Twin Deficit US

Diunggah oleh

Amith KumarDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Twin Deficit US

Diunggah oleh

Amith KumarHak Cipta:

Format Tersedia

FRBSF ECONOMIC LETTER

Number 2005-16, July 22, 2005

Understanding the Twin Deficits: New Approaches, New Results

Since 2002, the U.S. has seen the emergence of twin deficitsthat is, a growing budget deficit along with a growing current account deficit, which reflects increasing U.S. borrowing from abroad.To some analysts, this situation seems very reminiscent of the early 1980s. In the earlier episode, there were significant tax rate cuts that were not matched by spending cuts, and between 1981 and 1986, the U.S. budget deficit went from 2.5% of GDP to about 5% of GDP and the current account went from being roughly in balance to a deficit of 3.3% of GDP. In 2001, there were tax rate cuts that were not matched by spending cuts, and the U.S. budget went from a surplus to a deficit that reached 3.5% of GDP in 2004; the current account deficit also soared, rising from 3.8% of GDP in 2001 to 5.7% in 2004. Standard economic theory would not find either situation surprising. Other things being equal, a budget deficit implies a decrease in national saving, which is the sum of private saving plus the government fiscal balance. By definition, when national saving falls below domestic investmentthat is, when the U.S. does not have sufficient saving to finance its investment, and therefore borrows from abroadthe current account is in deficit. Of course, other things are not always equal. A number of factors may affect how much budget deficits explain current account deficits, and an extensive theoretical and empirical literature has emerged to evaluate them. This Economic Letter reviews several of these studies.The findings suggest that the relationship between the deficits may be fairly tenuous. And in a surprising result, one study finds thatin the short run, at least budget deficits actually have a positive effect on the current account balance. The basic theory of twin deficits A study by Baxter (1995) provides a good illustration of the standard case of the twin-ness of the budget deficit and the current account deficit. She studies the reaction of a model economy to two fiscal policies that can lead to a worsening budget deficit: first, an increase in government expenditure not matched by an increase in tax revenues; and, second, a decrease in labor and capital tax rates not matched by a reduction in expenditure. Under both policies, the increase in the budget deficit is equivalent to about 1% of GDP in the short run, and it dies out gradually over the longer run. Her results show that, following the increase in the budget deficit, the current account balance deteriorates by about 0.5% of GDP. How does each policy lead from a budget deficit to a deterioration in the current account balance? First, consider the policy based on an increase in government spending. When the budget deficit increases, domestic residents anticipate that the government will raise taxes in the future to close the fiscal gap and pay back the accumulated debt. To pay for the expected future increases in taxes, people will want to save and accumulate wealth, which they can do in two waysby spending less and by boosting their income by increasing the number of hours they work. To the extent that people choose the second route and increase the hours they work, they make the capital stock more productive, which fosters more private investment. The increase in investment partially offsets the increase in private saving, so that, overall, the current account balance deteriorates in response to the deterioration of the government fiscal balance. Next, consider the policy based on a persistent reduction in capital and labor tax rates. After the tax rate cuts, people choose to work harder and increase the number of hours worked to take advantage of the increase in their after-tax labor income. Given the higher supply of hours worked, both output and the productivity of capital increase. The increase in output mitigates the initial decline in tax receipts and in the governments budget situation. But this is more than offset by a strong expansion in domestic investment that is driven by two things: first, as in the previous policy, the higher number of hours worked increases the productivity

FRBSF Economic Letter

Number 2005-16, July 22, 2005

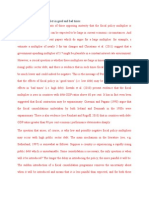

of capital, which fosters investment; second, the reduction in tax rates itself fosters investment. As a result, the current account deteriorates. Why the twins sometimes go their separate ways Although theory indicates that the budget deficit and the current account deficit should move together, Figure 1 shows that they followed quite divergent paths from 1987 to 2001. One possible explanation for this divergence is related to the impact of output fluctuations on budget and current account deficits. Suppose, for example, the economy enjoys a surge in productivity that prompts an expansion in economic activity.To reap the opportunities of higher productivity, private investment increases. As investment expenditure typically reacts more strongly to the business cycle than private saving does, the current account balance deteriorates. At the same time, the output expansion generates both an increase in tax receipts and a decline in government expenditure, due, for example, to a decline in unemployment benefits. Therefore, the budget balance improves. Kim and Roubini (2004) used a different methodology from Baxter (1995) to do an empirical study of the effects of budget deficits on the current account that captures the impact of output fluctuations.They found that, overall, at horizons of one to two years, output fluctuations explain most of the divergence between the budget balance and the current account. However, more importantly, after controlling for the effects of the business cycle on the budget and current account balances and isolating the variations in the budget balance that are independent of output fluctuations, they found a surprising result: increases in the budget deficit have a positive impact on the current account in the short run, regardless of whether the deficit arises from an increase in government expenditure or a reduction in taxes.The reason for this surprising finding is that, following an increase in the budget deficit, private saving increases, as discussed before; at the same time, interest rates rise because of increased government borrowing, and the higher interest rates dampen private domestic investment. In combination, Kim and Roubini (2004) found that the increase in private saving and the decline in domestic investment are more than enough to offset the decline in government saving in the short run and contribute to the current account improvement. Bringing theory closer to the data Recent studies by Erceg, Guerrieri, and Gust (2005) and Cavallo (2005) have helped bring the theo-

Figure 1 U.S. budget and current account balances

retical predictions closer to the empirical results of Kim and Roubini (2004). Erceg, Guerrieri, and Gust (2005) explore the twin deficits from the perspective of the balance of trade, which is the goods and services portion of the current account balance, and, by far, its largest component.They evaluate how the trade balance responds to an increase in the budget deficit that arises from either higher government expenditure or reduced labor tax rates. They find that budget deficits, regardless of their source, have a far more modest effect than Baxter (1995) found. In particular, a deficit-financed increase in government expenditure corresponding to 1% of GDP induces the trade balance to decline by about 0.15% of GDP, and a persistent cut in labor tax rates that produces a decline in tax receipts equivalent to 1% of GDP induces a trade balance deterioration of about 0.12% of GDP. What accounts for the more modest effect? When the budget deficit increases, the resulting higher interest rates induce an appreciation of the exchange rate, which makes domestic goods relatively more expensive than imported goods. In theory, these relative price changes would depress sales of domestic goods and stimulate sales of imported goods, thereby leading to a deterioration in the trade balance. In reality, however, a considerable share of international trade in goods and services between the United States and the rest of the world tends to be relatively insensitive to exchange rate fluctuations, at least in the short run.To account for this empirical regularity, the model introduces two crucial features. The first feature is a lower responsiveness of exports and imports to relative price changes in the long run.The second is the

FRBSF Economic Letter

Number 2005-16, July 22, 2005

presence of substantial adjustment costs involved in switching from domestic to imported goods, and vice versa, in the short run.The second feature, in particular, makes the demand for exported and imported goods even less responsive to fluctuations in exchange rates and relative prices in the short run than in the longer run, when adjustment costs are zero. Overall, both features significantly dampen the response of the trade deficit to an increase in the budget deficit. Cavallo (2005) draws attention to the composition of government current expenditures, in particular, the wage costs of government employees, which, essentially, correspond to expenditure on nontraded labor services.These services include, for example, general public service, national defense, public order and safety, health, education, and others.This study finds that an increase in government expenditure on these labor services corresponding to 1% of GDP produces a deterioration in the current account balance of barely 0.05% of GDP. An increase in this component of government expenditure is accommodated by an increase in the number of hours that people work, rather than a deterioration in the current account balance. These findings hint at the possibility that a budget deficit generated by an increase in expenditure on nontraded labor services has a substantially smaller impact on the current account than one generated by an increase in expenditure on, say, tradable goods. In addition, since the bulk of government current expenditures during the postwar period has gone toward nontraded labor services, these findings also suggest that budget deficits may have had a smaller impact on the current account than predicted by studies where government expenditures consist entirely of tradable goods. Conclusions Sibling relationships are always complicated, and, as these studies indicate, so is the relationship be-

tween the twin deficits. Although standard economic theory predicts that a deterioration in the budget balance results in a deterioration of the current account, the data in Figure 1 show that the two do not always move together. Indeed, the studies cited in this Economic Letter suggest that, if there is any relationship, it is fairly tenuous.The reason is that a number of factors can play a role in determining the impact of budget deficits on the current account. For policymakers, these results ultimately raise questions about the extent to which a reduction in the budget deficit can lead to an improvement in the current account deficit. Michele Cavallo Economist

References [URLs accessed June 2005.] Baxter, Marianne. 1995. International Trade and Business Cycles. In Handbook of International EconomicsVol. 3, eds. Gene M. Grossman and Kenneth Rogoff, pp. 18011864.Amsterdam: North-Holland. Cavallo, Michele. 2005. Government Consumption Expenditures and the Current Account. FRBSF Working Paper 2005-03. http://www.frbsf.org/ publications/economics/papers/2005/wp05-03bk.pdf Erceg, Christopher J., Luca Guerrieri, and Christopher Gust. 2005. Expansionary Fiscal Shocks and the Trade Deficit. International Finance Discussion Paper 825, Federal Reserve Board. http://www .federalreserve.gov/pubs/ifdp/2005/825/ifdp825.pdf Kim, Soyoung, and Nouriel Roubini. 2004. Twin Deficits or Twin Divergence? Fiscal Policy, Current Account and Real Exchange Rate in the U.S. Mimeo, Korea University and New York University. http://econ.korea.ac.kr/prof/sykim/files/fiscalus9.pdf

ECONOMIC RESEARCH

FEDERAL RESERVE BANK OF SAN FRANCISCO

P.O. Box 7702 San Francisco, CA 94120

PRESORTED STANDARD MAIL U.S. POSTAGE PAID PERMIT NO. 752 San Francisco, Calif.

Address Service Requested

Printed on recycled paper with soybean inks

Index to Recent Issues of FRBSF Economic Letter

DATE 11/26 12/3 12/10 12/17 12/24 1/7 1/21 2/4 2/18 3/11 4/8 4/15 4/29 5/20 5/27 6/3 6/10 6/17 6/24 7/15 NUMBER 04-34 04-35 04-36 04-37 04-38 05-01 05-02 05-03 05-04 05-05 05-06 05-07 05-08 05-09 05-10 05-11 05-12 05-13 05-14 05-15 TITLE Outsourcing by Financial Services Firms:The Supervisory Response October 6, 1979 What Determines the Credit Spread? Productivity Growth and the Retail Sector After the Asian Financial Crisis: Can Rapid Credit Expansion ... To Float or Not to Float? Exchange Rate Regimes and Shocks Help-Wanted Advertising and Job Vacancies Emerging Markets and Macroeconomic Volatility: Conference Summary Productivity and Inflation Gains in U.S. Productivity: Stopgap Measures or Lasting Change? Financial liberalization: How well has it worked for developing countries? A Tale of Two Monetary Policies: Korea and Japan The Long-term Interest Rate Conundrum: Not Unraveled Yet? Can Monetary Policy Influence Long-term Interest Rates? More Life vs. More Goods: Explaining Rising Health Expenditures Are State R&D Tax Credits Constitutional? An Economic Perspective Fiscal and Monetary Policy: Conference Summary IT Investment:Will the Glory Days Ever Return? Stress Tests: Useful Complements to Financial Risk Models Age and Education Effects on the Unemployment Rate AUTHOR Lopez Walsh Krainer Doms Valderrama Cavallo Valletta Glick/Valderrama Yellen Daly/Furlong Aizenman Cargill Wu Jord Jones Wilson Dennis/Williams Doms Lopez Valletta/Hodges

Opinions expressed in the Economic Letter do not necessarily reflect the views of the management of the Federal Reserve Bank of San Francisco or of the Board of Governors of the Federal Reserve System.This publication is edited by Judith Goff, with the assistance of Anita Todd. Permission to reprint portions of articles or whole articles must be obtained in writing. Permission to photocopy is unrestricted. Please send editorial comments and requests for subscriptions, back copies, address changes, and reprint permission to: Public Information Department, Federal Reserve Bank of San Francisco, P.O. Box 7702, San Francisco, CA 94120, phone (415) 974-2163, fax (415) 974-3341, e-mail sf.pubs@sf.frb.org. The Economic Letter and other publications and information are available on our website, http://www.frbsf.org.

Anda mungkin juga menyukai

- Golf Course Business Plan - Union College 2009Dokumen48 halamanGolf Course Business Plan - Union College 2009flippinamsterdam100% (2)

- Undertaking A Fiscal ConsolidationDokumen24 halamanUndertaking A Fiscal ConsolidationInstitute for GovernmentBelum ada peringkat

- 63 PDFDokumen161 halaman63 PDFLobito Solitario100% (1)

- Fiscal Policy, Public Debt Management and Government Bond Markets: The Case For The PhilippinesDokumen15 halamanFiscal Policy, Public Debt Management and Government Bond Markets: The Case For The Philippinesashish1981Belum ada peringkat

- Krugman Obstfeld Ch07Dokumen26 halamanKrugman Obstfeld Ch07Ruslan ValiulinBelum ada peringkat

- School Building Valuation in Rural AreasDokumen66 halamanSchool Building Valuation in Rural AreasMurthy BabuBelum ada peringkat

- Fiscal PolicyDokumen6 halamanFiscal Policyapi-3695543100% (1)

- Dividend Decision Analysis at Zen MoneyDokumen100 halamanDividend Decision Analysis at Zen MoneyRoji0% (1)

- Chapter OneDokumen119 halamanChapter Onegary galangBelum ada peringkat

- Manual of Regulation For BanksDokumen27 halamanManual of Regulation For BanksCLAINE AVELINOBelum ada peringkat

- MCW Newest and Final On WordDokumen20 halamanMCW Newest and Final On WordmahadshahzadBelum ada peringkat

- Budget Deficits, National Saving, and Interest RatesDokumen83 halamanBudget Deficits, National Saving, and Interest RatesshuvrodeyBelum ada peringkat

- U.S. Fiscal PoliciesDokumen5 halamanU.S. Fiscal PoliciesMai KieuBelum ada peringkat

- Attiya Y. JavedDokumen19 halamanAttiya Y. JavedAyesha Fareed KhanBelum ada peringkat

- ¿Qué Hacen Los Déficits Presupuestarios¿ - MankiwDokumen26 halaman¿Qué Hacen Los Déficits Presupuestarios¿ - Mankiwpandita86Belum ada peringkat

- The Economics of The Government Budget ConstraintDokumen16 halamanThe Economics of The Government Budget ConstraintManuel R. FragaBelum ada peringkat

- Fiscal Deficit Determinants and AnalysisDokumen14 halamanFiscal Deficit Determinants and AnalysisRISHAB LODH PhD ECO 2021Belum ada peringkat

- Macroeconomic - UlangkajiDokumen12 halamanMacroeconomic - UlangkajiAnanthi BaluBelum ada peringkat

- Coalition Government Policy EssayDokumen8 halamanCoalition Government Policy Essayzbarcea99Belum ada peringkat

- Panel Causality Example Xtabond2 - 5Dokumen15 halamanPanel Causality Example Xtabond2 - 5eruygurBelum ada peringkat

- Ehadig Final Research ProposalDokumen17 halamanEhadig Final Research Proposalአማን በአማንBelum ada peringkat

- Seven Unsustainable ProcessesDokumen16 halamanSeven Unsustainable Processesmirando93Belum ada peringkat

- Cut Deficits by Cutting SpendingDokumen4 halamanCut Deficits by Cutting SpendingAdrià LópezBelum ada peringkat

- Taylor PN 2010 - 3Dokumen7 halamanTaylor PN 2010 - 3marceloleitesampaioBelum ada peringkat

- Searching For Non-Keynesian Effects of Fiscal PolicyDokumen27 halamanSearching For Non-Keynesian Effects of Fiscal PolicyLavinia LazarBelum ada peringkat

- Rineesh Uog - Essay Project - EditedDokumen9 halamanRineesh Uog - Essay Project - EditedJiya BajajBelum ada peringkat

- Econ Macro Canadian 1st Edition Mceachern Solutions ManualDokumen8 halamanEcon Macro Canadian 1st Edition Mceachern Solutions Manualkathleenjonesswzrqcmkex100% (15)

- Ebook Econ Macro Canadian 1St Edition Mceachern Solutions Manual Full Chapter PDFDokumen29 halamanEbook Econ Macro Canadian 1St Edition Mceachern Solutions Manual Full Chapter PDFhannhijhu100% (11)

- RMBE ProjectDokumen24 halamanRMBE ProjectAbhishek JainBelum ada peringkat

- Applied Term PaperDokumen8 halamanApplied Term PapershaguftaBelum ada peringkat

- Proiecte EconomiceDokumen16 halamanProiecte EconomiceFlorina StoicescuBelum ada peringkat

- ECO-20054 Fiscal Policy FinallDokumen4 halamanECO-20054 Fiscal Policy FinallTendesai SpearzBelum ada peringkat

- Government Macroeconomic Policy ObjectivesDokumen13 halamanGovernment Macroeconomic Policy ObjectivesalphaBelum ada peringkat

- The Effects of Fiscal ConsolidationsDokumen65 halamanThe Effects of Fiscal ConsolidationsLorenzo RNBelum ada peringkat

- JEC Study Showing Spending Cuts Support Job GrowthDokumen20 halamanJEC Study Showing Spending Cuts Support Job GrowthSpeakerBoehnerBelum ada peringkat

- Project ProposalDokumen37 halamanProject ProposalOluwasegun KolawoleBelum ada peringkat

- Large+Changes+in+Fiscal+Policy October 2009Dokumen36 halamanLarge+Changes+in+Fiscal+Policy October 2009richardck50Belum ada peringkat

- Tutorial Question Practice Section 1 and 2Dokumen8 halamanTutorial Question Practice Section 1 and 2Jennifer YoshuaraBelum ada peringkat

- SF Fed Downturns and Fiscal PolicyDokumen4 halamanSF Fed Downturns and Fiscal PolicyZerohedge100% (1)

- Macro Answer - ChaDokumen7 halamanMacro Answer - Chashann hein htetBelum ada peringkat

- Fiscal Multiplier - Term PaperDokumen10 halamanFiscal Multiplier - Term PaperEzrah PlaisanceBelum ada peringkat

- 09.07.12 JPM Fiscal Cliff White PaperDokumen16 halaman09.07.12 JPM Fiscal Cliff White PaperRishi ShahBelum ada peringkat

- MPRA Paper 24227Dokumen23 halamanMPRA Paper 24227Joab Dan Valdivia CoriaBelum ada peringkat

- Fiscal PolicyDokumen20 halamanFiscal PolicyZəfər CabbarovBelum ada peringkat

- The University of Chicago PressDokumen55 halamanThe University of Chicago PresscaggiatoBelum ada peringkat

- The Fiscal Deficit: Themes Economic BriefsDokumen2 halamanThe Fiscal Deficit: Themes Economic BriefsVirendra PratapBelum ada peringkat

- Tax Revenue and Main Macroeconomic Indicators in Turkey: Harun Yüksel, Mehmet Orhan, Hakan ÖztunçDokumen16 halamanTax Revenue and Main Macroeconomic Indicators in Turkey: Harun Yüksel, Mehmet Orhan, Hakan ÖztunçSatria FrandyantoBelum ada peringkat

- 2.0 The Fiscal Policy Multiplier in Good and Bad TimesDokumen3 halaman2.0 The Fiscal Policy Multiplier in Good and Bad TimesMichael OppongBelum ada peringkat

- BL Fiscal Consolidation2Dokumen19 halamanBL Fiscal Consolidation2Mirko VelascoBelum ada peringkat

- Gazam Eco GRP Paraphrased May 17Dokumen8 halamanGazam Eco GRP Paraphrased May 17syedumarahmed52Belum ada peringkat

- Schools, Taxes and The New York EconomyDokumen16 halamanSchools, Taxes and The New York EconomyCitizen Action of New York100% (2)

- EC1009 May ExamDokumen10 halamanEC1009 May ExamFabioBelum ada peringkat

- 2004 Economics Notes TzuDokumen2 halaman2004 Economics Notes TzuwasaiyanBelum ada peringkat

- Macroeconomics Effects of Structural Fiscal Policy Changes in ColombiaDokumen44 halamanMacroeconomics Effects of Structural Fiscal Policy Changes in ColombiaAndres ZapataBelum ada peringkat

- Presidents Budget FY05Dokumen9 halamanPresidents Budget FY05Committee For a Responsible Federal BudgetBelum ada peringkat

- Volume4 Issue2 Richter Paparas PDFDokumen17 halamanVolume4 Issue2 Richter Paparas PDFGeorgescu GeorgianaBelum ada peringkat

- Democratic Budget Framework: A Balanced, Pro-Growth, and Fair Deficit Reduction PlanDokumen4 halamanDemocratic Budget Framework: A Balanced, Pro-Growth, and Fair Deficit Reduction PlanInterActionBelum ada peringkat

- Fiscal Adjustments at The Local Level: Evidence From ColombiaDokumen26 halamanFiscal Adjustments at The Local Level: Evidence From ColombiaJessica ValenzuelaBelum ada peringkat

- Treasury Working Paper 2010 04Dokumen33 halamanTreasury Working Paper 2010 04peter_martin9335Belum ada peringkat

- C Compare Net Export Effect and Crowding Out Effect With The Help of GDP?Dokumen5 halamanC Compare Net Export Effect and Crowding Out Effect With The Help of GDP?M Waqar ZahidBelum ada peringkat

- MacroDokumen11 halamanMacroAditya RajBelum ada peringkat

- Macro EconomicsDokumen20 halamanMacro EconomicskhalilBelum ada peringkat

- Twin Def PaperDokumen33 halamanTwin Def PaperGeorsh Maicol Paulino VictorianoBelum ada peringkat

- CHAPTER TWO and THREEDokumen18 halamanCHAPTER TWO and THREEPress KasangaBelum ada peringkat

- Fiscal DeficitDokumen3 halamanFiscal DeficitsukandeBelum ada peringkat

- Twin Deficit HypothesisDokumen42 halamanTwin Deficit HypothesisPress KasangaBelum ada peringkat

- A Corporate BondDokumen2 halamanA Corporate BondMuhammad KhurramBelum ada peringkat

- Derivatives - AshifHvcDokumen51 halamanDerivatives - AshifHvcadctgBelum ada peringkat

- Government of PunjabDokumen1 halamanGovernment of PunjabPunjab Drainage Department0% (1)

- Account Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokumen2 halamanAccount Statement From 1 Apr 2020 To 31 Mar 2021: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceVara Prasad AvulaBelum ada peringkat

- Question Bank 1. A and B Are Partners Sharing Profits in The Ratio of 3: 2 With Capitals of Rs. 50,000 and Rs. 30,000Dokumen2 halamanQuestion Bank 1. A and B Are Partners Sharing Profits in The Ratio of 3: 2 With Capitals of Rs. 50,000 and Rs. 30,000navin_raghuBelum ada peringkat

- Employees' Provident Fund Scheme: (0.18 %)Dokumen9 halamanEmployees' Provident Fund Scheme: (0.18 %)Shubhabrata BanerjeeBelum ada peringkat

- Admission of PartnersDokumen30 halamanAdmission of Partnersvansh gandhiBelum ada peringkat

- Business Valuation: Economic ConditionsDokumen10 halamanBusiness Valuation: Economic ConditionscuteheenaBelum ada peringkat

- Group 10 Informal Financial InstitutionsDokumen56 halamanGroup 10 Informal Financial InstitutionsRoxanne LutapBelum ada peringkat

- Global Risk Risk Methodology - Model Validation Risk Stress TestingDokumen4 halamanGlobal Risk Risk Methodology - Model Validation Risk Stress TestingRaj AgarwalBelum ada peringkat

- Combined Pdfs Katarina BookDokumen6 halamanCombined Pdfs Katarina Bookapi-300353710Belum ada peringkat

- Central Banking and Financial RegulationsDokumen9 halamanCentral Banking and Financial RegulationsHasibul IslamBelum ada peringkat

- Modern BankingDokumen15 halamanModern BankingRavi ChavdaBelum ada peringkat

- Country Wide Litigation Database 01072007Dokumen15 halamanCountry Wide Litigation Database 01072007Carrieonic100% (1)

- SK Illustrative Problems - For All SessionsDokumen6 halamanSK Illustrative Problems - For All SessionsLea Mae JenBelum ada peringkat

- Master Circular MSME - RBIDokumen32 halamanMaster Circular MSME - RBIMadan MohanBelum ada peringkat

- List of Project Topics For Accountancy DDokumen4 halamanList of Project Topics For Accountancy DnebiyuBelum ada peringkat

- 1 Introduction To BankingDokumen8 halaman1 Introduction To BankingGurnihalBelum ada peringkat

- SOP: Sales Invoices: Stage I: Recording A Sales InvoiceDokumen2 halamanSOP: Sales Invoices: Stage I: Recording A Sales InvoiceSuresh KattamuriBelum ada peringkat

- BIMBSec - Dayang Initial Coverage - 020412Dokumen9 halamanBIMBSec - Dayang Initial Coverage - 020412Bimb SecBelum ada peringkat

- MBA (E) 2021-23, 3rd Semester All Subjects SyllabusDokumen40 halamanMBA (E) 2021-23, 3rd Semester All Subjects SyllabusANISHA DUTTABelum ada peringkat

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDokumen2 halamanPT Astra Agro Lestari TBK.: Summary of Financial StatementIntan Maulida SuryaningsihBelum ada peringkat

- A Study On Working CapitalDokumen92 halamanA Study On Working CapitalNeehasultana ShaikBelum ada peringkat