols.con (Iulla Siinivas Roddy 9849O 2586O)

TOTAL

Slalononl Shoving lho SaIaiy IailicuIais of : Sii. Iulla Siinivas Roddy, SA, (Malhs), UIS Silhaianpooi, MandaI : Donakonda

Signaluio of lho Assoso

1

2 Rs. 256,376

3

a) Rs. 19,341

l) Rs. 20,426

c) Rs. 91,100 19,341

4 Rs. 237,035

5

a) Rs. 9,300

l) Rs. - 9,300

6 Rs. 227,735

7 Rs. -

8 Rs. -

9 Rs. - -

10 Rs. 227,735

11

a)

Rs.

l)

Rs. -

c)

Rs.

d)

Rs. -

o)

Rs. -

f)

Rs. -

g)

Rs. 75,000

h)

Rs. 40

Rs. 75,040 75,040

12 Rs. 152,695

13

a) A/c ( 826O ) Rs.

28,051

l) IoI. No.( L.13O2421 ) Rs.

5,400

c) CIS Rs.

360

d) Rs.

9,468

o) Rs.

-

f) Ropayononl of Hono Loan Iioniun Rs.

-

g) LIC AnnuaI Iioniuns Iaid ly Hand Rs.

2,200

h) ILI AnnuaI Iionuin Rs.

-

i) 5 Yoais Iixod Doposils Rs.

-

j) Unil Linkod Insuianco IIan Rs.

-

k) Olhois ( ) Rs.

-

Rs. 45,479 45,479

Rs. 20,000 20,000

14 Rs. 87,220

15

a) Rs. NI!

l) Rs. -

c) Rs. -

d) Rs. -

16 Rs. -

17 Rs. -

18 Rs. -

19 Rs.

a) Uplo Rs. -

l) Rs. -

c) Rs. -

-

2O Rs. 0

................................................

Prngrmmc dcvc!npcd by www.prtunzb.wcbs.cnm (Putta 5rInIvas Rcddy 98490 25860)

ANNLXURL - II

Nano UP5 5Itharampnnr

INCOME TAX CALCULATION FOR THE YEAR 2010-11

HYDM 06257 G

Dosignalion Dnmaknnda

Putta 5rInIvas Rcddy 5chnn!

Lnng Tcrm 5avIngs undcr 80CCF

DcductInns frnm 5a!ary Incnmc

Lxonplion fion Convoyanco AIIovanco U/s. 1O(14) (i)

AcluaI HRA iocoivod

Ronl paid in oxcoss of 1O SaIaiy(Ronl: 36OO/-IM)

ModicaI lioalnonl of Handicappod/Dopondonl

Grnss Tnta! Incnmc (6+7+8+9)

DcductInns

Lxpondiluio on nodicaI lioalnonl

ModicaI Insuianco Iioniun-S.Cilizons

Incnmc Frnm 5a!ary (4-5)

Add: Incono Iion olhoi souicos

LcavIng In : Rcntcd Hnusc

Grnss 5a!ary...

Tnta! 5avIngs

Donalion of ChaiilalIo Inslilulion

Inloiosl on LducalionaI Loan

Inloiosl on Housing Loan Advanco

ZI CII

Nct Taxab!c Incnmc (12-13) rnundcd tn ncarcst Rs.10/-

LIC Iioniun Doduclod in SaIaiy Savings Schono

ChiIdion Tulion Ioo

Mainlainco foi 8O and alovo disalIod LnpIoyoo

L.W.I, & S.W.I

TOTAL-----------

Grnss Tnta! Incnmc (10-11)

AICLI

O

5avIngs U/s 80C (LImItcd tn Onc !akh)

5A, (Maths) Manda!

Add: Incono Iion CapilaI Cains

Incono fion Houso Iiopoily U/s 24(vi)

Tnta! 5a!ary (2-3)

Emp!nycc PAN Numbcr

H.R.A. ExcmptInn as pcr c!IgIbI!Ity U/s. 10(13-A)

Iiofossion Tax U/s 16 (3)

4O of SaIaiy (SaIaiy noans asic Iay+D.A)

Nov-1O

Doc-1O

Up lo Rs. 1,8O,OOO

Rs.1,8O,OO1 To 5,OO,OOO. ( 1O)

Rs.5,OO,OO1 To 8,OO,OOO. ( 2O)

Tax nn Incnmc

}an-11

5Ignaturc nf thc DrawIng OffIccr 5Ignaturc nf thc Emp!nycc

above Rs.8,00,001. (@ 30)

TolaI Advanco Tax Rs.

Tax tn bc PaId nnw

Lducalion Coss 1

Socondaiy & Highoi Lducalion Coss 2

Tnta! Tax Payab!c (15+16+17)

DctaI!s nf Advancc Tax DcductInns

1 Rs. 256,376

a) Rs. -

l) Rs. -

c) Rs. -

d) Tnta! Rs. 256,376 Rs. 256,376

2

a) Houso Ronl AIIovonco Rs. 19,341

l) Rs. 9,3OO Rs. 28,641

3 Rs. 227,735

4

a) Lnloilainnonl AIIovonco Rs. -

l) Tax on LnpIoynonl Rs. -

5 Rs. -

6 Rs. 227,735

7 Rs. -

Rs. -

Rs. -

8 Rs. 227,735

9

A) Cioss

a) 5cctInn 80C Anounl Anounl Anounl

i C.I.I Rs. 28,O51 Rs. 28,O51 Rs. 28,O51

ii A.I.C.L.I Rs. 5,4OO Rs. 5,4OO Rs. 5,4OO

iii C.I.S Rs. 36O Rs. 36O Rs. 36O

iv Rs. 9,468 Rs. 9,468 Rs. 9,468

v Rs. - Rs. - Rs. -

vi Ropayononl of Hono Loan Iioniun Rs. - Rs. - Rs. -

vii LIC AnnuaI Iioniuns Iaid ly Hand Rs. 2,2OO Rs. 2,2OO Rs. 2,2OO

viii ILI AnnuaI Iionuin Rs. - Rs. - Rs. -

ix 5 Yoais Iixod Doposils Rs. - Rs. - Rs. -

x Unil Linkod Insuianco IIan Rs. - Rs. - Rs. -

xi Olhois (O) Rs. - Rs. - Rs. -

Rs. 45,479

b) 5cctInn 80CCC

i Rs. Rs. - Rs. - Rs. -

c) 5cctInn 80CCD

i Rs. - Rs. - Rs. - Rs. -

Rs. 45,479

Iioginno dovoIopod ly vvv.pilunzl.vols.con (Iulla Siinivas Roddy 9849O 2586O)

AcknovIodgononl Nos. of aII quailoiIy slalononls of TDS undoi sul-soclion 2OO as piovidod ly TIN

IaciIilalion Conloi oi NSDL vol-silo.

Manda!: Dnmaknnda 5A, (Maths)

UP5 5Itharampnnr

DcductInns

TAN Nn. nf DDO HYDM 06257 G PAN nF Emp!nycc HYDM 06257 G

Quailoi AcknovIodgononl No. Ioiiod

Aggrcatc nf 4 (a)&(b)

Grnss 5a!ary

SaIaiy as poi piovisions colainod in soclion 17 (1)

VaIuo of poicuisilos undoi soclion 17(2)

(as poi Ioin No. 12A, Whoivoi appIicalIo)

Loss: AIIovanco lo lho oxlonl oxonplod U/s 1O

Olhoi AIIovanco

Tnta! Undcr 5cctInn 80C.

ChiIdion Tulion Ioo

INCOML CHARCLALL UNDLR THL HLAD SALARIL

Add: Any olhoi incono iopoilod ly lho onpIoyoo

Add: Incono of CapilaI Cains

QuaIifying

LIC Iioniun Doduclod in SSS

Manda! EducatInna! OffIccr Putta 5rInIvas Rcddy

Dnmaknnda

4

1 Iion Yoai

(As Ioi Ioin No. 12A, Whoiovoi appIicalIo)

To

Iiofils in Iiou of saIaiy undoi soclion 17(3)

FORM Nn. 16

( Vido iuIo 31(1)(a) of Incono Tax RuIos, 1962 )

Coilificalo undoi soclion 2O3 of lho Incono-lax Acl, 1961

foi Tax doduclod al souico fion incono chaigoalIo undoi lho hoad "SaIaiios"

NAML AND ADDRLSS OI THL LMILOYLR NAML AND DLSICNATION OI THL LMILOYLL

3

Assossnonl

Ba!ancc (1-2)

Grnss Tnta! Incnmc (6+7)

DcductInns Undcr Chaptcr VI-A

Undcr5cctInn 80C,80CCC,80CCD.

DETAIL5 OF 5ALARY PAID AND ANY OTHER INCOME AND TAX DEDUCTED

2

March,10 Fcb,11 2011-2012

Loss:Inloiosl on Housing Loan U/s 24(l)

DoduclilIo

2.aggiogalo anounl doduclilIo undoi soclion 8OC,8OCCC,8OCCD, shaII nol oxcood ono Iakh iupoos.

LIC / UTI olc. Ionsion funds

Conliilulion lo Ionsion Iund

AggrIgatc Amnunt DcductIb!c Undcr 3 5cctInns...............

Nolo:

1.aggiogalo anounl doduclilIo undoi soclion 8Oc shaII nol oxcood ono Iakh iupoos.

B)

QuaIifying DoduclilIo

Anounl Anounl

Rs. 4O 4O 4O

Rs. O - -

Rs. O - -

Rs. 2OOOO - -

Rs. O - -

Rs. O - -

Rs. O - -

Rs. 75OOO 75,OOO 75,OOO

Tnta! Undcr 5cctInns 80G,80E,80DD ctc... Rs. 40

10 Rs. 45,519

11 Rs. 182,220

12 Rs. -

13 Rs. -

14 Rs. -

15 Rs. -

16 Rs. -

17 Rs. -

18 Rs. -

Rs.

Rs. -

19 Rs. -

SI. Suichaigo Lducalion TolaI Tax SR Codo Dalo on

No. Rs. Coss Doposilod of ank Which Tax

Rs. Rs. ianch Doposilod

1

2

3

4

5

6

7

8

9

1O

11

12

Sign--

Donakonda Signaluio of lho poison iosponsilIo foi doduclion of lax

IuII Nano--

Dosignalion-

Iiogianno DovoIopod ly : vvv.pilunzl.vols.con

LWI & SWI

Lxpondiluio on nodicaI lioalnonl

ModicaI Insuianco Iioniun-S.Cilizons

Donalion of ChaiilalIo Inslilulion

Inloiosl on LducalionaI Loan

Inloiosl on Housing Loan Advanco

MandaI LducalionaI Officoi

I V.5anjccva Rcddy wnrkIng as Manda! EducatInna! OffIccr dn hcrcby ccrtIfy that thc sum nf Rs. 0/-

Rupccs In wnrds (Zcrn rupccs nn!y) dcductcd at snurcc and paId tn thc crcdIt nf thc ccntra!

Gnvcrnmcnt. I furthcr ccrtIfy that thc InfnrmtInn gIvIn abnvc Is truc and cnrrcct bascd nn thc bnnks nf

accnunt, dncumcnts and nthcr avaI!ab!c rccnrds.

IIaco:

Dalo: 8-Doc-2O11 V.Sanjoova Roddy

Idonlificalion No

TAX PAYABLE / REFUNDABLE (17-18)

DETAIL5 OF TAX DEDUCTED AND DEPO5ITED INTO CENTRAL GOVERNMENT ACCOUNT

(Tho onpIoyoi is lo piovido lianclion - viso dolaiIs of lax doduclod and doposilod)

TDS Choquo/DD Tiansfoi

Lducalion Coss 1 (On Tax al S.No.12 )

Socondaiy and Highoi Lducalion Coss 2 (On Tax al S.No.12 )

Rs. No. (if any) vochoi/chaIana

RoIiof undoi soclion 89 (allach dolaiIs)

TAX PAYABLE (15-16)

Lcss:(a) Tax doduclod al souico U/s 192(1)

(l)Tax paid ly lho onpIoyoi on lohaIf of lho

LnpIoyoo U/S 192 (1A) on poiquisilod U/S 17 (2)

Mainlainco foi 8O and alovo disalIod LnpIoyoo

TAX PAYABLE (12+13+14)

ModicaI lioalnonl of Handicappod/Dopondonl

Othcr 5cctInns Undcr Chaptcr VI A Cioss

( Undcr 5cctInns 80E,80G,80DD ctc ) Anounl

Aggrcgatc nf DcductIb!c Amnunts U/Chaptcr VIA (A+B)...

TOTAL INCOME (8-10)

TAX ON TOTAL INCOME Rs.

Anda mungkin juga menyukai

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Fr22bpro Fixationn Pro DateDokumen4 halamanFr22bpro Fixationn Pro DateSatish HMBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Salary Certificate BY NAGARAJUDokumen3 halamanSalary Certificate BY NAGARAJUSatish HMBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Fr22b Inc DateDokumen6 halamanFr22b Inc DateSatish HMBelum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- G.O.Ms - No.610-Tentative List of Non Local Teachers To Be Retained in Krishna District Under 30% (Of 70:30)Dokumen27 halamanG.O.Ms - No.610-Tentative List of Non Local Teachers To Be Retained in Krishna District Under 30% (Of 70:30)Satish HMBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Medical ReumbercementDokumen21 halamanMedical ReumbercementSatish HMBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Nagaraju Ed Fee Reimbursement FinalDokumen21 halamanNagaraju Ed Fee Reimbursement FinalSatish HMBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Preface: Instructions To Use This ProgrammeDokumen25 halamanPreface: Instructions To Use This ProgrammeSatish HMBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- SA PHY - Ed STEPUPDokumen2 halamanSA PHY - Ed STEPUPSatish HMBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- 45 Days Plan For X ClassDokumen4 halaman45 Days Plan For X ClassSatish HMBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- SA Promotions Krishna DT Seniority List Nov 2011 Updated WEBDokumen27 halamanSA Promotions Krishna DT Seniority List Nov 2011 Updated WEBSatish HM100% (1)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Notional Increments To Municipal Teachers MS488 PDFDokumen2 halamanNotional Increments To Municipal Teachers MS488 PDFNarasimha Sastry100% (1)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Seniority List of School Assistants - Social Studies - Krishna District (For Step Up Purpose)Dokumen31 halamanSeniority List of School Assistants - Social Studies - Krishna District (For Step Up Purpose)Satish HMBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Seniority List of School Assistants - Physical Science - Krishna District (For Step Up Purpose)Dokumen18 halamanSeniority List of School Assistants - Physical Science - Krishna District (For Step Up Purpose)Satish HMBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Seniority List of School Assistants - English - Krishna District (For Step Up Purpose)Dokumen19 halamanSeniority List of School Assistants - English - Krishna District (For Step Up Purpose)Satish HMBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Seniority List of School Assistants - Biological Science - Krishna District (For Step Up Purpose)Dokumen20 halamanSeniority List of School Assistants - Biological Science - Krishna District (For Step Up Purpose)Satish HMBelum ada peringkat

- Seniority List TotalDokumen236 halamanSeniority List TotalSatish HMBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- 1) SAs Provisional List 10-8-2011Dokumen102 halaman1) SAs Provisional List 10-8-2011Satish HM100% (1)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Krishna 1Dokumen157 halamanKrishna 1Satish HMBelum ada peringkat

- Lfl-Tel-22 8 11Dokumen11 halamanLfl-Tel-22 8 11Satish HMBelum ada peringkat

- Edu StatisticsDokumen92 halamanEdu StatisticsSatish HMBelum ada peringkat

- Clarifications On G.O.96Dokumen4 halamanClarifications On G.O.96Satish HMBelum ada peringkat

- PS Maths 5tl Schol Com Tele 14.7Dokumen2 halamanPS Maths 5tl Schol Com Tele 14.7Satish HMBelum ada peringkat

- Format - 4:-Format For Collection of Information On Performance of Schools. Krishna District - Grama DarshiniDokumen4 halamanFormat - 4:-Format For Collection of Information On Performance of Schools. Krishna District - Grama DarshiniSatish HMBelum ada peringkat

- Format - 4:-Format For Collection of Information On Performance of Schools. Krishna District - Grama DarshiniDokumen4 halamanFormat - 4:-Format For Collection of Information On Performance of Schools. Krishna District - Grama DarshiniSatish HMBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- LFL - (U) - 22 8 11Dokumen1 halamanLFL - (U) - 22 8 11Satish HMBelum ada peringkat

- Seniority List TotalDokumen159 halamanSeniority List TotalSatish HMBelum ada peringkat

- Use Case NarrativeDokumen2 halamanUse Case NarrativePrajwol Sangat100% (1)

- Suggested Answer: Business Strategy May-June 2018Dokumen10 halamanSuggested Answer: Business Strategy May-June 2018Towhidul IslamBelum ada peringkat

- Environment Impact Assessment Notification, 1994Dokumen26 halamanEnvironment Impact Assessment Notification, 1994Sarang BondeBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Sample OTsDokumen5 halamanSample OTsVishnu ArvindBelum ada peringkat

- Ciplaqcil Qcil ProfileDokumen8 halamanCiplaqcil Qcil ProfileJohn R. MungeBelum ada peringkat

- Presentation On Ethics in ManagementDokumen20 halamanPresentation On Ethics in Managementnasif al islamBelum ada peringkat

- Lecture 1Dokumen12 halamanLecture 1asiaBelum ada peringkat

- Dua AdzkarDokumen5 halamanDua AdzkarIrHam 45roriBelum ada peringkat

- Pidato Bhs Inggris The HomelandDokumen1 halamanPidato Bhs Inggris The HomelandYeni NuraeniBelum ada peringkat

- War and Peace NTDokumen2.882 halamanWar and Peace NTAMBBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Biopolitics and The Spectacle in Classic Hollywood CinemaDokumen19 halamanBiopolitics and The Spectacle in Classic Hollywood CinemaAnastasiia SoloveiBelum ada peringkat

- 4 Secrets Behind Disney's Captivating Marketing StrategyDokumen10 halaman4 Secrets Behind Disney's Captivating Marketing StrategyJuan Camilo Giorgi MartinezBelum ada peringkat

- 11 Its A Magical World - Bill WattersonDokumen166 halaman11 Its A Magical World - Bill Wattersonapi-560386898100% (8)

- Notification: Professional Examination Result: November-December 2020Dokumen2 halamanNotification: Professional Examination Result: November-December 2020Zahidul Amin FarhadBelum ada peringkat

- Travel Insurance CertificateDokumen9 halamanTravel Insurance CertificateMillat PhotoBelum ada peringkat

- Unit 7:: Intellectual PropertyDokumen52 halamanUnit 7:: Intellectual Propertyمحمد فائزBelum ada peringkat

- Enrollment DatesDokumen28 halamanEnrollment DatesEdsel Ray VallinasBelum ada peringkat

- Current Legal Problems Volume 48 Issue Part 2 1995 (Doi 10.1093 - CLP - 48.part - 2.63) Bell, J. - English Law and French Law - Not So DifferentDokumen39 halamanCurrent Legal Problems Volume 48 Issue Part 2 1995 (Doi 10.1093 - CLP - 48.part - 2.63) Bell, J. - English Law and French Law - Not So DifferentCarlosBelum ada peringkat

- Case Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFDokumen7 halamanCase Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFFaizan SiddiqueBelum ada peringkat

- The New Rich in AsiaDokumen31 halamanThe New Rich in AsiaIrdinaBelum ada peringkat

- Resume 2022-2023Dokumen3 halamanResume 2022-2023Daniela ChavezBelum ada peringkat

- People V GGGDokumen7 halamanPeople V GGGRodney AtibulaBelum ada peringkat

- Macroeconomics NotesDokumen4 halamanMacroeconomics NotesishikaBelum ada peringkat

- The Role of Women in Trade Unions and Nation BuildingDokumen18 halamanThe Role of Women in Trade Unions and Nation BuildingSneha KanitCar Kango100% (1)

- Eliza Valdez Bernudez Bautista, A035 383 901 (BIA May 22, 2013)Dokumen13 halamanEliza Valdez Bernudez Bautista, A035 383 901 (BIA May 22, 2013)Immigrant & Refugee Appellate Center, LLCBelum ada peringkat

- JUNE 2018 QUESTION (1) (B)Dokumen6 halamanJUNE 2018 QUESTION (1) (B)BryanBelum ada peringkat

- DramaturgyDokumen4 halamanDramaturgyThirumalaiappan MuthukumaraswamyBelum ada peringkat

- Seven Lamps of AdvocacyDokumen4 halamanSeven Lamps of AdvocacyMagesh Vaiyapuri100% (1)

- Biology ProjectDokumen7 halamanBiology ProjectChitwan GuptaBelum ada peringkat

- Solution and AnswerDokumen4 halamanSolution and AnswerMicaela EncinasBelum ada peringkat