Worksheet Ratio Analysis

Diunggah oleh

Vishal BhardwajDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Worksheet Ratio Analysis

Diunggah oleh

Vishal BhardwajHak Cipta:

Format Tersedia

Ratio Analysis 1. ABC Ltd. provided the following information: Net Credit Sales (Rs.

) 200,000 Net Profit Margin Collection period (days) 180 Gross Profit Margin Net Profit to Stock Turnover Ratio 1.25 investment Receivables Turnover ratio 2 Debt-assets Ratio Fixed Assets Turnover Ratio 0.9 Face Value of each share (Rs.) 10 Additional information: Long-term debt = Rs. 2,00,000 Short-term debt = Rs. 50,000

10% 25% 4% 0.5

Using the above information of ABC Ltd., what is the earnings per share of the company? 2. Mayuri Distributors has made plans for the next year. The sales are expected to be Rs. 7,20,000. It is estimated that the company will employ total assets of Rs. 8,00,000, 50% of the assets being financed by borrowed capital at an interest rate of 16% per year. The direct costs for the year are estimated at Rs. 4,80,000 and all other operating expenses are estimated at Rs. 80,000. The profit after tax is Rs. 48,000. The goods will be sold to customers at 150% of the direct costs. Income tax rate is assumed to be 50%. What is the net profit margin and asset turnover? 3. Kashyap Electricals has furnished the following details: Current ratio 1.80 Liquid ratio 0.60 Fixed assets to proprietary fund 0.80 Bank overdraft Rs. 1,20,000 Working capital Rs. 2,40,000 There was no long-term loan or intangible asset. What are the other current assets and other current liabilities of this firm? 4. A company is presently working with Earnings before Interest and Taxes (EBIT) of Rs. 15 lakh. Its present borrowings are: 15% term loan 50 Borrowing from bank @ 20% 33 Public deposit @ 14% 15 The sales of the company are growing and to support this, the company proposes to obtain additional borrowings of Rs. 25 lakh. The increase in EBIT is expected to be 20%. Which of the following statements is true? (a) The interest coverage ratio will fall and hence revised proposal is not desirable. (b) The interest coverage ratio will rise and hence revised proposal is not desirable. (c) The interest coverage ratio will rise and hence revised proposal is desirable. (d) The interest coverage ratio will fall and hence revised proposal is desirable. (e) There is no change in the interest coverage ratio and hence revised proposal is not desirable. Ratio Analysis Page 1

5. Following is the information relating to movement of inventory in three firms. Which of the following is true regarding the Inventory turnover ratio (ITR)? Firm A Firm B Firm C Average Inventory (Rs.) 10,00,000 15,00,000 20,00,000 Cost of goods sold (Rs.) 60,00,000 75,00,000 80,00,000 Expenses of management (Rs.) 5,00,000 7,50,000 10,00,000 (a) ITR indicates that Firm A is having highest inventory turnover ratio. Firm A is able to make relatively higher sales with lower inventories and thus making efficient use of its working capital. (b) ITR indicates that Firm B is having highest inventory turnover ratio. Firm B is able to make relatively higher sales with lower inventories and thus making efficient use of its working capital. (c) ITR indicates that Firm C is having highest inventory turnover ratio. Firm C is able to make relatively higher sales with lower inventories and thus making efficient use of its working capital. (d) ITR indicates that Firm A and Firm C are having highest inventory turnover ratio. They are able to make relatively higher sales with lower inventories and thus making efficient use of their working capital. (e) ITR indicates that Firm B and Firm C are having highest inventory turnover ratio. They are able to make relatively higher sales with lower inventories and thus making efficient use of their working capital. 6. Calculate return on net worth if net profit margin is 7.50%, asset turnover ratio is 0.90 and debtasset ratio is 0.75. 7. Calculate the Return on Equity (ROE) if total asset turnover is 1.5, the net profit margin is 20% and the total assets to net worth ratio is 2. 8. In Dupont Analysis if the equity multiplier is 4, then what is the debt to assets ratio? 9. What is the ROE for the firm if net profit margin is 7%, asset turnover ratio is 2.5 and total assets to equity ratio is 1.2? 10. Liquidity ratios of Company X are given below along with a comparison with industry norms. Which of the following statements are true? Industry standard Company X Current Ratio 2.40 2.67 Debtors turnover ratio 8.00 10.00 (a) The ratios indicate that the firm is in worst liquidity position and is following stringent credit policy. (b) The ratios indicate that the firm is in better liquidity position and is following liberal credit policy. (c) The ratios indicate that the firm is in better liquidity position and is following stringent credit policy. (d) The ratios indicate that the firm is in worst liquidity position and is following liberal credit policy. Ratio Analysis Page 2

(e) The ratios indicate that the firm has a very good liquidity position. 12. Calculate the interest coverage ratio if the earning power of the firm is 0.3, average of total assets are Rs.20,000 and interest expense is Rs. 1,500. 13. Following is the balance sheet of M/s. Well done Ltd. as on 31.3.2001: Rs Equity Share Capital 3,000,000 Land Preference share capital 4,000,000 Building General Reserve 500,000 Plant & Machinery Profit & Loss Account 500,000 Furniture 12% Debentures 2,000,000 Debtors Trade Creditors 600,000 Stock Outstanding Expenses 150,000 Cash Provision for Taxation 200,000 Prepaid Expenses Proposed Dividends 300,000 Preliminary Expenses

Rs 500,000 3,000,000 3,000,000 400,000 2,000,000 1,500,000 400,000 100,000 350,000 11,250,000

11,250,000 From the above particulars, you are required to calculate: (i) Current Ratio (ii) Debt Equity Ratio (iii) Capital Gearing Ratio (iv) Liquid Ratio

14. The Balance Sheet of Y Ltd. stood as follows as on:

Liabilities Capital Reserves Loans Creditors and other current Liabilities

31.3.2001 31.3.2000 Assets 250 116 100 129 250 Fixed Assets 100 Less: Depreciation 120

(Rs. in lakhs) 31.3.2001 31.3.2000 400 140 260 40 120 70 20 25 60 595 300 100 200 30 100 50 20 25 70 495

25 Investment Stock Debtors Cash / Bank Other Current Assets Misc. Exp 595 495 You are given the following information for the year 2000-2001: Rs in lakhs Sales 60 PBIT 150 Interest 24 Provision for Tax 60 Proposed Dividend 50

Ratio Analysis

Page 3

From the above particulars, calculate for the year 2000-2001: a) Return on Capital Employed Ratio b) Stock Turnover Ratio c) Return on net worth ratio d) Current ratio e) Proprietary ratio 15. Shri Devdas asks you to prepare his balance sheet from the particulars furnished hereunder: Stock Velocity: 6 Gross Profit Margin: 20% Capital Turnover ratio: 2 Fixed Assets turnover ratio: 4 Debt Collection Period: 2 months Creditors Payment period: 73 days Gross Profit was RS 60,000 Excess of closing stock over opening stock was Rs 5,000. Difference in balance sheet represents bank balance. 16. From the following information and ratios, prepare the Profit & Loss Account for the year ended 31st March, 2001 and the Balance Sheet as on that date of M/s. Stan & Co., an export company: Current Assets to Stock 3:2 Current Ratio 3.00 Acid Test Ratio 1.00 Financial Leverage 2.20 Earnings per share (each of Rs 10) 10.00 Book Value per share (Rs.) 40.00 Average Collection period (assume 360 days in a year) 30 days Stock Turnover ratio 5.00 Fixed Assets Turnover ratio 1.20 Total Liabilities to Total Net worth 2.75 Net working capital Rs 10 lakhs Net Profit to Sales 10% Variable Cost 60% Long-term Interest 12% Taxation NIL

Ratio Analysis

Page 4

Anda mungkin juga menyukai

- Sales ApproachDokumen25 halamanSales ApproachRishabh JainBelum ada peringkat

- Upport Services Marketing of Ervices ProductsDokumen66 halamanUpport Services Marketing of Ervices ProductsVishal BhardwajBelum ada peringkat

- Bajaj Auto LTDDokumen44 halamanBajaj Auto LTDVishal BhardwajBelum ada peringkat

- Bajaj Auto LTDDokumen44 halamanBajaj Auto LTDVishal BhardwajBelum ada peringkat

- Factor AnalysisDokumen57 halamanFactor AnalysisMadhur AhujaBelum ada peringkat

- Foreign Exchange Management Act 1999 FemaDokumen38 halamanForeign Exchange Management Act 1999 FemaVishal BhardwajBelum ada peringkat

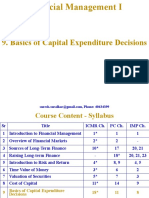

- Basics of Capital Expenditure DecisionsDokumen36 halamanBasics of Capital Expenditure DecisionsVishal BhardwajBelum ada peringkat

- Case Study: SuzlonDokumen6 halamanCase Study: SuzlonVishal BhardwajBelum ada peringkat

- Risk Analysis and Optimal Capital Expenditure DecisionDokumen24 halamanRisk Analysis and Optimal Capital Expenditure DecisionVishal BhardwajBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Consolidaton EntriesDokumen14 halamanConsolidaton Entriesask_raoBelum ada peringkat

- Cpar2017 Mas 8203 Cost Volume Profit Analysis PDFDokumen22 halamanCpar2017 Mas 8203 Cost Volume Profit Analysis PDFtanginamotalagaBelum ada peringkat

- Study Guide For Close CorporationsDokumen25 halamanStudy Guide For Close CorporationsPetrinaBelum ada peringkat

- Aluminium SilicateDokumen3 halamanAluminium Silicatemurali_kundulaBelum ada peringkat

- Retained EarningsDokumen72 halamanRetained EarningsItronix MohaliBelum ada peringkat

- Comparative Study of Loan SchemesDokumen48 halamanComparative Study of Loan Schemessumesh8940% (1)

- Lecture 6 - Capital Gain 66666Dokumen22 halamanLecture 6 - Capital Gain 66666Malik Muhammad SufyanBelum ada peringkat

- Unit One Media & AdvertisingDokumen19 halamanUnit One Media & AdvertisingAndrei AndreasBelum ada peringkat

- Popescu & Diaconu (2009)Dokumen6 halamanPopescu & Diaconu (2009)kautsarekaBelum ada peringkat

- Financial Ratio Analysis of Bangladesh Engineering SectorDokumen5 halamanFinancial Ratio Analysis of Bangladesh Engineering SectorAhmed NafiuBelum ada peringkat

- Exp Fia-Ffm NotesDokumen51 halamanExp Fia-Ffm Notesati19100% (1)

- Internship Report DraftDokumen26 halamanInternship Report Draftgoluchouhan314Belum ada peringkat

- Econ Old Test 2Dokumen7 halamanEcon Old Test 2Homer ViningBelum ada peringkat

- TS Grewal Solutions For Class 11 Accountancy Chapter 13 - Depreciation - CBSE TutsDokumen44 halamanTS Grewal Solutions For Class 11 Accountancy Chapter 13 - Depreciation - CBSE TutsRahul Kashiramka72% (18)

- Maersk GlossaryDokumen28 halamanMaersk GlossaryPrashant BhardwajBelum ada peringkat

- Notre Dame Educational Association: Mock Board Examination TaxationDokumen10 halamanNotre Dame Educational Association: Mock Board Examination TaxationirishjadeBelum ada peringkat

- AuditingDokumen4 halamanAuditingMaria Carmela MoraudaBelum ada peringkat

- Test Question For Math 12Dokumen5 halamanTest Question For Math 12Ernie Lahaylahay100% (1)

- Lecture5 6 Ratio Analysis 13Dokumen39 halamanLecture5 6 Ratio Analysis 13Cristina IonescuBelum ada peringkat

- Nolo's Essential Retirement Tax GuideDokumen436 halamanNolo's Essential Retirement Tax GuideabuaasiyahBelum ada peringkat

- JyothydrhpDokumen314 halamanJyothydrhpPiyush Shah0% (1)

- Chief Executive Officer Graeme Nehby (Shareholding 40%)Dokumen13 halamanChief Executive Officer Graeme Nehby (Shareholding 40%)Ka BoomBelum ada peringkat

- P5-2 Dan 3Dokumen5 halamanP5-2 Dan 3ramaBelum ada peringkat

- Financial Statement Analysis: by Uditha JayasingheDokumen19 halamanFinancial Statement Analysis: by Uditha JayasinghesanjuladasanBelum ada peringkat

- You Are TrashDokumen18 halamanYou Are TrashNivea Pamela Tidoy (Yhang)Belum ada peringkat

- Impact of GST On WholesalerDokumen20 halamanImpact of GST On Wholesalerjayesh50% (2)

- Answering Machine. The Company's Income Statement For The Most Recent Year Is Given BelowDokumen10 halamanAnswering Machine. The Company's Income Statement For The Most Recent Year Is Given BelowmeseleBelum ada peringkat

- Fundamental Analysis On Telecom SectorDokumen52 halamanFundamental Analysis On Telecom SectorShruthi Shetty0% (1)

- 3rd HRPTA Meeting - Minutes SY 2014-2015Dokumen2 halaman3rd HRPTA Meeting - Minutes SY 2014-2015Rey Salomon Vistal60% (5)

- Annual Report 2017 PDFDokumen216 halamanAnnual Report 2017 PDFemmanuelBelum ada peringkat