South Carolina Deficiency Judgments in Foreclosure Actions

Diunggah oleh

kwillsonDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

South Carolina Deficiency Judgments in Foreclosure Actions

Diunggah oleh

kwillsonHak Cipta:

Format Tersedia

DEFICIENCY JUDGMENTS IN FORECLOSURE ACTIONS

Presented by: T. Eugene Allen, III NEXSEN, PRUET JACOBS & POLLARD, LLP

Columbia Charleston Greenville

The South Carolina Bankruptcy Law Association Columbia, South Carolina November 14, 1994

NPCOL1:430888.1-DOC-(TEA) 000116-00068

DEFICIENCY JUDGMENTS IN FORECLOSURE ACTIONS

The South Carolina Bankruptcy Law Association Columbia, South Carolina November 14, 1994

I. II. III. IV. I. Pre-Foreclosure Analysis and Planning Procedure How to Bid Appraisal Statute PRE-FORECLOSURE ANALYSIS AND PLANNING A. B. C. Review the lender's loan file to determine if there is an existing appraisal and financial statements. Review the existing appraisal and obtain new appraisal if not current or if the property is likely to have changed much in value. Assess the debtor's (and guarantor's) financial position and ability to respond to a judgment. 1. 2. 3. Judgment good for ten years. Judgment automatically attaches as lien to real estate only. Judgment only attaches to non-realty when officer executing judgment (county sheriff) levies upon the specific property, example: motor vehicle, inventory, equipment, etc.

NPCOL1:430888.1-DOC-(TEA) 000116-00068

4.

Lien of judgment can be set aside if judgment debtor files bankruptcy within 90 days after judgment filed. Judgment lien can also be set aside to extent it impairs debtor exemption, regardless of when obtained. Transcript of judgment can be filed in any county (in addition to the county in which it was originally obtained) and in other states.

5. D.

Review any applicable credit/title insurance policy to see if insurer can require seeking deficiency judgment. 1. If applicable, communicate with insurer.

II.

PROCEDURE A. When must decision to seek deficiency be made? 1. Deficiency judgment can be waived in the complaint. a. Waiving deficiency in complaint generally increases likelihood that debtor will default, unless debtor thinks property has substantial equity. If deficiency waived, but creditor later changes his mind, will most likely require service of amended complaint and give defaulted debtor new chance to respond. Consider also Security Federal FSB v. Devlin, 424 S.E.2d 557 (Ct.App. 1992) (creditor unsuccessfully tried to get Court to Amend Order post-judgment to avoid deficiency judgment where waived in the Complaint).

b.

2. 3.

Deficiency judgment can be waived at the foreclosure hearing. Deficiency can also be waived after hearing, but before sale (if this method is used, notice of sale must specify that plaintiff reserves right to waive up to date of sale).

B.

Against which defendants may deficiency be sought? 1. 2. Maker of note and any co-makers. Guarantors. a. May be better to sue guarantor in separate action, especially if primary maker is not likely to defend foreclosure action (guarantor probably would defend if joined in the foreclosure action). 2

C.

Nature of judgment awarded in foreclosure. 1. 2. Whether or not deficiency sought, order of judgment will include all amounts due under note. 29-3-630. Order of foreclosure may also be order for immediate judgment and order of sale of foreclosed property to satisfy judgment. 29-3-650. Whether to grant immediate judgment is entirely within the Court's discretion. White v. Douglas, 128 S.E. 409, 123 S.E. 259 (1924). Judgment may include provision for deficiency judgment if sale proceeds are not sufficient to satisfy debt. 29-3-660. a. Mortgagee whose debt remains unsatisfied after sale of mortgaged property "is entitled to a deficiency judgment..." Court has no discretion in the matter. Bartles v. Livingston, 282 S.C.448, 319 S.E.2d 707 (Ct.App. 1984). Deficiency not extinguished if mortgagee is successful bidder at foreclosure sale.

3.

a.

III.

HOW TO BID A. Deficiency sought. 1. Should bid as close as possible to appraised value of the property; otherwise, risk of having deficiency reduced under appraisal statute with resulting delays. Initial bid should be final bid; otherwise, since bidding is reopened in thirty days and neither the mortgagee nor the successful bidder can rebid, risk losing the property for less than value.

2.

B.

Deficiency waived. 1. Determine upset price (price over which you are willing to let someone else buy it). a. In determining upset price, consider net proceeds after costs of disposing of the property after you buy it. (1) Realtors commissions 3

NPCOL1:430888.1-DOC-(TEA) 000116-00068

(2) (3) IV. APPRAISAL STATUTE A.

Property/hazard insurance Unpaid taxes

Where deficiency judgment is awarded, judgment debtors have right to petition for appraisal. 1. Petition must be filed (with clerk of court, even if order of reference includes appraisal proceedings) within thirty days after date of "sale". 29-3-680. a. Date of sale is date all bids have been received, i.e., generally date when bidding reopened. First South Savings v. Gold Coast Assoc., 301 S.C. 158, 390 S.E.2d 486 (Ct.App. 1990).

2.

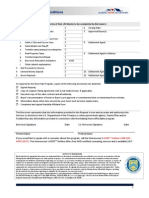

The S.C. Supreme Court has ruled that contractual waivers of the right of appraisal in mortgage foreclosures are void as against public policy. SCN Mortgage Corp. v. White, 440 S.E.2d 868 (S.C. 1994). "(We) hold the contractual waiver of appraisal rights invalid as against public policy." Subsequent to this ruling, the South Carolina General Assembly enacted legislation allowing the right of appraisal to be waived, except in foreclosures relating to a dwelling place or to a consumer credit transaction. For the waiver to be effective, the debtor (including co-makers and guarantors) must be notified in writing before the loan transaction that a waiver of appraisal rights will be required. Further, the debtor/comaker/guarantor must sign a statement during the transaction which contains certain specified waiver language. The waiver may be in any document relating to the transaction, but must be on a page containing the signature of the person making the waiver. Certain portions of the waiver language must be underlined or capitalized. 29-3-680 S.C. Code Ann. 1976.

B.

Procedure 1. In petition, debtor names one appraiser and judgment creditor has ten days in which to name another appraiser. Court appoints third appraiser. 29-3-710. a. Appraisers must be "disinterested individuals who must be statecertified real estate appraisers" of county where property is located, and not "connected in business with" any party or related by blood or related by blood or marriage within the sixth degree to any party. 293-700.

NPCOL1:430888.1-DOC-(TEA) 000116-00068

2. 3. 4. 5.

Appraisers must inspect property, consider certain factors listed in statute, and issue their return within thirty days after order of appointment. 29-3-720. Majority is sufficient - need not be unanimous agreement. 29-3-720. If appraisers' return shows property worth less than amount bid, judgment is unchanged. 29-3-740. If appraisers' return shows property had value greater than final bid, deficiency judgment is reduced accordingly or, depending on amount of appraisal, extinguished. 29-3-740.

C.

Cost of appraisal proceedings 1. 2. Statute (29-3-760) is unclear and there is no judicial interpretation as yet. Probable result is that debtor pays his appraiser, lender pays its appraiser and debtor deposits enough money at time of filing appraisal petition to pay courtappointed appraiser.

D.

Appeal from appraisers' return 1. 2. Either side may appeal within ten days after notice of filing of appraisers' return. 29-3-750. Appeal will be heard as a non-jury matter ("in open court or at chambers") with testimony by appraisers and such other testimony as either party wishes to submit regarding the value of the property. 29-3-750. (NOTE: important to specify in order of reference that master/special referee has jurisdiction over all matters in connection with appraisal, or appeal may languish on circuit court non-jury docket.) a. 3. Court not required to take any testimony. First Citizens Bank & Trust Co. v. Overlook, Inc., 286 S.C. 473, 334 S.E.2d 146 (Ct.App. 1985).

Court may affirm appraisers or order a new appraisal "upon such terms as he may deem equitable..." 29-3-750. a. Court may not change appraisal, but may only affirm the return or order a new appraisal. Peoples Fed. S & L v. Myrtle Beach Group, 302 S.C. 223, 394 S.E.2d 489 (Ct. App. 1990).

E.

A pending appraisal proceeding probably prevents collecting deficiency judgment until appraisal proceeding is concluded on theory that judgment is not final - again very little

NPCOL1:430888.1-DOC-(TEA) 000116-00068

case law precedent in this area. If concerned about debtor transferring assets, consider traditional pre-judgment provisional remedies such as attachment.

NPCOL1:430888.1-DOC-(TEA) 000116-00068

Anda mungkin juga menyukai

- California Supreme Court Petition: S173448 – Denied Without OpinionDari EverandCalifornia Supreme Court Petition: S173448 – Denied Without OpinionPenilaian: 4 dari 5 bintang4/5 (1)

- Bankr. L. Rep. P 73,548 in Re William and Debra Calvert, Debtors. Green Tree Acceptance, Inc. v. William and Debra Calvert, 907 F.2d 1069, 11th Cir. (1990)Dokumen6 halamanBankr. L. Rep. P 73,548 in Re William and Debra Calvert, Debtors. Green Tree Acceptance, Inc. v. William and Debra Calvert, 907 F.2d 1069, 11th Cir. (1990)Scribd Government DocsBelum ada peringkat

- Inc. (In Re Columbia Gas Sys., Inc.), 33 F.3d 294, 295-96 (3d Cir. 1994) (Noting That UST HasDokumen7 halamanInc. (In Re Columbia Gas Sys., Inc.), 33 F.3d 294, 295-96 (3d Cir. 1994) (Noting That UST HasChapter 11 DocketsBelum ada peringkat

- BF Homes, Incorporated vs. Court of AppealsDokumen14 halamanBF Homes, Incorporated vs. Court of AppealsKrystal Grace D. PaduraBelum ada peringkat

- United States Court of Appeals, Tenth CircuitDokumen5 halamanUnited States Court of Appeals, Tenth CircuitScribd Government DocsBelum ada peringkat

- 10000015270Dokumen5 halaman10000015270Chapter 11 DocketsBelum ada peringkat

- In Re Thinking MacHines Corporation, Debtor. Thinking MacHines Corporation v. Mellon Financial Services Corporation 1, 67 F.3d 1021, 1st Cir. (1995)Dokumen12 halamanIn Re Thinking MacHines Corporation, Debtor. Thinking MacHines Corporation v. Mellon Financial Services Corporation 1, 67 F.3d 1021, 1st Cir. (1995)Scribd Government DocsBelum ada peringkat

- In Re Third Ave. Transit Corp. Melniker v. Lehman, 198 F.2d 703, 2d Cir. (1952)Dokumen6 halamanIn Re Third Ave. Transit Corp. Melniker v. Lehman, 198 F.2d 703, 2d Cir. (1952)Scribd Government DocsBelum ada peringkat

- Not PrecedentialDokumen13 halamanNot PrecedentialScribd Government DocsBelum ada peringkat

- Motion to Stay Foreclosure and Grant Appeal PreferenceDokumen18 halamanMotion to Stay Foreclosure and Grant Appeal PreferenceNancy Duffy McCarron100% (2)

- United States Bankruptcy Court Southern District of New YorkDokumen6 halamanUnited States Bankruptcy Court Southern District of New YorkZerohedgeBelum ada peringkat

- United States Court of Appeals, Tenth CircuitDokumen3 halamanUnited States Court of Appeals, Tenth CircuitScribd Government DocsBelum ada peringkat

- Noah Greenspun v. Eugene F. Bogan, (Two Cases) - Appeal of Joseph Steir. Appeal of Morgan Guaranty Trust Company of New York, 492 F.2d 375, 1st Cir. (1974)Dokumen10 halamanNoah Greenspun v. Eugene F. Bogan, (Two Cases) - Appeal of Joseph Steir. Appeal of Morgan Guaranty Trust Company of New York, 492 F.2d 375, 1st Cir. (1974)Scribd Government DocsBelum ada peringkat

- No. 81-7087, 683 F.2d 1325, 11th Cir. (1982)Dokumen9 halamanNo. 81-7087, 683 F.2d 1325, 11th Cir. (1982)Scribd Government DocsBelum ada peringkat

- Montoya v. Garcia, 10th Cir. (2009)Dokumen5 halamanMontoya v. Garcia, 10th Cir. (2009)Scribd Government DocsBelum ada peringkat

- Collins & Aikman Corporation, Et AlDokumen16 halamanCollins & Aikman Corporation, Et AlChapter 11 DocketsBelum ada peringkat

- Docket #5380 Date Filed: 10/29/2010Dokumen26 halamanDocket #5380 Date Filed: 10/29/2010Chapter 11 DocketsBelum ada peringkat

- Torrens SystemDokumen112 halamanTorrens SystemAnonymous Azxx3Kp9Belum ada peringkat

- United States Trustee v. Gryphon at The Stone Mansion, Inc., D/B/A Erik Lewis Global D/B/A Wanner Van Helden, 166 F.3d 552, 3rd Cir. (1999)Dokumen8 halamanUnited States Trustee v. Gryphon at The Stone Mansion, Inc., D/B/A Erik Lewis Global D/B/A Wanner Van Helden, 166 F.3d 552, 3rd Cir. (1999)Scribd Government DocsBelum ada peringkat

- In Re James E. Comer and Martha E. Comer, His Wife, Debtors. Lefferage B. Moxley A/K/A Pete Moxley, and Anna Pauline Moxley v. James E. Comer and Martha E. Comer, 716 F.2d 168, 3rd Cir. (1983)Dokumen15 halamanIn Re James E. Comer and Martha E. Comer, His Wife, Debtors. Lefferage B. Moxley A/K/A Pete Moxley, and Anna Pauline Moxley v. James E. Comer and Martha E. Comer, 716 F.2d 168, 3rd Cir. (1983)Scribd Government DocsBelum ada peringkat

- State Street Bank & Trust Company v. Brockrim, Inc., 87 F.3d 1487, 1st Cir. (1996)Dokumen6 halamanState Street Bank & Trust Company v. Brockrim, Inc., 87 F.3d 1487, 1st Cir. (1996)Scribd Government DocsBelum ada peringkat

- United States v. Toni Leigh Bacus, 33 F.3d 62, 10th Cir. (1994)Dokumen6 halamanUnited States v. Toni Leigh Bacus, 33 F.3d 62, 10th Cir. (1994)Scribd Government DocsBelum ada peringkat

- United States Court of Appeals, Fourth CircuitDokumen4 halamanUnited States Court of Appeals, Fourth CircuitScribd Government DocsBelum ada peringkat

- California Court Rejects Builder's Effort To Compel Homeowner Compliance With SB-800Dokumen20 halamanCalifornia Court Rejects Builder's Effort To Compel Homeowner Compliance With SB-800CriticalPathBlogBelum ada peringkat

- Demorest v. City Bank Farmers Trust Co., 321 U.S. 36 (1944)Dokumen11 halamanDemorest v. City Bank Farmers Trust Co., 321 U.S. 36 (1944)Scribd Government DocsBelum ada peringkat

- G.R. No. 152580. June 26, 2008.: Commission Shall Retain Jurisdiction Over Pending SuspenDokumen12 halamanG.R. No. 152580. June 26, 2008.: Commission Shall Retain Jurisdiction Over Pending SuspenlaBelum ada peringkat

- Continental Oil Company v. The Frontier Refining Company, 338 F.2d 780, 10th Cir. (1964)Dokumen5 halamanContinental Oil Company v. The Frontier Refining Company, 338 F.2d 780, 10th Cir. (1964)Scribd Government DocsBelum ada peringkat

- Bankr. L. Rep. P 74,807 in Re David L. Coker in Re Elizabeth R. Coker, Debtors. David L. Coker Elizabeth R. Coker v. Sovran Equity Mortgage Corporation, 973 F.2d 258, 4th Cir. (1992)Dokumen4 halamanBankr. L. Rep. P 74,807 in Re David L. Coker in Re Elizabeth R. Coker, Debtors. David L. Coker Elizabeth R. Coker v. Sovran Equity Mortgage Corporation, 973 F.2d 258, 4th Cir. (1992)Scribd Government DocsBelum ada peringkat

- Production Credit Association of Southern New Mexico v. Alamo Ranch Company, 951 F.2d 1260, 10th Cir. (1991)Dokumen3 halamanProduction Credit Association of Southern New Mexico v. Alamo Ranch Company, 951 F.2d 1260, 10th Cir. (1991)Scribd Government DocsBelum ada peringkat

- United States Court of Appeals, Ninth CircuitDokumen7 halamanUnited States Court of Appeals, Ninth CircuitScribd Government DocsBelum ada peringkat

- Ben H. Frank v. United States, 384 F.2d 276, 10th Cir. (1967)Dokumen3 halamanBen H. Frank v. United States, 384 F.2d 276, 10th Cir. (1967)Scribd Government DocsBelum ada peringkat

- In The Matter of Country Lad Foods, Inc., Bankrupt. Marion B. Stokes, Trustee v. First Georgia Bank, 500 F.2d 393, 1st Cir. (1974)Dokumen2 halamanIn The Matter of Country Lad Foods, Inc., Bankrupt. Marion B. Stokes, Trustee v. First Georgia Bank, 500 F.2d 393, 1st Cir. (1974)Scribd Government DocsBelum ada peringkat

- Collins & Aikman Corporation, Et AlDokumen12 halamanCollins & Aikman Corporation, Et AlChapter 11 DocketsBelum ada peringkat

- United States Court of Appeals, Tenth CircuitDokumen5 halamanUnited States Court of Appeals, Tenth CircuitScribd Government DocsBelum ada peringkat

- American United Mut. Life Ins. Co. v. Avon Park, 311 U.S. 138 (1940)Dokumen8 halamanAmerican United Mut. Life Ins. Co. v. Avon Park, 311 U.S. 138 (1940)Scribd Government DocsBelum ada peringkat

- 118.instrument As Payment, 11 Am. Jur. 2d Bills and Notes 118Dokumen7 halaman118.instrument As Payment, 11 Am. Jur. 2d Bills and Notes 118Theplaymaker508Belum ada peringkat

- Harvey Taylor v. Thomas McCune Slick, Individually and As of The Estate of Dorothy M. Ballantine, Deceased, 178 F.3d 698, 3rd Cir. (1999)Dokumen8 halamanHarvey Taylor v. Thomas McCune Slick, Individually and As of The Estate of Dorothy M. Ballantine, Deceased, 178 F.3d 698, 3rd Cir. (1999)Scribd Government DocsBelum ada peringkat

- PrecedentialDokumen17 halamanPrecedentialScribd Government DocsBelum ada peringkat

- Civil Procedure Rules on Appeals and Demand LettersDokumen14 halamanCivil Procedure Rules on Appeals and Demand LettersRhinnell RiveraBelum ada peringkat

- In Re Peter Gordon Balbus, Debtor. Brown and Company Securities Corporation v. Peter Gordon Balbus, 933 F.2d 246, 4th Cir. (1991)Dokumen15 halamanIn Re Peter Gordon Balbus, Debtor. Brown and Company Securities Corporation v. Peter Gordon Balbus, 933 F.2d 246, 4th Cir. (1991)Scribd Government DocsBelum ada peringkat

- Julie Cotton, Plaintiff-Appellee-Cross-Appellant v. William Slone, Defendant-Appellant-Cross-Appellee, 4 F.3d 176, 2d Cir. (1993)Dokumen8 halamanJulie Cotton, Plaintiff-Appellee-Cross-Appellant v. William Slone, Defendant-Appellant-Cross-Appellee, 4 F.3d 176, 2d Cir. (1993)Scribd Government DocsBelum ada peringkat

- In Re WalkerDokumen28 halamanIn Re Walkerzulu333Belum ada peringkat

- United States Court of Appeals, Tenth CircuitDokumen8 halamanUnited States Court of Appeals, Tenth CircuitScribd Government DocsBelum ada peringkat

- MAC000000082-Memorandum of Law in Support of MotionDokumen44 halamanMAC000000082-Memorandum of Law in Support of MotionMoorish American United Trust100% (2)

- Torrens System FOR REVIEWRDokumen97 halamanTorrens System FOR REVIEWRjohn cruzBelum ada peringkat

- United States Court of Appeals, Ninth CircuitDokumen7 halamanUnited States Court of Appeals, Ninth CircuitScribd Government DocsBelum ada peringkat

- United States v. Melissa Harris, 302 F.3d 72, 2d Cir. (2002)Dokumen5 halamanUnited States v. Melissa Harris, 302 F.3d 72, 2d Cir. (2002)Scribd Government DocsBelum ada peringkat

- 10000003851Dokumen12 halaman10000003851Chapter 11 DocketsBelum ada peringkat

- Sunshine Development, Inc. v. Federal Deposit Insurance Corporation, As Liquidating Agent For First Service Bank For Savings, 33 F.3d 106, 1st Cir. (1994)Dokumen14 halamanSunshine Development, Inc. v. Federal Deposit Insurance Corporation, As Liquidating Agent For First Service Bank For Savings, 33 F.3d 106, 1st Cir. (1994)Scribd Government DocsBelum ada peringkat

- Irving B. GRUBER, Appellant, v. OWENS-ILLINOIS INC., AppelleeDokumen15 halamanIrving B. GRUBER, Appellant, v. OWENS-ILLINOIS INC., AppelleeScribd Government DocsBelum ada peringkat

- Bowles Financial Group, Inc. v. Stifel, Nicolaus & Company, Inc., 22 F.3d 1010, 10th Cir. (1994)Dokumen6 halamanBowles Financial Group, Inc. v. Stifel, Nicolaus & Company, Inc., 22 F.3d 1010, 10th Cir. (1994)Scribd Government DocsBelum ada peringkat

- Tolentino Vs CADokumen2 halamanTolentino Vs CAcheryl talisikBelum ada peringkat

- Spouses Santos vs. CA (G.R 120820)Dokumen12 halamanSpouses Santos vs. CA (G.R 120820)arra saquidoBelum ada peringkat

- United States Court of Appeals, Eleventh CircuitDokumen7 halamanUnited States Court of Appeals, Eleventh CircuitScribd Government DocsBelum ada peringkat

- Mordukhaev v. DausDokumen9 halamanMordukhaev v. Dausannax9Belum ada peringkat

- United States v. Petty Motor Co., 327 U.S. 372 (1946)Dokumen10 halamanUnited States v. Petty Motor Co., 327 U.S. 372 (1946)Scribd Government DocsBelum ada peringkat

- Columbia Casualty Company, Plaintiff-Counter-Defendant-Appellant v. Southern Flapjacks, Inc., and Ann Baldoria, Defendants-Counter-Plaintiffs-Appellees, 868 F.2d 1217, 11th Cir. (1989)Dokumen10 halamanColumbia Casualty Company, Plaintiff-Counter-Defendant-Appellant v. Southern Flapjacks, Inc., and Ann Baldoria, Defendants-Counter-Plaintiffs-Appellees, 868 F.2d 1217, 11th Cir. (1989)Scribd Government DocsBelum ada peringkat

- Exceptions To Sale MDDokumen7 halamanExceptions To Sale MDnilessorrell100% (2)

- State of Michigan Court of Appeals: Avanagh Elly ORT OODDokumen7 halamanState of Michigan Court of Appeals: Avanagh Elly ORT OODzahra ABelum ada peringkat

- United States Court of Appeals, Eleventh CircuitDokumen5 halamanUnited States Court of Appeals, Eleventh CircuitScribd Government DocsBelum ada peringkat

- Mortgage Servicer Settlement Stakeholder FAQsDokumen10 halamanMortgage Servicer Settlement Stakeholder FAQskwillsonBelum ada peringkat

- B65.37.1 Borrower Contributions and Relocation Assistance (11:01:12)Dokumen4 halamanB65.37.1 Borrower Contributions and Relocation Assistance (11:01:12)kwillsonBelum ada peringkat

- Chase Incentive Letter ($35,000)Dokumen1 halamanChase Incentive Letter ($35,000)kwillsonBelum ada peringkat

- FHA Short Sale Sales Contract Review ApprovedDokumen2 halamanFHA Short Sale Sales Contract Review ApprovedkwillsonBelum ada peringkat

- Bank of America Cooperative Short Sale ApprovalDokumen3 halamanBank of America Cooperative Short Sale ApprovalkwillsonBelum ada peringkat

- Citi Short Sale Approval Letter (Non-GSE)Dokumen2 halamanCiti Short Sale Approval Letter (Non-GSE)kwillsonBelum ada peringkat

- 2012 at 1801 Wells FargoDokumen9 halaman2012 at 1801 Wells FargoDinSFLABelum ada peringkat

- Bank of America FHA PFS Incentive LetterDokumen1 halamanBank of America FHA PFS Incentive LetterkwillsonBelum ada peringkat

- Real Time Resolutions Short Sale Approval (2nd Mortgage)Dokumen3 halamanReal Time Resolutions Short Sale Approval (2nd Mortgage)kwillsonBelum ada peringkat

- Module # 7 - Pre Foreclosure Sale OptionDokumen24 halamanModule # 7 - Pre Foreclosure Sale OptionkwillsonBelum ada peringkat

- Ocwen Loan Servicing LLC - Servicing Transfer InformationDokumen1 halamanOcwen Loan Servicing LLC - Servicing Transfer InformationkwillsonBelum ada peringkat

- Bank of America Short Sale Approval (FHA PFS)Dokumen4 halamanBank of America Short Sale Approval (FHA PFS)kwillsonBelum ada peringkat

- Ocwen Short Sale Approval (2nd Mortgage)Dokumen6 halamanOcwen Short Sale Approval (2nd Mortgage)kwillsonBelum ada peringkat

- Greenville County, SC Subdivision Restrictions Prior To 1990Dokumen50 halamanGreenville County, SC Subdivision Restrictions Prior To 1990kwillsonBelum ada peringkat

- Bank of America HAFA Short Sale Approval (Non-GSE)Dokumen5 halamanBank of America HAFA Short Sale Approval (Non-GSE)kwillsonBelum ada peringkat

- SunTrust Short Sale Approval (Fannie Mae)Dokumen3 halamanSunTrust Short Sale Approval (Fannie Mae)kwillson100% (1)

- Webinar III HUD Loss Mitigation Disposition Options ParticipantDokumen45 halamanWebinar III HUD Loss Mitigation Disposition Options Participantkwillson100% (1)

- Bank of America HELOC Short Sale PackageDokumen7 halamanBank of America HELOC Short Sale PackagekwillsonBelum ada peringkat

- Federal Register /vol. 70, No. 33 / Friday, February 18, 2005 / Proposed RulesDokumen23 halamanFederal Register /vol. 70, No. 33 / Friday, February 18, 2005 / Proposed RuleskwillsonBelum ada peringkat

- 5 RVT Nry-: - L TT RM L AelDokumen1 halaman5 RVT Nry-: - L TT RM L AelkwillsonBelum ada peringkat

- Bank of America HELOC Short Sale ApprovalDokumen2 halamanBank of America HELOC Short Sale ApprovalkwillsonBelum ada peringkat

- Compromise Sale AgreementsDokumen4 halamanCompromise Sale AgreementskwillsonBelum ada peringkat

- Suntrust Short Sale PackageDokumen12 halamanSuntrust Short Sale PackagekwillsonBelum ada peringkat

- Citi/Freddie Mac Short Sale Apporval LetterDokumen4 halamanCiti/Freddie Mac Short Sale Apporval LetterkwillsonBelum ada peringkat

- Webinar I HUD Early Delinquency Activities and Loss Mitigation Program Overview - ParticipantDokumen37 halamanWebinar I HUD Early Delinquency Activities and Loss Mitigation Program Overview - ParticipantkwillsonBelum ada peringkat

- Bank of America HAFA Short Sale Approval (Non-GSE)Dokumen4 halamanBank of America HAFA Short Sale Approval (Non-GSE)kwillsonBelum ada peringkat

- ALT RASS WorksheetDokumen1 halamanALT RASS WorksheetkwillsonBelum ada peringkat

- Bank of America - REQUEST FOR APPRAISAL OR REVIEW RECONSIDERATIONDokumen2 halamanBank of America - REQUEST FOR APPRAISAL OR REVIEW RECONSIDERATIONkwillsonBelum ada peringkat

- Wells Fargo - Dodd Frank ActDokumen1 halamanWells Fargo - Dodd Frank ActkwillsonBelum ada peringkat

- Petition For BailDokumen3 halamanPetition For BailMa Charisse E. Gaud - Bautista100% (2)

- SC Overturns CA Ruling on Illegal Dismissal CaseDokumen5 halamanSC Overturns CA Ruling on Illegal Dismissal CaseAlan Vincent FontanosaBelum ada peringkat

- Letter To Congress On The FIRST STEP ActDokumen9 halamanLetter To Congress On The FIRST STEP ActThe Brennan Center for JusticeBelum ada peringkat

- Petitioner vs. vs. Respondents Mariano C. Alegarbes Public Attorney's OfficeDokumen5 halamanPetitioner vs. vs. Respondents Mariano C. Alegarbes Public Attorney's OfficeRobin ScherbatskyBelum ada peringkat

- Joint Affidavit Ranido1Dokumen6 halamanJoint Affidavit Ranido1MarieBelum ada peringkat

- 1 North Sea Continental Shelf CasesDokumen9 halaman1 North Sea Continental Shelf CasesLourd MantaringBelum ada peringkat

- Rodriguez vs. CADokumen8 halamanRodriguez vs. CAAji AmanBelum ada peringkat

- United States Court of Appeals Third CircuitDokumen9 halamanUnited States Court of Appeals Third CircuitScribd Government DocsBelum ada peringkat

- HTJ Sentencing MemoDokumen62 halamanHTJ Sentencing MemozmtillmanBelum ada peringkat

- Code of Ethics for ECE EngineersDokumen3 halamanCode of Ethics for ECE EngineersTristan James Constantino100% (1)

- (PS) Lolmaugh v. County of Sacramento Et Al - Document No. 3Dokumen2 halaman(PS) Lolmaugh v. County of Sacramento Et Al - Document No. 3Justia.comBelum ada peringkat

- Spouses Gulla vs. Heirs of AlejandroDokumen13 halamanSpouses Gulla vs. Heirs of AlejandroJewel Ivy Balabag DumapiasBelum ada peringkat

- Ayodhya VerdictDokumen153 halamanAyodhya VerdictThe Wire100% (1)

- The Original Thirteenth AmendmentDokumen4 halamanThe Original Thirteenth Amendmentruralkiller100% (3)

- Rodolfo vs. People GR No 146964Dokumen2 halamanRodolfo vs. People GR No 146964attyyangBelum ada peringkat

- 2 Disciplinary Authorities Appellate Authorities in Case of Workmen Staff in Punjab National Bank 0Dokumen5 halaman2 Disciplinary Authorities Appellate Authorities in Case of Workmen Staff in Punjab National Bank 0Naishadh JoshiBelum ada peringkat

- Citybank vs. Chua G.R. NO. 102300 Facts of The CaseDokumen3 halamanCitybank vs. Chua G.R. NO. 102300 Facts of The CaseChristopher AndersonBelum ada peringkat

- California Clothing Inc. vs. Quiñones: Bad Faith Abuse of Rights Leads to DamagesDokumen1 halamanCalifornia Clothing Inc. vs. Quiñones: Bad Faith Abuse of Rights Leads to DamagesGigiRuizTicar100% (1)

- Flynn WithdrawalDokumen24 halamanFlynn WithdrawalWashington ExaminerBelum ada peringkat

- Rayo lacks standing to annul Metrobank foreclosureDokumen2 halamanRayo lacks standing to annul Metrobank foreclosureCzarDuranteBelum ada peringkat

- Us V Tayongtong: People vs. GalacgacDokumen10 halamanUs V Tayongtong: People vs. GalacgacReyrhye RopaBelum ada peringkat

- Totally Awesome Civ Pro Outline Alfieri PDFDokumen39 halamanTotally Awesome Civ Pro Outline Alfieri PDFBrett100% (1)

- Donziger 2Dokumen2 halamanDonziger 2Carter WoodBelum ada peringkat

- Civil Procedure - GRT - 1Dokumen10 halamanCivil Procedure - GRT - 1Genesy TimoneraBelum ada peringkat

- Benjamin W. Corey v. United States, 307 F.2d 839, 1st Cir. (1962)Dokumen2 halamanBenjamin W. Corey v. United States, 307 F.2d 839, 1st Cir. (1962)Scribd Government DocsBelum ada peringkat

- Order in Newegg v. SuttonDokumen5 halamanOrder in Newegg v. SuttonDouglas BarnesBelum ada peringkat

- Macamay v. People (2008)Dokumen22 halamanMacamay v. People (2008)LansingBelum ada peringkat

- Insurance Premium Payment RulingsDokumen9 halamanInsurance Premium Payment RulingsLDBelum ada peringkat

- Questions and Suggested Answers in Special ProceedingsDokumen5 halamanQuestions and Suggested Answers in Special ProceedingsFrancis A. DacutBelum ada peringkat

- History of England From The Accession of James II Vol 4 by Thomas Babington MacaulayDokumen532 halamanHistory of England From The Accession of James II Vol 4 by Thomas Babington MacaulayOogvanhorusBelum ada peringkat

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASDari EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASPenilaian: 3 dari 5 bintang3/5 (5)

- Introduction to Negotiable Instruments: As per Indian LawsDari EverandIntroduction to Negotiable Instruments: As per Indian LawsPenilaian: 5 dari 5 bintang5/5 (1)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDari EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingPenilaian: 4.5 dari 5 bintang4.5/5 (97)

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorDari EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorPenilaian: 4.5 dari 5 bintang4.5/5 (132)

- The Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessDari EverandThe Business Legal Lifecycle US Edition: How To Successfully Navigate Your Way From Start Up To SuccessBelum ada peringkat

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorDari EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorPenilaian: 4.5 dari 5 bintang4.5/5 (63)

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpDari EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpPenilaian: 4 dari 5 bintang4/5 (214)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsDari EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesWhite Collar CriminalsPenilaian: 5 dari 5 bintang5/5 (24)

- The Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesDari EverandThe Complete Book of Wills, Estates & Trusts (4th Edition): Advice That Can Save You Thousands of Dollars in Legal Fees and TaxesPenilaian: 4 dari 5 bintang4/5 (1)

- Dealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceDari EverandDealing With Problem Employees: How to Manage Performance & Personal Issues in the WorkplaceBelum ada peringkat

- Global Bank Regulation: Principles and PoliciesDari EverandGlobal Bank Regulation: Principles and PoliciesPenilaian: 5 dari 5 bintang5/5 (2)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesDari EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesPenilaian: 5 dari 5 bintang5/5 (1)

- The Streetwise Guide to Going Broke without Losing your ShirtDari EverandThe Streetwise Guide to Going Broke without Losing your ShirtBelum ada peringkat

- The Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicDari EverandThe Shareholder Value Myth: How Putting Shareholders First Harms Investors, Corporations, and the PublicPenilaian: 5 dari 5 bintang5/5 (1)

- The Motley Fool's Rule Makers, Rule Breakers: The Foolish Guide to Picking StocksDari EverandThe Motley Fool's Rule Makers, Rule Breakers: The Foolish Guide to Picking StocksPenilaian: 4 dari 5 bintang4/5 (3)

- Ben & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooDari EverandBen & Jerry's Double-Dip Capitalism: Lead With Your Values and Make Money TooPenilaian: 5 dari 5 bintang5/5 (2)

- The HR Answer Book: An Indispensable Guide for Managers and Human Resources ProfessionalsDari EverandThe HR Answer Book: An Indispensable Guide for Managers and Human Resources ProfessionalsPenilaian: 3.5 dari 5 bintang3.5/5 (3)

- The Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersDari EverandThe Startup Visa: U.S. Immigration Visa Guide for Startups and FoundersBelum ada peringkat

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementDari EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementPenilaian: 4.5 dari 5 bintang4.5/5 (20)