Benalec Holdings BHD 04012011

Diunggah oleh

Souffi RadziDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Benalec Holdings BHD 04012011

Diunggah oleh

Souffi RadziHak Cipta:

Format Tersedia

MALAYSIA INVESTMENT RESEARCH REPORT KDN PP13226/04/2010 (023662)

JF APEX SECURITIES BERHAD

(47680-X)

JF Apex Securities Berhad Newsletter

3 January 2011

IPO: Benalec Holdings Bhd

Integrated operations for a niche market IPO Price

Stock Data Board / Sector Post-IPO issued shares Post-IPO market cap (RM)* Financial Forecast (RMm) 00A Revenue 120.9 35.58 EBITDA Operating profit 29.12 Pretax profit 23.88 Net profit 17.27 DPS (sen)** EPS (sen) 2.74 PER (X)* 36.48 24.08 Gross profit margin (%) PBT margin (%) PAT margin (%) Effective tax rate (%) 19.75 14.28 27.70 10A 116.5 82.31 56.65 68.63 58.38 9.27 10.79 48.63 58.92 50.12 14.93

FULLY VALUED

Target Price: RM1.16

RM1.00

Main / Construction 730m RM730.00m

Benalec Holdings Berhad (BH) is an integrated marine construction service provider. BH operates in a niche market, focusing mainly on land reclamation and coastal construction works.

Highlights

11F 189.7 103.7 92.93 83.58 62.69 0.013 8.59 11.64 49.00 44.07 33.05 15.57 12F 177.9 97.50 87.15 78.63 58.97 0.024 8.08 12.38 49.00 44.21 33.16 12.85

Pioneer in marine and civil engineering BH has been in the marine construction industry since 1978. It is based in Alor Setar, Kedah. Integrated operations - Added advantages with its vertical integration, creating a highly scalable industry value chain. Wide range of vessels The group owns more than 90 vessels of various usage for more efficient and cost effective operations. Favourable order book With projects completion date ranging from year 2011 to 2016, BH has a total unbilled amount of more than RM670 million. Targeted dividend BH plans to distribute 15% and 30% of its net profit for financial year ending 30 June 2011 and 2012 respectively. Our dividend payout forecast is approximately 1.3 sen for FY2011 and 2.4 sen for FY2012.

Important Balance Sheet Items (as at 30 June 10) NA / share (RM)* 0.22 Total Receivables (RM) 2.94m Total Payables (RM) 3.55m Net Assets (RM) 151.18m Current Ratio (times) 0.94 Gearing (times) 0.44 * based on IPO offering price of RM1.00 and assumption that all shares offered are fully subscribed. ** 15% for FYE 30 June 2011 and 30% for FYE 30 June 2012 of net profit

Recommendation Fully valued with target price of RM1.16. This translate

into an upside potential of 16.0% as compared to its listing price of RM1.00.

Important dates (tentative)

Events Opening of retail offering Closing of retail offering Listing

Date 28 December 2010 6 January 2011 17 January 2011

The value of RM1.16 was derived based on the comparable

P/E (price earning) ratio of similar group in the industry of 13.5 times and FY2011 EPS of 8.59.

(Source: Company prospectus)

Please read carefully the important disclosures at end of this publication

3 January 2011

IPO Benalec Holdings Bhd

JF APEX SECURITIES

Company background

Over 30 years of operations

Benalec Holdings Bhd (BH) has been operating in the construction sector since 1978. It is based in Alor Setar, Kedah and provided civil engineering services. All of BHs subsidiaries (Oceanliner, Benship and Benalec Sdn Bhd) are wholly-owned. Under Benalec Sdn Bhd, it has another 24 fully-owned subsidiaries.

Corporate structure

Source: Groups Prospectus

Wide range of services

The Group is involved in various services which form an integrated vertical workflow. The services provided include: i) Land reclamation, dredging and beach nourishment. ii) Rock revetment works, shore protection works and breakwater construction. iii) Pre-bore and marine piling. iv) Construction of marine structures, bridges, jetties, ports and other offshore and ancillary structures. v) In-house marine construction (shipbuilding, repair, maintenance, fabrication and refurbishment) vi) Vessel chartering and towage services.

3 January 2011

IPO Benalec Holdings Bhd

JF APEX SECURITIES

Achievement of ISO and OHSAS certifications

The Group has obtained ISO 9001:2000 for the provision of marine engineering and construction works and provision of marine vessel and equipment chartering services. Certification was upgraded to ISO 9001:2008 in year 2000. In Singapore, the Group has been certified by ISO 9001:2008 and OHSAS 18001:2007 for civil engineering works in land reclamation (including supply and delivery).

Financial Highlights, FYE 30 June 2010

Significant growth

BH recorded 25% of Compounded annual growth (CAGR) for revenue, for the period of 2008 to 2010. Net profit rose to RM58.38 million in FY2010, more than double the net profit in FY2009. This was largely due to the gains on disposal of land, representing approximately 48.39% of other operating income as recognised in FYE 30 June 2010.

Lower cost

In addition to the gains on disposal land, we take note of the cost of sales has dropped 35% to RM59.83 million from RM91.82 million in FY2009. The lower actual cost of sales being recorded was due to awaiting of soil settlement and consolidation to take place before completion of the projects. Chart 1: Revenue & Revenue Annual Growth

200.0 150.0 100.0 50.0 0.0 2009 2010 2011F 2012F 0.8 0.6 0.4 0.2 0.0 -0.2

Revenue (RM'm,LHS)

Source: JF Apex Securities Compilation

Annual Growth(%,RHS)

Chart 2: Net Profit & Annual Growth

80.0 60.0 40.0 20.0 0.0 2009 2010 2011F 2012F 3.0 2.0 1.0 0.0 -1.0

Net Profit (RM'm,LHS)

Source: JF Apex Securities Compilation

Annual Growth (%,RHS)

3 January 2011

IPO Benalec Holdings Bhd

JF APEX SECURITIES

Key Prospects

Integrated workflow of operations

With a wide range of equipments, expertise and specialisation from its subsidiaries, the group is able to generate an efficient and cost effective vertical integration.

Vessels*

Upstream Equipment* Raw materials Midstream

Fuel

Dredging*

Marine piling*

Land reclamation*

Downstream Shore & beach Construction of coastal erosion structures* protection works*

Construction of Off-Coast Structures*

End users Property developer, local authorities, government department & agencies, ports & maritime, airports, oil & gas, energy sector Note:

* Benalecs activities

Cost-effective operations

BH currently owns over 90 vessels of various kind and functionality. This enables the group to lower their cost by reducing dependency on third party facilities and services. Furthermore with the groups integrated facilities, in-house operations such as repair, maintenance, shipbuilding, fabrication and refurbishment can be used to reduce time-lag and uprising cost from outsourcing to third parties.

Niche market

FYE 30 June 2010, 89% of Groups revenue was derived from marine construction services whereas the remaining 11% was from ship chartering in Singapore. This shows the Groups primary focus of services is centred at a specific area within the construction sector.

Industry barriers for newcomers

BH has been able to establish itself in the marine construction services business and gained the following key points: i) Capital intensive ii) Strong financial position iii) Availability of facilities, vessels, equipments, and experienced staffs iv) Vertical integration of the industry value chain Hence, newcomers of the industry will face challenges upon competing with established players.

3 January 2011

IPO Benalec Holdings Bhd

JF APEX SECURITIES

Table 2: Current Order Book

Favourable order book

Current order book todate HUSB Project, Klebang Besar Oriental Project, Kuala Sungai Melaka ABS Maju Project, Daerah Melaka Tengah SOSB Project, Daerah Melaka Tengah Maintenance dredging, Kapar Reclamation & shore protection, Port Klang Coastal reclamation, Sungai Melaka Reclamation & shore protection, Melaka Tengah Total

Total contract value (RMm) 71.3 123.2 3.9 77.2 9.5 75.0 27.6 468.0 855.7

Unbilled amount (RMm) 17.8 20.7 2.3 52.4 9.5 75.0 27.6 468.0 673.3

Estimation of period 2007-2011 2008-2011 2008-2010 2009-2011 2010-2010 2010-2013 2010-2011 2011-2016

Source: Groups presentation slide

Utilisation of IPO Proceeds

Table 3: Utilisation of IPO Proceeds Description Finance on-going projects Working capital Estimated listing cost Total Estimated timeframe upon listing Within 24 months Within 24 months Immediate Amount (RMm) 90 3.5 6.5 100.0 % of total gross proceeds 90.0 3.5 6.5 100.0

Source: Groups prospectus

Key Risks

Project based business

Marine construction contracts are typically done on a tender basis and per project. Hence, there will be no guarantee for securing long term contracts, including the continuation of using the same service provider by the project owner/client. The ability to replenish contracts are dependable on various changes of factors like the economy, policies and regulations, competitions and prices of raw materials, to name a few.

3 January 2011

IPO Benalec Holdings Bhd

JF APEX SECURITIES

Fluctuating market prices and disposal of Land Portion

Settlement for land reclamation projects can be in the form of a portion of the reclaimed land (settlement in-kind). The Land Portion would be subjected to land alienation process (issuance of documents) and such process usually takes up between 7 to 12 months to be completed. Disposal of Land Portion can only be done upon the process completion. During the waiting period, property market prices will fluctuate and cause risks in terms of the consideration receivable on disposal and/or in terms of saleability.

Supply of diesel, sand and rocks

In the FYE 30 June 2010, the Group has recorded approximately 21.5% of the operating cost was derived from diesel usage. Diesel are constantly exposed to price fluctuations. With the usage of sea sand instead of construction sand, the Group has not been experiencing any significant changes to the sand supplies and its prices. However, sand and rocks have been the core of raw material costs, therefore there will be a risk of supplies shortage if changes in Government policies and prices for the materials were to be made.

Future Plans

Potential order book

Table 4: Potential job bids Potential job bids (Malaysia) 1. Melaka 2. Penang 3. Selangor 4. Johor Potential job bids (Singapore) 1. Jurong Town Council 2. Housing & Development Board 3. Maritime & Port Authority

Source: Groups presentation slide

Total contract value (RMm) 5710 Contract value (SGDb)

Expected date of contract to be awarded Within 1-2 years

1-5 (each)

Within 1-2 years

Expansion

Apart from the current on-going projects and services in Selangor, Melaka and Singapore, the Group intend to bid for more large contracts in other states like Penang. The Group also plan to expand their marine transportation segment from Vietnam and/or to Singapore.

3 January 2011

IPO Benalec Holdings Bhd

JF APEX SECURITIES

Competitors

Table 5: Competitors Market cap (RMm) 6908.9 6039.2 2407.9 977.5 875.0 Current estimated price-earning (PE) ratio* (times) 20.97 20.37 18.21 13.04 8.33

Local construction peers IJM Gamuda WCT HSL Naim

Source: Groups presentation slide Note: *As of 30th December 2010

Valuation and Recommendation

Fair value of RM1.16 with EPS of 8.59 sen

We estimated BHs FY2011 EPS to be 8.59 sen. As at 30 November 2010, BHs comparable key companies (local and foreign) produced an industrys average price-earning (P/E) ratio of 13.51. Revenue for FY2011 was estimated with an y-o-y increase of more than 60% based on the valuation of unbilled amount from the current order book. This produced an estimated increase of 7% net profit for FYE 30 June 2011 Based on FYE 30 June 2011s EPS and current forward P/E ratio, this translates into a fair value of RM1.16 with an upside potential of 16.0%. Hence, we have a rating of fully-valued for this stock.

Table 6: BHs PER Valuation Market Cap (RM'm) 14585.09 8416.93 7857.45 2565.22 1013.86 845.00

Company BOSKALIS WESTMINSTER IJM CORP BHD GAMUDA BHD WCT BHD HOCK SENG LEE BERHAD NAIM HOLDINGS BERHAD Average BENALEC HOLDINGS BERHAD Valuation Average Industry P/E atio EPS, FY2011 Fair Value Upside Potential

P/E Ratio (Times) 13.61 18.11 16.95 14.36 10.42 7.61 13.51 11.64*

730.00

13.51 8.59 RM1.16 16.0%

Source: Bloomberg & JF Apex Securities Research Note: * Based on Rm1.00 per share with EPS FY2011 of 8.59 sen

3 January 2011

IPO Benalec Holdings Bhd

JF APEX SECURITIES

Table 7: Financial Information (RM million) Revenue Cost of sales Gross profit Other operating income Operating expenses Operating profits Financing costs PBT Taxation PAT Attributable to (RM million): Equity holders Minority interest Number of shares (million) Dividend per share (sen) Net EPS (sen) Fully diluted EPS (sen) P/E ratio (times)* Gross profit margin (%) PBT margin (%) PAT margin (%) Effective tax rate (%) 2008 74.06 (53.39) 20.67 2.74 (5.35) 18.06 (1.19) 16.87 (3.43) 13.44 2009 120.94 (91.82) 29.12 6.56 (8.30) 27.38 (3.50) 23.88 (6.61) 17.27 2010 116.48 (59.83) 56.65 23.09 (8.18) 71.56 (2.93) 68.63 (10.25) 58.38 2011F 189.65 (96.72) 92.93 7.00 (13.34) 86.58 (3.00) 83.58 (20.90) 62.69 2012F 177.85 (90.70) 87.15 7.00 (12.51) 81.63 (3.00) 78.63 (19.66) 58.97

13.44

17.27

58.38

62.69

58.97

630

630

630

730 0.013 8.59 8.59 11.64 49.00 44.07 33.05 15.57

730 0.024 8.08 8.08 12.38 49.00 44.21 33.16 12.85

2.13 1.84 46.88 27.91 22.78 18.15 20.36

2.74 2.37 36.48 24.08 19.75 14.28 27.70

9.27 8.00 10.79 48.63 58.92 50.12 14.93

Source: Company prospectus & JF Apex Securities Research Note: * Based on Rm1.00 per share

3 January 2011

IPO Benalec Holdings Bhd

JF APEX SECURITIES

JF APEX SECURITIES BERHAD CONTACT LIST

JF APEX SECURITIES BHD Head Office: 6th Floor, Menara Apex Off Jalan Semenyih Bukit Mewah 43000 Kajang Selangor Darul Ehsan Malaysia General Line: (603) 8736 1118 Facsimile: (603) 8737 4532 PJ Office: 15th Floor, Menara Choy Fook On No. 1B, Jalan Yong Shook Lin 46050 Petaling Jaya Selangor Darul Ehsan Malaysia General Line: (603) 7620 1118 Facsimile: (603) 7620 6388 DEALING TEAM Head Office: Kong Ming Ming (ext 3237) Shirley Chang (ext 3211) Norisam Bojo (ext 3233) Derrick Ng Wei Yee (ext 3239) Edwin Loh Ming Hon (ext 3236) Wong Wing Haur, Alvin (ext 3226) Gan Huai Hsia (ext 3214) Yap Maow Jun, David (ext 3228) Lim Soo Yee, Chloe (ext 3235) Institutional Dealing Team: Lim Teck Seng Sanusi Manso (ext 740) Edy Sukasma (ext 745) Fathul Rahman Buyong (ext 741) Ramlee Sulaiman (ext 742) Ahmad Mansor (ext 744) Lum Meng Chan (ext 743) PJ Office: Mervyn Wong (ext 363) Mohd Hanif Wan Said (ext 111) RESEARCH TEAM Head Office: Ng Keat Yung (ext 759) Phoon Thai Yoon (ext 755) Lee Cherng Wee (ext 756) Wong Miu Kee (ext 752)

JF APEX SECURITIES BERHAD - DISCLAIMER JF Apex Securities Berhad do and seek to do business with the company(ies) covered in this research report and may from time to time act as market maker or have assumed an underwriting commitment in securities of such company(ies), may sell them to or buy them from customers on a principal basis and may also perform or seek to perform significant advisory or underwriting services for or relating to such company(ies) as well as solicit investment, advisory or other services from any entity mentioned in this report. In reviewing this report, an investor should be aware that any or all of the foregoing, among other things, may give rise to real or potential conflict of interest.Additional information is, subject to the duties of confidentiality, available on request. The report is for internal and private circulation only and shall not be reproduced either in part or otherwise without the prior written consent of JF Apex Securities Berhad. The opinions and information contained herein are based on available data believed to be reliable. It is not to be construed as an offer, invitation or solicitation to buy or sell the securities covered by this report. Opinions, estimates and projections in this report constitute the current judgment of the author. They do not necessarily reflect the opinion of JF Apex Securities Berhad and are subject to change without notice. JF Apex Securities Berhad has no obligation to update, modify or amend this report or to otherwise notify a reader thereof in the event that any matter stated herein, or any opinion, projection, forecast or estimate set forth herein, changes or subsequently becomes inaccurate. JF Apex Securities Berhad does not warrant the accuracy of anything stated herein in any manner whatsoever and no reliance upon such statement by anyone shall give rise to any claim whatsoever against JF Apex Securities Berhad. JF Apex Securities Berhad may from time to time have an interest in the company mentioned by this report. This report may not be reproduced, copied or circulated without the prior written approval of JF Apex Securities Berhad.

Published & Printed by: JF Apex Securities Berhad (47680-X) (A Participating Organisation of Bursa Malaysia Securities Berhad)

Anda mungkin juga menyukai

- Dialog2011 MainDokumen73 halamanDialog2011 MainSopsky SalatBelum ada peringkat

- Annual Report: Malaysia Marine and Heavy Engineering Holdings BerhadDokumen34 halamanAnnual Report: Malaysia Marine and Heavy Engineering Holdings BerhadAzizan Mohamed YasinBelum ada peringkat

- YTL Corporation Berhad - Annual Report 2011Dokumen268 halamanYTL Corporation Berhad - Annual Report 2011Lowinox JohnBelum ada peringkat

- About Vti Vintage Berhad Group.: Finance For Manager AssignmentDokumen21 halamanAbout Vti Vintage Berhad Group.: Finance For Manager AssignmentSaravanan RasayaBelum ada peringkat

- Answer (Ii)Dokumen8 halamanAnswer (Ii)Fazlin GhazaliBelum ada peringkat

- YTL Cement Berhad - Annual Report 2011Dokumen130 halamanYTL Cement Berhad - Annual Report 2011Syukran RazakBelum ada peringkat

- Santo Port Project (Loans 843 & 1080-VAN (SF) )Dokumen40 halamanSanto Port Project (Loans 843 & 1080-VAN (SF) )Independent Evaluation at Asian Development BankBelum ada peringkat

- Sinindus 20110913Dokumen9 halamanSinindus 20110913red cornerBelum ada peringkat

- Naim Presentation Slides - 8 July 2012Dokumen78 halamanNaim Presentation Slides - 8 July 2012Liew Jiun BinBelum ada peringkat

- 3Q2011 Results Presentation: October 2011Dokumen37 halaman3Q2011 Results Presentation: October 2011AmitMalhotraBelum ada peringkat

- BIMBSec - Dayang Initial Coverage - 020412Dokumen9 halamanBIMBSec - Dayang Initial Coverage - 020412Bimb SecBelum ada peringkat

- Mercator Lines (Singapore) LTD.: Stock Code: EE6Dokumen31 halamanMercator Lines (Singapore) LTD.: Stock Code: EE6tsrayBelum ada peringkat

- Manager's Report: For The Financial Period 1 April To 30 June 2012Dokumen9 halamanManager's Report: For The Financial Period 1 April To 30 June 2012Madu BiruBelum ada peringkat

- EleconEngineering Sushil 020910Dokumen3 halamanEleconEngineering Sushil 020910Navarun ShomeBelum ada peringkat

- YTL-Cover To Page 20 (1.2MB)Dokumen22 halamanYTL-Cover To Page 20 (1.2MB)Luk Hoi KumBelum ada peringkat

- EADS Earning 9m 2011 FinalDokumen38 halamanEADS Earning 9m 2011 FinalJason GonzalezBelum ada peringkat

- Ezra Holdings (EZRA SP) : OW (V) : Shifting Gears - NDR TakeawaysDokumen13 halamanEzra Holdings (EZRA SP) : OW (V) : Shifting Gears - NDR TakeawaysTheng RogerBelum ada peringkat

- Rakon Announcement 14 Feb 08Dokumen6 halamanRakon Announcement 14 Feb 08Peter CorbanBelum ada peringkat

- Technics Oil & Gas: Initiation of CoverageDokumen15 halamanTechnics Oil & Gas: Initiation of Coveragecentaurus553587Belum ada peringkat

- Blue Dart Express LTD: Key Financial IndicatorsDokumen4 halamanBlue Dart Express LTD: Key Financial IndicatorsSagar DholeBelum ada peringkat

- Ratio Analysis AssignmentDokumen11 halamanRatio Analysis AssignmentNanozzi BrendahBelum ada peringkat

- New Horizon 2015: JGC Corporation JGC Corporation Medium-Term Management PlanDokumen15 halamanNew Horizon 2015: JGC Corporation JGC Corporation Medium-Term Management PlanJustinBelum ada peringkat

- Presentation 1Q Results 2010Dokumen20 halamanPresentation 1Q Results 2010Ion CucuBelum ada peringkat

- (CAS) - GLobal Detergents (A)Dokumen6 halaman(CAS) - GLobal Detergents (A)PRATIK MUKHERJEEBelum ada peringkat

- Coastal 160802 Cu (Kenanga)Dokumen4 halamanCoastal 160802 Cu (Kenanga)Faizal FazilBelum ada peringkat

- 2096 Presentation Q3 2011Dokumen16 halaman2096 Presentation Q3 2011ajclintBelum ada peringkat

- Dragon Oil Annual Report 2010Dokumen102 halamanDragon Oil Annual Report 2010faizulramliBelum ada peringkat

- NBCC IPO Analysis ReportDokumen5 halamanNBCC IPO Analysis Reportketu999Belum ada peringkat

- Global Research Sector - Construction Contractors Equities - MENA June 26, 2011Dokumen60 halamanGlobal Research Sector - Construction Contractors Equities - MENA June 26, 2011mazharkhan83Belum ada peringkat

- Mining Industry PresentationsDokumen38 halamanMining Industry Presentationspoitan2Belum ada peringkat

- Daibochi 1H11Briefing Presentation Final 110805Dokumen12 halamanDaibochi 1H11Briefing Presentation Final 110805Tay Wi KengBelum ada peringkat

- Mena-2 Wednesday Morning Round-Up: C C C C C C C C C C C C C C C C C C C C C C C C C C C CDokumen4 halamanMena-2 Wednesday Morning Round-Up: C C C C C C C C C C C C C C C C C C C C C C C C C C C Capi-66021378Belum ada peringkat

- Lundin CMD Presentation 2011Dokumen60 halamanLundin CMD Presentation 2011Samuel TsuiBelum ada peringkat

- Malaysia Marine and Heavy Engineering: New ListingDokumen10 halamanMalaysia Marine and Heavy Engineering: New ListingRhb InvestBelum ada peringkat

- Petrofac - Subsurface Technology Centre IndiaDokumen5 halamanPetrofac - Subsurface Technology Centre IndiaashwanikhareBelum ada peringkat

- ROKKO Holdings 2011 Annual ReportDokumen117 halamanROKKO Holdings 2011 Annual ReportWeR1 Consultants Pte LtdBelum ada peringkat

- UntitledDokumen3 halamanUntitledapi-66021378Belum ada peringkat

- POSCO.Q1 2012 IR - EngDokumen24 halamanPOSCO.Q1 2012 IR - EngSam_Ha_Belum ada peringkat

- PTTEP FinalDokumen27 halamanPTTEP FinalBancha WongBelum ada peringkat

- Montu - Lanco InfratechDokumen2 halamanMontu - Lanco InfratechMontu AdaniBelum ada peringkat

- Project ProposalDokumen23 halamanProject ProposalMohan.rBelum ada peringkat

- MMHE - First Major Slew of Contracts For The Year - 160615Dokumen3 halamanMMHE - First Major Slew of Contracts For The Year - 160615Liesa TalibBelum ada peringkat

- Annual ReportDokumen5 halamanAnnual ReportrakesharukalaBelum ada peringkat

- Darshan 28 Full FinishedDokumen24 halamanDarshan 28 Full FinishedKishan MBelum ada peringkat

- Fibria Corporate Presentation Mar 2011Dokumen21 halamanFibria Corporate Presentation Mar 2011FibriaRIBelum ada peringkat

- Tata Mutual Fund-FINALDokumen8 halamanTata Mutual Fund-FINALTamanna MulchandaniBelum ada peringkat

- PU-FS-1-Abednego Nugroho PahlawanDokumen12 halamanPU-FS-1-Abednego Nugroho PahlawanAbednego NugrohoBelum ada peringkat

- ONGC Mangalore Petrochemicals Limited: Project Management and FinanceDokumen14 halamanONGC Mangalore Petrochemicals Limited: Project Management and FinanceAnkit MishraBelum ada peringkat

- Ocean & Coastal Management: Jitendra K. Panigrahi, Ajay PradhanDokumen14 halamanOcean & Coastal Management: Jitendra K. Panigrahi, Ajay PradhanmahadarmaBelum ada peringkat

- Tanjung Offshore: Turning Attractive Upgrade To BuyDokumen4 halamanTanjung Offshore: Turning Attractive Upgrade To Buykhlis81Belum ada peringkat

- JRCDokumen54 halamanJRCTopcom Toki-VokiBelum ada peringkat

- Xcite Oil Reserve NewsDokumen9 halamanXcite Oil Reserve NewsthunderBelum ada peringkat

- KC 2 Pilot PaperDokumen10 halamanKC 2 Pilot Paperxanax_1984Belum ada peringkat

- Weremena Trading PLC Report March 4, 2023Dokumen53 halamanWeremena Trading PLC Report March 4, 2023Abera DinkuBelum ada peringkat

- PTTEP - Analyst Meeting 1Q13Dokumen31 halamanPTTEP - Analyst Meeting 1Q13spmzBelum ada peringkat

- Presentation 30 November 2006Dokumen37 halamanPresentation 30 November 2006barai09Belum ada peringkat

- Policies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportDari EverandPolicies to Support the Development of Indonesia’s Manufacturing Sector during 2020–2024: A Joint ADB–BAPPENAS ReportBelum ada peringkat

- List of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosDari EverandList of Key Financial Ratios: Formulas and Calculation Examples Defined for Different Types of Profitability Ratios and the Other Most Important Financial RatiosBelum ada peringkat

- Strategy and Action Plan for the Greater Mekong Subregion East-West Economic CorridorDari EverandStrategy and Action Plan for the Greater Mekong Subregion East-West Economic CorridorBelum ada peringkat

- Cementing PresentationDokumen34 halamanCementing PresentationKarwan Dilmany100% (3)

- Architecture Santo Tomas SyllabusDokumen3 halamanArchitecture Santo Tomas SyllabusrichellerojBelum ada peringkat

- Abdel-Rahman1988 2Dokumen7 halamanAbdel-Rahman1988 2majedsalehBelum ada peringkat

- Fire Rated Counter Doors Standard Cer C 10Dokumen11 halamanFire Rated Counter Doors Standard Cer C 10Valentinas PranskunasBelum ada peringkat

- SkylightsDokumen77 halamanSkylightszameer72790% (1)

- Residential Construction SpecificationsDokumen15 halamanResidential Construction SpecificationsRico EdureseBelum ada peringkat

- Amorkast 80al C - AdtechDokumen2 halamanAmorkast 80al C - AdtechFaisal YaniBelum ada peringkat

- Seko Dosing DiaDokumen12 halamanSeko Dosing DiaSeptriani LaoliBelum ada peringkat

- All House Kitchen: Monthly Cleaning ListDokumen6 halamanAll House Kitchen: Monthly Cleaning ListvandanaBelum ada peringkat

- Steel Tanks For Fire ProtectionDokumen21 halamanSteel Tanks For Fire ProtectionCkaal74Belum ada peringkat

- Tensar GeomallaDokumen13 halamanTensar GeomallaBrayhan MirkoBelum ada peringkat

- Estimate The Reinforcement in Shallow FoundationDokumen12 halamanEstimate The Reinforcement in Shallow FoundationEmdad Yusuf100% (2)

- Operation and Maint Manual Swill Hydraulic PlateformDokumen16 halamanOperation and Maint Manual Swill Hydraulic Plateformmicell dieselBelum ada peringkat

- 2.4 Ccontract ManagmentDokumen27 halaman2.4 Ccontract Managmentbereket gBelum ada peringkat

- Rough CostDokumen1 halamanRough CostKannanBelum ada peringkat

- Shell Gadus S2 A320 2Dokumen2 halamanShell Gadus S2 A320 2Raden ArdyBelum ada peringkat

- Searay 330 Sundancer-ReportDokumen11 halamanSearay 330 Sundancer-ReportAshok KamathBelum ada peringkat

- Divorce Rates by Profession - Lex Fridman BlogDokumen30 halamanDivorce Rates by Profession - Lex Fridman Blogkh_chu_1Belum ada peringkat

- Different Types of FoundationDokumen16 halamanDifferent Types of FoundationRedwan RanaBelum ada peringkat

- Alamillo Bridge, Seville, Spain - Santiago CalatravaDokumen16 halamanAlamillo Bridge, Seville, Spain - Santiago Calatravaelle_eleBelum ada peringkat

- Innova M3 New: 3. InstallationDokumen8 halamanInnova M3 New: 3. InstallationAndreea DanielaBelum ada peringkat

- Fire Resistance of Unprotected Steel Beams - Comparison Between Fire Tests and Calculation ModelsDokumen8 halamanFire Resistance of Unprotected Steel Beams - Comparison Between Fire Tests and Calculation Modelspametnica21Belum ada peringkat

- AL Alpha Essentials WebDokumen182 halamanAL Alpha Essentials WebVo Hong KietBelum ada peringkat

- 3-Typical Upgrade Trash RackDokumen1 halaman3-Typical Upgrade Trash RackRodelio Aboda Jr.Belum ada peringkat

- Plumbing (AutoRecovered)Dokumen3 halamanPlumbing (AutoRecovered)nicsBelum ada peringkat

- BCM-V U2 Part-B 19-07-2021Dokumen55 halamanBCM-V U2 Part-B 19-07-2021hyperloop707 designBelum ada peringkat

- Chapter 8Dokumen25 halamanChapter 8aung0024Belum ada peringkat

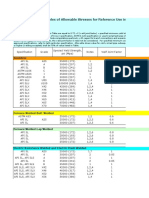

- Allowable Stress in PipingDokumen6 halamanAllowable Stress in PipingpelotoBelum ada peringkat

- Stub - Acme - Thread - Data - Sheets Rev ADokumen4 halamanStub - Acme - Thread - Data - Sheets Rev Aakaalj qhseBelum ada peringkat