The Bank of Punjab.1

Diunggah oleh

Malik Waqas AhmadDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

The Bank of Punjab.1

Diunggah oleh

Malik Waqas AhmadHak Cipta:

Format Tersedia

HISTORY OF BANKING

Bank is a pipeline through which currency moves into and out of circulation. Bank accepts deposits and repays cash to its customers on their demand. T h e Bank borrows money at a lesser rate of interest and lends it to t h e borrowers at a higher rate. It is thus a profit -lending concern. Bank cannotlend all the money that has been deposited with it. It has to keep a certain p o r t i o n o f t h e t o t a l d e p o s i t s i n c a s h w i t h t h e m i n o r d e r t o m e e t t h e c a s h requirements of the individuals and business concern. Banking History: Word Bank is said to be derived from the words Banc us or Banque or Bank. The history of banking is traced to as early as 200 BC. The priests in Greeceused to keep money and valuables of the people in temples . These prieststhus acted as financial agents. The origin of banking is also traced to

earlyg o l d s m i t h s . T h e y u s e d t o k e e p s t r o n g s a f e s f o r s t o r i n g t h e m o n e y a n d valuables of the people. The persons who had surplus money found it safeand convenient to deposit their valuables with them. The FIRST STAGE in thedevelopment of modern banking, thus, was the accepting of deposits of cashfrom those persons who had surplus money with them.The goldsmiths used to issue receipts for the money deposited with them.These receipts began to pass from hand to hand in settlement of transactionsbecause people had confidence in the integrity and solvency of goldsmiths.W h e n it was found that these receipts were drawn in

s u c h a w a y t h a t i t entitles any holder to claim the specified amount of money from goldsmiths. Adepositor who is to make the payments may now get the money in cash fromgoldsmiths or pay over the receipt to the creditor. These receipts were the earlier bank notes. The SECOND STAGE

in development of banking thus wasthe issue of bank notes.The goldsmiths soon discovered that all the people who had deposited moneywith them did not come to withdraw their funds in cash. They found that only afew persons presented the receipt for encashment during a given period of 1

The Bank of Punjab time. They also found that most of the money deposited with was lying idle. Atthe same time, they found that they were being constantly requested for loanon good security. They thought it profitable to lend at least some of the moneydeposited with them too the needy persons. This proved quite a

profitableb u s i n e s s f o r t h e g o l d s m i t h s . T h e y i n s t e a d o f c h a r g i n g i n t e r e s t f r o m t h e depositors began to give them interest on the money deposited with them.This was the THIRD STAGE, in the development of

banking.B y e x p e r i e n c e t h e b a n k s c a m e t o k n o w t h a t t h e y c o u l d k e e p a s m a l l proportion of the total deposits for meeting the demands of customers for cash and the rest they could easily lend. They allowed the depositors to drawo v e r and above the money actua lly standing to their credit. In

Economicsterminology we can say o v e r d r a f t f a c i l i t i e s t o t h e i r depositors. This was the FOURTH STAGE,

that they allowed the

in development of banking.When every bank issues receipts and most of them allowed the overdraftf a c i l i t i e s , t h e r e w a s t h e n t o o m u c h c o n f u s i o n i n t h e b a n k i n g s y s t e m . T h e banks in order to earn profits could not keep adequate reserves for meetingt h e d e m a n d s o f t h e c u s t o m e r s f o r c a s h . T h e f a i l u r e s o n t h e p a r t o f t h e bankers to return money caused widespread distress among the peoples.In order to create confidence among the people, steps were taken to regulatethe banking organization. A conference was held in Nuremberg in 1548.

It wasdecided that a bank should be set up by the state, which should streamline the banking organization and technique. The first central bank was formed inGeneva in 1578. Bank of England was established in 1694. The responsibilityof issuing of notes is now entrusted to a central bank of each country. COMMERCIAL BANKING IN PAKISTAN:

At the time of partition total number of Banks were 38 only. Out of t h e s e Banks the Pakistani Banks were only 2 , Indian Banks 29 & Exchange

Banksw e r e 7 . T h e t o t a l o f d e p o s i t s o f P a k i s t a n i B a n k s w a s R s . 8 8 0 M i l l i o n . & advances were Rs: 198 Million.. Accordin g to banking companies ordinanceB a n k s a r e t h e c o m p a n i e s , w h i c h t r a n s a c t s t h e b u s i n e s s o f Banking in 2

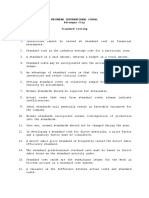

The Bank of Punjab 14. Group means persons, whether natural or juridical, if one of them or his dependentfamily members or its subsidiary, have control or hold substantial ownership interest over the other. For the purpose of this:(a) Subsidiary will have the same meaning as defined in sub-section 3(2) of theCompanies Ordinance, 1984 i.e. a company or a body corporate shall deemed to be asubsidiary of another company if that other company or body corporate directly or indirectly controls, beneficially owns or holds more than 50% of its voting securities or otherwise has power to elect and appoint more than 50% of its directors.(b) Control refers to an ownership directly or indirectly through subsidiaries, of more thanone half of voting power of an enterprise.(c) Substantial ownership / affiliation 3

means beneficial shareholding of more than 25%by a person and/or by his dependent family members, which will include his/her spouse,dependent lineal ascendants and descendants and dependent brothers and sisters.However, shareholding in or by the Government owned entities and financial institutionswill not constitute substantial ownership / affiliation, for the purpose of these regulations.15. Liquid Assets are the assets which are readily convertible into cash without recourseto a court of law and mean encashment / realizable value of government securities, bankdeposits, certificates of deposit, shares of listed companies which are actively traded onthe stock exchange, NIT Units, certificates of mutual funds, Certificates of Investment(COIs) issuedby DFIs / NBFCs rated at least A by a credit rating agency on the approved panel of State Bank of Pakistan, listed TFCs rated at least A by a credit rating agency on theapproved panel of State Bank of Pakistan and certificates of asset managementcompanies for which there is a book maker quoting daily offer and bid rates and there isactive secondary market trading. These assets with appropriate margins should be inpossession of the banks / DFIs with perfected lien.Guarantees issued by domestic banks / DFIs when received as collateral by banks / DFIswill be treated at par with liquid assets whereas, for guarantees issued by foreign banks,the issuing banks rating, assigned either by Standard & Poors, Moodys or Fitch-Ibca,should be A and above or equivalent.The inter-branch indemnity / guarantee issued by the banks overseas branch in favor of its sister branch in Pakistan, would also be treated at par with liquid assets, provided the 50

The Bank of Punjab bank is rated A and above or equivalent either by Standard & Poors, Moodys or Fitch-Ibca. The indemnity for this purpose should be similar to a guarantee i.e. unconditionaland demand in nature.16. Major Shareholder of a bank / DFI means any person holding 5% or more of theshare capital of a bank / DFI either individually or in concert with family members. Familymembers have the same meaning as defined in the Banking Companies Ordinance,1962.17. Medium and Long Term Facilities

mean facilities with maturities of more than oneyear and Short Term Facilities mean facilities with maturities up to one year 18. NBFC means Non-Banking Finance Company and includes a Modaraba, LeasingCompany, Housing Finance Company, Investment Bank, Discount House, AssetManagement Company and a Venture Capital Company.19. Other Form of Security means hypothecation of stock (inventory), assignment of receivables, lease rentals, contract receivables, etc.20. PBA means Pakistan Banks Association.21. Person means and includes an individual, a Hindu undivided family, a firm, anassociation or body of individuals whether incorporated or not, a company and everyother juridical person.22. Readily Realizable Assets mean and include liquid assets and stocks pledged to thebanks / DFIs in possession, with perfected lien duly supported with completedocumentation.23. Secured means exposure backed by tangible security and any other form of securitywith appropriate margins (in cases where margin has been prescribed by State Bank,appropriate margin shall at least be equal to the prescribed margin). Exposure withoutany security or collateral is defined as clean. 51

The Bank of Punjab The banks / DFIs may also take exposure against Trust Receipt. They are, however, freeto take collateral / securities, to secure their risks / exposure, in addition to the TrustReceipt.Banks /DFIs will be free to decide about obtaining security / collateral against theL/C facilities for the interim period, i.e. from the date of opening of L/C till the receipt of title documents to the goods.24. Subordinated Loan

means an unsecured loan extended to the borrower by itssponsors, subordinate to the claim of the bank / DFI taking exposure on the borrower anddocumented by a formal sub-ordination agreement between provider of the loan and thebank / DFI. The loan shall be disclosed in the annual audited financial statements of theborrower as subordinated loan.25. Tangible Security means readily realizable assets (as defined in these PrudentialRegulations), mortgage of land, plant, building, machinery and any other fixed assets.26. Underwriting Commitments mean commitments given by commercial banks / DFIsto the limited companies at the time of new issue of equity /debt instrument, that in casethe proposed issue of equity / debt instrument is not fully subscribed, the un-subscribedportion will be taken up by them (commercial banks / DFIs). 52

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Project Report FINAL DLFDokumen111 halamanProject Report FINAL DLFPunjabi Put33% (3)

- PartnershipDokumen15 halamanPartnershipchowchow12364% (11)

- Summer Internship ProjectDokumen51 halamanSummer Internship ProjectMahesh SatapathyBelum ada peringkat

- CocaDokumen8 halamanCocaRJ Rishabh TyagiBelum ada peringkat

- Sec 11-42Dokumen5 halamanSec 11-42Angel DeiparineBelum ada peringkat

- Parts List CT 20 NewDokumen204 halamanParts List CT 20 NewRightpepe100% (7)

- Reporte de Izipay 2023Dokumen47 halamanReporte de Izipay 2023Mary Sanchez de la CruzBelum ada peringkat

- Before You Read The Chapter One of The Project Topic Below, Please Read The Information Below - Thank You!Dokumen11 halamanBefore You Read The Chapter One of The Project Topic Below, Please Read The Information Below - Thank You!Adeola StephenBelum ada peringkat

- POC InfoDokumen3 halamanPOC InfoRooplata NayakBelum ada peringkat

- Amendments Toc A 1965Dokumen260 halamanAmendments Toc A 1965NuHar MisranBelum ada peringkat

- Fintech's Road To Regulatory Acceptance Is Just Starting - PaymentsSourceDokumen4 halamanFintech's Road To Regulatory Acceptance Is Just Starting - PaymentsSourceLondonguyBelum ada peringkat

- Pre and Post Merger P-E RatiosDokumen5 halamanPre and Post Merger P-E RatiosPeter OnyangoBelum ada peringkat

- BACH database overviewDokumen2 halamanBACH database overviewpaul_costasBelum ada peringkat

- Cost of Production Report - July 2018 v1Dokumen300 halamanCost of Production Report - July 2018 v1Mark christianBelum ada peringkat

- Nepal sole trading registration requirementsDokumen2 halamanNepal sole trading registration requirementsAnup Jung BasnetBelum ada peringkat

- LA BUGAL-B'LAAN Case Environmental Law CasesDokumen113 halamanLA BUGAL-B'LAAN Case Environmental Law CasesAnthony Rupac EscasinasBelum ada peringkat

- IFRS and US GAAP Revenue Recognition ConvergenceDokumen12 halamanIFRS and US GAAP Revenue Recognition Convergencesusieqnorthrock0% (1)

- T2 Accredited Fund Letter To Investors June 12Dokumen10 halamanT2 Accredited Fund Letter To Investors June 12VALUEWALK LLCBelum ada peringkat

- BYEJOE Teaser FinalDokumen2 halamanBYEJOE Teaser FinalMayur BhoyarBelum ada peringkat

- Assignment 3 - Standard CostingDokumen4 halamanAssignment 3 - Standard CostingJayhan PalmonesBelum ada peringkat

- RCom Gets Rs 1,400cr Order from HDFC Bank to Build Large Data CentreDokumen7 halamanRCom Gets Rs 1,400cr Order from HDFC Bank to Build Large Data CentreSamyra RathoreBelum ada peringkat

- Carol Lam Appointed Chief Creative Officer and Managing Director For DDB Group Hong KongDokumen2 halamanCarol Lam Appointed Chief Creative Officer and Managing Director For DDB Group Hong KongDDBcomPRBelum ada peringkat

- Vardhaman TextilesDokumen96 halamanVardhaman TextilesRathinakumar Natarajan100% (1)

- IFRS 5 Implementation GuidanceDokumen18 halamanIFRS 5 Implementation GuidanceMariana Mirela0% (1)

- Cityside Event-11.14Dokumen16 halamanCityside Event-11.14Anonymous MjYNGDGzUBelum ada peringkat

- Project Report for Term Loan of Rs. 45.40 LacsDokumen16 halamanProject Report for Term Loan of Rs. 45.40 LacsneerajthakurBelum ada peringkat

- Gupta's Strike Black GoldDokumen1 halamanGupta's Strike Black GoldCityPress67% (3)

- 068 Prequalification For Solid Waste MGTDokumen29 halaman068 Prequalification For Solid Waste MGTapi-257737819Belum ada peringkat

- Chapter 6Dokumen104 halamanChapter 6mrinalbohraBelum ada peringkat

- Advantages and Disadvantages of The FloatingDokumen22 halamanAdvantages and Disadvantages of The FloatingFarhana KhanBelum ada peringkat