ACTBAS2 Syllabus ELGA 050511 Portrait

Diunggah oleh

Gelloyd PsdDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

ACTBAS2 Syllabus ELGA 050511 Portrait

Diunggah oleh

Gelloyd PsdHak Cipta:

Format Tersedia

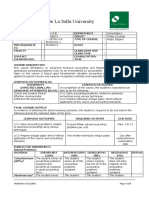

COLLEGE: BUSINESS DEPARTMENT: ACCOUNTANCY COURSE CODE: ACTBAS2 CLASS DAYS AND CLASS TIME: ____________________________ ROOM: _______

INSTRUCTOR NAME: ______________________________________________________________ CONTACT INFORMATION: _________________________________________________________ CONSULTATION HOURS: __________________________________________________________

COURSE DESCRIPTION: This course ACTBAS2, Introductory Accounting for a Merchandising Business, deals with the accounting cycle for a sole proprietorship form of business engaged in merchandising activities. It includes recording of business transactions involving merchandising business, property, plant, and equipment, and preparation of financial statements for business decision-making. The course is designed to respond to changes brought about by developments in information technology through the use of a computerized accounting system. Accounting topics on the voucher system, petty cash fund, and bank reconciliation statement are also included.

LEARNING OUTCOMES (LO): On completion of the course, the student is expected to be able to do the following: EXPECTED LASALLIAN GRADUATE ATTRIBUTES (ELGA) Critical and creative thinker LEARNING OUTCOMES

Recall basic accounting concepts and principles as applied to a sole proprietorship Review the steps in the accounting cycle Analyze transactions involving the purchase and sale of merchandise, including freight and VAT, under both periodic and perpetual inventory systems Use both special journals and general journal in recording business transactions Analyze the necessary steps in recording and posting transactions in journals and ledgers Measure cost and determine the journal entries concerning property, plant, and equipment Discuss the concepts specifically related to a merchandising business Illustrate the direct extension method in preparing a work sheet Contrast periodic inventory system with perpetual inventory system Compare data processing under manual and computerized environments Relate the importance of petty cash fund and its entries to actual business situations Value the importance of the computer as a medium for data processing in accounting Apply accounting principles in the national and global context Analyze business cases based on ethical and current issues Value professionalism and business ethics in all aspects of accounting work Develop the Lasallian values of faith, zeal for service, and communion in mission, in learning basic skills in accounting Set-up subsidiary ledgers, in addition to the general ledger, in posting transactions Prepare year-end adjusting entries and explain its effects on financial statements Prepare a bank reconciliation statement and related adjusting entries Develop and organize the steps and procedures of the voucher system Prepare financial statements and other reports for a sole proprietorship merchandising enterprise, under both manual and computerized environments

Effective communicator

Reflective lifelong learner

Service-driven citizen

FINAL COURSE OUTPUT: As evidence of attaining the above learning outcomes, the student is required to do and submit the following during the indicated dates of the term: LEARNING OUTCOMES LO 1: Recall basic accounting concepts and principles as applied to a sole proprietorship LO 2: Review the steps in the accounting cycle LO 3: Analyze transactions involving the purchase and sale of merchandise, including freight and VAT, under both periodic and perpetual inventory systems LO 4: Use both special journals and general journal in recording business transactions LO 5: Analyze the necessary steps in recording and posting transactions in journals and ledgers LO 6: Measure cost and determine the journal entries concerning property, plant, and equipment LO 7: Discuss the concepts specifically related to a merchandising business LO 8: Illustrate the direct extension method in preparing a work sheet LO 9: Contrast periodic inventory system with perpetual inventory system LO 10: Compare data processing under manual and computerized environments LO 11: Relate the importance of petty cash fund and its entries to actual business situations LO 12: Value the importance of the computer as a medium for data processing in accounting Workbook exercise Workbook exercise Week 1 Weeks 1 to 4 REQUIRED OUTPUTS DUE DATE

Workbook exercise Workbook exercise Workbook exercise Recitation Recitation Recitation Recitation Workbook exercise Computer practice set activity outputs: (1) Reports (2) Evaluation form

Week 6 Week 6 Weeks 4 to 5 Weeks 1 to 4 Week 13 Weeks 1 to 3 Week 7 Week 13 Weeks 8 to 12

LO 13: Apply accounting principles in the national and global context LO 14: Analyze business cases based on ethical and current issues LO 15: Value professionalism and business ethics in all aspects of accounting work LO 16: Develop the Lasallian values of faith, zeal for service, and communion in mission, in learning basic skills in accounting LO 17: Set-up subsidiary ledgers, in addition to the general ledger, in posting transactions LO 18: Prepare year-end adjusting entries and explain its effects on financial statements LO 19: Prepare a bank reconciliation statement and related adjusting entries LO 20: Develop and organize the steps and procedures of the voucher system LO 21: Prepare financial statements and other reports for a sole proprietorship merchandising enterprise, under both manual and computerized environments Workbook exercise (1) Workbook exercise (2) Recitation Workbook exercise Workbook exercise Complete set of financial statements for a sole proprietorship merchandising business Week 12 Week 13 Week 12 Weeks 6 to 7 Weeks 8 to 11 Business case report Week 7

RUBRIC FOR ASSESSMENT: CRITERIA Critical and creative thinker EXEMPLARY 4 The submitted work manifests qualities which go beyond the requirements. SATISFACTORY 3 The submitted work manifests the required qualities. DEVELOPING 2 The submitted work partially manifests the required qualities. Certain aspects are either incomplete or incorrect. The submitted/ presented work partially manifests the required qualities. Certain aspects are either incomplete or incorrect. The submitted work partially manifests the required qualities. Certain aspects are either incomplete or incorrect. The submitted work partially manifests the required qualities. Certain aspects are either incomplete or incorrect. BEGINNING 1 The submitted work does not manifest any of the requirements. RATING

Effective communicator

The submitted/ presented work manifests qualities which go beyond the requirements.

The submitted/ presented work manifests the required qualities.

The submitted/ presented work does not manifest any of the requirements.

Reflective lifelong learner

The submitted work manifests qualities which go beyond the requirements.

The submitted work manifests the required qualities.

The submitted work does not manifest any of the requirements.

Servicedriven citizen

The submitted work manifests qualities which go beyond the requirements.

The submitted work manifests the required qualities.

The submitted work does not manifest any of the requirements.

TOTAL:

OTHER REQUIREMENTS AND ASSESSMENTS: Aside from the final output, the student will be assessed at other times during the term by the following: Quizzes Midterm examination Departmental final examination Assignment folder

GRADING SYSTEM: GRADE POINT 4.0 3.5 3.0 2.5 2.0 1.5 1.0 0.0 DESCRIPTION Excellent Superior Very Good Good Satisfactory Fair Pass Fail PERCENTAGE 97 100 94 96 91 93 87 90 83 86 77 82 70 76 Below 70 1ST HALF 40% 40% 20% 100% 40% 2ND HALF 40% 40% 20% 100% 60%

The student will be graded according to the following: BASIS Average Quizzes Formal Examination Class Standing TOTAL Final Grade Computation

LEARNING PLAN: LEARNING OUTCOMES 1, 2 I. 7 II. TOPICS REVIEW OF THE ACCOUNTING CYCLE INTRODUCTION TO MERCHANDISING BUSINESS 2.1 Nature and operating cycle 2.2 Business documents used WEEK LEARNING NO. ACTIVITIES 1 Read text, pp. 147-148; Answer workbook, pp. 1-3 1 Read text, pp.183-184, 187, 190; Answer workbook, pp. 4-10

3, 9

III. ACCOUNTING CYCLE OF A MERCHANDISING BUSINESS 3.1 Recording purchase and sale of merchandise in general journal 3.1.1 Perpetual inventory system (gross method only) 3.1.2 Periodic inventory system (gross method only) 3.1.3 Freight terms 3.1.3.1 FOB Shipping point, Collect 3.1.3.2 FOB Shipping point, Prepaid 3.1.3.3 FOB Destination point, Collect 3.1.3.4 FOB Destination point, Prepaid With Value-added Tax

1-2

2-3

Read text, pp. 185-194, 195, 205-208; Answer workbook, pp. 1114; QUIZ 1 Read text, pp. 188-189; 237238; Answer workbook, pp. 1518, 21 Read lecture notes; Answer workbook, pp. 1920; QUIZ 2 Read text, pp. 407-410,419, 423-426; Answer workbook, pp. 2228; QUIZ 3

3.1.4

3-4

3.2

21

3.3

Recording purchase and disposal of property, plant, and equipment 3.2.1 Revenue vs. Capital expenditures 3.2.2 Journal entries related to purchase (net method) 3.2.3 Disposal of property, plant, and equipment through sale Preparing functional-form Income Statement (including computation of missing amounts)

4-5

5-6

4, 5, 14, 17

3.4

3.5

3.6

10, 12

3.7

Recording of business transactions using special journals and the general journal manual (for illustration purposes only) 3.4.1 Sales Journal 3.4.2 Cash Receipts Journal 3.4.3 Purchase Journal 3.4.4 Cash Payments Journal 3.4.5 General Journal Posting from the general and special journals to the general and subsidiary ledgers manual (for illustration purposes only) 3.5.1 Accounts Receivable/Customer subsidiary ledger 3.5.2 Accounts Payable/Creditor subsidiary ledger 3.5.3 General ledger Preparing Schedules of Accounts Receivable and Payable manual (for illustration purposes only) Manual vs. Computerized Accounting Systems

6-7

Read text, pp. 197-204; Check workbook exhibits; Answer workbook, pp. 2930 Read text, pp. 286-300; Answer workbook, pp. 3137 (selected exercises); Do 1st Half Business Case; MIDTERM EXAM

Read text, pp. 281-286; Do Computer Laboratory Practice Set activity

LEARNING OUTCOMES 3.8 18

TOPICS Completion of the accounting cycle 3.8.1 Journalizing and posting year-end adjustments (accrual basis) 3.8.1.1 Review: Accrued expenses 3.8.1.2 Review: Accrued revenues

WEEK NO.

LEARNING ACTIVITIES Read text, pp. 95-98; 109111 Read text, pp. 105-109; Answer workbook, pp. 4345; QUIZ 4 Read text, pp. 99-105, 115118; Answer workbook, pp. 4650; QUIZ 5 Read text, pp. 411-414; Answer workbook, pp. 5152 Read text, pp. 373-377; Answer workbook, pp. 5356

3.8.1.3 3.8.1.4 3.8.1.5 3.8.1.6

Review: Prepaid expenses Review: Unearned income Review: Amortization of discount Depreciation (straight-line method) Doubtful accounts (allowance method) 3.8.1.7.1 Estimation: Balance sheet approach 3.8.1.7.2 Write-off and recovery Merchandise inventory (periodic inventory system)

8-9

9-10

3.8.1.7

10-11

3.8.1.8

11

19

3.8.2

3.8.3

Bank reconciliation statement 3.8.2.1 Preparing a simple bank reconciliation statement (adjusted balances method) 3.8.2.2 Recording adjusting entries for reconciling items Preparing a work sheet (10- and 8-column work sheets) Preparing financial statements manual and computerized 3.8.4.1 Functional-form Income Statement 3.8.4.2 Report-form Statement of Financial Position 3.8.4.3 Statement of Changes in Equity 3.8.4.4 Direct-method Statement of Cash Flows 3.8.4.5 Notes to Financial Statements Journalizing and posting closing entries Preparing a post-closing trial balance Journalizing and posting reversing entries

11-12

Answer workbook, pp. 42, 57-59; QUIZ 6 Read text, pp. 344-352; Answer workbook, pp. 6065

12

21

3.8.4

Read text, pp. 135-141; 208209; Answer workbook, pp. 6769 (selected exercise) Check workbook exhibits; Read text, pp. 196-202; Answer workbook, pp. 7075

3.8.5 3.8.6 3.8.7 3.9

13

20

Introduction to Voucher System

11

3.10 Establishment and replenishment of petty cash fund under the imprest system

13-14

Read text, pp. 141-147, 161162; Answer workbook, pp. 66, 76-78 Read text, p. 340; Answer workbook, pp. 7983 Read text, pp. 342-344; Answer workbook, pp. 3841; DEPARTMENTAL FINAL EXAM

REFERENCES: Bernados, H., Velasco, E., Manalo, M., Aquino, N., and Manaligod, G. (2010). Workbook in Introductory Accounting for Merchandising Business. (WORKBOOK) Cabrera, M., Ledesma, E., and Lupisan, M. (2007). Fundamentals of Accounting, Vol. 1. Manila: GIC Enterprises and Co., Inc. Chalmers, K., Fyfe, M., Kieso, D., Kimmel, P., Mitrione, L., and Weygandt, J. (2010). Principles of Financial Accounting, 2nd edition. Australia: John Wiley & Sons, Ltd. (TEXT) Kieso, D., Kimmel, P., and Weygandt, J. (2008). Accounting Principles, 8th edition. New Jersey: John Wiley & Sons, Inc. Kimwell, Mercedes. (2009). Fundamentals of Accounting, 2nd edition. Manila: GIC Ent. & Co., Inc. Valencia, E., and Roxas, G. (2009). Basic Accounting, 3rd edition. Baguio City: Valencia Educational Supply

ONLINE RESOURCES: www.wiley.com/college/weygandt www.wileyplus.com

CLASS POLICIES: POLICIES SPECIFIC TO THE COURSE: o Only students who had obtained at least a 1.0 final grade in ACTBAS1 (for non-BSA students) and at least a 2.0 final grade in ACTBAS1 (for BSA students) are qualified to take this course. o This course is a prerequisite to the following courses: ACTPACO (a final grade of at least 2.0 for BSA students to qualify); ACTMANA (for business students who are not MFI nor BS-Ent majors); ENTMANA (for BS-Ent students); and FMANACC (for MFI students). A minimum of six (6) long quizzes [three (3) long quizzes before and after midterms] is required in this course. The 20% class standing shall consist of the following: (1) active participation in class; (2) prompt submission of assignments and compilation; (3) attendance; (4) business case for the 1st half; (5) practice set computer laboratory session attendance and outputs for the 2nd half; and (6) good manners and right conduct. The final examination is departmental and covers the entire course syllabus. This is held for three (3) hours during the Final Examinations Week (Week 14). NORMALLY, it involves 40% multiple choice and true/false theory questions; 10% journalizing merchandising transactions; 16% journalizing adjusting entries; 14% problem solving with solutions in good accounting format; and 20% financial statements preparation. The midterm examination, unlike the final examination, may not be departmental and covers topics discussed up to Week 6 or 7, depending upon the discretion of the faculty member. The business case for the first half of the term would be given by the faculty member to the class/class representative at least a week (for individual business case) or two weeks (for group business case) before the submission deadline. The computer laboratory practice set activity for the second half of the term is good for 1-1/2 to 2 hours and should be scheduled at least after the topic on Special Journals. A handout on student account activation, together with the laboratory and take home exercises, will be given by the faculty member to the class/class representative. Once advised by the faculty member, it is imperative that the student follow the instruction on student account activation immediately to prevent his/her account from expiring. It is the responsibility of the student to be mindful of his/her absences/tardiness and performance in class. Specific class policies on attendance, make-up quizzes, academic honesty, grading system, dress code, classroom management, and others not mentioned above, are to be discussed by the faculty member on the first day of classes.

o o

o o

o o

DEPARTMENT POLICIES: o Subject to the University policies on shifting, a shiftee applicant is accepted to the BSA program, if he/she had: (1) A cumulative GPA of at least 3.0 at time of shifting; (2) A final grade of at least 2.0 in ACTBAS1 and ACTBAS2, if taken; (3) Taken up at least one English course and had a final grade of at least 2.5 in all English courses taken up; (4) Taken up at least one Math-related course and had a final grade of at least 2.5 in all Math-related courses taken up; (5) Passed an interview conducted by the Accountancy Department Vice Chair or Faculty Member; and (6) Passed the ITEO shifting examination, for external shiftees. o o o An application for special final examination should be accomplished by the student if there are conflicts in the final examination schedule, following the University policies on order of priority. When inside the Accountancy Department, students are expected to observe silence, and maintain the cleanliness and orderliness of the room. Please observe consultation hours/schedule of the faculty member. Students are not allowed inside the Accountancy Department during the following times: (1) Before office hours: Monday to Saturday, before 0800; (2) Lunch break: Monday to Saturday, 1200-1300; (3) After office hours: Monday to Friday, after 1900 and Saturday, after 1400; (4) Grade consultation day; and (5) When no faculty member/staff is around. For student concerns regarding the BSA program or the course, please set an appointment with the Department Vice Chair. For all other inquiries, please visit the Accountancy Department at St. La Salle Building, 3rd floor, Room 324. Important announcements will be posted on the Accountancy Department bulletin board, St. La Salle Building, 3rd floor, North Wing.

Basic Accounting Two Committee 10/May/2011

Anda mungkin juga menyukai

- ACTBAS4 SyllabusDokumen5 halamanACTBAS4 Syllabusroyanna martinBelum ada peringkat

- Modmit1 Syllabus t11415 ElgaDokumen7 halamanModmit1 Syllabus t11415 ElgaKimyMalayaBelum ada peringkat

- Modaud1 Syllabus t31617 - ElgaDokumen5 halamanModaud1 Syllabus t31617 - ElgabrianrusselsanchezBelum ada peringkat

- Modfin1 Syllabus July 2015Dokumen6 halamanModfin1 Syllabus July 2015Csrli CatBelum ada peringkat

- De La Salle University: Completeness (80%)Dokumen6 halamanDe La Salle University: Completeness (80%)NikkiBelum ada peringkat

- ACTBAS1 ReviewerDokumen12 halamanACTBAS1 ReviewerRhobeMitchAilarieParelBelum ada peringkat

- MODFIN2 Calendar PDFDokumen1 halamanMODFIN2 Calendar PDFMich ClementeBelum ada peringkat

- Modadv3 Syllabus Ay2016-2017Dokumen7 halamanModadv3 Syllabus Ay2016-2017ダニエルBelum ada peringkat

- COMSATS Accounting CourseDokumen4 halamanCOMSATS Accounting CourseSajid Ali100% (1)

- Management Advisory ServicesDokumen18 halamanManagement Advisory ServicesAldrin Arcilla Simeon0% (1)

- Final Exam-Basic AccountingDokumen2 halamanFinal Exam-Basic AccountingNoel Buenafe JrBelum ada peringkat

- CAT Level 1 Mock Examination-1Dokumen4 halamanCAT Level 1 Mock Examination-1Nadine ReidBelum ada peringkat

- MODMGT2 Syllabus - 3T1617Dokumen5 halamanMODMGT2 Syllabus - 3T1617OwlHeadBelum ada peringkat

- Acc. Course OutlineDokumen5 halamanAcc. Course OutlineNoor DeenBelum ada peringkat

- Taxation Review Course Syllabus PDFDokumen21 halamanTaxation Review Course Syllabus PDFJordan ChavezBelum ada peringkat

- 3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3Dokumen14 halaman3 Module 3 - Notes To Financial Statements AE 17 Intermediate Accounting 3CJ Granada100% (1)

- Advanced Accounting SyllabusDokumen7 halamanAdvanced Accounting Syllabusapi-323483989Belum ada peringkat

- ACCTBA1 Compilation FolderDokumen3 halamanACCTBA1 Compilation Foldermia_catapang100% (1)

- 2006 THE CPA LICENSURE EXAMINATION SYLLABUS For Audit Theory and Audit ProblemsDokumen5 halaman2006 THE CPA LICENSURE EXAMINATION SYLLABUS For Audit Theory and Audit ProblemsNina Almonidovar-MacutayBelum ada peringkat

- Philippine PIC Q&A on Accounting for Costs of Public OfferingDokumen6 halamanPhilippine PIC Q&A on Accounting for Costs of Public OfferingSeth Relian100% (1)

- MODADV3 Handouts 1 of 2Dokumen23 halamanMODADV3 Handouts 1 of 2Dennis ChuaBelum ada peringkat

- MODMGT1 Syllabus - 2T1718Dokumen5 halamanMODMGT1 Syllabus - 2T1718OwlHeadBelum ada peringkat

- Losses: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersDokumen4 halamanLosses: Income Taxation 6Th Edition (By: Valencia & Roxas) Suggested AnswersJane Manumpay50% (4)

- MAS Summary TOPICSDokumen3 halamanMAS Summary TOPICSVenskie CincoBelum ada peringkat

- Rmo 16-2007Dokumen4 halamanRmo 16-2007Jaypee LegaspiBelum ada peringkat

- Diagnostic in Basic AccountingDokumen5 halamanDiagnostic in Basic Accountingjapvivi cece100% (2)

- Accounting Exam SolnDokumen17 halamanAccounting Exam SolnAsmara NoorBelum ada peringkat

- Ais MidtermDokumen5 halamanAis MidtermMosabAbuKhaterBelum ada peringkat

- Financial Accounting 1 Valix Part 1Dokumen2 halamanFinancial Accounting 1 Valix Part 1AkiBelum ada peringkat

- Updates From The PRBoADokumen68 halamanUpdates From The PRBoAJofritz ValleBelum ada peringkat

- Accounting DictionaryDokumen11 halamanAccounting DictionaryKhan MohammadBelum ada peringkat

- Acc 101 Final Exam PrintDokumen11 halamanAcc 101 Final Exam Printchristian garciaBelum ada peringkat

- Ey International Gaap 2022Dokumen3 halamanEy International Gaap 2022Makhosazana Th'KingBelum ada peringkat

- RVRCOB Course Checklist 113Dokumen32 halamanRVRCOB Course Checklist 113Bettina MangubatBelum ada peringkat

- CPALE TOS Eff May 2019Dokumen25 halamanCPALE TOS Eff May 2019Dale Abrams Dimataga75% (4)

- Fundamentals of Accounting Practice QuestionsDokumen17 halamanFundamentals of Accounting Practice QuestionsKimberly MilanteBelum ada peringkat

- Constructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONDokumen39 halamanConstructive Acctg. Report..... SINGLE ENTRY and ERROR CORRECTIONHoney LimBelum ada peringkat

- AC19 MODULE 5 - UpdatedDokumen14 halamanAC19 MODULE 5 - UpdatedMaricar PinedaBelum ada peringkat

- College of Business philosophy, vision and missionDokumen3 halamanCollege of Business philosophy, vision and missionHazelline DomingoBelum ada peringkat

- Accounting I SyllabusDokumen5 halamanAccounting I SyllabusRyan Busch100% (2)

- Notes FSUU AccountingDokumen18 halamanNotes FSUU AccountingRobert CastilloBelum ada peringkat

- Tax 1 Cases - Government Remedies Batch 2Dokumen24 halamanTax 1 Cases - Government Remedies Batch 2Krissie GuevaraBelum ada peringkat

- Presentation of Financial StatementsDokumen40 halamanPresentation of Financial StatementsQuinta NovitaBelum ada peringkat

- St. Columban College Accounting 101 Practice TestDokumen1 halamanSt. Columban College Accounting 101 Practice TestRalph Christer MaderazoBelum ada peringkat

- Acc 61 1stsem Sy2021 Gutierrez, FerdinandDokumen6 halamanAcc 61 1stsem Sy2021 Gutierrez, FerdinandrnBelum ada peringkat

- Accounting 1 Conceptual Framework and PrinciplesDokumen13 halamanAccounting 1 Conceptual Framework and PrinciplesTatyanna Kaliah0% (1)

- College of Law: University of Perpetual Help LagunaDokumen7 halamanCollege of Law: University of Perpetual Help LagunaHarold Cesar HuligangaBelum ada peringkat

- Case Digest Atty CabaneiroDokumen11 halamanCase Digest Atty CabaneiroChriselle Marie DabaoBelum ada peringkat

- Partnership Accounting ModuleDokumen15 halamanPartnership Accounting ModuleMon RamBelum ada peringkat

- AC17&18: Assurance Principles, AC17&18: Assurance Principles, Professional Ethics and Good Professional Ethics and Good Governance GovernanceDokumen32 halamanAC17&18: Assurance Principles, AC17&18: Assurance Principles, Professional Ethics and Good Professional Ethics and Good Governance GovernanceMark Anthony Estrada TibuleBelum ada peringkat

- Deferred Tax Lecture SlidesDokumen38 halamanDeferred Tax Lecture Slidesmd salehinBelum ada peringkat

- Chapter 2 Problems and Solutions EnglishDokumen8 halamanChapter 2 Problems and Solutions EnglishyandaveBelum ada peringkat

- Accounting BasicsDokumen13 halamanAccounting BasicskameshpatilBelum ada peringkat

- Chart of AccountsDokumen2 halamanChart of AccountsAina Charisse DizonBelum ada peringkat

- Aaca Receivables and Sales ReviewerDokumen13 halamanAaca Receivables and Sales ReviewerLiberty NovaBelum ada peringkat

- Ourse Yllabus AND Xpectations: Length: Academic Level: Credit: Prerequisite: Instructor: E-Mail Address: DescriptionDokumen7 halamanOurse Yllabus AND Xpectations: Length: Academic Level: Credit: Prerequisite: Instructor: E-Mail Address: DescriptionCris AngelBelum ada peringkat

- Ourse Yllabus AND Xpectations: Length: Academic Level: Credit: Prerequisite: Instructor: E-Mail Address: DescriptionDokumen7 halamanOurse Yllabus AND Xpectations: Length: Academic Level: Credit: Prerequisite: Instructor: E-Mail Address: DescriptionCris AngelBelum ada peringkat

- Accounting I Syllabus: Instructor's Name and Contact InformationDokumen6 halamanAccounting I Syllabus: Instructor's Name and Contact InformationDino DizonBelum ada peringkat

- Level 3 SyllabusDokumen17 halamanLevel 3 SyllabusBon Bon ChanBelum ada peringkat

- Jacey e Semester 20planDokumen3 halamanJacey e Semester 20planapi-260670362Belum ada peringkat

- Notes in Acctax1 Chapter 2 and 3Dokumen5 halamanNotes in Acctax1 Chapter 2 and 3Gelloyd PsdBelum ada peringkat

- BSA111Dokumen4 halamanBSA111Gelloyd PsdBelum ada peringkat

- Accounting For PayrollDokumen22 halamanAccounting For PayrollGelloyd PsdBelum ada peringkat

- Transactional AnalysisDokumen20 halamanTransactional AnalysisGelloyd PsdBelum ada peringkat

- Basic Accounting ConceptsDokumen21 halamanBasic Accounting ConceptsGelloyd PsdBelum ada peringkat

- Actbas 2 Downloaded Lecture Notes 2Dokumen7 halamanActbas 2 Downloaded Lecture Notes 2Charles Reginald K. HwangBelum ada peringkat

- Chapter 19 Managing Inventory, Accounts Receivable and Accounts PayableDokumen38 halamanChapter 19 Managing Inventory, Accounts Receivable and Accounts PayableJan ryanBelum ada peringkat

- ILS Examination For Budget AssistantDokumen7 halamanILS Examination For Budget AssistantTahinay KarlBelum ada peringkat

- You Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalDokumen28 halamanYou Will Get Questions From This Too 1Z0-1056-21 Oracle Financials Cloud Receivables 2021 Implementation ProfessionalSamima KhatunBelum ada peringkat

- Account XII For Board Exam PracticeDokumen18 halamanAccount XII For Board Exam PracticeBicky ShahBelum ada peringkat

- Unit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodDokumen6 halamanUnit 4 - Provision For Doubtful Debts - Adjustments at The End of An Accounting PeriodRealGenius (Carl)Belum ada peringkat

- Stock & Book Debts Statement: All The Fields in Yellow Colour Needs To Be Filled MandatorilyDokumen4 halamanStock & Book Debts Statement: All The Fields in Yellow Colour Needs To Be Filled Mandatorilygourav100% (1)

- AP 1403 Receivables Auditing ProblemsDokumen18 halamanAP 1403 Receivables Auditing ProblemsДжен Акино ОганизаBelum ada peringkat

- Audit of The Sales and Collection CycleDokumen43 halamanAudit of The Sales and Collection CyclesusilawatiBelum ada peringkat

- Accounts Receivable Management SpecialistsDokumen77 halamanAccounts Receivable Management SpecialistsVaibhav Badgi100% (3)

- Fundamentals of Credit ManagementDokumen23 halamanFundamentals of Credit Managementdaph_89100% (1)

- Take Home Midterms Mix 30Dokumen6 halamanTake Home Midterms Mix 30rizzelBelum ada peringkat

- Learning Guide: Accounting Department Basic Accounting Works Level IiDokumen25 halamanLearning Guide: Accounting Department Basic Accounting Works Level Iiembiale ayalu100% (1)

- Sources of Short and Secured FinancingDokumen4 halamanSources of Short and Secured FinancingIsaiah CruzBelum ada peringkat

- CH 04Dokumen4 halamanCH 04vivien33% (3)

- Accounting For Non AccountantsDokumen25 halamanAccounting For Non Accountantsamer_wahBelum ada peringkat

- Credit and Collection: Chapter 6 - Credit Decision MakingDokumen51 halamanCredit and Collection: Chapter 6 - Credit Decision MakingQuenne Nova DiwataBelum ada peringkat

- Qualifying Exam Reviewer 1Dokumen26 halamanQualifying Exam Reviewer 1dlaronyvette100% (2)

- Chapter 3 Ethiopian Govt AcctingDokumen19 halamanChapter 3 Ethiopian Govt AcctingwubeBelum ada peringkat

- Problem Cash FlowDokumen3 halamanProblem Cash FlowKimberly AnneBelum ada peringkat

- Accounting Applications - Part 4 - Lecture 2Dokumen7 halamanAccounting Applications - Part 4 - Lecture 2Ahmed Mostafa ElmowafyBelum ada peringkat

- Cbse Questions Adm RetirementDokumen19 halamanCbse Questions Adm RetirementDeepanshu kaushikBelum ada peringkat

- Cash flow statement case studiesDokumen2 halamanCash flow statement case studiesTanya PribylevaBelum ada peringkat

- Flores Bsafs h6Dokumen7 halamanFlores Bsafs h6Banana QBelum ada peringkat

- Paper 3 Revenue Cycle PDFDokumen46 halamanPaper 3 Revenue Cycle PDFNeema EzekielBelum ada peringkat

- Exercise 6-2: Revenue RecognitionDokumen34 halamanExercise 6-2: Revenue RecognitionPaulina CardenasBelum ada peringkat

- Financial Ratios GuideDokumen6 halamanFinancial Ratios GuideMae Angiela TansecoBelum ada peringkat

- Financial Instruments Definitions ExplainedDokumen5 halamanFinancial Instruments Definitions ExplainedAlinaBelum ada peringkat

- Study of Working Capital On Pepsico.Dokumen31 halamanStudy of Working Capital On Pepsico.Harsh Vardhan50% (2)

- Chapter 8 Advacc 1 DayagDokumen25 halamanChapter 8 Advacc 1 Dayagchangevela100% (11)

- Acc15 Workbook Answers Chapter 1& 2Dokumen8 halamanAcc15 Workbook Answers Chapter 1& 2Angelo Michael GoBelum ada peringkat