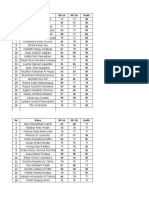

Table - 4.1 Gender Wise Classification of The Respondents

Diunggah oleh

Raj KumarDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Table - 4.1 Gender Wise Classification of The Respondents

Diunggah oleh

Raj KumarHak Cipta:

Format Tersedia

Table 4.

1 Gender wise classification of the respondents

Gender No of Respondent Percentage 58%

Male

58

Female

42

42%

Total Source : Primary Data

100

100%

Table 4.1 shows that more than half (58%) of the respondents were belongs to the male groups and (42%) percent of the respondents were belong to the female groups. It is clearly understood that the majority of the respondents were belongs to the male groups(58%)

Table 4.2 Age wise distribution of the Respondents

Age Below 12 Years 13- 24 Years 25 35 Years 36 50 Years Above 50 Years Total Source : Primary Data

No of Respondent 3 62 28 6 1 100

Percentage 3% 62% 28% 6% 1% 100

The age of the respondent is classified in table 4.2 out of the total respondents (62%) the majority of the respondents were belongs to the age group between 13-24 years. The respondents who belongs to the age group of 25-35 years is occupied second

position(28%) and the respondents between 36-50 years(6%) and below 12 years(3%) age group ranks first and fourth place respectively the respondent who comes under the category of above 50 years(1%) ranks the last. It is clearly understand that the most of respondents are belong to the age group between 13-24 years (62%)

Table 4.3 Education Wise Distribution Of Respondents

Educational

No.Of Responents

Percentage

School leavel HSC Leavel Degree leavel Literater

10 17 69 04

10% 17% 69% 04%

Total

100

100%

Source : Primary date The education wise classification of two respondent in the table 4.3 nearly majority (69.1%) of the total responents (100) fall under the category of two graduation. The respondents who studied up to Hight secondary level (17%)And School level(10%) ranks the first & scond the Literater level respondents (4%) Rank the last it is clearly understand that two most of respondents were under graduates (69%)

occupational

No.Of Responents

Persentage

Govt Employ Private Employee Unemployed Others

13 49 18 20

13 49 18 20

Total

100

100

Source : Primary date The occupation wise classification of the respondents is presented in table 4.4 out of the total responenets the majority (49%) of the respondents are private employes the other (20.1%) and unemployed (18%) ranks second and fourth respectively. The govt employs respondents (13%) ranks the last. It is clearly understand that the most of respondents (49%) belongs to private employs Table 4.5 Income wise distribution of responents

Income

No.Of Responents

Persentage

Below Rs.3000 Rs 3001- 5000 Rs 5001-10000 Above Rs 10000

19 32 25 24

19 32 25 24

Total

100

100

Source : Primary date

The respondents income wise classification is started in table 4.5 out of the total respondents, on the first (32%) of the respondent income group is Rs 3000 Rs 5000.The respondents income group between Rs 500/- Rs 1000 and above Rs 10000 ranks fourth and faith. The respondents who belongs to the income below Rs 3000 ranks last. It is understood that the respondents who earned to income is Rs 3001 5000 is move in number(32%)

Table 4.6 Respondents opinion on Distributor Good day Advertisements

Above Good Day Biscuits Through Friends & Relatives

No of Respondent 30

Percentage 30%

Through Family Members

22

22%

Through Advertisement

32

32%

others Total

16 100

16% 100%

Source : Primary Data The respondents above good day biscuits wise classification is stated in table 4.6 out of the total respondents on the first (32%) of the respondent above good day biscuits through advertisement . The respondent above good day biscuits (30%) and third (22%) of the through family members. The respondents who belongs to the above good Day biscuits (16%) ranks last. It is understood that the majority of the respondents were belongs to the through advertisement (32%)

Table 4.7 Respondents opinion on mode of purchase point

Usually purchase Whole seller

No of Respondent 15

Percentage 15 %

Retailer

36

36%

Distributor

23

23%

Others Total

26 100

26% 100%

Source : Primary Data The respondents wise classification is stated in table 4.7 out of the total respondents, the majority (36%) of the respondents are retailer. The others (26%) and distributor (23%) ranks second and third respectively. The whole seller respondents (15%) ranks the last. It is clearly that the most of respondents (36%) belongs to retailer.

Table 4.8 Respondents opinion on duration of usage Consuming the biscuits From the Beginning No of respondents 25 percentage 25%

1 -5 Months

35

35%

6 12 Months

22

22%

Above 12 Months

18

18%

Total

100

100%

Source : Primary Data The respondents wise classification is stated in table 4.8 out of the total respondents the majority (35%) of the respondents consumed the biscuits 1 -5 months. The beginning (25%)and 6 12 months (22%) ranks second and third respectively. The consumer the biscuits for above 12 months (18%) ranks the last. It is clearly understood that the most of respondents (35%) belongs to 1 5 months.

Table 4.9 Respondents opinion on Frequency of Usage Frequently Daily No of Respondents 20 Percentage 20%

Once in week

34

34%

Twice in week

21

21%

Monthly once Total

25 100

25% 100%

Source : Primary Data The income wise respondents opinion on frequency of usage of biscuits given the table 4.9. The respondents consumed the biscuits once in week (34%). The respondents monthly once (25%) and twice in week (21%) ranks second and third respectively. The daily

consumed the biscuits respondents (20%) ranks the last. It is clearly understood that the most of respondents(34%) belongs to once week.

Table 4.10 Respondents opinion on quantum of biscuits package Quantum 75 Grams No of respondents 43 Percentage 43%

100 Grams

27

27%

150 Grams

13

13%

200 Grams Total

17 100

17% 100%

Source : Primary Data The wise respondents opinion on quantum of biscuits package is presented in table 4.10 out of the total respondents. The majority of the (43%) of the 75 grams package. The respondents (27%) pretend 100 grams package and 150 grams (13%) ranks second and third respectively. The 200 grams (17%) ranks the last . It is clearly understood that the majority of the respondents were belongs to the 75 grams (43%)

Table 4.11 Respondents opinion on monthly Expenditure pattern Monthly No of Respondents Percentage

Below Rs 50

56

56%

RS 51- Rs 100

21

21%

Rs 101 Rs 200

12

12%

Above Rs 102 Total

11 100

11% 100%

Source : Primary Data The respondents opinion on monthly expenditure is given in table 4.11. The monthly expenditure pattern is verities according to the difference group. The respondents spend below Rs50(56%). The respondents spend Rs 51- Rs 100(21%) and Rs 101 Rs 200 is (12%) ranks seconds and third respectively .The above Rs 201 respondents (11%)ranks the last. It is clearly understood that the most of respondents (56%)belongs to below Rs 50. Table 4.12 Respondents opinion Reason for porches Brand of Biscuit Colour No of Respondent 19 Percentage 19%

Quality

37

37%

Price

12

12%

Taste

32

32%

Total

100

100 %

Source : Primary Data

The respondents wise classification is stated in table 4.12. The out of the total respondents , the majority of the (37%) of quality. The respondents (32%) of the taste and (19%) colour ranks second and third respectively . The price of the biscuits (12%)ranks cast. It is clearly understood that most of respondents (37%)belongs to quality.

Table 4.13 Respondents opinion of level of satisfaction on the package of biscuits

Taste of Biscuit Satisfied

No of Respondent 55

Percentage 55%

Highly satisfied

22

22%

Dissatisfied

10

10%

No idea

13

13%

Total

100

100 %

Source : Primary Data The respondents wise classification is stated in table 4.13 out of the total respondents the majority (55%) of the respondents are satisfied. The highly satisfied (22%) and No idea (13%) ranks second and third respectively. The dissatisfied respondents (10%) ranks the cast. It is clearly understood that the most of respondents (55%) belongs to satisfied . Table 4.14 Price level of this biscuits distribution Price level of this biscuits No of Respondent Percentage

Satisfied

49

49%

Highly satisfied

21

21%

Dissatisfied

10

10%

No idea

20

20%

Total

100

100 %

Source : Primary Data The respondents feel the price of this biscuits wise classification is stated in table 4.14 . out of the total respondents . The majority (49%) of the respondents satisfied. The highly satisfied (21%) and no idea (20%) ranks second and third respectively. The dissatisfied respondents (10%) ranks the cast. It is clearly understood that the most of the respondents (49%) belong to satisfied.

Table 4.15 Satisfied with the package Distribution Respondents Satisfied with the package Yes No of Respondent 79 Percentage 79 %

No Total

21 100

21% 100 %

Source : Primary data The respondent satisfied with the package this biscuits wise classification is stated in table 4.15 out of the total respondent, majority (79%) of the respondent yes. The no

respondent (21%). It is clearly understood that the most of the respondent (79%) belongs to yes.

Table 4.16 Respondents opinion regarding the package distribution

Opinion regarding the package Satisfied

No of Respondent 50

Percentage 63 %

Highly Satisfied

17

22%

Dissatisfied Total Source : Primary data

12 79

15 % 100 %

The respondents opinion about the level of satisfaction on two Good Day biscuits brand is presented in table 4.16. The majority (50%) of the respondents satisfied. The highly satisfied (17%)respondents. The Dissatisfied respondents (12%) ranks the cast. It is clearly understood that the most of respondents (50%) belongs to satisfied.

Table 4.17 Avai any offer from your retailed shop Distribution Avai any offer from your retailed shop Yes No of Respondent 70 Percentage 70 %

No

30

30%

Total

79

100 %

Source : Primary data The respondents opinion about the availability of offers stated in table 4.17 out of the total respondents. The majority (70%) of the respondents yes. Another respondents ( 30%) No. It is clearly understood that the most of respondents (70%) belongs to yes.

Table 4.18 Respondents opinion on Availability of offers

Kind of offer do you avail Price offer

No of Respondent 38

Percentage 54 %

Product offer

32

46%

Total

70

100 %

Source : Primary data The respondents wise classification is stated in table 4.18. Out of the respondents (32%) of the respondents gets product offer and (38%) of the respondents gets price offer. It is clear that the majority of the respondent gets(38%) price offer.

Table 4.19 Any other biscuit before using this Respondents Any other biscuit before using this Yes No of Respondent 73 Percentage 73 %

No

27

27%

Total

100

100 %

Source : Primary Data The respondents consume other biscuit before using of prand is stated in table 4.19 out of the total respondents. The majority (73%) respondents yes. Another respondents (27%) is the No. It is clearly understood that the most of respondents ( 73 %) belongs to yes.

Table 4.20 Which brand did you use Respondents Which brand did you use Good Day No of Respondent 38 Percentage 38 %

Nutrient

8%

Parle

13

13 %

Others

14

14%

Total

100

100 %

Source : Primary data The respondents wise classified which brand used stated in table 4.20. Out of the total respondent ,the majority (52%) of Good day biscuits. The respondents others (19%) and parle biscuits ranks seconds and third respectively. The nutrine of the busicuts (11%) ranks the cast. It is clearly understood that the most of respondents (52%) belongs to Good Gay Biscuits

Anda mungkin juga menyukai

- Thermal Physics Questions IB Question BankDokumen43 halamanThermal Physics Questions IB Question BankIBBhuvi Jain100% (1)

- Capgras SyndromeDokumen4 halamanCapgras Syndromeapi-459379591Belum ada peringkat

- ScientistsDokumen65 halamanScientistsmohamed.zakaBelum ada peringkat

- Cum in Mouth ScriptsDokumen10 halamanCum in Mouth Scriptsdeudaerlvincent72Belum ada peringkat

- Chapter 4 - Thesis (OCT 12)Dokumen19 halamanChapter 4 - Thesis (OCT 12)Leslie Diamond100% (2)

- Data Analysis and InterpretationDokumen18 halamanData Analysis and InterpretationDivya RajaveluBelum ada peringkat

- Communication and Globalization Lesson 2Dokumen13 halamanCommunication and Globalization Lesson 2Zetrick Orate0% (1)

- Oldham Rules V3Dokumen12 halamanOldham Rules V3DarthFooBelum ada peringkat

- Talent Development - FranceDokumen6 halamanTalent Development - FranceAkram HamiciBelum ada peringkat

- Hydrogen Peroxide DripDokumen13 halamanHydrogen Peroxide DripAya100% (1)

- 800 Pharsal Verb Thong DungDokumen34 halaman800 Pharsal Verb Thong DungNguyễn Thu Huyền100% (2)

- Chapter 4 ProfileDokumen9 halamanChapter 4 ProfileRon Magno100% (1)

- Chapter Four Final ADokumen31 halamanChapter Four Final AtonylizzyBelum ada peringkat

- Presentation, Analysis, Interpretation of Data: Female MaleDokumen6 halamanPresentation, Analysis, Interpretation of Data: Female MaleDann SolisBelum ada peringkat

- Descriptive Statistics - Quintos, Isnain, Majaba - Word FileDokumen3 halamanDescriptive Statistics - Quintos, Isnain, Majaba - Word FileIsabella QuintosBelum ada peringkat

- Chapter 4 ThesisDokumen6 halamanChapter 4 ThesisGenniaHernandezMartinezBelum ada peringkat

- Respondents Consumer No. of Respondents PercentageDokumen17 halamanRespondents Consumer No. of Respondents PercentageHaribabuPalaniBelum ada peringkat

- Sample FormatDokumen8 halamanSample Formatnick jakBelum ada peringkat

- Chapter - Iv Data Analysis and InterpretationDokumen26 halamanChapter - Iv Data Analysis and InterpretationSunnyBelum ada peringkat

- Chapter 4Dokumen31 halamanChapter 4CHRISTIAN LLOYD DE LEONBelum ada peringkat

- UntitledDokumen24 halamanUntitledMathi SBelum ada peringkat

- 05 - Chapter 4Dokumen42 halaman05 - Chapter 4Maha RajaBelum ada peringkat

- Chapter 4Dokumen10 halamanChapter 4marcaban.farniza81602Belum ada peringkat

- Age of The Respondents: Particular Frequency PercentDokumen35 halamanAge of The Respondents: Particular Frequency PercentDeevyaParthibanBelum ada peringkat

- Muna SiciiidDokumen15 halamanMuna SiciiidAbdiwadud AdamBelum ada peringkat

- The Above Table 4Dokumen3 halamanThe Above Table 4eswariBelum ada peringkat

- Summary of Findings A. Respondents ProfileDokumen3 halamanSummary of Findings A. Respondents ProfileAngela AquinoBelum ada peringkat

- Appendices 11.1 Market ResearchDokumen5 halamanAppendices 11.1 Market ResearchChristia Lyne SarenBelum ada peringkat

- Presentation, Analysis and Interpretation of DataDokumen21 halamanPresentation, Analysis and Interpretation of DatainamalaeyaBelum ada peringkat

- Customer Satisfaction EditedDokumen16 halamanCustomer Satisfaction EditedSheena NamucoBelum ada peringkat

- Chapter 4Dokumen21 halamanChapter 4ADEKUNLE MARIOBelum ada peringkat

- Table 1 Frequency and Percentage Distribution of Respondents AgeDokumen5 halamanTable 1 Frequency and Percentage Distribution of Respondents AgeLaksmi UyBelum ada peringkat

- 4.1 Background Information On RespondentsDokumen6 halaman4.1 Background Information On RespondentsManfred GithinjiBelum ada peringkat

- PRE-TEST RESULT Chapter 3 and 4Dokumen4 halamanPRE-TEST RESULT Chapter 3 and 4John Michael RebadaBelum ada peringkat

- BBA4009 Au Lee YauDokumen18 halamanBBA4009 Au Lee YauChristopher AuBelum ada peringkat

- Chapter Four Eunice IiDokumen13 halamanChapter Four Eunice IiRaytone Tonnie MainaBelum ada peringkat

- Extra QuestionsDokumen13 halamanExtra QuestionsVamsi SakhamuriBelum ada peringkat

- Market Survey ReportDokumen11 halamanMarket Survey ReportShane MillenaBelum ada peringkat

- This Chapter Includes The Summary, Findings, Conclusions, and Recommendations Based On The Result Presented in The Chapter IVDokumen1 halamanThis Chapter Includes The Summary, Findings, Conclusions, and Recommendations Based On The Result Presented in The Chapter IVAeris StrongBelum ada peringkat

- CHAPTER IV Final-WPS OfficeDokumen5 halamanCHAPTER IV Final-WPS OfficeJohnmar ButedBelum ada peringkat

- Manage-Awareness of FDI in Retail Sector-PriyadharshiniDokumen14 halamanManage-Awareness of FDI in Retail Sector-PriyadharshiniImpact JournalsBelum ada peringkat

- Assssement of Public RelationsDokumen25 halamanAssssement of Public RelationsTilahun MikiasBelum ada peringkat

- Non TeachingDokumen30 halamanNon TeachingEdwin Okoampa BoaduBelum ada peringkat

- Data Analysis and Interpretation: Table - 1 Distribution of The Respondents Opinion Regarding The AgeDokumen24 halamanData Analysis and Interpretation: Table - 1 Distribution of The Respondents Opinion Regarding The AgeRaja MadhanBelum ada peringkat

- No. of Respondents in %: Practical Analysis and Interpretation Sample Size 50Dokumen19 halamanNo. of Respondents in %: Practical Analysis and Interpretation Sample Size 50lokeshBelum ada peringkat

- Chapter Four IssaDokumen13 halamanChapter Four IssaRaytone Tonnie MainaBelum ada peringkat

- Table 1 (Give Table No. For All Tables) : Age Distribution of The RespondentsDokumen29 halamanTable 1 (Give Table No. For All Tables) : Age Distribution of The RespondentsZiju JohnBelum ada peringkat

- Analysis and Interperetation TABLE 4.1Dokumen32 halamanAnalysis and Interperetation TABLE 4.1rroshan91191Belum ada peringkat

- Problem 1: What Is The Socio-Demographic Profile of The Parturient Mother in Terms of TheDokumen10 halamanProblem 1: What Is The Socio-Demographic Profile of The Parturient Mother in Terms of TheJefferson BeraldeBelum ada peringkat

- Chapter II ThesisDokumen5 halamanChapter II ThesisJheiczhietoot KibasBelum ada peringkat

- From The Table-2 50% of The Respondent Says That Male, 50% of The Respondent SaysDokumen4 halamanFrom The Table-2 50% of The Respondent Says That Male, 50% of The Respondent SayseswariBelum ada peringkat

- Chapter 4Dokumen7 halamanChapter 4Shane Claire CaritativoBelum ada peringkat

- Online MarketingDokumen18 halamanOnline MarketingManoranjan BisoyiBelum ada peringkat

- Results and DiscussionDokumen4 halamanResults and DiscussionMarcos JeremyBelum ada peringkat

- Survey Table ChoocronDokumen6 halamanSurvey Table ChoocronJohn Cedrick AngelesBelum ada peringkat

- Respondent's Profile Table 1 Frequency and Percentage Distributions of The Respondents According To SexDokumen9 halamanRespondent's Profile Table 1 Frequency and Percentage Distributions of The Respondents According To SexnellafayericoBelum ada peringkat

- Findings of The StudyDokumen4 halamanFindings of The StudyYuvnesh KumarBelum ada peringkat

- Group 5 Business ResearchDokumen13 halamanGroup 5 Business ResearchNelia LorenzoBelum ada peringkat

- Data Analysis: The Pie Chart Shows 42 Total Responses Agreeing To Answer The QuestionnaireDokumen13 halamanData Analysis: The Pie Chart Shows 42 Total Responses Agreeing To Answer The QuestionnaireafiyqBelum ada peringkat

- Research Report Final DraftDokumen46 halamanResearch Report Final DraftThomas Colossus GrantBelum ada peringkat

- Chapter - 4 & 5Dokumen35 halamanChapter - 4 & 5asquareprojectcentre0120Belum ada peringkat

- Vidya ProjectDokumen29 halamanVidya Projectyathsih24885Belum ada peringkat

- The Behaviour and Knowledge of Taxpayers On Assessment Tax and Service Compliance of Tanjong Malim District CouncilDokumen45 halamanThe Behaviour and Knowledge of Taxpayers On Assessment Tax and Service Compliance of Tanjong Malim District CouncilhidayahBelum ada peringkat

- Table 1.0 Gender of The Respondent Gender No. Respondent Percentage %Dokumen3 halamanTable 1.0 Gender of The Respondent Gender No. Respondent Percentage %Bernardo Villavicencio VanBelum ada peringkat

- INTRODUCTIONDokumen26 halamanINTRODUCTIONJaishree JaishreeBelum ada peringkat

- Chapter VDokumen4 halamanChapter VSugar PandaBelum ada peringkat

- V V VV V V V VVV V V V VV V V V V V V VVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVDokumen25 halamanV V VV V V V VVV V V V VV V V V V V V VVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVVsenthamizBelum ada peringkat

- Chapter Four HoseaDokumen15 halamanChapter Four HoseaRaytone Tonnie MainaBelum ada peringkat

- Relationship Between Health Literacy Scores and Patient Use of the iPET for Patient EducationDari EverandRelationship Between Health Literacy Scores and Patient Use of the iPET for Patient EducationBelum ada peringkat

- Directions: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankDokumen2 halamanDirections: Choose The Best Answer For Each Multiple Choice Question. Write The Best Answer On The BlankRanulfo MayolBelum ada peringkat

- Right Hand Man LyricsDokumen11 halamanRight Hand Man LyricsSteph CollierBelum ada peringkat

- 67-Article Text-118-1-10-20181206Dokumen12 halaman67-Article Text-118-1-10-20181206MadelBelum ada peringkat

- Social Awareness CompetencyDokumen30 halamanSocial Awareness CompetencyudaykumarBelum ada peringkat

- Test Statistics Fact SheetDokumen4 halamanTest Statistics Fact SheetIra CervoBelum ada peringkat

- The Idea of Multiple IntelligencesDokumen2 halamanThe Idea of Multiple IntelligencesSiti AisyahBelum ada peringkat

- Copper Reaction: Guillermo, Charles Hondonero, Christine Ilao, Ellaine Kim, Yumi Lambrinto, Arl JoshuaDokumen6 halamanCopper Reaction: Guillermo, Charles Hondonero, Christine Ilao, Ellaine Kim, Yumi Lambrinto, Arl JoshuaCharles GuillermoBelum ada peringkat

- HIS Unit COMBINES Two Birthdays:: George Washington's BirthdayDokumen9 halamanHIS Unit COMBINES Two Birthdays:: George Washington's BirthdayOscar Panez LizargaBelum ada peringkat

- 2,3,5 Aqidah Dan QHDokumen5 halaman2,3,5 Aqidah Dan QHBang PaingBelum ada peringkat

- Administrative LawDokumen7 halamanAdministrative LawNyameka PekoBelum ada peringkat

- Mirza HRM ProjectDokumen44 halamanMirza HRM Projectsameer82786100% (1)

- Erika Nuti Chrzsoloras Pewri Tou Basileos LogouDokumen31 halamanErika Nuti Chrzsoloras Pewri Tou Basileos Logouvizavi21Belum ada peringkat

- 1027 12Dokumen3 halaman1027 12RuthAnayaBelum ada peringkat

- Level 5 - LFH 6-10 SepDokumen14 halamanLevel 5 - LFH 6-10 SepJanna GunioBelum ada peringkat

- Literature Review On Catfish ProductionDokumen5 halamanLiterature Review On Catfish Productionafmzyodduapftb100% (1)

- Saber Toothed CatDokumen4 halamanSaber Toothed CatMarie WilkersonBelum ada peringkat

- PETE 689 Underbalanced Drilling (UBD) : Well Engineering Read: UDM Chapter 5 Pages 5.1-5.41Dokumen74 halamanPETE 689 Underbalanced Drilling (UBD) : Well Engineering Read: UDM Chapter 5 Pages 5.1-5.41Heris SitompulBelum ada peringkat

- NetStumbler Guide2Dokumen3 halamanNetStumbler Guide2Maung Bay0% (1)

- 2019 Ulverstone Show ResultsDokumen10 halaman2019 Ulverstone Show ResultsMegan PowellBelum ada peringkat

- University of Dar Es Salaam MT 261 Tutorial 1Dokumen4 halamanUniversity of Dar Es Salaam MT 261 Tutorial 1Gilbert FuriaBelum ada peringkat

- Mathematics Trial SPM 2015 P2 Bahagian BDokumen2 halamanMathematics Trial SPM 2015 P2 Bahagian BPauling ChiaBelum ada peringkat