Waren Sports tax mixup

Diunggah oleh

bexbeslyDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Waren Sports tax mixup

Diunggah oleh

bexbeslyHak Cipta:

Format Tersedia

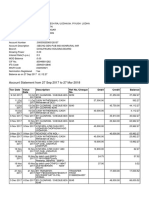

***Important note!: The income tax figure below is incorrect it should be $51,429.77. Sorry for the mixup.

**

Systems Understanding Aid

Waren Sports Assignment

OBJECTIVE: To help you learn about business processes, documents, internal controls, and the accounting cycle. The assignment provides an opportunity to observe a simple accounting system in action. The knowledge and understanding of the manual system will serve as a foundation for the topics to be discussed in the remainder of the course, and in future courses, especially auditing. REQUIRED: Complete all requirements in Part III. Requirements starting on page 10 of the instruction booklet. Use Option 2 for recording monthly transactions, and use Transaction List A, the blue one. You must completely fill out the worksheet that is in your packet in order to assure that you have done the accounting correctly. Important: This project is very time consuming. Please plan ahead so that you have time to check the solutions manual or consult with peers or the instructor. The project is due in Week 4. -You do not need to do a bank reconciliation, but you need to record the bank service charge ($27.50) to 41000 Other operating expense. -You do not need to create a statement of cash flows (although it is great practice). -You do need to create an income statement, a balance sheet, and trial balances for A/R, A/P, and fixed assets. You can do this using a word processor, spreadsheet, or pencil and paper. -Post transactions to the General Ledger only when instructed to do so. You do not need to post each transaction individually. Bring the completed packet, with the required financial statements to class. On the due date, at the beginning of class, I will give an open-packet quiz. I will not require the entire packetyou will be asked to turn in a few documents and reports, which will be determined on the day of the quiz. HELPFUL HINTS: General 1. Make the documents and reports neat; use a pencil so that you can erase errors, you are to submit something that you would be willing to give to a supervisor. 2. Make sure all general journal entries are correct. Use the reference book with your packet if you are having trouble. 3. Make sure you carefully follow the flowcharts and put proper signatures/initials on the documents. If there is no designated space for the signatures/initials, just be consistent and visible. 4. Write checks only when explicitly directed to do so. Do not write one because money is due, but when instructed to write the check. If you run out of checks, or have extras at the end, you have done something wrong.

1

5. You may wish to replace the separator tabs (Mailed/Given to Outsiders, Shipping/Banking, etc.) with file folders. Try to keep the documents in the proper files, but dont worry if they are out of place. I will hand out a page entitled File System that shows the final order of documents. 6. If you find a mistake and correct it, make sure that you correct both the recorded transaction and the related document. There should be an audit trail connecting documents, journals, ledgers, and financial statements. ** Also, make sure youve read the Important section above. Transactions Some transactions can be very confusing. If you get stuck on a transaction, skip it and move on until you can get help. The transactions do not need to be in order. 7. Every transaction in the General Journal should include a description in the Explanation column (e.g. December bank service charge). For transactions that require a calculation, show the complete calculation below your description. 8. On Dec. 22, Received check No. 28564 follow the flow chart on p. 21 9. On Dec. 22, Received legal notificationthe amount of the uncollectible debt from Stevenson College is more that you currently have available in the Allowance for Doubtful Accounts. This is OK it will just cause the Allowance account, which normally has a credit balance, to be negative, which results in a debit balance. When you prepare the Unadjusted Trial Balance portion of the worksheet, list this balance in the Debit column. (Using a negative number in the Credit column is fine too, but will cause your totals to differ from those in provided in the Check Figures). 10. On Dec. 23, Received vendor invoice No. 34719, remember that on Dec. 22 you only received part of the goods ordered. When you prepare the check, pay only for the goods you actually received. 11. Ignore the current balance in the Allowance for Doubtful Accounts when you prepare the yearend adjusting entry for Bad Debt Expense. Just use .4% of Net Sales as instructed. 12. When you are preparing the Federal Income Tax Expense adjusting entry, you must first create the worksheet, and calculate Total Income. Then, calculate the tax based on the information provided in the instructions. (The amount will be $52,429.77 if all transactions have been recorded correctly.) Finally, record the adjusting entry, and re-calculate Total Income.

Systems Understanding Aid

Check Figures 7th Edition Transaction List A, Main Solution

Journals Prior to Month-End Entries Sales Journal -- 2 entries Account # 10200 30200 Amount $ 49,398.00 $ 3,480.00 Cash Receipts Journal--4 entries Account # 10100 30300 10200 Amount $ 115,082.36 $ 261.64 $ 23,082.00 Purchases Journal--3 entries Account # 30500 20100 Amount $ 51,795.00 $64,279.15 Cash Disbursements Journal--3 entries Account # 10100 20100 30800 Amount $ 73,099.43 $59,162.00 $ 1,300.00 Payroll Journal--3 entries Account # 40500 20300 10100 Amount $ 15,152.48 $ 1,824.44 $ 12,168.89 General Journal1 entry Complete Project Financial Statements Current Assets Total Assets Net Sales Op. Exp. (excluding COGS, int exp, FIT) Net Income Accounts Receivable Aged Trial Balance Total Accounts Receivable Current Accounts Receivable Year-end Worksheet 12-31-01 Unadjusted Trial Balance Total Adjustments Column Total General Ledger Balances #10100--Cash #30100--Sales (pre closing) #30500--Purchases (pre closing) #30400--COGS (pre closing)

$362,240.75 $578,161.75 $1,516,028.18 $308,964.05 $ 128,236.25 $ 47,421.00 $ 26,316.00 $2,109,266.06 $1,247,780.69 $ 103,141.67 $1,592,545.00 $1,130,295.00 $1,028,021.74

Anda mungkin juga menyukai

- Bookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessDari EverandBookkeeping: Step by Step Guide to Bookkeeping Principles & Basic Bookkeeping for Small BusinessPenilaian: 5 dari 5 bintang5/5 (5)

- Peak Performance Instruction SheetDokumen2 halamanPeak Performance Instruction SheetnamnblobBelum ada peringkat

- Basic Accounting ConceptsDokumen3 halamanBasic Accounting ConceptsVanSendrel Parate100% (1)

- Re-Open Sask. June 4Dokumen76 halamanRe-Open Sask. June 4Saskatchewan WebBelum ada peringkat

- Impact - of - Customers Trust in E-Payment PDFDokumen15 halamanImpact - of - Customers Trust in E-Payment PDFSurajit SarbabidyaBelum ada peringkat

- Jacey e Semester 20planDokumen3 halamanJacey e Semester 20planapi-260670362Belum ada peringkat

- Lessonplan Completing The SquareDokumen2 halamanLessonplan Completing The Squareapi-297509922Belum ada peringkat

- Mice Laboratory Activity WorksheetDokumen1 halamanMice Laboratory Activity WorksheetBella MariaBelum ada peringkat

- Final Narrative Report v.20Dokumen1 halamanFinal Narrative Report v.20Christian Jay A MoralesBelum ada peringkat

- Lesson 4 The Quadratic Formula 1Dokumen2 halamanLesson 4 The Quadratic Formula 1api-491086227Belum ada peringkat

- Algebra 2b 8 3Dokumen2 halamanAlgebra 2b 8 3api-214653087Belum ada peringkat

- Uniformly Accelerated MotionDokumen2 halamanUniformly Accelerated MotionLeanna Marie F. Olis0% (2)

- Experiment 7 Pre Lab Worksheet Physics 101Dokumen3 halamanExperiment 7 Pre Lab Worksheet Physics 101Jonathan ZelayaBelum ada peringkat

- Telesom Minutes of Meeting Nov 1st 2012Dokumen2 halamanTelesom Minutes of Meeting Nov 1st 2012HoyaalayBelum ada peringkat

- Batangas City Elementary School CLT Method OrientationDokumen2 halamanBatangas City Elementary School CLT Method OrientationCastle GelynBelum ada peringkat

- Pain Relievers QuizDokumen3 halamanPain Relievers QuizAngeleen Joy CruzBelum ada peringkat

- SOLUTION To Selected Problems in WS14 and BOOK - Advanced AlgebraDokumen1 halamanSOLUTION To Selected Problems in WS14 and BOOK - Advanced AlgebrasakyamathBelum ada peringkat

- Carbon Cycle Game WorksheetDokumen2 halamanCarbon Cycle Game Worksheetapi-263841382Belum ada peringkat

- Graphing Linear Equations 2Dokumen3 halamanGraphing Linear Equations 2MisterLemusBelum ada peringkat

- Worksheet-4-Logs (Equations) (With WS)Dokumen2 halamanWorksheet-4-Logs (Equations) (With WS)Moloy GoraiBelum ada peringkat

- Balancing ws1Dokumen2 halamanBalancing ws1api-276967384Belum ada peringkat

- Tour The Basics - WorksheetDokumen3 halamanTour The Basics - WorksheetR. I. P.Belum ada peringkat

- WorksheetWorks Identifying Sentence Types 1Dokumen2 halamanWorksheetWorks Identifying Sentence Types 1Ruben Luna100% (1)

- Quiz PDFDokumen2 halamanQuiz PDFArshilgeniBelum ada peringkat

- Balancing Work Sheet # 1Dokumen2 halamanBalancing Work Sheet # 1Alexander PalaciosBelum ada peringkat

- Excel ExpertDokumen2 halamanExcel ExpertBogdan TudoseBelum ada peringkat

- Extendicare Statement To Toronto StarDokumen2 halamanExtendicare Statement To Toronto StarToronto StarBelum ada peringkat

- Mexican Whiteboy Seminar ReflectionDokumen1 halamanMexican Whiteboy Seminar ReflectionMady Brand100% (1)

- ACC 111 Chapter 5 Lecture Notes ADokumen3 halamanACC 111 Chapter 5 Lecture Notes ALoriBelum ada peringkat

- Drug Worksheet - Answers-4Dokumen3 halamanDrug Worksheet - Answers-4sirnBelum ada peringkat

- Cash DisbursmentsDokumen3 halamanCash Disbursmentsjoshpitcher18Belum ada peringkat

- ACCT 1005 Financial Accounting Worksheet SolutionsDokumen2 halamanACCT 1005 Financial Accounting Worksheet SolutionsChan SynergisticBelum ada peringkat

- Stem-and-Leaf Plots: Sample Worksheet FromDokumen1 halamanStem-and-Leaf Plots: Sample Worksheet Fromapi-256386911Belum ada peringkat

- Summative Assessment Draft2Dokumen3 halamanSummative Assessment Draft2api-393406373Belum ada peringkat

- Worksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsDokumen1 halamanWorksheet 1. Figuring Your Taxable Benefits: Keep For Your RecordsKelly Phillips ErbBelum ada peringkat

- Reflection Journal 34Dokumen3 halamanReflection Journal 34api-301347675Belum ada peringkat

- Algebra Expression 01Dokumen2 halamanAlgebra Expression 01Ezra PogiBelum ada peringkat

- The 4 Cycles in The Great Barrier ReefDokumen3 halamanThe 4 Cycles in The Great Barrier Reefapi-339744501100% (1)

- Mechanics Worksheet: Work, Energy, PowerDokumen2 halamanMechanics Worksheet: Work, Energy, PowerAmanuel Q. MulugetaBelum ada peringkat

- Mun Position PaperDokumen3 halamanMun Position Paperapi-458044515Belum ada peringkat

- Course Content Form: Practical Accounting ProceduresDokumen2 halamanCourse Content Form: Practical Accounting ProceduresOscar I. ValenzuelaBelum ada peringkat

- FNCE341 Assignment Worksheet 1Dokumen3 halamanFNCE341 Assignment Worksheet 1Khristos ZuluBelum ada peringkat

- Laboratory Worksheet: Pre-Lab QuestionsDokumen2 halamanLaboratory Worksheet: Pre-Lab QuestionsMf CloudzBelum ada peringkat

- Worksheet Elements of AccountingDokumen2 halamanWorksheet Elements of AccountingGladzangel LoricabvBelum ada peringkat

- Sorathi Bahārvatiyās: Meghāni's Folk TalesDokumen20 halamanSorathi Bahārvatiyās: Meghāni's Folk TalesAnonymous CwJeBCAXpBelum ada peringkat

- WeeblyresumeDokumen1 halamanWeeblyresumeapi-397526215Belum ada peringkat

- AP+Bio 042+Biological+Molecules+Worksheet WLDokumen2 halamanAP+Bio 042+Biological+Molecules+Worksheet WLSabrina LouiseBelum ada peringkat

- Balancing Equations 46 PDFDokumen2 halamanBalancing Equations 46 PDFIgnacio Jr. PaguyoBelum ada peringkat

- Circular Motion WorksheetDokumen2 halamanCircular Motion WorksheetJBelum ada peringkat

- MCR3U Formula SheetDokumen1 halamanMCR3U Formula SheetSidrah MakrodBelum ada peringkat

- Lesson 2.5 Worksheet: Express Each Number in Terms ofDokumen2 halamanLesson 2.5 Worksheet: Express Each Number in Terms ofapi-322448561Belum ada peringkat

- AMT NOL Calculation WorksheetDokumen2 halamanAMT NOL Calculation WorksheetcaixinranBelum ada peringkat

- Book Review OutlineDokumen1 halamanBook Review OutlineNora WiltseBelum ada peringkat

- Logarithmic Equations and Inequalities SolvedDokumen9 halamanLogarithmic Equations and Inequalities SolvedLex MeyBelum ada peringkat

- Business Solutions December financial statementsDokumen2 halamanBusiness Solutions December financial statementsretchiel love calinogBelum ada peringkat

- Physics 2204 Worksheet #4 - Advanced Kinematics: 1 of 2 14 Feb 07Dokumen2 halamanPhysics 2204 Worksheet #4 - Advanced Kinematics: 1 of 2 14 Feb 07wangks1980Belum ada peringkat

- Edible Cell WorksheetDokumen3 halamanEdible Cell Worksheetm_frajman100% (4)

- Function Notation Worksheet 2Dokumen2 halamanFunction Notation Worksheet 2Bienvenida Ycoy MontenegroBelum ada peringkat

- Chapter 6 LectureDokumen21 halamanChapter 6 LectureDana cheBelum ada peringkat

- UCC 3 Full TextDokumen42 halamanUCC 3 Full Textsolution4theinnocent100% (3)

- MOA of Actuarial Societ of BangladeshDokumen22 halamanMOA of Actuarial Societ of BangladeshActuarial Society of BangladeshBelum ada peringkat

- Quiz 1 - Semana 1 - PDFDokumen6 halamanQuiz 1 - Semana 1 - PDFLeonardo AlzateBelum ada peringkat

- Bacungan V CaDokumen2 halamanBacungan V CaJoy Margaret Maniego RituaBelum ada peringkat

- A Simple Explanation of How Money Moves Around The Banking System - Richard Gendal BrownDokumen12 halamanA Simple Explanation of How Money Moves Around The Banking System - Richard Gendal BrownAlijaNuhićBelum ada peringkat

- Deposit Pay in Slip in BengaliDokumen2 halamanDeposit Pay in Slip in Bengalibiswajit0% (1)

- Shaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service RequestedDokumen3 halamanShaheed Taylor 2223 Florey LN Apt. E8 ROSLYN PA 19001: Return Service Requestedshaheed taylorBelum ada peringkat

- Sfio Mca Au4110Dokumen4 halamanSfio Mca Au4110Moneylife FoundationBelum ada peringkat

- UniglobeDokumen2 halamanUniglobeGurdev SinghBelum ada peringkat

- HSBC London - Bank Comfort LetterDokumen3 halamanHSBC London - Bank Comfort Lettersumantri100% (1)

- Ca Final Audit MCQDokumen9 halamanCa Final Audit MCQKarthik Srinivas Narapalle0% (1)

- Acctstmt DDokumen4 halamanAcctstmt Dmaakabhawan26Belum ada peringkat

- OpTransactionHistoryUX524 08 2023Dokumen2 halamanOpTransactionHistoryUX524 08 2023Praveen SainiBelum ada peringkat

- Edward Fagan Disbarment 2009 Disciplinary Review Board To Supreme Court of New JerseyDokumen31 halamanEdward Fagan Disbarment 2009 Disciplinary Review Board To Supreme Court of New JerseyeliahmeyerBelum ada peringkat

- Sample Quiz On Acctg BasicsDokumen1 halamanSample Quiz On Acctg BasicsDarren Jacob EspinaBelum ada peringkat

- Titan AR 2002-03Dokumen10 halamanTitan AR 2002-03bondamiBelum ada peringkat

- ATM Transaction Card Type Transaction Type ISO Data Element Transaction DE-43.10 DE-43.11 DE-61.1 DE-61.2 Debit CreditDokumen4 halamanATM Transaction Card Type Transaction Type ISO Data Element Transaction DE-43.10 DE-43.11 DE-61.1 DE-61.2 Debit CreditTanmoy HasanBelum ada peringkat

- Unit 3 Ledger Posting and Trial Balance PDFDokumen46 halamanUnit 3 Ledger Posting and Trial Balance PDFPankaj VishwakarmaBelum ada peringkat

- Financial Accounting and Reporting Chapter 4 Problem 3Dokumen1 halamanFinancial Accounting and Reporting Chapter 4 Problem 3Paula BautistaBelum ada peringkat

- Bailment Bond and Eft Over LetterDokumen7 halamanBailment Bond and Eft Over LetterNikki Cofield100% (10)

- Comparing JPMorgan Chase and MAIB Banking ServicesDokumen7 halamanComparing JPMorgan Chase and MAIB Banking ServicesCatalina PinzariBelum ada peringkat

- Senior Manager Internal Audit in Boston MA Providence RI Resume Edward NolanDokumen3 halamanSenior Manager Internal Audit in Boston MA Providence RI Resume Edward NolanEdwardNolanBelum ada peringkat

- OpTransactionHistoryTpr24 01 2024Dokumen8 halamanOpTransactionHistoryTpr24 01 2024The Sherlock of StudiesBelum ada peringkat

- Account statement details for Mr. Chandresh Raj LodhaDokumen3 halamanAccount statement details for Mr. Chandresh Raj LodhaHemlata LodhaBelum ada peringkat

- Office of The General Manager (Com-Rev) : Assam Power Distribution Company LTDDokumen5 halamanOffice of The General Manager (Com-Rev) : Assam Power Distribution Company LTDishansri7776873Belum ada peringkat

- Microsoft Dynamics GP 2010 Table Reference GuideDokumen658 halamanMicrosoft Dynamics GP 2010 Table Reference Guidemereimages1844Belum ada peringkat

- Bahamas Company Cash Items ReportDokumen26 halamanBahamas Company Cash Items ReportMarie MagallanesBelum ada peringkat

- Key Principle and Characteristics of Micro FinanceDokumen18 halamanKey Principle and Characteristics of Micro Financedeepakbrt85% (40)

- List of Banks in IndiaDokumen5 halamanList of Banks in IndiamahendranmaheBelum ada peringkat

- Management of Primary ReservesDokumen13 halamanManagement of Primary ReservesNuhman.MBelum ada peringkat

- I Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Dari EverandI Will Teach You to Be Rich: No Guilt. No Excuses. No B.S. Just a 6-Week Program That Works (Second Edition)Penilaian: 4.5 dari 5 bintang4.5/5 (12)

- The Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindDari EverandThe Science of Prosperity: How to Attract Wealth, Health, and Happiness Through the Power of Your MindPenilaian: 5 dari 5 bintang5/5 (231)

- Excel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetDari EverandExcel for Beginners 2023: A Step-by-Step and Quick Reference Guide to Master the Fundamentals, Formulas, Functions, & Charts in Excel with Practical Examples | A Complete Excel Shortcuts Cheat SheetBelum ada peringkat

- The E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItDari EverandThe E-Myth Chief Financial Officer: Why Most Small Businesses Run Out of Money and What to Do About ItPenilaian: 5 dari 5 bintang5/5 (13)

- Love Your Life Not Theirs: 7 Money Habits for Living the Life You WantDari EverandLove Your Life Not Theirs: 7 Money Habits for Living the Life You WantPenilaian: 4.5 dari 5 bintang4.5/5 (146)

- Financial Accounting - Want to Become Financial Accountant in 30 Days?Dari EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Penilaian: 5 dari 5 bintang5/5 (1)

- Profit First for Therapists: A Simple Framework for Financial FreedomDari EverandProfit First for Therapists: A Simple Framework for Financial FreedomBelum ada peringkat

- Technofeudalism: What Killed CapitalismDari EverandTechnofeudalism: What Killed CapitalismPenilaian: 5 dari 5 bintang5/5 (1)

- How to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Dari EverandHow to Start a Business: Mastering Small Business, What You Need to Know to Build and Grow It, from Scratch to Launch and How to Deal With LLC Taxes and Accounting (2 in 1)Penilaian: 4.5 dari 5 bintang4.5/5 (5)

- Financial Accounting For Dummies: 2nd EditionDari EverandFinancial Accounting For Dummies: 2nd EditionPenilaian: 5 dari 5 bintang5/5 (10)

- Financial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanDari EverandFinancial Intelligence: A Manager's Guide to Knowing What the Numbers Really MeanPenilaian: 4.5 dari 5 bintang4.5/5 (79)

- Tax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesDari EverandTax-Free Wealth: How to Build Massive Wealth by Permanently Lowering Your TaxesBelum ada peringkat

- The ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Dari EverandThe ZERO Percent: Secrets of the United States, the Power of Trust, Nationality, Banking and ZERO TAXES!Penilaian: 4.5 dari 5 bintang4.5/5 (14)

- Bookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesDari EverandBookkeeping: An Essential Guide to Bookkeeping for Beginners along with Basic Accounting PrinciplesPenilaian: 4.5 dari 5 bintang4.5/5 (30)

- LLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyDari EverandLLC Beginner's Guide: The Most Updated Guide on How to Start, Grow, and Run your Single-Member Limited Liability CompanyPenilaian: 5 dari 5 bintang5/5 (1)

- Accounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsDari EverandAccounting 101: From Calculating Revenues and Profits to Determining Assets and Liabilities, an Essential Guide to Accounting BasicsPenilaian: 4 dari 5 bintang4/5 (7)

- Bookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesDari EverandBookkeeping: A Beginner’s Guide to Accounting and Bookkeeping for Small BusinessesBelum ada peringkat

- Project Control Methods and Best Practices: Achieving Project SuccessDari EverandProject Control Methods and Best Practices: Achieving Project SuccessBelum ada peringkat

- A Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineDari EverandA Beginners Guide to QuickBooks Online 2023: A Step-by-Step Guide and Quick Reference for Small Business Owners, Churches, & Nonprofits to Track their Finances and Master QuickBooks OnlineBelum ada peringkat

- Basic Accounting: Service Business Study GuideDari EverandBasic Accounting: Service Business Study GuidePenilaian: 5 dari 5 bintang5/5 (2)

- SAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsDari EverandSAP Foreign Currency Revaluation: FAS 52 and GAAP RequirementsBelum ada peringkat

- Mysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungDari EverandMysap Fi Fieldbook: Fi Fieldbuch Auf Der Systeme Anwendungen Und Produkte in Der DatenverarbeitungPenilaian: 4 dari 5 bintang4/5 (1)

- Finance Basics (HBR 20-Minute Manager Series)Dari EverandFinance Basics (HBR 20-Minute Manager Series)Penilaian: 4.5 dari 5 bintang4.5/5 (32)