Bollinger Band Manual - Mark Deaton

Diunggah oleh

Yagnesh PatelDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bollinger Band Manual - Mark Deaton

Diunggah oleh

Yagnesh PatelHak Cipta:

Format Tersedia

PSR System Copyright 2008 Mark T. Deaton Inc.

PSR Manual

U.S. Government Required Disclaimer - Commodity Futures Trading Commission Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the stock/options markets. Dont trade with money you cant afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in this manual. The past performance of any trading system or methodology is not necessarily indicative of future results. CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN. This material is protected under the Digital Millennium Copyright Act of 1998 and various international treaties. This material may not be replicated and redistributed. You may make one or more copies for archival purposes if those copies are for your own use. It is illegal to e-mail this material to any person other than yourself or to make this material available for downloading by any person other than yourself.

PSR System Copyright 2008 Mark T. Deaton Inc.

Dynamic support and resistance uses the lows on uptrending stocks, and the highs on downtrending ones.

Page | 2

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 3

PSR System Copyright 2008 Mark T. Deaton Inc.

Entry

Old dynamic Support

New

Page | 4

PSR System Copyright 2008 Mark T. Deaton Inc.

Adjustment to support

Page | 5

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 6

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 7

PSR System Copyright 2008 Mark T. Deaton Inc.

New support

Page | 8

PSR System Copyright 2008 Mark T. Deaton Inc.

Any missing support lines are simply a matter of trades we were in and waiting to close or similar.

Page | 9

PSR System Copyright 2008 Mark T. Deaton Inc.

Bollinger bands Bullish In response to approaching price to upper band. 1. Upper band and lower band rising with price, slow and steady. 2. Upper band rising lower band flat, rising slow and steady, maybe a little faster than #1. 3. Upper band rising, lower band falling - fast sharp, explosive moves. 4. Upper band flat lower band either, indicates reversal after band is hit / penetrated. Bearish In response to approaching price to lower band. 1. Lower and upper and falling with price, slow and steady. 2. Lower band falling and upper band flat, slow and steady, maybe a bit faster than #1. 3. Lower band falling, upper band rising, fast sharp explosive moves. 4. Lower band flat upper band either indicates reversal after band is hit / penetrated. I worte these rules in the manual so you would have clear rules for the bands, see the videos for examples.

Page | 10

PSR System Copyright 2008 Mark T. Deaton Inc.

Risk / Reward = Support & Resistance Your risk is directly related to where you enter relative to your support or resistance thresh hold. If you enter a trade .75 cents away from your S/R thresh hold, you then allow yourself to much risk to justify the trade. If price action wont allow entry right on top of your support or resistance line, then dont trade. The concept is simple and crucial to your long term success. You need to have clear and precise, and low risk exit points. Im reluctant to say zones because that implies discretion, when in fact this clear exit is so critical. DO NOT participate in trades that can fool you into holding on. For example:

Avoid trades like this. A move against you here would cause you to wait until that true support line (blue) is hit because truly that is where support is. This waiting for true support will blow out your account fast. This may seem simple but 99% of you have never even considered how important this is. That green dot may become true support, but right now its not. This is where mastering your dynamic support and resistance comes in. There are some very cool dynamic S&R tricks I use to generate very nice trades... Page | 11

PSR System Copyright 2008 Mark T. Deaton Inc.

On a short trade like this I will enter when I see the bullish sentiment fading into a long upper wick. This allows for great option pricing, staying 1 step ahead of the crowd, and an immediate exit the next morning after the first 2 hrs if Im wrong. Usually it results in a long 10 day + trade. Notice we have 2 resistance areas here, our diagonal line as well as the 21 day MA dashed line.

Only the risk that youre wrong should be taken here.

You missed it, this entry is to late, to much risk because your stop is at resistance.

Let the previous low be your trigger

Page | 12

PSR System Copyright 2008 Mark T. Deaton Inc.

Looking at the example on the last page I want to show you what gave us reason to enter short here. Couple of reasons. After the first say 2 hours this red candlestick was pushing down. Price failed to penetrate the recent high, or we can say basically its a little double top, or double attempt. AND its at our brand new resistance area. Because the diagonal line is brand new, and only there because of this new high, it needs other confirmation to enter. So this entry is made about 2 hrs into the day because of everything here. Also note that near days end Bollinger bands already begins to turn down.

Page | 13

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 14

PSR System Copyright 2008 Mark T. Deaton Inc.

We are measuring the trend down to identify potential reversal zones, so we need the top at 0 and the bottom at 100%. This way the lower retracement zones come first, 23.6, 38.2, 50 and so on... Measuring the H and L of the 2 ovals. We can see that we reached 161.8 which indicates a trend reversal. Noticed the bounce at 100% before 100% was penetrated 6 days later.

Page | 15

PSR System Copyright 2008 Mark T. Deaton Inc.

A closer look.

Page | 16

PSR System Copyright 2008 Mark T. Deaton Inc.

The dark ovals are the old areas we measured. Because price blew through our 100% its necessary to get a larger chunk of price action to see just where we are. My action was to take this swing down here.

Page | 17

PSR System Copyright 2008 Mark T. Deaton Inc.

Fibonacci is a valuable asset in applying your dynamic support and resistance entries.

Page | 18

PSR System Copyright 2008 Mark T. Deaton Inc.

Old Fibs.

The black ovals represent our initial and second measurment areas, now we reverse and make the bottom 0% and begin measuring the move relative to this high and low. Again we want to be moving in the posative direction 23.6%, 38.2%, 50% and so on...

Page | 19

PSR System Copyright 2008 Mark T. Deaton Inc.

Notice the reversal at exactly 161.8

Page | 20

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 21

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 22

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 23

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 24

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 25

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 26

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 27

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 28

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 29

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 30

PSR System Copyright 2008 Mark T. Deaton Inc.

Page | 31

Anda mungkin juga menyukai

- Trend Qualification and Trading: Techniques To Identify the Best Trends to TradeDari EverandTrend Qualification and Trading: Techniques To Identify the Best Trends to TradePenilaian: 2 dari 5 bintang2/5 (1)

- Dynamic Zone RSIDokumen2 halamanDynamic Zone RSIMiner candBelum ada peringkat

- High-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingDari EverandHigh-Probability Trade Setups: A Chartist�s Guide to Real-Time TradingPenilaian: 4 dari 5 bintang4/5 (1)

- Peter Aan - RSIDokumen4 halamanPeter Aan - RSIanalyst_anil14100% (1)

- TradeStation Made Easy!: Using EasyLanguage to Build Profits with the World's Most Popular Trading SoftwareDari EverandTradeStation Made Easy!: Using EasyLanguage to Build Profits with the World's Most Popular Trading SoftwareBelum ada peringkat

- Power SpikeDokumen130 halamanPower SpikeJagdish BhandariBelum ada peringkat

- Day Trading Using the MEJT System: A proven approach for trading the S&P 500 IndexDari EverandDay Trading Using the MEJT System: A proven approach for trading the S&P 500 IndexBelum ada peringkat

- Prashant Shah - RSIDokumen5 halamanPrashant Shah - RSIIMaths PowaiBelum ada peringkat

- Simple Profits from Swing Trading: The UndergroundTrader Swing Trading System ExplainedDari EverandSimple Profits from Swing Trading: The UndergroundTrader Swing Trading System ExplainedBelum ada peringkat

- Trading SetupsDokumen7 halamanTrading SetupsHeretic87100% (1)

- Trend Trading Set-Ups: Entering and Exiting Trends for Maximum ProfitDari EverandTrend Trading Set-Ups: Entering and Exiting Trends for Maximum ProfitPenilaian: 1.5 dari 5 bintang1.5/5 (5)

- General ACDDokumen41 halamanGeneral ACDlaozi222Belum ada peringkat

- Defining The Bull & BearDokumen8 halamanDefining The Bull & BearNo NameBelum ada peringkat

- Trading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketDari EverandTrading Triads: Unlocking the Secrets of Market Structure and Trading in Any MarketBelum ada peringkat

- Mathematical Indicators of Technical AnalysisDokumen10 halamanMathematical Indicators of Technical AnalysisMuhammad AsifBelum ada peringkat

- Use Keltner Channels Guide TradesDokumen6 halamanUse Keltner Channels Guide TradesThe Shit100% (1)

- Bollinger Bands Essentials 1Dokumen13 halamanBollinger Bands Essentials 1Kiran KudtarkarBelum ada peringkat

- Mastering RSI: by @cryptocredDokumen17 halamanMastering RSI: by @cryptocredmahonyboy .01Belum ada peringkat

- KKDokumen34 halamanKKgoud mahendharBelum ada peringkat

- MWDDokumen85 halamanMWDathos8000100% (2)

- 6 Best Books On Intraday Trading - Financial Analyst Insider PDFDokumen8 halaman6 Best Books On Intraday Trading - Financial Analyst Insider PDFAbhishek MusaddiBelum ada peringkat

- Pay Attention To What The Market Is SayingDokumen11 halamanPay Attention To What The Market Is SayingEmmy ChenBelum ada peringkat

- (Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)Dokumen6 halaman(Trading) Tips Using Fibonacci Ratios and Momentum (Thom Hartle, 2001, Technical Analysis Inc) (PDF)sivakumar_appasamyBelum ada peringkat

- Bobble Pattern Ebook PDFDokumen12 halamanBobble Pattern Ebook PDFContra_hourBelum ada peringkat

- Top 4 Fibonacci Retracement Mistakes To AvoidDokumen3 halamanTop 4 Fibonacci Retracement Mistakes To Avoidaleclhuang100% (1)

- Dynamic Cash TrackerDokumen23 halamanDynamic Cash TrackerRodrigo OliveiraBelum ada peringkat

- The (Almost) Complete Guide To Trading: by Anne ChapmanDokumen60 halamanThe (Almost) Complete Guide To Trading: by Anne ChapmanTheodoros Maragakis100% (1)

- 5EMAs AdvancedDokumen5 halaman5EMAs AdvancedMrugenBelum ada peringkat

- Schaff Trend Cycle Indicator - Forex Indicators GuideDokumen3 halamanSchaff Trend Cycle Indicator - Forex Indicators Guideenghoss77100% (1)

- How To Day Trade Stocks With A Trend Strategy - Entries, Exits, and Risk ManagementDokumen14 halamanHow To Day Trade Stocks With A Trend Strategy - Entries, Exits, and Risk ManagementTrader CatBelum ada peringkat

- ADX breakout scanning signals momentum tradesDokumen5 halamanADX breakout scanning signals momentum tradesedsnake80% (5)

- Traders Expo Las Vegas Intensive Workshop November 2011 Pocket PivotsDokumen38 halamanTraders Expo Las Vegas Intensive Workshop November 2011 Pocket PivotsteppeiBelum ada peringkat

- Abonacci Trading v11-11Dokumen12 halamanAbonacci Trading v11-11ghcardenas100% (1)

- Day Trading S&P 500 Index Futures ContractDokumen85 halamanDay Trading S&P 500 Index Futures ContractfendyBelum ada peringkat

- DMI LectureDokumen24 halamanDMI Lecture_karr99Belum ada peringkat

- The Secular Trend and Cyclical Outlook For Bonds, Stocks and CommoditiesDokumen69 halamanThe Secular Trend and Cyclical Outlook For Bonds, Stocks and Commoditiescommodi21Belum ada peringkat

- 5 6240273600583041308 PDFDokumen5 halaman5 6240273600583041308 PDFwendtoin sawadogoBelum ada peringkat

- Treading With CCI PDFDokumen29 halamanTreading With CCI PDFRakesh MishraBelum ada peringkat

- Pin Bar and Inside Bar Combo Trading StrategyDokumen5 halamanPin Bar and Inside Bar Combo Trading StrategyDoug TrudellBelum ada peringkat

- Trading Away from EMAs & Using TDI SignalsDokumen16 halamanTrading Away from EMAs & Using TDI SignalsdsudiptaBelum ada peringkat

- The Simplest Momentum Indicator - Alvarez Quant TradingDokumen8 halamanThe Simplest Momentum Indicator - Alvarez Quant Tradingcoachbiznesu0% (1)

- Set and Forget CourceDokumen109 halamanSet and Forget CourceChristiana OnyinyeBelum ada peringkat

- Bollinger Bands - Using Volatility by Matthew ClaassenDokumen5 halamanBollinger Bands - Using Volatility by Matthew ClaassenTradingTheEdgesBelum ada peringkat

- IFTA Journal article summarizes Volume Zone Oscillator trading indicatorDokumen15 halamanIFTA Journal article summarizes Volume Zone Oscillator trading indicatorRoberto Rossi100% (1)

- Swing Trading Four-Day Breakouts: Step 1: Visually Scan For Stocks in TheDokumen2 halamanSwing Trading Four-Day Breakouts: Step 1: Visually Scan For Stocks in TheShujun Yip100% (1)

- Williams %R RulesDokumen12 halamanWilliams %R RulesbigtrendsBelum ada peringkat

- Momentum Trend TraderDokumen121 halamanMomentum Trend Traderjordan881100% (1)

- Recognizing Profitable TrendDokumen82 halamanRecognizing Profitable TrendeliasguitarBelum ada peringkat

- 10 Must-Know Bar Patterns for Price Action TradersDokumen14 halaman10 Must-Know Bar Patterns for Price Action Traderssal8471100% (2)

- Trading Strategy v.1Dokumen4 halamanTrading Strategy v.1amitBelum ada peringkat

- Kevin Haggerty - Trading With The Generals 2002Dokumen233 halamanKevin Haggerty - Trading With The Generals 2002SIightly75% (4)

- Trading Nifty Futures For A Living by Chartless Trader Vol Book 1Dokumen3 halamanTrading Nifty Futures For A Living by Chartless Trader Vol Book 1Anantha TheerthanBelum ada peringkat

- Metastock Breakout FormulasDokumen5 halamanMetastock Breakout FormulasEd MartiBelum ada peringkat

- Fibonacci 2Dokumen27 halamanFibonacci 2shahzainkhan100% (1)

- Trend Vs No TrendDokumen3 halamanTrend Vs No TrendpetefaderBelum ada peringkat

- Straight Line Approach, The: Understanding Supply and Demand Through TrendlinesDokumen33 halamanStraight Line Approach, The: Understanding Supply and Demand Through Trendlinespjwillis100% (1)

- Market Wise Reversal Entry StrategiesDokumen21 halamanMarket Wise Reversal Entry StrategiesnettideBelum ada peringkat

- 8 Reasons Not To Daytrade Altucher ConfidentialDokumen30 halaman8 Reasons Not To Daytrade Altucher ConfidentialAndre MavroBelum ada peringkat

- Multi-Time Frame Analysis PDFDokumen50 halamanMulti-Time Frame Analysis PDFRekhaKingrani100% (1)

- Candle ChecklistDokumen5 halamanCandle ChecklistYagnesh PatelBelum ada peringkat

- Bull Bear FaceOff EbookK 1Dokumen27 halamanBull Bear FaceOff EbookK 1Yagnesh Patel67% (3)

- 5 Supply and Demand Rules You Need To Know FinalDokumen18 halaman5 Supply and Demand Rules You Need To Know FinalYagnesh Patel92% (12)

- Invoice ToDokumen1 halamanInvoice ToYagnesh PatelBelum ada peringkat

- Sample Swing Trade PlanDokumen1 halamanSample Swing Trade PlanYagnesh Patel0% (1)

- 3 Step Plan PDFDokumen16 halaman3 Step Plan PDFYagnesh Patel100% (3)

- FOREX - World Charting REPORT+Dokumen20 halamanFOREX - World Charting REPORT+Yagnesh PatelBelum ada peringkat

- Sample Swing Trade PlanDokumen1 halamanSample Swing Trade PlanYagnesh Patel0% (1)

- 50 KWord EbookDokumen247 halaman50 KWord EbookLio PermanaBelum ada peringkat

- Distinguishing Strong Legs Within Trading Ranges and Trends: Futures - Io Webinar - May 3, 2016Dokumen54 halamanDistinguishing Strong Legs Within Trading Ranges and Trends: Futures - Io Webinar - May 3, 2016Yagnesh Patel100% (8)

- Supply and Demand English PDFDokumen28 halamanSupply and Demand English PDFSufina Gold100% (2)

- Supply and Demand How To Find and Trade The Best ZonesNew PDFDokumen25 halamanSupply and Demand How To Find and Trade The Best ZonesNew PDFYagnesh Patel100% (12)

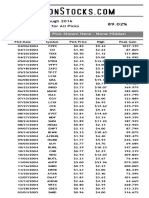

- Every Stock Pick Shown Here - None Hidden: 2004 Through 2016 Average Gain For All PicksDokumen14 halamanEvery Stock Pick Shown Here - None Hidden: 2004 Through 2016 Average Gain For All PicksYagnesh Patel100% (1)

- Southern Court Number 9 July 2018.compressed1Dokumen7 halamanSouthern Court Number 9 July 2018.compressed1Yagnesh PatelBelum ada peringkat

- Practical Elliott Wave Trading StrategiesDokumen0 halamanPractical Elliott Wave Trading StrategiesGeorge Akrivos100% (2)

- 1134 How To Use Fibonacci Retracement To Predict Forex Market PDFDokumen14 halaman1134 How To Use Fibonacci Retracement To Predict Forex Market PDFHmt NmslBelum ada peringkat

- Supply and DemandDokumen206 halamanSupply and DemandYagnesh Patel89% (9)

- Step by step guide to apply for OCI cardDokumen1 halamanStep by step guide to apply for OCI cardYagnesh PatelBelum ada peringkat

- Chart (1) - 5-Minute ES For Feb 3, 2009 - AMDokumen17 halamanChart (1) - 5-Minute ES For Feb 3, 2009 - AMYagnesh Patel100% (1)

- Gap TradingDokumen62 halamanGap TradingYagnesh Patel100% (1)

- New Concept in RSIDokumen25 halamanNew Concept in RSIYagnesh Patel86% (7)

- Gap TradingDokumen62 halamanGap TradingYagnesh Patel100% (1)

- Lane's Stochastics (1984) (1998)Dokumen14 halamanLane's Stochastics (1984) (1998)Yagnesh Patel100% (1)

- Supply and DemandDokumen206 halamanSupply and DemandYagnesh Patel75% (4)

- Lane's Stochastics (1984) (1998)Dokumen14 halamanLane's Stochastics (1984) (1998)Yagnesh Patel100% (1)

- Stock Market Miracle EbookDokumen38 halamanStock Market Miracle EbookYagnesh PatelBelum ada peringkat

- Beringer Weinstock Group - TA SignalsDokumen33 halamanBeringer Weinstock Group - TA SignalsYagnesh PatelBelum ada peringkat

- Stock Market Miracle EbookDokumen38 halamanStock Market Miracle EbookYagnesh PatelBelum ada peringkat

- Tri Ton Convergence ReportDokumen16 halamanTri Ton Convergence ReportYagnesh PatelBelum ada peringkat

- Risk Management in Agricultural FinanceDokumen52 halamanRisk Management in Agricultural Financesburkis100% (7)

- Paradise Villa Maui Management - Fraud ComplaintDokumen21 halamanParadise Villa Maui Management - Fraud ComplaintMarcus FelkerBelum ada peringkat

- Government Support Options: Laura Kiwelu Norton Rose FulbrightDokumen15 halamanGovernment Support Options: Laura Kiwelu Norton Rose FulbrightE BBelum ada peringkat

- Practical Accounting One PDFDokumen46 halamanPractical Accounting One PDFDea Lyn BaculaBelum ada peringkat

- Options Made EasyDokumen42 halamanOptions Made Easylee sandsBelum ada peringkat

- Computron Inc - Wac ReportDokumen10 halamanComputron Inc - Wac ReportnilayjBelum ada peringkat

- 3 Supply Chain Management HomeworkDokumen51 halaman3 Supply Chain Management HomeworkRhys SinclairBelum ada peringkat

- Traders Virtual MagazineDokumen68 halamanTraders Virtual Magazinedharmajain100% (1)

- Kel 2 Case Fuel Hedge SouthwestDokumen33 halamanKel 2 Case Fuel Hedge SouthwestYogi UtomoBelum ada peringkat

- Daily Strategy Note Daily Strategy Note: Pravit ChintawongvanichDokumen3 halamanDaily Strategy Note Daily Strategy Note: Pravit Chintawongvanichchris mbaBelum ada peringkat

- Strategicmarketingplan FijiwaterDokumen23 halamanStrategicmarketingplan FijiwaterEscobar Emilio PabloBelum ada peringkat

- Session 3 - Companies Act - Merger, Amalgamation, Share Capital & DebentureDokumen88 halamanSession 3 - Companies Act - Merger, Amalgamation, Share Capital & DebentureVaibhav JainBelum ada peringkat

- International Finance NoteDokumen35 halamanInternational Finance Noteademoji00Belum ada peringkat

- Netflix - Reference Guide On Our Freedom & Responsibility CultureDokumen128 halamanNetflix - Reference Guide On Our Freedom & Responsibility Cultureyejienihao100% (1)

- Financial Markets and Institutions Solved MCQs (Set-7)Dokumen6 halamanFinancial Markets and Institutions Solved MCQs (Set-7)Tonie NascentBelum ada peringkat

- Lecture 5 Risk AnalysisDokumen70 halamanLecture 5 Risk AnalysisAdrian BagayanBelum ada peringkat

- Trading in Future and OptionsDokumen9 halamanTrading in Future and Optionsyes1nth0% (1)

- Chap1 Intro To Engineering EconomicsDokumen70 halamanChap1 Intro To Engineering EconomicsArsalan AhmedBelum ada peringkat

- The Trade Desk, Inc.Dokumen212 halamanThe Trade Desk, Inc.vicr100Belum ada peringkat

- Preface: National Institute of Financial Market (NIFMDokumen65 halamanPreface: National Institute of Financial Market (NIFMSankitBelum ada peringkat

- Financial Engineering & Risk Management: Option Pricing and The Binomial ModelDokumen18 halamanFinancial Engineering & Risk Management: Option Pricing and The Binomial ModelYunpian Pamela ZhongBelum ada peringkat

- Interest Rate FuturesDokumen22 halamanInterest Rate FuturesHerojianbuBelum ada peringkat

- Project MbaDokumen15 halamanProject MbaSRISHIMOGABelum ada peringkat

- Derivatives Dealers ModuleDokumen9 halamanDerivatives Dealers ModulekedarisettivenkateshBelum ada peringkat

- Core HRDokumen18 halamanCore HRNonema Casera JuarezBelum ada peringkat

- Syllabus Student BWFN3013Dokumen3 halamanSyllabus Student BWFN3013Dik Rei ChooBelum ada peringkat

- SAP Guide of Long Term PlanningDokumen21 halamanSAP Guide of Long Term PlanningDario Franco100% (1)

- Commodity Market Full NotesDokumen83 halamanCommodity Market Full NotesHarshitha RBelum ada peringkat

- KDB TutorialDokumen189 halamanKDB TutorialWiwekMähthanii0% (1)

- 2023 - FRM - PI - PE2 - 020223 - CleanDokumen171 halaman2023 - FRM - PI - PE2 - 020223 - CleanRaymond Kwong100% (1)