MTG Planning Brochure

Diunggah oleh

Ken CaianiDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

MTG Planning Brochure

Diunggah oleh

Ken CaianiHak Cipta:

Format Tersedia

Suite of

Personalized Mortgage Plan

your goals +

Integrate your largest financial instrument with

your goals

RateWatch Report Mortgage

our planning = P l a n n i n g

Maintain complete control over how your loan is

performing

total strategy S e r v i c e s

Annual Equity Review

Achieve optimal equity through an in-depth review

Do you realize that your mortgage has a performance The Annual Equity Review service, t akes an in-depth look

record? It is either contributing to or detracting from at your complete equity and debt positions, providing you

your goals. It is either accelerating or reducing the speed with the information you need to make informed, mature,

at which you will reach your financial t argets. So why is and timely decisions that will optimize your equity for

it that most people simply view their home loan as if it short- and long-term planning.

were a financial obligation rather than a financial

instrument? One of the reasons is that the mortgage

industry has lacked the proper tools and training to give

you the information you need. That is, until now.

Personalized

To better serve my clients, I have invested in training,

propriet ary tools and technology to deliver a unique set

Mortgage Plan

of services. The Personalized Mortgage Plan, the

RateWatch, and the Annual Equity Review will

empower you as my client to integrate your mortgage RateWatch

into your financial plan. As a result, you can be

confident that your mortgage doesn’t inhibit the pace at Report

which you can reach your goals.

Services provided by:

The Personalized Mortgage Plan enables you to make Ken Caiani

the best financing choice by assessing every component Annual Equity

of each loan option over a period of time. By Review

underst anding the tot al cost and tot al benefits, you will

have full knowledge to make the best decision.

The RateWatch Review offers you the opportunity to

monitor the performance of your mortgage on an

ongoing basis. You will have the information you need By choosing to use me as your Owner, you will benefit Inform Mortgage

to determine if the changes in your life or in market from each of these core services as well as my team’s p 303-830-1151

conditions warrant fine tuning of your mortgage exceptional level of execution. f 303-539-9879

instrument.

www.informmortgage.com

Powered By Mortgage Coach

Personalized Mortgage Plan RateWatch Report Annual Equity Review

Integrate your largest Maintain complete Achieve optimal

financial instrument control over how your equity through an

with your goals loan is performing in-depth review

Your Personalized As your Mortgage It has been said that

Mortgage Plan can Planner, I believe that the only thing that is

have a powerful my work really begins const ant is change.

impact on your overall with the closing of your The Annual Equity

financial picture. loan. The RateWatch Review t akes an in-

Consumers who secure the services of a mortgage Report is a service designed to help you maint ain depth look at the various aspects of your mortgage’s

planning professional are uniquely empowered to continual control over the performance of your performance, allowing you to determine if your loan

make solid decisions. By using the Personalized mortgage. I will be proactively providing you with is continuing to contribute to the acceleration of your

Mortgage Plan, you will underst and the tot al cost information and analysis to review how your loan financial goals. If the changes in your life warrant

and the tot al benefit of every option available. compares to current options. You will enjoy const ant changes in your financing, you’ll be able to make

Whether it is optimizing equity or debt, aligning the control over having the financial dat a you need to that decision. Just as we go to the doctor for regular

determine if the changes in your life or in market checkups for our bodies, the Annual Equity Review

mortgage with your financial goals, adjusting for life

conditions warrant the fine tuning of your mortgage will empower you to optimize your equity by helping

events, or preserving cash flow, a mortgage plan

instrument. you to assess your mortgage’s “health” each year.

clarifies the decision-making process.

The Total Cost Analysis The RateWatch Analysis The Equity Repositioning Analysis

The Total Cost Analysis performs the The RateWatch Analysis captures the current The Equity Repositioning Analysis illustrates

industry’s most powerful side-by-side analysis of status of a loan’s performance (rate, payment, the value and power of restructuring debt and

a loan’s performance over time. More remaining balance) and presents it in the equity. This unique analysis helps you to calculate

importantly, it highlights two specific areas of meaningful context of today’s market conditions. the totality of your current debt structure and

the total loan cost and benefit. First, it measures If your goal is to pay off your mortgage as quickly assess how certain adjustments might support

the true financial impact for the homeowner if as possible, you can quickly determine the your financial goals. Whether it is increased

he or she were to invest the savings of a given savings achieved by doing so in varying amounts. savings, maximized investment return, or early

In addition, if you need to focus on maximizing retirement of your mortgage debt, specific

loan into an asset accumulation account.

your cash flow, that information is also at your numbers are available for your consideration.

Second, it demonstrates the power and benefits

fingertips. Because the information provided in Optimizing equity can be one of the most

of repaying the debt early. Because the

The RateWatch Analysis is timely and powerful controls for you as the homeowner. The

information provided in this unique report is Equity Repositioning Analysis will give you the

complete, you will appreciate the confidence of meaningful, you will experience a level of control

over your mortgage unique to most consumers. data you need to optimize your equity and

knowing your best interests are being served. properly manage your debt.

Anda mungkin juga menyukai

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Morals and Dogma of The Ineffable DegreesDokumen134 halamanMorals and Dogma of The Ineffable DegreesCelephaïs Press / Unspeakable Press (Leng)86% (7)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Descartes and The JesuitsDokumen5 halamanDescartes and The JesuitsJuan Pablo Roldán0% (3)

- ICargo Mobility QantasDokumen4 halamanICargo Mobility QantasViswateja KrottapalliBelum ada peringkat

- Barrier Solution: SituationDokumen2 halamanBarrier Solution: SituationIrish DionisioBelum ada peringkat

- CG Road EscortsDokumen3 halamanCG Road EscortsNeha SharmaBelum ada peringkat

- Ocampo - v. - Arcaya-ChuaDokumen42 halamanOcampo - v. - Arcaya-ChuaChristie Joy BuctonBelum ada peringkat

- Impacts of Cultural Differences On Project SuccessDokumen10 halamanImpacts of Cultural Differences On Project SuccessMichael OlaleyeBelum ada peringkat

- Quality Audit Report TemplateDokumen3 halamanQuality Audit Report TemplateMercy EdemBelum ada peringkat

- Final Advert For The Blue Economy PostsDokumen5 halamanFinal Advert For The Blue Economy PostsKhan SefBelum ada peringkat

- Farhat Ziadeh - Winds Blow Where Ships Do Not Wish To GoDokumen32 halamanFarhat Ziadeh - Winds Blow Where Ships Do Not Wish To GoabshlimonBelum ada peringkat

- Firewall Training, Checkpoint FirewallDokumen7 halamanFirewall Training, Checkpoint Firewallgaurav775588Belum ada peringkat

- Henry IV Part 1 Study GuideDokumen21 halamanHenry IV Part 1 Study GuideawtshfhdBelum ada peringkat

- About Debenhams Company - Google SearchDokumen1 halamanAbout Debenhams Company - Google SearchPratyush AnuragBelum ada peringkat

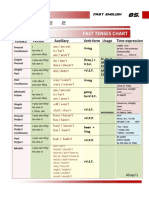

- Table 2: Fast Tenses ChartDokumen5 halamanTable 2: Fast Tenses ChartAngel Julian HernandezBelum ada peringkat

- Dewi Handariatul Mahmudah 20231125 122603 0000Dokumen2 halamanDewi Handariatul Mahmudah 20231125 122603 0000Dewi Handariatul MahmudahBelum ada peringkat

- Automated Behaviour Monitoring (ABM)Dokumen2 halamanAutomated Behaviour Monitoring (ABM)prabumnBelum ada peringkat

- A Wolf by The Ears - Mattie LennonDokumen19 halamanA Wolf by The Ears - Mattie LennonMirBelum ada peringkat

- Military Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersDokumen13 halamanMilitary Laws in India - A Critical Analysis of The Enforcement Mechanism - IPleadersEswar StarkBelum ada peringkat

- Methodology For Rating General Trading and Investment CompaniesDokumen23 halamanMethodology For Rating General Trading and Investment CompaniesAhmad So MadBelum ada peringkat

- Assignment MS-28 Course Code: MS - 28 Course Title: Labour Laws Assignment Code: MS-28/TMA/SEM - II /2012 Coverage: All BlocksDokumen27 halamanAssignment MS-28 Course Code: MS - 28 Course Title: Labour Laws Assignment Code: MS-28/TMA/SEM - II /2012 Coverage: All BlocksAnjnaKandariBelum ada peringkat

- Martin, BrianDokumen3 halamanMartin, Brianapi-3727889Belum ada peringkat

- ChinduDokumen1 halamanChinduraghavbiduru167% (3)

- On Ciber RimeDokumen9 halamanOn Ciber Rimenehil bhaktaBelum ada peringkat

- Asking Who Is On The TelephoneDokumen5 halamanAsking Who Is On The TelephoneSyaiful BahriBelum ada peringkat

- Role and Responsibilities of Forensic Specialists in Investigating The Missing PersonDokumen5 halamanRole and Responsibilities of Forensic Specialists in Investigating The Missing PersonMOHIT MUKULBelum ada peringkat

- Service Index PDF - PHP Content Id 2378053&content Tid 388906138&content Type TempDokumen2 halamanService Index PDF - PHP Content Id 2378053&content Tid 388906138&content Type Tempshiripalsingh0167Belum ada peringkat

- Mulanay SummaryDokumen1 halamanMulanay SummaryJex Lexell BrionesBelum ada peringkat

- Mormond History StudyDokumen16 halamanMormond History StudyAndy SturdyBelum ada peringkat

- Us and China Trade WarDokumen2 halamanUs and China Trade WarMifta Dian Pratiwi100% (1)

- Executive Summary: College of EngineeringDokumen17 halamanExecutive Summary: College of Engineeringjoel c. herreraBelum ada peringkat