Risk Management Manual

Diunggah oleh

Ahmed MahranDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Risk Management Manual

Diunggah oleh

Ahmed MahranHak Cipta:

Format Tersedia

RASHPETCO and BURULLUS Governance System

Document Title: Document Number:

Risk Management Manual RPC-COR-MS-RMP-201

THIS IS A CONTROLLED DOCUMENT NO. THIS IS AN UNCONTROLLED DOCUMENT X

Controlled documents will automatically be re-issued to recipients as and when changes occur. It is the recipients responsibility to replace and destroy the old version. Uncontrolled documents will not automatically be re-issued and users should ensure that they have the latest version. If in doubt, consult Governance department.

Accommodate validation checks; update meetings terms of reference; clarity of link to the Partners process; realignment of the responsibility matrix; link to Objectives, Performance Contracts & Business Improvement Plan; and some format changes. A Risk Register template has also been produced and referenced in this manual.

Approved Approved Checked

Chairman & MD

T El-Attar

MD & GM Internal Audit GM Governance Manager Chairman & M.D. M. D. & G. M. HSE GM HSE D/GM Governance Designation

F Ahrabi M Helmy

Prepared

B Williams T El-Attar R. Fox Alaa El Din Shinaishai Alan Spicer Chris. Thomas Name Signature Date

Approved Approved 1 Format and number changes only Checked Checked Prepared Revision Description Description

RASHPETCO and BURULLUS Governance System

Page 2 of 2 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

CONTENTS PART 1 1.1 1.2 1.3 1.4 Purpose Scope Definition of Risk Benefits of Risk Management PART 2 BUSINESS PROCESS MAPS 2.1 2.2 Risk Management Business Process New Register Preparation Business Process PART 3 RISK MANAGEMENT STRUCTURE 3.1 3.2 3.3 Process Hierarchy Risk Registers Risk Meetings PART 4 BUSINESS PROCESS NOTES NEW REGISTERS 4.1 4.2 4.3 4.4 4.5 4.6 4.7 4.8 Format and Content Ownership of Registers Preparation of new Registers Risk Ratings Elevation of risks Dealing with risks Managing risks Risk Meetings Terms of Reference PART 5 5.1 Responsibility Matrix PART 6 6.1 6.2 Method of Risk Rating Risk Register Template APPENDICES RESPONSIBILITY MATRIX INTRODUCTION

RASHPETCO and BURULLUS Governance System

Page 3 of 3 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

1 1.1

INTRODUCTION Purpose This document defines the Risk Management process. It covers the ongoing process of Business Risk identification, understanding, measurement and decision making to control and mitigate the identified risks, recognising that a risk may present e ither an opportunity or threat to the achievement of the COMPANY objectives. Risk management is an iterative process and should be used at all levels within the Company and at all stages within the business cycle. All employees have responsibility for managing the risks relevant to their role.

1.2

Scope This guideline outlines a methodology for the management of risk of all COMPANY activities, including all the phases of project lifecycles. Note: It is also the COMPANY intention to include the main contractors working on COMPANY Projects in the Risk Management process. The frequency, process and format for gathering the Risk information shall be agreed during the tender processes or kick-off meeting.

1.3

Definition of Risk Within this guideline risk is defined as either:

the threat that an event or action will adversely affect the COMPANY, and prevent it from achieving its objectives, or a missed opportunity for improvement.

The consequences can affect one or more of the following:

cost (CAPEX and OPEX) schedule quality, including plant capacity, flexibility, availability health, safety, security and environment company image and reputation licence to operate financial management third party relations.

RASHPETCO and BURULLUS Governance System

Page 4 of 4 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

1.4

Benefits of Risk Management The main benefits of a formalised risk management process are that it:

creates an understanding of the relationship between risks: cost, timescales, image, quality and safety and environment, and brings realism into the consideration of the trade-offs between them improves decision making at all levels in the company underpins a culture of continuous improvement; encouraging openness and enabling effective, pro-active and timely application of knowledge and expertise ensures ownership of risks, so they are effectively monitored and pro-actively managed focuses, through rating, on the key risk areas makes risks, and actions taken to resolve them, clearly visible to management reduces the likelihood of a risk materialising and the impact if it does reduces spending on resolution of problems, through addressing them earlier improves the quality and accuracy of CAPEX estimates and project schedules optimises exploitation of opportunities encourages the proper handling of risks rather than the management of crises.

RASHPETCO and BURULLUS Governance System

Page 5 of 5 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

2 2.1

BUSINESS PROCESS New Register Preparation Process

New Register Preparation Business Process

Risk Register Required

Objectives. Performance Contracts.

Define Risks

Evaluate and Rate Risks

Business Environment

Determine Mitigating Actions

Business Improvement Plan

Allocate Risk Owners

Department / Project Risk Register

Finalise and Issue Risk Register

Are risks higher rated than threshold 1 & 2 as defined by the MDs in discussion with Partners?

Cascade Risks to Corporate Register

YES

Threshold Ratings 1 and 2 Risk Management Business Process ((see 2.2 below)

NO

Retain and manage within the department or project

End of Process

RASHPETCO and BURULLUS Governance System

Page 6 of 6 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

2.2

Risk Management Business Process

Risk Management Business Process

Initiate Risk Management

New Register Preparation Process (see 2.1 above)

Initiate Mitigating Actions

Identify new and changes in Risks

Review Feedback and Update Register

Validate Risk Register contents through inter departmental reviews and challenges.

Hold Risk Meeting and Re-evaluate Risks Are risks higher rated than threshold 1 i.e. score of 12 and above? Department / Project Risk Register Finalise and Issue Risk Register

YES Cascade Risks to Corporate Register

Threshold Rating 1 Are risks higher rated than threshold i.e. score of 18 and above?

Corporate Risk Register

Hold Corporate Risk Meeting and Re-evaluate Risks

Submit Risks to Managing Partners Risk System

YES

Threshold Rating 2

End of Business Process

RASHPETCO and BURULLUS Governance System

Page 7 of 7 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

3. 3.1

BUSINESS RISK MANAGEMENT STRUCTURE Process Hierarchy The company Business Risk Management system is structured to enable Risks to be rated and prioritised in order to ensure that each risk receives the appropriate management attention. (As shown on the following chart):

HIGH LEVEL RISKS PARTNER LEVEL

Risk Prioritisation

MEDIUM LEVEL RISKS CORPORATE REGISTER CORPORATE RISK MEETING

ALL RISKS PROJECT & DEPARTMENT REGISTERS RISK MANAGEMENT MEETINGS

RASHPETCO RISK MANAGEMENT STRUCTURE 3.2 Risk Registers Risk Registers will be prepared and managed as defined in section 2 . Current registers will be kept within the Governance Documents suite. Risk Owners are responsible for sending a copy of the current register to the Governance Manager. As a minimum requirement, the COMPANY will maintain the following registers. REGISTER Corporate All Projects Operations Exploration Finance HSE IT Contract & Procurement OWNER Managing Directors Project General Managers Operations General Managers Exploration General Managers Finance General Managers HSE General Managers IT General Manager GM Material and GM Contract RISK LEVEL High and Medium All Project Risks All Department Risks All Department Risks All Department Risks All Department Risks All Department Risks All Department Risks

However, all departments are expected to routinely review their Business Risks, capture the risks and mitigating actions, preferably through a Risk Register, demonstrate the management of the risks and report any significant changes to the Managing Directors.

RASHPETCO and BURULLUS Governance System

Page 8 of 8 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

3.3

Risk Meetings Risk Meetings are the essential formal elements in managing risk at all risk levels within the COMPANY. There are three levels of risk meetings, which are as follows:

Partner Risk Meeting This meeting is held every quarter and it is owned and shared by BG Egypt (BGE) on behalf of other partners. Rashpetco risks scoring 18 and above are fed into this process by the submission of the Corporate Partner Level Risk Register to BGE in advance of this meeting. In addition, the BGE Managers responsible for the Projects receive and contribute to the Project/Operation Risk Registers routinely. These processes allow adequate review and challenge opportunities ahead of the quarterly meeting. Rashpetco/Burullus will be represented at this meeting by the Governance Manager, and Risk Owners may be invited by BGE should further clarification be required.

Corporate Risk Meetings This meeting is held every quarter and captures all risks scoring 12 and above from the departmental risk registers. These risks are contained in the Corporate General Risk Register. In addition, corporate specific risks are identified, processed and added to the register in advance of this meeting. This meeting will agree the contents of the register and the elevation of risks scoring 18 and above to the Corporate Partner Level Risk Register. An important role of this meeting is to re-evaluate and finalise the risk ratings and in the process identify the risks to be elevated to the Partners. For example, a risk item with a score of 18 and above from a department may end up with a lower score because Rashpetco management considers that the manageability factor should be lower; whilst manageability may be outside the control of the department, it is considered to be within the companys control.

Department and Project Risk Meetings These meetings will identify and evaluate all risks associated with their business objectives. All risks scoring 12 and above, after inter-department validation process, will be elevated to the Corporate Risk Register.

The terms of reference for the Corporate Risk meeting and the Departmental/Project Risk meetings are contained in Section 4. The terms of reference of the Partner Risk meeting are determined by BGE.

RASHPETCO and BURULLUS Governance System

Page 9 of 9 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

4 4.1

BUSINESS PROCESS NOTES FOR THE PREPARATION OF RISK REGISTERS Format and Content Adopting a standardised format for project risk registers facilitates the review and comparison of risks across projects, and the assembly of an assets risk register from its constituent projects. A suggested format is shown in Appendix 1. If there is a need to depart from this format because it does not fit in with a department/projects established procedures, this should be discussed with the Governance Manager who may use the opportunity to implement an improved format.

4.2

Ownership of Risk Registers Ownership of the overall risk register lies with the General Manager. Maintenance of the register may be delegated to an identified risk co-ordinator within the project/department team, whose role is to ensure that risks are added, updated and closed out on the register in a timely fashion. It is recommended that regular risk reviews are held, at least quarterly, to ensure that the register reflects the true risk status at all times.

4.3

Preparing New Risk Registers To initiate a Risk Register each department or project team should convene a risk identification review at the earliest suitable time. In the case of projects, it is recommended that this be at the point where the development concept has been selected but before the definition/FEED stage. At this point, reservoir knowledge, development concept, execution strategy, cost, schedule and commercial framework have been established in sufficient detail to enable meaningful risk assessments to be made. The information collation process can either be tasked to individuals or generated by brainstorming by the department or project team. The latter approach is likely to generate a more comprehensive risk register more efficiently and is therefore recommended. Regardless of the process, a major objective should be to ensure that:

the objectives and goals of the projects/departments are clearly understood and are reflected the business environment is taking into consideration clear team ownership of the risk register and management procedure.

The risks identified may be grouped under agreed headings or, in the case of project, using the Work Breakdown Structure (WBS) or functional team set-up. Once the risks have been grouped, the risks and the associated control options should be discussed with the objectives of:

agreeing that the risks or opportunities are realistic, meaningful and comprehensive agreeing the risk evaluation rating in accordance with example in the Appendix. The ratings must reflect the business environment and be objective as far as possible. agreeing the control procedure and actions that would mitigate each risk. These should be specific, clearly defined and include a timescale for completion of the mitigating actions, where relevant.

RASHPETCO and BURULLUS Governance System

Page 10 of 10 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

ensuring an alignment of documented mitigated actions with the contents Business Improvement Plan. validating the contents of the proposed risk register before the quarterly publication through interdepartmental consultation, review and challenge. This gives more credibility to, and wider acceptance of the contents of the register ahead of publication.

4.4

Risk Ratings The following method of rating of risks is a mandatory requirement for all Risk Registers. Each risk is evaluated in terms of its Impact (I), Probability (P) and its Manageability (M). See Appendix 7.1 for guidance notes. Each of these risk factors has a rating between 1 and 3. The final rating is calculated as shown below: FINAL RATING = IMPACT X PROBABILITY X MANAGEABILITY Using this method the minimum risk rating is 1 and the maximum is 27.

4.5

Elevation of Risks The main business risks will be elevated into the Corporate Risk Register, and potentially into the Partners Risk Management system. Proposed criteria for deciding which risks need to be elevated will be based on the following rating levels: 1 11 12-17 18+ Projects/Department Rashpetco/Burullus level Partner Level.

4.6

Dealing with Risks Central to risk management is selection of the most appropriate mitigation or control strategies. These may:

Avoid the risk by suggesting alternative courses of action Eliminate the cause(s) of the risk Reduce the likelihood of the risk occurring Reduce the direct consequence of the risk Minimise its impact in business terms Transfer the risk (e.g. Insurance) Instigate investigation to gather further information before a final decision is made Accept the risks as unavoidable.

The appropriate mitigation or control method is very context specific and there is no universally right or wrong approach. The above generic approaches can be used for guidance, but ultimately the decisions will be based on the knowledge, experience and judgment of the management team.

RASHPETCO and BURULLUS Governance System

Page 11 of 11 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

4.7

Managing Risk Risks will normally be identified during individual, dedicated sessions or on request prior to Risk Meetings, but all COMPANY employees and PMT members are responsible for being risk aware at all times. Any risk identified during a review process, or at any other time, that threatens the successful achievement of COMPANY business objectives should be brought to the attention of the relevant Department or Project Manager for inclusion, if appropriate, within the appropriate risk register. Risk is managed using a series of structured meetings, which are described in 3.3 and in the terms of reference in 4.8. All nominated personnel will attend each Risk Management meeting. The purpose of the meeting is to brief the attendees of all the risks (particularly those scoring medium and high ranking), discuss/rank new perceived risks and review/agree mitigating actions and actionees. Prior to the risk meeting, each member of the meeting will be responsible for forwarding a list of revised current ratings or new perceived risks, which will be processed by the nominated Risk Register Co-ordinator who will update the Risk Register prior to each meeting. All new Ratings or Risks will be evaluated during the meeting and the rating modified as appropriate.

4.8

Risk Meetings Terms of Reference The relevant terms of reference are stated below.

RASHPETCO and BURULLUS Governance System

Page 12 of 12 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

Terms of Reference - Corporate Risk Management Meeting Frequency / Time: Chair / Owner Quarterly / 1 hour MDs Agenda Minutes and action from the previous meeting Review of Corporate and Partner Level Risk Registers BIPS Review of Audit Log and outstanding items Chairman & MD General Manager & MD All General and Deputy General Managers All Project Managers Governance Manager Attendees

Action Log Owner

Governance Manager

Objectives To promote a comprehensive Risk Management Process within the COMPANY To maintain Corporate Risk Register To establish and agree a common understanding of specific mitigation actions To align Risk mitigations actions with BIPs To agree the Partner Level Risks. To evaluate the progress of outstanding audit actions.

Inputs Action log from prior meeting Departmental and Corporate Risk Registers Business Improvement Plans Audit Action Logs and Tracking Registers

Outputs Agreed Corporate Risk Registers Agreed Shareholder Risk Register Revised Business Improvement Plans. Revised Audit Action logs and Tracking Registers

Comments:

This meeting will be scheduled to align with Partners Risk Management meeting and Business Control meeting.

RASHPETCO and BURULLUS Governance System

Page 13 of 13 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

Terms of Reference - PROJECT & DEPARTMENT RISK MEETINGS Frequency / Time: Chair / Owner Action Log Owner Quarterly / 1 hour GMs As designated. GMS Key Managers Attendees

Objectives: To support the COMPANY Risk Management Manual requirements Maintain Department / Project Risk Register Co-ordinate Audit Activities and Reporting Develop Mitigating Action Lists Maintain the departmental Business Improvement Plan

Agenda: Minutes from previous meeting Review Register Agree Risks that will cascade to the Corporate Risk Register Review Audit Log Review BIP

Inputs: Action log from previous meeting Departmental Risk Register Corporate Risk Register Feedback from other departments & GMs Audit Reports and Action Logs BIP

Outputs: Updated Risk register Agreed Corporate levels risks Updated Action log and Audit findings Revised BIP

Comments:

RASHPETCO and BURULLUS Governance System

Page 14 of 14 Date: July 2003

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

5.

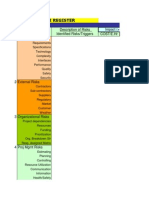

RESPONSIBILITY MATRIX

Governance Manager

Managing Directors

RISK MANAGEMENT - RACI MATRIX R A C I = Responsibility = Accountable = Consulted = Informed

Approval of this Manual

Maintenance of this Manual

Participation in Managing Partners Risk Process

Updating and Issuing of the Corporate Risk Registers

Approval of the Corporate Risk Registers

Elevating of risks to the Corporate Risk Registers

Updating and Issuing of Department / Project Risk Register

R/I

Approval of Department / Project Risk Registers

I/C

R/I

Preparation of the Department / Project Risk Register

I/C

Project/Department Risk Co-ordinator I A A A

Project/Department Managers

Managing Partner

RASHPETCO and BURULLUS Governance System

Page 15 of 15 Date: July 2003 6 6.1 APPENDICES

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

Guidelines for Risk Rating The following guidelines are general and may not be appropriate to all circumstances. IMPACT Factor Schedule Cost Quality Safety & environment RASHPETCO image Stakeholders image 1 (Low impact) < 7 days <$150k Acceptable with minor actions Tolerable with minor actions Acceptable with minor actions Acceptable with minor actions 2 (Medium impact) >7days, <1 month >$150k, <$6m Acceptable with major actions Tolerable with major actions Acceptable with major actions Acceptable with major actions 3 (High impact) >1 month >$6mm Not acceptable Not acceptable Not acceptable Not acceptable

PROBABILITY 1 (Low ) Less than once in 5 years very unlikely to occur 2 (Medium) Once in 5 years quite likely to occur 3 (High) Once a year very likely to occur

MANAGEABILITY 1 (Low ) Relatively easy to manage with normal management resources. 2 (Medium) Needs special attention and possibly enhanced management procedures 3 (High) Difficult to manage and may need outside assistance.

RISK RATING = IMPACT X PROBABILITY X MANAGEABILITY

RASHPETCO and BURULLUS Governance System

Page 16 of 16 Date: July 2003 6.2

Document Title: Risk Management Manual

Document Number:

RPC-COR-MS-RMP-201

Revision: 2

RISK REGISTER TEMPLATE The template can be found in the Governance Shared Drive, Under Risk Management. The document is self-explanatory and can be completed using the process detailed in section 4 above. Where you need to have an input in terms of the Register format, appropriate comments have been inserted in the register template to guide you. These are identified by the yellow marks. Just put your pointer over it to read the comment. Then highlight and type the required information over it.

Anda mungkin juga menyukai

- Project Risk Register GuidanceDokumen8 halamanProject Risk Register GuidanceGabriel LepadatuBelum ada peringkat

- Risk Management GuidanceDokumen35 halamanRisk Management Guidanceabarleyvscnet100% (1)

- Operational Risk Management Plan A Complete Guide - 2020 EditionDari EverandOperational Risk Management Plan A Complete Guide - 2020 EditionBelum ada peringkat

- Business Continuity Plan Administrator Complete Self-Assessment GuideDari EverandBusiness Continuity Plan Administrator Complete Self-Assessment GuideBelum ada peringkat

- L04 Qualitative Risk AnalysisDokumen14 halamanL04 Qualitative Risk AnalysisDimitris KokkalisBelum ada peringkat

- HSBC Bank Malaysia Berhad ("The Bank") Board of Directors Terms of ReferenceDokumen26 halamanHSBC Bank Malaysia Berhad ("The Bank") Board of Directors Terms of ReferenceAmrezaa IskandarBelum ada peringkat

- Governance Management Plan: (Insert Department Name) (Insert Project Name)Dokumen12 halamanGovernance Management Plan: (Insert Department Name) (Insert Project Name)ohhelloBelum ada peringkat

- AppendixHPreContractStageRiskRegister PDFDokumen3 halamanAppendixHPreContractStageRiskRegister PDFChris FindlayBelum ada peringkat

- Risk Register-Project Flip Sushrut SoodDokumen1 halamanRisk Register-Project Flip Sushrut Soodravapu345Belum ada peringkat

- Supporting Doc Risk MGMT Plan TDokumen9 halamanSupporting Doc Risk MGMT Plan TSujiya KhanBelum ada peringkat

- Lessons Learned ReportDokumen14 halamanLessons Learned ReportJohn N. ConstanceBelum ada peringkat

- Risk Register AllLevelsDokumen5 halamanRisk Register AllLevelsSam Atia100% (1)

- Prince A3 Process MapDokumen2 halamanPrince A3 Process Mapravin1976Belum ada peringkat

- Risk Management Training Slides EPX 200xv2Dokumen63 halamanRisk Management Training Slides EPX 200xv2Imran A. KhanBelum ada peringkat

- Risk ControlDokumen7 halamanRisk ControlDinesh AravindhBelum ada peringkat

- IT Governance FrameworkDokumen41 halamanIT Governance Frameworkmusaab elameenBelum ada peringkat

- C M P (P N) : OST Anagement LAN Roject AMEDokumen7 halamanC M P (P N) : OST Anagement LAN Roject AMERoqaia AlwanBelum ada peringkat

- Governance - Strategy and PMDokumen43 halamanGovernance - Strategy and PMpadmanabhdixitBelum ada peringkat

- Project Delivery ModelDokumen3 halamanProject Delivery ModelAnonymous ciKyr0tBelum ada peringkat

- Project Risk RegisterDokumen21 halamanProject Risk RegisterDIGITAL SIRBelum ada peringkat

- Risk Management Plan (3283)Dokumen44 halamanRisk Management Plan (3283)die-gol-8Belum ada peringkat

- Appendix L Warrington Risk RegisterDokumen2 halamanAppendix L Warrington Risk RegisterChris Findlay100% (1)

- ITH Risk MatrixDokumen11 halamanITH Risk Matrixsanjai_rahulBelum ada peringkat

- Risk Register For Project EPM Assignment-2Dokumen1 halamanRisk Register For Project EPM Assignment-2Awais MalikBelum ada peringkat

- Project Risk RegisterDokumen2 halamanProject Risk RegisterNixon100% (4)

- Project Risk RegisterDokumen14 halamanProject Risk RegisterNatarayan88% (8)

- Project Concept / Business Proposal / Business Case Fund Authorization Letter Project Definition and PlanningDokumen1 halamanProject Concept / Business Proposal / Business Case Fund Authorization Letter Project Definition and Planningvivekcp87Belum ada peringkat

- F4-40-03 Context & Interested Parties RegisterDokumen3 halamanF4-40-03 Context & Interested Parties RegisterGerritBelum ada peringkat

- Risk RegisterDokumen9 halamanRisk RegisterKingBelum ada peringkat

- Typical Elements in A Project CharterDokumen28 halamanTypical Elements in A Project CharterKGrace Besa-angBelum ada peringkat

- Risk LogDokumen13 halamanRisk LogSathi shBelum ada peringkat

- Risk Assessment and Audit Planning - JoyceDokumen44 halamanRisk Assessment and Audit Planning - JoyceTindu SBelum ada peringkat

- 2016 Risk Management ReportDokumen24 halaman2016 Risk Management ReportGere Tassew100% (1)

- The Project Control Framework Handbook v2 April 2013Dokumen58 halamanThe Project Control Framework Handbook v2 April 2013Angie DunnBelum ada peringkat

- Risk, Value and Cost ManagementDokumen54 halamanRisk, Value and Cost ManagementEdward AveryBelum ada peringkat

- RTA PTP Risk Management PresentationDokumen52 halamanRTA PTP Risk Management PresentationFurqanam196Belum ada peringkat

- Sample Project Charter PDFDokumen9 halamanSample Project Charter PDFAli HajirassoulihaBelum ada peringkat

- Project Risk Management Training Manual 13092012Dokumen175 halamanProject Risk Management Training Manual 13092012amithedau100% (1)

- PCF Product MatrixDokumen1 halamanPCF Product MatrixDebabrata Paul100% (1)

- Risk Management Framework May 2017Dokumen18 halamanRisk Management Framework May 2017Hedi Ben MohamedBelum ada peringkat

- Risk Assessment Questionnaire TemplateDokumen15 halamanRisk Assessment Questionnaire Templatezeimerhsu0% (1)

- Risk Management Project ReportDokumen42 halamanRisk Management Project Reportarakalareddy100% (2)

- Project Risk Register Template and GuideDokumen9 halamanProject Risk Register Template and Guidehamed100% (1)

- Primavera Risk Analysis Risk RegisterDokumen59 halamanPrimavera Risk Analysis Risk RegisterKhaled Abdel bakiBelum ada peringkat

- Risk Assessment Questionnaire TemplateDokumen14 halamanRisk Assessment Questionnaire TemplateJohn simpsonBelum ada peringkat

- Project Communication PlanDokumen4 halamanProject Communication PlanAnshid AshirBelum ada peringkat

- Risk Management Plan and Risk Management Using IBM IPWCDokumen35 halamanRisk Management Plan and Risk Management Using IBM IPWCdash.pradeep1741Belum ada peringkat

- Project Management Office (PMO) - Essential ConsiderationsDokumen8 halamanProject Management Office (PMO) - Essential ConsiderationsNitin ShendeBelum ada peringkat

- Risk Register ProjectDokumen749 halamanRisk Register ProjectmanojmoryeBelum ada peringkat

- Five Project Management Performance Metrics Key To Successful Project ExecutionDokumen7 halamanFive Project Management Performance Metrics Key To Successful Project ExecutionNaokhaiz AfaquiBelum ada peringkat

- Project Risk Register - FormatDokumen6 halamanProject Risk Register - FormatSameer MuntodeBelum ada peringkat

- Risk and Project CycleDokumen38 halamanRisk and Project CycleSwapnil MadgulwarBelum ada peringkat

- Embedding Risk Management For Improved Organisational PerformanceDokumen5 halamanEmbedding Risk Management For Improved Organisational PerformancePatrick OwBelum ada peringkat

- Risk RegisterDokumen34 halamanRisk RegisterMohamedMoideenNagoorMeeran33% (3)

- Project - Programme - Portfolio Management - View On ReportingDokumen62 halamanProject - Programme - Portfolio Management - View On ReportingjeffBelum ada peringkat

- 5 Identify RiskDokumen20 halaman5 Identify RiskSuhaib SghaireenBelum ada peringkat

- Risk Management TemplateDokumen72 halamanRisk Management TemplatehaphiBelum ada peringkat

- Initial Project Risk Assessment WorkbookDokumen26 halamanInitial Project Risk Assessment WorkbookShahul Vm100% (1)

- Research ProposalDokumen8 halamanResearch ProposalZahida AfzalBelum ada peringkat

- RPH 1Dokumen2 halamanRPH 1Amor VillaBelum ada peringkat

- Luovutuskirja Ajoneuvon Vesikulkuneuvon Omistusoikeuden Siirrosta B124eDokumen2 halamanLuovutuskirja Ajoneuvon Vesikulkuneuvon Omistusoikeuden Siirrosta B124eAirsoftBelum ada peringkat

- 1.1.1partnership FormationDokumen12 halaman1.1.1partnership FormationCundangan, Denzel Erick S.100% (3)

- Car Sale AGreement BIlal ShahDokumen3 halamanCar Sale AGreement BIlal ShahYasir KhanBelum ada peringkat

- G.R. No. 187512 June 13, 2012 Republic of The Phils Vs Yolanda Cadacio GranadaDokumen7 halamanG.R. No. 187512 June 13, 2012 Republic of The Phils Vs Yolanda Cadacio GranadaDexter Lee GonzalesBelum ada peringkat

- Washingtons PresidencyDokumen27 halamanWashingtons PresidencyoscaryligiaBelum ada peringkat

- Par Vol2i10Dokumen66 halamanPar Vol2i10Bakhita MaryamBelum ada peringkat

- University Institute of Legal Studies: Jurisprudence-Austin'S Analytical Positivism 21LCT114Dokumen15 halamanUniversity Institute of Legal Studies: Jurisprudence-Austin'S Analytical Positivism 21LCT114Harneet KaurBelum ada peringkat

- Regulus Astrology, Physiognomy - History and SourcesDokumen85 halamanRegulus Astrology, Physiognomy - History and SourcesAntaresdeSuenios100% (3)

- BARD 2014 Product List S120082 Rev2Dokumen118 halamanBARD 2014 Product List S120082 Rev2kamal AdhikariBelum ada peringkat

- Foundation of Education Catholic Counter Reformation Kerth M. GalagpatDokumen12 halamanFoundation of Education Catholic Counter Reformation Kerth M. GalagpatKerth GalagpatBelum ada peringkat

- "Ako Ang Daigdig" by Alejandro Abadilla: An AnalysisDokumen3 halaman"Ako Ang Daigdig" by Alejandro Abadilla: An AnalysisJog YapBelum ada peringkat

- Professionals and Practitioners in Counselling: 1. Roles, Functions, and Competencies of CounselorsDokumen70 halamanProfessionals and Practitioners in Counselling: 1. Roles, Functions, and Competencies of CounselorsShyra PapaBelum ada peringkat

- English File Intermediate. Workbook With Key (Christina Latham-Koenig, Clive Oxenden Etc.) (Z-Library)Dokumen2 halamanEnglish File Intermediate. Workbook With Key (Christina Latham-Koenig, Clive Oxenden Etc.) (Z-Library)dzinedvisionBelum ada peringkat

- AcadinfoDokumen10 halamanAcadinfoYumi LingBelum ada peringkat

- Letter ODokumen17 halamanLetter ObontalampasBelum ada peringkat

- Axess Group - Brazilian ComplianceDokumen1 halamanAxess Group - Brazilian ComplianceRicardoBelum ada peringkat

- Part II. Market Power: Chapter 4. Dynamic Aspects of Imperfect CompetitionDokumen9 halamanPart II. Market Power: Chapter 4. Dynamic Aspects of Imperfect Competitionmoha dahmaniBelum ada peringkat

- Ebook Accounting Information For Business Decisions 4Th Australian Edition PDF Full Chapter PDFDokumen67 halamanEbook Accounting Information For Business Decisions 4Th Australian Edition PDF Full Chapter PDFgina.letlow138100% (27)

- Tallado V. ComelecDokumen3 halamanTallado V. ComelecLorelain ImperialBelum ada peringkat

- Drugs: Use, Abuse and Addiction - Lesson Plan (Grades 9 & 10)Dokumen23 halamanDrugs: Use, Abuse and Addiction - Lesson Plan (Grades 9 & 10)Dimple Lasala ElandagBelum ada peringkat

- Indian Contract Act 1972Dokumen37 halamanIndian Contract Act 1972Ashutosh Saraiya100% (2)

- 121 Diamond Hill Funds Annual Report - 2009Dokumen72 halaman121 Diamond Hill Funds Annual Report - 2009DougBelum ada peringkat

- Geopolitical Assemblages and ComplexDokumen17 halamanGeopolitical Assemblages and ComplexCarmen AguilarBelum ada peringkat

- Amelia David Chelsea Cruz Ellaine Garcia Rica Mae Magdato Shephiela Mae Enriquez Jamaica Bartolay Jerie Mae de Castro Meryl Manabat Riejel Duran Alexis ConcensinoDokumen9 halamanAmelia David Chelsea Cruz Ellaine Garcia Rica Mae Magdato Shephiela Mae Enriquez Jamaica Bartolay Jerie Mae de Castro Meryl Manabat Riejel Duran Alexis ConcensinoRadleigh MercadejasBelum ada peringkat

- What Is GlobalizationDokumen19 halamanWhat Is GlobalizationGiovanni Pierro C Malitao JrBelum ada peringkat

- Fill in The Blanks, True & False MCQs (Accounting Manuals)Dokumen13 halamanFill in The Blanks, True & False MCQs (Accounting Manuals)Ratnesh RajanyaBelum ada peringkat

- Safe Hospitals ManualDokumen43 halamanSafe Hospitals ManualMaeDaphneYapBelum ada peringkat

- Finals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Dokumen6 halamanFinals Week 12 Joint Arrangements - ACTG341 Advanced Financial Accounting and Reporting 1Marilou Arcillas PanisalesBelum ada peringkat