Srep Pvof-1 q4 Update

Diunggah oleh

Bruce BartlettDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Srep Pvof-1 q4 Update

Diunggah oleh

Bruce BartlettHak Cipta:

Format Tersedia

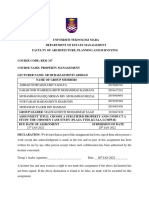

SEQUOIA REAL ESTATE PARTNERS

2011 Pacific Value Opportunities Fund I Update

The fourth quarter was a busy one for Pacific Value Opportunities Fund I, as we acquired two additional assets: a 24-unit apartment building located in the Koreatown area of Los Angeles, and another singlefamily home in South Los Angeles. The Fund now owns two apartment buildings (85 units total, including one non-conforming unit) and four homes. Of the original Fund equity, we have invested approximately 95% to fund the acquisitions and various capital improvements made to the acquired assets. As discussed in more detail below, we anticipate monetizing one or more Fund assets in the next 12 to 18 months. Details of the Fund assets are as follows: APARTMENT ASSETS 318 S. Commonwealth Avenue, Los Angeles 90020 Three stories, 24 units (18 singles, 6, one bedroom, one bath) Purchase price: $1.329 million ($53K per unit) Acquired November 2011 Year built: 1927 (rent-controlled) Construction: Brick

To fund the building purchase, we secured $1.09 million of 10-year fixed rate financing from Fannie Mae at a rate of 4.74%. The overall strategy is to hire a new on-site manager, renovate the common areas (lobby, hallways, laundry room) and exterior (paint and landscape), renovate unit interiors, and increase rents as tenants vacate. We have budgeted approximately $40-50K for the proposed renovations and unit turns. The building is rent-controlled, so we will actively manage leases and promote renter turn where feasible. We believe we acquired the asset at a very favorable price, and plan to reposition the property for a sale in either 2012 or 2013. 245 N. Alvarado Avenue, Los Angeles 90026 Three stories, 60 units (36, one bedroom, one bathroom; 19, two bed- two bath; five two bed + loft, one bath; and, one non-conforming) Purchase price: $7.525 million ($125K/unit) Renovation costs to date: approximately $400,000 Acquired November 2010 Year built: 1990 (not rent-controlled) Construction: wood-frame stucco

10990 Wilshire Blvd

Suite 420

Los Angeles

CA

90024

310 312 4807

SEQUOIA REAL ESTATE PARTNERS

We have essentially completed all of the common area and exterior renovation work at the 245 property, which was substantial. Many of you visited the property both "before and after" and can testify to the extensive work that was done. We have also completed upgrades on 23 of the units, have nine more unit renovations in progress, and have nearly finished work on a new assistant manager's unit (the nonconforming unit) and added a small gym on the building's ground floor. The building is now 90% occupied, with all rent-ready units rented. We will likely market the building for sale sometime towards the end of the first quarter of 2012. Depending on what interest received, we may decide to sell the building, though we may also decide to continue to own and operate the asset, with an eye towards commencing cash distributions. SINGLE-FAMILY RESIDENCES/OTHER ASSETS 4161 Mandalay Drive, Los Angeles 90063 Single-family home Four bedrooms, three bathrooms Acquired March 2011 Purchase price of $212,000 Renovation costs = approximately $45,000 Currently leased for $2,250 per month Estimated fair market value = $300,000

908 Frigate Avenue, Wilmington 90744 Duplex Six bedrooms, four bathrooms Acquired August 2011 Purchase price of $220,000 Renovation costs = approximately $11,000 Currently leased for $2,600 per month Estimated fair market value = $320,000

3118 Palo Verde Avenue, Long Beach 90808 Single-family home Three bedrooms, two bathrooms Acquired September 2011 Purchase price of $307,000 Renovation costs = approximately $3,000 Currently leased for $2,200 per month Estimated fair market value = $380,000

10990 Wilshire Blvd

Suite 420

Los Angeles

CA

90024

310 312 4807

SEQUOIA REAL ESTATE PARTNERS

3137 W. 108th Street, Los Angeles 90303

Single-family home Two-bedrooms, one bathroom Acquired November 2011 Purchas e price of $155,000 Renovation costs are to be determined, but likely to range from $9,000 - $60,000. We are contemplating adding on another one or two bedrooms and bathroom, and are soliciting bids for such work. Estimated fair market value = $220,000 - $320,000 (pending upgrades)

We are considering several alternatives for the four homes. They are all currently generating positive cash flows and cash returns on equity of between six and 10 percent. It is likely that we will market one or more of the homes for sale in 2012. Overall, we continue to be pleased with the progress that 2011 has brought Fund I both in terms of acquisitions and repositioning of assets. While the global economic picture remains decidedly uncertain and volatile - conditions that will likely continue well into 2012 until there is greater clarity into the situation in Europe, China (and its ability to steer itself to a "soft landing"), the toxic political climate here at home, and the impact all of this (and more) will have on GDP both here and globally - the rental housing market continues to perform very well for all of the reasons we have laid out in past missives. Rising rents, declining home ownership, dropping unemployment levels, and the declining cost of core inputs upon which we rely (e.g., labor, building materials, and capital) have launched significant interest in multifamily assets. Not surprisingly, many are now jumping on the multifamily bandwagon. A recent Wall Street Journal article (December 21st) noted that large commercial developers like Boston Properties, Mack-Cali Realty, SL Green, and Macerich have all either "acquired, completed, or broken ground on apartment buildings in recent months, or plan to do so next year". All have traditionally focused exclusively on office and/or retail projects. Data released by the Commerce Department a day earlier indicated that November multifamily construction starts increased 25.3% from the previous month. For experienced players like Sequoia, we believe that favorable acquisitions will remain available, while the markets provide significant opportunities to harvest our Fund I assets. Meanwhile, we will stick to our knitting, seeking out value-add opportunities (as opposed to higher-risk development and speculation), focusing on acquiring assets in need of significant repositioning and hands-on property management, and concentrating on assets overlooked by the larger institutional players and the Johnny Come Latelys. We look forward to reporting additional progress in upcoming reports and news surrounding the launch of our second fund sometime in early 2012. All of us at Sequoia Real Estate Partners and the Pacific Value Opportunity Fund I would like to wish you and yours a very healthy, happy, and prosperous holiday season and New Year.

10990 Wilshire Blvd

Suite 420

Los Angeles

CA

90024

310 312 4807

Anda mungkin juga menyukai

- Value Investing Congress Presentation-Tilson-10!1!12Dokumen93 halamanValue Investing Congress Presentation-Tilson-10!1!12VALUEWALK LLCBelum ada peringkat

- DLF New Town Gurgaon Soicety Handbook RulesDokumen38 halamanDLF New Town Gurgaon Soicety Handbook RulesShakespeareWallaBelum ada peringkat

- NYCAPPH Comments On NYCHA Plan Position 2017Dokumen10 halamanNYCAPPH Comments On NYCHA Plan Position 2017Susannah PasquantonioBelum ada peringkat

- Property Inc Magazine 01Dokumen84 halamanProperty Inc Magazine 01Rafael AlemanBelum ada peringkat

- Barclays US REITs Real Estate The Year Ahead Conference - Key TakeawaysDokumen17 halamanBarclays US REITs Real Estate The Year Ahead Conference - Key TakeawaysJames ChaiBelum ada peringkat

- What's Up With The Flipping Market - Research Center RedfinDokumen7 halamanWhat's Up With The Flipping Market - Research Center RedfinWilliam E. Nassour IIIBelum ada peringkat

- Scotsman201610ce DLDokumen101 halamanScotsman201610ce DLHelpin HandBelum ada peringkat

- Unité D'habitationDokumen21 halamanUnité D'habitationkenBelum ada peringkat

- High Rise Task Force ReportDokumen46 halamanHigh Rise Task Force ReportABC7NewsBelum ada peringkat

- Unlawful Detainer (Tolerance)Dokumen3 halamanUnlawful Detainer (Tolerance)Karlo YumulBelum ada peringkat

- Toll Brothers 2007Dokumen14 halamanToll Brothers 2007Eesha Ü CaravanaBelum ada peringkat

- Internship ReportDokumen78 halamanInternship ReportRakesh Rake100% (1)

- Srep Pvof1 q2 UpdateDokumen4 halamanSrep Pvof1 q2 UpdateBruce BartlettBelum ada peringkat

- Builders Outlook 2016 Issue 7Dokumen16 halamanBuilders Outlook 2016 Issue 7TedEscobedoBelum ada peringkat

- Makan Construction (Makan Land Development LLC), New YorkDokumen16 halamanMakan Construction (Makan Land Development LLC), New Yorkkumar1023Belum ada peringkat

- SPRING 2012: Policy Continues To Drive Housing PerformanceDokumen4 halamanSPRING 2012: Policy Continues To Drive Housing PerformancelsteamdebokBelum ada peringkat

- 2011 Annual Real Estate ReportDokumen12 halaman2011 Annual Real Estate ReportJohn McClellandBelum ada peringkat

- SPRING 2012: Policy Continues To Drive Housing PerformanceDokumen4 halamanSPRING 2012: Policy Continues To Drive Housing PerformanceJason CarrierBelum ada peringkat

- Sample Loan ProposalDokumen24 halamanSample Loan ProposalFarhan TariqBelum ada peringkat

- Hochul Housing Coalition Letter PrsDokumen4 halamanHochul Housing Coalition Letter PrsNick ReismanBelum ada peringkat

- H Inc.: Affordable Housing Milestone Reached, But More Work AheadDokumen13 halamanH Inc.: Affordable Housing Milestone Reached, But More Work AheadanhdincBelum ada peringkat

- UPD Bond BrochureDokumen24 halamanUPD Bond BrochureRobert PiechotaBelum ada peringkat

- Wakefield Reutlinger Realtors Newsletter 1st Quarter 2013Dokumen4 halamanWakefield Reutlinger Realtors Newsletter 1st Quarter 2013Wakefield Reutlinger RealtorsBelum ada peringkat

- October Builders OutlookDokumen15 halamanOctober Builders OutlookTedEscobedoBelum ada peringkat

- Havenpark Letter To Sen. Warren and Rep. LoebsackDokumen4 halamanHavenpark Letter To Sen. Warren and Rep. LoebsackZachary Oren SmithBelum ada peringkat

- H Inc.: The ReaderDokumen10 halamanH Inc.: The ReaderanhdincBelum ada peringkat

- $8.9Bln of U.S. CMBS Prices During 3Q: 3Q Investment-Sales in NYC Up 110% From 10Dokumen10 halaman$8.9Bln of U.S. CMBS Prices During 3Q: 3Q Investment-Sales in NYC Up 110% From 10danielpmoynihanBelum ada peringkat

- Too Little Too Late: A NH DDokumen20 halamanToo Little Too Late: A NH DanhdincBelum ada peringkat

- Request-Tejon Ranch AR10FinalDokumen20 halamanRequest-Tejon Ranch AR10Finalbrlam10011021Belum ada peringkat

- Mortgage Observer May 2012Dokumen36 halamanMortgage Observer May 2012NewYorkObserverBelum ada peringkat

- Builders Utlook: Housing Recovery Picks Up Steam Despite Persistent HeadwindsDokumen16 halamanBuilders Utlook: Housing Recovery Picks Up Steam Despite Persistent HeadwindsTedEscobedoBelum ada peringkat

- Asss HousingDokumen3 halamanAsss HousingJohn Renier AureadaBelum ada peringkat

- 37 Hillside Project Description 2.18.20Dokumen8 halaman37 Hillside Project Description 2.18.20Wenqi NiBelum ada peringkat

- Beverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsDokumen2 halamanBeverly Hills Market Watch: Home Prices Up 9.7% in January From Year Earlier, Corelogic ReportsNanette MarchandBelum ada peringkat

- Bam 2012 q1 LTR To ShareholdersDokumen6 halamanBam 2012 q1 LTR To ShareholdersDan-S. ErmicioiBelum ada peringkat

- Albuquerque Journal Homestyle 07/03/2016Dokumen11 halamanAlbuquerque Journal Homestyle 07/03/2016Albuquerque JournalBelum ada peringkat

- Home Economic Report Oct 21Dokumen2 halamanHome Economic Report Oct 21Adam WahedBelum ada peringkat

- H Inc.: The ReaderDokumen12 halamanH Inc.: The ReaderanhdincBelum ada peringkat

- Lakeside LLC Pre Due Diligence InvestorDokumen9 halamanLakeside LLC Pre Due Diligence InvestorTyson AllenBelum ada peringkat

- Bam 2012 q3 LTR To ShareholdersDokumen7 halamanBam 2012 q3 LTR To ShareholdersDan-S. ErmicioiBelum ada peringkat

- Fiscal Policy, Politics and Weather Patterns... : Julie WillisDokumen4 halamanFiscal Policy, Politics and Weather Patterns... : Julie WillisJulie Crismond WillisBelum ada peringkat

- Bienville Macro Review (U.S. Housing Update)Dokumen22 halamanBienville Macro Review (U.S. Housing Update)bienvillecapBelum ada peringkat

- Asss HousingDokumen4 halamanAsss HousingJohn Renier AureadaBelum ada peringkat

- Co 07-13-2016Dokumen72 halamanCo 07-13-2016NewYorkObserverBelum ada peringkat

- Builders Utlook: NAHB's Supreme Court Victory Stops EPA in Its TracksDokumen16 halamanBuilders Utlook: NAHB's Supreme Court Victory Stops EPA in Its TracksTedEscobedoBelum ada peringkat

- Atia Group USA Executive SummaryDokumen6 halamanAtia Group USA Executive SummaryHaitiGroupBelum ada peringkat

- ANZ Greater China Weekly Insight 2 April 2013Dokumen13 halamanANZ Greater China Weekly Insight 2 April 2013leithvanonselenBelum ada peringkat

- Median House Price Report 2001-2011Dokumen28 halamanMedian House Price Report 2001-2011ABC News OnlineBelum ada peringkat

- CED Report 1.28.14 PDFDokumen16 halamanCED Report 1.28.14 PDFRecordTrac - City of OaklandBelum ada peringkat

- Butner AptDokumen11 halamanButner Aptapi-306448793Belum ada peringkat

- Greater Metropolitan Denver Market Update MAY, 2012 Market MetricsDokumen3 halamanGreater Metropolitan Denver Market Update MAY, 2012 Market MetricsMichael KozlowskiBelum ada peringkat

- Senate Hearing, 112TH Congress - The State of The Housing MarketDokumen47 halamanSenate Hearing, 112TH Congress - The State of The Housing MarketScribd Government DocsBelum ada peringkat

- Midyear Report 2008Dokumen5 halamanMidyear Report 2008Missouri Netizen NewsBelum ada peringkat

- FAM Sample From Last SemsterDokumen12 halamanFAM Sample From Last SemsterCharles Mwangi WaweruBelum ada peringkat

- I. Introducing The OrganisationDokumen13 halamanI. Introducing The OrganisationGlyka K. RigaBelum ada peringkat

- Miami NAR12Dokumen1 halamanMiami NAR12citybizlist11Belum ada peringkat

- The Latest Forecast:: FrugalDokumen40 halamanThe Latest Forecast:: FrugalJonathan PeoplesBelum ada peringkat

- Bam q1 2017 LTR To Shareholders FinalDokumen8 halamanBam q1 2017 LTR To Shareholders FinalDan-S. ErmicioiBelum ada peringkat

- EPAB Parade Float Finds New Home at Fort Bliss: Builders OutlookDokumen15 halamanEPAB Parade Float Finds New Home at Fort Bliss: Builders OutlookTedEscobedoBelum ada peringkat

- REMAX National Housing Report - July 2012 FinalDokumen2 halamanREMAX National Housing Report - July 2012 FinalSheila Newton TeamBelum ada peringkat

- Housing Position Paper 2015Dokumen4 halamanHousing Position Paper 2015Drew AstolfiBelum ada peringkat

- Q3 PVOF I PortfolioDokumen4 halamanQ3 PVOF I PortfolioBruce BartlettBelum ada peringkat

- Own Rent Research Paper 2012Dokumen6 halamanOwn Rent Research Paper 2012Bruce BartlettBelum ada peringkat

- Executive Summary: Signs of Recovery in The For-Sale MarketDokumen6 halamanExecutive Summary: Signs of Recovery in The For-Sale MarketBruce BartlettBelum ada peringkat

- ULI Emerging Trends in Real Estate 2012Dokumen88 halamanULI Emerging Trends in Real Estate 2012Bruce BartlettBelum ada peringkat

- Housing Affordibility by MetroDokumen1 halamanHousing Affordibility by MetroBruce BartlettBelum ada peringkat

- Apartment Refers ToDokumen27 halamanApartment Refers ToGizachew BegnaBelum ada peringkat

- Housing Policies in Turkey Evolution of Toki As A Designing ToolDokumen11 halamanHousing Policies in Turkey Evolution of Toki As A Designing ToolsubhamBelum ada peringkat

- Topic Vocabulary About HomeDokumen4 halamanTopic Vocabulary About HomeBelosnezhkaBelum ada peringkat

- E-Brochure DaisanDokumen66 halamanE-Brochure DaisanWinerNainggolanBelum ada peringkat

- Aged About 91 Years, S/o. Late Vackayil KrishnaDokumen5 halamanAged About 91 Years, S/o. Late Vackayil KrishnaVenkatesh WBelum ada peringkat

- Corporate Landlords and Pandemic and Prepandemic Evictions in Las VegasDokumen23 halamanCorporate Landlords and Pandemic and Prepandemic Evictions in Las VegasNaoka ForemanBelum ada peringkat

- Rule-VII-And-VIII The National Building Code of The PhilipDokumen116 halamanRule-VII-And-VIII The National Building Code of The PhilipJerson EmataBelum ada peringkat

- The Lotus Riverside ComplexDokumen1 halamanThe Lotus Riverside Complexapi-31812472100% (1)

- Portfolio For Internship - Divyansh MishraDokumen12 halamanPortfolio For Internship - Divyansh MishraDivyansh MishraBelum ada peringkat

- Litreature Review Case DtudyDokumen31 halamanLitreature Review Case DtudyHULE ADDIS ENTERTAINMENTBelum ada peringkat

- UNA BrochureDokumen12 halamanUNA BrochureLee Foo WengBelum ada peringkat

- Khanna Sir FileDokumen8 halamanKhanna Sir FileMarketing Head Felix Hospital, Noida100% (1)

- UEMS Malaysia Property Johor 24 July 2023 RHBDokumen12 halamanUEMS Malaysia Property Johor 24 July 2023 RHBJun Li KhorBelum ada peringkat

- 17 Different Types of Houses in The PhilippinesDokumen17 halaman17 Different Types of Houses in The PhilippinesRuzel AmpoanBelum ada peringkat

- Airbnb: Making Hospitality AuthenticDokumen4 halamanAirbnb: Making Hospitality AuthenticIshaa Leluni SamulaBelum ada peringkat

- 7 Condos in District 9 You Could Possibly Own For $1.6 Million or Less - Property Blog Singapore - Stacked HomesDokumen29 halaman7 Condos in District 9 You Could Possibly Own For $1.6 Million or Less - Property Blog Singapore - Stacked HomesYC TeoBelum ada peringkat

- Report Rem317 Ap1155fDokumen21 halamanReport Rem317 Ap1155fSITI MARIAM MAILBelum ada peringkat

- Maplewood Proxy FormDokumen1 halamanMaplewood Proxy FormmaplewoodscBelum ada peringkat

- Land Transactions KalibalaDokumen7 halamanLand Transactions Kalibalachris.oyuaBelum ada peringkat

- Virginia Rent Relief ProgramDokumen18 halamanVirginia Rent Relief ProgrammarcelBelum ada peringkat

- ORO AVENUE Mini BrochureDokumen16 halamanORO AVENUE Mini BrochureRakesh KumarBelum ada peringkat

- Residential Lease Letter of IntentDokumen2 halamanResidential Lease Letter of IntentLelebeth SmithBelum ada peringkat

- Landlord Entry RestrictedDokumen2 halamanLandlord Entry RestrictedAdinaCMartinBelum ada peringkat

- Rent Control Act - SatvikDokumen129 halamanRent Control Act - Satvikshivani rana ranaBelum ada peringkat

- Upc - PrequalificationDokumen170 halamanUpc - PrequalificationMABelum ada peringkat