Purchasing Activities

Diunggah oleh

ashutoshvats16Deskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Purchasing Activities

Diunggah oleh

ashutoshvats16Hak Cipta:

Format Tersedia

IDRAC - 2012

27/01/2012

IDRAC 2012

January / february 2011

Jean-Christophe TRAN DGA, GIE BPCE Achats

Groupe BPCE

Deputy Chief Executive Officer Group & Head Office Procurement

BPCE Group Profile

http://www.bpce.fr/en BPCE Achats : The group purchasing organization

IDRAC - Procurement Training - 2012 - J-C TRAN

IDRAC - 2012

27/01/2012

--- Contents

Purchasing / Procurement Function & Process

Negotiation

(Fundamentals)

Legal: Incoterms

Purchasing categories (portfolio segmentation)

IDRAC - Procurement Training - 2012 - J-C TRAN

Price and enquiry

Buying with the Internet : e-procurement

Inventory Management Constraints Risks Strategies Market Knowledge

3

Everything you allways wanted toknow about Purchasing but you never dared to ask

What do we mean by Purchasing in a company ?

Purchasing expense Purchasing function (Procurement) : Buyer, Lead Buyer, Purchasing Director, Purchasing VP

What are the specific skills ?

Technical skills. Behavioral skills. (Project) Management skills.

Are there specific trainings ? What are the specific roles and responsibilities of buyers ?

IDRAC - Procurement Training - 2012 - J-C TRAN

What they have to do What they shouldnt do

Never choose this job if :

You dont like to work with others, You dont want to travel, Youre disguted with basic finance and math, You dont like to work on different projects at the same time. You dont like challenges. You dont want to negociate.

Is it a well-paid job ? Is it a nice job ? Is there a professional life before and after this job ?

Interesting previous experience

IDRAC - 2012

27/01/2012

The big change in economy (Indicative figures for manufacturing sector) Production driven or regulated economy (protected markets) Selling Price = Cost + Margin

Margin Overheads

IDRAC - Procurement Training - 2012 - J-C TRAN

Market driven economy or globalized economy (free trade) Cost = Market Price - Margin

Margin Overheads Labour Materials & Subcontracting

Purchasing expenses > 65 % Sales income (Turnover)

Labour

Materials

Purchasing expenses Turnover

= 25 %

Cost reduction and productivity

Competitiveness levers = how to reduce costs ?

External savings : Purchases

IDRAC - Procurement Training - 2012 - J-C TRAN

Purchasing

Internal savings :

Cost of product

Labour Overheads

Productivity

IDRAC - 2012

27/01/2012

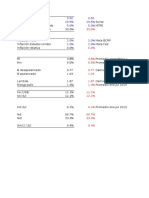

Cost reduction = impact of savings on profitability

Initial situation Turnover Purchasing Bought out expenses

IDRAC - Procurement Training - 2012 - J-C TRAN

10% saving 25% higher on purchases turnover 1000 450 (-10%) 300 100 150 1250 (+25%) 625 (+50%) 375 (30%) 100 150

1000 500 (50%) 300 (30%) 100 100

Labour Overheads (fixed) Net result

Profitability (Net Result / Turnover)

%

7

Overview of PROCUREMENT MANAGEMENT CYCLE

Procurement policy

Strategy

Portfolio analysis / Purchasing Strategy Action plans

Projects

Execution (Operations)

IDRAC - Procurement Training - 2012 - J-C TRAN

Purchasing Management Procurement IS Management (Databases, ERP, e-tools, )

Supply Management

Steering and controlling

Performance measurement / KPI

IDRAC - 2012

27/01/2012

Procurement Management = Purchasing and Supply Management

Purchasing Management process

Need analysis Sourcing Pre-selection Enquiry (RFQ / RFP) Negotiation Contracting Supplier follow-up / management

Data admin

IDRAC - Procurement Training - 2012- J-C TRAN

SRM

Items Prices Suppliers Intranet PO management and stock/reorder Follow-up, reminder, supply plans, Reception (goods, services) Invoice management

Supply Management process

9

2 complementary value chains

The separation between Purchasing and Supply Management value chains is a necessity to make the 2 functions more efficient and professional The Purchasing / Procurement Value Chain answers to the following questions : What need ? Why ? For whom ? From Whom (Which supplier) ? At what price ? What Costs (Total cost) ?

Need analysis Sourcing RFQ/RFP Negotiation Contracting Internal promotion Performance measurement

IDRAC - Procurement Training - 2012 - J-C TRAN

The Supply Management Value Chain answers to questions : When ? How much ? Where ?

P.R. Approval P. Order creation P. Order dispatch Supplier / Delivery Follow up and Reception Invoice Control

Purchasing Request (Qty, Delivery time, )

* (In small structures the same person sometimes may perform the 2 functions)

10

IDRAC - 2012

27/01/2012

The role of purchasing function - fundamentals

The mission of the Buyer : The buyer is an internal service provider

He has to provide value to his internal client and listen to his needs He has to satisfy the right need of the requester - right in the sense of adequate for the company In satisfying the requesters need, he has to make sure that the supplier and the negotiated product and/or services will effectively meet the needs

Quality + Cost + Lead-Times. What has the buyer to offer to his internal clients ?

IDRAC - Procurement Training - 2012 - J-C TRAN

Knowledge of the supplier market Globalisation of similar expenses to leverage volumes Decentralized and simplified Supply Management, as close as possible to the end users Efficient, professional procedures to organize competition between suppliers in order to :

Save time, Save money (optimize the company financial results) Improve quality level

What the buyers needs and demands from his internal customers (requesters) :

Be involved early in the procurement process : at the stage of the expression of the need

11

The Purchasing Function

Involvement of Purchasing as early as possible ! The earlier you intervene (at the initial stage of

definition of the need), the more levers you have at your disposal to optimise the purchase :

Potential savings

Redefine the need of the user in order to make use of standard goods and services Sort out suppliers which are capable of answering the need and stimulate competition Etc.

IDRAC - Procurement Training - 2012- J-C TRAN

III Specification of Need

II Negotiation I Supply management

Intervention time of Purchasing

12

IDRAC - 2012

27/01/2012

--- Contents

Purchasing / Procurement Function & Process

Negotiation

(Fundamentals)

Legal: Incoterms

Segmentation, Spend analysis, Needs analysis

IDRAC - Procurement Training - 2012 - J-C TRAN

Price and enquiry

Buying with the Internet : e-procurement

Inventory Management Constraints Risks Strategies Market Knowledge

13

The role of purchasing

The purchasing process will be adapted depending on the nature of the purchased goods

Different situations : examples

power differentiel (offer vs demand), simple need vs complex need, standard product (off the shelf) vs specific service or solution.

Differentiated techniques : examples

bargaining vs complex negotiation,

IDRAC - Procurement Training - 20112- J-C TRAN

spot buying vs long term commitment / partnership, Exclusive agreement vs co-buying.

Thus, it is necessary to organize the purchasing portfolio into Purchase Families :

to be able to use the right process for each purchase family to differentiate the practices according to the nature of purchase to define purchase families which are homogeneous on the market To identify the suppliers for a family, to optimize the supply base for each family.

14

IDRAC - 2012

27/01/2012

Purchasing category definition

A purchasing category is defined by

IDRAC - Procurement Training - 2012 - J-C TRAN

A similar type of needs

- internal expertise - specification - consumption

A unique supplier Market

(or similar in term of structure)

- Same suppliers - Same characteristics (oligopoly, monopoly)

15

Squence 3 : Le processus achats

Example of purchasing segmentation

(Aluminum Producer)

10 purchasing families / 164 segments

Ex : segment 140 : office equipment

A. General expenses

Ex : segment 180 : IT services Ex : segment 330 : hardware Ex : segment 355 : pumps Ex : segment 727 : specific metallurgy process equipment

B. Consumables C. Industrial supplies

and equipment

IDRAC - Procurement Training - 2012 - J-C TRAN

D. Industrial services

Ex : segment 740 : Winding and engine repair

E. Energy

Ex : segment 890 : energy

16

IDRAC - 2012

27/01/2012

Squence 3 : Le processus achats

Example of purchasing segmentation (Retail and Investment Banking Group - Extract)

POINT OF SALES AG1 Signs (external and internal) for PoS. AG2 Furniture AG3 Cleaning and facilities maintenance ARCHIVE AR1 Archive (digital and physical) MAIL CO1 Postal mail CO2 Subcontracted Mail CO3 Internal mail shuttles CO4 Express Mail CO5 Mail Room Equipment DOCUMENTATION DO1 Subscription UTILITIES PRINTS AND PHOTOCOPIES RI1 Production Printing Systems (Large Volumes) RI2 Printed Cheques RI3 Copy Machines and Self-Service Printing Devices RI4 Administrative Prints and Business Cards RI5 Sales Prints SECURITY AND SAFETY SE1 Funds Transportation SE2 Secured Contains for Cash SE3 Remote et Video Watch SE4 Security Equipement Maintenance and Control INTELLECTUAL SERVICES PI1 Consulting : Strategy, Organisation & Management PI2 Training PI3 Legal and Tax Advisory PI4 Financial Statement Control PI5 Interim / Temporary Labor

IDRAC - Procurement Training - 2012- J-C TRAN

EN1 Water EN2 Gas EN3 Electricity INFORMATION FLOW FI1 Real time financial Information (Market Data) FI2 Financial and Marketing Databases OFFICE SUPPLIES FB1 Paper FB2 Computer and printer supplies FB3 Stationary TRAVEL FD1 Travel Agencies FD2 Airlines FD3 Railway FD4 Car manufacturer (and Long Term Car Rental) FD5 Short Term Car Rental FD6 Hotels and restaurants

IT TEC1 IT Hardware and related maintenance TEC2 Cash Dispensers and Automats TEC3 Software TEC4 IT Services

TELECOM TEL1 VOIP TEL2 Wire Telephony TEL3 Mobile (Wireless) Telephony TEL4 Special Numbers and Interactive Vocal Servers TEL5 Data (Networks) TEL6 Pabx

17

Rpartition des dpenses d'achat par entit du Groupe

120 000

100 000

80 000

60 000

40 000

IDRAC - Procurement Training - 2012 - J-C TRAN

20 000

C N AS D EN BP C A BP M C C M M Au tre s BP PC BP I-B FO P N C IA BP R I BF BP BP V BP F BF BP C SU BP D O C C BP LC C C O O P BP AT BP L AL BP P AL S C AZ O SO 2L BP BP BP BP D

BR E

en K HT

BP

18

IDRAC - 2012

27/01/2012

Rpartition des dpenses par grandes familles d'achats (Primtre Groupe Banque Populaire - donnes 2005)

Mutualisable Non Mutualisable

350 000 300 000 250 000 200 000 150 000 100 000 50 000

tra va ux ,. .) ex pl oi ta tio n) AR C H IV AG E C O U D R O R IE C U R M EN TA TI O N FL EN U ER X FO D G 'IN IE U FO R N R IT M U AT R E IO FR S N D A PR E IS B ES D U E R TA E D A EP TI U O LA N S C E IN R M E TE E PR N LL T O E G C R TU A P EL H IE LE S et IM P R IM ES SE C U TE R IT C E H N O LO G IE B S AC TE K LE O M C FF A O R IC M K ET E S B IN A G N C C AI O R M E M U N IC A TI O N (E nt re tie n,

IDRAC - Procurement Training - 2012 - J-C TRAN

En K HT

IL IE R IM M O B LO G IS

TI Q

U E

(L oy er s,

19

Spend Analysis Tool Kit

Once the category scope is clearly identified, one has to start with a preliminary review of quantitative and qualitative datas : what we buy from whom ? The areas to be investigated are represented in the diagram here below.

Volumes Volume ordered by site or unit Volume ordered by supplier Volume seasonality

IDRAC - Procurement Training - 2012- J-C TRAN

Prices and contracts Prices by unit Prices by supplier Prices by location Prices fluctuation Payment terms Frame contracts Product & Service specification Technical and functional specs Design and Quality specs Specification ownership Logistic agreement : transport, packaging, incoterms, delivery lead time, inventory management, EDI, e.procurement .

Average stock level by units Forecast Current suppliers Name, Group dependency Location, countries, zones Turnover Current market shares Expertise and service level assessment

The Spend Analysis Check-list : Quick quantitative and qualitative analysis of the product or service purchased 20

10

IDRAC - 2012

27/01/2012

Where to get the data ? The preliminary RFI

Depending on the reliability of the various information systems

Accounting I.S : accounts payable

Turnover (VAT excluded) per fiscal year, per supplier code, If available : number of invoices, amount per invoice, quantities per invoice, unit prices, discounts,

Production and Inventory Management I.S :

Volumes per reference (or SKU Stock Keeping Units), Quantities variation per month, Average stock level

IDRAC - Procurement Training - 2012 - J-C TRAN

Purchasing and Supply Management I.S :

Frame agreements price conditions, price, yearly discount on turnover, currency, price indexes, Turnover per supplier and per company

Ask the suppliers !

Build a specific RFI table to be filled in. Ask equipment makers to get information on the market

Forecast :

Budgets, strategic plans, interviews.

21

How to organize data ? 2 basic tools

Tool n1 : the PARETO Chart

Who are we buying from ? How much are we spending ? Pareto chart Quantitative analysis

% of total value

100% 95% 80%

A

20%

B

50%

C

100%

IDRAC - Procurement Training - 2012 - J-C TRAN

% of total events

Tool n2 : the category spend table

Who is buying what ? Who is buying from whom ?

Category spend dispersion table

Plant \ suppliers Plant A

Sup 1

M M M M M M M M M M M M M M M

Quantitative analysis

22

11

IDRAC - 2012

27/01/2012

Quantitative analysis Tool n1 : Pareto tool ( ABC or 20/80 )

Why ? Method

To identify which are the priorities

% of total spend

100% 95% 80%

Pareto spend analysis of current supply base (ranking supplier per turnover)

Rank all data in a table from highest to lowest Calculate cumulative percentage for each line Split the table in three classes (A / B / C) representing respectively : 80%, 95% and 5% of the cumulative percentage

70 80%

A

20%

B

50%

C

100%

% of all suppliers

IDRAC - Procurement Training - 2012- J-C TRAN

90% 80% 70%

Output

Pareto analysis can be applied to supplier turnover, to turnover per sub-segment of the category, to turnover per plant or company

60

57,93

50 60% 40 50%

Suppliers Spend

30,03

30

40% 30%

20

14,78

13%

20% 10% 1% 0%

10

6,1

6%

0

TO > 0,76 M 0,15 < TO < 0,76 M 0,015 < TO < 0,15 M TO < 0,015 M

23

Quantitative analysis Tool n2 : The category spend dispersion table

Why ? To better understand the current spend on the category

Category spend dispersion table

Sub-Segment 2 Sub-Segment 1 Plant \ suppliers Plant \ suppliers Plant A Plant A

Is it concentrated ? Is it well-balanced ? Is it diluted ?

Sup 1 Sup 1

Sup

Sup2 2

M M M M M M

Sup Sup Sup Sup3 Sup4 Sup5 3 4 5

M M M M M M M M M M M M M M M M M

M M M

Method :

Identify for each supplier its turnover per plant, The analysis should combine the spend breakdown by sub-segment E-sourcing can be used to organize an internal RFIs and get datas from different companies buyers.

M M M

Concentrated Supply base

M Diluted Supply base

IDRAC - Procurement Training - 2012- J-C TRAN

POTENTIAL FOR LINK AND LEVERAGE ?

Output :

Is there a potential for leveraving volumes (LINK and LEVERAGE) ? Are there different needs explaining the current supply base profile ? Are there already different prices and costs (for one same supplier depending on sites or between the different suppliers) Are there geographical constraints ? Are there suppliers operating at a global level ? Is the market structure only a local one ?

24

12

IDRAC - 2012

27/01/2012

Rpartition des 53 M de dpenses parmi les tablissements du Groupe

Dpenses Transport de Fonds, Comptage et Gestion des automates par banque 2006 - M HT

9 7,9 8 7 6 5 4,0 4 3 3,2 3,1 3,0 3,0 2,9 2,6 2,6 2,0 2,0 2,0 1,8 1,8 1,5 1,4 0,9 1 0 BRED Alpes Sud Ouest Ouest Sud Rives de Paris Cote Azur Alsace Nord Loire et Lyonnais Toulouse Pyrnes Provence Corse Massif Central Atlantique Occitane Bourgogne Franche Comt Lorraine Champagne Centre Atlantique Crdit Maritime

(1)

100% 90% 80% 5,7 70% 60% 50% 40% 30% 20% 0,8 0,6 10% 0% Val de France

IDRAC - Procurement Training - 2012 - J-C TRAN

(1) Les dpenses des caisses maritimes de Littoral de la manche, littoral du sud ouest et Morbihan - Loire Atlantique sont extrapoles partir des rponses des autres caisses du Crdit Maritime Source Questionnaire BP Banque Fdrale et Collecte dinformations fournisseurs - 2006

25

La rpartition des dpenses gestion des espces est proche de la moyenne observe dans les banques mutualistes

Rpartition des dpenses Transport de Fonds, Comptage et Gestion des automates 2006 - M HT

Gestion DAB/GAB - 5,8 M 11%

10% 1/3

Comptage - 20,1 M

38%

30%

1/3

IDRAC - Procurement Training - 2012 - J-C TRAN

Transport de fonds - 27,0 M

51%

60%

1/3

Banques Populaires

Moyenne Banques Mutualistes

Moyenne Banques AFB

Transport de fonds Gestion de caisse centrale Gestion des automates bancaires

26

Source Questionnaire BP Banque Fdrale et Collecte dinformations fournisseurs 2006 - Analyse Mercuris

13

IDRAC - 2012

27/01/2012

2

2.99 M

La rpartition des dpenses gestion et transport des fonds reste trs htrogne au sein des Banques Populaires

Dpenses Transport de Fonds, Comptage et Gestion des automates par banque, 2006 - M HT

1.80 M 1.78 M 1.54 M 1.38 M 0.75 M 2.04 M 4.03 M 3.19 M 0.94 M 1.99 M 2.00 M 3.04 M 2.63 M 3.10 M 2.60 M 2.91 M

7.92 M

0.32

5.68 M

53 M

100%

100%

0.1 0.2

0.18

0.1

0.14 0.23

0.24

0.3 0.2

0.21

0.25 0.66

5,8

1.66 0.82

Gestion des DAB/GAB

80%

0.2

0.67

0.6

1.44

80%

0.5 0.3 0.3

0.72

3.58

1.48 0.82 1.21

1.80 1.68

20,1

60%

2.04 1.07 1.31

Gestion de caisse centrale

60%

2.98

IDRAC - Procurement Training - 2012 - J-C TRAN

40%

1.3 0.6

40%

1.31

1.0

2.41

0.9 0.8

0.4 1.09

4.01

1.58

0.94 1.21

27

1.30 1.10 2.00 0.87 0.78

Transport de fonds

20%

20%

Occitane Toulouse Pyr. Massif Central Atlantique

0% Nord Sud Ouest Bourgogne Fr. Comt Centre Atlant. Alsace Rives de Paris(1)

0% Cote Azur Loire et Lyonnais Lorraine Champagne Provence Corse

Val de France

Ouest

Alpes

Bred

BRED

Val de France

Sud

GLOBAL

27

(1) Donnes confirmer Source Questionnaire BP Banque Fdrale et Collecte dinformations fournisseurs - 2006

Securitas/Loomis et Brinks reprsentent 60% du march des BP, march comportant 16 acteurs

France Scurit CORSTRANS TAS - NIT ITEMS - CD

GARANCE

Est Valeur

Solymatic

Panel Fournisseur 2006

BRED Val de France Bourgogne Franche Comt Lorraine Champagne Sud Alpes Rives de Paris Ouest Loire et Lyonnais Provence Corse Atlantique Cote Azur Sud Ouest Alsace Centre Atlantique Occitane Toulouse Pyrnes Nord Massif Central Crdit Maritime - Finistre Crdit Maritime - Caisse du Nord Crdit Maritime - Med Crdit Maritime - Vende Total CA Fournisseur total (2006, M) CA moyen par BP (2006, M / banque (1))

Securitas

Prosegur

SAZIAS

VALTIS

Brink's

ESSE

Total

Asdf

CPR

G4S

GSI

Dpenses 2006

x x x x x x x x x x

x x x x x x x x x x x x x x

x x

x x x x x x x x x x x x x x x x x x x x x x

x x x x x

IDRAC - Procurement Training - 2012 - J-C TRAN

x x x x x x

x x

x x x 17 15 6

4 4 3 3 2 5 5 1 6 6 3 3 1 2 2 3 3 3 2 1 2 1 1

5 1,7 0,4

5 1,0 0,2

3 6,6 2,2

3 2,4 0,8

2 0,1 0,1

2 1,8 0,9

2 1,6 0,8

1 -

1 0,3 0,3

1 0,4 0,4

1 0,3 0,3

1 1,5 1,5

1 2,2 2,2

16,5 15,0 1,3 1,0 1,2 0,2

28

(1) Hors Crdit Maritime Source Analyse Mercuris

14

IDRAC - 2012

27/01/2012

Rpartition des CA fournisseurs par type de prestation (2006 HT)

2.19 M 2.37 M 1.76 M 1.67 M 1.54 M

0.08 0.26

16.32 M 100%

0.98

15.02 M

6.55 M

0.28

0.13 0.13 0.07

2.29

0.51

80%

6.41 2.62 0.55 0.89 0.76 0.33

1.30 M 0.98 M

1.63 M

0.44

5.98

1.13

Dpenses Transport de Fonds, Gestion de Fonds et Gestion des automates par prestataire 2006 - M HT

Gestion des automates bancaires (6M - 11%)

60%

1.30

IDRAC - Procurement Training - 2012 - J-C TRAN

Comptage (20M - 38%)

40%

1.73 1.08 8.93 6.75 3.65 0.91 1.17 0.93 0.55 Transport de fonds (27M - 51%)

20%

0.50

0% Est Valeur VALTIS SAZIAS G4S GSI Solymatic Prosegur(1) CPR(1) Securitas Brink's TAS - NIT ITEMS - CD

(1) Ces fournisseurs nont pas de CA gestion des automates avec le groupe des Banques Populaires, mais ils proposent nanmoins cette prestation Source Questionnaire BP Banque Fdrale et Collecte dinformations fournisseurs - 2006

29

Rpartition des dpenses par prestataire : transport de fonds uniquement

Dpenses Transport de Fonds par fournisseur (1) 2006 - K HT

10 000 9 000 8 000 7 000 6 000 5 000 4 000 3 000 2 000 1 728 1 173 1 087 937 914 545 Prosegur 500 CPR 273 France Scurit 214 ESSE 135 CORSTRANS 80 GARANCE 3 657 6 757 8 934 100% 90% 80% 70% 60% 50% 40% 30% 20% 10% 0% TAS - NIT ITEMS - CD Brink's Est Valeur SAZIAS VALTIS G4S Securitas(2) GSI

IDRAC - Procurement Training - 2012 - J-C TRAN

1 000 0

CA moyen par Banque Populaire (3) (2006- en K)

593

559

1219

576

1176

270

914

460

136

500

273

214

135

80

(1) Hors Caisses maritimes Nord, Finistre, Littoral de la manche, Littoral du sud ouest et Morbihan - Loire Atlantique pour lesquelles le dtail des dpenses par prestation nest pas connus (2) Le dtail des dpenses de Securitas ntant pas connu, la part des dpenses correspondant au transport de fonds a t estime partir du % observ pour les autres prestataires de la BRED BP (3) Hors Crdit Maritime Source Questionnaire BP Banque Fdrale et Collecte dinformations fournisseurs - 2006

30

15

IDRAC - 2012

27/01/2012

Definition of the need

Specification

Formalise the Need

IDRAC - Procurement Training - 2012 - J-C TRAN

Set up a frame for the answer which will facilitate evaluation by the buyer

Establish the reference for the future business relationship between both partners

Need

Responsible : Requester Support: Buyer

Enquiry

Responsible: Buyer Support: Buyer

Contract

Responsible: Buyer Validation :Legal counsel

31

Definition of the need

Technical specification

It is a document in which all properties are described which enable to define the product from a technical point of view. The key elements are, for example : For a cleaning service : cleaning frequency, materials and equipments, staff qualification, .... This technical specification is used to :

(it is made of)

IDRAC - Procurement Training - 2012 - J-C TRAN

Subcontract, i.e. let a supplier carry out tasks which are defined in a technical document Buy catalogue goods or services

32

16

IDRAC - 2012

27/01/2012

Definition of the need

Functional specification

(it is intended for)

It is a document in which the requester describes his need as a set of service functions and constraints. Assessment criteria and levels are defined for each function or constraint. Each level has a flexibility margin. EXAMPLE :

IDRAC - Procurement Training - 2012 - J-C TRAN

Functional specification for the internal lighting of a building : an number of lux , and a quality of colour of the light. (service function)

Technical specification : drafted by a design office : number of lamps, power in watt, fluorescent light A41 (technical function)

A technical function is a set of features of an existing product chosen by a designer to fulfil service functions.

33

Definition of the need

Functional analysis :

Without NEED Preliminary functional analysis : USEFUL FUNCTIONS UNUSEFUL FUNCTIONS

PRODUCT

IDRAC - Procurement Training - 2012 - J-C TRAN

With NEED

Preliminary functional analysis : USEFUL FUNCTIONS PRODUCT

34

17

IDRAC - 2012

27/01/2012

Definition of the need

Functional analysis in six steps :

1. Define the context (broadly speaking) around the good or service 2. Define the functions to be fulfilled by the good or service (verb + complement) 3. Split functions in a) service functions and b) constraints

IDRAC - Procurement Training - 2012 - J-C TRAN

4. Describe assessment criteria for each function 5. Define performance level for each criterion (measurement scale) 6. Define flexibility for each criterion ; this enables to decide whether the criterion is satisfied or not

35

Definition of the need

To buy means to compare To compare, one needs choice The flexible functional specification permits the buyer to formulate his demands in a way which directs suppliers towards several solutions or variants

IDRAC - Procurement Training - 2012 - J-C TRAN

FUNCTIONAL

FLEXIBLE

Clarifies roles between requester and designer

Favours innovation

Increases competition

Promotes discussion in order to optimise performance / cost

36

18

IDRAC - 2012

27/01/2012

Definition of the need

Example: Premises cleaning Floor

F1 F3

IDRAC - Procurement Training - 2012 - J-C TRAN

F4

Cleaning products

Cleaning

F4 F2

Buyer Requester

Windows

Cleaning Company

37

Definition of the need

Service Functions / Constraints

Functions Service Function F1 Clean floor

Criteria Poll Visual

Level >95% satisfied To be defined >95% de satisfaction To be defined 5 x / quarter 2 x / year

Flexibility +/- 2%

Service Function

IDRAC - Procurement Training - 2012 - J-C TRAN

F2 Clean Windows F4 Follow-up between supplier and buyer F3 Safety (non toxic)

Poll Visual

+/- 2%

Service Function

Constraint

Inspection by foreman Follow-up supplier / buyer Regulations

+/- 1 No

Official certification

No

38

19

IDRAC - 2012

27/01/2012

--- Contents

Purchasing & Procurement Function - Stakes

Negotiation

Segmentation, Spend analysis, Needs analysis

Legal: Incoterms

Buying on the Internet e-procurement

IDRAC - Procurement Training - 2012 - J-C TRAN

Price and enquiry Inventory Management Constraints Risks Strategies

Market Knowledge

39

What is the market structure ?

Two basic questions will illustrate the level of concentration in a market :

1- Are there many suppliers who buyers can purchase from ?

Suppliers

A lot Perfect competition Some Oligopoly

(risk of cartels)

Very few

A lot

Monopoly

Customers

What is the average market share of the suppliers ? 2- Are there many Buyers who can purchase from the supply market ? What is the average market size of the buyers ?

Some

IDRAC - Procurement Training - 2012 - J-C TRAN

Buyers market

Narrow market

Sellers market

Very few

Purchasing Monopoly

Buyers market

Bilateral Monopoly

Risk of false monopoly : Determine the difference between real monopoly / oligopoly and technological monopoly based on your needs specification

40

20

IDRAC - 2012

27/01/2012

Market knowledge

The types of markets :

Viscous Market

Only one homologated supplier

IDRAC - Procurement Training - 2012 - J-C TRAN

Supply

Demand

41

Supplier side

Supplier Market research :

Is the market concentrated split in many small units ? Number, size, age of competitors Overcapacity or scarcity ? Life expectancy of companies ? Market share of the leaders ?

IDRAC - Procurement Training - 2012 - J-C TRAN

Life stage of products ? Power of the supplier market ? Relative size of our supplier ? Motivation of current suppliers for this product ? ...

42

21

IDRAC - 2012

27/01/2012

Buyers side

Market research :

Is the market concentrated split in many small unit ? Number, size, age of customer companies ? Market share of the leaders ? Are there new competitors ? What is our power on the total buyer market ?

IDRAC - Procurement Training - 2012 - J-C TRAN

How important are we financially to our suppliers ?

43

According to Porter, all markets evolve due to 5 forces

New Entrants

IDRAC - Procurement Training - 2012- J-C TRAN

Upstream Market

Supply Market

Demand

Government action as disturbing flow

Substitutes

44

22

IDRAC - 2012

27/01/2012

Porter Force n1 : Demand

New Entrants

Bargaining power of Buyers

Upstream Market

The Bargaining Power of Suppliers

Internal rivalry among players

Supply Market

The Bargaining Power of Buyers

Demand

A Buyer Group is powerful if : Purchase volumes are large or concentrated Purchased products are standard The switching costs are low Capital investment is low to enter the market The buyer has full information about the supply market levers

IDRAC - Procurement Training - 2012 - J-C TRAN

Government action as disturbing flow

Substitutes

45

Porter Force n2 : Upstream market

Bargaining Power of Upstream Suppliers

New Entrants

A Supplier Group is powerful if : A few companies dominate Suppliers are more concentrated than buyers

IDRAC - Procurement Training - 2012 - J-C TRAN

Upstream Market

The Bargaining Power of Suppliers

Internal rivalry among players

Supply Market

The Bargaining Power of Buyers

Demand

No viable substitutes exist The supplier market industry is not an important customer of the supplier group Switching costs have been developed through product differentiation Forward integration is feasible

Government action as disturbing flow

Substitutes

46

23

IDRAC - 2012

27/01/2012

Porter Force n3 : New Entrants

New entrants

New entrants are players not present in this market today. They are a disturbing influence as they do not abide to the existing rules of the main market. Their strategies can be completely different :

Government action as disturbing flow

New Entrants

Upstream Market

The Bargaining Power of Suppliers

Internal rivalry among players

Supply Market

The Bargaining Power of Buyers

Demand

IDRAC - Procurement Training - 2012 - J-C TRAN

Quick market share via a pricing strategy below the market Takeover of existing players Target existing buyers to work with via strategic partnerships

Substitutes

They could choose between 2 types of strategies

Cost domination : low cost producers, cheap products Product differentiation : increased service level or quality level

47

Porter Force n4 : Substitutes

Substitutes

New Entrants

For example via innovation : this could mean that there are new materials which can satisfy the existing needs at a commercial advantage

Upstream Market

The Bargaining Power of Suppliers Internal rivalry among players

Supply Market

The Bargaining Power of Buyers

Demand

IDRAC - Procurement Training - 2012 - J-C TRAN

Substitute solutions disturb the current market offering new competitive advantage :

Lower costs Improved quality or reliability Improved service levels and easier service Removing the risks of shortages of supply by offering new sources to satisfy the same needs

Government action as disturbing flow

Substitutes

48

24

IDRAC - 2012

27/01/2012

Porter Force n5 : Main supplier market (1/2)

Internal Rivalry among players

New Entrants

The level of competition on the market is a combination of :

Upstream Market

The Bargaining Power of Suppliers Internal rivalry among players

Supply Market

The Bargaining Power of Buyers

Demand

IDRAC - Procurement Training - 2012 - J-C TRAN

The internal rivalry amongst players on the main market The market trends : growing, reducing The actions of the 4 other forces The existence of Barriers to exit & Barriers to entry*

Government action as disturbing flow

Substitutes

The level of competition on the market could be affected by Government action as a disturbing flow

Regulation : production quotas, WTO agreements Custom duties State Tax policies State Labor laws

49

Example of Porter Diagram for Folding box market

The main market is protected from new entrants by different entry barriers

The need for capital investment Cost of know-how acquisition Limited access to upstream market at profitable conditions Controlled access to distribution channels by major players Power of local or historical brands

Upstream Market

The Bargaining Power of Suppliers

New Entrants

Internal rivalry among players

Supply Market

The Bargaining Power of Buyers

Demand

IDRAC - Procurement Training - 2012 - J-C TRAN

Barriers to exit stop existing players from leaving the market

Not fully amortized production equipment The Business is covering a substantial part of the companies fixed costs Expected future profits Expecting better conditions to sale the business at an improved profit level

Government action as disturbing flow

Substitutes

50

25

IDRAC - 2012

27/01/2012

Collect & organize information based on facts and figures

Number of players within a specified geographical scope Market share as a % Turnover Average size of production unit(s) Global capacity and average utilization rate Concentration rates Average profitability Group dependency Backward integration ? Barriers to exit

Who are the Low Cost Producers ? Where ? Where are the new entrants with product differentiation ? What is current and forecasted market share of new entrants ? What are the entry barriers ?

New Entrants + Entry barriers

What are the different upstream markets ? For each main upstream market :

Number of buyers

IDRAC - Procurement Training - 2012 - J-C TRAN

Concentration rate Average profitability Barriers to entry or exit Average capacity and utilization rate New entrants ? Substitutes ? Government action ? Forward integration ?

Upstream Market

Supply Market + Exit barriers

Demand

direct competitors from same industry indirect competitors from different businesses

Relative Market share, Purchasing Turnover Demand profile : simple, complex, season effect Profitability, Price policies, Purchasing strategies

Substitutes

Government action

Evolution of technology Market share of substitutes on the supply market,or on other advanced markets Reliability of substitutes

Evolution of regulations Trends on custom duties or imports & exports limitation Impact of regulations price & cost

51

Purchasing Power

Purchasing power : 2 perspectives Turnover Bought by Buyer Turnover of supplier

Purchasing power =

1,5% < Best stay between < 20%

IDRAC - Procurement Training - 2012 - J-C TRAN

And :

Turnover Bought by Buyer Purchasing power = Turnover of entire market

52

26

IDRAC - 2012

27/01/2012

--- Contents

Purchasing & Procurement Function - Process

Negotiation

Segmentation, Spend analysis, Needs analysis

Legal: Incoterms

Buying on the Internet e-procurement

IDRAC - Procurement Training - 2012 - J-C TRAN

Price and enquiry Inventory Management Constraints Risks Strategies

Market Knowledge

53

Reverse Marketing

The 5 steps of Reverse Marketing :

1) Segmentation of purchases 2) Market Research :

Gather informations Process informations on the markets Analysis of both pans of the balance : supply and demand

3) Visualize the purchasing portfolio : constraints, risks, spent

IDRAC - Procurement Training - 2012 - J-C TRAN

4) Diagnostic of the situation 5) Purchasing strategy

54

27

IDRAC - 2012

27/01/2012

Purchase Constraints

Visualisation of portfolio with the Constraints Matrix.

A constraint is any element which limits the freedom of action of the buying side Constraints can be :

Internal ( Customer market, Company, Requester) or External ( Supplier market) Commercial or Technical Legal (Regulations)

IDRAC - Procurement Training - 2011 - J-C TRAN

55

Constraints Internal Commercial

Visualisation of portfolio with the Constraints Matrix :

Internal Commercial:

Imposed supplier Lack of forecasts Small purchasing power Imposed purchase price No globalisation of purchases Bad knowledge of supplier market

IDRAC - Procurement Training - 2012 - J-C TRAN

Lack of preparation ...

Internal Technical :

Tight specification, over engineering Quality assurance No value analysis The company cannot follow the technical speed of change on the market Certification is difficult

56

28

IDRAC - 2012

27/01/2012

Constraints : External Commercial

Visualisation of portfolio with the Constraints Matrix :

External Commercial :

IDRAC - Procurement Training - 2012 - J-C TRAN

Monopoly or oligopoly Collusions on the market Narrow supplier market Rigid distribution system

External Technical :

Rapidly changing technology Technical monopoly Many possible technical solutions Short product life

57

Constraints Matrix

Matrix of purchasing constraints :

Internal constraints

r

IDRAC - Procurement Training - 2012 - J-C TRAN

Internal Purchase

Complex Purchase

Every product is represented by a disk whose diameter is proportional to the purchased volume

Simple Purchase

External Purchase External constraints

58

29

IDRAC - 2012

27/01/2012

Strategy directions

IC

IC

EC

EC

Actions

IDRAC - Procurement Training - 2012- J-C TRAN

People

IC

IC

EC

EC

Duration of the relation with the suppliers

Negotiation types

59

Potential risks

Technical risks

Capacity of the chosen solution to answer the need No history of the chosen solution Quality level of the chosen solution

Logistical risks

Geographical distance Environment during transportation Communication means

Financial risks

Currency Financial covers Delivery guaranties

IDRAC - Procurement Training - 2012 - J-C TRAN

Supplier risks

Internal organisation Financial health Technical and/or R&D ability Supplier interest

Legal risks

Previous court cases Mastering of the legal environment Pressure means

Country risks

Social environment Political environment Economic environment International relationships

60

30

IDRAC - 2012

27/01/2012

Risk / Savings Matrix

The Risk/Savings Matrix: choosing priorities

Risk

High

PURCHASING

A

IDRAC - Procurement Training - 2012 - J-C TRAN

Average

B

Low

P R I O R I TY

A

Savings

61

C C B

The Risks & Turnover Category Matrix

LINKS TO INTERNAL CONSTRAINTS (Technical and commercial) Specification is too tight which limits your potential supply market. A customer dictates which supplier we must buy from We are unable to globalize our purchase turnover, leading to higher price conditions We are unable to quickly change from one supplier to a new one : homologation, toolings ownership

High

BOTTLENECK

CRITICAL

IDRAC - Procurement Training - 2012 - J-C TRAN

2 types of Risks

RISKS

LINKS TO EXTERNAL CONSTRAINTS (technical and commercial) Our bargaining power with the supplier is low The market is evolving in a not favorable way for us We are dependant on a supplier : our purchasing amount is too high compared to our suppliers turnover

Low

TACTICAL

Low

LEVERAGE Savings or Turnover

High

62

31

IDRAC - 2012

27/01/2012

The Risks & Turnover Matrix : example in Food Industry (Biscuits)

5M

BOTTLENECK CRITICAL

CHOCOLATES

CEREALS EGGS FATS FRUITS & NUTS CORRUGATED FLAVOURS COMPACT BOARD FLEXIBLES FLEXIBLES

IDRAC - Procurement Training - 2012 - J-C TRAN

0.5M

TRAYS

MILK INGREDIENT

SUGARS

TACTICAL

LEVERAGE

OTHERS RAWS

OTHER PACKS

20 M

100 M

63

Purchased SPEND/categories

Strategic objectives objectives - 5 key axes

The global objectives are defined in relation to 5 key axes

Secure supply and business

IDRAC - Procurement Training - 2012 - J-C TRAN

Innovate

Save costs

Improve Quality and service level

Promote sustainable development

64

32

IDRAC - 2012

27/01/2012

There are 6 main families of internal & external purchasing levers

Volume Globalization

Concentrate : downsize and optimize the supply base Link : Aggregate volumes of all units Leverage : Re-allocate market shares between selected suppliers to get optimum power differential Bundle : aggregate volumes from different categories

Cost Optimization

Cost model : In depth and detailed price and cost analysis TCO : all incurred costs analysis and optimization e-supply :e-procurement, e-supply. Make or buy : trade-off analysis between make, team and buy models Rent or Buy : rent or invest analysis. Facilities management with SLA. Coverage : Prices fluctuation and currency rate risk coverage.

New sources of supply

Global : Expand the geographical scope of sourcing LCC : Target Low Cost Countries Re-sourcing : Develop alternatives sources

IDRAC - Procurement Training - 2012 - J-C TRAN

Needs Optimization

Redesign to cost : functional and value analysis and product or service re-engineering Off the Shelf : Standardization of the specification Substitute : Develop alternative solution like product reformulation, ingredient or material substitution, SLA : develop SL requirements, including logistics agreement

Joint processes

Anticipate : optimize forecast models, improve reliability and frequency of forecast orders. SMI : supplier managed inventory No stock : consignment stock, Value chain re-engineering : redesign of the whole value chain. From upstream market to the final customer in order to optimize service level and maximize profit

Supplier Development

Identify and Develop suppliers : preferred, key or partner suppliers Co-business : alliances, partnership, risks, investment and benefits and shared wall to wall : supplier integration

65

Some levers are more appropriate than others

it depends on your category positioning on Risks / Savings matrix

Category positioning Strategic levers families Globalization

BOTTLENECK CRITICAL TACTIC LEVERAGE

Level of impact

++

Cost optimization

IDRAC - Procurement Training - 2012 - J-C TRAN

New sources of supply

Needs optimization

-Joint processes

SR Development

66

33

IDRAC - 2012

27/01/2012

1- Which supply base recommendation ?

What % of your expenditure to allocate to whom ?

To allocate market share, we need to take decisions regards to :

IDRAC - Procurement Training - 2012 - J-C TRAN

The ranking of suppliers after the pre-selection process The level of competition we want to keep in the supply base The level of risks we are willing to take with our supplier

At the end, each supplier will have a specific role & profile in your portfolio :

Platinum suppliers Gold suppliers Silver suppliers Iron suppliers

Fit to your strategy

Number of suppliers

67

1- Which supply base recommendation ?

What type of relationships ?

Fit between the supplier and your Category Buying Strategy (5 axes)

Meets your strategy 100%

Partner suppliers

Good almost everywhere Challenge on one axis but not on the others Achieve minimum requirements

Key suppliers

IDRAC - Procurement Training - 2012 - J-C TRAN

Preferred suppliers

Commercial suppliers

Relationship level

68

34

IDRAC - 2012

27/01/2012

--- Contents

Purchasing & Procurement Function - Process

Negotiation

Segmentation, Spend analysis, Needs analysis

Legal: Incoterms

Buying on the Internet e-procurement

IDRAC - Procurement Training - 2011 - J-C TRAN

Price and enquiry Inventory Management Constraints Risks Strategies

Market Knowledge

69

1 - Price

Price :

Play an active role :

Know the cost elements Be able to assess the price before negotiation : calculate target price Use productivity and learning curve to lower the purchasing price Make a difference between price, total acquisition cost and cost of ownership

IDRAC - Procurement Training - 2012 - J-C TRAN

70

35

IDRAC - 2012

27/01/2012

Price structure example

Price structure Cleaning Service) :

Base 100

Negotiation margin 3 different services Service 1: Desk cleaning

IDRAC - Procurement Training - 2012 - J-C TRAN

92 88 76

of the seller Profit margin Labour 3 Labour 2

Service 2: Floor cleaning Service 3: Windows cleaning The labour content is different according to the different services because techniques and frequencies are different.

65

Labour 1

48 20

Purchases

Overheads

71

Price typical structure

Profit

Revenue of shareholders Labour, specific purchases, patents,

Difficulty to obtain / check / understand

R&D

Overheads Non-quality Amortisation Transport Labour Purchases

Management, financial costs Scrap, rework, warranty claims, Production equipment Transport + duties, customs, Labour direct Energy, Raw material, components Value Industrial Added

IDRAC - Procurement Training - 2012 - J-C TRAN

Must know

72

36

IDRAC - 2012

27/01/2012

Basic cost calculation

Purchased Material + Industrial Added Value = EXW cost PM + AV = EXW Cost

IDRAC - Procurement Training - 2012- J-C TRAN

To be described in purchasing currency

73

Example : Price structure 35 dm3 pallet 7,02

Wood = main cost driver

Importance of wood acquisition cost Optimise wood volume

Transport = 110 km, lorry 600 pallets

Profit 4% Overheads 3% Comm Cost + Fin 3% Transport 8% Amortisation 8% Wood 66% Assembly 8%

IDRAC - Procurement Training - 2012 - J-C TRAN

74

37

IDRAC - 2012

27/01/2012

Global cost

Global cost versus purchase price

Price

Total cost

IDRAC - Procurement Training - 2012 - J-C TRAN

Complementary costs

-Transport - Packing

Landed cost

Acquisition costs Ownership

Insurance, taxes

Global cost of ownership

Maintenance Usage + elimination Non quality

75

The enquiry

The enquiry:

Before sending the enquiry make a market preselection :

Eliminate all suppliers which do not comply with the purchasing policy / strategy Optimise ones efforts in concentrating on a limited number of suppliers The preselection is made through definition of the criteria to be fulifilled by suppliers

IDRAC - Procurement Training - 2012 - J-C TRAN

76

38

IDRAC - 2012

27/01/2012

The enquiry

Preselection criteria :

Staff size Membership of a group Geographic distance Turnover

IDRAC - Procurement Training - 2012 - J-C TRAN

Customer references Financial viability

Every supplier is assessed accordig to the criteria The enquiry is sent to the best ones

77

The enquiry

After preselection the enquiry documents are sent :

Purchasing specification

Describes the functions to fulfil, The constraints and levels of performance Logistic requirements : delivery schedule, transport, packaging) Decision criteria

IDRAC - Procurement Training - 2012 - J-C TRAN

General Purchasing Conditions

78

39

IDRAC - 2012

27/01/2012

The enquiry

Assessment of offers :

List of criteria (price, delivery, quality...) Weight the criteria : priorities for the choice of a supplier Set up a comparison table with criteria and weights Fill in the table with a note for each criterion

IDRAC - Procurement Training - 2012 - J-C TRAN

Comparison with a global note

79

The enquiry

Comparison table - example

Criteria Price Delivery

IDRAC - Procurement Training - 2012 - J-C TRAN

Weight 20 25 30 15 90

Supplier 1 20 15 30 9 74

Supplier 2 15 25 15 10 65

Supplier 3 10 15 25 15 65

Quality Payment terms Global note

80

40

IDRAC - 2012

27/01/2012

The enquiry

The comparison table permits to :

Identify the clauses to negotiate with each supplier : those for which its offer is less good than its competitors. Visualise each suppliers position To make up the short list of suppliers with which we will negotiate

IDRAC - Procurement Training - 2012 - J-C TRAN

81

Example enquiry analysis presentations

Communication agencies competition for one of our retail banking network Competition for a multiple usage booth for fairs and exhibitions for one of our retail banking network Archive storage and handling services : selection of group preferred suppliers, negotiation of frame agreements.

IDRAC - Procurement Training - 2012 - J-C TRAN

82

41

IDRAC - 2012

27/01/2012

--- Contents

Purchasing & Procurement Function - Process

Negotiation

Segmentation, Spend analysis, Needs analysis

IDRAC - Procurement Training - 2012 - J-C TRAN

Price and enquiry

Constraints Risks Strategies

Market Knowledge

83

Negotiation

Bargaining vs. Negotiation Sellers tricks Negotiate as a team with designers or users Application: Internal negotiation and communication Quality of Argument

84

Buyer / Seller postions Tools : List of clauses Chessboard

IDRAC - Procurement Training - 2012 - J-C TRAN

Value of Argument

42

IDRAC - 2012

27/01/2012

Negotiation or Bargaining ?

NEGOTIATION BARGAINING Relationship between parties Midterm or long term Short term Negotiation = Game Positive sum game Zero sum game

Winner

IDRAC - Procurement Training - 2012 - J-C TRAN

Winner

Winner

Loser

Partnership

Stratagems - tricks

Negotiation vs; bargaining : Same or greater - gain and The relationship is protected Negotiation demands Methodology Psychology

Know how (50%) Success Behaviour (50%)

85

Negotiation Options

Negotiation Position Strong Bargaining Efficient

IDRAC - Procurement Training - 2012 - J-C TRAN

Negotiation Offensive

Weak

Bargaining Shared

Negotiation Prepared

Short

Long

Duration of relation

86

43

IDRAC - 2012

27/01/2012

Buyer / Seller positions

Floor Seller movement zone Only the boss of the Seller can lower the floor

SELLER

Offer Convince

IDRAC - Procurement Training - 2012 - J-C TRAN

Clause Agreement zone Buyer movement zone Ceiling Only the boss of the buyer can lift the ceiling

87

BUYER

Negotiation process : KC3

The key rules: KC3

Know The supplier, its market The sales person Set up negotiation file

Contact

IDRAC - Procurement Training - 2012 - J-C TRAN

Start the negotiation

Convince

Produce arguments and obtain agreement

Conclude

Conclusion of a negotiation Write report / agreement

88

44

IDRAC - 2012

27/01/2012

Negotiation: Know

Know : preparation is 80% of the negotiation effort

The supplier company, the supplier markets... The needs to fulfil, functions, specifications, quantities, schedules The history of the product, of the relationship The personality of the sales(wo)man : style, objectives...) The target : the stakes and objectives of the negotiation

The file:

The negotiation preparation

IDRAC - Procurement Training - 2012 - J-C TRAN

List all clauses to negotiate Identify needs for help from others, and make use of it Set objectives to reach for each criterion of the comparison table Decide the venue : In-house to feel at home : boosts the confidence of the buyer - but never negotiate in your office ! At the suppliers premises : show my determination Build the negotiation strategy and the negotiation chart ( = arguments, parades) and the chessboard strategy

89

Negotiation :

6 levers

Weight Choice Information Influence Sanction Time

IDRAC - Procurement Training - 2012 - J-C TRAN

Clauses

Price After sales service Quality Logistics Packaging Commissioning Payment terms Order to delivery Currency Spare parts

90

45

IDRAC - 2012

27/01/2012

Negotiation Arguments

Possible arguments :

General :

Financial health of my company Image of my company Viability of my company ...

Specific :

Scheduling of needs Learning curve Interest of learning from the needs of a demanding customer

IDRAC - Procurement Training - 2012 - J-C TRAN

Constraints :

Poor performance of the supplier Price structure description lacks accuracy Competition between suppliers...

91

Negotiation Chart

The negotiation chart :

Clause

The clause to negotiate

Offer Objective

Offer from the seller The objective the buyer w ants to reach

Argument

Objection

Reply

IDRAC - Procurement Training - 2012 - J-C TRAN

The arguments The The to reach the objections parades to objective w hich can the A good be expected sellers argument must from the objections be of seller advantage for the supplier or for the customer

92

46

IDRAC - 2012

27/01/2012

Negotiation: Chessboard strategy

The chessboard strategy

1: I wont give in

IDRAC - Procurement Training - 2012 - J-C TRAN

S 1 2 3

1 d c e

2: to be discussed 3: Ill give in

b a

93

Negotiation: Contact

Contact:

Welcome the supplier

Establish a climate of trust Dont make the seller wait

Civilities Presentation

Let the supplier present his company Present ones company

IDRAC - Procurement Training - 2012 - J-C TRAN

Mention strengths of the seller and of his company

It makes the seller feel comfortable and prevents him to use those points later as arguments

94

47

IDRAC - 2012

27/01/2012

Negotiation: Convince

Convince:

Explain Listen Reformulate Propose Argue State / remind your needs to the supplier Negotiate more simple clauses first Conclude agreement point in reformulating Then negotiate more complex criteria : use arguments and parades of the negotiation chart In case of blockade on an important clause switch to a lower stake clause Conclude final agreement in reformulating it

IDRAC - Procurement Training - 2012 - J-C TRAN

95

Negotiation in Team

A leader is nominated Define roles and power Complete solidarity is mandatory Prepare together Allocate sequences to team members

IDRAC - Procurement Training - 2012 - J-C TRAN

96

48

IDRAC - 2012

27/01/2012

Negotiation : 5 golden rules of the seller

Aim high to reach a good final result If one asks a concession from you, reply first with an argument Give a concession only against an other one If you have to go backwards make small steps Orient your customer towards conclusion

IDRAC - Procurement Training - 2012 - J-C TRAN

97

Negotiation : play with arguments

Give strength to your arguments:

Use examples Demonstrate : show, let touch, make hear, . Make your arguments visible, make drawings, Amplify feelings : enthusiasm, disappointment, Dramatise

IDRAC - Procurement Training - 2012 - J-C TRAN

98

49

IDRAC - 2012

27/01/2012

Negotiation: Conclude

Conclude:

Make an inventory of all agreements which were reached and reformulate them Propose to write a negotiation report, write and send it quickly:

To the supplier To internal correspondents design, production, logistics, with appropriate comments

IDRAC - Procurement Training - 2012 - J-C TRAN

And taking care of secrecy

99

50

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Globalization and IndiaDokumen21 halamanGlobalization and Indiaashutoshvats16Belum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Applied PhysicsDokumen2 halamanApplied Physicsashutoshvats16Belum ada peringkat

- Gold Card AddoncardDokumen1 halamanGold Card Addoncardashutoshvats16Belum ada peringkat

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Applied PhysicsDokumen2 halamanApplied Physicsashutoshvats16Belum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Comparative Study Between Audit On Profit Organizations and Audit On Non Profit OrganizationsDokumen63 halamanComparative Study Between Audit On Profit Organizations and Audit On Non Profit OrganizationsTrupti GonbareBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Meaning and DefinitionDokumen5 halamanMeaning and DefinitionAdi PoeteraBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Jorge Paulo Lemann - What I Learned at HarvardDokumen4 halamanJorge Paulo Lemann - What I Learned at HarvardSantangel's Review100% (2)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- BondsDokumen12 halamanBondsSai Hari Haran100% (1)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Black Book of ScamsDokumen46 halamanThe Little Black Book of ScamsJames Vuong100% (1)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- CQF Brochure June 24Dokumen22 halamanCQF Brochure June 24AASIM AlamBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Theises Urabn Entertainment CenterDokumen84 halamanTheises Urabn Entertainment CenterShah Prachi100% (4)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Venture Capital FinalDokumen26 halamanVenture Capital Finalaarzoo dadwalBelum ada peringkat

- Questions Problems Pre BQTAP 2018 2019Dokumen12 halamanQuestions Problems Pre BQTAP 2018 2019GuinevereBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Capital MArket MCQDokumen11 halamanCapital MArket MCQSoumit DasBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rapport Textile Ethiopië PDFDokumen38 halamanRapport Textile Ethiopië PDFgarmentdirectorate100% (1)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- PGPEM Brochure 2017 v12Dokumen18 halamanPGPEM Brochure 2017 v12srikar_scribdBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- DEPRECIATIONDokumen10 halamanDEPRECIATIONJohn Francis IdananBelum ada peringkat

- Specimen of Internship ReportDokumen25 halamanSpecimen of Internship Reportmadhukumar k. aBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Nifty 50 Reports For The WeekDokumen52 halamanNifty 50 Reports For The WeekDasher_No_1Belum ada peringkat

- Accounting For Present ValueDokumen2 halamanAccounting For Present ValueAn NguyenBelum ada peringkat

- PBI Producto Bruto Interno GDP Gross Domestic Product Indicador Industria, Valor Agregado (% Del PBI)Dokumen4 halamanPBI Producto Bruto Interno GDP Gross Domestic Product Indicador Industria, Valor Agregado (% Del PBI)Juan José CucchiBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Systematic Investment Plan (Sip) : Mutual Funds Post Office BankDokumen34 halamanSystematic Investment Plan (Sip) : Mutual Funds Post Office BankKonarPriyaBelum ada peringkat

- Solucionario - PC1 2019-02 EF71Dokumen37 halamanSolucionario - PC1 2019-02 EF71Adrian Pedraza AquijeBelum ada peringkat

- Chapter 4 QuestionsDokumen6 halamanChapter 4 QuestionsMariam HeikalBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Project Report OnDokumen50 halamanProject Report OnAnup MishraBelum ada peringkat

- Definition and Characteristics of PartnershipDokumen2 halamanDefinition and Characteristics of PartnershipShan SicatBelum ada peringkat

- Quiz 1 With Sol KeyDokumen5 halamanQuiz 1 With Sol KeySachin Gupta100% (1)

- BSMDokumen344 halamanBSMBagas Hanadi Yudo100% (1)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (120)

- Role of The Investment Bankers in The Financial SystemDokumen60 halamanRole of The Investment Bankers in The Financial Systemmanoj_mmm100% (1)

- Level 2 Webinar CMT TutorialDokumen103 halamanLevel 2 Webinar CMT Tutorialmr_agarwal100% (5)

- Nabil Standard Final ProjectDokumen29 halamanNabil Standard Final ProjectKafle BpnBelum ada peringkat

- Revocable Living TrustDokumen1 halamanRevocable Living TrustTricia100% (1)

- Investment Decision Making Pattern of Investors...Dokumen123 halamanInvestment Decision Making Pattern of Investors...Rijabul Talukdar63% (8)

- Part I Operations Management PDFDokumen250 halamanPart I Operations Management PDFShikha ShuklaBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)