Structured Note Hedging: Non-Inversion Notes (Nins) Characteristics and Sizes

Diunggah oleh

mattwallDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Structured Note Hedging: Non-Inversion Notes (Nins) Characteristics and Sizes

Diunggah oleh

mattwallHak Cipta:

Format Tersedia

Structured Note Hedging

December 11, 2006

Benjamin Martens (212) 526-6566 bmartens@lehman.com

Over the past three years, there has been an enormous volume of structured note issuance, and the sizes involved may have at times been enough to move markets. We discuss the nature and hedging of two of the most popular structures that have large curve and volatility components: non-inversion notes and leveraged steepeners. NON-INVERSION NOTES (NINs) Characteristics and Sizes Non-inversion notes are structures in which an above-market coupon is paid, contingent on the curve remaining above some specific value (usually, but not always, 0 bp). The structures are typically 15yNC3m Bermudan callables, and approximately $20-$25 billion of these notes have been issued since the beginning of 2004 in cash and derivative form. Much of the original issuance was in 10s30s NINs (some of which has already been called), while much of the issuance over the past year has been of the 2s10s and 2s30s varieties. Dealer Hedging One short NINs is in a flattener position and long curve convexity, as the dealer owns a series of digital floors, based on daily accrual, on the curve struck at 0 bp (the strike). The curve gamma and vega profile resulting from the notes exposure is shown in Figure 1. This results in the approximate net steepener hedge profile shown in Figure 2. As Figure 2 shows, dealer hedging due to non-inversion notes dampens curve moves north of the strike and accelerates curve moves south of strike. It should also be noted that for pricing purposes, it is the convexity-adjusted forward curve that is most critical (see Figure 3). For this reason, the spot curve trading to 0 bp (such as occurred recently in 2s10s) carries little importance for pricing or for hedging, as long as the convexity-adjusted forward curve remains steep; it is literally a matter of just one coupon.

More on Curve Hedging

The dealers curve delta is hedged with spot and forward steepeners. We calculate that $10 billion 10s30s NIN issuance implies a steepener position of approximately $15 billion 30s of 10s30s steepeners (before accounting for the Bermudan callability feature). For the sum of all NINs issued, we calculate that the curve dv01 is about $1.0-$1.5 million per bp near the strikes (split between 2s10s, 2s30s, and 10s30s). The exact figure is unknown because an indeterminant percentage of NINs have already been called. As noted earlier, this curve delta-hedging exerts a dampening effect north of the strike, in that if the curve flattens, dealers respond by putting on more steepeners and vice-versa. The effect is potentially much more interesting once the market trades through the strike embedded within the notes and the dealer become short curve convexity (see Figure 1). Here curve inversion results in further flatteners being initiateda form of positive feedback cycle. However, we find it unlikely that hedging needs of $1.0-$1.5 million dv01 per bp would distort unless a large curve move occurred very quickly.

PLEASE SEE ANALYST CERTIFICATIONS AND IMPORTANT DISCLOSURES STARTING AFTER PAGE 4

Lehman Brothers | Structured Note Hedging

Figure 1. The Approximate Curve Convexity Profile Buried Within a 10s30s NIN

Net Gamma/Vega Position in 10s30s 1.0 0.8 0.6 0.4 0.2 0.0 -0.2 -0.4 -0.6 -0.8 -1.0 -50 The dealer gets rapidly short gamma in 10s30s as it falls through zero In reality, this tail is depressed further because note is callable

Figure 2. The Steepener Hedge Is Maximal When the Convexity-Adjusted Strike Reaches Zero

Total Steepener Hedge 1.2 1.0 0.8 0.6 Dealer puts on Flattener in Response to Flattening Dealer puts on Steepener in Response to Flattening

Gamma Vega

0.4 0.2 0.0 -40

-25

25

50

-20

10s30s Spot Slope (bp)

0 20 10s30s Spot Slope (bp)

40

Source: Lehman Brothers

Source: Lehman Brothers

Figure 3. The Approximate Curve Convexity Profile Buried Within a 10s30s NIN

bp 35 30 25 20 15 10 5 0 -5 Dec-06 Dec-08 Dec-10 Dec-12 Dec-14 Dec-16 2s10s Spot and Forw ard Sw ap Curve 2s10s Conv-Adj Spot and Forw ard Sw ap

Figure 4. NIN Issuance Likely Drove the Richening of 30yr Vega in 2004-2005

40 35 30 25 20 15 10 5 0 Nov-96 5y10y-5y30y bpvol Spread NIN Peak Issuance

Nov-98

Nov-00

Nov-02

Nov-04

Nov-06

Source: LehmanLive

Source: LehmanLive

Volatility Hedging Realities

The issuance of non-inversion notes, as long as the market is steeper than the strikes, results in the dealer being long curve convexity (or alternatively, short correlation). As the proper hedgea digital curve flooris not liquid, the dealer has to approximate the position with short-tenor vs. longer tenors vega and gamma spreads; these spreads are difficult to manage because the exposure is curve dependent and even sensitive to the level of yields! (because the notes are callable). To hedge the correlation, the dealer must own long-tenor vega vs. shorter tenor vega as long as the market is steeper than the strike. In the case of 10s30s NINs, we calculate that $10 10s30s NIN issuance generates up to $50 million of vega demand for 30-year tails on the surface. 10s30s NIN issuance peaked in the 3Q04-2Q05 timeframe; this vega demand was surely associated with the compression of 30-year vega and 10-year vega shown in Figure 4.

December 11, 2006 2

Lehman Brothers | Structured Note Hedging

It is interesting to consider the vega profile shown in Figure 1 with this in mind. A key point to realize is that it is likely that dealers have put on a significant amount of vega spreads over the past few years, but this vega requirement is highly curve dependent: It would decay both as the curve steepens (because the underlying NIN becomes callable) and as the convexity-adjusted forward curve trades through zero (because of the nature of the underlying option). Hence it is our expectation that shorter-tenor vega vs. longer tenor vega spreads are near maximal flatness right now; a move to a steeper curve will cause a gradual unwind of such vega spreads as the notes become callable, while a move to an inverted curve will cause a rapid unwind of such spreads as dealers must actually reverse the position in such an environment. The twist of the volatility surface may behave like a long straddle position on the curve over the next year for this reason. A last note we would make is that because of the difficulties in managing curve- and ratedependent vega spreads, as discussed above, dealers may have left themselves moderately net short correlationmeaning that dealers benefit when the curve moves. This may be part of the reason that correlation is bid up to such an extent currently. Figure 5 shows a history of 1-year trailing 2s10s realized correlation, as well as the current level of implieds. One-year options on 2s10s straddles are offered around 32 bpvol, which is on the low end of what has been delivered historically. We mentioned in an earlier write-up that even contingent on beginning from a nearly flat curve, realized 2s10s curve volatility during the Bretton Woods I period averaged 60 bpvol. We think 2s10s curve options are cheap, and the reason for the opportunity may be the residual risk of non-inversion note issuance. LEVERAGED STEEPENERS Characteristics and Sizes Leveraged steepeners are notes in which one is paid a leveraged factor times the realized spread of a particular section of the curve, floored at zero. There is oftentimes an abovemarket upfront fixed coupon payment over a lockout period. Leveraged steepeners may have been introduced in response to dealers need to cover some of the short correlation exposure remaining from non-inversion notes. There has been about $3 billion issued since the beginning of 2004 (see Figure 6), but the leverage in some of these notes is large, so the notional size may not be the best guide to their potential impact. There are records of notes paying coupons equal to 50X the 10s30s spread in the public domain.

Figure 5. 1y Trailing Realized Correlation and Implied Correlation in 2s10s. Correlation is expensive relative to history.

100% 95% 90% 85% 80% 75% 70% Jul-88

Source: LehmanLive

Figure 6. NIN Issuance helped drive leveraged steepener issuance. Bear in mind that leverage is large in leverage steepeners.

Gross Issuance, $bn 3.5 3.0 2.5 2.0 NIN Issuance by Quarter Leveraged Steepener Issuance by Quarter

1yr Trailing 2s 10s Correlation Current Correlation Pricing of 1yr Options Jul-93 Jul-98 Jul-03

1.5 1.0 0.5 0.0 Q1'04

Source: mtn-i.com

Q3'04

Q1'05

Q3'05

Q1'06

Q3'06

December 11, 2006

Lehman Brothers | Structured Note Hedging

Hedging Leveraged Steepeners Relative to NINs, hedging of leveraged steepeners is relatively straightforward. One who is short a leveraged steepener is simply short a call option on the curve, struck at 0 bp, and is therefore always short curve convexity. The convexity profile is shown in Figure 7, and the net steepener hedge profile is shown in Figure 8. Most interestingly, the net effect of the two notes is subtractive, meaning that leveraged steepeners reduce any net actively hedged curve convexity that may exist in the market (see Figure 7). However, if the market trades through the strike, then the effects from the two types of notes are additive. We therefore think it likely that curve realized volatility will pick up quickly and significantly due to dealer hedging if ever the markets convexity-adjusted forward curve manages to invert. CONCLUSIONS/SUMMARY The net curve impact of non-inversion note and leveraged steepener hedging is unlikely to be large above the strikes, as the curve convexities resulting from the two types of notes partially cancel. In general, the net hedging requirements are unlikely to be large enough to matter too much unless the move comes quickly, and other factors (especially mortgageconvexity-related) are likely to be more important. To the extent there is limited impact from these notes on the broader market, we expect to see asymmetric behaviour around the point where the convexity-adjusted forward 2s10s curve inverts. At that point, the short curve convexities of NINs and leverage steepeners become additive, and dealer steepener unwinds, in response to flattening, may exacerbate the inversion move and increase curve realized volatility, rather than having the dampening effect that we are used to seeing. We think the relationship between curve slope and twist of the vega surface across vega spreads is interesting, and we expect long-tenor vega to cheapen slowly vs. short-tenor vega as the curve steepens and rapidly if the convexity-adjusted forward curve inverts. Related trading opportunities driven by this analysis: 1. 2. We think 2s10s curve options are cheap (perhaps an excess return opportunity). We think vega spreads bear watching once the curve begins to move.

Figure 8. The Steepener Hedge in Leveraged Steepeners is Monotonically Increasing

Total Steepener Hedge (Times Leverage Factor) 1.2 1.0 0.8 0.6 0.4 0.2 0.0 -30

Figure 7. The Approximate Curve Convexity Profile Buried within Leverage Steepeners

Net Gamma/Vega Position in 10s30s 1.5 1.2 0.9 0.6 0.3 0.0 -0.3 -0.6 -0.9 -1.2 -1.5 -50 NIN Correl Gamma Steep Correl Gamma Net Correl Gamma

-25

0 10s30s Spot Slope (bp)

25

50

-20

-10

10

20

30

10s30s Spot Slope (bp)

Source: Lehman Brothers

Source: Lehman Brothers

December 11, 2006

Analyst Certification The views expressed in this report accurately reflect the personal views of Benjamin Martens, the primary analyst responsible for this report, about the subject securities or issuers referred to herein, and no part of such analyst's compensation was, is or will be directly or indirectly related to the specific recommendations or views expressed herein. Important Disclosures Lehman Brothers Inc. and/or an affiliate thereof (the "firm") regularly trades, generally deals as principal and generally provides liquidity (as market maker or otherwise) in the debt securities that are the subject of this research report (and related derivatives thereof). The firm's proprietary trading accounts may have either a long and / or short position in such securities and / or derivative instruments, which may pose a conflict with the interests of investing customers. Where permitted and subject to appropriate information barrier restrictions, the firm's fixed income research analysts regularly interact with its trading desk personnel to determine current prices of fixed income securities. The firm's fixed income research analyst(s) receive compensation based on various factors including, but not limited to, the quality of their work, the overall performance of the firm (including the profitability of the investment banking department), the profitability and revenues of the Fixed Income Division and the outstanding principal amount and trading value of, the profitability of, and the potential interest of the firms investing clients in research with respect to, the asset class covered by the analyst. Lehman Brothers generally does and seeks to do investment banking and other business with the companies discussed in its research reports. As a result, investors should be aware that the firm may have a conflict of interest. To the extent that any historical pricing information was obtained from Lehman Brothers trading desks, the firm makes no representation that it is accurate or complete. All levels, prices and spreads are historical and do not represent current market levels, prices or spreads, some or all of which may have changed since the publication of this document. Lehman Brothers' global policy for managing conflicts of interest in connection with investment research is available at www.lehman.com/researchconflictspolicy. To obtain copies of fixed income research reports published by Lehman Brothers please contact Valerie Monchi (vmonchi@lehman.com; 212-526-3173) or clients may go to https://live.lehman.com/.

Legal Disclaimer This material has been prepared and/or issued by Lehman Brothers Inc., member SIPC, and/or one of its affiliates ("Lehman Brothers"). Lehman Brothers Inc. accepts responsibility for the content of this material in connection with its distribution in the United States. This material has been approved by Lehman Brothers International (Europe), authorised and regulated by the Financial Services Authority, in connection with its distribution in the European Economic Area. This material is distributed in Japan by Lehman Brothers Japan Inc., and in Hong Kong by Lehman Brothers Asia Limited. This material is distributed in Australia by Lehman Brothers Australia Pty Limited, and in Singapore by Lehman Brothers Inc., Singapore Branch ("LBIS"). Where this material is distributed by LBIS, please note that it is intended for general circulation only and the recommendations contained herein do not take into account the specific investment objectives, financial situation or particular needs of any particular person. An investor should consult his Lehman Brothers' representative regarding the suitability of the product and take into account his specific investment objectives, financial situation or particular needs before he makes a commitment to purchase the investment product. This material is distributed in Korea by Lehman Brothers International (Europe) Seoul Branch. Any U.S. person who receives this material and places an order as result of information contained herein should do so only through Lehman Brothers Inc. This document is for information purposes only and it should not be regarded as an offer to sell or as a solicitation of an offer to buy the securities or other instruments mentioned in it. With exception of the disclosures relating to Lehman Brothers, this report is based on current public information that Lehman Brothers considers reliable, but we do not represent that this information, including any third party information, is accurate or complete and it should not be relied upon as such. It is provided with the understanding that Lehman Brothers is not acting in a fiduciary capacity. Opinions expressed herein reflect the opinion of Lehman Brothers' Fixed Income Research Department and are subject to change without notice. The products mentioned in this document may not be eligible for sale in some states or countries, and they may not be suitable for all types of investors. If an investor has any doubts about product suitability, he should consult his Lehman Brothers representative. The value of and the income produced by products may fluctuate, so that an investor may get back less than he invested. Value and income may be adversely affected by exchange rates, interest rates, or other factors. Past performance is not necessarily indicative of future results. If a product is income producing, part of the capital invested may be used to pay that income. Lehman Brothers may, from time to time, perform investment banking or other services for, or solicit investment banking or other business from any company mentioned in this document. No part of this document may be reproduced in any manner without the written permission of Lehman Brothers. 2006 Lehman Brothers. All rights reserved. Additional information is available on request. Please contact a Lehman Brothers' entity in your home jurisdiction.

Anda mungkin juga menyukai

- Understanding Duration and Volatility: Salomon Brothers IncDokumen32 halamanUnderstanding Duration and Volatility: Salomon Brothers IncoristhedogBelum ada peringkat

- A Primer On Interest Rate Markets and Relative ValueDokumen15 halamanA Primer On Interest Rate Markets and Relative ValuekevBelum ada peringkat

- Lehmansn 1Dokumen17 halamanLehmansn 1sajivshriv100% (1)

- Valuing Interest Rate Swaps Using OIS DiscountingDokumen26 halamanValuing Interest Rate Swaps Using OIS DiscountingLawrenceGalitz100% (1)

- (Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-ValueDokumen12 halaman(Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-Valuecoolacl0% (2)

- From Asset Swaps To Z SpreadsDokumen20 halamanFrom Asset Swaps To Z SpreadsAudrey Lim100% (1)

- Nomura US Vol AnalyticsDokumen26 halamanNomura US Vol Analyticshlviethung100% (2)

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresDari EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresBelum ada peringkat

- Trading the Fixed Income, Inflation and Credit Markets: A Relative Value GuideDari EverandTrading the Fixed Income, Inflation and Credit Markets: A Relative Value GuideBelum ada peringkat

- Market Consistency: Model Calibration in Imperfect MarketsDari EverandMarket Consistency: Model Calibration in Imperfect MarketsBelum ada peringkat

- FI - Cross Currency Swap Theory and Practice (Nicholas Burgess) PDFDokumen26 halamanFI - Cross Currency Swap Theory and Practice (Nicholas Burgess) PDFpierrefrancBelum ada peringkat

- (Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-ValueDokumen12 halaman(Citibank) Using Asset Swap Spreads To Identify Goverment Bond Relative-ValueMert Can GencBelum ada peringkat

- Asset Swap PDFDokumen11 halamanAsset Swap PDFemerging11Belum ada peringkat

- Cds PrimerDokumen15 halamanCds PrimerJay KabBelum ada peringkat

- JPM Bond CDS Basis Handb 2009-02-05 263815Dokumen92 halamanJPM Bond CDS Basis Handb 2009-02-05 263815ccohen6410100% (1)

- Nomura CDS Primer 12may04Dokumen12 halamanNomura CDS Primer 12may04Ethan Sun100% (1)

- Interest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsDokumen14 halamanInterest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsReema RatheeBelum ada peringkat

- (Lehman Brothers) Quantitative Credit Research Quarterly - Quarter 3 2001Dokumen44 halaman(Lehman Brothers) Quantitative Credit Research Quarterly - Quarter 3 2001anuragBelum ada peringkat

- Forward Rate BiasDokumen9 halamanForward Rate BiasHafsa Hina100% (2)

- (Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsDokumen14 halaman(Lehman Brothers, Tuckman) Interest Rate Parity, Money Market Baisis Swaps, and Cross-Currency Basis SwapsJonathan Ching100% (1)

- Analyzing CDS Credit Curves - A Fundamental PerspectiveDokumen11 halamanAnalyzing CDS Credit Curves - A Fundamental PerspectiveMatt WallBelum ada peringkat

- Riding The Yield Curve 1663880194Dokumen81 halamanRiding The Yield Curve 1663880194Daniel PeñaBelum ada peringkat

- Up-Front Credit Default SwapsDokumen17 halamanUp-Front Credit Default SwapscwakimBelum ada peringkat

- A Guide To Commercial Mortgage-Backed SecuritiesDokumen50 halamanA Guide To Commercial Mortgage-Backed SecuritiesJay Kab100% (1)

- (Lehman Brothers) Mortgage Options - A Primer PDFDokumen22 halaman(Lehman Brothers) Mortgage Options - A Primer PDFshih_kaichihBelum ada peringkat

- ACOMB-Correlation in PracticeDokumen25 halamanACOMB-Correlation in PracticefloqfloBelum ada peringkat

- Interest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis SwapsDokumen14 halamanInterest Rate Parity, Money Market Basis Swaps, and Cross-Currency Basis Swapsultr4l0rd100% (1)

- Repos A Deep Dive in The Collateral PoolDokumen7 halamanRepos A Deep Dive in The Collateral PoolppateBelum ada peringkat

- Barclays US Futures H3-M3 Treasury Futures Roll Outlook PDFDokumen9 halamanBarclays US Futures H3-M3 Treasury Futures Roll Outlook PDFLorenzo RossiBelum ada peringkat

- Explaining The Lehman Brothers Option Adjusted Spread of A Corporate Bond - Claus PedersenDokumen20 halamanExplaining The Lehman Brothers Option Adjusted Spread of A Corporate Bond - Claus PedersentradingmycroftBelum ada peringkat

- CMS Inverse FloatersDokumen8 halamanCMS Inverse FloaterszdfgbsfdzcgbvdfcBelum ada peringkat

- Swap Curve BuildingDokumen12 halamanSwap Curve BuildingNaveen KumarBelum ada peringkat

- (Bank of America) Prepayments On Agency Hybrid ARM MBSDokumen11 halaman(Bank of America) Prepayments On Agency Hybrid ARM MBSJay KabBelum ada peringkat

- (Lehman Brothers) Introduction To Asset Swaps, PDFDokumen12 halaman(Lehman Brothers) Introduction To Asset Swaps, PDFexplore651100% (1)

- Barclays Capital Equity Correlation Explaining The Investment Opportunity PDFDokumen2 halamanBarclays Capital Equity Correlation Explaining The Investment Opportunity PDFAnonymous s41KVlqkBelum ada peringkat

- Non-Agency Mbs PrimerDokumen50 halamanNon-Agency Mbs Primerab3rd100% (1)

- Lehman Risk Model Sep 2009Dokumen10 halamanLehman Risk Model Sep 2009domokane100% (1)

- Convertible ArbitrageDokumen10 halamanConvertible ArbitrageGorakhnathBelum ada peringkat

- TurboCarryZoomsAhead PDFDokumen8 halamanTurboCarryZoomsAhead PDFkiza66Belum ada peringkat

- Lehman Brothers 2001 DerivativesDokumen46 halamanLehman Brothers 2001 DerivativesFloored100% (3)

- FI - Overview of Cross Currency Swaps Via Swap PricerDokumen59 halamanFI - Overview of Cross Currency Swaps Via Swap PricerDao QuynhBelum ada peringkat

- OIS Discounting PiterbargDokumen6 halamanOIS Discounting PiterbargharsjusBelum ada peringkat

- JPM MBS Primer PDFDokumen68 halamanJPM MBS Primer PDFAndy LeungBelum ada peringkat

- 807512Dokumen24 halaman807512Shweta SrivastavaBelum ada peringkat

- Variance Swaps - An IntroductionDokumen5 halamanVariance Swaps - An IntroductionAngelo TorresBelum ada peringkat

- Lehman Futures ModelDokumen12 halamanLehman Futures ModelzdfgbsfdzcgbvdfcBelum ada peringkat

- Qis - Insights - Qis Insights Style InvestingDokumen21 halamanQis - Insights - Qis Insights Style Investingpderby1Belum ada peringkat

- Fixed Income Relative Value Analysis: A Practitioners Guide to the Theory, Tools, and TradesDari EverandFixed Income Relative Value Analysis: A Practitioners Guide to the Theory, Tools, and TradesBelum ada peringkat

- The Handbook of Convertible Bonds: Pricing, Strategies and Risk ManagementDari EverandThe Handbook of Convertible Bonds: Pricing, Strategies and Risk ManagementBelum ada peringkat

- Trading Fixed Income and FX in Emerging Markets: A Practitioner's GuideDari EverandTrading Fixed Income and FX in Emerging Markets: A Practitioner's GuideBelum ada peringkat

- CLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketDari EverandCLO Liquidity Provision and the Volcker Rule: Implications on the Corporate Bond MarketBelum ada peringkat

- The Meadow DanceDokumen22 halamanThe Meadow DancemarutishBelum ada peringkat

- Exam QA - Corporate Finance-1Dokumen38 halamanExam QA - Corporate Finance-1NigarBelum ada peringkat

- Afar Exercise 5 PDF FreeDokumen8 halamanAfar Exercise 5 PDF FreeRialeeBelum ada peringkat

- Bridge Course Accounting and Finance: MBA Class of 2022Dokumen20 halamanBridge Course Accounting and Finance: MBA Class of 2022Mahima GirdharBelum ada peringkat

- Interview Valentine Flynn - Aldus Aviation FundDokumen9 halamanInterview Valentine Flynn - Aldus Aviation FundjamesbrentsmithBelum ada peringkat

- Mini Project On NseDokumen19 halamanMini Project On Nsecharan tejaBelum ada peringkat

- Assignment f1Dokumen9 halamanAssignment f1Nur AzlindaBelum ada peringkat

- JLL Asia Pacific Property Digest 4q 2015Dokumen76 halamanJLL Asia Pacific Property Digest 4q 2015limpuppyBelum ada peringkat

- 211 - F - Bevcon Wayors-A Study On Financial Cost Efficiency at Bevcon WayorsDokumen70 halaman211 - F - Bevcon Wayors-A Study On Financial Cost Efficiency at Bevcon WayorsPeacock Live ProjectsBelum ada peringkat

- Carnegie BiographyDokumen6 halamanCarnegie Biographyayax1Belum ada peringkat

- J Smythe Shell FileDokumen2 halamanJ Smythe Shell FileAnkita DasBelum ada peringkat

- Credit Risk Management in Uk Banks DissertationDokumen7 halamanCredit Risk Management in Uk Banks DissertationPayToWriteAPaperUK100% (1)

- Corporate Governance Report Bangladesh PDFDokumen311 halamanCorporate Governance Report Bangladesh PDFAsiburRahmanBelum ada peringkat

- Willoughby Square EB-5 PromotionDokumen7 halamanWilloughby Square EB-5 PromotionNorman OderBelum ada peringkat

- Session 1 - FDDokumen24 halamanSession 1 - FDDaksh KhullarBelum ada peringkat

- General Insurance Corporation of India DRHPDokumen524 halamanGeneral Insurance Corporation of India DRHPAshok YadavBelum ada peringkat

- Reflection Paper#2 - PFRS 9 in BanksDokumen2 halamanReflection Paper#2 - PFRS 9 in BanksnerieroseBelum ada peringkat

- Chapter 10 Discounted DividendDokumen5 halamanChapter 10 Discounted Dividendmahnoor javaidBelum ada peringkat

- Balance Scorecard FrameworkDokumen178 halamanBalance Scorecard FrameworkNouman HassanBelum ada peringkat

- What Is Return On Equity - ROE?Dokumen12 halamanWhat Is Return On Equity - ROE?Christine DavidBelum ada peringkat

- What Is Finance?: Key TakeawaysDokumen3 halamanWhat Is Finance?: Key TakeawaysAnubhavBelum ada peringkat

- MODAUD1 UNIT 3 - Audit of ReceivablesDokumen11 halamanMODAUD1 UNIT 3 - Audit of ReceivablesJake BundokBelum ada peringkat

- AccesstoCapital InvestmentBanksinSoCalDokumen3 halamanAccesstoCapital InvestmentBanksinSoCalRob Gu100% (1)

- Agm ChecklistDokumen3 halamanAgm ChecklistMohd MohdBelum ada peringkat

- Measures To Improve Life Insurance ProfitabilityDokumen9 halamanMeasures To Improve Life Insurance ProfitabilityTirth ShahBelum ada peringkat

- Marketing Strategy of Bharti Axa Life Insurance - 191468884Dokumen36 halamanMarketing Strategy of Bharti Axa Life Insurance - 191468884Jammu & kashmir story catcherBelum ada peringkat

- WebinarDokumen13 halamanWebinarAnirudh SrikantBelum ada peringkat

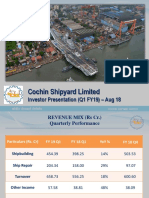

- CSL Investor Presentation Aug 18Dokumen21 halamanCSL Investor Presentation Aug 18gopalptkssBelum ada peringkat

- IAS 36 Example: Calculation of WACCDokumen36 halamanIAS 36 Example: Calculation of WACCJessyRityBelum ada peringkat

- Annamalai University Solved AssignmentsDokumen10 halamanAnnamalai University Solved AssignmentsAiDLo50% (2)