Nucor Final

Diunggah oleh

Nhamie CastilloDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Nucor Final

Diunggah oleh

Nhamie CastilloHak Cipta:

Format Tersedia

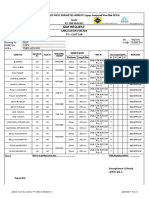

First Asia Institute of Technology and Humanities School of Technology College of Engineering Bachelor of Science in Industrial Engineering

Case Analysis

Case Analysis #10: Nucor Corporation: Competing Against Low- Cost Steel Imports

Submitted by: Alvarez, Jerimae M. Dimapilis, Roberto Jr. P.

Submitted to: Engr. Darwin R. Gevaa

November 29, 2011

NAME: Alvarez, Jerimae and Dimapilis, Roberto Jr. P COURSE AND SECTION: IEELEC3/ BSIE-4 Case Analysis # 10- Nucor Corporation: Competing Against Low- Cost Steel Imports DATE: January 10, 2012 OVERVIEW Nucor earlier started with the nuclear equipment and electronics business in the early 1950s and 60s. The company was facing heavy losses and was on the margin of declaring bankruptcy, when the Board of Directors was seeking for new leadership. Iverson was appointed from within the Board in 1964 with a completely new vision. He concluded that the best way was for Nucor to take a different path altogether with their successful Vulcraft subsidiary in the steel business. It was then the company earned its current name and divulged in to the industry. Later on, in 1968, management of Nucor decided for backward integration which is into steel making to apply benefits of supplying their own steel to their requirements. Iversons long term strategy was to become the major player in the U.S steel industry. By 1985, Nucor was the seventh largest in America with high held revenue figures and net profit margins. Nucor was regarded as the low-cost and technologically innovative steel producer to the world. During the recession in 2000/01 25% of U.S companies declared bankrupt and some of them suffered heavily even as Nucor survived the depression healthily since their efficient and low-cost strategy was successful. Iverson was a leader who walked the talk. He proved himself as a Master in crafting and executing a low-cost leadership strategy and he made a point of making sure he practiced what he preached. Nucor was not a company that had jet planes for their directors or company membership schemes with outside clubs, or executive dining facilities. Iverson thought of this to be a factor of rising costs. In fact he being the President and CEO of Nucor took the subway in the city. Iverson had to leave the company following disagreements with the Board in 1998 and was succeeded by DiMicco. Disagreements may have been due to the lack of extravagance that was not offered by the president.

Other firms from China, Russia, Brazil and India are dumping steel in to the U.S which affects the demands for Nucor. Those companies are being subsidized by their governments for support. After many acquisitions and joint ventures globally, Nucor is in the environment that is highly volatile and economy at a slow down. The 2008 recession affected Nucors profits. Although Nucor has a competitive advantage of being large they still have to face impact from the outside environment. One of the strategies of Nucor is acquiring new companies that have an advantage, such as Birmingham steel would broaden customer base. INDUSTRY HIGHLIGHTS INCLUDE: In 2001, Nucor paid $115 million to acquire substantially all of the assets of Auburn Steel Companys 400,000-ton steel bar facility in Auburn, New York. In November 2001, Nucor announced the acquisition of ITEC Steel Inc. for a purchase price of $9 million. ITEC Steel had annual revenues of $10 million and produced load bearing light gauge steel framing for the residential and commercial market at facilities in Texas and Georgia.

In July 2002, Nucor paid $120 million to purchase Trico Steel Company, which had a 2.2 million ton sheet steel mill in Decatur, Alabama. Trico Steel was a joint venture of LTV (which owned a 50 percent interest), and two leading international steel companiesSumitomo Metal Industries and British Steel.

In December 2002, Nucor paid $615 million to purchase substantially all of the assets of Birmingham Steel Corporation, which included four bar mills in Alabama, Illinois, Washington, and Mississippi.

In August 2004, Nucor acquired a cold rolling mill in Decatur, Alabama, from Worthington Industries for $80 million.

In June 2004, Nucor paid a cash price of $80 million to acquire a plate mill owned by Britain-based Corus Steel that was located in Tuscaloosa, Alabama.

In February 2005, Nucor completed the purchase of Fort Howard Steels operations in Oak Creek, Wisconsin; the Oak Creek facility produced cold nished bars in size ranges up to 6-inch rounds and had approximately 140,000 tons of annual capacity.

In June 2005, Nucor purchased Marion Steel Company located in Marion, Ohio, for a cash price of $110 million. Marion operated a bar mill with annual capacity of about 400,000 tons; the Marion location was within close proximity to 60 percent of the steel consumption in the United States.

In May 2006, Nucor acquired Connecticut Steel Corporation for $43 million in cash.

In late 2006, Nucor purchased Verco Manufacturing Co for approximately $180 million; Verco produced steel oor and roof decking at one location in Arizona and two locations in California.

In January 2007, Nucor announced plans to acquire all of the shares of Canadabased Harris Steel for a total of about $1.07 billion.

COMPANY MISSION Nucor Corporation is made up of 17,300 teammates whose goal is to "Take Care of Our Customers." We are accomplishing this by being the safest, highest quality, lowest cost, most productive and most profitable steel and steel products company in the world. We are committed to doing this while being cultural and environmental stewards in our communities where we live and work. We are succeeding by working together

INTERNAL/ EXTERNAL ANALYSIS STRENGTHS: Nucor acquires many companies and increase their capacity and size. They are a large group integrated backwards and they can enjoy multiple economies of scale. The industry is in a mature product life cycle stage but Nucor had remarkable profits by earning a profit in every quarter. Nucors technological advantage by having efficient new state of the art equipment and facilities keeps them higher than their rivals. Their low cost strategy where the labor cost is only 8% of revenue helps them to maintain their long term growth. Also their employment pay schemes are widely accepted by their workforce which automatically improves their efficiency and no pressure is required by

top management. Nucor also carries out a environmental program by planting trees that absorb the carbon emission from their factories. This can help show their CSR values and reduce pressure group resistance.

WEAKNESSES Nucor seems to be more self consciences by growing larger but do not consider other factors like industry rivalry and product diversity like shifting from steel to other components. Nucor faces some very significant weaknesses with its location. Nucor has 14 plants all of which are located within the US. The problem that Nucor has is that they cannot effectively serve international markets as good as competitors who have plants worldwide. The shipping of steel to overseas countries is extremely expensive. Nucor is not in a great market position. Customers can go some place closer to buy their steel essentially knocking off a large shipping cost. Nucor also does not give deals on quantities purchased. Nucors most significant weakness lies with its domestic market. With the US market being Nucors primary customer base, Nucor is not able to offset losses because of a diversified location worldwide. This is the current large problem Nucor faces along with a few others that will be mentioned later in the threats section. Nucor is currently in a Market where growth is declining significantly. Real Estate sales are down substantially because of the sub-prime mortgage problem. Nucor has to also be concerned with the failing domestic auto industry. The production of the big-three has substantially declined over the past 5 years and is not close to rebounding anytime soon.

OPPORTUNITIES Nucor has a significant opportunity to continue innovating with the Hismelt Technology or liquid iron project in Australia. If successful it could help give Nucor additional advantages to manufacturing and reduce pollution. This is a significant project because

it will allow for Nucor to continue spreading its brand name as an innovator in the industry. It will also allow them to offset operating cost. Growing the companys sales and market share in those product categories where it already competes. Nucors expansion into additional product categories. Acquiring the plants of other steel industry participants in North America and operating these plants more cost-effectively than prior management. THREATS Nucor faces significant threats through the global market and at home. In the global market the Chinese continue to dump steel. The competition with Chinese steel makers hurts Nucor because there are very little government regulations in China. Plants in China are integrated mills with large scale pollution impacts on the environment. Chinese officials do not regulate this to the extent US officials do. Chinese companies do not have to pay significant fines and conform to environmental standards like in the US. Many Chinese steel plants still burn coal for an energy source to produce steel.18 These coal burning steel factories are cause about 400,000 premature deaths a year.18 Particles of sulfur compounds, carbon and other byproducts of coal combustion originating from China have been found in California, Oregon, and Washington.18 Even plants who use electric power in china are directly linked to coal based power plant. China uses more coal than the US, EU and Japan combined and pops up a new coalbased power plant every ten days.18 What this means for Nucor is that the Chinese steel factories receive substantial operating advantages because of their weak government policies and enforcement rules. Nucor and the rest of the steel world have to deal with China over

STRATEGIC IMPLICATION Nucor can indulge into new global markets and increase markets. They can go into the markets like Russia, Brazil, China because they dump into the U.S market. However Nucor should analyze the five forces before entering those markets. They could be highly competitive.

Nucor can find other alternative ways of collecting scrap steel for cheap. They can find new suppliers who offer cheaper raw material. Nucor can also open a dump yard where domestic household customers can dump the waste scrap steel. Nucor may even be able to collect free scrap from this. However there may be pressure groups and environmental problems from these yards. Nucor should consider developing the Vulcraft and Nucor brand further without more acquisitions. May be the acquisitions would have covered the idea for self development. STRATEGY SELECTION Nucors key corporate strategy is low-cost industry leadership, focused on the core competencies of building steel manufacturing facilities economically and operating them productively. Their strategy is characterized by continuous technical innovation, modern facilities, excellence in customer service and producing high-quality steel and steel products at competitive prices.

RECOMMENDATION: Continue with decentralised organisation structure Continue with its innovative style to keep an edge over its competitors Positive measures to enter new markets Focus more on competitors Evaluate opportunities to ensure that quality improvement would still help to keep low cost in the long run Keep up with their social responsibility by setting up environment-friendly recycling plant that will be located at a relatively central location from all its plants Form an alliance with the south Asian markets to gain exposure to international markets

1. What are the primary competitive forces impacting U.S. steel producers in general and the producers like Nucor that make new steel products via recycling scrap steel in particular? Please do a ve-forces analysis to support your answer. Primary Competitive Forces Impacting US Steel Producers Global competition Domestic competition Pricing competition Economies of scale Access to raw material Product differentiation Alternatives-Plastics

5 Forces Analysis

THREAT OF MED HIGH SUBSTITUTE S

SUPPLIER MED HIGH POWER

COMPETITIV HIGH E RIVALRY

BUYER LOW POWER

THREAT OF NEW ENTRANTS

MED HIGH

Intensity of Rivalry among Competitors Global competition Domestic market there are more than 20 competitors ranging from large scale operations to the small and regional. Competition amongst these competitors causes a cyclical effect within the industry. The industry is not based on differentiated products, but rather price competition. Ultimately, the business with the lowest fixed costs will survive the longest and, probably, be the most profitable. Nucors use of both base pay and incentive pay ensure output is relative to pay and, therefore, decreases its fixed costs. Different business models are also prime means of competition. Nucor boasts a decentralized structure with control at the local factory level. Arguable, this allows for focused decision making and more efficient use of profits.

Threat of new entrants Economies of scale and capital requirements are the greatest barriers in the steel industry. Larger quantity orders of raw materials are usually discounted. Product differentiation is also a major barrier to entry. Steel is not sold on its overall difference, but more commonly on price. Many manufacturers utilize the same technologies and process.

Price wars are seen in minimization of fixed costs as stated earlier. Directly with this, there are few switching costs from one manufacturer to another.

Little brand loyalty is recognized in an industry that does not appeal to consumer loyalty or brand image.

Access to raw materials is additionally a barrier. Many times raw materials must be bought in large quantities (economies of scale). The cost disadvantages associated with small material purchases can be huge and directly increase overall manufacturing costs

Government policy is not a major threat to entry on the domestic level, but at the international level the barriers are enormous.

Bargaining Power of Suppliers Supply of raw materials: steel shreds, iron ore, or recycled steel, can make or break a cost strategy. Most of the steel used in domestic manufacturing in the United States is imported. On a large scale there are relatively few suppliers that can meet the constant demands of companies such as Nucor. It is common for joint ventures to be established between suppliers and manufacturers. The overall goal is to ensure decreased costs of supplies. In some cases the manufacturer even may acquire the supplier. The current trend is for consolidation of the steel industry; therefore, whatever the direction is, supplier purchase manufacturer or manufacturer purchase supplier, there is a major threat of take over.

Bargaining Power of Buyers Buyers pose arguably the greatest threat. Price competition stems from buyers having low switching costs and low product differentiation. Buyers have the power to negotiate down a deal to their terms due to these factors.

Many buyers purchase in large quantities, thus creating economies of scale. Contracts are set in place many month if not years in advance of delivery. The goal of the seller, Nucor for example, is to gain the most financial return for the least cost. The steel industry is commonly a buyers market.

Threat of product substitutes There are few substitutes for the use of steel. From auto manufacturing, to structural supports, to fasteners, there are relatively few products available with the strength, durability, and cost efficiencies of steel. The largest alternative to steel would be use of another material. Plastics are gaining ground, but have not found the same durability as steel. The goal is to maintain low costs and market share during times of economic fluctuation.

2. What driving forces do you see at work in this industry? Are they likely to impact the industrys competitive structure favorably or unfavorably? Increasing globalization Steel technology and processes Entry or exit of major firms Advances in materials technology

These driving forces impacted the industry through: Boost competitive pressure Lower margins for high-cost producers Benefit foreign steel producers

3. How attractive are the prospects for future protability of U.S. steelmakers?

Should Nucor consider expanding in this type of industry environment? Why or why not? Prospects of future profitability in US for steelmakers seem not promising due to following reasons. High cost producers face a dim future of weak demand and price concessions Low cost producers are poised to succeed, but they must fight foreign firms seeking to dump excess capacity and gain market share Expansion in the U.S. steel market should be viewed cautiously

To consider whether Nucor should consider expanding in steelmaking industry they must consider: Technology is one of Nucors key strengths because of the amount of resources they can save due to it. Nucor faces some very significant weaknesses with its location. Nucor has 14 plants all of which are located within the US. They cannot effectively serve international markets as good as competitors who have plants worldwide. Nucor is currently in a Market where growth is declining significantly. Nucor has to also be concerned with the failing domestic auto industry. Nucor has a significant opportunity to continue innovating with the Hismelt Technology or liquid iron project. Nucor could utilize acquisitions of small steelmaking companies to gain international grounds. Nucor faces significant threats through the global market and at home. In the global market the Chinese continue to produce and ship steel.

4. What type of strategy has Nucor followed? Which of the ve generic strategies discussed in Chapter 5 is Nucor employing? Is there any reason to believe that Nucor has achieved a sustainable competitive advantage over many of its steel industry rivals? If so, what type of competitive advantage does Nucor enjoy? Nucor is pursuing the strategy of low- cost leadership strategy same as toin commodity product industry. From being a low- cost provider, they gave incentive workforce and advance

technology and processes. Their plants are built inexpensively and operate efficiently. 5. What are the specic policies and operating practices that Nucor has employed to implement and execute its chosen strategy? Aggressively pursue and implement cost-saving technologies Employ incentive compensation that motivate above-average output Empower plant employees Create a low-cost culture Offshore joint ventures Backward integration of supply chain several decades? Do these factors have more to do with great strategy, great strategy execution, or great leadership? Cost control Automation Low cost locations Organizational behavior Technology and processes Production Order fulfillment and distribution

6. What specic factors account for why Nucor has been so successful over the past

Carefully chosen joint ventures These factors are made through Great strategy Great execution Great strategic leadership

7. What does a SWOT analysis reveal about Nucors situation? Does Nucor have any core or distinctive competencies? STRENGHTS

Low prices and high profit margins Technological expertise and innovative capabilities State-of-the-art plants Strong top management Proven skills at lowering costs Productive, well compensated, and empowered workforce

WEAKNESSES Limited global presence Lack of control over feedstock Scrap steel Iron ore OPPORTUNITIES Growing sales and share in existing product categories Licensing HIsmelt technology Acquiring high-cost producers and making them more efficient Buying ownership rights in innovative new technologies

THREATS Rising prices for scrap steel and iron ore Slack demand Foreign dumping More foreign competition

Continued excess capacity Aggressive rivals that are becoming proficient at cost cutting Global environmental regulations

Core Competencies A total corporate commitment to lowering production costs while maintaining quality Spans management, supply chain, operations, and technology Drive for innovation Enhance productivity Generate new revenue streams Block rivals

8. What is your assessment of Nucors nancial performance the past several years? How strong is the companys nancial condition? Nucors net sales grew from $4.76 billion in 2000 to $14.75 billion in 2006, a very healthy CAGR of 20.7%. The strong increase is due both to rising unit sales volume and rising selling prices per ton Nucors net earnings grew from $310.9 million in 2000 to $1.76 billion in 2006, equal to a robust CAGR of 33.4%. However the big gains came primarily in the 2004-2006 period. Nucors diluted net earnings per share of common stock jumped from $0.95 in 2000 to $5.68 in 2006, a strong CAGR of 34.7%. Again, the big gains came in the past three yearsEPS was below the 2000 level in 2001, 2002, and 2003.

The big gains in earnings per share in 2004-2006 have permitted Nucor to boost its dividends quite signicantly.

9. What issues does Nucor management need to address? Exit certain product categories? Steel joist and decking Make more acquisitions? Expand in China, Latin America? Boost the quality of Nucor steel? Differentiation strategy Set royalty for HIsmelt? Traditional license or JV?

10. What recommendations would you make to Dan DiMicco? Acquire Mittal Steel Dominate the domestic market Continue BESTmarking All plants to be ISO 9000/14001 Continue Foreign JVs License HIsmelt through ownership with some operating control Innovative backward integration Reduce dependence on acquired scrap steel and iron ore Divest forward integration

Anda mungkin juga menyukai

- Nucor ADokumen15 halamanNucor Adharma_1001Belum ada peringkat

- Nucor Corporation Final WorkDokumen7 halamanNucor Corporation Final WorkVamsi_Ramachan_4724Belum ada peringkat

- Nucor Strategy AnalysisDokumen12 halamanNucor Strategy Analysisnoel_manroeBelum ada peringkat

- Nucor Corporation Case AnalysisDokumen12 halamanNucor Corporation Case Analysisdeepak_manabBelum ada peringkat

- Nucor's Strategic ShiftDokumen4 halamanNucor's Strategic ShiftmiramunBelum ada peringkat

- Nucor Case AnalysisDokumen6 halamanNucor Case AnalysisAsjad HameedBelum ada peringkat

- Nucor in 2009: Submitted By: Group6Dokumen46 halamanNucor in 2009: Submitted By: Group6kgupta0311Belum ada peringkat

- Case NuCor FulltextDokumen93 halamanCase NuCor FulltextlakiluckyBelum ada peringkat

- SOLUTIONS Final Exam StrategiesDokumen12 halamanSOLUTIONS Final Exam StrategiesNeeru GuptaBelum ada peringkat

- Nucor Value Chain AnalysisDokumen8 halamanNucor Value Chain AnalysisabhinavsurajBelum ada peringkat

- Nucor Corporation AnalysisDokumen16 halamanNucor Corporation AnalysisKaran Veer Singh100% (4)

- STP Strategy, 4p's, Loophole, Recommendation On NokiaDokumen19 halamanSTP Strategy, 4p's, Loophole, Recommendation On Nokiampx123Belum ada peringkat

- Nucor's Competitive Environment and Strategies for Achieving Low Cost LeadershipDokumen22 halamanNucor's Competitive Environment and Strategies for Achieving Low Cost LeadershipDamyanti Shaw100% (1)

- NUCORDokumen12 halamanNUCORKurniawan Che-uBelum ada peringkat

- Swot BournvilleDokumen3 halamanSwot BournvilleHimanshu Rajan jainBelum ada peringkat

- Scribd Nucor Case StudyDokumen12 halamanScribd Nucor Case StudyCheryl MartinBelum ada peringkat

- Maintaining Growth Momentum for 6Ballygunge PlaceDokumen11 halamanMaintaining Growth Momentum for 6Ballygunge PlaceAthikho AthikhoBelum ada peringkat

- Cases FoulkeDokumen30 halamanCases FoulkeYudis Tiawan50% (4)

- Zhujiang IronDokumen9 halamanZhujiang Ironrajendra_samy100% (1)

- HR Managers Duties, Functions, and StrategiesDokumen10 halamanHR Managers Duties, Functions, and StrategiesMd Shadab Alam0% (1)

- NucorDokumen15 halamanNucorIvan Rafael Fagundez100% (1)

- Nestle Global Strategy Case Study AnalysisDokumen16 halamanNestle Global Strategy Case Study AnalysisSameer Bin Sadaqat0% (1)

- ToshibaDokumen2 halamanToshibaRian KrisnaBelum ada peringkat

- Operation ManagementDokumen8 halamanOperation ManagementBhaavyn SutariaBelum ada peringkat

- Nucor Case PresentationDokumen21 halamanNucor Case PresentationDougBelum ada peringkat

- Mystic Monk CoffeeDokumen2 halamanMystic Monk CoffeeNhan Ka KaBelum ada peringkat

- IB PhilipsDokumen3 halamanIB Philipsabinash adhikariBelum ada peringkat

- Strategy As Revolution'Dokumen4 halamanStrategy As Revolution'Misti WalkerBelum ada peringkat

- Chapter 9 Strategic Positioning for Competitive AdvantageDokumen9 halamanChapter 9 Strategic Positioning for Competitive AdvantageHannah Reinecke100% (1)

- Sport Obermeyer (Handout)Dokumen62 halamanSport Obermeyer (Handout)Abhishek SahuBelum ada peringkat

- Intel Case StudyDokumen30 halamanIntel Case StudyNisshu RainaBelum ada peringkat

- Strategic Planning at United Parcel Services: 1/28/2009 Baringin Emily Matthew Smith Shin-HaaDokumen21 halamanStrategic Planning at United Parcel Services: 1/28/2009 Baringin Emily Matthew Smith Shin-Haaadeeltariq409100% (1)

- Case Analysis NucorDokumen1 halamanCase Analysis NucorSunil Jathar0% (2)

- Convertible and Non Convertible DebenturesDokumen2 halamanConvertible and Non Convertible Debenturesvenkatrao_100Belum ada peringkat

- Nike Sprints Ahead of Competition But Still Has A Long Way To RunDokumen14 halamanNike Sprints Ahead of Competition But Still Has A Long Way To Rundollie100% (8)

- Nucor CaseDokumen33 halamanNucor CasedrankitamayekarBelum ada peringkat

- Sample Case ReebokDokumen31 halamanSample Case ReebokIcuwootBelum ada peringkat

- Merrimack Tractors and MowersDokumen10 halamanMerrimack Tractors and MowersAtul Bhatia0% (1)

- As We Know Derivative Is One of The Instrument Which Is Relating To Financial Risk Management Depend On The Underlying AssetsDokumen27 halamanAs We Know Derivative Is One of The Instrument Which Is Relating To Financial Risk Management Depend On The Underlying AssetsSyai GenjBelum ada peringkat

- Thyrocare's Success Through Affordability & Strategic PromotionDokumen4 halamanThyrocare's Success Through Affordability & Strategic PromotionrishiganeshBelum ada peringkat

- Jawaban Tugas Mis Strategi SearsDokumen2 halamanJawaban Tugas Mis Strategi SearsHon FelixBelum ada peringkat

- Economic ExposureDokumen6 halamanEconomic ExposureAnshulGuptaBelum ada peringkat

- Anne Mulcahy's Leadership Turns Around XeroxDokumen15 halamanAnne Mulcahy's Leadership Turns Around XeroxSandarsh SureshBelum ada peringkat

- Case AnalysisDokumen16 halamanCase AnalysisXuân MaiBelum ada peringkat

- Nucor Case Analysis - Strategic ManagementDokumen9 halamanNucor Case Analysis - Strategic ManagementSubhankar Chowdhury100% (1)

- NucorDokumen9 halamanNucorMisaki UsuiBelum ada peringkat

- Nucor - ReportDokumen14 halamanNucor - ReportSteve Mclean83% (6)

- Nucor Corporation SynopsisDokumen3 halamanNucor Corporation SynopsisgarvitBelum ada peringkat

- KELOMPOK 10 StramenDokumen7 halamanKELOMPOK 10 StramenhajarawBelum ada peringkat

- NucorDokumen21 halamanNucorHamed RiyadhBelum ada peringkat

- SM Nucor CorporationDokumen4 halamanSM Nucor CorporationAlberto Torres NavarroBelum ada peringkat

- Nucor Project PresentationDokumen12 halamanNucor Project Presentationapi-362642940Belum ada peringkat

- Case 3-2 Nucor CorpDokumen5 halamanCase 3-2 Nucor CorpMuhammad Nur Fachruzi JayaBelum ada peringkat

- Assignment Nucor CorporationDokumen8 halamanAssignment Nucor CorporationUmma HabibaBelum ada peringkat

- Nucor Corporation (B)Dokumen3 halamanNucor Corporation (B)Fabio Luiz PicoloBelum ada peringkat

- External Risks: Identify The Enterprise Risks and Articulate The Risk Mitigation Mechanisms Employed by NucorDokumen4 halamanExternal Risks: Identify The Enterprise Risks and Articulate The Risk Mitigation Mechanisms Employed by NucorManu SrivastavaBelum ada peringkat

- Nucor Corporation: Competing Against Low-Cost Steel ImportDokumen20 halamanNucor Corporation: Competing Against Low-Cost Steel ImportSri WidaningsihBelum ada peringkat

- Strategic Analysis of ARCELOR MITTAL STEELDokumen29 halamanStrategic Analysis of ARCELOR MITTAL STEELharsh_desai2429100% (1)

- Nucor Case Analysis: A Leader in the US Steel IndustryDokumen23 halamanNucor Case Analysis: A Leader in the US Steel Industryaryanraj444444Belum ada peringkat

- Case 3 From Reo To Nuclear To Nucor (Key Points)Dokumen4 halamanCase 3 From Reo To Nuclear To Nucor (Key Points)JULLIE CARMELLE H. CHATTOBelum ada peringkat

- Exercise 1 Water and IceDokumen9 halamanExercise 1 Water and IceNhamie CastilloBelum ada peringkat

- What Makes a True Leader - Emotional Intelligence Key to Effective LeadershipDokumen3 halamanWhat Makes a True Leader - Emotional Intelligence Key to Effective LeadershipNhamie Castillo100% (1)

- VSM FPDokumen9 halamanVSM FPNhamie CastilloBelum ada peringkat

- Assignment Questions Case 2Dokumen3 halamanAssignment Questions Case 2Nhamie CastilloBelum ada peringkat

- Case 1Dokumen2 halamanCase 1Nhamie CastilloBelum ada peringkat

- SR Metal IndustriesDokumen3 halamanSR Metal Industries99308635160% (1)

- Iron and Steel Technology Roadmap IEADokumen190 halamanIron and Steel Technology Roadmap IEAmaveryq0% (1)

- ASME BPVC Sec IX 2023 - Demonstration FormDokumen1 halamanASME BPVC Sec IX 2023 - Demonstration Formmr.bakhtiari.mahmoudBelum ada peringkat

- DESPONIA 1545enDokumen8 halamanDESPONIA 1545enkad-7Belum ada peringkat

- 12 Samss 007Dokumen33 halaman12 Samss 007marghoobBelum ada peringkat

- E1235Dokumen5 halamanE1235LLBelum ada peringkat

- Bureau of Indian Standards ListDokumen10 halamanBureau of Indian Standards ListVasu RajaBelum ada peringkat

- Is 280 - Gi Wire Technical SpecificationDokumen5 halamanIs 280 - Gi Wire Technical SpecificationBhavesh Keralia100% (1)

- Nde-Wqt-011 - Structure (08-05-23)Dokumen2 halamanNde-Wqt-011 - Structure (08-05-23)cindy anggrilitaBelum ada peringkat

- Rebar Bending Formula & Hook Design - ACI-318Dokumen1 halamanRebar Bending Formula & Hook Design - ACI-318ויליאם סן מרמיגיוס100% (4)

- Journeyman Welding & Piping Master ListDokumen17 halamanJourneyman Welding & Piping Master ListKeneth Del CarmenBelum ada peringkat

- 5 - Cast Iron and Tool SteelsDokumen25 halaman5 - Cast Iron and Tool Steelsbarry nancooBelum ada peringkat

- Projection Welding Guide for Materials & DesignDokumen20 halamanProjection Welding Guide for Materials & DesignCebrac ItatibaBelum ada peringkat

- 2 - Wheels and Castors Cataloguem PDFDokumen116 halaman2 - Wheels and Castors Cataloguem PDFalim fakihBelum ada peringkat

- 4.12 Complete Joint Penetration (CJP) Groove Welds For Thbular ConnectionsDokumen1 halaman4.12 Complete Joint Penetration (CJP) Groove Welds For Thbular ConnectionsIbrahim shaikBelum ada peringkat

- Wps For Aluminium WeldingDokumen8 halamanWps For Aluminium WeldingMohammed MusaBelum ada peringkat

- Content Content Standard Performance Standard Learning Competencies Code Learning Materials Week Prepare Weld Materials (WM) LO 1. Set-Up Cutting EquipmentDokumen9 halamanContent Content Standard Performance Standard Learning Competencies Code Learning Materials Week Prepare Weld Materials (WM) LO 1. Set-Up Cutting Equipmentlip100% (1)

- ASME B18.9 TabDokumen2 halamanASME B18.9 TabmarceloBelum ada peringkat

- Welding InspectionDokumen19 halamanWelding InspectionMaricrisMendozaBelum ada peringkat

- EN 10152 Grade DC01Dokumen3 halamanEN 10152 Grade DC01Vanesh KumarBelum ada peringkat

- Naffco Diesel Tank For Fire Protection DetailsDokumen2 halamanNaffco Diesel Tank For Fire Protection DetailsRdb Haxor100% (1)

- Welding Complete by S K MondalDokumen50 halamanWelding Complete by S K MondalVipul RanaBelum ada peringkat

- SAE Steel Grades - WikipediaDokumen30 halamanSAE Steel Grades - Wikipediamanoj ranathiive100% (1)

- Explosive WeldingDokumen54 halamanExplosive WeldingNallappan Rajj ABelum ada peringkat

- 0000 Pi SPC 002Dokumen24 halaman0000 Pi SPC 002zsmithBelum ada peringkat

- UDokumen1 halamanUmohd as shahiddin jafriBelum ada peringkat

- Welding Daily Progress ReportDokumen2 halamanWelding Daily Progress ReportAsrolBelum ada peringkat

- Bucket Elevator Capacity FormulasDokumen3 halamanBucket Elevator Capacity Formulasmkiani2Belum ada peringkat

- Australian Standards-projects-by-sector-31-Jan-2013 PDFDokumen36 halamanAustralian Standards-projects-by-sector-31-Jan-2013 PDFAbhijit Kumar GhoshBelum ada peringkat

- A0-EnG-M-STD-001 - Standard For Submerged Arc Welded Line Pipe (Based On API SPEC 5L)Dokumen54 halamanA0-EnG-M-STD-001 - Standard For Submerged Arc Welded Line Pipe (Based On API SPEC 5L)Jaseel ValiyaparambilBelum ada peringkat