Olivier de La Grandville-Bond Pricing and Portfolio Analysis-The MIT Press (2000)

Diunggah oleh

João Henrique Reis MenegottoDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Olivier de La Grandville-Bond Pricing and Portfolio Analysis-The MIT Press (2000)

Diunggah oleh

João Henrique Reis MenegottoHak Cipta:

Format Tersedia

M

d

.

d

a

l

i

m

#

5

3

3

8

4

7

8

/

9

/

0

0

C

y

a

n

M

a

g

Y

e

l

o

B

l

a

c

k

BOND PRICING AND PORTFOLIO

ANALYSIS

BOND PRICING AND PORTFOLIO

ANALYSIS

Protecting Investors in the Long Run

Olivier de La Grandville

The MIT Press

Cambridge, Massachusetts

London, England

: 2001 Massachusetts Institute of Technology

All rights reserved. No part of this book may be reproduced in any form by any electronic or

mechanical means (including photocopying, recording, or information storage and retrieval)

without permission in writing from the publisher.

This book was set in Times New Roman on `3B2' by Asco Typesetters, Hong Kong.

Printed and bound in the United States of America.

Library of Congress Cataloging-in-Publication Data

La Grandville, Olivier de.

Bond pricing and portfolio analysis : protecting investors in the long run /

by Olivier de La Grandville.

p. cm.

Includes bibliographical references and index.

ISBN 0-262-04185-5

1. BondsPrices. 2. Interest rates. 3. Investment analysis. 4. Portfolio

management. I. Title.

HG4651.L325 2000

332.63

/

23dc21 00-058682

For my wife, Ann, and our children,

Diane, Isabelle, and Henry,

and in loving memory of my mother,

Anika Pataki

CONTENTS

Introduction ix

1 A First Visit to Interest Rates and Bonds 1

2 An Arbitrage-Enforced Valuation of Bonds 25

3 The Various Concepts of Rates of Return on Bonds: Yield to

Maturity and Horizon Rate of Return 59

4 Duration: Denition, Main Properties, and Uses 71

5 Duration at Work: The Relative Bias in the T-Bond Futures

Conversion Factor 95

6 Immunization: A First Approach 143

7 Convexity: Denition, Main Properties, and Uses 153

8 The Importance of Convexity in Bond Management 171

9 The Yield Curve and the Term Structure of Interest Rates 183

10 Immunizing Bond Portfolios Against Parallel Moves of the

Spot Rate Structure 209

11 Continuous Spot and Forward Rates of Return, with Two

Important Applications 221

12 Two Important Applications 237

13 Estimating the Long-Term Expected Rate of Return, Its

Variance, and Its Probability Distribution 267

14 Introducing the Concept of Directional Duration 295

15 A General Immunization Theorem, and Applications 307

16 Arbitrage Pricing in Discrete and Continuous Time 327

17 The Heath-Jarrow-Morton Model of Forward Interest

Rates, Bond Prices, and Derivatives 359

18 The Heath-Jarrow-Morton Model at Work: Applications to

Bond Immunization 383

By Way of Conclusion: Some Further Steps 405

Answers to Questions 411

Further Reading 437

References 441

Index 447

viii Contents

INTRODUCTION

Duke of Suffolk. I will reward thee for this venturous deed.

Henry VI

The last two decades have witnessed an unusually high volatility of

interest rates, making the choice of so-called xed-income instruments a

dicult but potentially rewarding task. The reasons for such increasing

volatility can be traced back to the end of the system of xed exchange

rates set up at Bretton Woods. Perhaps the dividing date in the postwar

period is August 15, 1971, when the United States announced that it

would not commit itself further to selling gold to foreign central banks at

$35 per ounce. Since that date, foreign exchange markets have been

shaken by high turbulence, which has had direct consequences on the price

of loanable funds throughout the world.

It may be useful to remember how the whole problem started. In the

twenty years following the end of World War II, the U.S. dollarafter

being scarce for some timebecame relatively abundant because of the

increasing decit of the American balance of payments. This decit had

three main causes: relatively higher ination in the United States led to a

decit of the U.S. trade balance; direct investment made by American

rms abroad far outweighed foreign direct investments in the United

States; and important aid abroad contributed to increasing the decit. In

order to maintain the quasi-xed parities of their currencies with the U.S.

dollar, foreign monetary authorities were compelled to intervene in the

foreign exchange markets in order to buy the excess supply of dollars; this

excess supply was quickly compounded by expectations of a downfall

of the system when it appeared, in the early 1970s, that the amount of

foreign exchange held by foreign central banks was nearly four times the

amount of the gold reserves held by the United States.

In the years that followed, the major economic powers were unable to

set up a durable system of xed exchange rates. As a result, huge capital

movements, anticipating increases or falls in exchange rates, led to strong

uctuations in rates of interest. And monetary authorities, in order to pro-

tect the external value of their currencies or to prevent them from rising,

took a number of measures that aected those interest rates. Such volatility

was increased by two major factors: the two oil shocks of 1973 and 1979,

and ination spells, varying in intensity from country to country. Finally,

we should keep in mind that today most countries, following the example

set by the United States in 1979, have decided to dene their monetary

policies on the basis of specied monetary targets in lieu of pursuing the

even more illusory objective of xing interest ratesa denite blow to

stability.

Analytical background

In nance, as in any science, entirely novel ideas have been relatively

scarce, but each time they appeared they have had a profound inuence

on our way of thinking, and wide applications. In this study on the

valuation of bonds, we will make use of some remarkable discoveries that

span more than two centuries: they range from Turgot de L'Aulne's Re-

exions (1766) to the Heath-Jarrow-Morton (1992) stochastic model of

the interest rate term structure. Let us now say a brief word about those

developments.

To the best of our knowledge, we owe to Turgot de L'Aulne the rst

explanation of the equilibrium price dierence between a high-quality as-

set with given risk and a low-quality asset bearing the same risk. Speci-

cally, his purpose was to determine the equilibrium prices of good lands

and bad lands. In his Reexions sur la formation et la distribution des

richesses1 he gave the correct answer: through arbitrage, from an initial

disequilibrium situation that would enable arbitrageurs to step in, prices

would move to levels such that the expected return on both assets (on both

types of land) would be the same. He added that the yieldsand conse-

quently the priceson all types of investments bearing dierent risks

were linked together (in his days, the asset bearing the least risk, land

ownership, was followed by loans, and nally by assets in trade and in-

dustry). The equilibrium levels of the expected returns were separated by

a risk premium, as the levels of two liquids of dierent densities in the two

branches of a siphon would always remain separated from each other; one

1A. Turgot de L'Aulne, Reexions sur la formation et la distribution des richesses, 1776.

Reprinted by Dalloz, Paris, 1957. See particularly propositions LXXXII through XCIX,

pp. 128139.

x Introduction

level could not increase, though, without the other one moving up as

well.2

It would take more than a century for Turgot de L'Aulne's basic idea,

corresponding to a given risk level, to be formalized into an equation,

which we owe to Irving Fisher (1892).3 Fisher showed that in a risk-free

world, equilibrium prices corresponded to the equality between the rate of

interest and the sum of the direct yield of the capital good and its relative

increase in price. Fisher had obtained his equation through an ``integral''

approach, by equating the price of an asset to the sum (an integral in

continuous time) of the discounted cash ows of the asset and dierentiat-

ing the equality with respect to time. It is interesting to note that, to the

best of our knowledge, the rst time this equation was obtained through a

dierential, and an arbitrage, point of view was in Robert Solow's fun-

damental 1956 ``Contribution to the theory of economic growth.''4

The power and generality of Fisher's equation can hardly be overstated.

Since optimal economic growth theory is the theory of optimal investment

over time, it is of no surprise that the Fisher equation is central to the

solution of variational problems in growth theory. For instance, a typical

problem of the calculus of variations is to determine the optimal path of

investment to maximize a sum, over time, of utility ows generated in a

given economy; the problem can be extended to the optimal allocation of

exhaustible resources. It can be shown that the Euler equations governing

the optimal paths of renewable stocks of capital or those of nonrenewable

resources are nothing else than extensions of the Fisher equation.5

2We cannot resist the pleasure of quoting Turgot in his beautiful eighteenth-century style:

``Les dierents emplois des capitaux rapportent donc des produits tres inegaux : mais cette

inegalite n'empeche pas qu'ils s'inuencent reciproquement les uns les autres et qu'il ne

s'etablisse entre eux une espece d'equilibre, comme entre deux liquides inegalement pesants,

et qui communiqueraient ensemble par le bas d'un siphon renverse, dont elles occuperaient

les deux branches ; elles ne seraient pas de niveau, mais la hauteur de l'une ne pourrait

augmenter sans que l'autre montat aussi dans la branche opposee'' (Turgot de L'Aulne,

1776, op. cit., p. 130).

3Irving Fisher's original work on the equation of interest was published in Mathematical

Investigations in the Theory of Value and Price (1892); Appreciation and Interest (1896); in

``Reprints of Economic Classics'' (New York: A. M. Kelley, 1965).

4Robert M. Solow, ``A contribution to the theory of economic growth,'' The Quarterly

Journal of Economics, 70 (1956), pp. 439469.

5The interested reader may refer to Olivier de La Grandville, Theorie de la croissance econ-

omique (Paris: Masson, 1977), and to ``Capital theory, optimal growth and eciency condi-

tions with exhaustible resources,'' Econometrica, 48, no. 7 (November 1980), pp. 17631776.

xi Introduction

In the present study, the Fisher equation will quickly be put to work.

We will ask the following question: suppose that interest rates do not

change within a year (or, equivalently, that within a year, interest rates

have come back to their initial level) and that interest rates are described

by a at structure. Consider a coupon-bearing bond without default risk,

with a remaining maturity of a few years; suppose, nally, that the bond

was initially, and therefore still is after one year, under par. At what

speed, within one year, has it come back toward par (in other words, what

was the relative change in price of the bond over the course of one year)?

We will show that the Fisher equation gives an immediate answer: the

relative rate of change will always be equal to the dierence between the

rate of interest and the bond's simple (or direct) yield, dened as the ratio

between the coupon and the bond's initial value.

A central question, however, set up by Turgot remained yet unsolved:

for any two assets bearing dierent risks, what are the equilibrium risk

premia born by each asset which lead to equilibrium asset prices? A rst

answer to this question would have to wait for nearly two centuries: it was

not until the 1960s that William Sharpe and Jack Lintner would develop

independently their famous capital asset pricing model on the basis of

optimal portfolio diversication principles set by Harry Markovitz about

a decade earlier. The importance of their discovery is that it yields, at the

same time, a measure of risk and the asset's risk premium.

It would take the development of organized markets of derivative

products for other major advances to be made: there was rst the Black-

Scholes6 and Merton7 valuation formula of European options (1973);

then the recognition by Harrison and Pliska8 (1981) that the absence of

arbitrage was intimately linked to the existence of a martingale probabil-

ity measure. And a major discovery was nally made by David Heath,

Robert Jarrow, and Andrew Morton in 1992;9 it is of central importance

to our subject, since it deals with the stochastic properties of the term

6Fischer Black and Myron Scholes, ``The pricing of options and corporate liabilities,''

Journal of Political Economy, 81 (1973), pp. 637654.

7Robert Merton, ``Theory of rational option pricing,'' Bell Journal of Economics and Man-

agement Science, 4 (1973), pp. 141183.

8Michael Harrison and Stanley Pliska, ``Martingales and stochastic integrals in the theory of

continuous trading,'' Stochastic Processes and their Applications, 11 (1981), pp. 215260.

9David Heath, Robert Jarrow, and Andrew Morton, ``Bond pricing and the term structure

of interest rates: a new methodology for contingent claims valuation,'' Econometrica, 60

(1992), pp. 77105.

xii Introduction

structure of interest rates. Heath, Jarrow, and Morton's fundamental

discovery is the following: arbitrage-free markets imply that, if a Wiener

process drives the forward interest rate, the drift term of the stochastic

dierential equation cannot be independent from its volatility term; on

the contrary, it will be a deterministic function of the volatility. Today

this surprising result is central to bond pricing and hedging in the context

of a stochastic term structure.

An overview of the book

Volatility of interest rates has direct consequences on the returns of bonds,

because of both a price eect and an eect on the reinvestment of cou-

pons. This naturally leads the money manager to play two dierent roles.

Often he will choose to have an active style of management, trying to use

maximum information to forecast interest rates and take positions on the

bond market; or he can try to protect the investor from the up-and-down

swings of rates of interest and try to immunize bond portfolios against

those changes.

Our purpose in this book is to discuss some of the most important

concepts pertaining to bond analysis and management, with major em-

phasis on the protection of investors against changes in interest rates. In

our introductory chapter, we pay a rst visit to bonds and interest rates.

In particular, we explain how the various types of bonds are quoted in the

nancial press by dening basic concepts related to those xed-income

securities, and we introduce the various ways of dening interest rates.

But we also ask the rather innocuous question: why do interest rates exist

in the rst place? The concept of forward rates gives us an opportunity to

meet the concept of arbitrage. In the nal part of our rst chapter, we

describe the main features of a particularly important nonstandard type

of bondthe convertible. In chapter 2, we take up the valuation of a bond.

One special feature of this chapter is to relate the valuation of bond to the

arbitrage equation of interest; in particular, we show that the price of the

bond and its rate of change must be such that this equation always holds.

In chapter 3, we survey the most relevant measures of rates of return on

bonds, namely the yield to maturity and the horizon rate of return.

We are then able to turn to the central concept of duration, its main

properties and uses (chapters 4 and 5). The all-important concept of

xiii Introduction

immunization (protection of the investor against uctuations in interest

rates) is introduced in chapter 6. In chapters 7 and 8, the concept of con-

vexity is introduced and related to that of duration. With concrete exam-

ples, we show its role in bond management. Chapter 9 deals with the

question of the term structure of interest rates and its signicance in esti-

mating what the future structure may look like.

The fundamental result of immunization of bond portfolios for parallel

changes in the term structure of interest rates is demonstrated in chapter

10. In the next chapter, we discuss spot and forward rates of return in

continuous time and apply the central limit theorem to justify the work-

horse of today's nancial theory, the lognormal distribution of the dollars

returns and asset prices. This leads us, in chapter 12, to a theoretical jus-

tication of the lognormal distribution of asset prices and to an exami-

nation of recent methods used to determine the term structure of interest

rates. In chapter 13, we take up a subject that seems to us little known and

particularly important to bond investors: estimating the long-term

expected rate of return, its variance, and its probability distribution. We

introduce in chapter 14 a new concept, directional duration, which gen-

eralizes the Macaulay and Fisher-Weil concepts.

We then oer, in chapter 15, a general immunization theorem, which

we put to the test of any change received by the term structure of interest

rates. This theorem generalizes the result demonstrated in chapter 10.

Arbitrage in discrete and continuous time, which is so central to modern

nancial analysis, is described in chapter 16. Here we present the concept

of probability measure change. In chapter 17, we discuss the famous

Heath-Jarrow-Morton model of forward interest rates and bond prices,

and in chapter 18 we put this model to work by applying it in some detail

to bond portfolio immunization.

The target audience

We have tried to keep the level of technicality of this study as low as

possible. For the most part, mathematical developments have been given

in appendixes, and only quite simple ones remain in the main text. The

rst ten chapters can be used for core studies in an undergraduate course;

the last part of the book, which requires some familiarity with probability

and stochastic calculus, can be used together with a quick review of the

rst part for a graduate course.

xiv Introduction

What is new in this book?

We can promise a systematic valuation of bonds through arbitrage as well

as some (nice) surprises and hopefully novel results.

.

For instance, the value of a bond can always be expressed as a weighted

average between 1 and the ratio of the coupon rate to the rate of interest,

with weights that are moving through time. The formula we suggest may

be very useful in understanding how the bond's value will evolve over

time toward par for any given rate of interest (chapter 2).

.

An explanation for the apparently strange phenomenon of the indeter-

minacy between an increase in a bond's maturity and its duration; we will

also give an economic interpretation of the value of the duration of a

perpetual bond, whatever its coupon rate may be (chapter 4).

.

An introduction of the concept of the relative bias regarding the most

important contract an nancial futures markets, the Chicago Board of

Trade T-bond futures contract (chapter 5).

.

The importance of convexity in bond management and ways of

improving the convexity of a bond portfolio (chapters 7 and 8).

.

A proof of the immunization theorem for parallel changes in the spot

rate curve, based on a variational approach (chapter 10).

.

A discussion of the exact relationship between spot and forward rates of

return. In particular, we show that a spot rate structure cannot increase

and reach a plateau without the forward rate decreasing on an interval

before that stage (chapter 11).

.

Recent methods in deriving the structure of interest rates from coupon

bond prices (chapter 12).

.

Exact formulas for the expected value and variance of the long-term

rate of return on bonds and, more generally, on any investment, directly

expressed as functions of one-year estimates, and an explanation of the

probability distribution governing the one-year return and the long-

horizon return (chapter 13).

.

A new concept of duration, based on the directional derivative: direc-

tional duration (chapter 14). We use this to cope with nonparallel shifts in

the spot rate structure.

xv Introduction

.

A general immunization theorem, applicable to any kind of shock the

spot rate curve may receive (chapter 15).

.

A geometrical interpretation of a martingale probability construction

(chapter 16).

.

An intuitive demonstration of the Cameron-Martin-Girsanov theorem

(chapter 16).

.

A complete discussion of the one-factor Heath-Jarrow-Morton model

of interest term structure and its applications to bond portfolio duration

and immunization. In particular, we give the full demonstration of the

HJM one-factor model in the all-important case of the Vasicek volatility

coecient (chapter 17).

.

We discuss in detail how the HJM model duration and immunization

results dier fromand generalizethe classical results (chapter 18).

In order for this text to be as user-friendly as possible, each chapter is

followed by a series of questions, problem sets, and projects, and detailed

solutions for all of these can be found at the back of the book.

Acknowledgments

Many individuals, by their comments and support, have been very helpful

in the completion of this book. It is a pleasure for me to thank the part-

ners at Lombard, Odier & Cie in Geneva, in particular Jean Bonna,

Thierry Lombard, Patrick Odier, and Philippe Sarrasin, their xed in-

come group in Geneva, Zurich, and London, and especially Ileana Regly,

for their support. I also thank my colleagues Christopher Booker, Samuel

Chiu, Ken Clements, Jean-Marie Grether, Roger Guerra, Yuko Hara-

yama, Roger Ibbotson, Blake Johnson, Paul Kaplan, Rainer Klump,

David Luenberger, Michael McAleer, Paul Miller, Anthony Pakes,

Elisabeth Pate-Cornell, Jacques Peyriere, Elvezio Ronchetti, Wolfgang

Stummer, James Sweeney, Meiring de Villiers, Nicolas Wallart, Juerg

Weber, and Pierre-Olivier Weill. Special thanks are due to Eric Knyt, who

has read the entire manuscript with his usual eagle eye and has made

many useful suggestions. And I would like to extend my deepest appreci-

ation to Mrs. Huong Nguyen, for her admirable typing, cheerfulness, and

her devotion to her job.

xvi Introduction

Parts of this book were written while I was visiting the Department

of Management Science and Engineering (formerly the Department of

EngineeringEconomics and Operations Research) at Stanford Univer-

sity, and the Department of Economics at the University of Western

Australia. I would like to extend my appreciation to both institutions for

their wonderful working environment and friendly atmosphere.

Finally, it is a pleasure to express my thanks to the sta at MIT Press

and to Peggy M. Gordon for their eciency and genuine care in produc-

ing this book.

About the author

Olivier de La Grandville is Professor of Economics at the University of

Geneva. Since 1988 he has been a Visiting Professor at the Department

of Management Science and Engineering at Stanford University. Profes-

sor de La Grandville is the rst recipient of the Chair of Swiss Studies at

Stanford; his teaching and research interests range from microeconomics

to economic growth and nance. The author of six books in these areas,

his papers have been published in journals such as The American Eco-

nomic Review, Econometrica, and the Financial Analysts Journal. He has

also held visiting positions at the following institutions: Massachusetts

Institute of Technology, University of Western Australia, University of

Lausanne, and Ecole Polytechnique Federale de Lausanne. He is a regu-

lar lecturer to practitioners.

Although, for no apparent reason, he has not yet made the team, his

favorite baseball club is still the San Francisco Giants.

xvii Introduction

1

A FIRST VISIT TO INTEREST RATES

AND BONDS

Shylock. . . . and he rails . . . on my well-won thrift

Which he calls interest.

The Merchant of Venice

Macbeth. Cancel and tear to pieces that great bond

Which keeps me pale.

Macbeth

Chapter outline

1.1 A rst look at interest rates or rates of return 3

1.1.1 Horizons shorter than or equal to one year 4

1.1.2 Horizons longer than one year 5

1.1.2.1 Horizons longer than one year and integer numbers 5

1.1.2.2 Horizons longer than one year and fractional 5

1.2 Forward rates and an introduction to arbitrage 6

1.3 Creating synthetically a forward contract 9

1.4 But why do interest rates exist in the rst place? 10

1.5 Kinds of bonds, their quotations, and a rst approach to yields on

bonds 13

1.5.1 Treasury bills 13

1.5.2 Treasury notes 17

1.5.3 Treasury bonds 18

1.6 Bonds issued by rms 18

1.7 Convertible bonds 19

Overview

A bond is a certicate issued by a debtor promising to repay borrowed

money to a lender or, more generally, to the owner of the certicate, at

xed times. The following glossary will be immediately useful.

.

The amount borrowed is called the principal; it is often referred to as the

par value, or face value, of the security.

.

The time span until reimbursement will be called the maturity of the

bond. Normally, ``maturity'' designates the date at which the principal

is due; in this book, however, we will often consider maturity to be the

dierence between the date of reimbursement and today.

.

The contract underlying the security may involve a number of pay-

ments of equal size. Those cash ows to be received at regular intervals

by the lender are called coupons; they may be paid yearly (as is the case

frequently in Europe), twice a year, or on a quarterly basis (as in the

United States).

.

The coupon rate is the yearly value of cash ows paid by the bond issuer

divided by the par value.

.

If no coupons are to be paid, the bond is called a zero-coupon bond. A

zero-coupon bond is said to be a pure-discount security. Notice that all

coupon-bearing bonds automatically become pure-discount securities

once the last coupon and par value are all that remain to be paid out by

the issuer.

If the borrower does not default on his promises, the lender can count on

xed payments throughout the lifetime of the security. But even in this

case, owning such a nancial instrument does not guarantee a xed yearly

yield on invested money.

The rst and foremost reason yields on bonds are likely to uctuate

comes from an essential property of the bond: as a promise on future cash

ows, it has a value that is most likely to move up or down, because each

of those promises can uctuate in valuea fact which, in turn, needs to

be explained.

Suppose a large company with an excellent credit rating (soon to be

dened) borrows today at a 5% coupon rate by issuing 20-year maturity

bonds. The company has done this in a nancial market where a supply of

loanable funds meets a demand for such funds; presumably, the numbers

of lenders and borrowers are such that none of them, individually, is able

to have a signicant impact on this market. We can reasonably imagine

that if the company has tried to obtain, and has been able to secure, a 5%

loan in that peculiar securities market, it is because:

1. It would have been unable to obtain it at a lower coupon rate (4.75%

for instance); competition from other borrowers for relatively scarce

loanable funds has pushed up the coupon rate to 5%.

2. It would have been foolish for rms to oer a higher coupon rate; for a

5.25% coupon rate, borrowers would have faced an excess supply of

loanable funds, which would have driven down the coupon rate to 5%.

Suppose now, a few weeks later, conditions on that nancial market

have considerably changed. Due to good economic prospects, demand for

loans from the same category of rms has increased; however, supply has

2 Chapter 1

not changed. On the 20-year maturity market, the coupon rate is bound

to increase, perhaps to 5.50%. Obviously, something momentous will

happen to our 5% coupon rate security; its price will fall. Indeed, there

exists a market for that bond, and the initial buyer may want to sell it. It

is evident, however, nobody will want to buy a ``5% coupon'' at par when

for the same price the buyer can get a ``5.5%.'' Therefore, both the seller

and the buyer of the previously issued security may agree on a price that

will be lower than par. If a few days later market conditions change

again (this time in the opposite direction, perhaps because large inows of

capital movements from abroad have increased the supply of loanable

funds on that market, entailing a decrease in the coupon rate from 5.5%

to 5.25%), the price of the security is bound to move again, this time

upward.

We will determine in chapter 2, on bond valuation, exactly how large

those uctuations will be. For the time being, our aim is to recognize that

bond values will move up or down according to conditions of the nancial

market, and this creates the rst factor of uncertainty for the bond holder.

To understand a second reason for uncertainty, suppose that our

investment horizon, in buying the 20-year bond, is a few yearsor even

20 years. The various cash ows received will be reinvested at rates we do

not know today. So even if we buy a bond at a given price and hold onto

it until maturity, we cannot be certain of the yield of that investment. This

uncertainty is referred to as reinvestment risk.

There are thus two reasons why assets that do not carry any default risk

are still prone to uncertainty. First, even for zero-coupon bonds there is

some price risk if bonds are not held until maturity; second, there is re-

investment risk. These two sources of risk nd their origins in the general

conditions of supply and demand of loanable funds, which usually are

liable to change, in most cases in an unpredictable way. Naturally, some

fund managers will try to know more, and quicker, than other managers

about such changes in order to benet from bond price increases, for

instance.

1.1 A rst look at interest rates or rates of return

Until now we have not yet referred to, much less dened, rate of interest.

The dierent concepts of rate of interest can be distinguished according to

3 A First Visit to Interest Rates and Bonds

.

the time of the inception of the contract;

.

the time at which the loan begins;

.

the time at which the loan ends;

.

the mode of calculation of the interest between the beginning and the

end of the loan.

A loan agreed upon on a certain date, starting at that date will give rise

to a spot interest rate. A loan starting after the date of the contract is a

forward contract. In the following discussion we will refer to the horizon

as the length of time between the start of the loan and the time of its

reimbursement. This horizon will also be referred to as the trading period.

The easiest way to dene a spot rate is to say it is equal to the (yearly)

return of a zero-coupon with a remaining maturity equal to the investor's

horizon. Therefore, it is the yearly rate of return that transforms a zero-

coupon value into its par value. Unfortunately, this denition is not quite

precise, because there are many dierent ways to calculate a ``per year

rate.'' Generally, however, the following rules are followed: Call i the rate

of interest, B

t

the value of the zero-coupon bond at time t, and B

T

the par

value of the zero-coupon bond (or the reimbursement value of the bond at

time T). The investor's horizon is h = T t.

1.1.1 Horizons shorter than or equal to one year

For horizons T t equal to or shorter than one year, the rate of interest is

the relative rate of increase between the bond's value at t, B

t

, and the par

value B

T

, divided by the horizon's length T t. This is the simplest de-

nition that can exist, since it corresponds to capital gain per time unit (per

year, if the time unit is a year). For example, suppose a zero-coupon with

par value equal to B

T

= 100 is worth 98 at time t (today, three months

before maturity). The rate of interest for the three-month period,

expressed on a yearly basis, is

i =

B

T

B

t

B

t

_

(T t) =

100 98

98

_

1

4

= 8X163% per year (1)

Notice there is an alternate way to dene the same concept: rearrange the

above expression and write it as

i(T t) =

B

T

B

t

B

t

4 Chapter 1

or, equivalently,

B

t

i(T t)B

t

= B

t

[1 i(T t)[ = B

T

(2)

The short-term spot interest rate is thus seen as one that determines the

interest due on the loan in the following way: The interest due, i(T t)B

t

,

is directly proportional to the amount loaned B

t

and to the horizon of the

loan (T t). In other words, the interest to be paid for xed B

T

is a linear

function of the horizon (T t).

1.1.2 Horizons longer than one year

We will consider two cases: First, the horizon is an integer number of

years; second, the horizon is not an integer (for instance, T t = 3X45

years).

1.1.2.1 Horizons longer than one year and integer numbers

For horizons longer than one year and integer numbers, another way of

determining and computing rates of interest is generally used. Since over a

number of years the amount borrowed often does not imply payment of

interest at the end of each year but only at the maturity of the loan, the

amount due at T, after T t years, is the following, applying the well-

known principle of compound interest:

B

t

(1 i)

Tt

= B

T

(3)

Therefore, the rate of interest i, or the rate of return on a loan starting at t

and reimbursed T t years later, is

i =

B

T

B

t

_ _

1a(Tt)

1 (4)

For instance, consider a zero-coupon bond with three years of maturity,

par value B

T

= 100, and value today B

t

= 78X48. Applying (4), the rate of

return on that default-free bond is 8.413%. And we can infer that the

three-year spot rate, or the rate of interest for three-year loans, is 8.413%.

1.1.2.2 Horizons longer than one year and fractional

We can tackle the case of a horizon T t larger than one year and frac-

tional in the following way. When horizons are longer than one year and

not an integer number (for instance, 3.45 years), there are two possibil-

5 A First Visit to Interest Rates and Bonds

ities: Either directly apply formula (4), replacing T t by 3.45, which

leads to 7.277%; or, logically, consider applying a combination of formula

(4) (compound interest), the integer number of years (3 years) and for-

mula (2) (simple interest), the remaining fraction of a year (0.45 of a

year). This implies that our rate of interest would be calculated as follows.

When T t designates the integer part of the horizon and : the remaining

fraction of the year (we have T t = T t :; in our example, T t =

3X45 years; T t = 3 years and : = 0X45 year), i would be such that

B

t

(1 i)

Tt

B

t

(1 i)

Tt

:i = B

t

(1 i)

Tt

(1 :i) = B

T

(5)

Unfortunately, equation (5) cannot be solved analytically for i, and

only trial and error (or numerical methods) can be used. Applying such

methods would lead to a value of i = 7X2576%.1 Since this method is

cumbersome, formula (4) is usually preferred.

There are many other ways to determine a rate of return or rate of

interest. First, an interest can be calculated and paid once a year, or a

number of times per year. (It can be paid, for instance, twice a year, four

times a year, every month; for reasons that will become clear later in this

book, dealt with in detail in chapter 11, it can even be considered to be

calculated an innite number of times per periodequivalently, it can

then be considered as being paid continuously.)

1.2 Forward rates and an introduction to arbitrage

On the other hand, as we mentioned earlier, interest rates can be agreed

upon today for loans starting only at a future date, for a xed horizon

or trading period; those are forward rates. Call f (0Y tY T) a forward rate

decided upon today, at time 0, for a loan starting at t and reimbursed at T.

A spot rate (for a loan that starts at time 0 and is reimbursed at any time

u) is a particular case of a forward rate. We denote it f (0Y 0Y u) Ii(0Y u)

for a maturity u, or f (0Y 0Y t) Ii(0Y t) for a maturity t. The arbitrage-

enforced links between forward rates and spot rates are very strong, and

we will briey explain here why.

There is in fact an arbitrage-driven equivalency either in borrowing or

in lending directly at rate i(0Y T)Y on the one hand, or via the shorter rate

1The reason we get a lower rate of return applying equation (5) instead of equation (4) is that

1 :i is larger than (1 i)

:

when 0 ` : ` 1; the converse is true for : b 1.

6 Chapter 1

i(0Y t) and the forward rate f (0Y tY T), on the other. This equivalency must

translate via this equation:

[1 i(0Y t)[

t

[1 f (0Y tY T)[

Tt

= [1 i(0Y T)[

T

(6)

because arbitrageurs would otherwise step in, and their very actions

would establish this equilibrium. We will now demonstrate this, but rst

we must dene what we mean by arbitrage.

Arbitrage consists of taking nancial positions that require no invest-

ment outlay and that guarantee a prot. At rst sight, it may seem strange

that a prot may be generated without any upfront personal outlay or

expenditure, but in many circumstances this is precisely the case. We will

now present such a case, supposing to that eect that the left-hand side of

(6) is larger than the right-hand side. We would thus have

[1 i(0Y t)[

t

[1 f (0Y tY T)[

Tt

b [1 i(0Y T)[

T

This means it is more rewarding to lend and more expensive to borrow

over a period T via two contracts (the spot, short one, and the forward

contract) than via the unique long-term contract. Arbitrageurs would im-

mediately borrow $1 on the long contract, invest this dollar in the short

contract, and at the same time invest the proceeds to be received at t,

[1 i(0Y t)[Y on the forward market for a time period T t. The forward

rate being f (0Y tY T), they would receive [1 i(0Y t)[

t

[1 f (0Y tY T)[

Tt

at

time T, which is larger than their disbursement [1 i(0Y T)[

T

by hypothe-

sis. Thus, without any initial outlay on their part, they would reap at time

T a sure prot equal to [1 i(0Y t)[

t

[1 f (0Y tY T)[

Tt

[1 i(0Y T)[

T

b 0.

What would be the consequences of such actions? First, demand would

increase on the long spot market, and the price of loanable funds on that

market, i(0Y T), would start to increase; second, supply both on the short

spot market and on the forward market would start to increase, entailing

a decrease in the prices of funds on those markets, i(0Y t) and f (0Y tY T),

respectively. This would take place until, barring transaction costs, equi-

librium was restored.

But arbitrageurs would not be the only ones to ensure a quick return to

equilibrium. Consider the ``ordinary'' operators on these three markets;

by ``ordinary'' operators we mean the persons, rms, or government

agencies that are the lenders or the borrowers acting on those markets as

simple investors or debtors; they simply carry out the operation for its

own sake. Suppliers, or lenders, have no reason to lend on the long spot

7 A First Visit to Interest Rates and Bonds

market when, at no additional risk, they can get higher rewards on the

short spot market and on the forward market; thus their supply will

shrink on the long spot market, contributing to the increase of i(0Y T).

Supply will therefore increase on the short spot market and on the for-

ward market, thus driving down i(0Y t) and f (0Y tY T). And of course,

symmetrically, borrowers have no reason to take the two-market route

when they can borrow directly on the long spot market; demand will

decline on the former markets and will increase on the latter, thus con-

tributing to the increase of i(0Y T) and the decrease of i(0Y t) and

f (0Y tY T).

One can easily see what would happen if initially the converse were

true; arbitrageurs, if they reacted quickly enough, could reap the (posi-

tive) dierence between the right-hand side of (6) and its left-hand side by

borrowing on the shorter markets and lending the same amount on the

long one. The rest of the analysis would be the same, and all results would

be symmetrical. We thus can conclude that, barring special transaction

costs, equation (6) will be maintained by forces generated both by arbi-

trageurs and ordinary operators on those nancial markets.

Equation (6) permits us to express the forward rate f (0Y tY T) as a

function of the spot rates, i(0Y t) and i(0Y T). Indeed, we can rearrange (6)

to obtain

f (0Y tY T) =

[1 i(0Y T)[

Ta(Tt)

[1 i(0Y t)[

ta(Tt)

1

(7)

Any interest rate plus one is usually called the ``dollar return''; it is equal

to the coecient of increase of a dollar when invested at the yearly rate

i(0Y t). For instance, if a rate of interest (spot or forward) is 7% per year,

1.07 is the dollar return corresponding to that rate of interest. We can

deduce from (6) an important property of the spot dollar return

1 i(0Y T). Taking (6) to the 1aT power, it can then be written as

1 i(0Y T) = [1 i(0Y t)[

taT

[1 f (0Y tY T)[

(Tt)aT

(8)

Remembering that the spot rate i(0Y t) can be considered as the forward

rate at time 0 for a loan starting immediately, written f (0Y 0Y t), we can see

immediately that the T-horizon spot dollar return, 1 i(0Y T), is the

8 Chapter 1

weighted geometric average2 of the dollar forward returns, the weights

being the shares of the various trading periods for the forward rates in the

total trading period T.

Of course, what we have demonstrated through arbitrage and tradi-

tional trading in equations (6), (7), and (8) generalizes to any arbitrary

partitioning of the time interval [0Y T[; let t

1

Y t

2

Y F F F Y t

n

be an arbitrary

partitioning of [0Y T[ into n intervals, those intervals being not necessarily

the same size. We then have the arbitrage-enforced equation

[1 i(0Y t

1

)[

t

1

[1 f (0Y t

1

Y t

2

)[

t

2

t

1

F F F [1 f (0Y t

n1

Y t

n

)[

t

n

t

n1

= [1 i(0Y t

n

)[

t

n

(9)

The t

n

horizon spot dollar return is the geometric average of all dollar

forward rates:

1 i(0Y t

n

) =

n

j=1

[1 f (0Y t

j1

Y t

j

)[

(t

j

t

j1

)at

n

(10)

Forward rates will be discussed again in chapter 9 of this book; we will

deal in more detail with the way interest rates are calculated in chapter 11.

Finally, forward rates will be used extensively in chapters 14 and 15.

1.3 Creating synthetically a forward contract

We will now show that we are always able to create synthetically a for-

ward contract from spot rates. Indeed, suppose you want to borrow $1 at

the future date t, to be reimbursed at T.

If you want to receive $1 at t, you can borrow on the long market an

amount (to be determined) and lend it on the short market; the amount to

be lent must be such that, at rate i(0Y t), it becomes 1 at t. It must there-

fore be equal to 1a[1 i(0Y t)[

t

. If this is the amount you borrow at time 0,

you owe 1a[1 i(0Y t)[

t

[1 i(0Y T)[

T

at time T. You have incurred no

disbursement at time 0, because at the same time you have borrowed and

lent 1a[1 i(0Y t)[

t

; at time t you have received 1, and at time T you re-

imburse the amount just mentioned; notice, of course, this corresponds

2Recall that the geometric weighted average of x

1

Y F F F Y x

n

with weights f

1

Y F F F Y f

n

(such that

n

j=1

f

j

= 1) is G =

n

j=1

x

fj

j

. We will make use of this concept again in chapter 13, when

dealing with the estimation of the long-term expected return of a bond or bond portfolios.

9 A First Visit to Interest Rates and Bonds

exactly to the amount we would have obtained applying the forward rate

dened implicitly in (6) and explicitly in (7). Indeed, applying that rate to

$1 borrowed on the forward market, we would have to repay at T

[1 f (0Y tY T)[

Tt

= 1

[1 i(0Y T)[

Ta(Tt)

[1 i(0Y t)[

ta(Tt)

1

_ _

Tt

=

[1 i(0Y T)[

T

[1 i(0Y t)[

t

(11)

which is exactly the amount to be reimbursed in this synthetic forward

contract made up of two spot rate contracts.

1.4 But why do interest rates exist in the rst place?

Until now we have examined a variety of interest rates, depending on the

date of the contract and the trading period. In particular, we were led to

distinguish between spot rates and forward rates. However, there is an

important question that we could have asked in the rst place: why do

interest rates exist? The answer to this question is not so obvious and

merits some comments.

Most people, when asked this apparently innocuous question, respond

that since ination is a pervasive phenomenon common to all places and

times, it is therefore only natural that lenders will want to protect them-

selves against rising prices; borrowers might well agree with that, there-

fore establishing the existence of an equilibrium rate of interest.

It is rather strange that ination is so often the rst explanation given

for the existence of interest rates. In fact, positive interest rates have

always been observed in countries where there was practically no ina-

tionor even a slight decrease in prices. Although ination is certainly a

contributor to the magnitude of interest rates, it is in no way their primary

determinant. There are two other principal causes.

First, and foremost, an interest rate exists because one monetary unit

can be transformed, through xed capital, into more than one unit after a

certain period of time. Some people are able, and willing, to perform that

rewarding transformation of one monetary unit into some xed capital

good. On the other hand, some are willing to lend the necessary amount,

and it is only tting that a price for that monetary unit be established

10 Chapter 1

between the borrowers and the lenders. Let us add that on any such

market both borrowers and lenders will nd a benet in this transaction.

Let us see why.

Suppose that at its equilibrium the interest rate sets itself at 6%. Gen-

erally, lots of borrowers would have accepted a transaction at 7%, or even

at much higher levels, depending on the productivity of the capital good

into which they would have transformed their loan. The dierence be-

tween the rate a borrower would have accepted and the rate established in

the market is a benet to him. On the other hand, consider the lenders:

they lent at 6%, but lots of them might well have settled for a lower rate of

interest (perhaps 4.5%, for instance). Both borrowers and lenders derive

benets (what economists call surpluses) from the very existence of a

nancial market, in the same way that buyers and suppliers derive sur-

pluses from their trading at an equilibrium price on markets for ordinary

goods and services.

Second, an interest rate exists because people usually prefer to have a

consumption good now rather than later. For that they are prepared to

pay a price; and as before, others may consider they could well part with a

portion of their income or their wealth today if they are rewarded for

doing so. There again, borrowers and lenders will come to terms that will

be rewarding for both parties, in a way entirely similar to what we have

seen in the case of productive investments.

Together with expected ination, these reasons explain the existence of

interest rates. The level of interest rates will depend on the attitudes of the

parties regarding each kind of transaction, and of course on the perceived

risk of the transactions involved.

An important point should be made here that, to the best of our

knowledge, has received short shrift until now. Anyone can agree that, for

a certain category of loanable funds, there exists at any point in time a

supply and a demand that lead to an equilibrium price, that is, an equi-

librium rate of interest. We should add here that, as in any commodity

market, the mere existence of an equilibrium interest rate set at the inter-

section of the supply-and-demand curves for loanable funds entails two

major consequences: First, the surplus of society (the surplus of the

lenders and the borrowers) is maximized (shaded area in gure 1.1);

second, the amount of loanable funds that can be used by society is also

maximized (gure 1.1).

11 A First Visit to Interest Rates and Bonds

Suppose now that for some reason interest rates are xed at a level

dierent from the equilibrium level (i

e

). Two circumstances, at least, can

lead to such xed interest rates. First, government regulations could pre-

vent interest rates from rising above a certain level (for instance i

0

, below

i

e

). Alternatively, a monopoly or a cartel among lenders could x the

interest above its equilibrium value i

e

(for instance, at i

1

).

If interest rates are xed in such a way, the funds actually loaned will

always be the smaller of either the supply or the demand. Indeed, the very

existence of a market supposes that one cannot force lenders to lend

whatever amount the borrowers wish to borrow if interest rates are below

their equilibrium valueand vice versa if interest rates are above that

value. We can then draw the curve of eective loans when interest rates

are xedthe kinked, dark line in gure 1.2. Should the interest rate be

xed either at i

0

or at i

1

, the loanable funds will be l (less than l

e

), and the

loss in surplus for society will be the shaded area abE. Innocuous as these

properties of nancial markets may seem, they are either unknown or

ignored by governments when they nationalize banksor when they

close their eyes to cartels established among banks (nationalized or not).

E

D

S

Loanable funds l

e

Interest

rate

i

e

Borrowers

surplus

Lenders

surplus

Figure 1.1

An equilibrium rate of interest on any nancial market maximizes the sum of the lenders' and

the borrowers' surpluses, as well as the amount of loanable funds at society's disposal.

12 Chapter 1

1.5 Kinds of bonds, their quotations, and a rst approach to yields on bonds

There are two main ways to distinguish between bonds: First, according

to their maturity, starting with personal saving deposits or very short-

term deposits, going to long-term (for instance, 30-year maturity secu-

rities); and second, by separating bonds according to their level of

riskiness, from entirely risk-free bonds issued by the U.S. Treasury, for

example, to so-called ``junk'' bonds. Since this book is concerned mainly

with defaultless bonds, we will consider bonds according to their matu-

rity. But we will also say a word about ranking bonds according to their

riskiness.

1.5.1 Treasury bills

Treasury bills have a maturity of one year or less and of course are issued

on a discount basis; their par value is usually $10,000. In table 1.1 (see the

last part of the table), six features of Treasury bills are presented:

par = par value of the Treasury bill (for instance: par = $10,000)

E

a

b

D

S

Loanable funds l

e

l

Interest

rate

i

e

i

1

i

0

Figure 1.2

Any articially xed interest rate reduces both the amount of loanable funds at society's dis-

posal and the surplus of society (the hatched area).

13 A First Visit to Interest Rates and Bonds

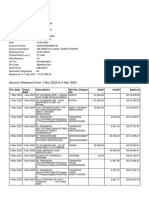

Table 1.1

Information about U.S. Treasury Bonds, notes, and bills

U.S. TREASURY I SSUES

Monday, June 7, 1999

Representative and indicatve Over-the-Counter quotations based on transactions of $1 million or more.

Treasury bond, note and bill quotes are as of mid-afternoon. Colons in bond and note bid-and-asked quotes represent 32nds; 101:01

means 101 1/32. Net changes in 32nds. Treasury bill quotes in hundredths, quoted on terms of a rate of discount. Days to maturity cal-

culated from settlement date. All yields are based on a one-day settlement and calculated on the offer quote. Current 13-week and

26-week bills are boldfaced.

For bonds callable prior to maturity, yields are computed to the earliest call date for issues quoted above par and to the maturity.

date for issues quoted below par. n-Treasury note.wi-When issued; daily change is expressed in basis points.

Source: Dow Jones Telerate/Cantor Fitzgerald

``U.S. Treasury Issues, Monday, June 7, 1999,'' by Dow Jones Telerate/Cantor Fitzgerald,

copyright 1999 by Dow Jones & Co., Inc. Reprinted by permission of Dow Jones & Co.,

Inc. via Copyright Clearance Center.

d

b

= the bid discount rate applied by dealers when they buy

a Treasury bill

p

b

= the dealers' price bid when buying a Treasury bill,

resulting from the discount bid rate

n = the number of days remaining until the T-bill's maturity

360 = the number of days in a year arbitrarily chosen when linking

d

b

to p

b

, and when calculating the ``ask yield''

0 = na360 Ifraction of an ``accounting year'' remaining

until the T-bill's maturity

The formula linking the discount bid d

b

(quoted in nancial news-

papers) to the price oered by the dealers p

b

is then calculated in the

following natural way:

d

b

=

par p

b

par

_

0 =

par p

b

par

360

n

(12)

Conversely, p

b

can be calculated from (12) as

0 par d

b

= par p

b

Therefore,

p

b

= par(1 0d

b

) = par 1

n

360

d

b

_ _

(13)

In consequence, any quoted bid discount translates immediately into an

oered price p

b

by the dealer. For instance, consider the T-bill on the last

line of table 1.1. Its remaining maturity is 352 days, and its bid discount is

4.80% per accounting year. Therefore, applying (13), the price oered by

the dealers is

p

b

= $10Y000 1

352

360

(0X048)

_ _

= $9530X67

for a transaction of $1 million or more.

Let us now introduce the following additional notation:

d

a

= the asked discount rate applied by dealers

when the dealers sell a Treasury bill

15 A First Visit to Interest Rates and Bonds

p

a

= the dealers' asked price when they sell a Treasury bill

Of course, the asked discount rate d

a

is related to the dealers asked price

p

a

by a formula entirely symmetrical to (1):

d

a

=

par p

a

par

_

0 =

par p

a

par

360

n

(14)

Conversely, the asked price is linked to the quoted asked discount by

p

a

= par(1 0d

a

) = par 1

n

360

d

a

_ _

(15)

Let us consider the same Treasury bill as before. Its asked discount is

4.79% per accounting year; therefore, the price asked by the dealers is

p

a

= $10Y000 1

352

360

(0X0479)

_ _

= $9531X64

Suppose now that we want to know the yield y received by the buyer if

he keeps his Treasury bill until maturity. He will of course make a calcu-

lation with a 365-day year. His yield will be

y =

par p

a

p

a

_

n

365

=

par

p

a

1

_ _

365

n

In our example, the yield received by the bond's buyer is

y =

10Y000

9531X64

1

_ _

365

352

= 5X09%ayear

However, the ``ask yield'' printed in the Wall Street Journal (5.03%)

still takes into account the ``accounting'' year of 360 days, and not the

calender year of 365 days. This is why they get

y

a

Iprinted asked yield =

10Y000

9531X64

1

_ _

360

352

= 5X03% per accounting year

It is easy enough to see why the yield for the buyer will always be

higher than the asked discount. We can see that

y b d

a

16 Chapter 1

since the above inequality translates as

par p

a

p

a

365

n

b

par p

a

par

360

n

This inequality leads to

365

p

a

b

360

par

which is always true, since p

a

` par. In fact, the ratio yield/asked dis-

count is equal to

y

d

a

=

par

p

a

365

360

b 1

a product of two numbers that are both larger than one. In our example,

this ratio is 1.0637.

1.5.2 Treasury notes

These are bonds with maturities between one and 10 years; they could be

called ``medium-term'' bonds. They usually pay semi-annual coupons in

the United States, contrary to many European bonds with the same

maturity that pay only one coupon yearly.

For those coupon-bearing, longer-term (more than a year) bonds, the

quotations are made on quite a dierent basis than the Treasury bills;

instead of quoting a bid or asked discount, professionals, together with

the nancial newspapers, quote both a bid price and an asked price (ask

price). In turn, those prices have two main features: First, they are not

quoted in dollars, but in percent of par value; second, the gure following

those percents is not a decimal but

1

32

. For instance, a Treasury note with

given maturity (between 1 and 10 years) and an ask price of 105.17 means

that the ask price is 105

17

32

= 105X53125% of its nominal value (

1

32

trans-

lates into 3.125% of one percent3).

The ask yield of that bond requires that we explain in detail what a

bond's yield to maturity is. We do this in chapter 3, where the central

concepts of yield to maturity and horizon rate of return are discussed.

3In nancial parlance,

1

100

1

100

=

1

10Y000

= one ten-thousandth and is called ``one basis point'';

so

1

32

of 1% is 3.125 basis points. For instance, if an interest rate, initially at 4%, increases by

50 basis points, it means that it has gone from 0.04 to 0.045, or from 4% to 4.5%.

17 A First Visit to Interest Rates and Bonds

However, for those who are already familiar with the concept of the

internal rate of return on an investment (IRR), suce it to say that the

bond's ask yield exactly corresponds to the IRR of the investment con-

sisting of buying this bond, with one proviso: the price to be paid by the

investor is not just the ask price; the buyer has to pay the ask price plus

whatever accrued interest has incurred on this bond that has not yet been

paid by the issuer of the debt security. Consider, for instance, that an

investor decides to buy a bond with an 8% coupon. As is often the case in

the United States, this bond pays the coupon semi-annually, that is, 4%

of the par value every six months. Suppose three months have elapsed

since the last semi-annual coupon payment. The holder of the bond will

receive the ask price, plus the accrued interest, which is 2% of the bond's

par value. So the cost to the investor, which is the price he will have to

pay and consider in the calculation of his internal rate of return, is the

quoted ask price (translated in dollars by multiplying the ask price by the

par value), plus the incrued interest.4 This is the cost the investor will

have to take into account for the calculation of his internal rate of return,

or, in bond parlance, its ask yield to maturity.

1.5.3 Treasury bonds

These bonds are long-term: their maturity is longer than 10 years. Some

of them have an embedded feature, in the sense that they are ``callable'';

they can be reimbursed at a date that is usually xed between 5 and 10

years before maturity. For the Treasury, this feature enables it to take

into account a drop in interest rates in order to reissue bonds with smaller

coupons.

Table 1.1, extracted from the Wall Street Journal, summarizes much of

this information regarding the quotation of bonds.

1.6 Bonds issued by rms

The bonds issued by rms, also called corporate bonds, generally have

characteristics very close to those described abovein particular, they

might be callable by the issuer. Their trademark, of course, is that they

4The quoted price is also called the at price. The quoted, or at, price plus incrued interest

is called the full, or invoice price. In England, British government securities are called gilts;

their prices carry special names: the quoted, or at, price is called ``clean price''; the full, or

invoice, price is the ``dirty price.''

18 Chapter 1

are usually more risky than Treasury bonds. Their degree of riskiness is

evaluated by two large organizations: Standard & Poor's and Moody's. In

table 1.2 the reader will nd Standard & Poor's debt rating denition;

table 1.3 gives Moody's corporate rankings.

1.7 Convertible bonds

Convertible bonds are hybrid nancial instruments that lie between

straight bonds and stocks. They are bonds that give their holder the right

(but not the obligation) to convert the bond (issued generally by a com-

pany) into the company's shares at a predetermined ratio. This ratio (the

conversion ratio) r is the number of shares to which one bond entitles

its owner. For instance, in January 1999, an on-line bookseller issued a

10-year convertible with a 4.75% coupon. Each $1000 bond could be

converted into 6.408 shares. (For the story of that issue, see the excellent

article by Mitchell Martin in the New York Herald Tribune of February

1314, 1999.) Suppose that the price at which the convertible bond was

issued was exactly par; it then follows that its holder would have converted

Table 1.2

Standard & Poor's debt rating denitions

AAA Debt rated ``AAA'' has the highest rating assigned by Standard & Poor's.

Capacity to pay interest and repay principal is extremely strong.

AA Debt rated ``AA'' has a very strong capacity to pay interest and repay principal

and diers from the higher-rated issues only in small degree.

A Debt rated ``A'' has a strong capacity to pay interest and repay principal

although it is somewhat more susceptible to the adverse eects of changes in

curcumstances and economic conditions than debt in higher-rated categories.

BBB Debt rated ``BBB'' is regarded as having an adequate capacity to pay interest

and repay principal. Whereas it normally exhibits adequate protection

parameters, adverse economic conditions or changing circumstances are more

likely to lead to a weakened capacity to pay interest and repay principal for debt

in this category than in higher-rated categories.

BB, B,

CCC,

CC, C

Debt rated ``BB,'' ``B,'' ``CCC,'' ``CC,'' and ``C'' is regarded, on balance, as

predominantly speculative with respect to capacity to pay interest and repay

principal in accordance with the terms of the obligation. ``BB'' indicates the

lowest degree of speculation and ``C'' the highest degree of speculation. While

such debt will likely have some quality and protective characteristics, these are

outweighed by large uncertainties or major risk exposures to adverse conditions.

CI The rating CI is reserved for income bonds on which no interest is being paid.

D Debt rated D is in payment default.

Source: Standard & Poor's Bond Guide, June 1992, p. 10.

19 A First Visit to Interest Rates and Bonds

Table 1.3

Moody's corporate bond ratings

Aaa

Bonds that are rated Aaa are judged to be of the best quality. They carry the smallest

degree of investment risk and are generally referred to as ``gilt edge.'' Interest payments are

protected by a large or exceptionally stable margin, and principal is secure. While the

various protective elements are likely to change, the changes that can be visualized are

most unlikely to impair the fundamentally strong position of such issues.

Aa

Bonds that are rated Aa are judged to be of high quality by all standards. Together with

the Aaa group they comprise what are generally known as high-grade bonds. They are

rated lower than the best bonds because margins of protection may not be as large as in

Aaa securities; or the uctuation of protective elements may be of greater amplitude; or

other elements may be present that make the long-term risks appear somewhat larger than

in Aaa securities.

A

Bonds that are rated A possess many favorable investment attributes and are considered to

be upper medium-grade obligations. Factors giving security to principal and interest are

considered adequate but elements may be present which suggest a susceptibility to

impairment sometime in the future.

Baa

Bonds that are rated Baa are considered to be medium-grade obligations, i.e., they are

neither highly protected nor poorly secured. Interest payments and principal security

appear adequate for the present but certain protective elements may be lacking or may be

characteristically unreliable over any great length of time. Such bonds lack outstanding

investment characteristics and in fact have speculative characteristics as well.

Ba

Bonds that are rated Ba are judged to have speculative elements; their future cannot be

considered as well assured. Often the protection of interest and principal payments may be

very moderate and thereby not well safeguarded during future good and bad times.

Uncertainty of position characterizes bonds in this class.

B

Bonds that are rated B generally lack characteristics of the desired investment. Assurance

of interest, principal payments, or maintenance of other terms of the contract over any long

period of time may be small.

Caa

Bonds that are rated Caa are of poor standing. They may be in default or elements of

danger may be present with respect to principal or interest.

Ca

Bonds that are rated Ca represent obligations that are highly speculative. They are often in

default or have other marked shortcomings.

20 Chapter 1

it into shares if the share price had been more than the par/conversion

ratio = $1000a6X408 = $156X05. Of course, the price of the stock that day

was lower than that benchmark: it was $122.875.

The possibility given to the owner of the bond to convert it into shares

has two drawbacks: rst, the coupon rate is always lower than the level

corresponding to the kind of risk the market attributes to the issuer;

second, convertibles rank behind straight bonds in case of bankruptcy of

the rm.

In order to get a clear picture of the option value embedded in the

convertible, let us consider that a rm has S shares outstanding and has

issued C convertible bonds with face value B

T

. Suppose also that the

bonds are convertible only at maturity T. Let us rst determine what

share (z) of the rm the convertible bond holders will own if they convert

at maturity. This share will be equal to the number of securities they were

allowed to convert for their C convertibles, rC, divided by the total

number of securities outstanding after the conversion: S rC. So our

bondholders have access to the following fraction of the rm:

z =

rC

S rC

At maturity, suppose that the rm's value is V and that V is above the

par value of all convertibles issued, CB

T

. Convertible bonds' holders have

two choices: either they convert, or they do not. If they do convert, their

portfolio of stocks is worth zV (the share z of the rm they own times the

rm's value); if they do not convert, they will receive from the rm the par

value of their bonds, that is, CB

T

. So the decision to convert will hinge on

the rm's value at maturity. Conversion will occur if and only if

zV b CB

T

or

V b

CB

T

z

and the value of the convertible portfolio will be a linear function of the

rm's value, zV. If, on the other hand, zV ` CB

T

, conversion will not

take place; convertible holders will stick to their bonds and will receive a

value equal to par (B

T

) times the number of convertible bonds (C), CB

T

.

This quantity is independent from the rm's value.

21 A First Visit to Interest Rates and Bonds

Finally, suppose that the rm's value at maturity is less than CB

T

. In

that unfortunate case, as sole creditors of the rm the convertible holders

are entitled to the rm's entire value, that is, they will receive V.

Table 1.4 summarizes the convertible's portfolio value and the payo

to an individual convertible as functions of the rm's value.

So the convertible's value at maturity is just its par value if the rm's

value is between CB

T

and CB

T

az. If the rm's value is outside those

bounds, the convertible's value is a linear function of the rm's value:

VaC if V ` CB

T

and zVaC if V b

cB

T

z

. These functions are depicted in

gure 1.3(a). In gure 1.3(b), the option (warrant) part of the convertible

is separated from its straight bond part. We can write:

.

value of straight bond: min (

V

C

Y B

T

)

.

value of warrant: min (0Y

zV

C

B

T

)

This last value is the value of a call on the part of the rm with an exercise

price (per convertible) of B

T

az.

Most convertible bonds have more complicated features than the one

depicted above. In particular, conversion can be performed before matu-

rity. Furthermore, often the rm can call back the convertible, and the

holder can as well put it to the issuer under specied conditions. Thus a

convertible has a number of imbedded options: a warrant, a written (sold)

call feature, and a put feature.

The rst valuation studies of convertibles were carried out by Brennan

and Schwartz5 and Ingersoll6 in the case where interest rates are non-

Table 1.4

Convertible's value at maturity T

Firm's value Convertible's portfolio value Convertible's value

V ` CB

T

V VaC

CB

T

` V `

CB

T

z

CB

T

B

T

V b

CB

T

z

zV zVaC

5M. J. Brennan and E. S. Schwartz, ``The Case for Convertibles,'' Journal of Applied Cor-

porate Finance, 1 (1977): 5564.

6J. E. Ingersoll, ``An Examination of Convertible Securities,'' Journal of Financial

Economics, 4 (1977): 289322.

22 Chapter 1

V

Firms value

Convertibles

value

B

T

V

C

V

C

CB

T

CB

T

(a)

V

Firms value

Convertibles

value

B

T

B

T

V

C

CB

T

CB

T

Straight bond

Warrant

(b)

Figure 1.3

(a) A convertible's value at maturity if stocks and convertibles are the sole nancial components

of its nancial structure. (b) Splitting the convertible's value at maturity into its components:

straight bond and warrant.

23 A First Visit to Interest Rates and Bonds

stochastic. The extension to a stochastic term structure was carried out by

Brennan and Schwartz7.

Questions

1.1. Suppose a default-free zero-coupon bond expires in four months

and is worth $97 today. What is the annualized return for its owner at

maturity?

1.2. A zero-coupon bond has a 6% annualized return per year and will be

redeemed in six months at $100. Supposing it is default-free, what is its

price today?

1.3. Suppose a zero-coupon bond has a maturity equal to 2.65 years;

its par value is $100, and its value today is $87. What is its annualized

return?

1.4. What is the price today of a zero-coupon bond that will be redeemed

at $1000 in 3.2 years, if its annualized rate of return is 6%?

1.5. Consider a two-year spot rate of 5% and a ve-year spot rate of 6%.

What is the (equilibrium) implied forward rate for a loan starting in two

years and maturing three years later? What is the interpretation of the

ve-year dollar spot return in terms of the two-year dollar spot return and

the dollar forward rate corresponding to the forward return you have just